Liveblog Archief woensdag 3 maart 2021

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Ruwe Olievoorraden | Actueel: 21,563M Verwacht: -0,928M Vorige: 1,285M |

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: ISM niet-verwerkende Industrie Index (Feb) | Actueel: 55,3 Verwacht: 58,7 Vorige: 58,7 |

Markt snapshot Wall Street 3 maart

TOP NEWS

• Jobless aid, direct checks could get trimmed as U.S. Senate takes up COVID-19 aid bill

The U.S. Senate is expected to take up President Joe Biden's $1.9 trillion coronavirus relief package, with fellow Democrats seeking to advance key priorities and jettison aspects that have drawn unflattering scrutiny.

• Samsung considers four sites in U.S. for $17 billion chip plant -documents

Samsung Electronics is considering two sites in Arizona and another one in New York in addition to Austin, Texas, for a new $17 billion chip plant, according to documents filed with Texas state officials.

• Microsoft says Chinese hackers targeted groups via server software

A China-linked cyber-espionage group has been remotely plundering email inboxes using freshly discovered flaws in Microsoft mail server software, the company and outside researchers said on Tuesday - an example of how commonly used programs can be exploited to cast a wide net online.

• Exxon to cut 7% of Singapore workforce amid 'unprecedented market conditions'

Exxon Mobil plans to cut its workforce in Singapore, home to its largest oil refining and petrochemical complex, by about 7% amid the "unprecedented market conditions" resulting from the COVID-19 pandemic, it said.

• Texas electricity regulator under pressure to slash winter storm bills

The Texas electricity regulator meets for the first time since a devastating winter storm fueled a financial crisis in its power market, amid calls to slash billions of dollars from costs facing businesses and consumers.

BEFORE THE BELL

U.S. stock index futures gained, tracking global equities, on hopes of a rebound in economic growth on faster vaccinations and record stimulus support. The dollar fell as investor sentiment improved and government bond yields extended their losses. Oil prices rose, boosted by expectations that OPEC+ producers might decide against increasing crude output. Gold prices slipped.

STOCKS TO WATCH

Results

• Nordstrom Inc: The company warned on Tuesday that it would have to go through its off-price channel to clear some of its holiday merchandise inventory in the first quarter that piled up due to shipping delays. Although some of the merchandise did not reach the shelves on time, the upscale department store chain reported a smaller-than-expected fall in quarterly revenue powered by online sales and its off-price business. Total revenue fell 19.7% to $3.65 billion in the fourth quarter from a year earlier, compared with estimates of $3.60 billion. For the holiday quarter, net income fell 83% to $33 million, largely hurt by higher markdowns and COVID-19-induced labor and shipping expenses. On a per share basis, it earned 21 cents, beating the estimate of 14 cents, according to analysts surveyed by Refinitiv IBES.

• Prudential PLC: The British insurer expects to split off its U.S. business in the second quarter, it said as it posted a 4% rise in full-year operating profit on the back of strength in Asia. Prudential, which has been pressed by activist investor Third Point to split the business in two, said in January that it would separate U.S. unit Jackson through a demerger and could raise up to $3 billion in new equity. "These two transactions constitute the largest structural change in Pru’s 172-year history," Chief Executive Mike Wells, a former boss of the insurer's U.S. business, said on a media call. After deducting restructuring costs and other one-offs, Britain's largest insurer reported 2020 adjusted operating profit from continuing operations up 4% at $5.5 billion, beating a company-supplied consensus forecast of $5.26 billion. Prudential said it would pay a second interim dividend of 10.73 cents per share and a total dividend of 16.10 cents per share.

• Stellantis NV: Low global car inventories and cost cuts should boost Stellantis's profit margins this year, though a shortage of semiconductors and investments in electric vehicles could weigh on results, the newly-formed automaker said. The forecast came as Stellantis, created by the January merger of Peugeot-maker PSA and Fiat Chrysler, reported better-than-expected results for 2020 that sent its shares up in morning trading. "Stellantis gets off to a flying start and is fully focused on achieving the full promised synergies (from the merger)," Chief Executive Carlos Tavares said in a statement. The carmaker is targeting an adjusted operating profit margin of 5.5%-7.5% this year. Combined adjusted earnings before interest and tax (EBIT) amounted to 7.1 billion euros ($8.6 billion) last year. Stellantis proposed to distribute a 1 billion euro dividend to its shareholders.

