Liveblog Archief vrijdag 24 september 2021

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Nieuwe Woningen Verkoop (Aug) | Actueel: 740K Verwacht: 714K Vorige: 729K |

Markt snapshot Wall Street 24 september

TOP NEWS

• U.S. CDC director breaks with panel, backs COVID-19 boosters for high-risk workers

The U.S. Centers for Disease Control and Prevention backed a booster shot of the Pfizer and BioNTech COVID-19 vaccine for Americans aged 65 and older, some adults with underlying medical conditions and some adults in high-risk working and institutional settings.

• Google, India antitrust watchdog tussle in court over probe leak

Google accused India's antitrust regulator in court of being a "habitual offender" by leaking confidential information of cases it was examining, an accusation the watchdog rejected.

• Quad leaders to meet at White House amid shared China concerns

Leaders of United States, Japan, India and Australia, sharing concerns about China's growing power and behavior, meet in person as a group for the first time for a summit expected to bring progress on COVID-19 vaccines, infrastructure and technological cooperation.

• U.S. oil refiners pick Iraqi, Canadian crudes to replace storm losses -traders

U.S. oil refiners hunting to replace crude lost after a storm hit the U.S. Gulf of Mexico last month have been turning to Iraqi and Canadian oil, while Asian buyers have been pursuing Middle Eastern and Russian grades, analysts and traders said.

• Evergrande investors in limbo after payment deadline passes

China Evergrande has left global investors guessing over whether it will make a key interest payment, adding to fears that Beijing will let overseas bondholders swallow large losses as a liquidity crisis deepens at the world’s most indebted property company.

BEFORE THE BELL

U.S. stock index futures edged lower following a sharp rally in the past two days after the Federal Reserve kept its policy stance largely in-line with market expectations. European shares slipped as concerns over the fate of debt-ridden China Evergrande weighed on investor sentiment. Japanese shares soared led by cyclical stocks on economic recovery hopes. The dollar fell, while gold prices rose. Oil prices were headed for a third straight week of gains, supported by global output disruptions and inventory draws. Building permits and new home sales data are on the economic radar.

STOCKS TO WATCH

Results

• Costco Wholesale Corp: The membership-only retail chain said on Thursday it was reinstating limits on purchases of key items including bath tissues, roll towels and bottled water, spurred by panic buying from customers amid rising COVID-19 cases. While there was a shortage of cleaning supplies even last year, transportation issues this year are causing delays in deliveries to stores despite suppliers having plenty of stock, Costco Chief Financial Officer Richard Galanti said in an earnings call. Total revenue rose to $62.68 billion in the fourth quarter from $53.38 billion a year earlier. Analysts on average had expected revenue of $61.30 billion.

• Nike Inc: The company on Thursday cut its fiscal 2022 sales expectations and said it expects delays during the holiday shopping season, blaming a supply chain crunch that has left it with soaring freight costs and products stuck in transit. Months-long factory closures in Vietnam, where about half of all Nike footwear is manufactured, have piled more pressure on global supply chains already reeling from the impact of the pandemic. Nike said revenue rose to $12.25 billion from $10.59 billion in the first quarter ended Aug. 31, while analysts on average had expected $12.46 billion.

In Other News

• Alphabet Inc: Google accused India's antitrust regulator in court of being a "habitual offender" by leaking confidential information of cases it was examining, an accusation the watchdog rejected. The Times of India and Reuters reported on Saturday that an investigation by the Competition Commission of India (CCI) had found that Google abused the dominant position of its Android operating system in India, using its "huge financial muscle" illegally to hurt competitors. In an unusual move on Thursday, Google sued the CCI in the Delhi High Court, saying in a statement it was "protesting against the breach of confidence" and "to prevent any further unlawful disclosures of confidential findings". In a near hour-long court showdown, Google's lawyer, Abhishek Manu Singhvi, accused the CCI of leaking information repeatedly, saying it did so to "give a dog a bad name in advance and then hang him by these selective leakages".

