Liveblog Archief woensdag 10 juni 2020

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Rentevoetbeslissing | Actueel: 0,25% Verwacht: 0,25% Vorige: 0,25% |

Ach ja, ter info ... Tesla boven de 1000 dollar, het zal allemaal wel, dat ze nog nooit een stuiver winst hebben gemaakt is een bijzaak uiteraard ... Over 5 jaar zal iedereen wel met zo'n karretje voorbij scheuren als we het allemaal mogen geloven. Is al meer waard dan Daimler, BMW, Volkswagen en Porsche samen sinds vandaag ...

rood rood rood hahaha

rood rood rood hahaha

Wat dacht je van IPO Nikola Motors Company deze week pfff

Wat dacht je van IPO Nikola Motors Company deze week pfff

en terug groen, groen, groen

en terug groen, groen, groen

lucht lucht lucht lucht

lucht lucht lucht lucht

Fed sees interest rates staying near zero through 2022, GDP bouncing to 5% next year

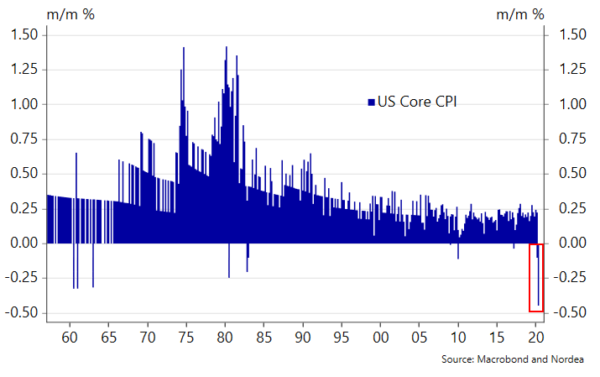

Fed sees interest rates staying near zero through 2022, GDP bouncing to 5% next yearVoor het eerst OOIT zakt de Core CPI maand op maand 3 opeenvolgende keren, het ruikt echt naar deflatie deze tijd, een groot risico mijn inziens en zeker niet hetgeen de beurzen ons laten zien momenteel. Let dus op voor de Robin Hood Traders ... Het wordt met de dag ernstiger op Wall Street ... Maar hoe zal de FED inflatie op gang brengen deze keer?

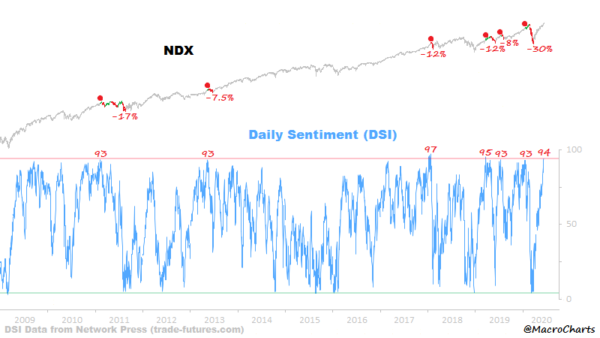

Nasdaq 100 op topniveau aan alle kanten, en de dagelijkse sentiment indicator bereikt 94-95 momenteel, eerder gebeurde daarna hetgeen je ziet op de chart van de index, beste correcties volgen erop ...

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Ruwe Olievoorraden | Actueel: 5,720M Verwacht: -1,738M Vorige: -2,077M |

Markt snapshot Wall Street

OP NEWS

• With crisis response in place, Fed looks to long term

The Federal Reserve completes its latest policy meeting with attention turning from its massive response to the coronavirus pandemic and toward its still-developing plans to strengthen and lengthen a nascent economic recovery.

• Pompeo chides HSBC for 'corporate kowtow' to Beijing

U.S. Secretary of State Mike Pompeo on Tuesday chided British bank HSBC for backing moves by China to end Hong Kong's autonomy, saying such "corporate kowtows" got little in return from Beijing.

• Europe to accelerate trials of gene-engineered COVID-19 vaccines - sources

European officials aim to speed up trials for coronavirus vaccines containing genetically modified organisms, two EU sources told Reuters, in a move that could help shots developed by companies like AstraZeneca and Johnson & Johnson.