In Other News

• AGCO Corp: Tractors and Farm Equipment Limited, the largest investor in AGCO, on Tuesday again pressed the agricultural machinery maker to refresh its board and consider strategic alternatives as it risks falling further behind its rivals. Indian tractor manufacturer Tractors and Farm Equipment, known as TAFE, said in a U.S. regulatory filing that it made a presentation to the company in which it outlined AGCO's weakening long-term competitive position and urged immediate action. "We believe that material risks exist for AGCO's shareholders in the inevitable cycle downturn and that the Board should proactively focus on minimizing such risk now," TAFE, which is AGCO's largest shareholder with a 16.2% stake, said in the presentation. AGCO was not immediately available for comment. "Strategic missteps have resulted in a deteriorating market position in Brazil, continued sub-scale presence in North America (a key market) and an unsuccessful investment initiative in China," TAFE said in the presentation, which was attached to the regulatory filing.

• Alibaba Group Holding Ltd & Pinduoduo Inc: China fined five community group-buying platforms owned and backed by the likes of Meituan, Pinduoduo, Tencent Holdings, Alibaba Group and Didi Chuxing, citing "improper pricing behaviour". The State Administration of Market Supervision said it had decided to fine the registered firms behind Didi-owned Chengxin Youxuan, Pinduoduo's Duo Duo Maicai, Meituan Select, and Nicetuan 1.5 million yuan ($230,000) each, and that of Shixianghui 500,000 yuan. Nicetuan and Shixianghui respectively count Alibaba and Tencent as investors. These platforms had issued since the second half of 2020 a large amount of price subsidies which disrupted market order, the regulator said. Some of them also used false or misleading price tactics to "trick" consumers into buying from them, it added. Duoduo Maicai and Chengxin Youxuan said that they attach great importance to the issues and will carry out rectifications.

• Amazon.com Inc and Micro Focus International PLC: IT firm Micro Focus International said it had joined hands with Amazon.com Inc's cloud computing division to help customers migrate their mainframe applications and workloads to the platform. As part of the collaboration, Micro Focus has issued warrants to Amazon.com to subscribe for up to 15.9 million ordinary shares in the company at 446.6 pence per share. Micro Focus' deal with Amazon Web Services comes soon after it re-instated its dividend, while making "solid progress" in the first year of its three-year turnaround plan.

• Artisan Partners Asset Management Inc: The U.S investment company said that Danone needed to appoint a new, independent chairman, adding more pressure on Emmanuel Faber who holds that position at the French food company. "With Mr. Faber as chairman, the incoming CEO will not have the appropriate latitude to set a new direction," wrote Artisan, which has a stake of around 3% in Danone. Artisan Partners' letter to Danone's board of management echoed a similar position from investment company Bluebell, which also said Danone should appoint another independent chairman instead of Faber. Activist investors say Danone needs a management revamp as they believe that under Faber's tenure, Danone's sales growth, margins and share price have lagged rivals, including Perrier-owner Nestle and Unilever, the maker of Cornetto ice cream and Lipton tea.

• Boeing Co: The company has raised concerns over the design of arch-rival Airbus' newest narrow-body jet, the A321XLR, saying a novel type of fuel tank could pose fire risks. The U.S. plane giant's intervention is not without precedent in a global system that regularly allows manufacturers to chime in whenever safety rules are being interpreted in a way that might affect the rest of the industry. In a submission to the European Union Aviation Safety Agency, Boeing said the architecture of a fuel tank intended to increase the A321XLR's range "presents many potential hazards." "An integral fuselage fuel tank exposed to an external fire, if not adequately protected, may not provide enough time for the passengers to safely evacuate the aircraft," it said. "Public consultation is part-and-parcel of an aircraft development programme," an Airbus spokesman said, adding any issues raised would be tackled together with regulators.

