Liveblog Archief vrijdag 26 maart 2021

Markt snapshot Wall Street 26 maart

TOP NEWS

• Fed to lift restrictions on bank dividends, share buybacks for 'most firms' after June stress test

The U.S. Federal Reserve announced on Thursday it would likely remove income-based restrictions on bank dividends and share buybacks for "most firms" after its June stress tests.

• Moderna delays shipment of about 600,000 COVID-19 vaccine doses to Canada

Moderna has delayed the shipment of 590,400 doses of its COVID-19 vaccine that were due to arrive in Canada this weekend, the federal procurement minister said on Thursday.

• UiPath last valued at $35 billion, reveals revenue surge ahead of U.S. IPO

Robotic process automation startup UiPath disclosed its filing for an initial public offering (IPO) in New York, weeks after it raised fresh capital from investors at a valuation of $35 billion.

• Software vendors would have to disclose breaches to U.S. government users under new order -draft

A planned Biden administration executive order will require many software vendors to notify their federal government customers when the companies have a cybersecurity breach, according to a draft seen by Reuters.

• Uber to reopen San Francisco offices with limited capacity next week

Uber said on Thursday it plans to reopen its offices at Mission Bay, San Francisco, with 20% occupancy on March 29, and provide an option for its staff to return to work on a "voluntary basis".

BEFORE THE BELL

Wall Street futures edged higher as investors awaited a reading on inflation data later in the day. European stocks rose, helped by gains in commodity-linked companies. Japan’s Nikkeiclosed higher, as investors scooped up beaten-down names after their sharp retreat this week. The dollar was in the green, buoyed by hopes over improving U.S. economic data, while goldprices steadied. Oil prices rose on mounting fears that it could take weeks to dislodge a giant container ship blocking the Suez Canal, which would squeeze supplies of crude and refined products. Advance goods trade balance, wholesale inventories and personal income data are due on the U.S. economic schedule.

STOCKS TO WATCH

Deals Of The Day

• Annaly Capital Management Inc: The company has agreed to sell its commercial real estate business to investment firm Slate Asset Management in a deal valued at $2.33 billion to sharpen its focus on its core residential mortgage finance business. Annaly said in a statement on Thursday that the deal, which is expected to close by the third quarter of 2021, includes equity interests, loan assets and commercial mortgage-backed securities that were part of the commercial real estate unit. The company said it expects the deal to have an immaterial impact on its key financial metrics and that it plans to use proceeds to repay its financing facilities related to the commercial real estate assets.

• BowX Acquisition Corp: WeWork has agreed to go public through a merger with the blank-check firm that values the office-sharing startup at $9 billion including debt, the Wall Street Journal reported, citing people familiar with the matter. The company disclosed to prospective investors it had lost about $3.2 billion last year as part of a pitch for a stock market listing by merging with a special purpose acquisition company, sources told Reuters earlier this week. The company is also raising $1.3 billion in capital, including $800 million in private investment from Insight Partners, funds managed by Starwood Capital Group, Fidelity Management and others, the Journal reported. WeWork did not immediately respond to a Reuters request for comment.

IPOs

• Zhihu Inc: The Chinese question and answer website raised $523 million in its U.S. initial public offering (IPO) after pricing its shares at $9.50 each, according to two sources with direct knowledge of the matter. Zhihu sold 55 million American Depository Shares (ADS) at the bottom of the $9.50 to $11.50 range the stock was marketed at during the deal. The sources could not be named as the information was not yet public. Zhihu did not respond to a request for comment.

In Other News

• AstraZeneca Plc: The company cannot export any more COVID-19 vaccines from Europe until is makes good on its contracts with the European Union, EU Commission chief Ursula von der Leyen said after a meeting of the leaders of the 27-nation bloc. "We have to and want to explain to our European citizens that they get their fair share," she told a news conference late on Thursday, adding that companies had to honour their contracts with the EU before exporting to other regions. "And this is of course the case with AstraZeneca," von der Leyen said. Seperately, scientists who have watched with dismay a series of disputes over the company's COVID-19 vaccine say strong efficacy data from a large U.S. trial should lay concerns to rest, but worry the skirmishes may leave a lasting mark on public trust. Among researchers working to develop vaccines, treatments and other weapons against COVID-19, the frustration is evident.

