Markt snapshot Wall Street 14 mei

Markt snapshot Wall Street 14 mei

TOP NEWS

• Colonial Pipeline ramps up as U.S. seeks to emerge from fuel crunch

Colonial Pipeline ramped up deliveries to fuel-starved markets up and down the East Coast following a nearly week-long outage caused by hackers, as Washington sought to reassure motorists that supplies would return to normal soon.

• TSMC looks to double down on U.S. chip factories as talks in Europe falter

Taiwan Semiconductor Manufacturing Co is weighing plans to pump tens of billions of dollars more into cutting-edge chip factories in the U.S. state of Arizona than it had previously disclosed, but is cool on prospects for an advanced European plant, people familiar with the matter told Reuters.

• Tesla in talks with China's EVE for low-cost battery supply deal - sources

Tesla is in talks with Chinese battery maker EVE Energy to add the firm to its Shanghai factory supply chain, four people familiar with the matter said, as it seeks to boost procurement of lower cost batteries.

• Disney's streaming growth slows as pandemic lift fades

Disappointing growth of Walt Disney's namesake streaming service on Thursday overshadowed better-than-expected overall profits, driving down shares of the entertainment company.

• General Mills to buy Tyson Foods' pet treats business for $1.2 billion

General Mills said it would buy Tyson Foods' pet treats business for $1.2 billion in cash, as the cereal maker builds its pet food portfolio.

BEFORE THE BELL

U.S. stock index futures firmed at the end of a volatile week marred by worries about rising inflation and a subsequent tightening of monetary policy, while investors awaited retail sales data. European shares crawled higher. Japanese stocks clocked their biggest weekly loss in nine months as investors refrained from placing big bets, while China stocks ended the week higher. The dollar edged lower as risk appetite recovered across markets. Oil prices rose, though gains were capped by the coronavirus situation in major oil consumer India and the restart of a fuel pipeline in the United States. Gold prices were higher.

STOCKS TO WATCH

Results

• Aeva Technologies Inc: The company said on Thursday it signed a deal to develop a sensor for a self-driving car to be made by an "undisclosed large company," and its shares rose even as it reported that its loss ballooned and sales came in far below forecasts. Aeva reported first-quarter revenue of $300,000, down from $500,000 a year earlier and far below analysts' estimate of $1.38 million. Its adjusted operating loss more than doubled to $15.6 million from $6.1 million a year ago. Aeva said on Thursday it had signed a "foundational agreement with an undisclosed large company to develop best-in-class lidar" for the customer's autonomous driving program.

• Airbnb Inc: The company beat Wall Street expectations for first-quarter gross bookings and revenue on Thursday, as speedy COVID-19 vaccinations and easing restrictions encouraged more people to check into its vacation rentals. Gross bookings jumped 52% to $10.29 billion in the quarter, easily beating analysts' estimates of $6.93 billion. Its revenue rose 5.4% to $886.9 million in the first quarter ended March 31, exceeding estimates of $714.4 million. Adjusted loss before interest, taxes, depreciation and amortization narrowed to $59 million, from $334 million a year earlier, largely due to cost cuts.

• DoorDash Inc: The company raised its forecast for annual gross order value on Thursday, as stimulus checks helped keep food delivery demand resilient in the first quarter even as vaccinations and an easing of restrictions encouraged people to dine out again. DoorDash, which has also branched out into delivery from grocery and convenience stores last year, reported a near three-fold jump in quarterly revenue to $1.08 billion, beating analysts' estimates of $993.3 million. DoorDash said it expects full-year marketplace gross order value (GOV) of $35 billion to $38 billion, up from its previous forecast of $30 billion to $33 billion.

• Honda Motor Co Ltd: The company reported a rebound to profit for the fourth quarter helped by cost cuts but warned semiconductor shortages and higher raw material costs would curb growth in the current year. Its forecast for operating profit for the year that began on April 1 of 660 billion yen was short of the 791.7 billion forecast by analysts, SmartEstimate data showed. In the three months to March 31, Japan's No.2 carmaker by sales posted an operating profit of 213.2 billion yen following a 5.6 billion yen loss a year earlier. That result was better than a consensus estimate of 107.4 billion yen profit from nine analysts surveyed by SmartEstimate.

• Mizuho Financial Group Inc & Sumitomo Mitsui Financial Group Inc: Two of Japan's megabanks forecast a drop in credit-related costs this year on expectations the economy will recover as vaccination proceeds. Mizuho is predicting credit-related costs of 100 billion yen this year, while SMFG's sees costs at 300 billion yen. Both figures were smaller than those of the last financial year.

• Walt Disney Co: Disappointing growth of Disney's namesake streaming service on Thursday overshadowed better-than-expected overall profits, driving down shares of the entertainment company. Adjusted earnings-per-share for the fiscal second quarter came in at 79 cents for January through April 3, Disney said. Analysts had expected 27 cents. The average monthly revenue per paid subscriber for Disney+ decreased from $5.63 to $3.99, the company said, due to the launch of the lower-priced Disney+ Hotstar in overseas markets. Factset estimates showed Wall Street was expecting average revenue of $4.10 per user. Separately, J.P.Morgan expressed confidence that Disney+ will grow at a robust pace despite a sluggish showing in the second quarter, and said its legacy businesses will also improve as economies reopen.

Deals of the Day

• General Mills Inc & Tyson Foods Inc: General Mills said it would buy Tyson Foods' pet treats business for $1.2 billion in cash, as the cereal maker builds its pet food portfolio. The deal would add Nudges, Top Chews and True Chews brands to General Mills' portfolio that already includes Blue Buffalo pet foods label. As part of the deal, which would be funded with cash on hand and short-term borrowing, General Mills would also acquire a manufacturing facility in Independence, Iowa.

