Liveblog Archief maandag 15 juni 2020

De Dow wel een forse draai vandaag maar er is technisch niet zoveel anders, de dalende beweging onder het 200-MA werd ingezet en de index staat er nog onder nu. Wel veel voor en nabeurs geweld, moeilijk te begrijpen waar het vandaan komt maar het is wel een waarneming ...

Je kan je inschrijven bij de fed om press releases, ik had dit al gekregen kort in de namiddag- dus voor 17h

Je kan je inschrijven bij de fed om press releases, ik had dit al gekregen kort in de namiddag- dus voor 17h

https://outlook.live.com/mail/0/inbox/id/AQQkADAwATM3ZmYAZS0wNGU2LTdmNGUtMDACLTAwCgAQAPo%2F%2BY7CYDFAmi66ZDz32Lg%3D?RpsCsrfState=fe0dd80f-a64d-80aa-54c3-af0726a02d83&wa=wsignin1.0

https://outlook.live.com/mail/0/inbox/id/AQQkADAwATM3ZmYAZS0wNGU2LTdmNGUtMDACLTAwCgAQAPo%2F%2BY7CYDFAmi66ZDz32Lg%3D?RpsCsrfState=fe0dd80f-a64d-80aa-54c3-af0726a02d83&wa=wsignin1.0

vannacht terug alles hoger, fed start opkopen obligaties

vannacht terug alles hoger, fed start opkopen obligaties

https://www.cnbc.com/2020/06/15/dollar-crash-is-almost-inevitable-asia-expert-stephen-roach-warns.html

https://www.cnbc.com/2020/06/15/dollar-crash-is-almost-inevitable-asia-expert-stephen-roach-warns.html

Markt draait snel na slechte start van de dag

Je kijkt ernaar en je ziet het stevig draaien op Wall Street, dat zet meteen de indices in Europa de andere kant op waardoor de DAX al even in de plus terecht kwam. Toch een 3% draai wat betreft de DAX, de AEX kan nog niet naar groen maar het scheelt ook niet zoveel meer. Vanmorgen stonden de DAX en de AEX nog diep in het rood. Hoe de dag zal evolueren op Wall Street moeten we afwachten, dat het volatiel zal blijven lijkt een feit.

Ik kijk ook naar de standen van vrijdag, en vooral ook die van afgelopen donderdag, ik zie trouwens wel lagere bodems op de grafiek en dat zowel bij de Dow, de S&P 500 en de beide Nasdaq indices ... De grote 5 doen trouwens een keer niet mee vandaag, alleen Facebook sleept er een mini plusje uit terwijl Amazon, Apple, Microsoft en Alphabet op verlies staan. Normaal gezien zal het moeilijk worden om de Nasdaq positief te krijgen zonder die grote 5 ...

Tot straks ... Guy

Markt snapshot Wall Street

TOP NEWS

• Chinese capital reinstates curbs as coronavirus resurfaces

Several districts of the Chinese capital put up security checkpoints, closed schools and ordered people to be tested for the coronavirus after an unexpected spike of cases linked to the biggest wholesale food market in Asia.

• China's factory output perks up but consumers stay cautious

China's factories stepped up production for a second straight month in May, as the country shook off the economic torpor of the coronavirus, although the weaker-than-expected gain suggested the recovery remained fragile.

• BP cuts up to $17.5 billion from assets' value with bleaker oil outlook

BP will write off up to $17.5 billion from the value of its assets after cutting its long-term oil and gas price forecasts, betting the COVID-19 crisis will cast a lasting chill on energy demand and accelerate a shift away from fossil fuels.

• Nokia adds Broadcom as third 5G chip vendor to diversify supply

Finland's Nokia said it had partnered with Broadcom to develop chips for 5G equipment in its third such deal following ones with Intel and Marvell.

• U.S. to unveil voluntary self-driving testing data-sharing effort

U.S. auto safety regulators will unveil a voluntary effort to collect and make available nationwide data on existing autonomous vehicle testing.

BEFORE THE BELL

Worries over a second wave of COVID-19 infections sent jitters across markets putting U.S. stock futures, global shares and oil under pressure. Against a basket of currencies, the dollar pared gains. Despite the risk-off mood, the safe-haven Japanese yen did not strengthen significantly versus the dollar. Gold prices slipped.

