Liveblog Archief maandag 1 maart 2021

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: ISM Productie Inkoopmanagersindex (PMI) (Feb) | Actueel: 60,8 Verwacht: 58,8 Vorige: 58,7 |

Analyse AEX index: Voor de leden ....

Analyse AEX index: De AEX test een stevige steun vandaag, de eerste sessie van maart ofwel een nieuwe maand. Na...

Deze inhoud is alleen beschikbaar voor betalende leden.

Markt snapshot Wall Street 1 maart

TOP NEWS

• Spotlight moves to U.S. Senate as Democrats push $1.9 trillion COVID-19 relief bill

U.S. Democrats are anxious for Congress to pass President Joe Biden's top priority - his $1.9 trillion coronavirus relief bill - in the next two weeks. Their biggest challenge lies just ahead: getting it through a Senate where they have the slimmest of majorities.

• SPECIAL REPORT- Donors bet a U.S. firm could transform disease testing in Africa. Then COVID-19 hit

Donor organizations poured millions of dollars into U.S. firm Cepheid's diagnostic equipment to tackle disease in poor countries. When COVID-19 struck, the system fell apart.

• McKesson begins distribution of Johnson & Johnson's COVID-19 vaccine

McKesson said it had begun distribution of Johnson & Johnson's COVID-19 vaccine.

• China moving 'step by step' in recertifying Boeing 737 MAX

China's aviation regulator said its major safety concerns with the Boeing 737 MAX had to be "properly addressed" before conducting flight tests but it was studying a plan with U.S. planemaker for clearing aircraft to fly.

• AstraZeneca sold out of vaccine maker Moderna last year

AstraZeneca sold a stake it held in rival COVID-19 vaccine maker Moderna over the course of last year, the Anglo-Swedish drugmaker's latest annual report shows.

BEFORE THE BELL

U.S. stock index futures jumped as Johnson & Johnson's newly approved COVID-19 vaccine and progress in a new $1.9 trillion coronavirus relief package boosted investor sentiments of a swift economic recovery. European stocks and Asian equities edged higher on optimism over global COVID-19 vaccination programmes. The dollar rose and gold prices edged up on safe-haven buying. Oil prices advanced on demand recovery hopes.

STOCKS TO WATCH

Results

• Berkshire Hathaway Inc: Warren Buffett's enthusiasm for the future of America and his company Berkshire Hathaway has not been dimmed by the coronavirus pandemic. Buffett used his annual letter to investors to assure he and his successors would be careful stewards of their money at Berkshire, where "the passage of time" and "an inner calm" would help serve them well. Berkshire on Saturday also reported net income of $35.84 billion in the fourth quarter, and $42.52 billion for the year, both reflecting large gains from its stocks. Operating income, which Buffett considers a more accurate measure of performance, fell 9% for the year to $21.92 billion. Berkshire said quarterly operating income rose 14% to $5.02 billion, or approximately $3,252 per Class A share, from $4.42 billion, a year earlier. The stock buybacks have continued in 2021, with Berkshire repurchasing more than $4 billion of its own stock. It ended 2020 with $138.3 billion of cash. However, Buffett bemoaned fixed income as an investment, saying that "bonds are not the place to be these days." The income from a 10-year U.S. Treasury bond fell 94% from a 15.8% yield in September 1981 to 0.93% at the end of 2020.

Deals Of The Day

• AstraZeneca PLC & Moderna Inc: AstraZeneca sold a stake it held in rival COVID-19 vaccine maker Moderna over the course of last year, the Anglo-Swedish drugmaker's latest annual report shows. AstraZeneca did not specify how much it sold the stake for, but said that "a large proportion" of the $1.38 billion it recorded in equity portfolio sales last year came from the Moderna disposal. Moderna last week said it was expecting $18.4 billion in sales from the vaccine this year, putting it on track for its first profit since its founding in 2010. AstraZeneca's stake in Moderna was put at 7.7% by British newspaper The Times. AstraZeneca declined to comment when asked by Reuters about the size of the stake. Moderna shares were up in U.S. premarket trading.

In Other News

• Alphabet Inc & Facebook Inc: Reliance Industries has partnered with Facebook, Google and fintech player Infibeam to set up a national digital payment network, Economic Times newspaper reported on Saturday, citing unnamed sources. Last year, India's central bank invited companies to forge new umbrella entities (NUEs) to create a payments network that would rival the system operated by the National Payments Council of India (NPCI), as it seeks to reduce concentration risks in the space. Citing three unnamed sources, Economic Times said that the group led by Reliance and Infibeam was in the advanced stages of submitting their proposal to the Reserve Bank of India. A spokesperson for Infibeam declined comment on the report, saying the company was bound by the confidentiality of process, while Reliance, Google and Facebook did not immediately respond to a request for comment. Facebook and Google are already partnered with Reliance and own stakes in Jio Platforms - the unit which houses Reliance's music, movie apps and telecoms venture.