• Chinese companies put U.S. listing plans on ice as tensions mount

Chinese companies are putting off plans for U.S. listings as tensions between the world's top two economies rise, lawyers, bankers, accountants and regulators involved in what has been a major capital-raising route told Reuters.

• Facebook, Twitter, Google to report monthly on fake news fight, EU says

Facebook, Google and Twitter should provide monthly reports on their fight against disinformation, two senior EU officials said as they called out Russia and China for their roles in the spread of fake news.

BEFORE THE BELL

Futures for U.S. stock indexes were little changed, ahead of the Federal Reserve’s interest rate decision, due to be announced later in the day. European shares were in the red. Japan’s Nikkei closed slightly higher, as investors paused to take stock of the market. The euro rose against the dollar, amid speculation the Fed might announce more steps to check a recent rise in bond yields. Goldprices were up, helped by a weaker dollar. Oil fell after a report showed a rise in U.S. crude inventories, reviving concerns about oversupply and weak demand. On the economic schedule, consumer price index data is due.

STOCKS TO WATCH

Results

• AMC Entertainment Holdings Inc (AMC). The movie theatre operator said on Tuesday it was expecting to reopen its theaters globally in July after shutting them down in mid-March due to the COVID-19 pandemic, sending its shares up in extended trading. The company said it was planning to reopen almost all its U.S. and UK theaters in time to showcase Christopher Nolan's "Tenet", slated for release on July 17, and Walt Disney "Mulan" on July 24. AMC on Tuesday said it was conducting an "exhaustive analysis" of its theaters to determine which ones to shut permanently, due to lack of profitability. AMC's total revenue fell 21.6% to $941.5 million in the quarter ended March 31, missing analysts' average estimate of $951.4 million, according to IBES data from Refinitiv. Net loss widened to $2.18 billion, largely due to an impairment charge of about $1.85 billion driven by suspension of global operations and the resulting declines in the company's market capitalization.

In Other News

• Abbvie Inc (ABBV). The drugmaker said it is partnering with Genmab to jointly develop and commercialize cancer treatment, as it looks to expand its cancer franchise. The U.S. based pharma giant will pay Genmab $750 million upfront to jointly develop and commercialize three of Genmab's cancer-targeting antibody products, including its potential blood cancer treatment epcoritamab, which is currently in a mid-stage study. Genmab could receive up to $3.15 billion in additional development, regulatory and sales milestone payments.

• AstraZeneca Plc (AZN) & Johnson & Johnson (JNJ). European officials aim to speed up trials for coronavirus vaccines containing genetically modified organisms, two EU sources told Reuters, in a move that could help shots developed by companies like AstraZeneca and Johnson & Johnson. The reform is expected to reduce member states' power to impose extra requirements on drug companies when they conduct clinical trials on medicines and vaccines containing genetically modified organisms (GMOs), according to the sources. Vaccines Europe, which represents many big pharmaceutical players, said planned changes would create a level playing field between vaccines which contain GMOs and those that do not.

• CME Group Inc (CME). The exchange operator said on Tuesday it will reopen its eurodollar options trading pit on Aug. 10, making it the latest U.S. exchange operator to resume open outcry trading, which had been put on hold due to the coronavirus pandemic. CME said all its other trading pits, which were shuttered after the market closed on March 13, would remain closed until Chicago, where they are based, reached Phase 5 of its reopening plans. "As the coronavirus crisis remains fluid, the company will continue to monitor the situation and communicate any changes as needed," the company said in a statement. CME said all traders and clerks will have to sign a waiver acknowledging and accepting the risk that COVID-19 presents in an open-outcry environment.

• Facebook Inc (FB), Alphabet Inc (GOOGL) & Twitter Inc(TWTR). The companies should provide monthly reports on their fight against disinformation, two senior EU officials said as they called out Russia and China for their roles in the spread of fake news. The comments by EU foreign policy head Josep Borrell and the European Commission's Vice President for values and transparency Vera Jourova underscore the bloc's concerns about the prevalence of misleading news on COVID-19 and the attempts by foreign actors to influence Europe. She said the next fake news front was vaccination, citing a study showing that Germans' willingness to be vaccinated had fallen by 20 percentage points in two months.