• Carlyle Group Inc: A Japanese fund backed by veteran activist investor Yoshiaki Murakami cancelled its offer for energy and environment firm Japan Asia Group, after pressuring private equity firm Carlyle Group to withdraw a competing bid last month. City Index Eleventh said it was withdrawing its bid after JAG refused to cooperate with its efforts to carry out due diligence and announced a large, special dividend. JAG shares were halted on the Tokyo Stock Exchange after trading earlier at around 1,083 yen. City Index Eleventh had offered 1,210 yen per share, more than double Carlyle's initial offer of 600 yen and beating a later offer of 1,200 yen.

• Exxon Mobil Corp: The company plans to cut its workforce in Singapore, home to its largest oil refining and petrochemical complex, by about 7% amid the "unprecedented market conditions" resulting from the COVID-19 pandemic, it said. About 300 positions out of 4,000 current jobs will be impacted by the end of 2021, the company said. The city-state will remain a strategic location for the company, it said. "This is a difficult but necessary step to improve our company's competitiveness and strengthen the foundation of our business for future success," said Geraldine Chin, chairman and managing director, ExxonMobil Asia Pacific Pte Ltd.

• General Motors Co, Macy's Inc, Target Corp & Toyota Motor Corp: Employees at General Motors, Toyota Motor, Target Corp, and Macy's Inc in Texas will keep face masks on at work, the companies said on Tuesday, even as the U.S. state lifted most of its coronavirus curbs allowing businesses to reopen at full capacity as of next week. "The early read is – no change for us," Toyota spokesman Scott Vazin said. "We'll keep our COVID-19 safety protocols in place to ensure we continue to protect our employees," GM spokesman Patrick Morrissey said. "Relaxing common-sense safety protocols like wearing masks is a mistake," Jason Brewer, vice president of Communications and State Affairs at the Retail Industry Leaders Association, said, adding that going back on safety measures will "unfairly put retail employees back in the role of enforcing guidelines still recommended by the CDC and other public health advocates."

• Intercontinental Exchange Inc: New York Stock Exchange-owner said on Tuesday Chief Financial Officer Scott Hill would retire on May 14 and be replaced by Warren Gardiner, the company's head of investor relations. Hill, who was appointed as CFO in 2007, will be with the company as an adviser through February 2023, ICE said. Before joining ICE, Hill had worked at IBM Corp for 16 years.Gardiner will take up his new role as CFO after the annual shareholders' meeting, the company said.

• JM Smucker Co: Coffee processors in the United States, the world's largest consumer of the beverage, are reporting significant cost increases in their operations, mostly related to transportation, and expect to raise retail prices soon. Mid-sized and smaller roasters, particularly specialty coffee companies, have been hit hardest, company executives said, but even larger companies such as Peet's and JM Smucker say they are coping with higher costs. JM Smucker, owner of brands such as Folgers and Dunkin, said in a statement: "Like others in the industry, we have experienced some recent coffee supply chain challenges." Smucker added: "While we regularly evaluate costs to determine appropriate actions, we do not have any imminent planning to share at this time." Large coffee companies boosted stocks last year as a precaution during the pandemic.

• Microsoft Corp: A China-linked cyber-espionage group has been remotely plundering email inboxes using freshly discovered flaws in the company's mail server software, the company and outside researchers said on Tuesday - an example of how commonly used programs can be exploited to cast a wide net online. In a blog post, Microsoft said the hacking campaign made use of four previously undetected vulnerabilities in different versions of the software and was the work of a group it dubs HAFNIUM, which it described as a state-sponsored entity operating out of China. In a separate blog post, cyber-security firm Volexity said that in January it had seen the hackers use one of the vulnerabilities to remotely steal "the full contents of several user mailboxes." All they needed to know were the details of Exchange server and of the account they wanted to pillage, Volexity said. China opposes all forms of cyber-attacks, Chinese foreign ministry spokesman Wang Wenbin said at a news briefing in Beijing. Microsoft said targets included infectious disease researchers, law firms, higher education institutions, defense contractors, policy think tanks, and non-governmental groups.

• Petroleo Brasileiro SA: Brazil's state-run oil firm Petrobras said late on Tuesday that four of its board members would leave at the end of their terms, requesting not to be reappointed after President Jair Bolsonaro decided to replace the company's chief executive. Petroleo Brasileiro SA, as the company is formally known, disclosed messages from the board members in a securities filing stating their reasons for effectively resigning. Two of the board members said they could not accept reappointment because of personal reasons, while another said his term was being "interrupted unexpectedly" without explanation. A fourth board member said that he would not continue because of "upper management changes," which he said weren't in-line with best management practices.