• AMC Entertainment Holdings Inc: The theater operator has approved millions in bonuses to its top executives and eligible employees as a means to preserve stockholder value during the COVID-19 pandemic, the company said. In a regulatory filing on Friday, the company said Chief Executive Officer Adam Aron would receive $3.75 million as bonus, while other top executives are entitled to bonuses of $173,000 to $507,000. The move comes at a time when cinema chains like AMC have taken a blow due to coronavirus-led restrictions that caused delays in film releases.

• Amazon.com Inc: President Joe Biden defended workers' rights to form unions and warned against intimidation of workers in a video posted on Twitter on Sunday night, as the company’s employees in Alabama vote on whether to unionize. Biden didn't mention Amazon, but specifically referenced "workers in Alabama" in the video and a tweet introducing it. He said every worker should have a free and fair choice to join a union, and no employer could take that away. "It's your right...So make your voice heard," he said. "There should be no intimidation, no coercion, no threats, no anti-union propaganda. No supervisor should confront employees about their union preferences." A spokeswoman from the Retail, Wholesale & Department Store Union (RWDSU) said there had been many reports of various "various intimidation tactics used by Amazon on this campaign and during the voting period." Amazon did not immediately respond to a request for comment.

• Atmos Energy Corp, NRG Energy, One Gas Inc & Vistra Corp: Retail power marketers in Texas are appealing multi-million dollar bills from last week's blackout that they say could cripple them and unravel Texas' nearly two-decade-old experiment as the most deregulated U.S. electricity market. "The state will likely experience the largest number of failures of retailers ever seen," said Patrick Woodson, chief executive of Green Energy Exchange. "Competition will all but cease to exist." His firm will survive, he said, despite service charges hitting nearly $19 million, up from $37,000. Texas in 2002 deregulated its power system, splitting generation from transmission lines and from retail sales. It spawned 100s of marketers offering fixed, variable and indexed rate plans and fuel choices. Fallout from the outage will accelerate consolidation, experts said. Atmos Energy and One Gas spent over $2 billion each to buy gas as prices hit a record high of nearly $24 per million British thermal units (mmBtu), from $2.30 per mmBtu. The borrowing costs would wind up in consumer bills, analysts said. Consolidation could leave more than 80% of deregulated Texas retail customers with giants Vistra and NRG Energy, consumer advocates and industry executives said. Both have been buying up rivals in recent years.

• Boeing Co: China's aviation regulator said its major safety concerns with the Boeing 737 MAX had to be "properly addressed" before conducting flight tests but it was studying a plan with U.S. planemaker for clearing aircraft to fly. The Civil Aviation Administration of China (CAAC) conducted comprehensive and in-depth technical scrutiny of the Boeing 737 MAX, the agency's vice head Dong Zhiyi said, giving the regulator's stance on the plane which China grounded in early 2019. The CAAC has outlined three principles for the jet to return to service, including certified design changes, proper training for the pilots and specific findings into the crashes. The U.S. Federal Aviation Administration (FAA) lifted its flight ban on the aircraft in January. It was followed by the European Union Aviation Safety Agency (EASA) and several others.

• CAE Inc & L3Harris Technologies Inc: Canada's CAE is nearing a deal to buy L3Harris Technologies military training division for $1.05 billion, The Wall Street Journal reported on Sunday. An agreement on the deal is expected on Monday, unless the talks fall apart, the newspaper said, citing people familiar with the matter. Flight simulator maker CAE will fund the deal by a private placement of roughly $550 million from two institutional investors, the report said. Following the close of the deal, the military training division is expected to be based in Tampa, Florida, according to the newspaper. CAE expects the deal to be accretive to earnings per share and forecasts annual cost savings of about $27.6 million to $35.4 million in the second year following closing, the Journal added.

• Citigroup Inc & Revlon Inc: The bank said it recorded an additional $390 million in operating expenses in the 2020 fourth quarter after a U.S. federal judge ruled it was not entitled to recoup money it mistakenly wired to lenders of last year. As a result, Citigroup revised its fourth-quarter earnings to $1.92 per share down from $2.08, according to a filing. To date, $389.8 million had been repaid to the bank at its request, but some lenders have held on to the funds leading the bank to wage a legal battle against a group of hedge funds to recover the remainder. This month, U.S. District Judge Jesse Furman in Manhattan said the transfers were complete transactions not subject to revocation and declined to force the defendants to return the funds. Citigroup is planning to fight the decision. "I do believe that we have good grounds for an appeal, and we're going to pursue that," Chief Financial Officer Mark Mason said an industry conference. Jane Fraser will take over the reins of the company on Monday.