• Gilead Sciences Inc (GILD). Singapore approved the use of Gilead's antiviral drug remdesivir for the treatment of severely ill patients with COVID-19 infection. Singapore's Health Sciences Authority (HSA) said the conditional approval would allow treatment of adult patients if they have low blood oxygen levels, require supplemental oxygen or intensive breathing support. "Although the data on its efficacy and safety is very limited at this point in time, HSA has expedited the review of remdesivir given the urgent public health need during the COVID-19 pandemic," HSA said in statement.

• HSBC Holdings plc (HSBC). U.S. Secretary of State Mike Pompeo on Tuesday chided British bank HSBC for backing moves by China to end Hong Kong's autonomy, saying such "corporate kowtows" got little in return from Beijing. Pompeo said the United States stood ready to help Britain with alternatives after Beijing reportedly threatened to punish HSBC and break commitments to build nuclear power plants in the country unless it allowed China's Huawei Technologies to build its 5G network. "The United States stands with our allies and partners against the Chinese Communist Party’s coercive bullying tactics," Pompeo said in a statement, his latest swipe at China's ruling party.

• Mack-Cali Realty Corp (CLI). Bow Street LLC is close to having eight directors elected to the board of Mack-Cali Realty, which would give the hedge fund control of the real estate investment trust's board, sources familiar with the matter said on Tuesday. All votes have not been cast before Wednesday's annual meeting and the results could still change. But preliminary numbers show Bow Street's entire eight-member slate will be elected to the 11-strong board, the sources said. The slate includes four directors who were elected to the board last year but were not re-nominated by the company and four others, including Akiva Katz, one of Bow Street's co-founders.

• Merck & Co (MRK). The drugmaker said on Tuesday its blockbuster therapy Keytruda used along with chemotherapy failed to meet the main goals of a late-stage study testing the combination as a first-line treatment for bladder cancer. The trial did not meet the main goals of overall survival or progression-free survival, compared with standard-of-care chemotherapy alone, the company said in a statement. The company said Keytruda helped improve overall survival and progression-free survival, but failed to achieve statistical significance. Keytruda, which brought in sales of $3.28 billion in the first quarter, has already received three U.S. regulatory approvals for different types of bladder cancers.

ANALYSIS

Yield control bets increase as investors wait for Fed

As investors weigh the chances the Federal Reserve will take new measures to ensure short-term interest rates remain anchored near zero for the next several years, strategies that aim to capitalize on a likely steepening of the Treasury yield curve are looking more appealing.

ANALYSTS' RECOMMENDATION

• American Express Co (AXP). Jefferies raises target price to $110 from $90, saying the company’s customers have a high "stick" rate and are incrementally willing to pay higher and increased fees for their premium products given the strong perceived value, which provides unique competitive advantages.

• ConocoPhillips (COP). Goldman Sachs raises target price to $56 from $51, viewing the long term value proposition of the company as intact.

• Occidental Petroleum Corp (OXY). JPMorgan raises target price to $17 from $7, saying with the recent recovery in oil prices and improvement in credit markets, fears that the company might go bankrupt have subsided.

• Synaptics Inc (SYNA). JPMorgan raises target price to $58 from $50, saying the company’s solid long term financial targets seem achievable.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0830 Core CPI mm, SA for May: Expected 0.0%; Prior -0.4%

0830 Core CPI yy, NSA for May: Expected 1.3%; Prior 1.4%

0830 CPI Index, NSA for May: Expected 256.837; Prior 256.389

0830 (approx.) Core CPI Index, SA for May: Prior 265.60

0830 CPI mm, SA for May: Expected 0.0%; Prior -0.8%

0830 CPI yy, NSA for May: Expected 0.2%; Prior 0.3%

0830 Real weekly earnings mm for May: Prior 5.8%

0830 (approx.) CPI mm NSA for May: Prior -0.670%

0830 (approx.) CPI Index SA for May: Prior 255.900

1100 (approx.) Cleveland fed CPI for May: Prior 0.1%

1200 TR IPSOS PCSI for Jun: Prior 45.37

1400 Fed funds target rate for 10 Jun: Prior 0-0.25%

1400 Federal budget, for May: Expected -$625.00 bln; Prior -$738.00 bln

1400 Fed int on excess reserves for 10 Jun: Prior 0.10%

COMPANIES REPORTING RESULTS

No major S&P 500 companies are scheduled to report.

