Liveblog Archief woensdag 20 oktober 2021

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Ruwe Olievoorraden | Actueel: -0,431M Verwacht: 1,857M Vorige: 6,088M |

Markt snapshot Wall Street 20 oktober

TOP NEWS

• Facebook plans rebrand with new name, says The Verge

Facebook, under fire from regulators and lawmakers over its business practices, is planning to rebrand itself with a new name that focuses on the metaverse, the Verge reported.

• Anthem ups 2021 outlook after profit beat on lower costs

Anthem raised its earnings forecast for 2021 after the second-largest U.S. health insurer beat third-quarter profit estimates on the back of lower-than-expected medical costs.

• Nasdaq profit beats on robust demand for investment products

Nasdaq reported a third-quarter profit that topped Wall Street estimates, helped by strong demand for its investment-related products and a jump in the number of initial public offerings.

• Micron considering new U.S. memory chip factory as it gears up spending

Micron Technology said it is considering building a new memory factory in the United States but that state and federal subsidies will be needed to offset costs that are higher than its factories in Asia.

• Texas refinery workers overwhelmingly reject Exxon contract offer

Union workers at Exxon Mobil's Beaumont, Texas, oil refinery overwhelmingly rejected the company's six-year labor contract, extending a lengthy standoff over job assignments.

BEFORE THE BELL

U.S. stock index futures were steady as investors digested Netflix' earnings and geared up for quarterly reports from companies including Tesla, while a dip in oil prices eased some concerns about inflation. European shares were mostly flat as upbeat earnings from Nestle offset underwhelming results from French luxury group Kering and Dutch semiconductor company ASML. China stocks slipped, with property shares extending falls and coal stocks tumbling. The dollar was marginally up against a basket of major currencies. Gold prices rose, but gains were capped by elevated Treasury yields.

STOCKS TO WATCH

Results

• America Movil SAB de CV: The Mexican telecommunications giant reported a 16% dip in third-quarter net profit compared to the year earlier period as the peso currency weakened versus the U.S. dollar, falling short of some analyst expectations. The company posted net profit of 15.8 billion pesos, compared with 18.9 billion pesos a year earlier, in part due to the depreciation of the peso. America Movil's revenue dipped to 253.4 billion pesos from 260.2 billion pesos during the year-ago quarter. That still beat the Refinitiv forecast of 244.32 billion pesos. EBITDA was 87.6 billion pesos, an increase of about 1% in nominal terms from a year ago.

• Anthem Inc: The company raised its earnings forecast for 2021 after the U.S. health insurer beat third-quarter profit estimates on the back of lower-than-expected medical costs. Anthem forecast 2021 adjusted profit to exceed $25.85 per share, raising its outlook for the third time this year. Earlier, the insurer had forecast a profit of more than $25.5 per share. Excluding special items, Anthem earned $6.79 per share in the quarter ended Sept. 30, ahead of the average analyst estimate of $6.37. The group said its benefit expense ratio - the percentage of premiums paid for medical services - was 87.7% in the third quarter, better than the 88.38% forecast by analysts.

• Baker Hughes Co: The company reported a quarterly profit compared to a year-ago loss, as crude prices recovered to pre-pandemic levels, fueling drilling activity and demand for oilfield services. "As we look ahead to the rest of 2021 and into 2022, we see continued signs of global economic recovery that should drive further demand growth for oil and natural gas," Baker Hughes Chief Executive Officer Lorenzo Simonelli said. Quarterly net income stood at $8 million, or 1 cent per share, compared to a loss of $170 million, or 25 cents per share, last year.

• Lithia Motors Inc: The auto retailer reported a 94% rise in quarterly profit, helped by tight vehicle inventories that have pushed prices to record levels. The company's net income rose to $307.9 million, or $10.11 per share, for the third quarter ended Sept. 30, from $158.8 million, or $6.86 per share, a year earlier. Lithia said average gross profit per new vehicle jumped 78.7% to $5,221 and rose 3.9% to $3,046 for used vehicles. Quarterly revenue rose to $6.17 billion from $3.62 billion, a year earlier.