• Amazon.com Inc: The company launched in India eight global and local streaming services on its video platform, in a move aimed at boosting subscriptions. The move comes at a time of increasing competition from global and domestic rivals in an important market for the U.S. tech company. The Amazon Channels service will help customers using its Prime flagship loyalty programme to subscribe to multiple streaming services on a single interface, Gaurav Gandhi, the head of Amazon Prime Video in India, told Reuters in an interview ahead of the launch. Separately, new company data revealed the company's executives ranks remained largely white, although the share of non-white executives rose modestly, while minorities continued to account for most of its blue-collar workforce as the online retailer grew rapidly during the COVID-19 pandemic.

• IAC/InterActiveCorp & Meredith Corp: The company is in advanced talks to buy magazine publisher Meredith at a valuation expected to be over $2.5 billion, the Wall Street Journal reported on Thursday. Television mogul Barry Diller-owned IAC could strike a deal with Meredith in the next few days, the Journal said, adding the talks could still fall apart. Meredith's magazine brands, which include People, Better Homes & Gardens and Allrecipes, would compliment and expand IAC's collection of digital publications such as Investopedia, Serious Eats and Brides.

• McDonald's Corp: The burger chain said on Thursday it would restart share buybacks and also increased its quarterly dividend by 7%, as the world's largest fast food chain recovers from the impact of the COVID-19 pandemic. McDonald's had suspended its $15 billion buyback program early last year as the burger chain looked to conserve cash in order to navigate through the COVID-19 health crisis that had forced many of its restaurants to close their doors to diners.

• Regeneron Pharmaceuticals Inc: A World Health Organization panel recommended the use of Regeneron and Roche's COVID-19 antibody cocktail for patients at high risk of hospitalisations and those severely ill with no natural antibodies. The treatment has been granted U.S. emergency use authorisation, having gained attention when used to treat former President Donald Trump's COVID-19 illness last year. Europe is reviewing the therapy, while Britain approved it last month. While acknowledging costs associated with the treatment, the WHO panel said that given the recorded benefits of the therapy, "the recommendations should provide a stimulus to engage all possible mechanisms to improve global access to the intervention and associated testing." In a separate statement, the WHO called on Regeneron to lower prices and distribute the treatment equitably worldwide, especially in low- and middle-income countries. The agency also urged the firms to transfer tech to help make biosimilars.

• Tesla Inc: San Francisco transport authorities on Thursday raised concerns about the safety record of Tesla's advanced driver assistant system, as the electric car maker prepared a wide release of a test version of the software that works on city streets and highways. The San Francisco County Transportation Authority also disputed the name of the system, "Full Self-Driving" (FSD) saying it is an advanced driver assistance program, not an autonomous vehicle system. Tilly Chang, Executive Director of the SFCTA, said in a statement to Reuters that a human driver should "continuously monitor" Tesla's FSD system. "We are concerned about the safety record of this service and the name of the service as it could be confusing for consumers, and hope DMV, FTC and NHTSA continue to monitor and analyze this issue to protect consumers and the traveling public," she said.

• Twitter Inc: The company will allow people to tip their favorite content creators with bitcoin and will launch a fund to pay some users who host audio chat rooms on its Spaces feature, the company said on Thursday. The San Francisco-based company added it will test new ways to help users have a safer experience on Twitter, such as warning when people are entering a "heated" conversation or letting them leave tweet threads. The product announcements are part of Twitter's effort to compete with rival platforms like Facebook and YouTube for popular content creators with large followings, and turn around its image as a site where polarized discussions can fester. "We believe we can continue to incentivize the types of conversations that people want to see," said Esther Crawford, product lead for creator monetization at Twitter, in a briefing with reporters.

• Uber Technologies Inc: The ride-hailing company said it would start rolling out its pension plan to all eligible drivers in the United Kingdom, months after the ride-hailing service granted workers' rights to its drivers in the country. In March, Uber had reclassified its more than 70,000 drivers in Britain as workers following a Supreme Court ruling. Uber had also said it would offer guaranteed entitlements, including holiday pay, a pension plan and limited minimum wage. The Silicon Valley company said it would contribute 3% of a driver's earnings into a pension plan, while drivers can choose to contribute a minimum of 5% of their qualifying earnings.