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0730 Dick's Sporting Goods Inc (DKS). Annual Shareholders Meeting

0800 Brighthouse Financial Inc (BHF). Annual Shareholders Meeting

0800 Deciphera Pharmaceuticals Inc (DCPH). Annual Shareholders Meeting

0830 Editas Medicine Inc (EDIT). Annual Shareholders Meeting

0830 United Natural Foods Inc (UNFI). Q3 earnings conference call

0900 Big Lots Inc (BIG). Annual Shareholders Meeting

0900 Caterpillar Inc (CAT). Annual Shareholders Meeting

0900 Michaels Companies Inc (MIK). Annual Shareholders Meeting

0900 Shake Shack Inc (SHAK). Annual Shareholders Meeting

0900 Reata Pharmaceuticals Inc (RETA). Annual Shareholders Meeting

0900 Altice USA Inc (ATUS). Annual Shareholders Meeting

0900 Kosmos Energy Ltd (KOS). Annual Shareholders Meeting

1000 Target Corp (TGT). Annual Shareholders Meeting

1000 American Airlines Group Inc (AAL). Annual Shareholders Meeting

1000 Penn National Gaming Inc (PENN). Annual Shareholders Meeting

1000 Marketaxess Holdings Inc (MKTX). Annual Shareholders Meeting

1000 Fidelity National Financial Inc (FNF). Annual Shareholders Meeting

1045 Redfin Corp (RDFN). Annual Shareholders Meeting

1100 Crocs Inc (CROX). Annual Shareholders Meeting

1100 LendingTree Inc (TREE). Annual Shareholders Meeting

1100 SeaWorld Entertainment Inc (SEAS). Annual Shareholders Meeting

1100 Vivint Solar Inc (VSLR). Annual Shareholders Meeting

1100 Black Knight Inc (BKI). Annual Shareholders Meeting

1130 Ligand Pharmaceuticals Inc (LGND). Annual Shareholders Meeting

1200 Mattel Inc (MAT). Annual Shareholders Meeting

1200 Kaiser Aluminum Corp (KALU). Annual Shareholders Meeting

1200 Mack-Cali Realty Corp (CLI). Annual Shareholders Meeting

1200 Expedia Group Inc (EXPE). Annual Shareholders Meeting

1200 Santander Consumer USA Holdings Inc (SC). Annual Shareholders Meeting

1200 Roku Inc (ROKU). Annual Shareholders Meeting

1300 Stamps.Com Inc (STMP). Annual Shareholders Meeting

1300 National Vision Holdings Inc (EYE). Annual Shareholders Meeting

1400 MFA Financial Inc (MFA). Annual Shareholders Meeting

1400 PTC Therapeutics Inc (PTCT). Annual Shareholders Meeting

1400 Qualys Inc (QLYS). Annual Shareholders Meeting

1600 Blackbaud Inc (BLKB). Annual Shareholders Meeting

EX-DIVIDENDS

Best Buy Co Inc (BBY). Amount $0.55

Mdu Resources Group Inc (MDU). Amount $0.20

Mercury General Corp (MCY). Amount $0.63

NIC Inc (EGOV). Amount $0.09

Perspecta Inc (PRSP). Amount $0.07

Spire Inc (SR). Amount $0.62

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Kern CPI (Maandelijks) (May) | Actueel: -0,1% Verwacht: -0,1% Vorige: -0,4% |

