Liveblog Archief dinsdag 9 juni 2020

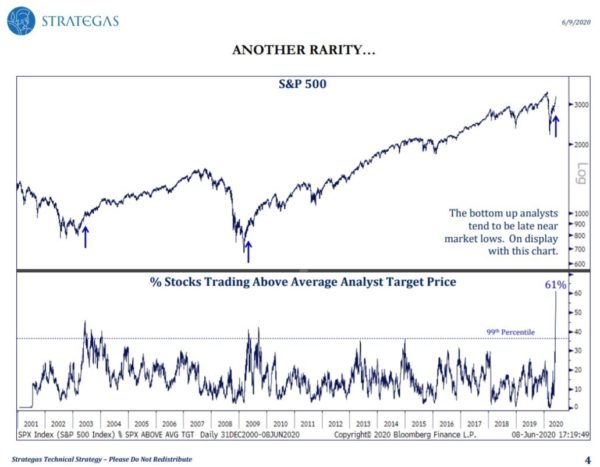

Maar liefst 61% van de 500 aandelen binnen de SP 500 index staat boven de gemiddelde targets die werden afgegeven door de fundamentele analisten ...

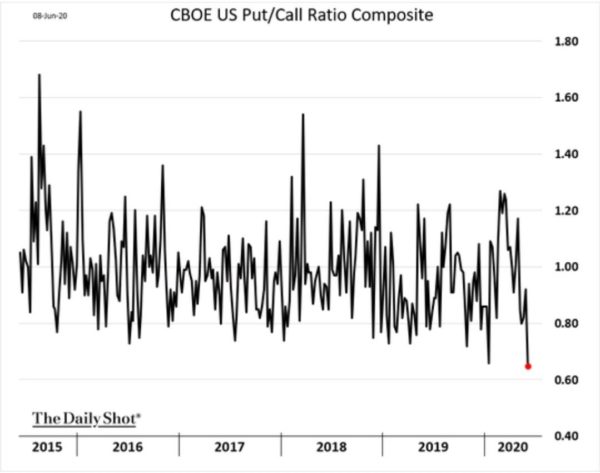

Men noemt ze in de VS al de Robin Hooders ... nieuwe beleggers die volop CALLS kopen (opties) ... De CALL/PUT ratio staat al lager dan toen bij de vorige top die al een CRASH aankondigde ... CRASH#2 op komst?

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: JOLTs Vacatures (Apr) | Actueel: 5,046M Verwacht: 5,000M Vorige: 6,011M |

Markt snapshot Wall Street

TOP NEWS

• Gilead's remdesivir slows disease progression in monkeys with COVID-19

Gilead's antiviral drug, remdesivir, prevented lung disease in macaques infected with the new coronavirus, according to a study published in medical journal Nature.

• Tiffany amends debt agreements amid LVMH deal, sales slump

U.S. luxury jeweler Tiffany said it had amended certain of its debt agreements in order to have sufficient liquidity to navigate the coronavirus outbreak as it posted a 43% slump in quarterly sales.

• TSMC says could fill order gap if unable to sell chips to Huawei

Taiwan Semiconductor Manufacturing Co could quickly fill any order gap should U.S. restrictions against Huawei Technologies prevent sales to the Chinese firm, the company's chairman said.

• IBM exits facial recognition business, calls for police reform

International Business Machines disclosed Monday it will no longer offer facial recognition or analysis software in a letter to Congress calling for new efforts to pursue justice and racial equity, new Chief Executive Officer Arvind Krishna said.

• Chanel, Revlon, L'Oreal pivoting away from talc in some products

Chanel, Revlon and L'Oreal, three of the biggest brands in cosmetics, are quietly moving away from using talc in some products as U.S. cancer lawsuits and consumer concerns mount.

BEFORE THE BELL

U.S. stock index futures dropped with investors focused now on the Federal Reserve's two-day policy meeting. European shares fell, dragged down by declines in cyclical stocks. In Asia, Japan’s Nikkei ended lower with automakers and chip-related companies leading the fall. The Australian dollar slipped after China's education ministry warned students to carefully consider studying there amid tension between the trading partners. The U.S. dollar was higher against a basket of rival currencies. Gold rose on increased appeal for the safe-haven metal. Oil prices were in the red, weighed down by oversupply concerns after it was announced that a trio of Gulf producers would end voluntary output cuts.

