Liveblog Archief dinsdag 26 mei 2020

En ja, de beurs sluit hoger op hoop ... hoop en nogmaals hoop ... Wel onder de hoogste dagstand waar de markt dan ook meteen bij de start al stond en er niet meer boven geraakte in de loop van de sessie ... Het lijkt allemaal sterk maar er werden geen nieuwe kopers gevonden zo te zien aan de dagchart ...

Ledenupdate: Ik maak me nog geen zorgen over mijn strategie, wat ik doe geef ik door

Beste leden, want het is een ledenupdate, vandaag nog een positie door geschoven naar de volgende maand, ik blijf zitten...

Deze inhoud is alleen beschikbaar voor betalende leden.

Artikel over Hertz, vreselijk hoe dat gaat, zakken vullen en wegwezen ...

The CEO of Hertz will get a $700,000 payday as his 103-year-old company crumbles into bankruptcy

Hertz paid its 340 top executives an average of $47,709 the day before it filed for bankruptcy, the company quietly announced in a federal filing on May 26.

That's $16.2 million total, which was distributed on May 19. Hertz declared bankruptcy on May 20.

Its CEO, Paul Stone, got the biggest payday at $700,000, though he took the role just three days prior to Hertz filing for bankruptcy. Hertz CFO Jamere Jackson received $600,000 and chief marketing officer Jodi Allen nabbed just under $190,000.

"[K]ey employees at the director level and above" received the cash payment to ensure they stay at the company, Hertz said in its May 26 filing. The company gave four reasons for the payout:

- Hertz and its employees are facing "financial and operational uncertainty" thanks to the coronavirus pandemic, which has had an "adverse impact on the global travel sector"

- The "substantial additional efforts undertaken by the Company's key employees with a reduced work force in response to an extremely challenging business environment"

- Due to the coronavirus-triggered bankruptcy, top executives have lost out on their annual bonus plan

- A risk that "key employees" may depart Hertz when the company needs them

The filing did not make clear how its non-executive employees will fare, and Hertz did not respond immediately to a request for comment. According to its most recent annual report, Hertz employs 38,000 worldwide, with the majority in the US. (That's likely now around 28,000, as Hertz laid off 10,000 employees last month.)

When a company goes bankrupt, executives usually get a parachute — and workers get burned

Massive bankruptcies at other public companies have included big paydays for top executives who stick around the company. Sears, which filed for bankruptcy in the fall of 2018, made available up to $4.2 million to give quarterly retention bonuses to more than 300 executives.

Meanwhile, Sears employees like Sheila Brewer, who was a full-time employee at Sears-owned Kmart for 17 years, did not receive their full severance pay, making it challenging to pay bills even as executives received thousands in bonuses. "It was a big toll emotionally and financially," Brewer told the Guardian. "It's a big slap in the face, them telling me I can't get the rest of my severance because of bankruptcy."

Coronavirus-induced bankruptcies will seemingly still favor the executive over the associate. JCPenney, which filed for bankruptcy on May 15, gave CEO Jill Soltau a $4.5 million bonus. Three other top executives also got a $1 million bonus — all distributed 10 days before the company told the world it was going bankrupt.

Under these executives, JCPenny accrued $3.7 billion in debt. Like JCPenney, Hertz was struggling long before the coronavirus took down global travel, carrying $19 billion total in debt.

Trieste figuren.

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: CB Consumentenvertrouwen (May) | Actueel: 86,6 Verwacht: 88,0 Vorige: 85,7 | ||||

| USA: Nieuwe Woningen Verkoop (Apr) | Actueel: 623K Verwacht: 490K Vorige: 619K |

