Liveblog Archief donderdag 11 juni 2020

Vluchten de Robin Hood Traders voor de beren in aantocht?

WALL STREET sluit fors lager en zet de slechtste sessie neer sinds 16 maart, de Corona besmettingen lopen weer fors op in de VS zo blijkt ... Dat zou de hoofdreden van de daling zijn. Trump zei vandaag dat het virus tot as is verbrand, ook schopte hij nog een keer na richting de FED dat ze het niet goed zien en dat hij er van overtuigd is dat Q3 prachtig wordt Q4 nog beter wordt en dat 2021 het beste jaar ooit wordt in de VS ... Ofwel, Trump zegt gewoon, stem AUB op mij want ik doe het heel goed ... Hmmmm.....

DOW 🔴⬇️-1861 Punten ofwel 🔴⬇️-6.9%

S&P 500 🔴⬇️5.84%

NASDAQ 🔴⬇️ -5.27%

RUSSELL 2000 🔴⬇️ -7.8%

VIX ENDS 🟢⬆️ +47.8%

Goeie nacht en tot morgen .... Guy

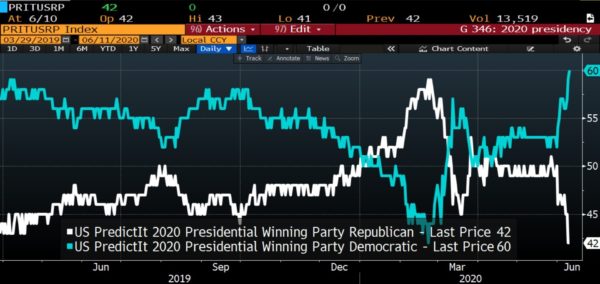

Trump nog 4 jaar erbij zal extreem hoge beurzen betekenen, maar erna een onherstelbaar afstort.

Trump nog 4 jaar erbij zal extreem hoge beurzen betekenen, maar erna een onherstelbaar afstort.  Biden wordt je denk ik ook niet heel vrolijk van, maar trump is gek geworden

Biden wordt je denk ik ook niet heel vrolijk van, maar trump is gek geworden

Vrijwel alles in het rood vandaag, meer dan 95% van de aandelen binnen de SP 500

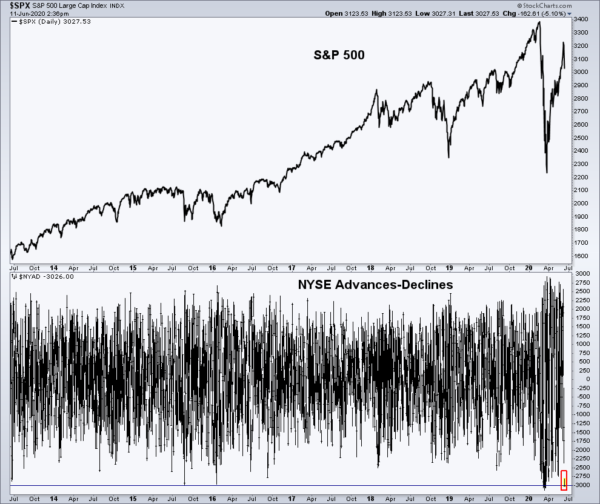

We zien haast nooit dat de NYSE ADVANCE-DECLINE indicator tot -3,000 gaat ... net als begin maart en tijdens andere grote correcties ... Zou de top van de rally er nu echt staan?

Robin Hood meets real Traders ... opletten vanaf nu

Wat ik al lang wist is dat de markt hoog werd gehouden door de newbies, let wel ik heb met ze te doen maar aan de andere kant ook niet, ze moeten nog leren want je kunt niet zomaar kopen om te kopen, dat gaat niet op de beurs en dat zag je aan de de koopdrang en de waarde van de markten vooral op Wall Street en met aandelen waar je je in hemelsnaam van afvraagt hoe kan het toch allemaal ...