STOCKS TO WATCH

Results

• Tiffany & Co (TIF). The luxury jeweler said it had amended certain of its debt agreements in order to have sufficient liquidity to navigate the coronavirus outbreak as it posted a 43% slump in quarterly sales. Tiffany also said it had received antitrust clearances from Mexican and Russian authorities for its $16.2-billion purchase by French giant LVMH. LVMH CEO Bernard Arnault was reportedly said to be exploring ways to reopen negotiations and potentially pressure Tiffany to lower the agreed deal price of $135 per share, including by examining its compliance with financial covenants. However, Arnault has decided not to renegotiate the agreed price, sources told Reuters on Friday. The acquisition has yet to receive some of the necessary regulatory approvals, and LVMH could revisit the issue before the deal closes, especially if Tiffany's financial condition were to deteriorate.

IPO

• Vroom Inc (VRM). The online used car seller raised $467.5 million in its U.S. initial public offering, the company said on Monday, as the IPO market picks up momentum after the COVID-19 pandemic placed many debuts on hold. Vroom priced its IPO at $22, above the initially marketed range of $18 to $20, valuing the company, which is backed by funds such as T Rowe Price Associates and L Catterton, at $2.48 billion. The company sold 21.25 million shares compared with the earlier plan of 18.8 million shares. Vroom, which had filed for an IPO last month, reported a more than twofold rise in sales at its e-commerce business in the first quarter of 2020 as the virus outbreak and stay-at-home orders stoked a surge in online shopping.

In Other News

• Alibaba Group Holding Ltd (BABA). Alibaba said its cloud unit aims to recruit 5,000 staff globally from now until the end of this financial year, in areas including network, database, servers, chips and artificial intelligence, it said in a statement. "The digital transformation journey for businesses in China, which was previously expected to take three to five years, is now likely to be accelerated to be completed within one year," said Jeff Zhang, president of Alibaba Cloud Intelligence. "To move forward in full speed, we are not only building trusted cloud technologies and services, but also investing in worldwide IT talents," he said.

• AstraZeneca PLC (AZN). AstraZeneca said it expects to move two COVID-19 antibody therapies it has licensed from U.S. researchers into clinical studies in the next two months as the drugmaker ramps up efforts to help combat the health crisis. The British company said it has agreed terms with the United States' Defense Advanced Research Projects Agency (DARPA) and Biomedical Advanced Research and Development Authority (BARDA) to back its project to develop a monoclonal antibody treatment against the coronavirus. The company did not disclose the financial terms of the agreements.

• Blackrock Inc (BLK). The U.S. investment fund and other investors have built stakes in Spanish telecom operator MasMovil in the days after the filing of a formal bid on June 1, according to the Spanish stock market regulator. Since KKR, Cinven and Providence launched a 2.96 billion euro offer, MasMovil stock has been trading above the 22.50 euro implied share price, suggesting investors expect rival bids or a sweetened offer from the funds. Between June 2 and June 5, Blackrock gradually raised its stake in MasMovil to 6.49% from 5.70%, while Sand Grove Opportunities Management, Simon Davies, Wellington Management all bought shares in MasMovil in early June, according to data released on Tuesday by the regulator.

• General Electric Co (GE). General Electric said on Monday it reopened portions of its prior debt offerings for $3 billion in total proceeds to boost its cash reserves amid the coronavirus crisis. The company said the reopening was in response to a reverse inquiry from a long-term strategic investor seeking to buy the company's debt. GE said it expects to use these proceeds to reduce shorter-duration debt and the deal is expected to be leverage neutral over time.

• Gilead Sciences Inc (GILD). Gilead's antiviral drug, remdesivir, prevented lung disease in macaques infected with the new coronavirus, according to a study published in medical journal Nature. Remdesivir has been cleared for emergency use in severely-ill patients in the United States, India and South Korea. Some European nations are also using it under compassionate programs. Trials of the drug in humans are ongoing, and early data has shown the drug helped patients recover more quickly from the illness caused by the new coronavirus. In the study, 12 monkeys were deliberately infected with the coronavirus, and half of them were given early treatment with remdesivir. Macaques that received remdesivir did not show signs of respiratory disease and had reduced damage to the lungs, according to the study authors.