STOCKS TO WATCH

• Alphabet Inc (GOOGL). Google and the National Football League have joined a growing list of U.S. private sector organizations choosing to commemorate June 19th, the date marking the emancipation of the last remaining slaves at the end of the U.S. Civil War. Google, a unit of Alphabet, has instructed employees to cancel unnecessary meetings on "Juneteenth," according to a staff memo seen by Reuters.

• American Express Co (AXP). China's central bank has given the final nod to a network clearing license for an American Express joint venture, allowing it to be the first foreign credit card company to launch onshore operations in China. The People's Bank of China (PBOC) said in a statement Saturday that it had approved the license for Express (Hangzhou) Technology Services, a joint venture between American Express and LianLian DigiTech. It said the move reflected China's continued opening up of its financial industry. In a statement, American Express said it expects to begin processing transactions later this year.

• AstraZeneca Plc (AZN). A deal between the company and France over potential COVID-19 vaccines involves doses being split between countries on a pro-rata basis based on population, a source at the French President's office said. The British drugmaker signed a contract with European governments at the weekend to supply the region with up to 400 million doses of its potential vaccine. It was the first contract signed by Europe's Inclusive Vaccines Alliance (IVA), a group formed by France, Germany, Italy and the Netherlands to secure vaccine doses for all member states as soon as possible.

• BP Plc (BP). The company will write off up to $17.5 billion from the value of its assets after cutting its long-term oil and gas price forecasts, betting the COVID-19 crisis will cast a lasting chill on energy demand and accelerate a shift away from fossil fuels. The British oil major is set to take a big hit to revenue from an unprecedented collapse in oil demand due to the pandemic. The impairments are set to raise its debt burden sharply and increase pressure to reduce its dividend. BP lowered its benchmark Brent oil price forecasts to an average of $55 a barrel until 2050, down by around 30% from previous assumptions of $70.

• Eli Lilly and Co (LLY). The company said it was launching a study of its rheumatoid arthritis drug baricitinib in patients hospitalized for COVID-19. The trial is one of several efforts by the U.S. drugmaker to help combat the coronavirus pandemic, which has killed more than 400,000 people globally, according to a Reuters tally. The drug is being tested to see if it can reduce deaths from the COVID-19 illness and lessen its severity. Scientists at Lilly believe that baricitinib could help suppress a potentially lethal immune response to COVID-19 called "cytokine storm" and reduce COVID-19's ability to reproduce in infected cells.

• Facebook Inc (FB). The company fired an employee who had criticized Chief Executive Mark Zuckerberg's decision not to take action against inflammatory posts by U.S. President Donald Trump this month, citing his tweet challenging a colleague's silence on the issue. Brandon Dail, a user interface engineer in Seattle, wrote on Twitter that he was dismissed for publicly scolding a colleague who had refused to include a statement of support for the Black Lives Matter movement on developer documents he was publishing. "Intentionally not making a statement is already political," Dail wrote in the tweet, sent on June 2. He said on Friday that he stood by what he wrote. Facebook confirmed Dail's characterization of his dismissal, but declined to provide additional information. The company said during the walkout that participating employees would not face retaliation.

• Honda Motor Co Ltd (HMC). An explosion was reported at the company’s plant in central Japan, police said on Sunday, with two workers sent to the hospital with burns. The explosion at a switchboard occurred at around 9:15 am local time in Honda's plant in Suzuka city, Mie prefecture, an officer with the prefectural police said. Two workers in their 20s, who were checking the switchboard, were injured and sent to be treated, the officer said. The company is investigating, a spokesman said.

• NetEase Inc (NTES). The Chinese gaming giant announced a strategic partnership with Warner Bros Interactive Entertainment to develop a new "Lord of the Rings" mobile game, bolstering its pipeline following its secondary listing in Hong Kong. The new officially licensed strategy game, "The Lord of the Rings: Rise to War", is based on the hugely popular trilogy of books by J.R.R. Tolkien, NetEase said in a statement.

• Nokia Oyj (NOK) & Broadcom Inc (AVGO). Nokia said it had partnered with Broadcom to develop chips for 5G equipment in its third such deal following ones with Intel and Marvell. Nokia initially chose a type of chip -- Field Programmable Gate Arrays (FPGAs) -- for its 5G equipment that customers could reprogramme but high costs and supply hurdles last year forced it to change course. "We still stand by the decision of going with FPGAs because it was the right thing to do at that time," Sandro Tavares, Nokia's head of mobile networks marketing, told Reuters.