Maar goed, de traditionele aandelen gaven het dinsdag en woensdag al aan, het zat niet goed zo hoog, nu het vervolg. De Nasdaq was al te vet gemest en ging boven de 10.000 wat teveel is volgens de PE waarden, ook daar nu een draai ofwel de start ervan. We gaan het zien ...

En dan de Robin Hood's, ik weet het, wat een term, maar dat waren de newbies die plots de markten betreden, ik vrees voor grote Margin Calls op hun vetgemeste accounts, dat wil zeggen dat de vlag de lading niet meer denkt hoe minder de aandelen waard worden. Let wel, dat hoeft vandaag niet, kan ook morgen of volgende week maar reken erop dat daar nog heel wat pijn zit. Ik las dat zelfs tieners (tussen de 12 en 15 jaar oud) volop aan het speculeren waren met opties, hefboom producten met een extreme hedge ... Opletten dus en nogmaals, ze moeten het ook leren en handelen op de beurs gaat met vallen en opstaan en ja ... bij een oude rot als ikzelf ook, dat hebben we gemerkt de afgelopen weken richting de toppen. Al neem ik niet zoveel risico en blijft de inleg acceptabel ... In ieder geval lopen de posities nu goed ... Ik zal wel zien waar we eventueel wat moeten doen ...

Lid worden kan, nu tot 1 augustus voor €39 ... https://www.usmarkets.nl/tradershop

Tot straks ... Guy

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: PPI (Maandelijks) (May) | Actueel: 0,4% Verwacht: 0,1% Vorige: -1,3% | ||||

| USA: Eerste Aanvragen Werkloosheidsvergoeding | Actueel: 1.542K Verwacht: 1.550K Vorige: 1.897K |

Markt snapshot Wall Street

TOP NEWS

• U.S. weekly jobless claims seen declining further, but millions still unemployed

Layoffs in the United States are abating, but millions who lost their jobs because of COVID-19 continue to draw unemployment benefits, suggesting the labor market could take years to heal from the pandemic even as businesses resume hiring workers. New applications for state unemployment benefits likely totaled a seasonally adjusted 1.55 million for the week ended June 6, according to a Reuters survey of economists.

• How Uber hailed a deal with Grubhub only to let it slip

Uber CEO Dara Khosrowshahi has spent much of his career deftly negotiating acquisitions. Yet his $6.5 billion all-stock bid for Grubhub ended with the food delivery company being acquired by European rival Just Eat Takeway.com.

• Tesla wins China approval to build Model 3 vehicles with LFP batteries -ministry

Tesla has received government approval to build Model 3 vehicles in China equipped with lithium iron phosphate (LFP) batteries, a document on Ministry of Industry and Information Technology website showed.

• Battling anti-encryption drive, tech companies pledge new child abuse disclosures

Tech companies including Facebook, Google and Microsoft pledged to improve and standardise annual disclosures around online child exploitation, as they fight off moves to limit encryption.

• Zoom suspends U.S.-based activists' account after Tiananmen event

Zoom Video Communications temporarily shut the account belonging to a group of U.S.-based Chinese activists after they held an event to commemorate the 31st anniversary of China's Tiananmen Square crackdown, the activists said.

BEFORE THE BELL

Wall Street futures declined, a day after the Federal Reserve's economic forecast confirmed that the pain from the coronavirus outbreak will be felt for years, with investors also nervous about a second wave of infections. European shares fell and Japan’s Nikkei suffered its biggest one-day fall in six weeks. The dollar was little changed against its rival currencies. Spot gold edged lower on profit-booking. Oil prices fell, hit by another record build-up in U.S. crude inventories. On the economic schedule, initial jobless claims and producer prices index numbers are due to be released.

STOCKS TO WATCH

• Amazon.com Inc (AMZN). The e-commerce giant on Wednesday said it was implementing a one-year moratorium on police use of its facial recognition software, halting a business it long defended as many protested law enforcement brutality against people of color. The decision culminates a two-year battle between Amazon and civil liberties activists, who have voiced concern that inaccurate matches could lead to unjust arrests. Critics have pointed to a past study showing Amazon's "Rekognition" service struggled to identify the gender of individuals with darker skin, research that Amazon has contested. The company, which sells cloud computing technology via its Amazon Web Services division, said in a statement it has pushed for regulations to ensure the software was used ethically.