• International Business Machines Corp (IBM). International Business Machines Corp disclosed Monday it will no longer offer facial recognition or analysis software in a letter to Congress calling for new efforts to pursue justice and racial equity, new Chief Executive Officer Arvind Krishna said. The company will stop offering facial recognition software and opposes any use of such technology for purposes of mass surveillance and racial profiling, Krishna said, who also called for new federal rules to hold police more accountable for misconduct. IBM did not explain the timing of its decision to exit facial recognition development but Krishna told lawmakers "now is the time to begin a national dialogue on whether and how facial recognition technology should be employed by domestic law enforcement agencies."

• Macy's Inc (M). Macy’s said on Monday it raised a total of $4.5 billion, including $3.15 billion in new borrowings against its real estate assets, as the department store chain tries to navigate through the fallout from the COVID-19 pandemic. "The high quality of our real estate portfolio positioned us well to execute this offering," Chief Executive Officer Jeff Gennette said in a statement. Gennette said the funding gives the retailer sufficient flexibility and liquidity to steer the business for the foreseeable future. The company said it would be able to purchase new inventory as stores reopen and repay upcoming debts in fiscal 2020 and 2021. The raised funding includes a previously announced $1.3 billion in bond offering.

• Occidental Petroleum Corp (OXY). Oil and gas producer Occidental Petroleum is reviewing options for its Middle Eastern assets in a bid to ease its debt load, Bloomberg News reported on Monday, citing people familiar with the matter. Occidental is considering reducing its stakes in oil and natural gas fields in Oman, where its assets could be valued at more than $1 billion, the report said. The Houston-based company is also open to divesting other assets in the Middle East, though it is not formally soliciting interest, Bloomberg said. Outside of Oman, Occidental operates in the United Arab Emirates and Qatar.

• Revlon Inc (REV). Revlon, Chanel, and L'Oreal, three of the biggest brands in cosmetics, are quietly moving away from using talc in some products as U.S. cancer lawsuits and consumer concerns mount. Luxury beauty company Chanel has removed talc from a loose face powder and dropped a talc body powder because of negative perceptions around the mineral, court documents reviewed by Reuters show. Revlon removed talc from its body products, and L'Oreal is exploring alternatives for the mineral, those companies told Reuters. J&J announced last month that it would stop selling talc Baby Powder in the United States and Canada, attributing the decision to declining sales and negative publicity.

ANALYSIS

Once bitten, not shy: Investors again seek margin loans as stocks rally

Global banks are seeing renewed appetite from wealth management clients to borrow money to buy stocks as markets rebound, bankers said, which comes just months after the strategy burned some investors.

ANALYSTS' RECOMMENDATION

• Coupa Software Inc (COUP). RBC raises target price to $245 from $140, seeing the company likely to reaccelerate post COVID-19, and expecting cloud-based financial software to see demand tailwinds.

• Equifax Inc (EFX). Jefferies raises target price to $207 from $150, believing the company’s EWS segment to be a truly unique counter-cyclical asset that continues to have a long runway ahead.

• Toll Brothers Inc (TOL). RBC raises target price to $43 from $37, reflecting positively on U.S. housing following sequential improvements in the availability of financing.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

1000 JOLTS job openings for Apr: Expected 5.000 mln; Prior 6.191 mln

1000 Wholesale inventory, R mm for Apr: Expected 0.4%; Prior 0.4%

1000 Wholesale sales mm for Apr: Expected -4.0%; Prior -5.2%

COMPANIES REPORTING RESULTS

Brown-Forman Corp (BFb). Expected Q4 earnings of 28 cents per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 HD Supply Holdings Inc (HDS). Q1 earnings conference call

