Liveblog Archief dinsdag 15 december 2020

TA AEX, ABN, Adyen en AB Inbev

Het is dinsdag en de hoogste tijd voor weer een nieuwe column. Van de vier grafieken die ik vandaag met u ga bespreken is er één een verzoek. Het verzoek is AB Inbev en de andere drie grafieken zijn de AEX, Adyen en ABN AmRo.Ik stel voor met het verzoek te beginnen. Het verzoek kwam van lezer 040…

Lees verder »Markt snapshot Wall Street vandaag

TOP NEWS

• Fresh off Electoral College win, Biden to stump in Georgia for Democratic Senate candidates

A day after the Electoral College confirmed his presidential victory, Joe Biden will travel to Georgia to campaign for two Democratic U.S. Senate candidates whose Jan. 5runoff elections could make or break his domestic policy agenda.

• Irish watchdog fines Twitter in landmark for EU data privacy regime

Ireland's data regulator has fined Twitter 450,000 euros for a bug that made some private tweets public, the regulator said, in the first sanction against a U.S. firm under a new European Union data privacy system.

• Aon's $30 billion Willis Towers deal faces EU probe

Aon's $30 billion bid for Willis Towers to create the world's largest insurance broker faces a full-scale investigation because of its complexity, two people familiar with the matter said.

• Facing year-end cut off, U.S. banks scramble to extend COVID accounting relief

U.S. banks are scrambling to persuade Washington policymakers to extend the Dec. 31 expiry of an accounting waiver that has allowed lenders to give struggling borrowers more leeway on their loans, several bankers and lobbyists said.

• Eli Lilly to buy gene therapy developer Prevail in $1.04 billion deal

Eli Lilly said it would buy Prevail Therapeutics in a deal valued at $1.04 billion to expand its presence in the lucrative field of gene therapy.

BEFORE THE BELL

U.S. stock index futures rose as progress toward a government spending bill and COVID-19 relief measures kept spirits high, while investors awaited new economic cues from the Federal Reserve's final meeting of the year. European shares were up with optimism from vaccine roll-outs helping traders shake off concerns about tighter curbs due to the rising cases. Most Asian equities ended in the negative territory. The dollar edged lower, whereas gold prices gained. Oil prices advanced, supported by hopes of demand recovery.

STOCKS TO WATCH

Deals Of The Day

• Eli Lilly and Co (LLY) & Prevail Therapeutics Inc (PRVL). Eli Lilly said it would buy Prevail in a deal valued at $1.04 billion to expand its presence in the lucrative field of gene therapy. Lilly said it would acquire Prevail for $22.50 per share, which represents a premium of 80% to Monday's closing price. The deal also includes a "contingent value right" worth $4 per share in cash, payable upon the first regulatory approval of a product from Prevail's pipeline. Lilly also said it expects 2021 sales to be between $26.5 billion and $28 billion, which includes revenue of about $1 billion to $2 billion from its COVID-19 treatments. Analysts had expected sales of $26.47 billion in 2021.

In Other News

• Amazon.com Inc (AMZN), Apple Inc (AAPL), Facebook Inc (FB) & Alphabet Inc (GOOGL). The companies may have to change their business practices in Europe or face hefty fines between 6-10% under new draft EU rules to be announced. One set of rules called the Digital Markets Act calls for fines up to 10% of annual turnover for online gatekeepers found breaching the new rules, a person familiar with the matter told Reuters. It also sets out a list of dos and don'ts for gatekeepers, which will be classified according to criteria such as number of users, revenues and the number of markets in which they are active, other sources said.

• Aon PLC (AON) & Willis Towers Watson PLC (WLTW). Aon's $30 billion bid for Willis Towers to create the world's largest insurance broker faces a full-scale investigation because of its complexity, two people familiar with the matter said. The European Commission, which will open the probe following the end of its preliminary review on Dec. 21, and Aon declined to comment. A full-scale EU investigation takes about five months. Aon did not provide concessions on Monday, the deadline for doing so in the preliminary phase to address EU competition concerns, the EU competition enforcer's website showed.