• Amazon.com Inc (AMZN) & eBay Inc (EBAY). The e-commerce companies have been instructed by the U.S. Environmental Protection Agency (EPA) to stop selling unproven or unsafe disinfectants, including products falsely marketed as killing COVID-19, on their platforms, Bloomberg reported. The EPA issued orders directing the companies to stop selling or distributing 70 products, including sprays, lanyards and other products touted as "preventing epidemics", the report said. The companies are required to remove the products from their websites and to certify that they have done so, the report said. "We are removing the products in question and are taking action against the bad actors who listed them," an Amazon spokesperson said in an email statement. The EPA and eBay did not immediately respond to emailed requests for comment from Reuters.

• Apple Inc (AAPL). New York-based podcasting platform Pocket Casts said its app had been taken down from Apple's app store in China. Reuters couldn't immediately verify why the app was no longer available in the store. Pockets Casts, ranked 85th most popular in the podcast news app section on Apple's U.S website, said on Wednesday the move was taken by Apple after intervention by Beijing's top internet watchdog. The removal comes amid growing debate over China and freedom of speech after a resurgence of activity by pro-democracy protesters in Hong Kong, angered by Beijing's plans to impose new security laws. In a message on Twitter, Pocket Casts said that its app "has been removed ... by Apple at the request of the Cyberspace Administration of China (CAC)". "We were contacted by the CAC through Apple around two days before the app was removed from the store," Pocket Casts said on Twitter.

• Endo International Plc (ENDP). New York state filed civil charges on Wednesday accusing Endo International of insurance fraud for misrepresenting the safety and efficacy of its opioid drugs, adding fuel to the nation's opioid crisis. Governor Andrew Cuomo said the charges brought by New York's Department of Financial Services are the second in that regulator's probe into the opioid industry, following similar charges against Mallinckrodt on April 21. New York said Endo, which made 18.4% of opioids distributed from 2006 to 2014 in the state, downplayed the risks of addiction and abuse of opioids such as its Opana ER, giving patients greater comfort about using them to relieve pain.

• Facebook Inc (FB), Alphabet Inc (GOOGL) & Microsoft Corp (MSFT). Tech companies including Facebook, Google and Microsoft pledged to improve and standardise annual disclosures around online child exploitation, as they fight off moves to limit encryption. The Technology Coalition, which coordinates industry action around child sexual abuse, also said its 18 member companies would establish a "multi-million" dollar research fund to study patterns of abuse and build technological tools to prevent them. Child welfare advocates say the number of known child sexual abuse images has soared from thousands to tens of millions in recent years, as predators have increasingly used social networks to groom victims and exchange explicit images. The U.S.-led "Five Eyes" alliance last year threatened to weaken legal protections and called on Facebook to suspend plans to extend end-to-end encryption across its messaging services.

• Fiat Chrysler Automobiles NV (FCAU). Fiat Chrysler and Peugeot maker PSA face a lengthy EU antitrust investigation after declining to offer concessions to allay EU antitrust concerns about their planned $50 billion merger, people familiar with the matter said on Wednesday. Fiat and PSA, which are seeking to create the world's fourth-biggest carmaker, were told last week that their combined high market share in small vans was a worry for competition enforcers, other people familiar with the matter had told Reuters. The companies had until Wednesday to put in concessions but did not do so, the sources said. That will automatically trigger a four-month-long investigation by the European Commission when it completes its preliminary review on June 17. The EU competition enforcer, Fiat Chrysler and PSA declined to comment.

• Ford Motor Co (F). The carmaker said on Wednesday it will recall 2.15 million U.S. vehicles with potentially faulty door latches. The second largest American automaker said the recall covers many 2011 through 2015 model-year vehicles. The recalled vehicles may not have had all door latches replaced or correctly replaced when repaired by dealerships under recalls issued in 2015 and 2016. Ford said a recalled vehicle with a faulty latch may unlatch while driving, but said it is not aware of any reports of accident or injury related to the condition. Ford previously recalled more than 5 million vehicles for varying door latch-related issues since 2015 and has booked hundreds of millions of dollars in costs.