• Nasdaq Inc: The firm reported a third-quarter profit that topped Wall Street estimates, helped by strong demand for its investment-related products and a jump in the number of initial public offerings. Nasdaq reported an adjusted profit of $1.78 per share for the quarter ended Sept. 30. Analysts were expecting $1.72 per share. The company's net revenues rose 17% to $838 million in the quarter. Market services revenue rose 15% to $295 million. The exchange operator bought back $475 million worth of common shares in the quarter, it said.

• Netflix Inc: The company's global sensation "Squid Game" helped lure more new customers than expected, the world's largest streaming service said as it predicted a packed lineup would further boost signups through the end of the year. After a sharp slowdown in the first half of 2021, Netflix added 4.38 million subscribers from July through September to reach 213.6 million worldwide. Wall Street analysts had projected 3.86 million additions. For the quarter that ended in September, diluted earnings-per-share came in at $3.19, beating analyst expectations of $2.57. Revenue rose 16% to $7.5 billion.

• United Airlines Holdings Inc: The company reported a smaller quarterly loss than a year ago, but a resurgence in coronavirus cases slowed bookings and drove up cancellations, upending the carrier's plan to return to profit. Chief Executive Scott Kirby, however, said recent headwinds the airline has faced are "turning to tailwinds." United said it expects revenue in the current quarter to recover to up to 75% of 2019 levels, improving from about 68% in the quarter through September. The company reported an adjusted loss for the third quarter of $1.02 per share, compared with a loss of $8.16 per share last year at the height of the coronavirus pandemic. Analysts were forecasting a loss of $1.67 per share.

In Other News

• 3M Co: Industrial conglomerate 3M Co said it had agreed to pay about $98.4 million to settle claims that it contaminated the Tennessee River with toxic chemicals. 3M agreed to resolve a lawsuit by environmental group Tennessee Riverkeeper and a separate class action by residents of Alabama's Morgan County. It also negotiated a private settlement with Morgan County, the city of Decatur, where 3M's local facility is based, and Decatur's utility provider. The three agreements all involve 3M's manufacturing and disposal of polyfluoroalkyl and perfluoroalkyl substances, or PFAS, at its Decatur industrial site in Morgan County. The agreements are subject to final approval, 3M said in a statement. The company did not admit wrongdoing.

• Activision Blizzard Inc: The videogame publisher said it had fired more than 20 employees following allegations of sexual harassment and discrimination at the workplace, with 20 more individuals facing other forms of disciplinary action. The actions are based on an increase in number of reports ranging from years ago to the present, Activision said in a letter to employees. The owner of "Call of Duty" and "Candy Crush" franchises added it would expand its ethics and compliance team in order to create a "more accountable workplace and culture". The company will add 19 full-time roles to the team. "Two of those roles will be specifically dedicated to overseeing investigations related to the EMEA and APAC regions," it added.

• Alphabet Inc: A Swiss court has dismissed Google's bid to block the award of a government cloud computing contract worth up to 110 million Swiss francs to rival bidders. "In an interim decision, the Federal Administrative Court rejects Google's request to grant suspensive effect to its appeal. The Federal Office for Buildings and Logistics may therefore conclude the public cloud contracts with the selected tenderers," the court said in a statement. The decision may be appealed to the Swiss supreme court.

• Alphabet Inc & Snap Inc: The U.S. Senate will hold an Oct. 26 hearing with tech firms Snap's Snapchat, TikTok, and Alphabet's YouTube about their platforms' impact on young users, a panel said on Tuesday. "Recent revelations about harm to kids online show that Big Tech is facing its Big Tobacco moment — a moment of reckoning," said Senator Richard Blumenthal, who chairs the Senate Commerce consumer protection subcommittee holding the hearing. "We need to understand the impact of popular platforms like Snapchat, TikTok, and YouTube on children and what companies can do better to keep them safe."