• Apple Inc (AAPL). The company plans to manufacture up to 96 million iPhones in the first half of 2021, a nearly 30% year-on-year increase, Nikkei reported. It has asked suppliers to produce around 95 million to 96 million iPhones, including the latest iPhone 12 range as well as older iPhone 11 and SE, though shortage of key parts could threaten the target, the report said, citing people familiar with the matter. This would mark a 20% rise from 2019 though the target will be regularly reviewed and revised in response to any changes in consumer demand, according to the report. Separately, the ransacking of an iPhone manufacturing facility in India caused up to $7.12 million in damage though production facilities were not as badly hit as reported, its Taiwan-based operator Wistron said.

• Baidu Inc (BIDU). The company is considering making its own electric vehicles and has held talks with automakers about the possibility, three people with knowledge of the matter said, the latest move in a race among tech firms to develop smart cars. The search-engine leader, which also develops autonomous driving technology and internet connectivity infrastructure, is considering contract manufacturing, one of the people said, or creating a majority-owned venture with automakers. Baidu has held preliminary talks - without reaching any decisions - with automakers including Zhejiang Geely, Guangzhou Automobile Group and China FAW's Hongqi, on a possible venture, the people said.

• Citigroup Inc (C). The bank and other finance companies and executives will likely face trial in Australia in 2022, people familiar with the matter said, seven years after a share sale they are accused of colluding on. Citi, Deutsche Bank, the Australia and New Zealand Banking and six of their current and former staff are fighting charges of colluding as a cartel during a 2015 ANZ stock issue to withhold unwanted shares and prevent a price decline. After the parties entered their pleas, the matter went before a Federal Court judge who said he hoped the trial would start in 2022, people familiar with the matter said.

• Comcast Corp (CMCSA). Starting in January, most seasons of popular workplace comedy "The Office" will be accessible only with a monthly subscription to Comcast's Peacock Premium streaming service, the company announced on Monday. Paying subscribers to those two plans also will have access to previously unreleased behind-the-scenes footage and deleted scenes from "The Office," according to an announcement from series creator Greg Daniels.

• Credit Suisse Group AG (CS). The bank is targeting 10% annual earnings growth in its wealth management business over the next three years as it tries to get back on track to hit its profit goals after loan losses and legal provisions threw it off course this year. Kicking off the bank's investor day, Chief Executive Thomas Gottstein said the bank expected to grow wealth-related pre-tax profit to 5.0 - 5.5 billion Swiss francs by 2023, from 4.0 billion francs in the first nine months of 2020, as it shifts more of its available capital into the core business and refocuses its investment bank to better serve rich private clients. The bank said that business in the fourth quarter had continued the trend of the previous three months with investment banking revenues ahead of the last year's fourth quarter.

• General Motors Co (GM), Toyota Motor Corp (TM) & Ford Motor Co (F). A major automotive trade association urged U.S. policymakers to back sweeping support for electric vehicles (EV), including new incentives for research and development and consumer purchases. The Alliance for Automotive Innovation, the auto trade group representing General Motors, Volkswagen, Toyota, Ford and nearly all major automakers, called in a report for a series of steps to boost the EV market and to revamp regulatory oversight of self-driving vehicles. John Bozzella, the group's chief executive, in an interview argued "the future of the industry" is at stake as it spends heavily on electric and self-driving vehicles.

• Johnson & Johnson (JNJ). Spanish pharmaceutical Reig Jofre said it had agreed with J&J to produce the U.S. company's COVID-19 vaccine, becoming the third Spanish company to be chosen to take part in manufacturing coronavirus vaccines. J&J's Janssen subsidiary will transfer the technology required for large-scale manufacture of the vaccine candidate to Reig Jofre, allowing production at its plant in Barcelona to get underway once the shot receives regulatory approval, the Spanish company said in a statement. Under the terms of the agreement, Reig Jofre said it will be responsible for the formulation, filling and packaging of the vaccine, while Janssen will handle distribution.

• Pfizer Inc (PFE) & BioNTech SE (BNTX). The European Medicines Agency (EMA) is set to issue a positive verdict on the first COVID-19 vaccine on Dec. 23, a German government source told Reuters, putting EU countries on track to catch up with the United States and Britain, where immunisation campaigns are underway. "Yes, the EMA will be done on December 23," the source said, referring to the watchdog's review of Pfizer-BioNTech's vaccine. German Health Minister Jens Spahn also told a news conference that he hoped European Union approval for the vaccine would be in place before Christmas, clearing a path for innoculations before the end of the year.