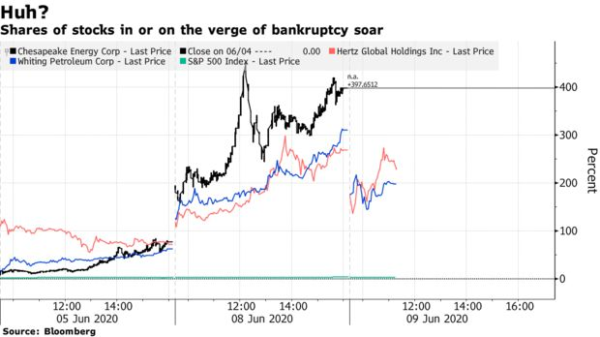

Bedrijven die al bankroet waren eerder dit jaar laten zoals je ziet allemaal extreme stijgingen zien, vanmorgen had ik het al over Hertz maar ook Chesapeake Energy en Whiting Petroleum zoals je kunt zien via deze grafiek ...

TA Food

Laten we vandaag eens kijken naar wat plaatjes uit de sector voeding. Ik heb vier aandelen gekozen die iets met voeding te maken hebben, bedrijven die in de USA en Nederland genoteerd staan: McDonald’s, Just Eat Take Away, Yum! en Ahold Delhaize. Laten we snel kijken hoe de plaatjes erbij liggen.Ik…

Lees verder »TA - Onze eigen NASDAQ

Technologie neemt steeds meer de overhand op de internationale beurzen. We denken al gauw aan bedrijven als Apple, Microsoft, Amazon, Alibaba, Facebook en Tencent. Dat Nederland haar eigen NASDAQ heeft is natuurlijk overdreven maar met Adyen, ASML, ASMI, Just Eat, Philips en Prosus weegt…

Lees verder »Wake-up call: Nieuwe term, Robin Hood traders sturen markt omhoog

GoedemorgenGisteren toch een eerste indicatie dat het zou kunnen draaien bij de meeste indices maar de al zo dure Nasdaq...

Deze inhoud is alleen beschikbaar voor betalende leden.

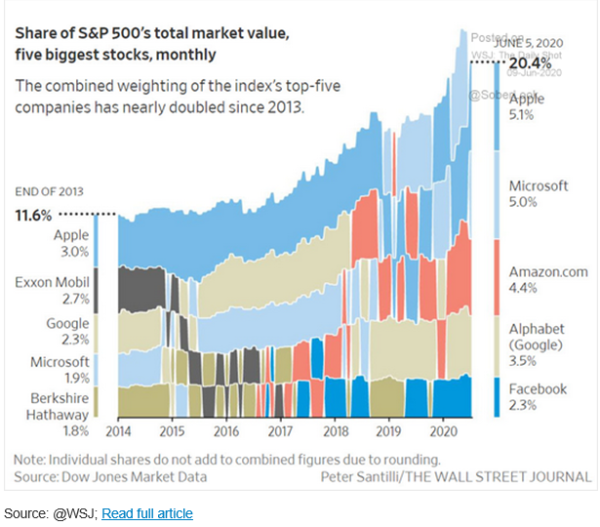

Een overzicht van het gewicht van de top 5 aandelen binnen de SP 500 index ...

geen shorts van winnaars kopen, dat is verliezen.

Zelfs bedrijven die bankroet werden verklaard een paar weken geleden worden stevig verhandeld op de beurs met stijgingen van honderden procenten, zoals Hertz. Een paar weken geleden werden top stukken van dat bedrijf nog fors uitbetaald net voor het bankroet. Wat er allemaal gaande is blijft een mysterie maar wel een feit ...

Markt snapshot vandaag Europa

GLOBAL TOP NEWS

The Federal Reserve completes its latest policy meeting on Wednesday with attention turning from its massive response to the coronavirus pandemic and toward its still-developing plans to strengthen and lengthen a nascent economic recovery.

China's producer prices fell by the sharpest rate in more than four years, underscoring pressure on the manufacturing sector as the COVID-19 pandemic reduces trade flows and global demand.

George Floyd, a black man whose death under the knee of a white police officer roused worldwide protests against racial injustice, was memorialized at his funeral on Tuesday as "an ordinary brother" transformed by fate into the "cornerstone of a movement."