• Graphic Packaging Holding Co: The company said it would acquire Europe's AR Packaging from CVC Capital Partners Fund for about $1.45 billion in cash to expand its footprint. Graphic Packaging said the deal with Europe's second-largest producer of fiber-based consumer packaging is expected to add $1.1 billion to its annual sales, besides being immediately accretive to its earnings per share and cash flow. The deal, which has been unanimously approved by the boards of both the companies, is expected to close in four to six months.

In Other News

• Alphabet Inc: A U.S. judge on Thursday dismissed antitrust claims against Google brought by a group of advertisers, but offered them a chance to try again after addressing what she called "serious concerns." The ruling by District Judge Beth Labson Freeman in San Jose, California, marks one of the first major decisions in a spate of antitrust cases filed against Google over the last two years by users and rivals as well as the U.S. Department of Justice and state attorneys general. Labson Freeman said plaintiffs, including Hanson Law Firm and Prana Pets, that alleged Google abuses its dominance in digital advertising need to clarify which market they think it monopolizes. Separately, Google said it was leading about 30 companies and trade groups in opposing a lawsuit that seeks to stop over 90,000 spouses of highly skilled U.S. visa workers from having jobs in the country.

• Amazon.com Inc: The company will create 10,000 new permanent jobs in the United Kingdom in 2021, taking its total workforce in the country to more than 55,000, it said. Amazon said the new jobs will include roles across its operations network, at its corporate offices and Amazon Web Services (AWS). The group plans to open a new fulfilment centre in Hinckley, central England, creating 700 jobs. It will also open a parcel centre in Doncaster, northern England, and further fulfilment centres in Dartford, near London, Gateshead in northeastern England and Swindon in western England, each creating more than 1,300 permanent jobs. Separately, the company is in talks with Japanese power utilities and trading houses to build a renewable power plant in Japan to procure clean energy for its local data centres, the Nikkei reported late on Thursday.

• Aurora Cannabis Inc: The company said on Thursday it would move its U.S. stock listing to the Nasdaq due to the exchange's "cost-effectiveness," following similar moves by rivals last year. The company missed expectations for third-quarter revenue, hit by the impact of coronavirus-induced restrictions in Canada. "This listing transfer will enable us to realize cost efficiencies as part of our efforts to deliver long-term value to shareholders," Chief Executive Officer Miguel Martin said in a statement. Aurora's shares will start trading on the Nasdaq on May 25 under the ticker symbol "ACB."

• Bank of America Corp: Three senior tech bankers at Bank of America have left the bank to join boutique advisory firm Centerview Partners, according to people familiar with the matter. Jack McDonald has joined Centerview as a partner, after spending over two decades at Bank of America where he was recently co-head of global investment banking. Two other senior tech bankers, Steve Miller and Gary Kirkham, have also joined Centerview.

• Citigroup Inc & Credit Suisse Group AG: Citi has hired Didier Denat from Credit Suisse to chair its alternative assets franchise in Europe, the Middle East and Africa (EMEA), according to a memo seen by Reuters. Denat, who spent 21 years at Credit Suisse, was a member of the Swiss bank's executive board and most recently headed its corporate banking business. Citi has also promoted Theo Giatrakos, who was in charge of investment banking for Central and South East Europe, as head of its alternative assets group in EMEA, the memo said.

• Fisker Inc: The electric car maker has finalized its vehicle-assembly deal with Foxconn, including plans to open a U.S. plant in 2023, the companies said on Thursday. The plant's location has not been identified, but Fisker Chief Executive Henrik Fisker said four states are under consideration, including Foxconn's plant site in Wisconsin. Foxconn Chairman Liu Young-way previously said electric vehicles (EVs) have a "promising future" in Wisconsin but did not elaborate. The annual capacity for the U.S. plant will be at least 150,000 vehicles to start, Fisker said.

• iQiyi Inc: The Chinese video streaming platform, majority-owned by Baidu, may be able to turn a profit in five years, its chief executive told Reuters in an interview. iQiyi, which incorporates artificial intelligence to predict viewership and box office, will turn to "intelligent production" to partly help it cut cost and turn a profit in the future, founder and CEO Gong Yu said.

• Moderna Inc: Samsung BioLogics said no decision has been made yet on producing Moderna's COVID-19 vaccine in South Korea after a newspaper reported the two companies had agreed on a contract manufacturing deal. The Chosun Ilbo reported that the biotech arm of Samsung Group has agreed to produce the Moderna vaccine in its plant in Songdo, part of which will be used for domestic vaccination, citing unnamed government and pharmaceutical industry sources. Samsung BioLogics said in a short filing to the stock exchange that no decision has been finalised. The company will provide an update within a month as required by regulations, a company official said.

• Pfizer Inc: The company's COVID-19 vaccine generates antibody responses three-and-a-half times larger in older people when a second dose is delayed to 12 weeks after the first, a British study said. "Our study demonstrates that peak antibody responses after the second Pfizer vaccine are markedly enhanced in older people when this is delayed to 12 weeks," Helen Parry, an author of the study based at the University of Birmingham, said. Separately, Vietnam is seeking 31 million doses of the COVID-19 vaccine jointly developed by Pfizer and BioNTech in 2021, its health ministry said, as the country seeks to secure its vaccines amid competition and supply uncertainty.

• Royal Dutch Shell PLC: The company said it will be working with a university in Singapore in a research project worth S$4.6 million over three years to convert carbon dioxide to fuels and petrochemicals. Researchers from Shell and the National University of Singapore (NUS) will develop processes to produce ethanol and n-propanol from carbon dioxide, a byproduct from industrial processes, the two organizations said in separate statements on their websites.