• Pilgrim's Pride Corp (PPC). The company’s CEO Jayson Penn began a paid leave of absence following his indictment earlier this month on charges of seeking to set a fixed price for chickens with other industry executives, the company said Sunday. Pilgrim's Pride's board of directors appointed chief financial officer Fabio Sandri as interim president and chief executive of the company, which is mostly owned by Brazilian meat packer JBS. The charges against Penn and three others in the industry are the first in a criminal probe of price-fixing and bid-rigging involving broiler birds, which account for most chicken meat sold in the United States.

• Tesla Inc (TSLA). The electric vehicle maker's China car registrations in May jumped 150% month on month, data from auto consultancy LMC Automotive showed. Tesla's China registrations, including imported cars, grew to 11,565 in May from 4,633 units in April. Data from China Passenger Car Association shows sales of Tesla's Shanghai-made Model 3 sedan hit 11,095 units.

• Twitter Inc (TWTR). The company said it had restored the account of financial market website Zero Hedge on its platform on Friday after concluding that suspending it was an error. In February Twitter banned Zero Hedge after it published an article linking a Chinese scientist to the coronavirus outbreak. "We made an error in our enforcement action in this case. Based on additional context from the account holder in appeal, we have reinstated the account," Twitter said in a statement. It gave no further detail and did not say what additional context it had received.

• Unilever Plc (UL). The company said it will invest 1 billion euros in a fund to invest in climate change projects and reduce to net zero greenhouse gas emissions from all its products by 2039, 11 years ahead of the Paris Agreement deadline. The fund will invest in projects including reforestation, water preservation and carbon sequestration over the next ten years, it said. The net zero emission target is an extension of efforts already underway to cut emissions within the company by 2030 - such as reducing electricity consumption within offices. Unilever's total greenhouse gas footprint was around 60 million tonnes of carbon dioxide equivalent in 2019 according to its website.

• VF Corp (VFC). The apparel maker is eyeing further acquisitions despite coronavirus uncertainty, saying it could be a good time to expand its collection, the Financial Times reported on Sunday. "In times like this, some of the greatest returns could be generated through acquiring," the newspaper quoted chief executive officer and chairman, Steve Rendle, as saying. Rendle said he saw potential opportunities to buy smaller rivals in subsectors including athleisure, outdoor and activewear, FT added.

• Walt Disney Co (DIS). Hong Kong's Disneyland theme park said it will reopen on June 18 to a reduced number of visitors and with enhanced health measures after the coronavirus outbreak forced it to close in late January. The majority of the park's shopping and dining locations will restart operations with "controlled capacity," while social distancing measures will be implemented in queues, restaurants and other facilities. Hotel services will also resume gradually. Disinfection will be carried out more frequently and hand sanitizers will be made available for visitors, who will be required to go through temperature screening and wear a face mask. A health declaration will be required as part of the reservation process.

COLUMN

U.S. gasoline consumption rebounds, jet stays depressed

U.S. petroleum consumption is rebounding strongly, led by gasoline, as stay-at-home orders are lifted, but recovery in diesel has been erratic, and there is no sign of a return in jet fuel use yet.

ANALYSTS' RECOMMENDATION

• Fox Corp (FOXA). Evercore ISI raises price target to $32 from $29, believing advertising trends have largely improved sequentially in both May and June following a soft April.

• Intel Corp (INTC). KeyBanc raises rating to overweight from sector weight, saying the company is aggressively tackling new markets; quickly launching products on 10nm; and unifying chips, software, and developers.

• Selectquote Inc (SLQT). Jefferies initiates coverage with hold rating, saying the company’s insurance broker model is well positioned to benefit from attractive Medicare Advantage market growth and a shift in senior purchasing behavior to the telephonic channel.

• Shopify Inc (SHOP). Piper Sandler raises rating to overweight from neutral, citing accelerating trends in April and May coupled with increasing conviction that digital commerce penetration rates could double or even triple in a post CV-19 world by 2030.