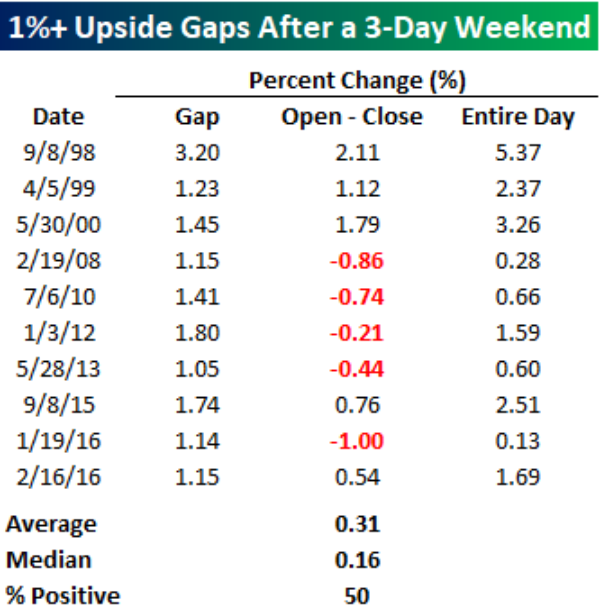

Wall Street start met een enorme GAP omhoog vandaag na een 3 dagen weekend, even zien hoe dat in vandaag en in het verleden uitpakte.

Markt snapshot Wall Street

TOP NEWS

• Merck leaps into COVID-19 development fray with vaccine, drug deals

Merck, which has largely kept to the sidelines of the race for COVID-19 treatments, said it was buying Austrian vaccine maker Themis Bioscience and would collaborate with research nonprofit IAVI to develop two separate vaccines.

• Warner Music seeks $13 billion valuation in Nasdaq debut

Warner Music Group said it expects to raise up to $1.82 billion in its Nasdaq debut at a valuation of about $13 billion, as some companies gingerly test investor appetite after the COVID-19 pandemic put many debuts on hold.

• China to strengthen policy, lower lending rates-PBOC Gov

China will strengthen its economic policy and continue efforts to lower interest rates on loans, central bank Governor Yi Gang said, reinforcing expectations of further support measures to revive an economy ravaged by the coronavirus pandemic.

• Uber cuts 600 jobs in India as lockdown hits business

Uber Technologies will cut around 600 jobs in India as part of its plans to cut 23% of its global workforce, as the company navigates a lockdown that has brought businesses in the country to a grinding halt.

• LATAM becomes largest airline to file for bankruptcy amid coronavirus

LATAM Airlines Group filed for U.S. bankruptcy protection, becoming the largest carrier to seek an emergency reorganization amid the coronavirus crisis.

BEFORE THE BELL

Global stocks forged ahead, with the S&P 500 futures clearing the 3,000 level for the first time since early March, as investors welcomed the promise of more stimulus in China and the gradual re-opening of the global economy. Against a basket of major currencies, the dollar was lower. In commodity markets, gold prices eased, while oil prices were supported by falling supplies as OPEC cut production and the number of U.S. and Canadian rigs dropped to record lows for the third week running. A flurry of housing market indicators is due for release later in the day.

STOCKS TO WATCH

Results

• Elbit Systems Ltd (ESLT). The Israeli defence electronics firm reported higher quarterly profit and said its business has not been substantially impacted by the coronavirus outbreak. The maker of drones, pilot helmet displays and cyber security systems said it earned $1.63 per diluted share excluding one-time items in the first quarter, up from $1.54 a year earlier. Revenue rose to $1.07 billion from $1.02 billion. Still, Elbit has taken precautionary measures, including reducing its dividend in the quarter to 35 cents a share from 44 cents a year earlier. Chief Executive Bezhalel Machlis said this was temporary.

In Other News

• Apple Inc (AAPL) & Alphabet Inc (GOOGL). Latvia aims to become one of the first countries to launch a smartphone app using a new toolkit created by U.S. tech giants Apple and Alphabet's Google to help trace coronavirus infections. Early success of tracing apps in countries like Singapore and Australia has been patchy because Apple's iPhone does not support their approach to using Bluetooth short-range radio as a proxy for measuring the risk of infection. Latvia's Apturi Covid (Stop Covid) app is, by contrast, based on technology launched last week by Apple and Google, whose iOS and Android operating systems run 99% of the world's smartphones.

