Pittige prijs voor anti virus middel Gilead

Pittige prijs voor anti virus middel Gilead

In een open brief zegt Gilead Sciences Chairman & CEO Dan O'Day dat de prijs voor het antiviral remdesivir, wat tot nu toe het enige medicijn is dat werd goedgekeurd door de FDA als nood middel voor gebruik tegen COVID-19, per injectie 390 dollar zal kosten ofwel 2340 dollar voor een kuur van 5 dagen ... Best een pittige prijs maar analisten dachten dat het nog duurder zou worden ...

Het bedrijf voert de productie verder op en verwacht dat zijn investering in de ontwikkeling en productie van remdesivir tegen het einde van het jaar meer dan 1 miljard dollar zal bedragen.

In de derde wereld heeft Gilead deals met generieke fabrikanten om behandeling tegen aanzienlijk lagere kosten mogelijk te maken.Liveblog feed

Wall Street wat terughoudend, Europa opnieuw hoger

Beste beleggers,

De markten blijven redelijk stabiel nu de deadline is bereikt, Trump begint al met uitstel te geven tot 1 augustus dus TACO speelt weer mee momenteel. Dat wil zeggen dat er veel wordt geroepen maar dat er amper iets tot stand komt. De komende dagen zullen wel weer belangrijk worden voor de richting. Veel economische cijfers zijn er niet deze week, vanaf volgende week komen er grote bedrijven met kwartaalcijfers. Zowel de Nasdaq, de Nasdaq 100 en de S&P 500 blijven dicht bij hun records. De Brent olie zien we vanmorgen rond de 70 dollar, de 10 jaar rente loopt verder op tot rond de 4,41%.

Aanbieding signaaldiensten:

We overwegen om Nvidia samen met Microsoft voor een tijdje op te nemen via Guy Trading en Systeem Trading, deze 2 aandelen volgen we altijd en zijn zeer interessant om er wat mee te doen door de volatiliteit. Een positie op de AEX index overwegen we ook nog steeds. Voor de details kunt u de trdershop raadplegen na dat zich inschrijft ...

Tot 1 september kunt u ons volgen via een mooie aanbieding, als u zich inschrijft kan dat nu voor € 25. Of u gaat naar onze Tradershop en daar kunt u kiezen tussen Systeem Trading en Guy Trading ...

Schrijf u via deze link in voor Systeem Trading

Schrijf u via deze link in voor Guy Trading

Woensdag 9 juli 2025:

Het verhaal blijft uiteraard wat er gaat gebeuren met de tarieven want vandaag wordt de deadline bereikt. Er zijn nog maar amper akkoorden bereikt en iedere overeenkomst wordt met veel aandacht aan de pers vertoont. De aandelenmarkten in Europa sluiten dinsdag opnieuw hoger, zelfs na dat de Amerikaanse president Donald Trump meer dreigementen rondstuurde. Toch lijkt het erop dat de scherpe kantjes van de dreigende importheffingen er af worden gehaald en dat de lang vastgehouden deadline wat wordt verschoven tot 1 augustus.

Trump stuurde maandagavond al de eerste brieven naar veertien landen die fors hogere importtarieven van 25 tot 40% krijgen opgelegd. Onder meer Japan, Zuid-Korea, Zuid-Afrika en Indonesië kregen al zo'n brief, er stond ook een boodschap bij dat als ze met tegenmaatregelen komen, de Amerikaanse importheffingen nog hoger zullen worden. In de loop van deze week zal Het Witte Huis meer van dit soort eenzijdige brieven versturen onder andere naar de EU landen.

Verder ondertekende Trump een decreet waarin hij de datum waarop de zogenaamde wederzijdse tarieven van kracht worden met drie weken opschoof tot 1 augustus. Daarmee lijkt de deadline van 9 juli niet meer als een zwaard van Damocles boven de markt te hangen en gebeurde er niet zoveel. Men zal zich nu vooral richten op 1 augustus ofwel over 3 weken.