• Cigna Corp: The company’s pharmacy benefit unit said it will prefer Viatris and Biocon Biologics' insulin drug Semglee, a cheaper alternative to Sanofi's Lantus, on the list of medicines it reimburses on behalf of health insurers. The unit, Express Scripts, said it expects cost savings of $20 million in 2022 by preferring the Semglee injection.

• Exxon Mobil Corp: Union workers at Exxon Mobil Corp's Beaumont, Texas, oil refinery overwhelmingly rejected the company's six-year labor contract, extending a lengthy standoff over job assignments. "We are disappointed that the company's enhanced offer was not ratified," Exxon spokesperson Julie King said. "The lockout of USW-represented workers will continue," she said of the United Steelworkers members. "We will continue to operate our facility safely and reliably with our fully trained workforce," King added. "Exxon's take it or leave it offer is not what we're looking for," said Bryan Gross, a USW International representative.

• Facebook Inc: The tech giant, under fire from regulators and lawmakers over its business practices, is planning to rebrand itself with a new name that focuses on the metaverse, the Verge reported. The name change will be announced next week, The Verge reported, citing a source with direct knowledge of the matter. Zuckerberg plans to talk about the name change at the company's annual Connect conference on Oct. 28, but it could be unveiled sooner, the Verge said. Separately, Britain's competition regulator has fined Facebook 50.5 million pounds for breaching an order imposed during its investigation into the U.S. social media giant's purchase of GIF platform Giphy, the agency said. Also, a group of U.S. lawmakers said Facebook cannot be trusted to manage cryptocurrency and urged the social media platform to discontinue immediately a small pilot of its cryptocurrency wallet named Novi, which was launched on Tuesday.

• Micron Technology Inc: The U.S. memory chip maker will build a new factory at its Japanese production site in Hiroshima at a cost of 800 billion yen, the Nikkan Kogyo newspaper reported. The new facility will make DRAM chips, which are widely used in data centres, with production set to begin in 2024, the report said, without citing sources. Separately, Micron said it is considering building a new memory factory in the United States but that state and federal subsidies will be needed to offset costs that are higher than its factories in Asia. Micron plans to spend up to $12 billion in capital expenditure and $3 billion on research and development next year, Sumit Sadana, Micron's chief business officer, said, and up to $150 billion over the next decade.

• NatWest Group Plc: British lawmakers have asked the Financial Conduct Authority why it took five years to prosecute NatWest for failing to prevent the laundering of nearly 400 million pounds, after the lender pled guilty earlier this month. The bank on Oct. 7 admitted three criminal charges of not adequately monitoring customer accounts between 2012 and 2016, the first time a bank in Britain acknowledged it committed a criminal offence of this kind. "There are questions which remain to be answered, most notably why it has taken five years after the police raid in 2016 to bring this case to a successful conclusion," Mel Stride, chair of the cross-party Treasury Select Committee, said in a letter to the FCA published on Wednesday. "We’ve received the letter and will be responding shortly," a spokesperson for the FCA said.

• Rio Tinto Plc: The Anglo-Australian miner announced a $7.5 billion plan to reduce carbon emissions by 50% by 2030, a reduction three times greater than its previous target, but shares fell as investors reacted to the higher spend. Rio brought forward its target to 2025 for a 15% reduction in emissions from 2018 levels, five years faster than it had previously targeted. "It’s a massive shift but it’s the future for Rio Tinto," Chief Executive Jakob Stausholm told a media briefing ahead of an investor day conference and presentation. Rio raised its capital spending plans for 2022 to $8 billion from $7.5 billion and said it expected to spend $9 billion for 2023, and $10 billion for 2024. RBC had consensus estimates for 2023 spending at $6.8 billion and $5.8 billion for 2024.