• Banco Santander Mexico SA Institucion de Banca Multiple Grupo Financiero Santander Mexico: Spain's Banco Santander said it will offer to buy the 8.3% stake in its Mexican unit it doesn't already own, strengthening its grip on its Latin American businesses. Santander is offering Banco Santander Mexico minority shareholders 24 Mexican pesos per share, representing a 24% premium on the March 25 closing price and a total of about 550 million euros. Santander's offer is comfortably above the unit's share price over the past year, though still below pre-pandemic levels and 22% lower than where it was when the Spanish lender first sought full ownership of its Mexican business in 2019. With full control of Santander Mexico, the Spanish bank will increase its exposure to a region that has "structural growth and high and increasing profitability," the lender said.

• Deutsche Bank AG: CEO Christian Sewing, is willing to give up his role overseeing the investment bank in the foreseeable future, a person with knowledge of the matter said, a move likely to reassure regulators. The person, speaking on condition of anonymity, said Sewing never intended to permanently keep this role that he had added to his duties in a management overhaul in 2019. Deutsche Bank and its regulators, the European Central Bank and BaFin, declined to comment. Handelsblatt reported earlier on Friday that there is movement on the topic of the Sewing's dual role. The investment bank is the German lender's main profit driver, but also represents a concentration of risk for a bank that is deemed "systemically important" in terms of the functioning of the global financial system.

• Ford Motor Co: The U.S. Supreme Court on Thursday unanimously ruled against the company in a case in which the second-largest U.S. automaker had sought to bar two state courts from hearing product liability suits involving a pair of serious crashes. "When a company like Ford serves a market for a product in a state and that product causes injury in the state to one of its residents, the state's courts may entertain the resulting suit," Justice Elena Kagan wrote for the court. Seperately, the company said on Thursday it will idle production of its highly profitable F-150 pickup truck at a plant in Michigan through Sunday due to the global semiconductor chip shortage. Ford's Dearborn, Michigan, plant will be idled from Friday through Sunday, and resume work on Monday. A spokeswoman declined to say how much volume would be lost.

• Lyft Inc & Uber Technologies Inc: A Massachusetts judge on Thursday denied a bid to dismiss a lawsuit by the state's attorney general challenging Uber's and Lyft's classification of drivers as independent contractors instead of employees entitled to sick time and other costly benefits. Suffolk County Superior Court Judge Kenneth Salinger did not rule on whether or not drivers are misclassified, but his decision allows Massachusetts Attorney General Maura Healey to pursue her claims against Uber and Lyft in court. "(T)he allegations in the complaint plausibly suggest that Uber and Lyft misclassify their drivers and, as a result, deprive some drivers of required minimum wages, overtime, and sick leave," Salinger wrote in his decision. Uber and Lyft deny that their drivers are misclassified, saying the vast majority enjoy the flexibility that comes with on-demand work. Separately, Uber said on Thursday it plans to reopen its offices at Mission Bay, San Francisco, with 20% occupancy on March 29, and provide an option for its staff to return to work on a "voluntary basis".

• Microsoft Corp, SalesForce.com Inc & SolarWinds Corp: A planned Biden administration executive order will require many software vendors to notify their federal government customers when the companies have a cybersecurity breach, according to a draft seen by Reuters. A National Security Council spokeswoman said no decision has been made on the final content of the executive order. The order could be released as early as next week. The proposed order would adopt measures long sought by security experts, including requiring multi-factor authentication and encryption of data inside federal agencies. The order would impose additional rules on programs deemed critical, such as requiring a "software bill of materials" that spells out what is inside.

• Moderna Inc: The company has delayed the shipment of 590,400 doses of its COVID-19 vaccine that were due to arrive in Canada this weekend, the federal procurement minister said on Thursday. Moderna informed Canadian officials that the delay was due to a "backlog in its quality assurance process", Anita Anand said, adding that the company assured the remaining doses will be shipped no later than Thursday next week. "Once Moderna's final quality assurance process has been completed, the doses will be released for shipment." Anand said the U.S. drugmaker gave assurance that the issue was a "minor hiccup" and it would not impact the shipment of 855,600 doses set for the week of April 5.