• Credit Suisse Group AG: The bank said that it has suspended redemptions from its supply chain finance funds. In a note to investors, the asset manager said that "a certain part of the subfunds' assets is currently subject to considerable uncertainties with respect to their accurate valuation", and that as a result it had taken the decision to suspend them. The announcement came hours after the Wall Street Journal reported the Swiss lender was trying to reduce its exposure to supply chain finance firm Greensill Capital. Credit Suisse had sourced supply chain finance notes for several of its supply chain finance funds exclusively from Greensill, but terminated that agreement last year.

• Hyatt Hotels Corp: The hotel chain called symbols of hate "abhorrent" on Sunday after the design of a stage at the Conservative Political Action Conference at one of its hotels drew comparisons to a Norse rune used by Nazis during World War Two. Hyatt said all aspects of conference logistics, including the stage design, were managed by the American Conservative Union, which organized the conference. The comparisons were "outrageous and slanderous," Matt Schlapp, American Conservative Union chair, said in a Twitter post on Saturday. He added the organization had a "long standing commitment to the Jewish community" and that the conference featured several Jewish speakers. In its statement on Sunday, Hyatt said: "We take the concern raised about the prospect of symbols of hate being included in the stage design at CPAC 2021 very seriously as all such symbols are abhorrent and unequivocally counter to our values as a company."

• Johnson & Johnson & McKesson Corp: U.S. drug distributor McKesson said it had begun distribution of Johnson & Johnson's COVID-19 vaccine. McKesson is the partner for the U.S. government's COVID-19 vaccine distribution and the company has established four distribution centers which will be specifically used to distribute the Johnson & Johnson COVID-19 vaccine. The U.S. government makes the administration decisions, including where, when and how many vaccine doses McKesson will distribute, the company said. Initial deliveries of the vaccine should begin on Tuesday, senior Biden administration officials had said on Sunday. A U.S. Centers for Disease Control and Prevention advisory panel voted unanimously on Sunday to recommend Johnson & Johnson's COVID-19 shot for widespread use, and U.S. officials said initial shipments would start on Sunday. "We believe today's recommendation from the CDC to begin use of our vaccine as part of the U.S. national immunization program will add a critical tool in the fight against COVID-19," Paul Stoffels, J&J's chief scientific officer, said in a statement. J&J expects to ship more than 20 million doses by the end of March and 100 million by midyear, enough to vaccinate nearly a third of Americans.

• Logitech International SA: The computer goods maker increased its 2021 guidance and issued a 2022 forecast, saying growth trends in remote work, video collaboration, esports and digital content creation would continue beyond the 2021 boom. Logitech said sales for fiscal 2022, measured in constant currency terms, would be flat to plus or minus 5%. "Several years ago, we set out to become a design company and positioned our business against long-term growth trends in remote work, video collaboration, esports, and digital content creation. These trends have accelerated over the course of the fiscal year and have seen a coming of age for Logitech," Chief Executive Bracken Darrell said in a statement. Operating income for fiscal 2022 is expected to be $750 million to $800 million, the Swiss-U.S. company said, down from the $1.1 billion it now expects for fiscal 2021 and a fraction up from a previous estimate of $1.05 billion. The company also said its expectations of long-term sales growth in constant currency had increased to 8% to 10%, up from high-single digits and its non-GAAP operating margin target had improved to between 14% and 17%, up from 11% to 14%.

• McDonald's Corp: The Chicago-based hamburger chain is exploring selling part of Israeli artificial intelligence startup Dynamic Yield, which it acquired two years ago in an attempt to boost online marketing efforts, the company said on Friday. Dynamic Yield, run as a standalone company within McDonald's, personalises customers' experience by changing offerings on the chain's Drive Thru menu displays, according to time of day, weather, customer traffic and trending choices. "The potential sale of the non-McDonald's part of our business has been discussed from the outset and now feels like the right time to explore that possibility," its chief executive, Liad Agmon, said in a statement. The company said it was considering a sale of only the part of Dynamic Yield that works with other companies with no timeline set for the deal.

• Mizuho Financial Group Inc: Mizuho Bank, the core banking unit of the financial group, said it had restored most cash machine and online banking services after a data glitch closed down around half of its automated teller machines (ATMs) on Sunday. "The problem was caused by a failed data migration for time deposit transactions," the company said in a statement on its website in which it apologised for the disruption. The bank said it would return cards, bank books to customers retained by faulty ATMs.