• Pfizer Inc: The first doses of the Pfizer COVID-19 shots to be dispatched to Africa under the global COVAX vaccine-sharing scheme were to arrive in Rwanda, as efforts to inoculate the world's poorest nations accelerate. The batch of 102,960 doses were due in Kigali hours after a flight landed carrying 240,000 AstraZeneca doses from the Serum Institute of India, the health ministry said. "We will receive additional doses until we reach 7 million doses under COVAX, but also we will be getting them through other mechanisms like African Union," Health Minister Daniel Ngamije said during a ceremony to receive the consignment. "I am ultimately accountable for the failings that led to this tragic event," Thompson said in a statement.

• Rio Tinto PLC: The company said its chairman would step down next year to take responsibility for the destruction of ancient rock shelters, the latest in a string of high-profile departures over the blasts. Simon Thompson will step down after next year's annual general meetings, while non-executive director Michael L'Estrange, who led the review into the company's handling of the incident, will retire in May. "Other Rio Tinto directors who enabled the unhappy regime of the past few years, or who have made excuses for it, are encouraged to reflect on whether their continuing presence on the board is truly in the interest of the company and its shareholders," said James Fitzgerald, a lawyer with activist investor the Australasian Centre for Corporate Responsibility.

• Sumitomo Mitsui Financial Group Inc: The company is likely to halt new financing for any coal-fired power plants, sources close to the matter said, reflecting increasing pressure on Japanese lenders to cut coal funding. While SMFG has said it would not finance new coal-fired power plants in principle, until now it has not ruled out funding projects considered to be more environmentally friendly, such as so-called ultra-supercritical (USC) power plants that burn coal more efficiently than older designs. However, the company is now likely to remove that exception from its lending policy, meaning a complete halt to new finance for coal plants, said the two sources, who declined to be named as the information is not public. A spokesman for SMFG said that while nothing had been decided, it would review its policy for businesses and industries that could have a major impact on the environment.

• TreeHouse Foods Inc: The private label food group on Tuesday appointed two new independent directors to its board, three weeks after activist investment firm Jana Partners urged the company to consider selling itself. TreeHouse said it shares a "common perspective" with Jana, which has said the stock remains undervalued nearly three years into a turnaround. "I look forward to working with John, Ken and the rest of the board to focus on accelerating our momentum and achieving a stock price that reflects the true value of our business," TreeHouse CEO Steve Oakland said in a statement. After settling, Barry Rosenstein, Jana's managing partner, said in a statement; "We are encouraged by the steps the Company has been taking, including these director additions, and by the ongoing commitment to unlocking stockholder value."

ANALYSIS

Biden's SEC chair nominee signals more regulation for cryptocurrencies

The U.S. Securities and Exchange Commission appears likely to work on its first guidelines for cryptocurrencies after President Joe Biden's nominee to lead the agency promised to provide "guidance and clarity" to the rapidly evolving market.

ANALYSTS' RECOMMENDATION

• Abercrombie & Fitch Co: B.Riley raises target price to $31 from $27, stating the company’s higher-than-expected EPS in its fourth quarter and improving store traffic.

• Hewlett Packard Enterprise Co: JPMorgan raises target price to $17 from $16, following the company’s strong first-quarter results and higher EPS forecast for 2021.

• Kohl’s Corp: Evercore ISI raises target price to $58 from $50, reflecting on the company’s higher growth guidance and better-than-expected EPS estimates.

• Target Corp: Jefferies cuts target price to $188 from $205, citing the company’s lower same store sales and higher annual capital expenditure in the coming years.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0815 (approx.) ADP national employment for Feb: Expected 177,000; Prior 174,000

0945 Markit Composite Final PMI for Feb: Prior 58.8

0945 Markit Services PMI Final for Feb: Prior 58.9

1000 ISM N-Manufacturing PMI for Feb: Expected 58.7; Prior 58.7

1000 ISM N-Manufacturing Business Activity for Feb: Expected 60.0; Prior 59.9

1000 ISM N-Manufacturing Employment Index for Feb: Prior 55.2

1000 ISM N-Manufacturing New Orders Index for Feb: Prior 61.8

1000 ISM N-Manufacturing Price Paid Index for Feb: Prior 64.2

COMPANIES REPORTING RESULTS

Brown-Forman Corp: Expected Q3 earnings of 43 cents per share

Dollar Tree Inc: Expected Q4 earnings of $2.11 per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0830 Wendys Co: Q4 earnings conference call