Dat is wat het nieuws bepaald momenteel, meer is er niet te melden enkel dat de indices nog steeds veel te hoog staan. Dat kunnen we niet negeren, er zit momenteel zoveel hoop in de markt en dat op alle vlakken. Denk aan de tarieven, de AI vooruitzichten die nog waar moeten worden gemaakt en zaken zoals het verloop van de rente enz... De tijd zal het ons leren ...

Marktoverzicht:

Europa sluit dinsdag hoger, de AEX sluit met 0,3% winst met een slot op 916,76 punten terwijl de CAC 40 de sessie met 0,56% winst afsloot, de DAX won 0,55%.

Op Wall Street zien we een verdeelde sessie dinsdag, de Dow Jones verloor 0,37% terwijl de S&P 500 met 0,1% verlies de sessie afsloot. De Nasdaq won 0,03% terwijl de Nasdaq 100 de sessie afsloot met 0,07% winst. De SOX index was een uitschieter en won 1,8%.

De indicatie van de markt voorbeurs:

- Europa zal volgens de futures neutraal openen

- De futures op Wall Street staan vanmorgen iets lager

- De beurzen in Azië sluiten verdeeld

- De Hang Seng staat rond de 1% lager

- China zien we vanmorgen zo'n 0,25% hoger

- De Nikkei index staat zo'n 0,2% in de plus

- De VIX-index staat vanmorgen rond de 17,8

- De euro/dollar komt uit rond de 1,172 dollar

- De 10 jaar rente in de VS komt uit rond de 4,41%

- De goudprijs komt vanmorgen uit rond de 3.300 dollar

- Voor een vat Brent olie betaalt men nu 70 dollar

- Bitcoin komt vanmorgen uit op 108.900 dollar

AEX analyse:

De AEX-index zit nu in een soort driehoek omlaag gericht met vooral lagere toppen en gelijke bodems. Het is wachten op een uitbraak ofwel omhoog of omlaag. De steun die we daarbij in de gaten moeten houden komt uit rond de 905-906 punten, we merken dat er daar al meerdere bodems uitkomen en dat is ook het begin van de GAP omhoog van begin mei en die is duidelijk te zien op de grafiek.

Onder de 905-906 punten kan de AEX-index snel verder zakken want van veel steun is er geen sprake onder die 905-906 punten en zeker niet onder de 900 punten.

De eerste belangrijke weerstand (het zijn er in feite 2) komt nu uit rond de 918-920 punten door de lijn over de recente toppen. Daar zien we meteen ook het 50-daags gemiddelde uitkomt, de 2e lijn of weerstand. Later na een duidelijke uitbraak kan de AEX-index doorstoten richting de 935 punten waar we de lijn over de toppen van februari en juni nu uitkomt.

De indicatoren staan neutraal ofwel in het midden, het is wachten op het vervolg dat moeilijk in te schatten is wat betreft de AEX-index.