• Regeneron Pharmaceuticals Inc (REGN). The drugmaker said on Monday it was pausing patient enrollment in two trials testing its experimental lymphoma drug, after the U.S. health regulator requested changes in trial protocols. Participants benefiting from the drug, odronextamab, may continue treatment, the company said, if they give their consent. The U.S. Food and Drugs Administration had placed the trials on partial clinical hold and asked the company to change protocols to reduce the occurrence of an inflammatory response called cytokine release syndrome in patients, according to Regeneron.

• Twitter Inc (TWTR). Ireland's data regulator has fined the company 450,000 euros for a bug that made some private tweets public, the regulator said, in the first sanction against a U.S. firm under a new European Union data privacy system. The Twitter fine relates to a 2019 probe into a bug in its Android app, where some users' protected tweets were made public. In particular it was levied due to Twitter's "failure to notify the breach on time to the DPC and a failure to adequately document the breach," the Data Protection Commission said in a statement. Separately, Facebook, Twitter and TikTok face fines of up to 10% of turnover if they fail to remove and limit the spread of illegal content under laws proposed by Britain.

• Uber Technologies Inc (UBER). The ride-hailing firm was fined $59 million on Monday for failing to provide the California Public Utilities Commission (CPUC) with information on certain sexual assault and harassment claims. Uber's permit could be suspended if it fails to pay the penalty within 30 days, according to the ruling. "The CPUC has been insistent in its demands that we release the full names and contact information of sexual assault survivors without their consent," Uber said in a statement. "We opposed this shocking violation of privacy, alongside many victims' rights advocates."

• WPP PLC (WPP). The world's biggest advertising firm said it would restate its financial statements from 2017 to 2019 but its headline operating profit, debt and cash flow were not affected. The British company said its presentation of cash and overdrafts as part of notional cash pooling arrangements did not meet accounting norms, while net investment hedging was inappropriately applied against some foreign exchange exposures. WPP said in a statement that the adjustments will not impact on any of its headline measures of operating profit, net debt, net assets, net current liabilities or statement of cash flows.

INSIGHT

Fed will be tested in 2021 as vaccines boost U.S. economic outlook

If 2020 was the year the Federal Reserve overhauled its game plan for supporting the U.S. economy, 2021 will be the year its new approach gets tested should a coronavirus vaccine deliver the lift that many analysts expect.

ANALYSTS' RECOMMENDATION

• Abbvie Inc (ABBV). JPMorgan raises target price to $135 from $120, following the company's immunology analyst meeting, saying there is a pathway for significant growth for both Skyrizi and Rinvoq products.

• Alexion Pharmaceuticals Inc (ALXN). Baird raises target price to $175 from $140, after Astrazeneca agreed to acquire the company for $39 billion.

• Estee Lauder Companies Inc (EL). RBC raises target price to $271 from $258, following a meeting with the investors, saying the company will emerge stronger post COVID-19 due to accelerated migration to online and ongoing strength in skincare.

• Phillips 66 (PSX). Cowen and Company raises target price to $70 from $67, reflecting the company's high-quality earnings and a favorable capital structure.

• Wells Fargo & Co (WFC). KBW raises target price to $36 from $28, saying the longer-term prospects for the company are still substantial, and the current valuation an attractive entry point.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0830 NY Fed Manufacturing for Dec: Expected 6.90; Prior 6.30

0830 (approx.) Import prices mm for Nov: Expected 0.3%; Prior -0.1%

0830 (approx.) Export prices mm for Nov: Expected 0.3%; Prior 0.2%

0830 (approx.) Import prices yy for Nov: Prior -1.0%

0915 (approx.) Industrial production mm for Nov: Expected 0.3%; Prior 1.1%

0915 (approx.) Capacity utilization SA for Nov: Expected 72.9%; Prior 72.8%

0915 (approx.) Manufacturing output mm for Nov: Expected 0.3%; Prior 1.0%

0915 (approx.) Industrial production YoY for Nov: Prior -5.34%

COMPANIES REPORTING RESULTS

No major S&P 500 companies are scheduled to report for the day.