• Westpac Banking Corp: The company said it would launch a digital credit card this year that would offer zero interest and be aimed primarily at young customers who are seeking the convenience of fast and efficient payment services. Australia's second-largest lender said customers can apply for the card, called Flex, online or through its mobile banking app, and would be given access to A$1,000 of credit with no interest on purchases and no late payment fees. "Consumer research shows that younger Australians are less likely to use a traditional credit card, compared to older generations," Westpac's Chief Executive Consumer and Business Banking, Chris de Bruin said.

INSIGHT

AI can see through you: CEOs' language under machine microscope

Some investors see the technology - known as natural language processing (NLP) - as one new tool to gain an edge over rivals, according to Reuters interviews with 11 fund managers that are using or trialling such systems.

ANALYSTS' RECOMMENDATION

• Bank of New York Mellon Corp: Barclays raises target price to $62 from $57, stating the company’s third-quarter EPS was ahead of consensus as fee income, net interest income and its pro vision were better than expected.

• Dover Corp: RBC raises target price to $171 from $163, based on the company’s upbeat third-quarter results.

• Ford Motor Co: Credit Suisse raises rating to outperform from neutral, saying there is still more opportunity ahead, as the company can continue to benefit from improving near-term fundamentals, while also more meaningfully changing its perception on its longer term positioning in EV, AV, and digital.

• Halliburton Co: JPMorgan raises target price to $30 from $26, citing the company’s better view for frac and international activity.

• Netflix Inc: JPMorgan raises target price to $750 from $705, citing the company’s solid third-quarter results & fourth-quarter guidance, reflecting the benefits of stronger content and greater distance from the pandemic.

ECONOMIC EVENTS

No major economic indicators are scheduled for release.

COMPANIES REPORTING RESULTS

Abbott Laboratories: Expected Q3 earnings of 95 cents per share

Crown Castle International Corp: Expected Q3 earnings of 76 cents per share

CSX Corp: Expected Q3 earnings of 38 cents per share

Discover Financial Services: Expected Q3 earnings of $3.53 per share

Equifax Inc: Expected Q3 earnings of $1.72 per share

Globe Life Inc: Expected Q3 earnings of $1.91 per share

International Business Machines Corp: Expected Q3 earnings of $2.50 per share

Kinder Morgan Inc: Expected Q3 earnings of 24 cents per share

Las Vegas Sands Corp: Expected Q3 loss of 20 cents per share

Nextera Energy Inc: Expected Q3 earnings of 71 cents per share

Northern Trust Corp: Expected Q3 earnings of $1.67 per share

PPG Industries Inc: Expected Q3 earnings of $1.58 per share

Tesla Inc: Expected Q3 earnings of $1.59 per share

Verizon Communications Inc: Expected Q3 earnings of $1.36 per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Biogen Inc: Q3 earnings conference call