• Twilio Inc (TWLO). Piper Sandler raises rating to overweight from neutral, based on accelerating digital adoption trends in April and May across retail, healthcare, education, communications, and media.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0830 NY Fed Manufacturing for Jun: Expected -27.50; Prior -48.50

COMPANIES REPORTING RESULTS

No major S&P 500 companies are scheduled to report for the day.

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Howmet Aerospace Inc (HWM). Annual Shareholders Meeting

0830 Dicerna Pharmaceuticals Inc (DRNA). Annual Shareholders Meeting

0830 Exlservice Holdings Inc (EXLS). Annual Shareholders Meeting

0900 Equitrans Midstream Corp (ETRN). Shareholders Meeting

0900 Tri-Continental Corp (TY). Annual Shareholders Meeting

0930 EQM Midstream Partners LP (EQM). Shareholders Meeting

1000 Supernus Pharmaceuticals Inc (SUPN). Annual Shareholders Meeting

1130 Karuna Therapeutics Inc (KRTX). Annual Shareholders Meeting

1130 Turning Point Therapeutics Inc (TPTX). Annual Shareholders Meeting

1630 10X Genomics Inc (TXG). Annual Shareholders Meeting

1630 Medifast Inc (MED). Annual Shareholders Meeting

EX-DIVIDENDS

Amphenol Corp (APH). Amount $0.25

Ares Management Corp (ARES). Amount $0.40

Ecolab Inc (ECL). Amount $0.47

El Paso Electric Co (EE). Amount $0.41

Fidelity National Financial Inc (FNF). Amount $0.33

First Financial Bankshares Inc (FFIN). Amount $0.13

Hillenbrand Inc (HI). Amount $0.21

Horace Mann Educators Corp (HMN). Amount $0.30

Intercontinental Exchange Inc (ICE). Amount $0.30

Legg Mason Inc (LM). Amount $0.40

Marten Transport Ltd (MRTN). Amount $0.04

New Jersey Resources Corp (NJR). Amount $0.31

Prologis Inc (PLD). Amount $0.58

Rayonier Inc (RYN). Amount $0.27

Renasant Corp (RNST). Amount $0.22

Telephone and Data Systems Inc (TDS). Amount $0.17

Vistra Energy Corp (VST). Amount $0.13

Western Union Co (WU). Amount $0.22

Coaching, signalen deze week nu een mooie aanbieding

Beste beleggers,

De afgelopen week toch wat leuke zaken kunnen doen, er werden wat shorts gekocht en die kon ik vrijdag met een mooie winst sluiten, dat brengt juni nog niet op winst maar we komen meteen een grote stap dichterbij nu. De bedoeling is om in de 2e helft van de maand nog wat posities uit te zoeken en ik denk dat er deze week wel een signaal komt. Veel indices zouden wel eens een lagere top kunnen maken, dat zie ik vooral bij de AEX, de DAX, de Dow Jones en bij de S&P 500. Ook andere en dan sector indices zouden de draai al zijn ingezet wel blijft de Nasdaq ofwel de technologie aandelen een belangrijke graadmeter, vooral de TOP 5 houden we goed in de gaten.

Ik doe in ieder geval rustig verder, zal met kleine posities blijven werken door de volatiliteit die hoog blijft en waar nodig zal ik op tijd winst of de stop nemen. De komende week dus kansen, ik zal de leden goed proberen te begeleiden tijdens de komende fase ...

Meedoen tot 1 augustus kan nu voor €39 ...

Schrijf u meteen in via de link https://www.usmarkets.nl/tradershop

Dan staat u morgen al op de lijst en kunt u de posities die ik verstuur meteen opnemen.