CORPORATE EVENTS (All timings in U.S. Eastern Time)

1000 K12 Inc (LRN). Annual Shareholders Meeting

1000 MTS Systems Corp (MTSC). Q4 earnings conference call

1130 Ligand Pharmaceuticals Inc (LGND). Shareholders Meeting

1500 Veeva Systems Inc (VEEV). Shareholders Meeting

1630 Guidewire Software Inc (GWRE). Annual Shareholders Meeting

1700 Winnebago Industries Inc (WGO). Annual Shareholders Meeting

EXDIVIDENDS

American Eagle Outfitters Inc (AEO). Amount $0.13

Big Lots Inc (BIG). Amount $0.30

Cincinnati Financial Corp (CINF). Amount $0.60

First Financial Bankshares Inc (FFIN). Amount $0.13

FS KKR Capital Corp (FSK). Amount $0.60

FS KKR Capital Corp II (FSKR). Amount $0.55

Guess? Inc (GES). Amount $0.11

Hill-Rom Holdings Inc (HRC). Amount $0.22

Horace Mann Educators Corp (HMN). Amount $0.30

Intercontinental Exchange Inc (ICE). Amount $0.30

Mercury General Corp (MCY). Amount $0.63

New Jersey Resources Corp (NJR). Amount $0.33

New Mountain Finance Corp (NMFC). Amount $0.30

Pultegroup Inc (PHM). Amount $0.14

Regency Centers Corp (REG). Amount $0.59

Telephone and Data Systems Inc (TDS). Amount $0.17

Vistra Corp (VST). Amount $0.13

Bekijk dit overzicht even goed, 2021 kan wel eens anders worden

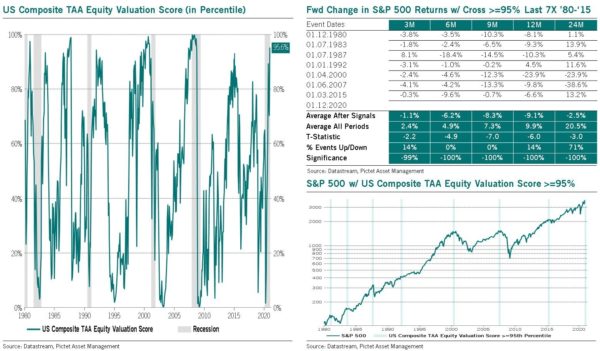

Het nu voor het eerst sinds maart 2015 dat de samengestelde score van de waardering van de 500 aandelen binnen de S&P 500 tot boven die 95% uitkomt. De grafiek loopt vanaf 1980 ofwel 40 jaar, een lange periode dus waar je een mooi overzicht door krijgt. Zoals u ziet is dit in die 40 jaar nog maar 7 keer voorgekomen dat het niveau op 95% uitkomt sinds.

Ik zeg absoluut niet dat de markt gaat dalen door deze waarneming maar het is wel zo dat het wel zo was tijdens de vorige keren dat we op zo'n punt terecht kwamen. Daarom zeg ik nog altijd, onze tijd komt eraan en dat zie je aan heel veel waarnemingen, niet alleen via deze weg. Wat ik ga doen is er bovenop zitten in 2021 en waar het kan mijn momenten zien te pakken. Het zal volgens mij redelijk snel over en uit zijn voor de vele nieuwkomers die veel te grof speculeren in deze markt, ze hebben wel de wind in de zeilen gehad maar nog nooit enige tegenwind moeten doorstaan.

En voor deze fase moet je toch echt bij mij zijn, op dalingen kan ik goed scoren, dus een mooie periode komt eraan. Het moment om lid te worden dus en dat via een mooie aanbieding die loopt tot 1 MAART voor €39 ... Let wel ik kan het mogelijk niet goed hebben, maar de kans van wel komt nu toch al op zo'n 70-75% te liggen. Mis dus de eerste fase van 2021 vooral niet ... Ga naar https://www.usmarkets.nl/trade... en schrijf u meteen in ...

Met vriendelijke groet,

Guy Boscart

Grafiek met waardering aandelen, de tabel met de reactie nadien van de markt en deze momenten in de SP 500 chart (blauwe verticale lijnen !!) ...