0800 Comerica Inc: Q3 earnings conference call

0800 Nasdaq Inc: Q3 earnings conference call

0830 Anthem Inc: Q3 earnings conference call

0830 Baker Hughes Co: Q3 earnings conference call

0830 MSC Industrial Direct Co Inc: Q4 earnings conference call

0830 Verizon Communications Inc: Q3 earnings conference call

0900 Abbott Laboratories: Q3 earnings conference call

0900 Citizens Financial Group Inc: Q3 earnings conference call

0900 Nextera Energy Inc: Q3 earnings conference call

0900 Nextera Energy Partners LP: Q3 earnings conference call

0930 First Horizon Corp: Q3 earnings conference call

1000 BOK Financial Corp: Q3 earnings conference call

1000 Lithia Motors Inc: Q3 earnings conference call

1000 Marketaxess Holdings Inc: Q3 earnings conference call

1000 Northern Trust Corp: Q3 earnings conference call

1000 Watsco Inc: Q3 earnings conference call

1030 United Airlines Holdings Inc: Q3 earnings conference call

1100 M&T Bank Corp: Q3 earnings conference call

1200 Seagate Technology Holdings PLC: Annual Shareholders Meeting

1200 Wintrust Financial Corp: Q3 earnings conference call

1630 CSX Corp: Q3 earnings conference call

1630 Kinder Morgan Inc: Q3 earnings conference call

1630 Las Vegas Sands Corp: Q3 earnings conference call

1630 SEI Investments Co: Q3 earnings conference call

1630 Ufp Industries Inc: Q3 earnings conference call

1700 International Business Machines Corp: Q3 earnings conference call

1700 Lam Research Corp: Q1 earnings conference call

1700 Qualtrics International Inc: Q3 earnings conference call

1730 Tesla Inc: Q3 earnings conference call

EX-DIVIDENDS

Colgate-Palmolive Co: Amount $0.45

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| EUROPA: CPI (Jaarlijks) (Sep) | Actueel: 3,4% Verwacht: 3,4% Vorige: 3,0% |