• State Street Corp: The company agreed to pay a $115 million criminal penalty and enter a deferred prosecution agreement to resolve charges the bank defrauded customers by secretly overcharging them for back-office expenses, the U.S. Department of Justice said on Thursday. According to settlement papers, State Street admitted that from 1998 to 2015 its executives defrauded customers out of more than $290 million through hidden markups. The Boston-based company also admitted that its executives tried to conceal the markups by leaving the details off invoices and "actively" misleading customers who questioned them.

• Taiwan Semiconductor Manufacturing Co: The company is weighing plans to pump tens of billions of dollars more into cutting-edge chip factories in the U.S. state of Arizona than it had previously disclosed, but is cool on prospects for an advanced European plant, people familiar with the matter told Reuters. TSMC announced last year that it would invest $10 billion to $12 billion to build a chip factory in Phoenix. Reuters this month reported that previously disclosed factory could be the first of up to up to six planned plants at the site. Now, company officials are debating whether the next plant should be a more advanced facility that can make chips with so-called 3-nanometer chipmaking technology compared to the slower, less-efficient 5-nanometer technology used for the first factory. The more advanced 3-nanometer plant could cost $23 billion to $25 billion, one person familiar with the matter told Reuters. Details of TSMC's plans for the additional factories at the Arizona site have not been previously reported. Separately, the company does not see any major impact on chip exports from Taiwan's largest airline having to cut flights while pilots are quarantined over a COVID-19 outbreak, it said.

• Tesla Inc: The company is in talks with Chinese battery maker EVE Energy to add the firm to its Shanghai factory supply chain, four people familiar with the matter said, as it seeks to boost procurement of lower cost batteries. The talks are advanced and the Palo Alto, California-based company is seeking to finalise the partnership in the third quarter, said two of the people. Shenzhen-listed EVE is running some final-stage tests of its products for Tesla, said one person.

• Total SE: The company plans to raise gasoline production at its 225,500 barrel-per-day (bpd) Port Arthur, Texas, refinery after drawing down the fuel in full storage tanks, sources familiar with plant operations said on Thursday. A Total spokeswoman did not immediately reply to a request for comment.

ANALYSIS

U.S. investors looking for protection as inflation pressures bubble, stocks volatile

U.S. investors grappling with the latest stock volatility and evidence of inflation say they have been positioning themselves for more unexpected kinks in the road to recovery.

ANALYSTS' RECOMMENDATION

• Cadence Bancorp: Raymond James raises rating to outperform from market perform, reflecting improved loan growth, a more favorable credit outlook and better management of excess liquidity.

• Churchill Downs Inc: Jefferies raises rating to buy from hold, following expansion of racetrack and casino along with prospective digital gaming.

• Farfetch Ltd: Credit Suisse raises price target to $84 from $83, after reporting a better-than-expected revenue in first-quarter results.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0830 (approx.) Import prices mm for Apr: Expected 0.6%; Prior 1.2%

0830 (approx.) Export prices mm for Apr: Expected 0.6%; Prior 2.1%

0830 (approx.) Import prices yy for Apr: Prior 6.9%

0830 (approx.) Retail sales mm for Apr: Expected 1.0%; Prior 9.8%

0830 (approx.) Retail sales ex-autos mm for Apr: Expected 0.7%; Prior 8.4%

0830 (approx.) Retail ex gas/autos for Apr: Prior 8.2%

0830 (approx.) Retail control for Apr: Expected -0.2%; Prior 6.9%

0830 (approx.) Retail sales YoY for Apr: Prior 27.72%

0915 (approx.) Industrial production mm for Apr: Expected 1.0%; Prior 1.4%

0915 (approx.) Capacity utilization SA for Apr: Expected 75.0%; Prior 74.4%

0915 (approx.) Manufacturing output mm for Apr: Expected 0.4%; Prior 2.7%

0915 (approx.) Industrial production YoY for Apr : Prior 1.02%

1000 (approx.) Business inventories mm for Mar: Expected 0.3%; Prior 0.5%

1000 (approx.) Retail inventories ex-auto revenue for Mar: Prior 0.6%

1000 U Mich Sentiment Preliminary for May: Expected 90.4; Prior 88.3

1000 U Mich Conditions Preliminary for May: Expected 99.6; Prior 97.2

1000 U Mich Expectations Preliminary for May: Expected 85.0; Prior 82.7

1000 (approx.) U Mich 1 year inflation preliminary for May: Prior 3.4%

1000 (approx.) U Mich 5-year inflation preliminary for May: Prior 2.7%

COMPANIES REPORTING RESULTS

No major S&P 500 companies are scheduled to report for the day.

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Zimmer Biomet Holdings Inc: Annual Shareholders Meeting