• Nio Inc: The Chinese electric vehicle maker said it would halt production for five working days at its Hefei plant, due to a shortage in semiconductor chips. Nio said it planned to suspend production from Monday. It also cut its first quarter delivery forecast to around 19,500 vehicles, compared to the 20,000 to 20,500 vehicles it had previously expected. The company is one of several automakers to halt manufacturing this season.

• Root Inc: The auto insurer whose stock price tumbled more than 50% since its public listing late last year, is a bargain that is currently misunderstood by investors and should be trading higher, Andrew Left, founder of Citron Research, said on Thursday. "We believe Root is a misunderstood short," Left said, calling the six-year-old company a "disruptive tech company" whose shares should not be trading below their IPO price of $27. The company relies on smartphone data to keep tabs on drivers' habits which it uses to price risk, leaving it with a usage-based insurance (UBI) score that "is almost ten times more predictive than an industry leading UBI provider according (international actuarial and consulting firm) Milliman," Root wrote in its filing last year. Still, Wall Street has turned its back on the company as short interest in the company stood at roughly 10.9 million shares on March 15, according to Refinitiv data. It currently ranks among the 10 most widely shorted U.S. companies.

• Takeda Pharmaceutical Co: The company said on Thursday it had started regulatory submissions to Europe's health regulator for its dengue vaccine candidate, which is being developed for individuals aged four to 60. The drugmaker said in a statement that the European Medicines Agency would conduct an assessment of the vaccine, TAK-003, under a procedure that also allows it to assess and give opinions on medicines that are intended for use in countries outside the European Union. Initial and additional data from a late-stage trial showed the vaccine succeeded overall but failed to protect against one of the four types of the virus in children and teens who had never previously been exposed to the mosquito-borne disease. Takeda said it planned to submit regulatory filings in certain Latin American and Asian countries this year, as well as in the United States.

• Telus Corp: The company said on Thursday it would raise C$1.3 billion through an equity offering as the Canadian telecom company boosts investments in broadband connectivity and 5G. The company said it would sell 51.3 million of its shares to underwriters at C$25.35 apiece, a 3.4% discount to the stock's last close on the Toronto Stock Exchange. Telus intends to use the net proceeds to speed up its broadband capital investment program, including the build-out of its PureFibre infrastructure in Alberta, British Columbia and Eastern Quebec, as well as an accelerated roll-out of its national 5G network. U.S.-listed shares of the company were down 3.6% in extended trading.

• Tesla Inc: Chief Executive Officer Elon Musk's 2018 tweet threatening employees would lose their stock options if they formed a union was illegal and should be deleted, the U.S. National Labor Relations Board said on Thursday. The NLRB backed a ruling from a U.S. labor judge in 2019 that the electric-car maker had committed a series of violations of the National Labor Relations Act in 2017 and 2018. "Nothing stopping Tesla team at our car plant from voting union. Could do so tmrw if they wanted. But why pay union dues & give up stock options for nothing? Our safety record is 2X better than when plant was UAW & everybody already gets healthcare", Musk wrote in the May 2018 tweet. The board ordered Tesla to direct Musk to delete the tweet and to post a notice addressing the unlawful tweet at all of its facilities nationwide and include language that says "WE WILL take appropriate steps to ensure Musk complies with our directive."

• Twitter Inc: CEO Jack Dorsey tweeted his frustration with U.S. lawmakers' questions on the social media platform during a hearing about misinformation on Thursday, leading one member of congress to call out his multi-tasking. Lawmakers grilled Dorsey and the CEOs of Facebook and Google's parent Alphabet for almost five hours. Tensions were high as they asked them to answer "yes or no" to questions ranging from whether their platforms bore any responsibility for the Jan. 6 riot to whether they understood the difference between the two words. During the hearing, Dorsey tweeted "?" with a poll asking Twitter users to vote "yes" or "no." Democratic Representative Kathleen Rice asked: "Mr. Dorsey, what is winning, yes or no, on your Twitter account poll?"

• Wallgreens Boot Alliance Inc: The company is opening its first corporate COVID-19 vaccine clinics at several Amtrak offices in early April to vaccinate "large numbers" of the U.S. passenger railroad's employees, the companies told Reuters exclusively. Deerfield, Illinois-based Walgreens said the clinics will be similar to those set up for flu vaccinations and will be run by a combination of pharmacists and technicians from Walgreens stores. American corporations are counting down the days to when their employees will be eligible for vaccine shots. Walmart, CVS Health and Kroger and others have yet to set up corporate clinics with companies. CVS, Walgreens' biggest rival, said it does not have information to share on its plans.