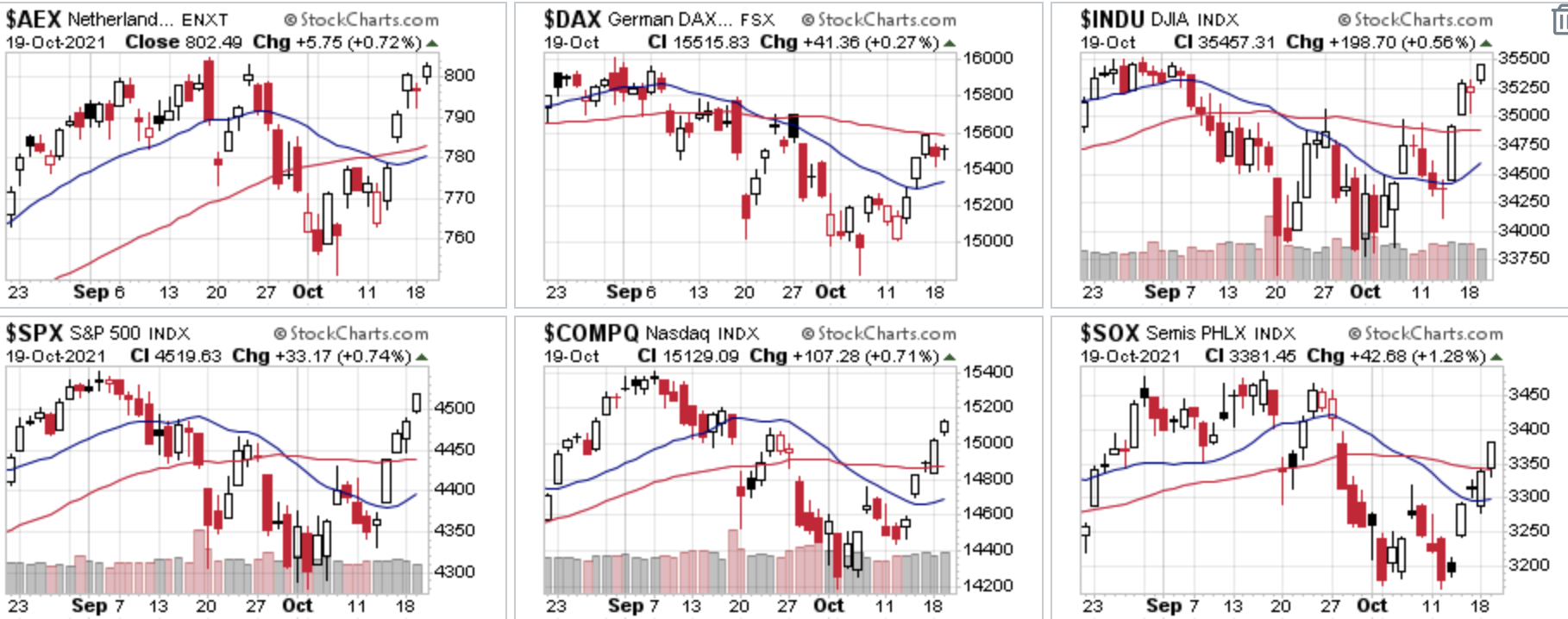

AEX en Dow Jones ruiken records, Nasdaq trekt door omhoog

Goedemorgen,

Weer hogere koersen dinsdag, zo komen de AEX, de Dow Jones en de S&P 500 staan nu wel heel dicht bij hun record, de AEX nog een punt of 2 en de Dow Jones nog zo'n 170 punten te gaan. De S&P 500 moet nog 25 punten hoger zien te geraken. De kwartaalcijfers vallen mee tot nu toe, ook die van ASML vanmorgen voldoen aan de verwachtingen. Het is nu afwachten of het aandeel daar positief op weet te reageren vandaag. Azië zien we vanmorgen wat hoger afsluiten.

Update woensdag 20 oktober:

Veel kwartaalcijfers komen er nu uit, op Wall Street kregen we enkele grote Dow Jones bedrijven met cijfers en ook Netflix kwam nabeurs met een sterk resultaat. Vanmorgen kregen we de cijfers van ASML en AKZO binnen en die waren in ieder geval wat beter dan werd verwacht. Gisteren deed Philips het al goed na de cijfers. Vanaf nu zullen er elke dag een behoorlijk aantal bedrijven in hun boeken laten kijken, de vraag is hoe de markt erop zal reageren, tot nu toe positief en zelfs zo sterk dat er enkele indices al heel dicht bij hun record uitkomen.

We kijken vandaag met de nodige belangstelling naar de AEX, de Dow Jones en de S&P 500 omdat die amper onder hun record staan, nog zo'n 0,5% te gaan ongeveer en dat moet lukken. We weten dat als een index naar een record oploopt dat het ook vrijwel altijd lukt om dat te realiseren om daarna een nieuwe reeks met records neer te zetten. Ook de periode waar we in zitten verloopt vaak positief, tussen de start van de 3e kwartaalcijfers tot rondom Thanksgiving (25 november) zien we over het algemeen een positief verloop van de markten. Het is natuurlijk geen zekerheid maar in 9 van de 10 gevallen is dat zo en nu we op punt staan om de All Time Highs te bereiken verwacht ik wel dat de markt zal doortrekken.

Ik blijf uiteraard zoeken naar kansen, waar het kan zal ik instappen en dat laat ik de leden op tijd weten. Bij een DIP zou ik weer wat nieuwe long posities kunnen opnemen maar wel pas als er zich een mooi momentum voordoet. Mocht de markt de topzone aantikken zou ik ook voor een kleine terugval wat shorts op kunnen nemen. Dat zien we wel zodra het momentum dat toelaat, op dit moment moet ik wachten op een signaal om wat te kunnen doen.

Mij via Twitter volgen? Ga naar @USMarkets of

Overzicht resultaat deze maand oktober en dit jaar (2021):

We blijven voorzichtig, afgelopen donderdag en vrijdag heb ik winst genomen op de long posities tijdens de opleving van de markt. Later zoek ik weer naar een momentum om in te stappen, dat kan zowel long of short worden, eerst maar eens bekijken wat de markt zal doen de komende sessies. Wat betreft deze maand staan we er goed voor, er werd al 2 keer winst genomen op long posities. Er komen zeker nog kansen maar het momentum moet dus goed zijn.

Schrijf u nu in via de nieuwe aanbieding tot 1 JANUARI voor €35. Ga meteen naar onze tradershop via de link https://www.usmarkets.nl/trade...