0830 Diversey Holdings Ltd: Q1 earnings conference call

0830 Intercontinental Exchange Inc: Annual Shareholders Meeting

0900 Integra Lifesciences Holdings Corp: Annual Shareholders Meeting

0900 Marriott Vacations Worldwide Corp: Annual Shareholders Meeting

0900 Medpace Holdings Inc: Annual Shareholders Meeting

1000 Baker Hughes Co: Annual Shareholders Meeting

1000 Morningstar Inc: Annual Shareholders Meeting

1000 Vulcan Materials Co: Annual Shareholders Meeting

1000 Western Union Co: Annual Shareholders Meeting

1100 IAC/Interactive Corp: Annual Shareholders Meeting

1100 Weyerhaeuser Co: Annual Shareholders Meeting

1130 ANSYS Inc: Annual Shareholders Meeting

1130 Zebra Technologies Corp: Annual Shareholders Meeting

1200 Sempra Energy: Annual Shareholders Meeting

1730 Seagen Inc: Annual Shareholders Meeting

EX-DIVIDENDS

Allison Transmission Holdings Inc: Amount $0.19

Amerisourcebergen Corp: Amount $0.44

Amgen Inc: Amount $1.76

Bio-Techne Corp: Amount $0.32

BOK Financial Corp: Amount $0.52

Capital One Financial Corp: Amount $0.40

Carlisle Companies Inc: Amount $0.52

CF Industries Holdings Inc: Amount $0.30

Chemours Co: Amount $0.25

CNA Financial Corp: Amount $0.38

Dolby Laboratories Inc: Amount $0.22

Highwoods Properties Inc: Amount $0.48

Jefferies Financial Group Inc: Amount $0.20

Kemper Corp: Amount $0.31

KKR & Co Inc: Amount $0.14

KLA Corp: Amount $0.90

Louisiana-Pacific Corp: Amount $0.16

MSA Safety Inc: Amount $0.44

PacWest Bancorp: Amount $0.25

Pool Corp: Amount $0.80

Rockwell Automation Inc: Amount $1.07

Southern Co: Amount $0.66

Ubiquiti Inc: Amount $0.40

Valero Energy Corp: Amount $0.98

Liveblog feed

We krijgen mogelijk een momentum om long posities op te nemen

Beste beleggers,

De komende week, en ik denk al aan het begin van de week kunnen we mogelijk een mooi instapmoment krijgen op meerdere indices en dus ook op enkele aandelen. De 5% correctie hebben zo ongeveer achter de rug en de reactie omhoog kan 2 tot 3% worden. We gaan voorzichtig met wat posities daarop anticiperen. U kunt meedoen door lid te worden. Er loopt vanaf vandaag een nieuwe aanbieding voor een proefabonnement, nu €35 tot 1 JULI

Schrijf u meteen in via deze aanbieding via de link https://www.usmarkets.nl/tradershop ... Dan krijgt u zicht op onze updates en mag u signalen van ons verwachten ...