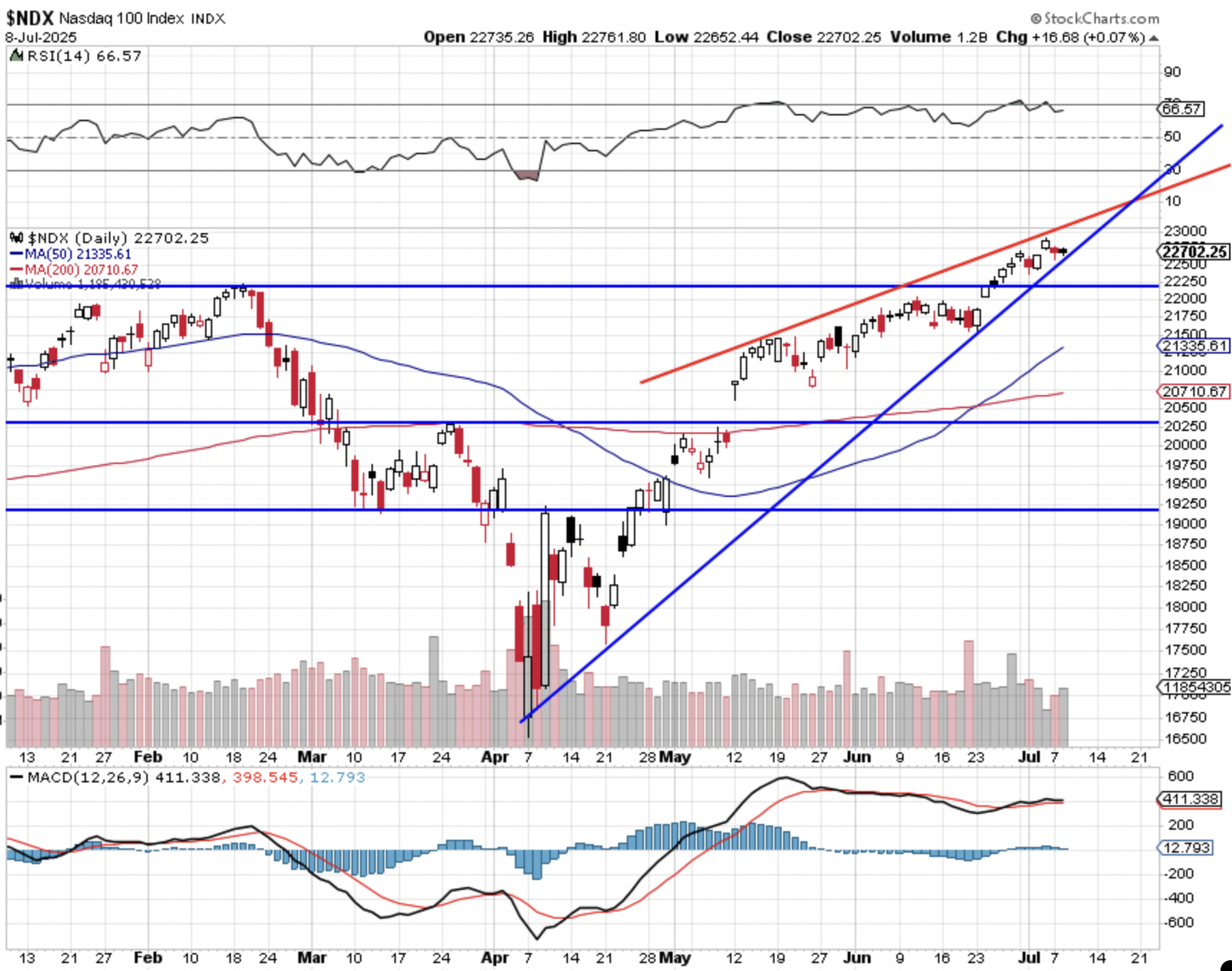

Nasdaq 100 analyse:

Bij de Nasdaq 100 die met een kleine plus wist te sluiten dinsdag merken we dat de kans op een verdere stijging aanwezig blijft. De index blijft dicht bij de topzone ofwel de hoogste stand ooit die nu uitkomt net onder de 22.900 punten. Aan de onderkant letten we op de steunlijn rond de 22.650 punten, er is dus weinig marge zodat de index een keuze zal moeten maken de komende sessies.

Steun eerst rond de 22.650 punten, later steun rond de 22.500 en de 22.250 punten. De index blijft ruim boven zowel het 50-daags en 200-daags gemiddelde.

Weerstand nu de topzone rond de 22.900 punten, later weerstand rond de 23.000 en 23.150 punten maar dan hebben we het al over nieuwe records.

De indicatoren verzwakken wel wat, de RSI lijkt te draaien, de MACD blijft neutraal aan de bovenkant.

Aanbieding signaaldiensten:

We overwegen om mogelijk de aandelen Nvidia samen met Microsoft voor een tijdje op te nemen via Guy Trading en Systeem Trading, deze 2 aandelen volgen we altijd en zijn zeer interessant om er wat mee te doen door de volatiliteit. Een positie op de AEX index overwegen we ook nog steeds.