FOCUS

New wave of ‘hacktivism’ adds twist to cybersecurity woes

At a time when U.S. agencies and thousands of companies are fighting off major hacking campaigns originating in Russia and China, a different kind of cyber threat is re-emerging: activist hackers looking to make a political point.

ANALYSTS' RECOMMENDATION

• American Well Corp: Berenberg cuts target price to $34 from $39, saying if the company is unable to achieve scale, either via pricing or increasing annual contract value through more modules, this could pressure revenue growth as well as the pathway to profitability.

• Clean Energy Fuels Corp: Cowen and Company starts coverage with market perform rating and target price $14, stating the company is transitioning to an attractive higher-margin business of producing renewable gas rather than distributing it.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0830 (approx.) Advance goods trade balance for Feb: Prior -$84.58 bln

0830 (approx.) Wholesale inventories advance for Feb: Prior 1.3%

0830 (approx.) Retail inventories ex-auto advance for Feb: Prior -0.1%

0930 (approx.) Personal income mm for Feb: Expected -7.3%; Prior 10.0%

0930 (approx.) Personal consumption real mm for Feb: Prior 2.0%

0930 (approx.) Consumption, adjusted mm for Feb: Expected -0.7%; Prior 2.4%

0930 (approx.) Core PCE price index mm for Feb: Expected 0.1%; Prior 0.3%

0930 (approx.) Core PCE price index yy for Feb: Expected 1.5%; Prior 1.5%

0930 (approx.) PCE price index mm for Feb: Prior 0.3%

0930 (approx.) PCE price index yy for Feb: Prior 1.5%

1000 U Mich Sentiment Final for Mar: Expected 83.6; Prior 83.0

1000 U Mich Conditions Final for Mar: Prior 91.5

1000 U Mich Expectations Final for Mar: Prior 77.5

1000 (approx.) U Mich 1-year inflation final for Mar: Prior 3.1%

1000 (approx.) U Mich 5-year inflation final for Mar: Prior 2.7%

1200 (approx.) Dallas fed PCE for Feb: Prior 1.9%

COMPANIES REPORTING RESULTS

Carnival Corp: Expected Q1 loss of $1.54 per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 RLX Technology Inc: Q4 earnings conference call

0800 Cloopen Group Holding Ltd: Q4 earnings conference call

1000 HMS Holdings Corp: Shareholders Meeting

2100 UP Fintech Holding Ltd: Q4 earnings conference call

EX-DIVIDENDS

Equity Residential: Amount $0.60

Santander Consumer USA Holdings Inc: Amount $0.22

Two Harbors Investment Corp: Amount $0.17

Zimmer Biomet Holdings Inc: Amount $0.24

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| DEU: Duitse Ifo Bedrijfsklimaat Index (Mar) | Actueel: 96,6 Verwacht: 93,2 Vorige: 92,4 |

Update vrijdag 26 maart: Diepe duik en stevig herstel, AEX op recordjacht?

Goedemorgen

We merken dat de markten telkens wat prikkels geven om onderuit te gaan maar het niet kunnen doorzetten, beleggers willen in de markt blijven en dat hebben we gisteren duidelijk kunnen zien. Per sector pakt men weer wat op, eerst traditioneel of de optisch achtergebleven aandelen, daarna weer de tech aandelen die in een correctiefase zitten maar waarvan men nog niet goed weet of ze al uit bodemen momenteel. Na de correctie van zo'n 12% vanaf de top tot de bodem zou het wel zo kunnen zijn maar men blijft nog even voorzichtig. De tech aandelen blijven hoe dan ook wat betreft hun waardering zeer duur !!

Dat de recordniveaus het doel blijven wordt met de dag wat duidelijker en zeker hier in Europa waar we er in feite naartoe sluipen. Ik ben dan ook zeer benieuwd tot waar de AEX zal geraken pakweg volgende week want zo dicht kwamen we sinds 2000 niet meer. Bij de DAX, de Dow Jones en de S&P 500 zijn we het al gewend en blijft ook alles op amper een paar tikken omhoog hangen. De Nasdaq, de Nasdaq 100 en de SOX index moeten wel nog een extra inspanning leveren van pakweg 7% al kan het daar ook heel snel gaan. Nog ongeveer 1000 punten te gaan bij de Nasdaq en de Nasdaq 100.