Met vriendelijke groet,

Guy Boscart

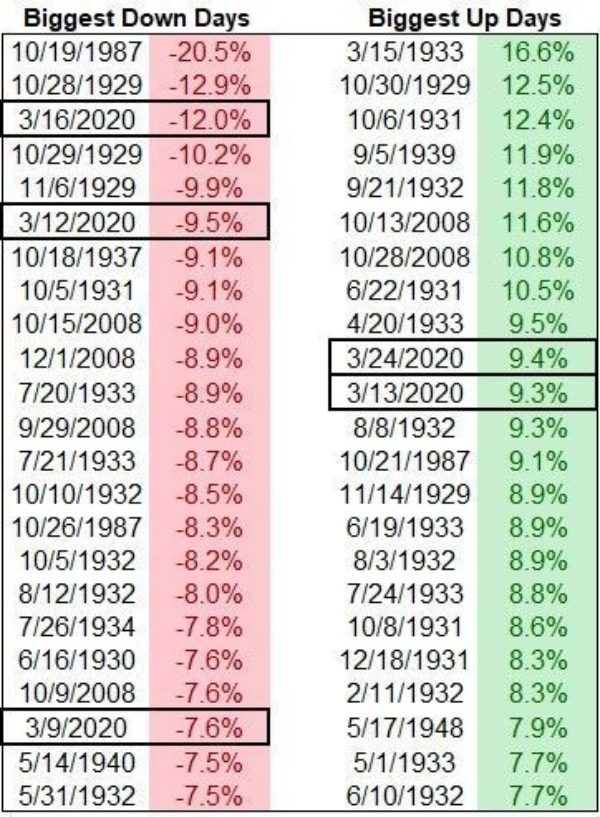

2020 zullen we nooit vergeten en we moeten nog een half jaar ... Zie de tabel met grootste plus en grootste min dagen ... Er zitten er maar liefst 5 tussen en afgelopen donderdag valt er net buiten (negatief) ... Er komen nog genoeg kansen, doen mee https://www.usmarkets.nl/tradershop voor €39 tot 1 augustus ...

TA een greep uit de AEX

Het is maandag, het begin van een nieuwe week en om de reis niet te vermoeiend te maken op de eerste werkdag van de week blijf ik dichtbij huis met een greep uit de AEX. Vier aandelen die onderdeel uitmaken van de AEX en wel Aalberts, KPN, Unilever en Vopak. Ik bespreek ze vandaag op alfabetische…

Lees verder »TA - Big oil

Vandaag bekijken we ‘Big Oil’ oftewel de grootste bedrijven binnen de gas/olie sector. Onder andere Royal Dutch Shell, Exxon Mobil, Chevron, ENI, BP en Total horen thuis in deze categorie, ze worden ook wel de ‘supermajors’ genoemd. Vandaag bespreken we de eerste drie uit het…

Lees verder »Wake-up call: Futures zakken fors, op weg naar bodemzone?

Goedemorgen

De futures zakken fors weg vanmorgen, zo te zien lijkt de Dow Jones weer onderweg om een 1000-klapper te maken vandaag, tenminste als we naar de indicaties voorbeurs kijken ... Verder wil de DAX ook omlaag net als de AEX die straks slecht de week zal starten. Zou het dan toch na die weken van voorspoed met bij de Nasdaq zelfs een nieuwe All Time High vorige week over en uit zijn? De kans daarop blijft want de markt had maar weinig redenen om zo ver door te schieten vorige week.

Goed, vandaag lager maar we weten hoe het kan lopen in deze markt, alles gaat snel en soms heel snel en dan ook nog in beide richtingen. Als ik naar de standen kijk vanmorgen dan zie ik dat de Dow Jones al zo'n 3000 punten lager staat dan vorige week toen de top werd gemaakt rond de 27.600 punten. Dat is een behoorlijke daling en die kunnen we snel gaan kwalificeren als het begin van een nieuwe CRASH, die gaf ik al aan de afgelopen 2 weken, je weet wel CRASH#2 in 2020 want dit jaar is echt een heel bijzonder jaar op de beurzen. We moeten het allemaal nog zien maar het gaat alle kanten op momenteel, wat een half jaar en met wat een geweld.

Vrijdag heb ik achteraf bekeken de shorts mogelijk te vroeg gesloten, aan de andere kant liep de markt zo snel en zo fors op dat ik weinig keuze had. Het enige wat ik mogelijk niet goed deed was om later op de dag opnieuw in te stappen maar door dat het weekend voor de deur stond besloot ik in ieder geval te wachten tot vandaag om wat nieuws uit te zoeken. Nu wordt het moeilijk want je kunt niet op deze standen nog instappen door dat je snel enkele procenten verkeerd kunt zitten. Dan zou je zeggen, ga long, maar ook dat is gevaarlijk op dit moment nu de markt aan het wegzakken is. Opletten dus, stap voor stap bekijken en vorige week gaf ik al aan dat ik voorzichtig moet blijven juist door dat je ook met kleine posities snel verkeerd kunt zitten. Dus vandaag kijk ik rustig aan wat er voorbij komt en waar het eventueel kan zal ik wat doen.