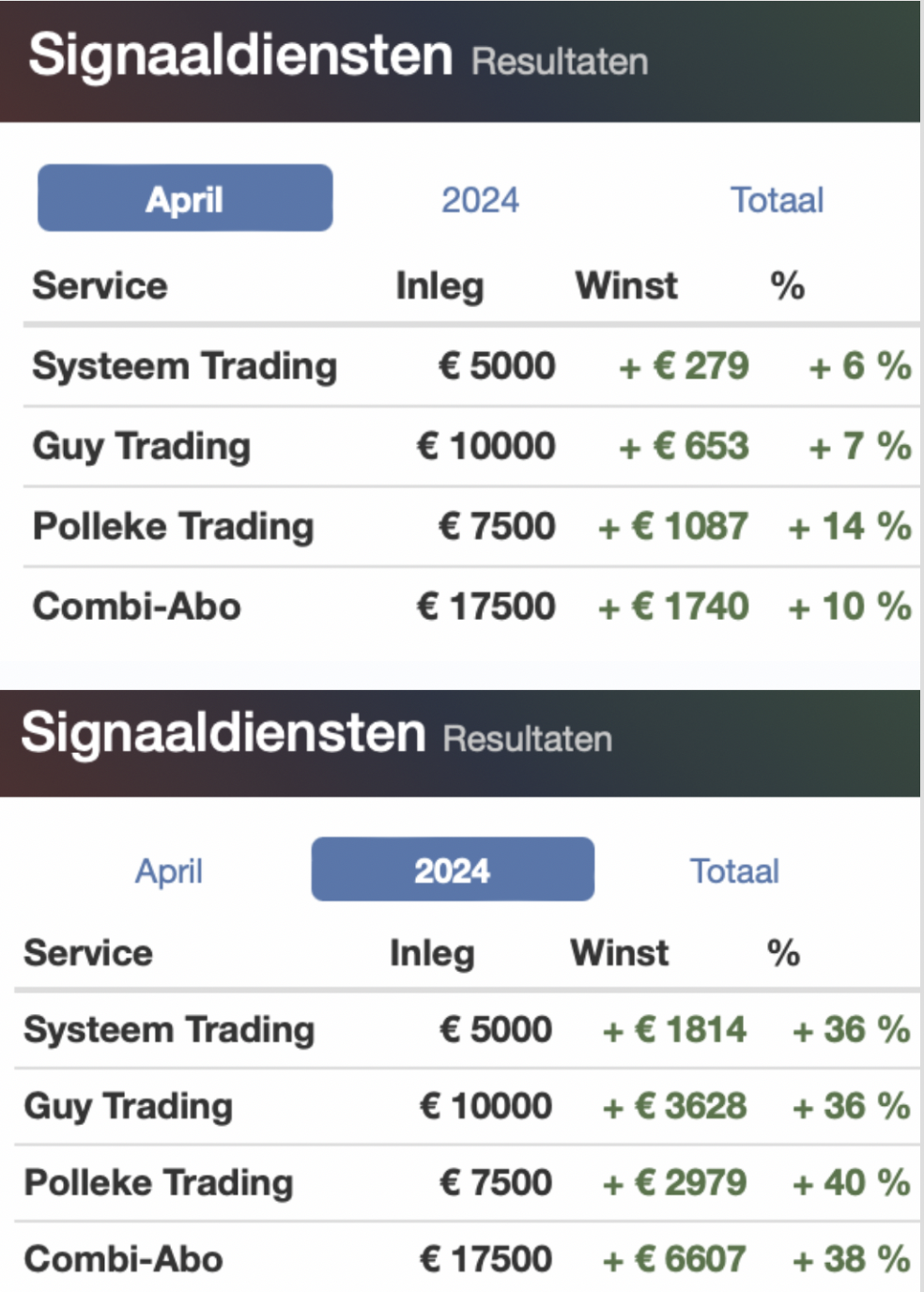

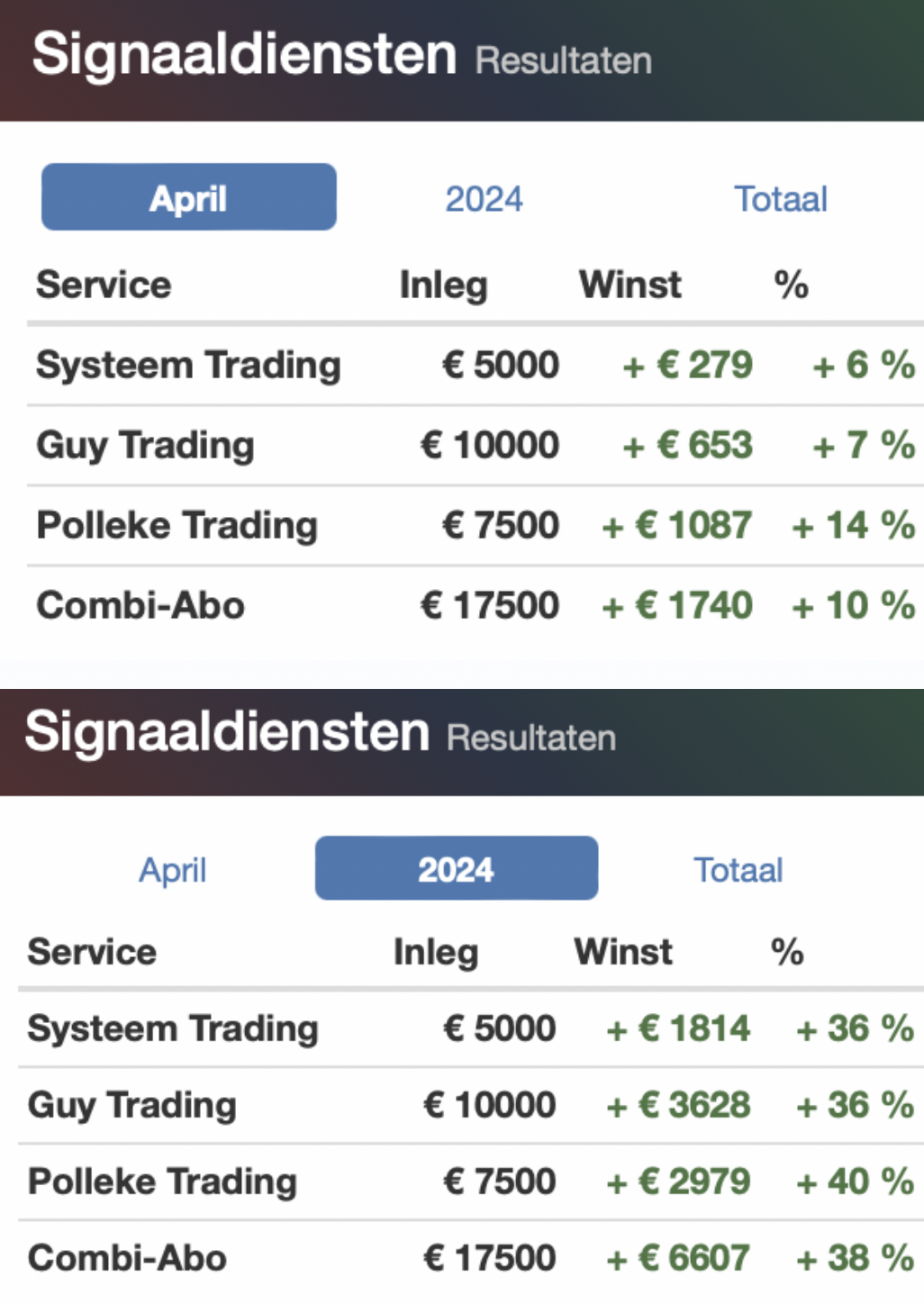

Hieronder ziet u een overzicht van de resultaten dit jaar en deze maand:

Met vriendelijke groet,

Guy Boscart

Markten blijven verdeeld, technologie krijgt het moeilijk

Beste beleggers, beursvolgers ...

De markten blijven verdeeld en moeilijk te voorspellen, gisteren zien we opnieuw divergentie tussen de meer traditionele indices ten opzichte van de technologie. Ook bij de verschillende regio's zien we verschillen, het is maar te zien welke index er meer afhankelijk is van de technologie bedrijven. De AEX moest eerder deze week al fors terug door ASML dat heel zwaar weegt op de index, daarom staat de AEX nu al zo'n 40 punten onder de top. De DAX daarentegen kent ook een mindere periode maar de afgelopen dagen viel de daling dan weer mee. De futures staan vanmorgen over de gehele lijn lager door de reactie van Israël richting Iran, dat doet de markten ook geen goed. We zien de Brent olie zo'n 2% hoger, de 10 jaar rente in de VS zien we rond de 4,58%. De euro komt uit rond de 1,064 dollar. We gaan bekijken of we iets kunnen doen in de loop van de dag, aan de andere kant kunnen we beter het weekend afwachten na wat er vanmorgen gebeurde in het Midden Oosten. We zitten in een moeilijke fase waarbij we vooral moeten opletten. Er komen wel snel opnieuw kansen, zeker in de loop van volgende week ...