ANALYSIS

Fed's bond-buying program may be on the way out, but it's not going far

The Federal Reserve will start to shutter its pandemic-era bond-buying program later this year, leaving the U.S. central bank with a balance sheet of more than $8.5 trillion before the purchases end in mid-2022 and a likely debate coming about what to do different next time.

ANALYSTS' RECOMMENDATION

• Accenture Plc: Cowen and Company raises price target to $370 from $365, citing strong growth outlook for 2022.

• Cheesecake Factory Inc: Jefferies raises price target to $60 from $55, saying the management seemed fairly upbeat about consumer demand remaining fairly consistent.

• Costco Wholesale Corp: D.A. Davidson raises price target to $423 from $390, after the company beat EPS estimate in the fourth quarter.

• Hershey Co: JPMorgan raises price target to $181 from $180, citing higher sales forecasts.

• Nike Inc: Cowen and Company cuts price target to $180 from $196, following the company's decision to lower FY22 revenue outlook.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0800 (approx.) Building permits R number for Aug: Prior 1.728 mln

0800 (approx.) Building permits r change mm for Aug: Prior 6.0%

1000 (approx.) New home sales-units for Aug: Expected 0.714 mln; Prior 0.708 mln

1000 (approx.) New home sales change mm for Aug: Prior 1.0%

COMPANIES REPORTING RESULTS

Carnival Corp: Expected Q3 loss of $1.48 per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Uxin Ltd: Q1 earnings conference call

1000 Carnival Corp: Q3 earnings conference call

1000 Kansas City Southern: Shareholders Meeting

1200 AeroVironment Inc: Annual Shareholders Meeting

EX-DIVIDENDS

Cerner Corp: Amount $0.22

Equity Residential: Amount $0.60

General Electric Co: Amount $0.08

Independent Bank Corp (Massachusetts): Amount $0.48

Omega Flex Inc: Amount $0.30

Portland General Electric Co: Amount $0.43

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| DEU: Duitse Ifo Bedrijfsklimaat Index (Sep) | Actueel: 98,8 Verwacht: 98,9 Vorige: 99,6 |

Markt duwt door omhoog, blijf wel opletten voor verrassing

Goedemorgen,

Op Wall Street een forse stijging nu bij de Dow Jones die al diep was weg gezakt, ook de Nasdaq, de Nasdaq 100 en de SOX laten een stevige rebound zien vanaf de bodem van maandag. In Europa een recordslot voor de AEX terwijl de DAX een stap vooruit zet en de 15.500 zone doorbreekt alsof die niet bestaat. Voor het eerst sluit de AEX index boven die 800 punten grens. Opvallend is het verloop van de olie, de Brent staat al 77,5 dollar.

Update vrijdag 24 september:

Na de bodem die maandag werd gezet zien we de indexen fors herstellen en met de nodige kracht. De kracht van de daling die eind vorige week begon was al zeer krachtig maar het herstel dat we nu zien kan ook zeldzaam worden genoemd. Dat bewijst nog maar weer eens hoe de markt zich tegenwoordig gedraagt en dat is compleet anders dan vroeger ofwel een aantal jaar geleden. We zien 2 zaken door elkaar lopen, eerst de onzekerheid maar daar naast de enorme hebzucht en het gevoel dat men bang is om wat te missen. Meestal rond een top in de markt zie je dat soort gedrag al is het tegenwoordig wel zeer uitzonderlijk.