Wake-up call: Draai op Wall Street, AEX blijft wat hangen

Goedemorgen

Een moeilijke en volatiele sessie gisteren met vooral de draai op Wall Street die opviel, de Dow Jones stond eerst nog tot 300 punten hoger maar sluit via winstnemingen 185 punten lager. Een grote draai gisteren tegen de avond van bijna 500 punten. De SP 500 verloor 0,4% terwijl de technologie indices nog 0,5% en 0,7% hoger wisten te sluiten door dat men hoopt dat de lockdowns die eraan komen goed zullen uitpakken voor de grote techbedrijven. Denk er wel aan dat deze bedrijven al behoorlijk fors zijn gestegen de afgelopen periode zodat er nogal wat lucht in deze aandelen zit.

Wat betreft de lockdowns zitten we hier in Europa met Duitsland dat vanaf morgen dicht gaat, Nederland zelfs al vanaf vandaag en de kans is groot dat ook andere landen met nieuwe maatregelen zullen komen om het aantal besmettingen terug te dringen. Verder was er ook een waarschuwing dat New York in een lockdown terecht zal komen nu het daar ook weer uit de hand dreigt te lopen.

Verder is het nu ook wachten op de FED die morgen met een beslissing komt over de rente en eventueel een nieuw opkoop programma om de economie te steunen al zal dat niet gemakkelijk worden nu alle beurzen records maken. En het blijft maar wachten op het steunpakket voor de economie in de VS, men is er al weken over aan het onderhandelen maar er komt niet genoeg steun in de Senaat. Ook dat drukt op de markt ofwel op Wall Street zodat we maar niet loskomen van de bovenkant ofwel de topzone. Eigenlijk trappelen we al een paar weken ter plaatse wat betreft de indices ook al voelt het aan dat alles oploopt, dat komt door dat de grotere correctie niet op gang komt maar dat de markt klaar staat om het lager op te zoeken lijkt me via de WIG die we overal zien (grafieken).

De AEX begon de week ook goed maar moest richting het slot behoorlijk inleveren, vooral Shell, Prosus en Unibail kregen het moeilijk. De lockdowns in Duitsland en Nederland, het gedoe rondom de Brexit en ook de technische verslechtering van de index maken het moeilijker om verder door te stoten boven de 620 punten. Verder zien we dat de DAX wel wat hoger wist af te sluiten, de DAX won nog 1%. De CAC 40 won 0,5% gisteren.

De olie en de olie aandelen deden het niet goed door dat de OPEC de verwachtingen naar beneden heeft bijgesteld. Shell, ExxonMobil en Chevron verloren door dit bericht behoorlijk.

Euro, olie en goud:

De euro zien we nu rond de 1.215 dollar, de prijs van een vat Brent olie komt uit op 50 dollar terwijl een troy ounce goud nu op 1843 dollar staat.

Posities en strategie:

We hebben nog altijd wat posities open staan bij de signaaldiensten, die kunt u nog opnemen door lid te worden. De posities hebben we voor als de markt de grote draai maakt die eraan zit te komen, ik verwacht dat we met hier en daar wat aanpassingen mogelijk voor een tijdje kunnen blijven zitten. Waar nodig zal ik schakelen, de posities wisselen of waar nodig uitbreiden. Wat betreft 2021 zie ik zeker genoeg mooie kansen om met het handelen er een mooi jaar van te maken ...

U kunt mij en dus @USMarkets uiteraard ook volgen via onze Twitter account, ga naar ... https://twitter.com/USMarkets waar ik tussentijds wat charts over de markt en sentiment plaats, ook opvallende beursfeiten komen er vaak langs !

Maak nu gebruik van de aanbieding op US Markets Trading:

Zoals ik al aangaf sta hoe dan ook klaar om goed uit te pakken in 2021 wat betreft Trading, lid worden is nu dus belangrijk om alles optimaal te volgen.

Doe nu mee via de nieuwe proef aanbieding voor €39 tot 1 MAART. Dan pakt u december en de eerste 2 maanden van het nieuwe jaar meteen mee als lid en ontvangt u alle updates en signalen. Voor Polleke Trading is dat dan €49 tot 1 maart 2021 ...

Schrijf u vandaag nog in via de link https://www.usmarkets.nl/tradershop en dan staat u meteen op de lijst.