Voor wie graag een tijdje één van onze signaaldiensten wil volgen kan nu gebruik maken van onze aanbieding. U kunt dan een abonnement proberen tot 1 JULI 2024. Systeem Trading voor €35, Guy Trading voor €40, Polleke Trading voor €45 en COMBI-Trading voor €75. Kijk nu een tijdje met ons mee en beslis daarna of een signaaldienst bij u past ... Schrijf u in via de link https://www.usmarkets.nl/trade...

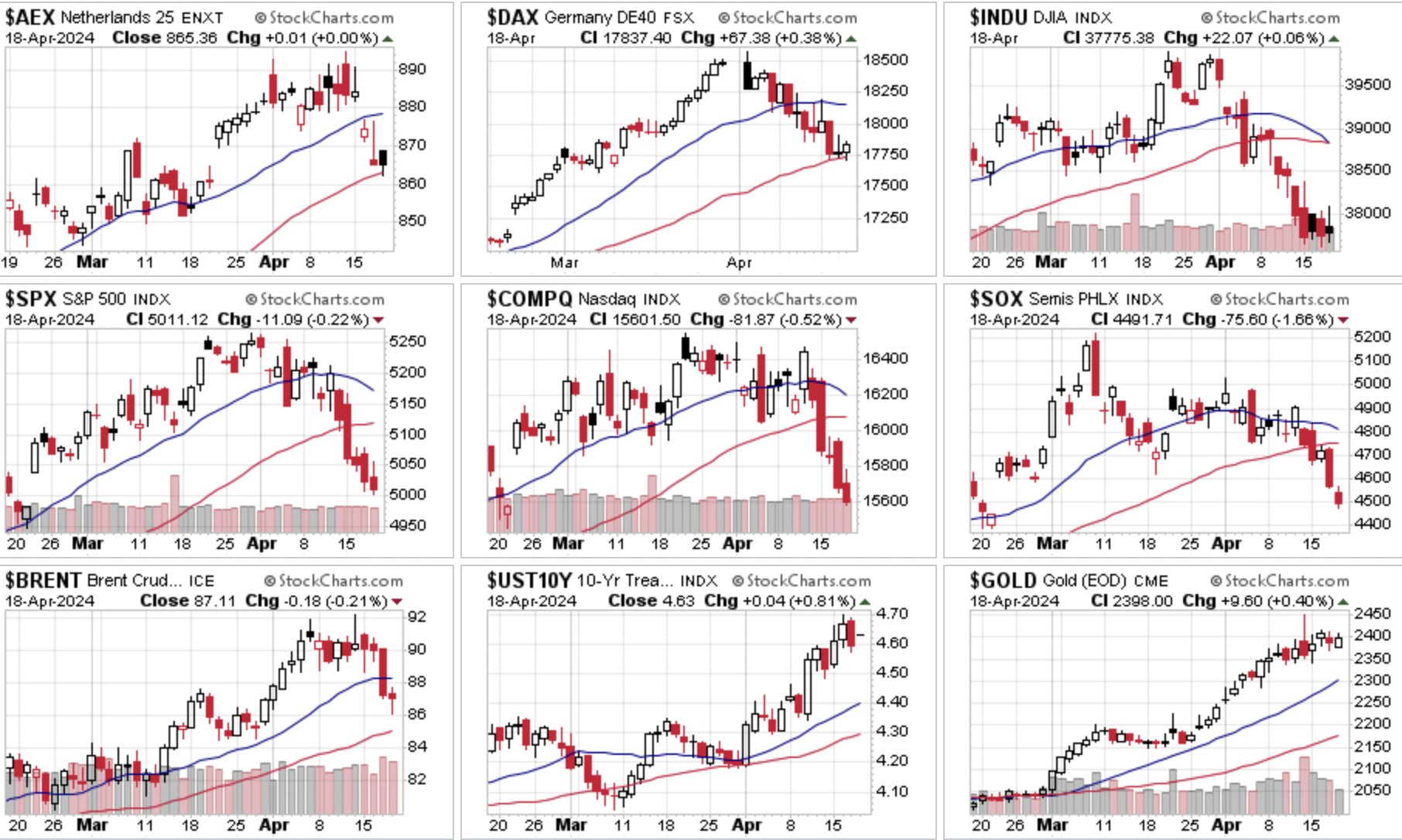

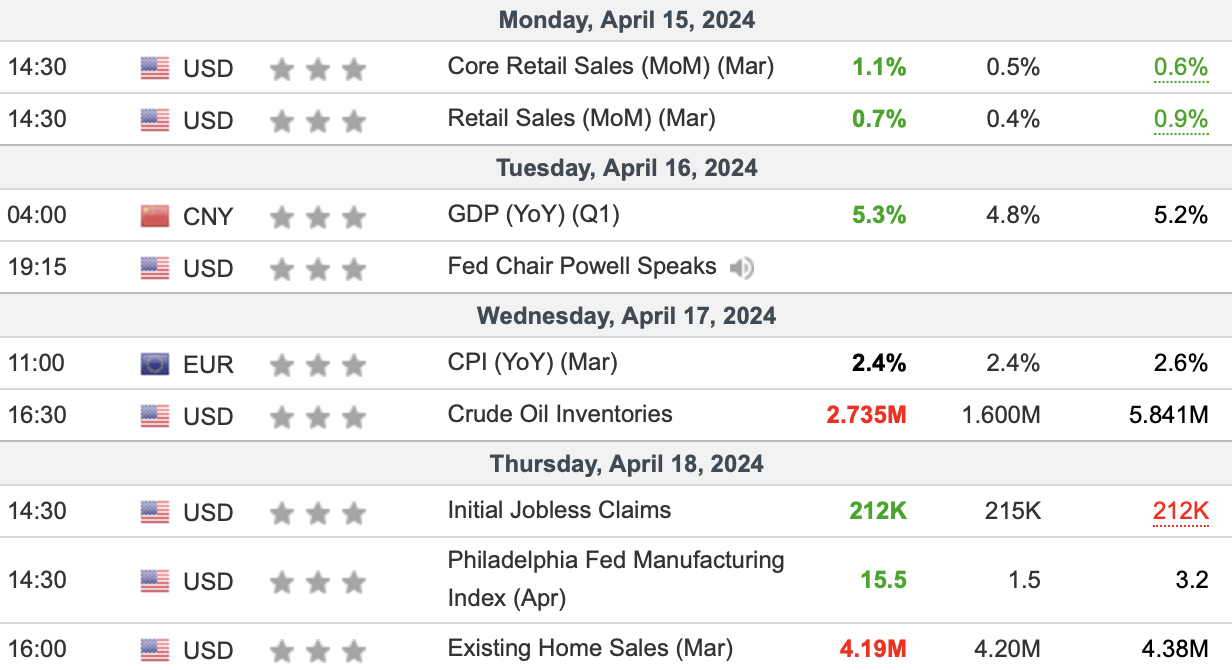

Marktupdate 19 april:

Een wat verdeelde sessie donderdag op Wall Street want de technologie indices verloren opnieuw terwijl de Dow Jones een kleine winst behaalde. De Dow Jones won 0,06% en sluit de sessie af op 37.775 punten maar gedurende de sessie stond de index net als woensdag weer even boven de 38.000 punten. De brede S&P 500 sluit met 0,22% verlies met een slot nog iets dichter bij de 5.000 punten, de index komt nu uit op 5.011 punten wat al zo'n 250 punten onder de top (5.265) van begin april is. De Russel 2000 (small cap index) verloor 0,31%. De Dow Transport index sluit met 0,26% verlies en blijft slecht presteren.

Bij de technologie indices zien we een groter verlies, de Nasdaq sluit 0,52% lager terwijl de Nasdaq 100 met 100 punten verlies de sessie afsloot (-0,57%) om op 17.394 punten uit te komen. Beide indices blijven onder hun 50-daags gemiddelde. De SOX index verloor 1,65%, de chip sector ligt wat onder druk na de cijfers van onder andere ASML.

Via de futures zien we vanmorgen opnieuw lagere koersten bij alle indices, zowel in Europa als op Wall Street staan de futures behoorlijk wat lager door de aanval van Israël op Iran. De situatie in het Midden Oosten blijft een item dat voor volatiliteit zorgt. De Brent olie staat vanmorgen ook 2% hoger daardoor.

Voor de markten krijgen we volgende week de meer belangrijke bedrijven die met cijfers komen, op de agenda staan dan onder andere Microsoft, Alphabet, Amazon, Meta Platforms en AMD.

Hieronder nog wat nieuws samengevat rondom cijfers en de wat meer opvallende feiten.

We zien enkele hoofdpunten:

- Spanningen in het Midden Oosten zorgen ervoor dat de olieprijzen weer oplopen en dat de indexen een lagere opening aangeven via de futures. We moeten de impact van de aanval nog afwachten en vooral de reactie daarop die er mogelijk kan komen door Iran.