0900 CMC Materials Inc: Annual Shareholders Meeting

0900 Darling Ingredients Inc: Q4 earnings conference call

0900 Dollar Tree Inc: Q4 earnings conference call

1000 Brown-Forman Corp: Q3 earnings conference call

1230 Fair Isaac Corp: Annual Shareholders Meeting

1630 Splunk Inc: Q4 earnings conference call

1700 Okta Inc: Q4 earnings conference call

1700 Snowflake Inc.: Q4 earnings conference call

1700 Vroom Inc: Q4 earnings conference call

EXDIVIDENDS

Allstate Corp: Amount $0.81

Equitable Holdings Inc: Amount $0.17

Eversource Energy: Amount $0.60

Lear Corp: Amount $0.25

Mosaic Co: Amount $0.05

Newmont Corporation: Amount $0.55

Qualcomm Inc: Amount $0.65

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: ADP Werkgelegenheidswijziging buiten de Landbouw (Feb) | Actueel: 117K Verwacht: 177K Vorige: 195K |

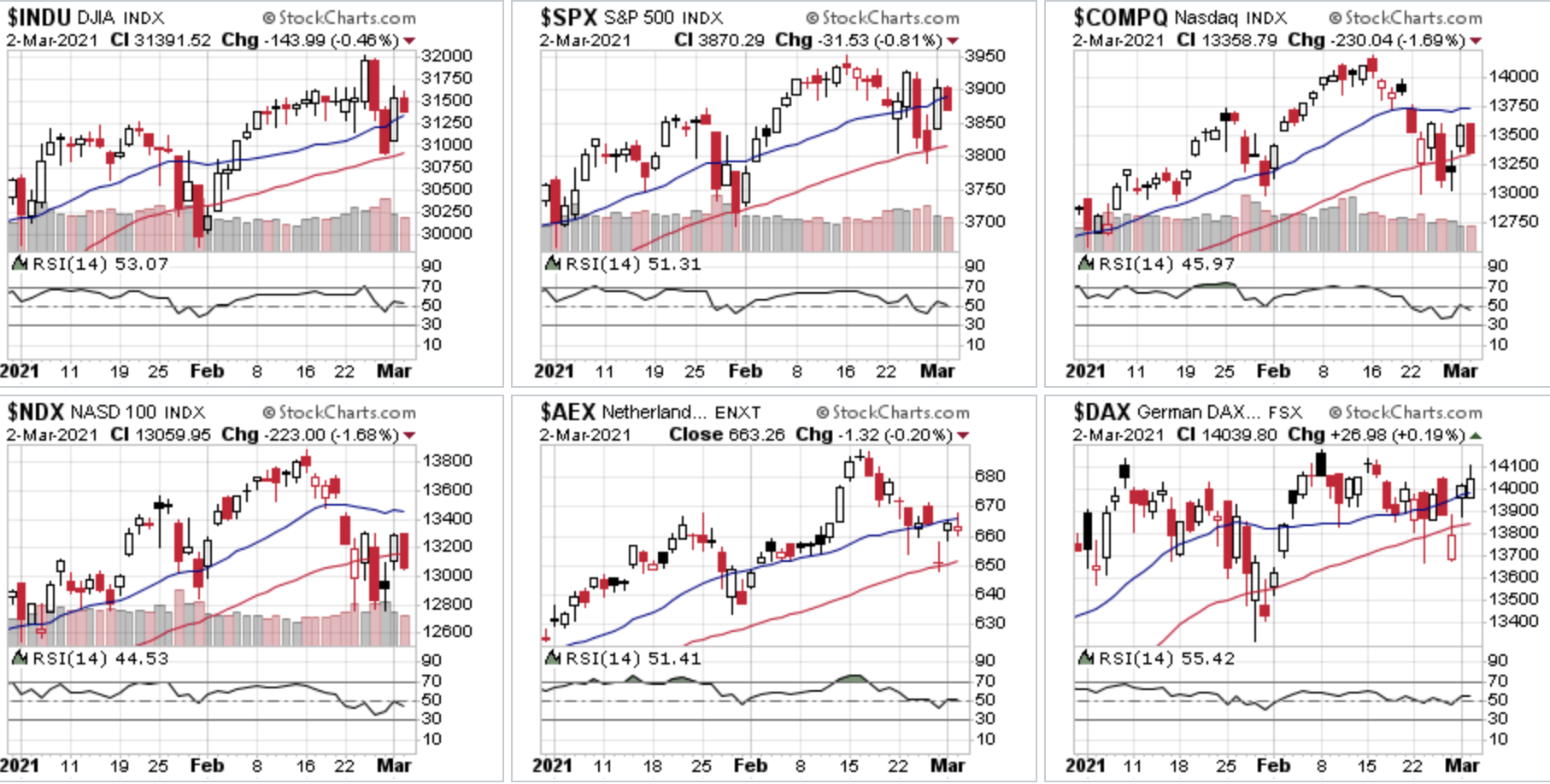

Wake-up call: Markten twijfelen, Nasdaq sluit weer lager

Een lager slot op Wall Street dinsdag waar vooral de technologie aandelen, een dag na de beste sessie in meer dan 3 maanden hebben gezien (maandag), lag weer onder vuur en er kwam een stevige terugval op gang die tot het slot aanhield. De Dow Jones verloor 144 punten, de brede SP 500 moest 31,5 punten inleveren terwijl de Nasdaq 230 punten lager afsloot.

De dag na dat de Dow Jones zijn beste dag liet zien sinds 9 november en de Nasdaq de beste dag sinds 4 november kunnen we er weer een volatiele sessie aan toevoegen maar dan in de negatieve zin. De daling was best fors en opnieuw werden de TOP-8 aandelen in de uitverkoop gedaan. De volatiliteit blijft, het zorgt ervoor dat we voorzichtig moeten blijven en met kleine posities moeten werken, laat ik zeggen op zijn minst op halve kracht ofwel met de helft minder geld in de markt wat betreft het handelen. Dat is ook hetgeen ik doe voor mezelf en voor de leden, voorzichtiger wat betreft het nemen van risico.

Wat drijft de markten nu?