Met vriendelijke groet,

Guy Boscart

Markt snapshot Europa vandaag

GLOBAL TOP NEWS

A New York City intensive care unit nurse on Monday became the first person in the United States to receive a coronavirus vaccine, saying she felt "healing is coming," as the nation's COVID-19 death toll crossed a staggering 300,000 lives lost.

European Union Brexit negotiator Michel Barnier said on Monday that sealing a trade pact with Britain was still possible before the country's final break with the 27-nation bloc on Dec. 31 but the next few days of negotiations would be critical.

President-elect Joe Biden delivered a forceful rebuke on Monday to President Donald Trump's attacks on the legitimacy of his victory, hours after winning the state-by-state Electoral College vote that officially determines the U.S. presidency.

EUROPEAN COMPANY NEWS

The head of European planemaker Airbus called on Monday for an end to separate diplomatic squabbles over Britain's exit from the European Union and a transatlantic aircraft subsidy dispute that collectively overshadow its business.

German sportswear maker Adidas said on Monday it is considering strategic options, including a potential sale, for Reebok, 15 years after it bought the U.S.-focused brand to take on archrival Nike on its home turf.

Volkswagen's supervisory board on Monday said Chief Executive Herbert Diess had its full support as he leads a new executive team to transform the German automaker but stopped short of bringing forward a contract extension.

TODAY'S COMPANY ANNOUNCEMENTS

Adler Real Estate AG Annual Shareholders Meeting

Artnet AG Annual Shareholders Meeting

Aryzta AG Annual Shareholders Meeting

Blancco Technology Group PLC Annual Shareholders Meeting

Ceconomy AG Earnings Q4 2020 Release and Strategy Update

Chemring Group PLC FY 2020 Earnings Call

De' Longhi SpA Shareholders Meeting

Dynagas LNG Partners LP Annual Shareholders Meeting

Etablissementen Franz Colruyt NV HY 2021 Earnings Release

Medincell SA Shareholders Meeting

Metro AG FY 2020 Earnings Call

Purplebricks Group PLC HY 2021 Earnings Call

Sareum Holdings PLC Annual Shareholders Meeting

Virbac SA Shareholders Meeting

Westgrund AG Annual Shareholders Meeting

ECONOMIC EVENTS (All times GMT)

0700 (approx.) United Kingdom Claimant Count Unemployment Change for Nov: Prior -29,800

0700 (approx.) United Kingdom ILO Unemployment Rate for Oct: Expected 5.1%; Prior 4.8%

0700 (approx.) United Kingdom Employment Change for Oct: Expected -250,000; Prior -164,000

0700 (approx.) United Kingdom Average Weekly Earnings 3m yy for Oct: Expected 2.2%; Prior 1.3%

0700 (approx.) United Kingdom Average Earnings (Ex-Bonus) for Oct: Expected 2.6%; Prior 1.9%

0730 Switzerland Producer/Import Price mm for Nov: Prior 0.0%

0730 Switzerland Producer/Import Price yy for Nov: Prior -2.9%

0745 France CPI (EU Norm) Final mm for Nov: Expected 0.2%; Prior 0.2%

0745 France CPI (EU Norm) Final yy for Nov: Expected 0.2%; Prior 0.2%

0745 (approx.) France CPI yy NSA for Nov: Prior 0.2%

0745 (approx.) France CPI mm NSA for Nov: Prior 0.2%

0745 (approx.) France CPI NSA for Nov: Prior 104.51

0900 (approx.) Italy CPI Ex-Tobacco for Nov: Prior 102.0

0900 (approx.) Italy CPI Ex-Tobacco m/m for Nov: Prior -0.4%

0900 (approx.) Italy Consumer Prices Final mm for Nov: Expected -0.1%; Prior -0.1%

0900 (approx.) Italy Consumer Prices Final yy for Nov: Expected -0.2%; Prior -0.2%

0900 (approx.) Italy CPI (EU Norm) Final mm for Nov: Expected 0.0%; Prior 0.0%

0900 (approx.) Italy CPI (EU Norm) Final yy for Nov: Expected -0.3%; Prior -0.3%

1100 (approx.) Italy Trade Balance EU for Oct: Prior 0.576 bln EUR

1100 (approx.) Italy Global Trade Balance for Oct: Prior 5.849 bln EUR

1100 (approx.) Euro Zone Reserve Assets Total for Nov: Prior 914.71 bln EUR