• Microsoft Corp: Brazilian delivery app Loggi announced a 1.15 billion-real funding round, as the firm seeks to expand its distribution footprint and shorten delivery times amid an e-commerce boom in South America's top economy. The round was led by Sao Paulo-based CapSur Capital, and included current investors Monashees, Softbank Group, GGV, Microsoft and Sunley House, Loggi said in a statement. The company plans to make hundreds of additional hires in 2021 and open seven additional logistics centers throughout the nation, Thibaud Lecuyer, the company's chief financial officer, said in an interview.

• NavSight Holdings Inc: Satellite data company Spire Global said it has agreed to go public through a merger with blank-check acquisition firm NavSight Holdings Inc at a $1.6 billion valuation. Spire said it expects the deal will provide it with up to $475 million in proceeds. NavSight is providing $230 million of this, with the rest coming from a private investment in public equity (PIPE) transaction. Investors in the PIPE include Tiger Global Management, BlackRock and the family office of billionaire Barry Sternlicht.

• Netflix Inc: Drama "Nomadland" and satire "Borat Subsequent Moviefilm" won movie honors at the Golden Globes on Sunday in a mostly virtual bicoastal ceremony that was marked by impassioned calls for more diversity and the dominance of Netflix. Netflix’s period drama "Mank," about "Citizen Kane" screenwriter Herman Mankiewicz, had gone into Sunday's show with a leading six nods but ended the night empty-handed. Nevertheless, the streaming service was the biggest winner on Sunday, with four wins in the movie field and six for television, including best TV drama series "The Crown" and limited series chess saga "The Queen's Gambit."

• Polaris Inc: The motorcycle and all-terrain vehicle maker unveiled plans to launch its first electric vehicle, with an aim to advance the company's position in the electric vehicle market. Polaris said the full-size Ranger, which it is developing in partnership with Zero Motorcycles, will launch in late December. Deliveries of the vehicle will start in early 2022.

• Twitter Inc: Russia's communications regulator accused Twitter of violating Russian law, saying the social media platform had not complied with some of its requests to delete banned content. Roskomnadzor said Twitter had failed to delete 2,862 posts containing material linked to suicide, pornography and drugs since 2017. It could be fined heavily it found guilty of repeatedly failing to delete content deemed illegal under Russian law, it said. The platform is used extensively by Kremlin critic Alexei Navalny and his allies to criticize the authorities and announce new protests. Twitter has been fined in the past for breaching Russia's data laws, but the fines have so far been relatively small. It did not immediately respond to a request for comment.

• Willian Companies Inc: A Delaware judge struck down Williams Cos' "poison pill" that the energy company adopted early last year as a defense against a possible takeover in the wake of a sharp drop in oil prices. The company's poison pill was found to be a disproportionate response to the threat that an activist investor might swoop in when the stock was at a low point during the start of the pandemic, said the judge on Delaware's Court of Chancery. "They have failed to show that this extreme, unprecedented collection of features bears a reasonable relationship to their stated corporate objective," wrote Vice Chancellor Kathaleen McCormick in her ruling. Williams did not respond to a request for comment.

ANALYSIS

One year into pandemic, sky begins to clear over U.S. economy

Despite the U.S. economy's near miss with a depression last year and an ongoing coronavirus pandemic that has brought travel to a virtual halt, Jeff Hurst, the chief executive of vacation rental firm VRBO, sees a boom on the horizon.

ANALYSTS' RECOMMENDATION

• AMC Networks Inc: JPMorgan raises target price to $50 from $20, saying the company beat fourth quarter revenue estimates along with plans to increase its subscriber base through 2021.

• Apache Corp: Truist Securities raises target price to $27 from $22, following the company's better-than-expected fourth quarter earnings and positive growth outlook for the coming quarters.

• Draftkings Inc: Canaccord Genuity raises price target to $80 from $65, noting the company’s strong fourth-quarter results and upbeat 2021 guidance.

• Park Hotels & Resorts Inc: Jefferies raises target price to $26 from $22, citing improving group bookings for the company and a strong deleveraging strategy.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0945 Markit Manufacturing PMI Final for Feb: Prior 58.5

1000 (approx.) Construction spending mm for Jan: Expected 0.8%; Prior 1.0%

1000 ISM Manufacturing PMI for Feb: Expected 58.9; Prior 58.7

1000 ISM Manufacturing Prices Paid for Feb: Expected 80; Prior 82.1

1000 ISM Manufacturing Employment Index for Feb: Expected 53; Prior 52.6

1000 ISM Manufacturing New Orders Index for Feb: Prior 61.1

COMPANIES REPORTING RESULTS

NRG Energy Inc: Expected Q4 earnings of 41 cents per share

Perrigo Company PLC: Expected Q4 earnings of $1.00 per share

Progressive Corp: Expected Q4 earnings of $1.80 per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Acacia Communications Inc: Shareholders Meeting