De markten kwamen maandag sterk uit de startblokken door positieve berichten over de kracht van de economie in de VS en omdat er ook een kleine daling kwam op de rentemarkt. Dat zette meteen de risicovolle activa op kopen en daarom kregen beleggers en dan vooral de groep nieuwe retail beleggers de intentie om te kopen omdat ze een nieuwe rally vooral niet willen missen, u weet wel ... het FOMO gedrag dat we vaker zien.

Verder kregen we goeie vooruitzichten rondom de vaccin strategie waarvan de tijdlijn nu in ons voordeel opschuift. In de VS heeft men het al vanaf eind mei, gisteren zei de Jonge dat we begin juli in Nederland allemaal al de 1e prik hebben gekregen. Dat alles is een beetje de euforie waar we nu mee te maken hebben, of dat allemaal wel zo positief kan worden gezien is een andere vraag.

Dat was maandag, maar gisteren de 2e dag van de week begonnen beleggers zich alweer zorgen te maken over de plotseling stevige stijging van de rente op staatsobligaties. Dan krijg je de term inflatie, en niet een klein beetje ook nog, weer om de oren. De inflatie komt vooral door de overwaardering van de markten samen met de enorme hoeveelheid geld dat er nog bij dreigt te komen via de FED en via de regering die met die 1,9 biljoen blijft zwaaien. Marten duur, nog meer geld en dan kun je niet anders dan denken aan inflatie en dus verder oplopende rentes. Zou de FED en de regering Biden hier een grote fout maken? We gaan het zien en ik denk snel genoeg. Een nadeel is dat al het goeie nieuws nu zo goed als opgebruikt is, zou niet weten wat er nog uit de mouw kan worden geschud op de korte termijn.

We zien in ieder geval de nodige volatiliteit op de markten al was die er altijd al gedurende het afgelopen jaar. De markten weten steeds wel een item te vinden waarop men kan reageren, de ene keer positief de andere keer negatief. Zelf probeer ik me er zo goed als mogelijk doorheen te loodsen en op zich lukt me dat prima met de conditie van de huidige markt.