Via de abonnementen heb ik daar een strategie voor in ieder geval, doe mee met de posities door lid te worden via de proef aanbieding tot 1 JUNI ...

Resultaat dit jaar 2021 verloopt naar wens:

Onderaan deze update ziet u nog een overzicht tot nu toe wat betreft de signalen die we naar de leden versturen en dat vanaf begin dit jaar. Verder ziet u de nieuwe aanbieding om mee te doen met onze signalen tot 1 JUNI. Via de site en dan de Tradershop kunt u als lid de lopende posities met alle details altijd inzien via https://www.usmarkets.nl/tradershop

Indicatie markt:

Ook na gisteren waar de markt even een niveau lager moest na de opening zien we kracht en herstel richting het slot. Daarom zitten de indices die we volgen nog altijd in hun opgaande trend en blijven nieuwe records haalbaar. Ik zie ook die veerkracht bij de Nasdaq nu, het zag er even slecht uit maar ook daar een herstel richting het slot wat hoopgevend is. In ieder geval over de gehele lijn eerst weer wat twijfels maar beleggers willen in de markt blijven en switchen heel makkelijk van de ene naar de andere sector.

Wat nog altijd opvalt is dat Europa niet traditioneel meer verliest bij twijfel dan Wall Street en gewoon eigen weg kiest. De AEX geraakt op slotbasis tot de jaartop en kan bij nog een sterke sessie definitief richting het record van 2000. Nu moeten we ons daar ook niet teveel op richten want toen zag de AEX er wat betreft de samenstelling TOTAAL anders uit zodat een vergelijk niet aan de orde is. Wel voor de boeken is het belangrijk.

De kon DAX zich na een verlies intraday herstellen om alsnog met een kleine plus sluiten. Ook de DAX lijkt onderweg naar een nieuw record vandaag want ook via de futures staat de index wat hoger vanmorgen. Ook de CAC 40 kon na een daling gedurende de dag net met een plusje de dag afsluiten, ook de CAC 40 kan richting een nieuwe jaartop oplopen na het testen van de steunlijn.

We zien vanmorgen dat de indices hoger willen starten via de futures, de S&P en de Nasdaq 100 futures staan hoger. Ook de AEX kan meteen rond de 688-690 punten starten waar de weerstand nu wacht, bij een uitbraak komt zoals ik al aangaf het record in zicht. De DAX future zien we rond de 14.750 punten wat net onder het record van de index is (14.805). Een mooie sessie vandaag en een traditioneel groene maandag erbij en we zijn er, daar kan ik dan winst nemen op de posities als mijn plan uitkomt !!

Technische conditie markt:

Wat betreft Wall Street ziet het er technisch nog altijd goed uit als we naar de wat langere termijn kijken, nieuwe records blijven binnen bereik. Pas als de traditionele indices 2 tot 3% onder hun record terecht komen kan het voor een tijdje over en uit zijn.

Deze moeilijke fase zien we nu vooral bij de tech indices die wel al ruim onder hun hoogste stand uitkomen en de nodige moeite vertonen om weer op stoom te komen voor een langere fase. Belangrijk hierbij zijn de belangrijke MA's want zowel de Dow Jones, de S&P 500 en de Dow Transport index staan nog steeds ruim boven hun 20-MA en 50-MA (MA = daags gemiddelde) en staan nu al een lange periode boven hun 200-MA.

De technologie indices (de Nasdaq, de Nasdaq 100 en de SOX index) halen dat niet meer, er kwam een mooie poging maandag maar werd afgeslagen gisteren (woensdag) zodat ze alle 3 weer onder hun 50-daags gemiddelde staan. Dat kan snel weer wisselen de komende dagen, we zien al een tijdje erboven of eronder in deze fase, opletten dus want de volatiliteit blijft aanhouden.