- Netflix rapporteerde over de hele linie winst over het 1e kwartaal, met nog eens 9,3 miljoen abonnees erbij. De tegenvallende omzetverwachtingen in het 2e kwartaal zorgden er echter voor dat het aandeel in de nabeurshandel 5% moest inleveren. Het aantal abonnees van 9,3 miljoen overtrof wel de verwachtingen van 4,8 miljoen.

- Netflix dat met cijfers kwam gisteren zal vanaf volgend jaar niet langer lidmaatschapsaantallen rapporteren. Dat was eerder wel zo en was de graadmeter over hoe het bedrijf zich evolueert.

- De S&P 500 daalde voor de vijfde achtereenvolgende sessie.

- Fed-functionarissen hebben de zorgen over een renteverlaging donderdag nog wat aangewakkerd. Raphael Bostic, president van de Fed van Atlanta, herhaalde dat hij niet verwacht dat de Fed de rente voor het einde van het jaar zal verlagen.

- De laatste kwartaalresultaten van TSMC waren gemengd want de Taiwanese chipgigant waarschuwde voor zijn groeivooruitzichten dit jaar buiten zijn geheugenchips activiteiten waardoor het aandeel ruim 5% omlaag moest.

- Het aandeel Tesla daalde opnieuw met 3,5% nadat het bedrijf door Deutsche Bank werd gedegradeerd van Buy naar Hold.

- De president van de New York Fed, John Williams, zei donderdag dat hij geen enkele ‘urgentie’ ziet om de rente te verlagen, en is daarmee de laatste centrale bankfunctionaris die de timing van een versoepeling van het monetaire beleid heeft teruggedraaid.

Europa:

In Europa sluiten de indices donderdag over het algemeen hoger, de AEX maakt wel een pas op de plaats en sluit vlak. De DAX kende wel een redelijke sessie met 67 punten (0,38%) winst en een slot op 17.837 punten. De CAC 40 sluit met 42 punten (0,52%) winst, het slot komt nu uit op 8023 punten. De BEL 20 sluit de sessie af met 0,8% winst.

Economische cijfers deze week:

Signaaldiensten:

We hebben de posities dinsdag met een mooie winst kunnen sluiten, we kijken nu naar een nieuwe instap, mogelijk eerst long om later opnieuw short posities op te nemen. De leden krijgen op tijd bericht, wie nog geen lid is en de posities wil opvolgen kan zich inschrijven via de nieuwe aanbieding hieronder.