Hieronder ziet u nog een overzicht wat betreft Trading en een aanbieding om mee te doen met onze signalen tot 1 MEI. We zijn maandag al met 2 kleine posities ingestapt, nu is het afwachten of het de richting op gaat zoals mijn korte termijn analyse het aangeeft. U kunt uiteraard nog mee met de posities die lopen door lid te worden. Via de site en dan de Tradershop kunt u dan de posities met alle details inzien.

Technische conditie markt:

De herstelbeweging van maandag viel nogal op, vooral de kracht ervan en het gedrag gedurende de sessie. Enkele indices kwamen eind vorige week op een belangrijke steun terecht en wisten te draaien vanaf dat punt, wel vreemd is dat de Nasdaq en de Nasdaq 100 van onder het 50-daags gemiddelde kracht konden ontwikkelen om dat niveau ruim terug te winnen. We zien wel dat de verkoopdruk dinsdag terug kwam zodat het wat betreft Wall Street de vraag blijft of alles verder zal herstellen. Kan moeilijk worden zie ik aan de grafieken, de beide Nasdaq indices kunnen hier zelfs een kop-schouder patroon neerzetten. We hebben wel nog een paar dagen nodig om daar een definitief oordeel over de geven.

Andere indices bewegen nu tussen hun 20- en 50-daags gemiddelde, ook een belangrijk gegeven voor het verdere verloop zo lijkt me. Alleen de Dow Jones en de DAX staan weer net boven hun 20-MA.

Eind vorige week wat enkele posities goed kunnen sluiten:

De maand februari en dit jaar verlopen naar wens, nu al voor de 3e maand op rij werd er winst behaald zodat het jaar 2021 tot nu toe goed verloopt (december was ook al goed). De markt blijft wel moeilijk en uitdagend zodat ik voorzichtig moet blijven, dat wil zeggen handelen met kleine posities en niet teveel posities gelijktijdig. Het is momenteel niet de bedoeling om teveel risico te nemen, we moeten de markt zo rustig mogelijk zien te benaderen en vooral kalm blijven.

De LIVEBLOG en. Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

Euro, olie en goud:

De euro zien we nu rond de 1.208 dollar, de prijs van een vat Brent olie komt uit op 63,15 dollar terwijl een troy ounce goud nu op 1732 dollar staat.

Inter Market overzicht op slotbasis ...

Wordt nu lid tot 1 MEI voor €39 (nieuwe aanbieding):

Blijven schakelen tussen long en short blijft belangrijk de komende weken. Ook de komende maand (maart) krijgen we genoeg kansen. Doe nu in ieder geval mee met de proef aanbieding voor nieuwe leden, die loopt tot 1 MEI en dat met een mooie korting !! ... €39 tot 1 MEI 2021 ... en voor Polleke €49 tot 1 MEI 2021 !!!

Schrijf u in voor Systeem Trading (€39 tot 1 MEI)

Schrijf u in voor Index Trading (€39 tot 1 MEI)

Schrijf u in voor Guy Trading (€39 tot 1 MEI)

Schrijf u in voor Polleke Trading (€49 tot 1 MEI)

Schrijf u in voor de Aandelen portefeuille (€30 tot 1 MEI)

Schrijf u in voor COMBI TRADING (€79 tot 1 MEI)

Hieronder het resultaat maand februari (2021) ...

Hieronder het resultaat tot nu toe dit jaar (2021) ...

Met vriendelijke groet,

Guy Boscart

Markt snapshot Europa 3 maart

GLOBAL TOP NEWS

The United States will have enough COVID-19 vaccine for every American adult by the end of May, President Joe Biden said on Tuesday after Merck & Co agreed to make rival Johnson & Johnson's inoculation.

China's services sector activity grew at its slowest pace in 10 months in February as firms struggled with sluggish demand and high costs, a private sector survey showed, prompting them to cut jobs.

Negotiations over President Joe Biden's $1.9 trillion COVID-19 relief bill go into overdrive this week as the U.S. Senate begins debate over the sweeping legislation and lawmakers jockey to include pet projects, while tossing others overboard.