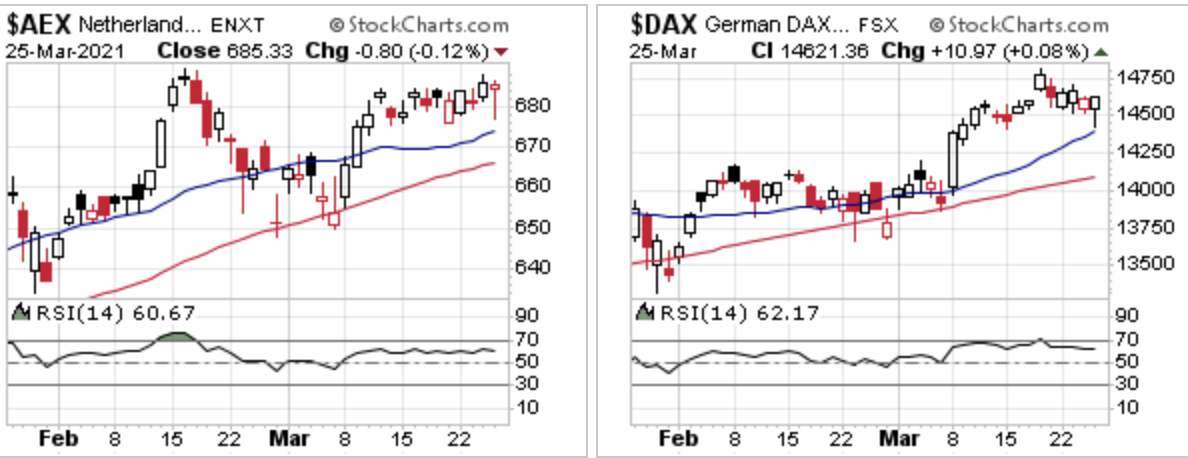

AEX en DAX:

Europa blijft zoals ik al aangaf sterk liggen, de indices die we volgen, zowel de AEX en de DAX staan nog ruim boven hun 20-MA en 50-MA. De DAX blijft ook dicht bij de recordstand terwijl de AEX nu boven die 688-690 punten moet zien te geraken om dan de oversteek richting het record rond de 702 punten te maken. Voor wat betreft de AEX index komt er nu mogelijk een mooie fase aan als de stijging door kan zetten.

Inter Market overzicht op slotbasis ...

Inflatie en rente:

De 10 jaars rente in de VS zien we vanmorgen tot rond de 1,635% en kent deze week toch een wat kalmer verloop dan de weken ervoor. De rente in Duitsland zien we vanmorgen rond de -0,38% en laat nu ook een wat kalmer verloop zien.

De LIVEBLOG en Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

Euro, olie en goud:

De euro zien we nu rond de 1.178 dollar, de prijs van een vat Brent olie komt uit op 62,7 dollar terwijl een troy ounce goud nu op 1726 dollar staat.

Nu lid worden tot 1 JUNI voor €39?

Blijven schakelen tussen long en short blijft belangrijk de komende weken. Ook deze maand (maart) krijgen we genoeg kansen. Doe nu in ieder geval mee met de proef aanbieding voor nieuwe leden, die loopt tot 1 JUNI en dat met een mooie korting !! ...

Nu tot 1 JUNI 2021 voor €39 ... en voor Polleke €49 tot 1 JUNI 2021 !!! https://www.usmarkets.nl/tradershop

Schrijf u in voor Systeem Trading (€39 tot 1 JUNI)

Schrijf u in voor Index Trading (€39 tot 1 JUNI)

Schrijf u in voor Guy Trading (€39 tot 1 JUNI)

Schrijf u in voor Polleke Trading (€49 tot 1 JUNI)

Schrijf u in voor de Aandelen portefeuille (€30 tot 1 JUNI)

Schrijf u in voor COMBI TRADING (€79 tot 1 JUNI)

Hieronder het resultaat tot nu toe dit jaar (2021) ...

Met vriendelijke groet,

Guy Boscart

Markt snapshot Europa 26 maart

GLOBAL TOP NEWS

President Joe Biden vowed on Thursday to push China to play by international rules, criticized his Republican opponents and defended his policy to provide shelter to children crossing the U.S. border from Mexico at his first solo news conference since taking office.

Reeling from the blockage in the Suez Canal, shipping rates for oil product tankers have nearly doubled this week, and several vessels were diverted away from the vital waterway as a giant container ship remained wedged between both banks.