Tot 1 september kunt u ons volgen via een mooie aanbieding, als u zich inschrijft kan dat nu voor € 25. Of u gaat naar onze Tradershop en daar kunt u kiezen tussen Systeem Trading en Guy Trading ...

Schrijf u via deze link in voor Systeem Trading

Schrijf u via deze link in voor Guy Trading

AEX blijft duidelijk achter, ASML blijft daarbij zeer belangrijk

De AEX en ASML gaan vrijwel altijd hand in hand, de index kan moeilijk een vuist maken zonder de hulp van het meest populaire aandeel binnen de index dat tegelijk ook het zwaarst meeweegt binnen het mandje van de 25 bedrijven die deel uitmaken van de AEX-index. Daarom bekijken we vandaag deze 2…

Lees verder »Divergentie: Wall Street lager, Europa hoger

Beste beleggers,

De indices in Europa sluiten allemaal hoger, op Wall Street zien we een lager slot waardoor de indices even hun topzone verlaten. Verschillen tussen de regio's noemen we divergentie, want zo vaak komt het niet voor dat Wall Street en Europa zo ver uit elkaar lopen gedurende een sessie. We zoeken dan altijd naar de redenen, ligt het aan het verloop van de dollar of komt het door dat beleggers beginnen te denken dat de VS zich te dwingend opstelt wat betreft de tarieven? Japan en Zuid-Korea kregen al een tarief opgelegd door Trump, blijkbaar maakt men er zich niet eens meer druk over die tarieven en denkt men 'zoek het maar uit'. Hoe dan ook gaan we het morgen allemaal wel merken, wie zal er nog over de lijn stappen en met de opgelegde tarieven akkoord gaan? Let op de 10 jaar rente in de VS, die loopt gestaag weer op en komt uit rond de 4,4%. De dollar blijft hangen boven de 1,17 dollar ...

Aanbieding signaaldiensten:

We overwegen om Nvidia samen met Microsoft voor een tijdje op te nemen via Guy Trading en Systeem Trading, deze 2 aandelen volgen we altijd en zijn zeer interessant om er wat mee te doen door de volatiliteit. Een positie op de AEX index overwegen we ook nog steeds.

Tot 1 september kunt u ons volgen via een mooie aanbieding, als u zich inschrijft kan dat nu voor € 25. Of u gaat naar onze Tradershop en daar kunt u kiezen tussen Systeem Trading en Guy Trading ...

Schrijf u via deze link in voor Systeem Trading

Schrijf u via deze link in voor Guy Trading

Dinsdag 8 juli 2025:

Het verhaal van maandag kwam weer van President Trump, hij verzond een stortvloed aan brieven aan leiders van de landen. Daarin kondigde hij aan dat hij een reeks tarieven zou gaan opleggen die vergelijkbaar zijn met de niveaus die hij op 2 april aankondigde. De belangrijkste brieven tot nu toe waren die aan de leiders van Japan en Zuid-Korea, hij informeerde hen dat ze vanaf 1 augustus 25% invoerrechten zullen moeten betalen.

In totaal postte Trump maandag 14 brieven naar landen zoals Zuid-Afrika, Maleisië en Thailand. Daarin had hij het over tarieven van tussen de 25% tot 40%. Vandaag zullen er denk ik brieven volgen naar Europa, Canada en Mexico ...

Het Witte Huis meldde ook dat Trump maandag een uitvoerend bevel heeft ondertekend waarmee de invoering van deze tarieven, evenals de ingrijpende "wederzijdse" tarieven voor de meeste handelspartners, wordt uitgesteld tot 1 augustus.

En zo start die langdurige carrousel van dreiging, onzekerheden en plagerij opnieuw. Dat zal de beurzen in ieder geval volatiel houden want als veel terug gaat naar 2 april moeten we ook kijken naar waar de beurskoersen toen op terecht kwamen.