EUROPEAN COMPANY NEWS

U.S. Secretary of State Mike Pompeo on Tuesday chided HSBC for backing moves by China to end Hong Kong's autonomy, saying such "corporate kowtows" got little in return from Beijing.

AstraZeneca on Tuesday received $23.7 million in funding from a U.S. government agency to advance the development of antibody-based COVID-19 treatments as the British drugmaker ramps up efforts beyond its potential vaccine to combat the pandemic.

SoftBank Group Corp-owned chip technology firm Arm said the chief executive officer of its China joint venture, Allen Wu, has stepped down and been replaced.

TODAY'S COMPANY ANNOUNCEMENTS

Acanthe Developpement SE Annual Shareholders Meeting

Advanced Medical Solutions Group PLC Annual Shareholders Meeting

Aqua Bio Technology ASA Annual Shareholders Meeting

Bremer Lagerhaus Gesellschaft Aktiengesellschaft von 1877 Annual Shareholders Meeting

Brenntag AG Annual Shareholders Meeting

Clasquin SA Annual Shareholders Meeting

DiaSorin SpA Annual Shareholders Meeting

Eckert & Ziegler Strahlen und Medizintechnik AG Annual Shareholders Meeting

EKF Diagnostics Holdings PLC Annual Shareholders Meeting

Ergomed PLC Annual Shareholders Meeting

Eurokai GmbH & Co KGaA Annual Shareholders Meeting

Finlab AG Annual Shareholders Meeting

Flowtech Fluidpower PLC Annual Shareholders Meeting

Fonciere Inea SA Annual Shareholders Meeting

Franks International NV Annual Shareholders Meeting

Gaming Realms PLC Annual Shareholders Meeting

Gelsenwasser AG Annual Shareholders Meeting

GenKyoTex SA Annual Shareholders Meeting

Hiddn Solutions ASA Annual Shareholders Meeting

K&S AG Annual Shareholders Meeting

La Doria SpA Annual Shareholders Meeting

Mediaset Espana Comunicacion SA Annual Shareholders Meeting

MedicPen AB (publ) Annual Shareholders Meeting

Nordic Nanovector ASA Annual Shareholders Meeting

Novocure Ltd Annual Shareholders Meeting

OVB Holding AG Annual Shareholders Meeting

Paragon Banking Group PLC Half Year 2020 Earnings Release

Prosiebensat 1 Media SE Annual Shareholders Meeting

Sacyr SA Annual Shareholders Meeting

Selectirente SA Annual Shareholders Meeting

Societe Marseillaise du Tunnel Prado Carenage SA Annual Shareholders Meeting

Soitec SA Full Year 2020 Earnings Release

Sto SE & Co KgaA Annual Shareholders Meeting

TBC Bank Group PLC Annual Shareholders Meeting

TTL Beteiligungs und Grundbesitz AG Annual Shareholders Meeting

Verallia SAS Annual Shareholders Meeting

Vergnet SA Annual Shareholders Meeting

Wallix Group SA Annual Shareholders Meeting

Willis Towers Watson PLC Annual Shareholders Meeting

WPP PLC Annual Shareholders Meeting

Xilam Animation SA Annual Shareholders Meeting

ECONOMIC EVENTS (All times GMT)

0600 (approx.) Sweden CPIF Inflation 1 Year for Q2: Prior 1.4%

0600 (approx.) Sweden CPIF Inflation 5 Years for Q2: Prior 1.8%

0600 (approx.) Sweden Money Mkt CPIF Inflation 1 Yr for June: Prior 0.8%

0600 (approx.) Sweden Money Mkt CPIF Inflation 5 Yrs for June: Prior 1.6%

0645 France Industrial Output mm for April: Expected -20.0%; Prior -16.2%

0730 Sweden Household Consumption yy for April: Prior -3.1%

0730 Sweden Household Consumption mm for April: Prior -5.4%

2301 United Kingdom RICS Housing Survey for May: Expected -24; Prior -21