• Delta Air Lines Inc (DAL) & United Airlines Holdings Inc (UAL). The U.S. government late on Friday accused the Chinese government of making it impossible for U.S. airlines to resume service to China and ordered four Chinese air carriers to file flight schedules with the U.S. government. The U.S. Transportation Department, which is trying to persuade China to allow the resumption of U.S. passenger airline service there, earlier this week briefly delayed a few Chinese charter flights for not complying with notice requirements. In an order posted on a U.S. government website and seen by Reuters, the department noted Delta Air Lines and United Airlines want to resume flights to China in June, even as Chinese carriers have continued U.S. flights during the COVID-19 pandemic.

• Deutsche Bank AG (DB). The company said on Friday it has asked more of its senior managers to waive one month of fixed pay in an effort to cut costs as Germany's largest lender deals with the fallout of the coronavirus crisis. "As our restructuring plans progress, the management board and the group management committee have decided to lead by example and give a broader group of senior managers the opportunity to be part of this initiative", Jörg Eigendorf, a spokesman for the bank, said in an emailed statement. The statement added that it was a voluntary measure. It did not specify how many more were going to undertake the pay cuts.

• Fiat Chrysler Automobiles NV (FCAU). Italian bank Intesa Sanpaolo is expected to give a preliminary green light at a board meeting to a state-backed $6.9 billion three-year loan for Fiat Chrysler, a source close to the matter said. Before the loan is granted, FCA's Italian unit will need to complete the approval process with Italy's export credit agency SACE, through which the state provides its guarantee, and then obtain a final authorisation and conditions for the loan from the Treasury.

• Gilead Sciences Inc (GILD). The U.S. National Institutes of Health (NIH) on Friday said that data from its trial of Gilead's remdesivir show that the drug offers the most benefit for COVID-19 patients who need extra oxygen but do not require mechanical ventilation. The peer-reviewed data was published in the New England Journal of Medicine. The trial, for which final results are still trickling in, showed that recovery time for patients given remdesivir was shortened by four days, or 31%, compared to placebo patients. The biggest benefit was seen in patients who were sick enough to need supplemental oxygen, but were not on a ventilator.

• Hertz Global Holdings Inc (HTZ). The more than a century old car rental firm filed for bankruptcy protection on Friday after its business was decimated during the coronavirus pandemic and talks with creditors failed to result in much needed relief. With nearly $19 billion of debt and roughly 38,000 employees worldwide as of the end of 2019, Hertz is among the largest companies to be undone by the pandemic. The size of Hertz's lease obligations have increased as the value of vehicles declined because of the pandemic. In an attempt to appease creditors holding asset-backed securities that finance its fleet of more than 500,000 vehicles, Hertz has proposed selling more than 30,000 cars a month through the end of the year in an effort to raise around $5 billion, a person familiar with the matter said.

• Merck & Co Inc (MRK). The company, which has largely kept to the sidelines of the race for COVID-19 treatments, said it was buying Austrian vaccine maker Themis Bioscience and would collaborate with research nonprofit IAVI to develop two separate vaccines. It also announced a partnership with privately-held Ridgeback Biotherapeutics to develop an experimental oral antiviral drug against COVID-19, the respiratory disease caused by the novel coronavirus. It did not disclose the terms of acquisition of Themis, a privately held company. Most big pharmaceutical companies have already placed their bets on COVID-19 treatments, but Merck has been waiting for opportunities with proven track records, Chief Executive Ken Frazier said.

• Regeneron Pharmaceuticals Inc (REGN) & Sanofi SA (SNY). The U.S. drugmaker said on Monday it would repurchase about $5 billion of its shares directly from France's Sanofi, without altering their over-a-decade-long partnership. Sanofi, which owns some 23.2 million shares of Regeneron's common stock or about a 20.6% stake, said it would continue to own about 400,000 Regeneron shares to support the collaboration. Sanofi's Chief Executive Officer Paul Hudson said the sale would help the company "execute on our strategy to drive innovation and growth."