In their first appearance before Congress since Trump supporters stormed the U.S. Capitol, the chief executives of Facebook, Google and Twitter were asked by U.S. lawmakers whether their platforms bore some responsibility for the riot: "yes or no?"

EUROPEAN COMPANY NEWS

EU leaders voiced frustration on Thursday over a massive shortfall in contracted deliveries of AstraZeneca COVID-19 vaccines, as a third wave of infections surged across Europe.

Burberry has lost a Chinese brand ambassador and its hallmark tartan design was scrubbed from a popular video game, becoming the first luxury brand assailed by the Chinese backlash to Western accusations of abuses in Xinjiang.

German insurer Allianz is nearing a 2.5 billion euro deal to buy Aviva's Polish unit, trumping rival bids from Italy's Generali and Dutch insurer NN, sources familiar with the matter told Reuters.

TODAY'S COMPANY ANNOUNCEMENTS

Atrium European Real Estate Ltd Annual Shareholders Meeting

Banco de Sabadell SA Annual Shareholders Meeting

Banco Santander SA Annual Shareholders Meeting

BayWa AG Q4 2020 Earnings Call

Beazley PLC Annual Shareholders Meeting

Caisse Regionale de Credit Agricole Mutuel d'Ille-et-Vilaine SC Annual Shareholders Meeting

Cosmo Pharmaceuticals NV FY 2020 Earnings Call

Ecomiam SA Annual Shareholders Meeting

Emova Group SA Annual Shareholders Meeting

ENCE Energia y Celulosa SA Annual Shareholders Meeting

Eurocommercial Properties NV FY 2020 Earnings Release

Gofore Oyj Annual Shareholders Meeting

Kape Technologies PLC Shareholders Meeting

Neles Oyj Annual Shareholders Meeting

Nilfisk Holding A/S Annual Shareholders Meeting

North Media A/S Annual Shareholders Meeting

PCF Group PLC Annual Shareholders Meeting

Repsol SA Annual Shareholders Meeting

Sartorius AG Annual Shareholders Meeting

Sigma Capital Group PLC Annual Shareholders Meeting

Supersonic Imagine SA Annual Shareholders Meeting

Tryg A/S Annual Shareholders Meeting

Upper Thames Holdings PLC Annual Shareholders Meeting

Vente-Unique.Com SA Annual Shareholders Meeting

ECONOMIC EVENTS (All times GMT)

0530 Netherlands GDP Final SA qq for Q4: Expected -0.1%; Prior -0.1%

0530 Netherlands GDP Final NSA yy for Q4: Expected -2.9%; Prior -2.9%

0700 (approx.) United Kingdom Retail Sales mm for Feb: Expected 2.1%; Prior -8.2%

0700 (approx.) United Kingdom Retail Sales Ex-Fuel mm for Feb: Expected 1.9%; Prior -8.8%

0700 (approx.) United Kingdom Retail Sales yy for Feb: Expected -3.5%; Prior -5.9%

0700 (approx.) United Kingdom Retail Sales Ex-Fuel yy for Feb: Expected -1.5%; Prior -3.8%

0700 Spain GDP qq for Q4: Expected 0.4%; Prior 0.4%

0700 Spain GDP yy for Q4: Expected -9.1%; Prior -9.1%

0830 Sweden Retail Sales mm for Feb: Prior 3.4%

0830 Sweden Retail Sales yy for Feb: Prior 3.1%

0830 Sweden Trade Balance for Feb: Prior 5.2 bln SEK

0830 Sweden Swedish Exports for Feb: Expected ; Prior 113.4 bln SEK

0830 Sweden Swedish Imports for Feb: Expected ; Prior 108.2 bln SEK

0900 (approx.) Germany Ifo Business Climate New for Mar: Expected 93.2; Prior 92.4

0900 (approx.) Germany Ifo Current Conditions New for Mar: Expected 91.3; Prior 90.6

0900 (approx.) Germany Ifo Expectations New for Mar: Expected 95.0; Prior 94.2

0900 Italy Manufacturing Business Confidence for Mar: Expected 99.4; Prior 99.0

0900 Italy Consumer Confidence for Mar: Expected 100.7; Prior 101.4