EUROPEAN COMPANY NEWS

Rio Tinto said its chair and a board director would step down, bowing to investor pressure over the destruction of two ancient Aboriginal rock shelters for an iron ore mine last year in Western Australia.

Boeing has raised concerns over the design of arch-rival Airbus' newest narrow-body jet, the A321XLR, saying a novel type of fuel tank could pose fire risks.

France's banking industry body wants a new European Union law that would force non-EU banks to shift swathes of euro derivatives clearing from the City of London to Frankfurt, people familiar with the matter said.

TODAY'S COMPANY ANNOUNCEMENTS

Amplifon SpA Q4 2020 Earnings Call

Andritz AG FY 2020 Earnings Release

Atento SA Q4 2020 Earnings Release

Avast PLC FY 2020 Earnings Call

dormakaba Holding AG HY 2021 Earnings Call

Elia Group SA FY 2020 Earnings Call

Georg Fischer AG FY 2020 Earnings Release

Gunsynd PLC Annual Shareholders Meeting

Implenia AG FY 2020 Earnings Call

International Personal Finance PLC FY 2020 Earnings Release

Jeronimo Martins SGPS SA FY 2020 Earnings Release

Kuehne und Nagel International AG FY 2020 Earnings Release

Neurones SA FY 2020 Earnings Release

Nilfisk Holding A/S Q4 2020 Earnings Release

Pagegroup PLC FY 2020 Earnings Release

Permanent TSB Group Holdings PLC FY 2020 Earnings Release

Persimmon PLC FY 2020 Earnings Release

Photocure ASA Q4 2020 Earnings Call

Poligrafici Printing SpA Annual Shareholders Meeting

Polymetal International PLC FY 2021 Earnings Call

Property Franchise Group PLC Shareholders Meeting

Prudential PLC FY 2020 Earnings Release

Royal Unibrew A/S Q4 2020 Earnings Release

Stellantis NV Q4 2020 Earnings Call

Swiss Steel Holding AG Q4 2020 Earnings Release

Talenom Oyj Annual Shareholders Meeting

Vifor Pharma AG FY 2020 Earnings Release

Vivendi SE FY 2020 Earnings Release

Vivo Energy PLC FY 2020 Earnings Call

ECONOMIC EVENTS (All times GMT)

0700 United Kingdom Reserve Assets Total for Feb: Prior $1,81,451.20 mln

0730 Switzerland CPI mm for Feb: Expected 0.4%; Prior 0.1%

0730 Switzerland CPI yy for Feb: Expected -0.3%; Prior -0.5%

0730 Switzerland CPI NSA for Feb: Prior 100.1

0730 Sweden PMI Services for Feb: Prior 59.3

0745 France Budget Balance for Jan: Prior -178.10 bln EUR

0815 Spain Services PMI for Feb: Expected 43.0; Prior 41.7

0845 Italy Markit/IHS Services PMI for Feb: Expected 46.0; Prior 44.7

0845 Italy Composite PMI for Feb: Expected 49.1; Prior 47.2

0850 France Markit Services PMI for Feb: Expected 43.6; Prior 43.6

0850 France Markit Composite PMI for Feb: Expected 45.2; Prior 45.2

0855 Germany Markit Services PMI for Feb: Expected 45.9; Prior 45.9

0855 Germany Markit Composite Final PMI for Feb: Expected 51.3; Prior 51.3

0900 Italy GDP Final qq for Q4: Expected -2.0%; Prior -2.0%

0900 Italy GDP Final yy for Q4: Expected -6.6%; Prior -6.6%

0900 Euro Zone Markit Services Final PMI for Feb: Expected 44.7; Prior 44.7

0900 Euro Zone Markit Composite Final PMI for Feb: Expected 48.1; Prior 48.1

0930 United Kingdom Markit/CIPS Services PMI Final for Feb: Expected 49.7; Prior 49.7

0930 United Kingdom Composite PMI Final for Feb: Expected 49.8; Prior 49.8

1000 Euro Zone Producer Prices mm for Jan: Expected 1.2%; Prior 0.8%

1000 Euro Zone Producer Prices yy for Jan: Expected -0.4%; Prior -1.1%

1100 Portugal Unemployment Rate for Jan: Prior 6.50%