Volg ons nu tot 1 JULI vanaf €35, ga naar https://www.usmarkets.nl/trade... en schrijf u snel in zodat u niets hoeft te missen.

Rente 10 jaar VS:

Olieprijs:

Vanmorgen zien we dat de Brent olie rond de 88,75 dollar uitkomt, weerstand nu rond de 90-91 dollar en verder de 92 en de 94 dollar. Steun nu eerst rond de 87,5-88 dollar, later steun rond de 86 dollar. De olie blijft volatiel door de spanningen in het Midden-Oosten.

We handelen via zowel Systeem Trading, Guy Trading en COMBI-Trading op het verloop van de Brent olie.

Indicatie markt voorbeurs:

Vanmorgen geven de futures zowel op Wall Street als in Europa een lagere opening aan door de spanningen in het Midden Oosten. De 10 jaar rente in de VS komt vanmorgen uit rond de 4,57%, de Brent olie komt vanmorgen uit op 88,75 dollar. De euro zien we vanmorgen rond de 1,064 dollar. Het goud komt vanmorgen uit rond de 2.397 dollar, de Bitcoin staat vanmorgen rond de 62.000 dollar.

Analyse AEX:

De belangrijke steun niveaus komen nu uit rond de 865, 860 en rond de 855 punten, later steun rond de 850 en 845 punten.

Weerstand nu rond de 870, 875 en 880-882 punten.

De indicatoren verzwakken nu, de RSI zakt onder de 50 terwijl de MACD richting de 0-lijn daalt. De AEX staat nog net boven het 50-daags gemiddelde (863).

We handelen via onze signaaldiensten vaak op de AEX index. Om de signalen te ontvangen kunt u lid worden. Schrijf u in via de link https://www.usmarkets.nl/tradershop en ontvang onze signalen en updates tot 1 JULI ...

Grafiek AEX:

Analyse Nasdaq 100:

Steun nu rond de 17.350 en 17.250 punten, later steun rond de 17.000 punten. Verder letten we op de 16.850 en 16.750 punten als mogelijke doelen omlaag.

Weerstand nu eerst rond de 17.500, 17.650, 17.750 en rond de 17.985 punten waar het 50-daags gemiddelde uitkomt. Later weerstand rond de 18.150, 18.250 en rond de 18.340 punten (oude top).

De indicatoren verslechteren bij de Nasdaq 100, de RSI zien we rond de 35 terwijl de MACD nu onder de 0-lijn zakt. De Nasdaq sluit voor de 4e sessie op rij onder het 50-daags gemiddelde wat negatief is.

Om mee te doen met onze signalen op de Nasdaq 100 index kunt u nu gebruik maken van onze aanbieding tot 1 JULI. Schrijf u meteen in via onze Tradershop op de website, de link daarvoor is https://www.usmarkets.nl/trade...

Grafiek Nasdaq 100:

Analyse DAX:

Nu de DAX onder de 18.000 punten uitkomt moeten we letten op de 17.745 punten als steun waar nu het 50-daags gemiddelde uitkomt. Verder nog steun rond de 17.600, 17.500 en 17.350 punten.

Weerstand zien we nu rond de 17.850, 18.000, 18.150, 18.250 punten, later weerstand rond de 18.350 en 18.500 punten.

De indicatoren verzwakken, de RSI komt uit onder de 50 terwijl de MACD draait met een verkoopsignaal.

We handelen via onze signaaldiensten vaak op de DAX index. Om de signalen te ontvangen kunt u lid worden. Schrijf u in via de link https://www.usmarkets.nl/tradershop en ontvang onze signalen en updates tot 1 JULI ...

Grafiek DAX:

Analyse Dow Jones:

Weerstand nu rond de 38.000, 38.250 en 38.500 punten. Later weerstand rond de 38.750 punten en rond de 39.000 punten.

Steun nu eerst rond de 37.700 en 37.500 punten, later steun rond de 37.250 en 37.000 punten.

De indicatoren blijven negatief, de RSI komt onder de 50 uit terwijl de MACD onder de 0-lijn zakt. De Dow Jones sluit nu al voor de 7e sessie na elkaar onder het 50-daags gemiddelde dat rond de 38.830 punten uitkomt.

We handelen via onze abonnementen vaak op de Dow Jones index. Om de signalen te ontvangen kunt u lid worden. Schrijf u in via de link https://www.usmarkets.nl/tradershop en ontvang onze signalen en updates tot 1 JULI ...

Grafiek Dow Jones:

Handelen met Turbo's of Boosters op indexen en aandelen?

Voor wie een tijdje een signaaldienst wil volgen dan kunt u nu gebruik maken van de aanbieding. Een abonnement kunt u nu proberen tot 1 JULI 2024, Systeem Trading voor €35, Guy Trading voor €40, Polleke Trading voor €45 en COMBI-Trading kan nu voor €75 !! Kijk vooral even een tijdje met ons mee en beslis daarna of het bij u past ...

Schrijf u in via de link https://www.usmarkets.nl/tradershop en dan staat u snel op onze lijst met leden ...

Resultaat totaal 2024 en maand april (1 januari tot 17 april)

Met vriendelijke groet,

Guy Boscart

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Bestaande Huizenverkopen (mrt.) | Actueel: 4,19M Verwacht: 4,20M Vorige: 4,38M |

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Eerste Aanvragen Werkloosheidsvergoeding | Actueel: 212K Verwacht: 215K Vorige: 212K | ||||

| USA: Philadelphia Fed Productie-index (apr.) | Actueel: 15,5 Verwacht: 1,5 Vorige: 3,2 |