We zien al een daling van tussen de 0,8% en 1% op Wall Street maandag, de SOX index verloor zelfs bijna 2%. De 10 jaar rente in de VS liep ook meteen weer op tot rond de 4,4%, de vraag naar obligaties uit de VS neemt weer af merken we. De Brent olie loopt ook weer op tot rond de 69,5 dollar.

Op het gebied van economische cijfers en kwartaalresultaten verwacht men op Wall Street een rustige week. De notulen van de Fed vergadering in juni worden woensdag gepubliceerd en Delta Airlines zal donderdag met kwartaalcijfers komen.

Marktoverzicht:

Europa sluit maandag hoger, de AEX sluit met 0,6% winst met een slot op 913,98 punten terwijl de CAC 40 de sessie met 0,35% winst afsloot. De DAX sluit met 1,2% winst.

Op Wall Street zien we een negatieve start van de week, de Dow Jones verloor 0,95% terwijl de S&P 500 met 0,8% verlies de sessie afsloot en zo de reeks met records afbreekt. De Nasdaq verloor 0,9% terwijl de Nasdaq 100 de sessie afsloot met 0,8% verlies. De SOX index verloor 1,9%.

De indicatie van de markt voorbeurs:

- Europa zal volgens de futures iets hoger openen

- De futures op Wall Street laten wat winst zien

- De beurzen in Azië sluiten wat hoger

- De Hang Seng staat rond de 0,6% hoger

- China zien we vanmorgen zo'n 0,6% hoger

- De Nikkei index staat zo'n 0,3% hoger

- De VIX-index staat vanmorgen rond de 18,4

- De euro/dollar komt uit rond de 1,174 dollar

- De 10 jaar rente in de VS komt uit rond de 4,4%

- De goudprijs komt vanmorgen uit rond de 3.340 dollar

- Voor een vat Brent olie betaalt men nu 69,5 dollar

- Bitcoin komt vanmorgen uit op 108.300 dollar

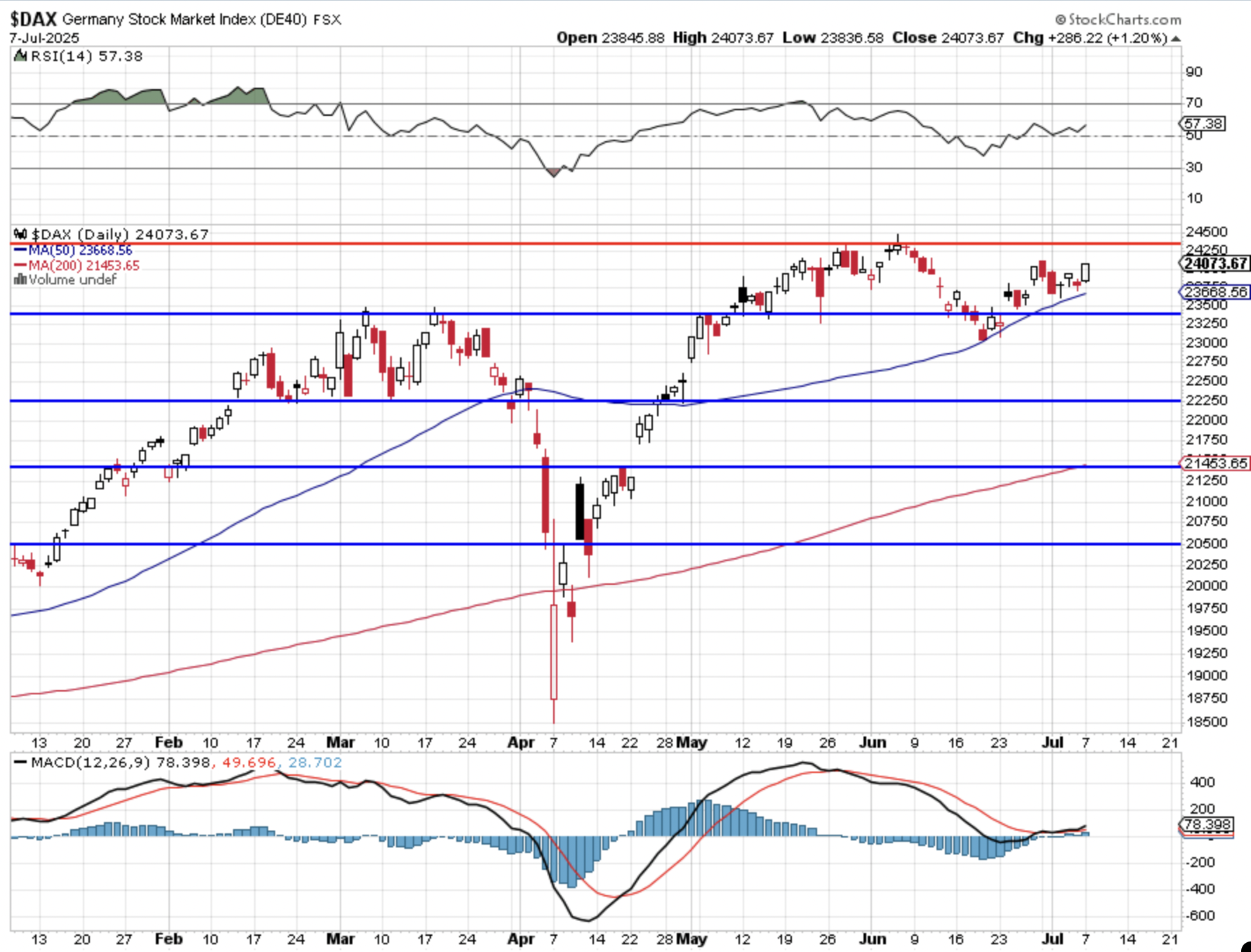

DAX analyse:

De DAX won maandag 286 punten om op 24.073 punten te sluiten. De index herpakt zich dan toch opnieuw na een test van het 50-daags gemiddelde, dat 50-daags gemiddelde komt nu uit rond de 23.670 punten. Voor het vervolg zal veel afhangen van hoe het verloopt met de tarieven, morgen wordt de deadline van 9 juli bereikt.