0800 TJX Companies Inc (TJX). Annual Shareholders Meeting

0830 Phreesia Inc (PHR). Q1 earnings conference call

0830 Yext Inc (YEXT). Annual Shareholders Meeting

1000 Affiliated Managers Group Inc (AMG). Annual Shareholders Meeting

1000 Alliance Data Systems Corp (ADS). Annual Shareholders Meeting

1000 Atlas Air Worldwide Holdings Inc (AAWW). Annual Shareholders Meeting

1000 Brown-Forman Corp (BFb). Q4 earnings conference call

1000 EPAM Systems Inc (EPAM). Annual Shareholders Meeting

1000 Omnicom Group Inc (OMC). Annual Shareholders Meeting

1030 Caseys General Stores Inc (CASY). Q4 earnings conference call

1100 Amedisys Inc (AMED). Annual Shareholders Meeting

1100 Appian Corp (APPN). Annual Shareholders Meeting

1100 Groupon Inc (GRPN). Annual Shareholders Meeting

1100 IGM Biosciences Inc (IGMS). Annual Shareholders Meeting

1100 TripAdvisor Inc (TRIP). Annual Shareholders Meeting

1130 Ehealth Inc (EHTH). Annual Shareholders Meeting

1200 Fastly Inc (FSLY). Annual Shareholders Meeting

1200 Vivint Smart Home Inc (VVNT). Annual Shareholders Meeting

1200 Workday Inc (WDAY). Annual Shareholders Meeting

1300 Ladder Capital Corp (LADR). Annual Shareholders Meeting

1330 Hope Bancorp Inc (HOPE). Annual Shareholders Meeting

1400 NVIDIA Corp (NVDA). Annual Shareholders Meeting

1400 Q2 Holdings Inc (QTWO). Annual Shareholders Meeting

1500 ACI Worldwide Inc (ACIW). Annual Shareholders Meeting

1600 Green Dot Corp (GDOT). Annual Shareholders Meeting

1630 Five Below Inc (FIVE). Q1 earnings conference call

1630 Verint Systems Inc (VRNT). Q1 earnings conference call

1700 Chewy Inc (CHWY). Q1 earnings conference call

1700 Zillow Group Inc (ZG). Annual Shareholders Meeting

2200 Studio City International Holdings Ltd (MSC). Annual Shareholders Meeting

EX-DIVIDENDS

Ameren Corp (AEE). Amount $0.49

Anthem Inc (ANTM). Amount $0.95

CME Group Inc (CME). Amount $0.85

CNO Financial Group Inc (CNO). Amount $0.12

Hewlett Packard Enterprise Co (HPE). Amount $0.12

HP Inc (HPQ). Amount $0.17

Ladder Capital Corp (LADR). Amount $0.20

NortonLifeLock Inc (NLOK). Amount $0.12

PPL Corp (PPL). Amount $0.41

South Jersey Industries Inc (SJI). Amount $0.29

Travelers Companies Inc (TRV). Amount $0.85

UMB Financial Corp (UMBF). Amount $0.31

VF Corp (VFC). Amount $0.48

Victory Capital Holdings Inc (VCTR). Amount $0.05

Wake-up call: Nooit geziene omstandigheden op de beurs, wees enorm alert vanaf nu !!

Goedemorgen

Weer 460 Dow punten erbij gisteren, de S&P 500 sprokkelt er 38 punten bij, de Nasdaq zet een nieuwe All Time High neer op slotbasis net als de Nasdaq 100 en we zien dat de VIX 5% hoger gaat naar 25,8 wat hoog blijft en dat bij een stijgende markt. Volgens mij niet meer voorgekomen sinds de jaren '90 maar goed ... De vraag die ons het meest interesseert is waar we nu staan, wat er staat te gebeuren en waar de gevaren loeren? Hebt u de waarderingen gezien die ik gisteren in de LIVEBLOG heb geplaatst? Die moet u anders eens bekijken en ze zullen nog verder oplopen als de cijfers over Q2 binnen zijn want men verwacht een behoorlijke daling van de winst na de quarantaine in april en mei. Maar nogmaals, de markt is nog gek genoeg om door te duwen en dat zeker nu de records op Wall Street aan de ene kant al sneuvelen (Nasdaq, Nasdaq 100 en de SOX) en bij de blue chips we snel aan het naderen zijn want de Dow moet nog 6,7% terwijl de S&P 500 er nu nog slechts 4,7% onder zit. De vraag is nu of men doordrukt tot die records?