• Tesla Inc (TSLA). The company is seeking Chinese government approval to build model 3 vehicles in the country equipped with lithium iron phosphate batteries, a document on the website of the Ministry of Industry and Information Technology showed. The document does not show the name of the battery maker.

• Molson Coors Beverage Co (TAP). The company said on Friday it had suspended quarterly dividends for fiscal 2020 and furloughed some employees in Europe and North America, as the Miller Lite beer maker looks to save cash amid the coronavirus crisis. Molson Coors will also cut capital expenditure by about $200 million, reduce marketing expenses and limit the number of new hires, while also evaluating various European government liquidity programs.

• Novavax Inc (NVAX). The company said on Monday it has started the Phase 1 clinical trial of a novel coronavirus vaccine candidate and has enrolled the trial's first participants, with preliminary results slated for July. The Maryland-based late-stage biotechnology company in April said it identified the candidate, NVX-CoV2373, with which it planned to use its Matrix-M adjuvant to enhance immune responses. Novavax said it expects preliminary immunogenicity and safety results from the trial in July.

• Uber Technologies Inc (UBER). The company will cut around 600 jobs in India as part of its plans to cut 23% of its global workforce, as it navigates a lockdown that has brought businesses in the country to a grinding halt. "The impact of Covid-19 and the unpredictable nature of the recovery has left Uber IndiaSA with no choice but to reduce the size of its workforce," Uber India and South Asia President Pradeep Parameswaran said.

• UBS Group AG (UBS). The company said on Monday it has created a new global financing team, a group that will span across divisions under one group in order to serve clients in a faster and simpler fashion. The new team will be led by Remi Mennesson, who will join the Swiss lender in November 2020, and report to the firm's four co-presidents, said a memo seen by Reuters and confirmed by the bank. One of the reasons for the creation of the new team was to align employees working in global wealth management, investment bank financing and risk management under one umbrella. In addition, UBS said it will increase the bank's financing capabilities in the regions it operates and expand its product offering to meet the financing needs of all clients.

INSIGHT

U.S. small firms leave $150 billion in coronavirus stimulus untapped

When the U.S. government first rolled out forgivable loans to small businesses in early April under the Paycheck Protection Program, loan officers at Bank of the West in Grapevine, Texas worked nights and weekends to process a tsunami of applications. But since those first few frantic weeks, demand has "just dried up," said bank president Cindy Blankenship. On May 15 the bank stopped taking applications for PPP loans.

ANALYSTS' RECOMMENDATION

• Cooper Companies Inc (COO). Keybanc cuts target price to $330 from $380, factoring anticipated headwinds from COVID-19.

• Hewlett Packard Enterprise Co (HPE). JPMorgan raises to neutral from underweight, saying the company’s stock looks attractively valued relative to its peer group.

• L Brands Inc (LB). Keybanc cuts target price to $21 from $25, to reflect the coronavirus impact.

• Workday Inc (WDAY). Evercore ISI raises target price to $195 from $170, believing demand is being delayed, not destroyed, and expecting billings to reaccelerate in CY21 and for revenue to reaccelerate in CY22.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0800 (approx.) Building permits R number for Apr: Prior 1.074 mln

0800 (approx.) Building permits R change mm for Apr: Prior -20.8%

0830 National Activity Index for Apr: Prior -4.19

0900 (approx.) Monthly home price mm for Mar: Prior 0.7%

0900 (approx.) Monthly home price yy for Mar: Prior 5.7%

0900 (approx.) Monthly Home Price Index for Mar: Prior 287.0

0900 Caseshiller 20 mm SA for Mar: Expected 0.2%; Prior 0.4%

0900 Caseshiller 20 mm NSA for Mar: Prior 0.5%

0900 Caseshiller 20 yy for Mar: Expected 3.3%; Prior 3.5%

1000 (approx.) Consumer Confidence for May: Expected 88.0; Prior 86.9

1000 New home sales units for Apr: Expected 0.490 mln; Prior 0.627 mln

1000 New home sales change mm for Apr: Expected -21.9%; Prior -15.4%

1030 (approx.) Dallas Fed Manufacturing Business Index for May: Prior -73.70

COMPANIES REPORTING RESULTS

Keysight Technologies Inc (KEYS). Expected Q2 earnings of $1.16 per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Booz Allen Hamilton Holding Corp (BAH). Q4 earnings conference call