Steun nu eerst rond de 24.050, 23.750 en 23.670 punten waar nu ook het 50-daags gemiddelde uitkomt. Verder steun rond de 23.400 en 23.250 punten.

Weerstand nu eerst rond de 24.050-24.100 punten, later rond de 24.250 en 24.350 punten weerstand. Verder letten we op de topzone rond de 24.450-24.500 punten.

Dow Jones analyse:

Bij de Dow Jones een lager slot, met het slot op 44.406 punten komt de index weer wat verder onder de hoogste stand ooit en werd de sprong naar een nieuwe mijlpaal in ieder geval onderbroken.

Weerstand eerst rond de 44.500 en 44.750 punten, later de topzone rondom de 45.050-45.100 punten.

Steun nu eerst rond de 44.250 punten, later letten we op de 44.000 en 43.750 punten als steun.

Aanbieding signaaldiensten:

We overwegen om Nvidia samen met Microsoft voor een tijdje op te nemen via Guy Trading en Systeem Trading, deze 2 aandelen volgen we altijd en zijn zeer interessant om er wat mee te doen door de volatiliteit. Een positie op de AEX index overwegen we ook nog steeds.

Tot 1 september kunt u ons volgen via een mooie aanbieding, als u zich inschrijft kan dat nu voor € 25. Of u gaat naar onze Tradershop en daar kunt u kiezen tussen Systeem Trading en Guy Trading ...

Schrijf u via deze link in voor Systeem Trading

Schrijf u via deze link in voor Guy Trading

Zullen we even een totale beurswaarde bijna 8 biljoen dollar kijken?

Het lijkt, ik zeg wel lijkt, dat een van deze 2 bedrijven de 4 biljoen dollar aan beurswaarde zal bereiken. Nvidia werd al verhandeld als het meest waardevolle bedrijf ooit op Wall Street en ook wat betreft de gehele wereld. Toch kwam Apple ook even heel dicht bij dat niveau terecht en faalde om…

Lees verder »