Vaag allemaal, ik weet het en wat kan ik eraan doen? Het blijft voor iedereen moeilijk want niemand weet hoe alles er over pakweg een paar maanden uit gaat zien? Krijgen we een MEGA economische impuls? Komt er een 2e golf van het virus aan? Kunnen de mensen weer doen alsof er niks aan de hand is of was? Zal de consument net zo stevig gaan uitgeven als voor dat deze crisis er kwam? Ik zal het eens in een POLL plaatsen in de loop van de dag maar ik denk dat het antwoord al te raden is ...

Goed, het zijn de normen van vandaag, we moeten ermee zien om te gaan. Zeg niet dat ik het niet heb geprobeerd maar helaas was dat niet de juiste strategie, wel de meest logische maar dus niet de juiste achteraf bekeken. Verder is het zo dat ik me afvraag wie er het maximale heeft kunnen uithalen? Zeker niet de oude rotten in het vak want ik spreek wel eens iemand en men zegt vrijwel unaniem dat dit alles verslaat wat er al is voorgekomen wat betreft de financiële markten (beurzen). Wat ik doe is mijn uiterste best om alles te communiceren richting de lezers en mijn leden maar ik ben ook maar iemand die hetgeen wat er nu gaande is aanschouw als nieuw. Wel beschik ik over de ervaring en de rust om het allemaal te accepteren en om ervan te leren maar vergeet niet dat ik ook een koude douche heb gekregen de afgelopen weken.

Vanmorgen zien we dat de markt vlak tot iets hoger wil beginnen, Europa doet even niet mee zo te zien, gisteren in ieder geval amper en de AEX al helemaal niet door ASML. De Nasdaq wist zich stevig te herpakken gisteren na het slot van de AEX dus ASML zal wel weer een groot deel terugpakken denk ik. Voorlopig zit ik nog even long met wat posities op de indexen, er lopen bij andere abonnementen ook nog wat kleine shorts op aandelen en een grondstof. Wel kijk ik uit om te draaien waar het kan, maar we zitten nog met de FED die morgen komt rond 20:00 en om 20:30 met een persconferentie ... Welke strategie ik ga volgen zal ik wel richting de leden communiceren. In ieder geval staan we op Wall Street hoger en hoger, dat wordt dus voor de BULLS gevaarlijker en gevaarlijker. Het zal op de timing aankomen ...

Doe nu mee tot 1 augustus voor €39 ... En let op, als je de draai mee wil pakken dan heb ik in het verleden vaak genoeg bewezen dat short handel iets is wat je moet begrijpen en daar kan ik u mee helpen als uw coach. Suggesties worden dan verzonden, het is altijd aan uzelf om mee te doen of niet. Maar nu kan dat tot 1 augustus, bijna 2 maanden volgen en dat bij een zeer volatiele beurs. Een kans dus ...

Inschrijven? Ga naar https://www.usmarkets.nl/tradershop

Tot later ... Guy

Markt snapshot vandaag Europa

GLOBAL TOP NEWS

The U.S. economy ended its longest expansion in history in February and entered recession as a result of the coronavirus pandemic, the private economics research group that acts as the arbiter for determining U.S. business cycles said on Monday.

Hong Kong leader Carrie Lam warned the city could not afford further "chaos" as it marked the first anniversary of the start of rolling mass pro-democracy protests.

Thousands of mourners braved sweltering Texas heat on Monday to view the casket of George Floyd, whose death after a police officer knelt on his neck ignited worldwide protests against the mistreatment of African Americans and other minorities by U.S. law enforcement.

EUROPEAN COMPANY NEWS

Fiat Chrysler's planned $50 billion merger with Peugeot maker PSA has hit a bump after EU regulators voiced concerns about the companies' market share in small vans, indicating concessions may be required, sources said.

Volkswagen replaced Herbert Diess as chief executive of the VW brand on Monday and installed chief operating officer Ralf Brandstaetter to lead cost cutting efforts at the company's largest plants in Germany.

A merger between AstraZeneca and Gilead Sciences Inc is unlikely due to significant political hurdles, Wall Street analysts said on Monday after a Bloomberg report that the British drugmaker last month had contacted its U.S. rival about a deal.