0800 Clearway Energy Inc: Q4 earnings conference call

0830 Biohaven Pharmaceutical Holding Company Ltd: Q4 earnings conference call

0830 Covetrus Inc: Q4 earnings conference call

0830 DENTSPLY SIRONA Inc: Q4 earnings conference call

0900 NRG Energy Inc: Q4 earnings conference call

1000 Novanta Inc: Q4 earnings conference call

1100 Middleby Corp: Q4 earnings conference call

1630 AppFolio Inc: Q4 earnings conference call

1630 Novavax Inc: Q4 earnings conference call

1630 Sarepta Therapeutics Inc: Q4 earnings conference call

1630 Turning Point Therapeutics Inc: Q4 earnings conference call

1700 C3Ai Inc: Q3 earnings conference call

1700 ChemoCentryx Inc: Q4 earnings conference call

1700 FibroGen Inc: Q4 earnings conference call

1700 Zoom Video Communications Inc: Q4 earnings conference call

2000 Nio Inc: Q4 earnings conference call

EX-DIVIDENDS

Goldman Sachs Group Inc: Amount $1.25

Harley-Davidson Inc: Amount $0.15

Kellogg Co: Amount $0.57

KeyCorp: Amount $0.18

Mckesson Corp: Amount $0.42

Olin Corp: Amount $0.20

Westlake Chemical Corp: Amount $0.27

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| DEU: Duitse Productie Inkoopmanagersindex (PMI) (Feb) | Actueel: 60,7 Verwacht: 60,6 Vorige: 57,1 |

Wake-up call: Herstel op eerste dag nieuwe maand

Goedemorgen

De beurzen gaan op de eerste sessie van de nieuwe maand maart zo te zien goed van start want de futures staan zowel in Europa als op Wall Street goed in de plus. De AEX staat een punt of 7 hoger, de DAX laat 110 pluspunten zien terwijl de Nasdaq future 190 punten hoger staat voorbeurs. Verder zien we de SP future met een plus van 36 punten terwijl de Dow Jones future een 250 punten hogere opening aangeeft en zich dus herpakt van de daling van vrijdag.

Na de slechte week met overal verlies bekeken over de gehele week dus herstel vandaag. De tech aandelen die vorige week zo fors terug moesten nemen nu het voortouw en herstellen, dat begon vrijdag al toen bleek dat de rente in de VS even wat terug moest na de scherpe stijging van de dagen ervoor. Wat we zien blijft FOMO handel ofwel Fear Of Missing Out wat wil zeggen bang zijn om iets te missen. De start van de week is dus sterk, nu maar eens goed kijken waar er zich kansen gaan voordoen vandaag of morgen.

Volgens enkele analisten is de rente- en inflatievrees niet terecht en dan al zeker niet hier in Europa. Mogelijk is dat in de VS wat meer het geval maar ook daar blijft de FED verder gaan met het opkopen van obligaties. Aan de andere kant is de kans groot op teveel geld op de markten waardoor er echt een groot gevaar is voor inflatie, men kan er blind voor worden in deze tijd waar de pandemie alles beheerst en met stijgende inflatie is het zo dat je de rente niet tegen kan houden. Mijn gedacht is dan ook dat we er nog wel een tijdje mee te maken gaan krijgen. Aan de andere kant is een grotere correctie op de beurzen meer dan welkom na de overdrijving die we hebben gezien de afgelopen maanden, ook dat is niet echt logisch en worden er bubbels gevormd.

We zien in ieder geval de nodige volatiliteit terugkeren op de markten al was die er altijd al gedurende het afgelopen jaar. De markten weten altijd wel een item te vinden waarop men kan reageren, de ene keer positief de andere keer negatief. Hieronder een overzicht van de markten en verder nog een overzicht wat betreft trading en een aanbieding om mee te doen met onze signalen tot 1 MEI. Maandag starten we de nieuwe maand maart op ... Dus zorg dat u op tijd erbij bent ...