De FED gaf aan dat ze gaan afbouwen en de markt is er blij mee, als de FED eerder aangaf meer geld in de markten te pompen was dat iets waar men blij mee werd omdat de rente dan laag zou blijven. We zitten echt in een soort fase dat blijkbaar alles goed te ontvangen is maar nogmaals, daar schuilt het grote gevaar momenteel. We gaan de markt wat laten zwemmen nu en bespelen alles met de nodige voorzichtigheid, waar het kan anticipeer ik dan met kleine posities maar door dat het zo snel gaat moet je wel alert blijven hetgeen ik ook doe. Wees gerust, er komen genoeg kansen maar we moeten als er posities lopen geduld hebben.

De S&P 500 won gisteren 1,2% terwijl de Dow Jones 1,5% hoger wist te geraken. De Nasdaq en de Nasdaq 100 net als woensdag rond de 1% hoger winst boeken. De SOX index won 1,35% en lijkt onderweg om een 4e top neer te zetten. In Europa ook weer een sterke sessie waar de AEX een nieuw recordslot neerzet op 800,61 punten, een winst van 1%. De DAX sluit de sessie met 0,9% winst af en geraakt dus weer tot boven de zone 15.500-15.550 punten. De Franse CAC 40 gaat er ook met 1% op vooruit.

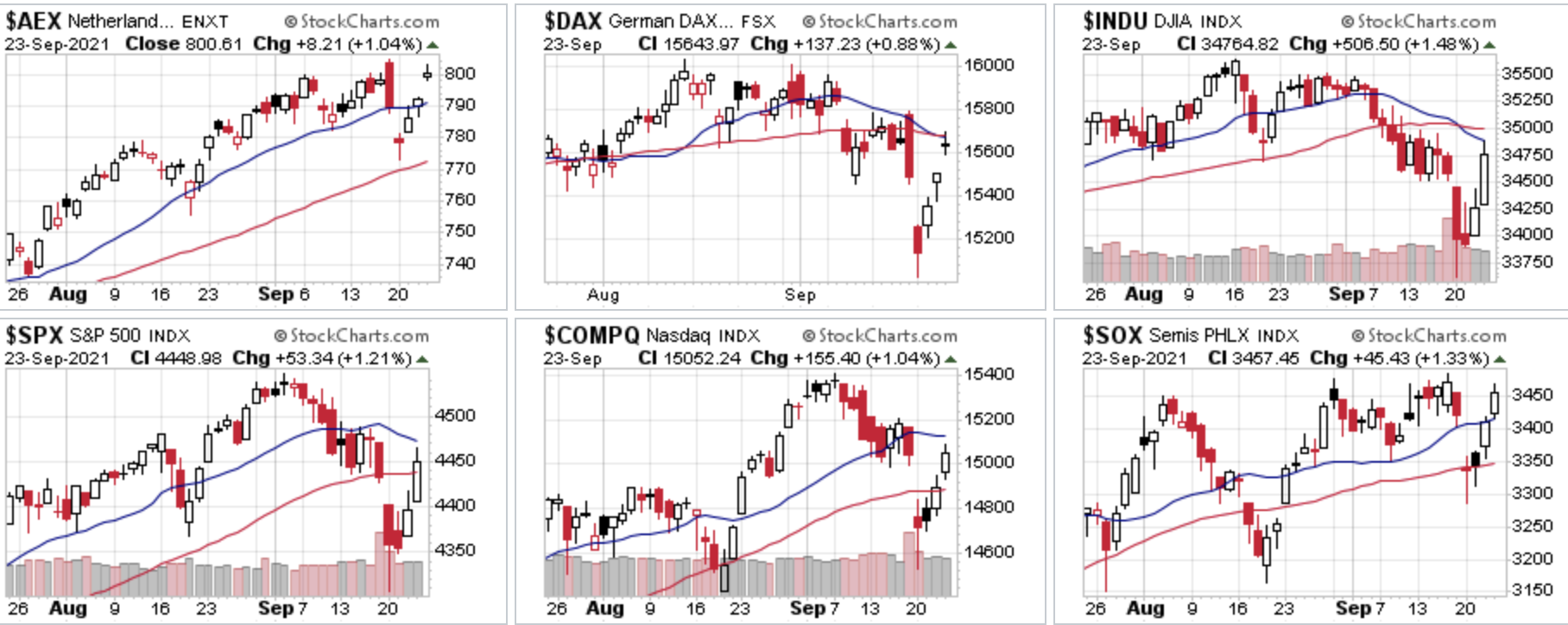

Marktoverzicht:

Zou het dan toch zo zijn dat alle indices weer richting hun record oplopen? We zien opnieuw de 2 bekende indexen in het overzicht naar een record toe bewegen, dat zijn net als vorige week de AEX en de SOX index. We zien ook een fors herstel vanaf de bodem van maandag bij de Dow Jones, de S&P 500 en de DAX maar deze indexen blijven wel nog ver onder hun record. De Nasdaq was ook sterk maar ook hier nog niet in de buurt van het record.

Dow Jones:

De Dow Jones spurt in 2 dagen behoorlijk omhoog en sluit net boven de bekende weerstand die we rond de 34.500 punten zien uitkomen. Dat is nog net onder het 50-daags gemiddelde dat nu rond de 34.950 punten wacht. Weerstand nu het 50-MA met daarboven de 35.500 punten.

Steun nu eerst de 34.500 punten, later 34.250 en de 34.000 punten. De bodem van maandag wordt dan de volgende steun en die zien we rond de 33.600 punten. De index staat nu al 1150 punten boven de laagste stand van deze week, aan volatiliteit geen gebrek dus.

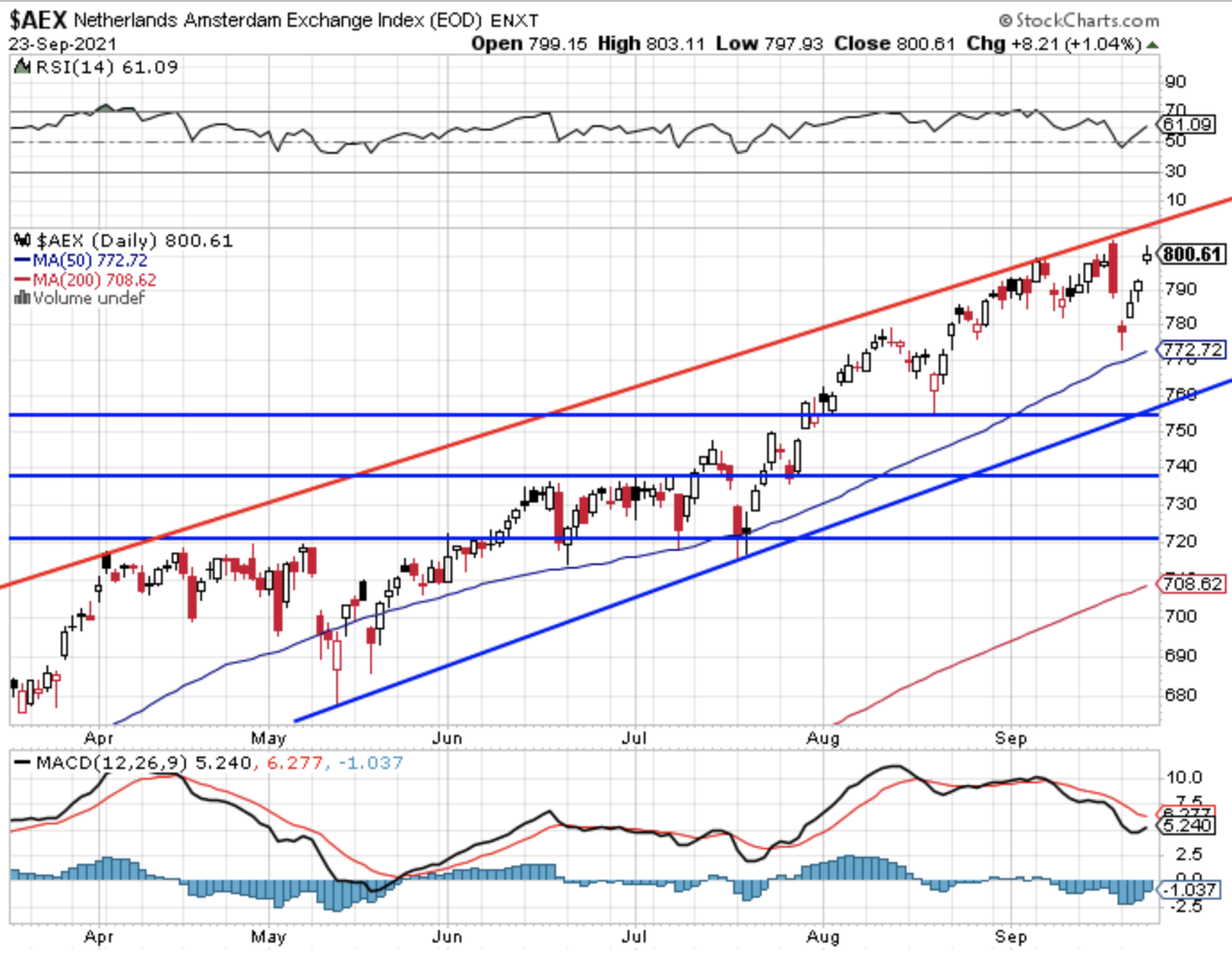

AEX index:

De AEX trekt door tot boven de 800 punten met een recordslot op 800,61 punten. De eerste weerstand is nu de top van vorige week vrijdag en die komt uit net onder de 805 punten. Bij een doorbraak kan de AEX de weerstandslijn die nu rond de 810 punten uitkomt opzoeken maar zo ver is het nog niet.

Steun nu de 790 punten, later de 782 en het 50-daags gemiddelde rond de 773 punten. Deze niveaus houden we eerst in de gaten, eerst maar een bekijken wat er komt de volgende sessies.

DAX index:

De DAX trekt nu ook door, de index is meer industrieel gericht en aangezien de Dow aantrekt volgt de DAX vanzelf. We zien een bodem rond de 15.000 punten maandag, het slot van donderdag lag op 15.644 punten waardoor we een heftig herstel zien bij de DAX. Weerstand nu weer de 15.810 punten na het slot boven de 15.550 punten, later de topzone rond de 16.000 punten.

Steun nu weer de bekende zone 15.500-15.550 punten met daaronder de 15.300 punten. Later de bodem van maandag rond de 15.000 punten als belangrijke steun.

Nasdaq Composite:

De Nasdaq herpakt zich verder donderdag en de index sluit weer boven het 50-daags gemiddelde. Vanaf de bodem van maandag een stevige rebound want we sluiten al zo'n 500 punten boven de laagste stand van deze week. Rond de 15.100-15.125 punten weerstand met daar net boven de 15.200 en de topzone rond de 15.400 punten. De Nasdaq blijft wel nog ver onder het record maar in deze volatiele markt kan het snel gaan. Ook hier worden de komende sessies weer belangrijk voor het vervolg.

Steun nu de 15.000 punten met daaronder de 14.800 punten, later de 14.700 punten waar we de steunlijn onder de recente bodems nu zien uitkomen.

Overzicht resultaat 2021 blijft goed:

Er lopen wat posities voor de leden die u nog kunt opnemen zodra u lid wordt. Er komen weer nieuwe posities bij zodra het kan. Om mee te doen kan dat nu via de nieuwe aanbieding tot 1 december. Deze maand en dit jaar staan we in ieder geval op een mooie winst en dat in een moeilijke markt. Wat ik doe is vooral tijd nemen en de rust bewaren, er komen dus weer nieuwe en vooral mooie kansen aan.

Schrijf u nu in via de nieuwe aanbieding en dat is tot 1 DECEMBER voor €35. Ga meteen naar onze tradershop via de link https://www.usmarkets.nl/trade... en schrijf u in voor deze mooie aanbieding ...

Met vriendelijke groet,

Guy Boscart