0800 Douyu International Holdings Ltd (DOYU). Q1 earnings conference call

0900 Merck & Co Inc (MRK). Annual Shareholders Meeting

1000 Autozone Inc (AZO). Q3 earnings conference call

1000 First Financial Bancorp (FFBC). Annual Shareholders Meeting

1000 Healthcare Services Group Inc (HCSG). Annual Shareholders Meeting

1000 PDC Energy Inc (PDCE). Annual Shareholders Meeting

1000 Varonis Systems Inc (VRNS). Annual Shareholders Meeting

1100 American Woodmark Corp (AMWD). Q4 earnings conference call

1100 Rexford Industrial Realty Inc (REXR). Annual Shareholders Meeting

1100 Verra Mobility Corp (VRRM). Annual Shareholders Meeting

1300 Incyte Corp (INCY). Annual Shareholders Meeting

1500 Novanta Inc (NOVT). Annual Shareholders Meeting

1600 Trade Desk Inc (TTD). Annual Shareholders Meeting

1630 Keysight Technologies Inc (KEYS). Q2 earnings conference call

1630 Omnicell Inc (OMCL). Annual Shareholders Meeting

1700 StoneCo Ltd (STNE). Q1 earnings conference call

1700 ViaSat Inc (VSAT). Q4 earnings conference call

1730 Allakos Inc (ALLK). Annual Shareholders Meeting

1900 Servicemaster Global Holdings Inc (SERV). Annual Shareholders Meeting

EX-DIVIDENDS

Callaway Golf Co (ELY). Amount $0.01

International Paper Co (IP). Amount $0.51

John B Sanfilippo & Son Inc (JBSS). Amount $1.00

Loews Corp (L). Amount $0.06

S&P Global Inc (SPGI). Amount $0.67

Scotts Miracle-Gro Co (SMG). Amount $0.58

Teradyne Inc (TER). Amount $0.10

Wake-up call: Hoop op vaccin, stimuli en herstel economie

Goedemorgen

De vraag is nu, en die stel ik ook aan mezelf vanmorgen toen ik wakker werd en naar de koersen van de futures keek, wat is er in hemelsnaam aan de hand op de beurzen momenteel? Het verdict van iemand die anders denkt, erop handelt en momenteel nogal verkeerd in de markt zit. Je doet iets met de intentie dat het goed zal lopen, let wel, afgelopen vrijdag was dat ook zo aangezien de AEX even de 515 aantikte, de DAX naar de 10.850 terug moest net als Wall Street waar de Dow even tot rond de 24.100 terug moest. Vanmorgen zien we de S&P future tot net boven de 3000 punten geraken, de Dow future staat rond de 25.000 punten terwijl de Nasdaq future vanmorgen al bijna de 9600 aantikt. Let wel, dat scheelt nog niet zoveel met wat er gisteren op de borden stond tijdens de dag waar de futures wel liepen maar de markten dicht bleven. Blijven altijd rare dagen als een markt dicht is terwijl de futures wel meelopen.

In ieder geval een GAP omhoog op Wall Street met deze indicaties ook omdat alles vrijdag op de hoogste stand van de dag afsloot, een GAP van pakweg 1,5 a 2% is best behoorlijk, alle sectoren zullen volop mee moeten werken om deze opening van nieuwe energie te voorzien om nog hoger te geraken en om de Dow tot boven de 25.000 punten te brengen. Dat zou kunnen, we sluiten NIKS meer uit in deze fase en met deze markt omstandigheden maar toch, een GAP, een rond getal en een zware weerstand (200-MA bij de S&P 500) allemaal pakken vandaag? En met de huidige economische malaise? Ik moet het nog zien, maar we hebben al veel moeten zien de afgelopen tijd.