TODAY'S COMPANY ANNOUNCEMENTS

accesso Technology Group PLC Shareholders Meeting

Albion Development VCT PLC Annual Shareholders Meeting

AVEVA Group PLC Full Year 2020 Earnings Call

Danske Bank A/S Annual Shareholders Meeting

Ecomb AB (publ) Annual Shareholders Meeting

edding AG Annual Shareholders Meeting

Equatorial Palm Oil PLC Shareholders Meeting

Ferroglobe PLC Q1 2020 Earnings Call

Fincantieri SpA Annual Shareholders Meeting

Heidelberger Druckmaschinen AG Q4 2020 Earnings Call

HSBC Trinkaus & Burkhardt AG Annual Shareholders Meeting

Hypoport SE Annual Shareholders Meeting

Instone Real Estate Group AG Annual Shareholders Meeting

La Fonciere Verte SA Annual Shareholders Meeting

Menhaden PLC Annual Shareholders Meeting

Nostrum Oil & Gas PLC Annual Shareholders Meeting

O Sorbet d'Amour SA Annual Shareholders Meeting

PSI Software AG Annual Shareholders Meeting

Quotient Ltd Q4 2020 Earnings Call

Reworld Media SA Annual Shareholders Meeting

S&U PLC Annual Shareholders Meeting

Safe Bulkers Inc Q1 2020 Earnings Call

Scorpio Tankers Inc Annual Shareholders Meeting

Silence Therapeutics PLC Annual Shareholders Meeting

Sligro Food Group NV Annual Shareholders Meeting (Dutch)

Sopra Steria Group SA Annual Shareholders Meeting (French)

Systemair AB Q4 2020 Earnings Release

Tikkurila Oyj Annual Shareholders Meeting

Tissue Regenix Group PLC Shareholders Meeting

Umanis SA Annual Shareholders Meeting

Unibail-Rodamco-Westfield SE Annual Shareholders Meeting

Worldline SA Annual Shareholders Meeting

Zegona Communications PLC Annual Shareholders Meeting

ECONOMIC EVENTS (All times GMT)

0545 Switzerland Unemployment Rate Unadjusted for May: Expected 3.5%; Prior 3.3%

0545 Switzerland Unemployment Rate Adjusted for May: Expected 3.7%; Prior 3.3%

0600 (approx.) Germany Exports mm SA for April: Expected -15.6%; Prior -11.8%

0600 (approx.) Germany Imports mm SA for April: Expected -16.0%; Prior -5.1%

0600 (approx.) Germany Trade Balance, SA for April: Expected 10.0 bln EUR, Prior 12.8 bln EUR

0600 (approx.) Germany Current Account - Balance NSA for April: Prior 24.4 bln EUR

0645 France Current Account for April: Prior -3.3 bln EUR

0645 (approx.) France Current Account - Balance NSA for April: Prior -3.98 bln EUR

0645 France Trade Balance, SA for April: Prior -3.34 bln EUR

0645 France Imports, for April: Prior 38.54 bln EUR

0645 France Exports, for April: Prior 35.190 bln EUR

0900 (approx.) Euro Zone Employment Overall final for Q1: Prior 16,03,63,000

0900 Euro Zone Employment final yy for Q1: Expected 0.3%; Prior 0.3%

0900 Euro Zone Employment final qq for Q1: Expected -0.2%; Prior -0.2%

0900 Euro Zone GDP Revised qq for Q1: Expected -3.8%; Prior -3.8%

0900 Euro Zone GDP Revised yy for Q1: Expected -3.2%; Prior -3.2%

1000 (approx.) Portugal Global Trade Balance for April: Prior -4.647 bln EUR

1000 (approx.) Portugal Trade Balance 1-Month for April: Prior -1.586 bln EUR

DEBT AUCTIONS

Belgium- Reopening of 3-month and 11-month government debt auctions.

Germany- Reopening of 7-year government debt auction.

Netherlands- Reopening of 10-year government debt auction.

Spain- Reopening of 6-month and 1-year government debt auctions.

Switzerland- Reopening of 3-month government debt auction.