Technische conditie markt:

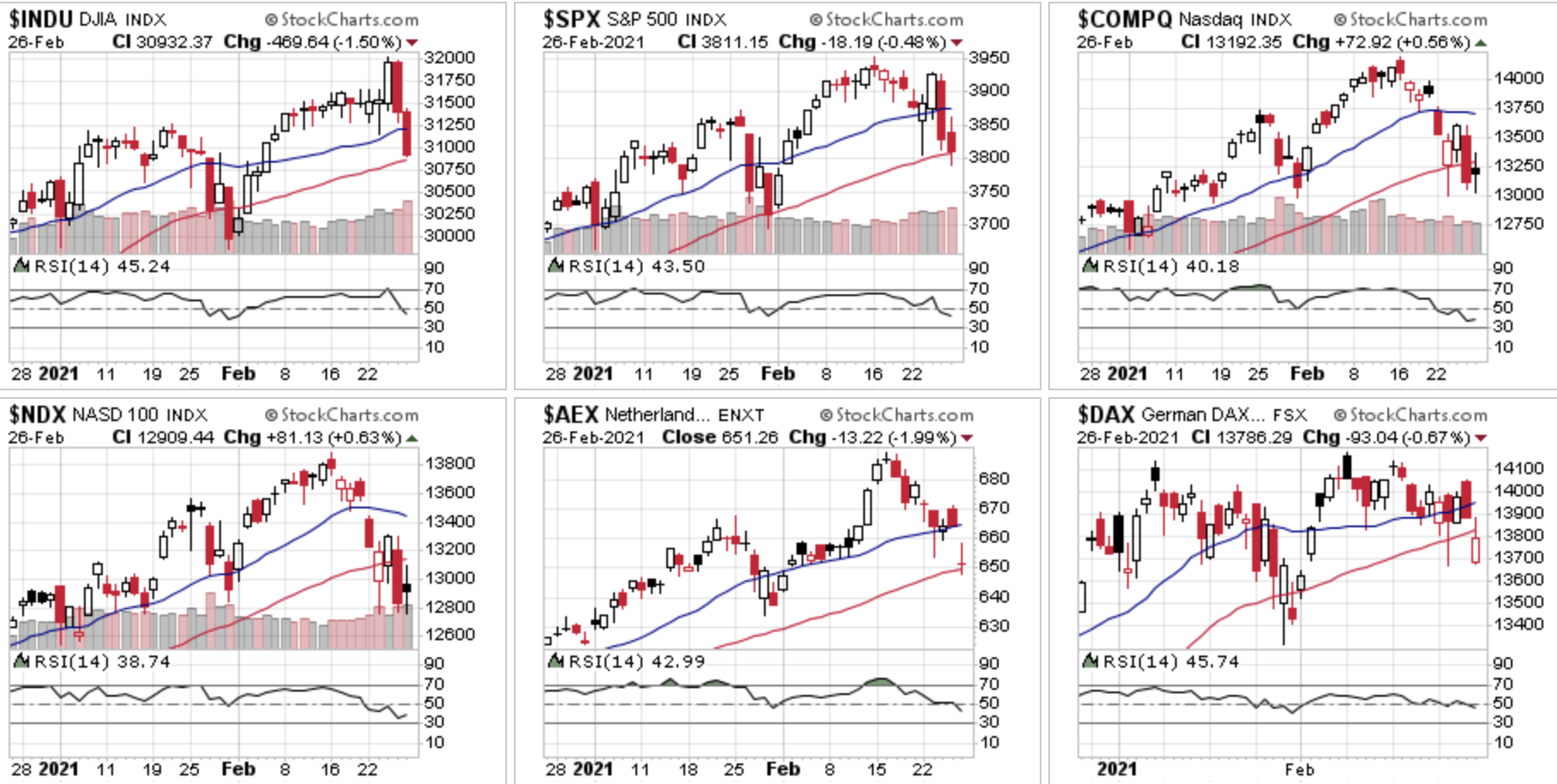

De correctie van vorige week hebben we vooral gezien bij de tech aandelen en dus bij die grote 8 waar ik het steeds over heb. Daardoor viel het in eerste instantie dan ook op dat de correctie niet overal ofwel in de gehele breedte van de markt samen ging want indices met de meer traditionele economie zoals de Dow Jones Industrial en de Dow Transport wisten aan het begin van de week nog dicht bij hun recordstand te blijven hangen en er werd zelfs nog een nieuw record neergezet woensdag.

Toch de markt even goed in de gaten houden de komende dagen, via de charts (grafieken) zien we dat er enkele indices met hun belangrijk MA ofwel 20 en 50 daags gemiddelde aan het vechten zijn. Zo staan alle indices die we volgen al onder hun 20-daags gemiddelde en staan de Dow Jones, de S&P 500 en de AEX exact op hun 50-daags gemiddelde. De Nasdaq en de Nasdaq 100 staan nu onder hun 50-daags gemiddelde en dat voor het eerst sinds begin november vorig jaar.

Vanaf donderdag kwam er dus een opvallende verandering, de Dow Jones wist even tot de 32.000 punten door te stijgen maar donderdag en vrijdag gaan er 1000 punten vanaf. De grote vraag is nu of we hier ergens een bodem gaan vinden of is het zo dat we een tijdje verder moeten inleveren? Opvallend was dat de Dow Jones vrijdag in verder omlaag ging maar dat de Nasdaq en de Nasdaq 100 zich juist weten te herstellen.