De AEX zal wel in de buurt van de 535-536 punten starten zo te zien, boven de weerstand en in het gebied waar de index in maart voor de 2e keer in de problemen geraakte. Op de grafiek van de AEX kunt u dat gebied wel zien (hieronder) ... Als de index doorstoot, zou me echt verwonderen maar nogmaals, in deze gekke markt weet je nooit, dan zit een stijging tot rond de 545-550 er mogelijk in. Dan zijn we nog niet helemaal van de bear markt af want de index moet nog altijd meer dan 20% omhoog om de top van februari te bereiken.

Goed, het wordt weer een moeilijke dag, wat moet je doen, wil je nog wachten of kies je voor de korte pijn en richt je de pijlen op de volgende maand, juni? Dat moet ik nog even aanvoelen, bedenken en vooral de juiste keuze zien te maken. Ik ga hoe dan ook de uitdaging aan voor JUNI en JULI want ik ben zoals we dat noemen zeer ontevreden over de afgelopen weken, dat wat de markt betreft en vooral ook over mijn eigen strategie en handel. Dat moet en dat gaat beter zijn de komende maanden en wie weet krijgen we ook wat meer van de markt die nu zeer uitdagend voor de dag komt.

Als ik mijn pijlen ga richten op deze uitdaging die ik aangaf moet men opletten want dan volgen meestal de beste periodes voor mij als handelaar, het komt niet vaak voor dat ik 2 maanden na elkaar in het rood terecht kom. Kortom, een reden om lid te worden en ook lid te blijven, deze uitdaging wil ik aangaan en wil vooral winnen de komende weken. Let wel, de posities lopen nog, de markt kan heel snel van richting veranderen, dus we hebben nog enkele sessies voor ik er een punt achter zet, op de lopende posities dan.

Wie gaat deze mooie uitdaging, revange met mij aan de komende weken? Wordt vandaag nog lid en dat tot 1 AUGUSTUS voor €39 ... Om u in te schrijven gaat u naar onze Tradershop via de link https://www.usmarkets.nl/tradershop

Tot later ... Guy

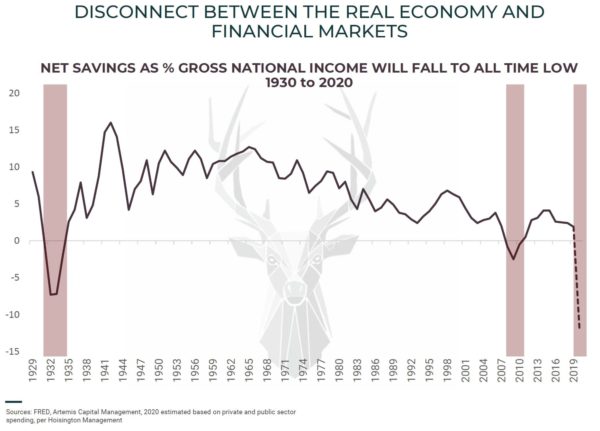

We zitten in de VS met vrijwel alles in de slechtste periode wat de economie betreft ooit, dat is te zien via deze grafiek. Toch zien we volop speculanten de beurzen hoger zetten, de vrees van mijn kant voor een 2e crash groeit met de dag ...

Markt snapshot vandaag Europa

GLOBAL TOP NEWS

British Prime Minister Boris Johnson's closest aide refused to resign on Monday, saying he had done nothing wrong by driving 250 miles from London to access childcare when Britons were being told to stay at home to fight COVID-19.

Bank of Japan Governor Haruhiko Kuroda said the central bank may take more steps to cushion the economic impact from the coronavirus pandemic, maintaining his gloomy outlook even as a state of emergency was lifted in the capital Tokyo.