Nu dus geen posities die open staan, er komen wel kansen de komende dagen en die probeer ik te pakken, let wel dat het zowel LONG als SHORT kan worden, dat hangt af van hoe de markt zich zal gedragen de komende uren, dagen ... De posities moeten klein blijven, de timing zal goed moeten zijn en het moment van winst nemen of de stop nemen zal snel moeten door de extreme volatiliteit ... Hoe dan ook, er komen nog signalen deze week ...

Meedoen tot 1 augustus kan, nu voor €39 kunt u meedoen en mijn coaching volgen.

Schrijf u in via https://www.usmarkets.nl/tradershop en dan komt u meteen op de verzendlijst ...

Tot straks ... Guy

Wie drijft de prijzen van de losers zo fors op?

Het blijft moeilijk om te ontdekken wie alles wat op zich onmogelijk lijkt zo omhoog drijft. Dat vooral omdat we...

Deze inhoud is alleen beschikbaar voor betalende leden.

Markt snapshot vandaag Europa

GLOBAL TOP NEWS

Beijing reported its second consecutive day of record new numbers of COVID-19 cases, adding urgency to efforts to rein in a sudden resurgence of the coronavirus in the Chinese capital.

China's factories stepped up production for a second straight month in May, as the country shook off the economic torpor of the coronavirus, although the weaker-than-expected gain suggested the recovery remained fragile.

President Emmanuel Macron said on Sunday he was accelerating France's exit from its coronavirus lockdown and that the crisis had laid bare the country's need for greater economic independence.

EUROPEAN COMPANY NEWS

AstraZeneca has signed a contract with European governments to supply the region with its potential vaccine against the coronavirus, the British drugmaker's latest deal to pledge its drug to help combat the pandemic.

Unilever said it will invest 1 billion euros in a fund to invest in climate change projects and reduce to net zero greenhouse gas emissions from all its products by 2039, 11 years ahead of the Paris Agreement deadline.

EasyJet aircraft will take to the skies on Monday for the first time since March 30, as the British carrier resumes a small number of mainly domestic flights after weeks of lockdown.

TODAY'S COMPANY ANNOUNCEMENTS

AppSpotr AB Annual Shareholders Meeting

Augean PLC Annual Shareholders Meeting

Borregaard ASA Annual Shareholders Meeting

EEMS Italia SpA Annual Shareholders Meeting

Home Concept France SA Annual Shareholders Meeting

IQ-AI Ltd Annual Shareholders Meeting

Karolinska Development AB Annual Shareholders Meeting

Kings Arms Yard VCT PLC Annual Shareholders Meeting

Lewag Holding AG Annual Shareholders Meeting

Mgi Digital Technology SA Annual Shareholders Meeting

Obrascon Huarte Lain SA Annual Shareholders Meeting

Rootfruit Scandinavia AB Annual Shareholders Meeting

Shortcut Media AB Annual Shareholders Meeting

SosTravel.com SpA Annual Shareholders Meeting

Star Vault AB Annual Shareholders Meeting

TomTom NV Annual Shareholders Meeting

Valaris PLC Annual Shareholders Meeting

Vitrolife AB Annual Shareholders Meeting

Zardoya Otis SA Annual Shareholders Meeting (Spanish)

ECONOMIC EVENTS (All times GMT)

0630 Switzerland Producer/Import Price mm for May: Prior -1.3%

0630 Switzerland Producer/Import Price yy for May: Prior -4.0%

0800 Italy CPI Excluding Tobacco for May: Prior 102.5

0800 Italy CPI Excluding Tobacco m/m for May: Prior -0.1%

0800 Italy Consumer Prices Final mm for May: Expected -0.1%; Prior -0.1%

0800 Italy Consumer Prices Final yy for May: Expected -0.1%; Prior -0.1%

0800 Italy CPI (EU Norm) Final mm for May: Expected -0.2%; Prior -0.2%

0800 Italy CPI (EU Norm) Final yy for May: Expected -0.2%; Prior -0.2%

0900 Euro Zone Eurostat Trade NSA for Apr: Prior 28.2 bln EUR

0900 Euro Zone Total Trade Balance SA for Apr: Prior 23.50 bln EUR

1000 Euro Zone Reserve Assets Total for May: Prior 909.92 bln EUR