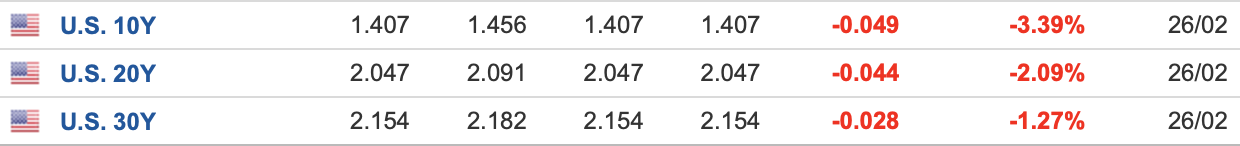

Rente VS:

Dat kan komen door dat de rente vrijdag wat terugviel in de VS, de dagen ervoor was er juist sprake van een forse stijging van de rente. We zijn nu zeker meer dan gewoonlijk benieuwd naar wat er de komende week gaat gebeuren met de rente in de VS. Voor de tech aandelen is het zoals we weten belangrijk dat de rente laag blijft.

Weekoverzicht belangrijke indices:

Op weekbasis toch wat opvallende veranderingen, op Wall Street zien we dat de Dow Jones op weekbasis 572 punten lager sluit (-1,8%), de S&P 500 verloor 95 punten (-2,45%). De Nasdaq 100 verloor dan weer 671 punten (-4,95%) terwijl de Nasdaq Composite 682 punten lager sluit (-4,9%), de Semi conductor index (SOX) verloor 156 punten (-4,8%) terwijl de Dow Transport 57 punten winst boekt (+0,4%).

In Europa zien we de AEX 27 punten verliezen (-4%) terwijl de DAX in Duitsland met 207 punten terug moet (-1,5%) op weekbasis en het wat dat betreft beter doet dan de AEX. De CAC 40 (Frankrijk) doet het zelfs nog wat beter met een 70 punten verlies (-1,2%). Het werd hoe dan ook een volatiel weekje op alle markten en zeker binnen bepaalde sectoren.

Eind vorige week wat enkele posities goed kunnen sluiten:

De maand februari en dit jaar verlopen naar wens, nu al voor de 3e maand op rij werd er winst behaald zodat het jaar 2021 tot nu toe goed verloopt (december was ook al goed). De markt blijft wel moeilijk en uitdagend zodat ik voorzichtig moet blijven, dat wil zeggen handelen met kleine posities en niet teveel posities gelijktijdig. Het is momenteel niet de bedoeling om teveel risico te nemen, we moeten de markt zo rustig mogelijk zien te benaderen en vooral kalm blijven.

De LIVEBLOG en. Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

Euro, olie en goud:

De euro zien we nu rond de 1.209 dollar, de prijs van een vat Brent olie komt uit op 65,55 dollar terwijl een troy ounce goud nu op 1753 dollar staat.

Inter Market overzicht op slotbasis ...

Wordt nu lid tot 1 MEI voor €39 (nieuwe aanbieding):

Blijven schakelen tussen long en short blijft belangrijk de komende weken. Ook de komende maand (maart) krijgen we genoeg kansen. Doe nu in ieder geval mee met de proef aanbieding voor nieuwe leden, die loopt tot 1 MEI en dat met een mooie korting !! ... €39 tot 1 MEI 2021 ... en voor Polleke €49 tot 1 MEI 2021 !!!

Schrijf u in voor Systeem Trading (€39 tot 1 MEI)

Schrijf u in voor Index Trading (€39 tot 1 MEI)

Schrijf u in voor Guy Trading (€39 tot 1 MEI)

Schrijf u in voor Polleke Trading (€49 tot 1 MEI)

Schrijf u in voor de Aandelen portefeuille (€30 tot 1 MEI)

Schrijf u in voor COMBI TRADING (€79 tot 1 MEI)

Hieronder het resultaat maand februari (2021) ...

Hieronder het resultaat tot nu toe dit jaar (2021) ...

Met vriendelijke groet,

Guy Boscart

TA - Verkoopdruk bij (Big) Tech

Het zal u waarschijnlijk niet ontgaan zijn, vooral de Tech sector had het de afgelopen handelsdagen zwaar. Binnen 8 dagen verloor de NASDAQ zo’n 1000 punten, oftewel een daling van 7%. De hamvraag, een gezonde correctie of is er meer aan de hand? We lopen even langs een aantal Big Tech aandelen…

Lees verder »Markt snapshot Europa 1 maart

GLOBAL TOP NEWS

Iran on Sunday ruled out holding an informal meeting with the United States and other major powers to discuss ways to salvage the unravelling 2015 nuclear deal, insisting Washington must first lift all its unilateral sanctions.