Russia overtook Saudi Arabia as China's top crude oil supplier in April, customs data showed, with imports rising 18% from the same month a year earlier as refiners snapped up cheap raw materials amid a price war between the two producers.

EUROPEAN COMPANY NEWS

Germany threw Lufthansa a 9 billion euro lifeline on Monday, agreeing a bailout which gives Berlin a veto in the event of a hostile bid for the airline.

U.S. drugmaker Regeneron said on Monday it would repurchase about $5 billion of its shares directly from France's Sanofi, without altering their over-a-decade-long partnership.

Daimler plans to invest in Farasis Energy's planned $480 million IPO, aiming to ensure a stable supply of batteries from the Chinese firm as it ramps up electric vehicle production, three people familiar with the matter said.

TODAY'S COMPANY ANNOUNCEMENTS

Advicenne SA Annual Shareholders Meeting

Adyen NV Annual Shareholders Meeting

Air France KLM SA Annual Shareholders Meeting

Aviva PLC Annual Shareholders Meeting

Basler AG Annual Shareholders Meeting

CA Immobilien Anlagen AG Q1 2020 Earnings Release

Castleton Technology PLC Ordinary Shareholders Meeting

Chesnara PLC Annual Shareholders Meeting

Creditshelf AG Annual Shareholders Meeting

Dassault Systemes SE Annual Shareholders Meeting

doValue SpA Annual Shareholders Meeting

Dr Hoenle AG Annual Shareholders Meeting

Fingerprint Cards AB Annual Shareholders Meeting

First Sensor AG Annual Shareholders Meeting

Fraport AG Frankfurt Airport Services Worldwide Annual Shareholders Meeting

Gas Plus SpA Annual Shareholders Meeting

Hafnia Ltd Q1 2020 Earnings Call

Hexaom SA Annual Shareholders Meeting

JTC PLC Annual Shareholders Meeting

Magnora ASA Annual Shareholders Meeting

Metro Bank PLC Annual Shareholders Meeting

Mortgage Advice Bureau (Holdings) PLC Annual Shareholders Meeting

Naturgy Energy Group SA Ordinary Shareholders Meeting

Navigator Company SA Q1 2020 Earnings Call

Nordex SE Annual Shareholders Meeting

Nordic Nanovector ASA Q1 2020 Earnings Call

Octopus Titan VCT PLC Annual Shareholders Meeting

OHB SE Annual Shareholders Meeting

Oriole Resources PLC Annual Shareholders Meeting

Prada SpA Annual Shareholders Meeting

Prosegur Cash SA Q1 2020 Earnings Call

Publity AG Annual Shareholders Meeting

Relx PLC Ordinary Shareholders Meeting

RIT Capital Partners PLC Annual Shareholders Meeting

S Immo AG Q1 2020 Earnings Call

Saga Tankers ASA Annual Shareholders Meeting

SBF AG Annual Shareholders Meeting

SDL PLC Annual Shareholders Meeting

SMT Scharf AG Annual Shareholders Meeting

Spineway SA Annual Shareholders Meeting

Uniphar Group Plc Annual Shareholders Meeting

Vetoquinol SA Annual Shareholders Meeting

Xpediator PLC Annual Shareholders Meeting

ECONOMIC EVENTS (All times GMT)

0600 Germany GfK Consumer Sentiment for Jun: Expected -18.3; Prior -23.4

0600 Switzerland Trade balance for Apr: Prior 4,020 mln CHF

0630 Switzerland Non-Farm Payrolls for Q1: Prior 5.130 mln

0645 France Business Climate for manufacturing industry for May: Expected 85; Prior 82

1000 United Kingdom CBI Distributive Trades for May: Expected -50; Prior -55

1. Lockdown Beige Book Arrives

The Federal Reserve will release its Beige Book assessment of the economy at 2:00 PM ET (18:00 GMT).

The report should take on extra importance for its unprecedented glimpse into the pandemic economy.

Views will come from the 12 Fed districts, giving insight into how different parts of the country handled lockdown measures and early moves to reopen.