Marktoverzicht:

Via het marktoverzicht zien we nu al 3 indices heel dicht bij het record uitkomen, dat zijn de AEX, de S&P 500 en de Dow Jones. De DAX en de SOX index blijven wat achter maar zetten ook een mooie reeks in met de DAX die rondom de 15.500 punten weet te blijven. De DAX blijft wel de zwakste van de 6 uit het overzicht hieronder. De SOX index doet het na de 3e bodem zeker goed en sluit nu duidelijk boven het 50-daags gemiddelde. De DAX is ook de enige index die nog niet boven dat 50-daags gemiddelde geraakt.

Dow Jones:

De Dow Jones trekt door en sluit bijna 200 punten hoger, de index komt nu op zo'n 175 punten onder de hoogste stand ooit uit. Het lijkt nu een kwestie van dagen voor dat de index die stap kan maken, dan wordt het vooral uitkijken naar het vervolg na dat de index een nieuw record neerzet.

Weerstand nu eerst het record rond de 35.630 punten, bij een verdere stijging ofwel bij een record kan de index daarna makkelijk richting eerst de 35.750 en later tot zelfs de 36.000 punten oplopen. Tussendoor kunnen we wel wat winstnemingen verwachten maar ik merkt dat de positieve flow terug is gekomen. Deze week maar eens zien wat de index kan bereiken, de motor achter de stijging kunnen de kwartaalcijfers zijn die tot nu toe goed vallen.

Steun nu eerst de 35.000 punten, later de zone rondom de 35.750 punten en de 34.400 punten. Later zien we de 34.200 en de bodemzone rondom de 33.750 punten uitkomen als steun.

AEX index:

De AEX doet het heel goed met al bijna een test van het record op slechts 1 punt er vanaf, het is nu afwachten wat het vervolg zal brengen. De AEX zit nu wel in een sterke fase, mocht de index uitbreken dan kunnen we snel naar de 810-815 punten en zelfs richting de 820-825 punten.

Steun nu eerst de 790-792 punten met daaronder vooral de 780-782 punten en de zone 770-771 punten als steun.

DAX index:

De DAX blijft nog steeds wat achter op de rest, de index blijft de 15.500 punten steun wel verdedigen. Dat is belangrijk voor het vervolg want dan komt de index uit in de zone 15.500-15.810 punten. De index moet wel eens de stap zetten want er zit momenteel geen echte kracht achter. Let ook op het 50-daags gemiddelde dat rond de 15.590 punten uitkomt als volgende weerstand.

Steun nu eerst de 15.500 punten, later de 15.300 punten als steun. We zien uiteraard ook het 200-daags gemiddelde als steun rond de 15.100 punten. De bodem van eerder deze maand zien we rond de 14.800 punten.

Nasdaq Composite:

De Nasdaq blijft sterk en zet opnieuw een stap in de positieve richting, de index komt zoals u ziet op de grafiek hieronder terecht boven de oude steunlijn van de range tussen juni en eind september. Als de Nasdaq binnen deze range weet te blijven dan ziet het er goed uit en kan de recordzone worden opgezocht. Eerst nog weerstand rond de 15.200 punten met daarna de topzone rond de 15.400 punten.

Steun zien we eerst rond de 15.000 punten met daaronder snel de 14.800 punten, later de zone 14.600-14.650 punten met daarna rond 14.450-14.475 punten de volgende steun.

Overzicht resultaat deze maand oktober en dit jaar (2021):

We blijven voorzichtig, vorige week heb ik winst genomen tijdens de opleving. Later kies ik weer een momentum om in te stappen, dat kan zowel long of short worden, eerst maar eens bekijken wat de markt zal doen de komende sessies. Wat betreft deze maand staan we er al heel goed voor, er werd al 2 keer winst genomen op long posities. Er komen zeker nog kansen maar het momentum moet dus goed zijn.

Om mee te doen kan dat via het nieuwe proefabonnement tot 1 januari en voor €35. Schrijf u nu in via de nieuwe aanbieding en ga meteen naar onze tradershop via de link https://www.usmarkets.nl/trade...

Overzicht resultaten oktober en dit jaar (2021)

Met vriendelijke groet,

Guy Boscart