A U.S. Centers for Disease Control and Prevention advisory panel voted unanimously on Sunday to recommendJohnson & Johnson's COVID-19 shot for widespread use, and U.S. officials said initial shipments would start on Sunday.

Protesters marched in Myanmar in defiance of a crackdown by security forces that killed at least 18 people a day earlier, as calls grew for a more united international response after the worst violence since a coup one month ago.

EUROPEAN COMPANY NEWS

AstraZeneca has sold its 7.7% stake in Moderna for more than $1 billion after the U.S. biotechnology company's shares soared on the back of its coronavirus vaccine breakthrough, The Times reported.

Credit Suisse is exploring ways to reduce ties to Greensill Capital over concerns about the finance company's exposure to a single client, U.K.-based steel magnate Sanjeev Gupta, The Wall Street Journal reported on Sunday.

British insurer Aviva plans to become a net zero carbon emissions company by 2040, it said, claiming this was the most demanding target set by any major insurer worldwide.

TODAY'S COMPANY ANNOUNCEMENTS

Acerinox SA FY 2020 Earnings Call

AFH Financial Group PLC Shareholders Meeting

Aggreko PLC FY 2020 Earnings Call

Atlantica Sustainable Infrastructure PLC Q4 2020 Earnings Call

Bank of Ireland Group PLC FY 2020 Earnings Release

Driver Group PLC Annual Shareholders Meeting

Eurofins Scientific SE FY 2020 Earnings Call

Ferroglobe PLC Q4 2020 Earnings Release

Orsted A/S Annual Shareholders Meeting

Perrigo Company PLC Q4 2020 Earnings Call

PostNL NV Q4 2020 Earnings Release

q.beyond AG FY 2020 Earnings Call

Talktalk Telecom Group PLC Shareholders Meeting

Torm PLC FY 2020 Earnings Call

ECONOMIC EVENTS (All times GMT)

0730 Switzerland Retail Sales yy for Jan: Prior 4.7%

0730 (approx.) Sweden PMI Manufacturing Sector for Feb: Prior 62.4

0800 (approx.) Austria Unemployment for Feb: Prior 468,300

0800 (approx.) Austria Unemployment Rate for Feb: Prior 11.4%

0815 Spain Manufacturing PMI for Feb: Expected 52.0; Prior 49.3

0830 Switzerland Manufacturing PMI for Feb: Expected 60.0; Prior 59.4

0845 Italy Markit/IHS Manufacturing PMI for Feb: Expected 57.0; Prior 55.1

0850 France Markit Manufacturing PMI for Feb: Expected 55.0; Prior 55.0

0855 Germany Markit/BME Manufacturing PMI for Feb: Expected 60.6; Prior 60.6

0900 Euro Zone Markit Manufacturing Final PMI for Feb: Expected 57.7; Prior 57.7

0930 (approx.) United Kingdom BOE Consumer Credit for Jan: Expected -1.900 bln GBP; Prior -0.965 bln GBP

0930 (approx.) United Kingdom Mortgage Lending for Jan: Prior 5.586 bln GBP

0930 (approx.) United Kingdom Mortgage Approvals for Jan: Expected 96,000; Prior 103,381

0930 (approx.) United Kingdom M4 Money Supply for Jan: Prior 0.7%

0930 (approx.) United Kingdom for Broad Money for Jan: Prior 2,819,010 mln GBP

0930 United Kingdom Markit/CIPS Manufacturing PMI Final for Feb: Expected 54.9; Prior 54.9

1000 Italy Consumer Price Prelim mm for Feb: Prior 0.7%

1000 Italy Consumer Price Prelim yy for Feb: Prior 0.4%

1000 Italy CPI (EU Norm) Prelim mm for Feb: Expected -0.5%; Prior -0.9%

1000 Italy CPI (EU Norm) Prelim yy for Feb: Expected 0.6%; Prior 0.7%

1000 (approx.) Italy CPI NSA for Feb: Prior 103.3

1300 (approx.) Germany CPI Prelim mm for Feb: Expected 0.5%; Prior 0.8%

1300 (approx.) Germany CPI Prelim yy for Feb: Expected 1.2%; Prior 1.0%

1300 (approx.) Germany HICP Prelim mm for Feb: Expected 0.5%; Prior 1.4%

1300 (approx.) Germany HICP Prelim yy for Feb: Expected 1.6%; Prior 1.6%

1400 Belgium GDP qq Revised SA for Q4: Prior 0.2%