• Goldman Sachs Group Inc (GS). The Wall Street bank said on Wednesday it plans to start the return of an initial group of its employees to its offices in New York, Jersey City, Dallas and Salt Lake City from June 22. The bank also announced the return of more employees to its London office from June 15 and added that it was expecting to review the process of employees returning to its Bengaluru office towards the end of June. Working from home was made mandatory across many Wall Street firms in March as financial firms reported their first confirmed cases of coronavirus and the outbreak triggered a state of emergency in New York City.

• JD.com Inc (JD) The Chinese e-commerce retailer has priced its shares at HK$226 each and raised about $3.87 billion in its Hong Kong secondary listing, according to two people with direct knowledge of the matter. JD.com, which is already listed on the Nasdaq in New York, had previously flagged it would sell 133 million shares. Under the terms of the deal, one of JD.com's American depository shares will be equal to two Hong Kong shares. That means the Hong Kong price represents a 3.9% discount to the firm's closing share price of $60.07 on the Nasdaq on Wednesday. The retail portion of the deal is open until noon Hong Kong time.

• News Corp (NWSA). Rupert Murdoch's News Corp will need to cut jobs in its British newspaper and radio operations as part of a business review aimed at reducing costs, News UK Chief Executive Rebekah Brooks said in a letter to staff on Wednesday. "In the coming months, we will need to streamline the business and take some tough decisions, saying goodbye to some valued and talented colleagues," Brooks said in the letter seen by Reuters. The letter did not mention the scale or number of job losses that could occur after the step. The review has been triggered by the impact of the coronavirus outbreak and its resulting lockdown, according to a News UK spokeswoman.

• Nikola Corp (NKLA). The maker of hydrogen-fueled vehicles is in the process of picking a partner to produce its Badger pickup truck, while also aiming to start deliveries of its electric commercial big rigs next year, founder Trevor Milton said on Wednesday. Nikola shares have nearly doubled since their debut on the Nasdaq last week, getting a bump on Monday after Milton tweeted that the company would open reservations for Badger on June 29. "There are three (automakers) in the running right now for a joint venture on Badger, and we will announce who that is in the next few months," Milton, who is also the company's executive chairman, told Reuters. The production of Badger, which will compete with electric car maker Tesla's Cybertruck, is set to start in 2022 or earlier, Milton said.

• Regeneron Pharmaceuticals Inc (REGN). The drugmaker said it has begun human testing of its experimental antibody cocktail as a treatment for COVID-19, the disease caused by the novel coronavirus. The trial has an "adaptive" design and could quickly move from dozens of patients to eventually include thousands, Chief Scientific Officer George Yancopoulos told Reuters. "If it goes perfectly well, within a week or two we will move to the second phase. Within a month or so of that we will have clear data that this is or isn't working. By the end of summer, we could have sufficient data for broad utilization." Regeneron said its treatment could be useful even if a COVID-19 vaccine is developed since the elderly and people with compromised immune systems often do not respond well to vaccines.

• Spirit AeroSystems Holdings Inc (SPR). The aircraft parts maker announced on Wednesday a 21-day layoff for staff doing production and support work for Boeing’s 737 program. Spirit, which makes the 737 fuselage, said the temporary layoffs and furloughs of roughly 900 workers at its Wichita, Kansas, facility would be effective June 15. The company cited impacts of the COVID-19 pandemic and uncertainty surrounding the 737 MAX's return to service following fatal crashes as reasons for the cuts. Spirit's announcement comes two weeks after Boeing said it resumed production of the 737 MAX, with a goal of handing jets over to airlines in the third quarter.

• Tailored Brands Inc (TLRD). The Men's Wearhouse owner said on Wednesday it may have to seek bankruptcy protection or discontinue operations, if the COVID-19 crisis continues to pummel sales. The retailer said it has taken "decisive actions to manage liquidity", including borrowing money, while opening nearly half of its stores across the United States and Canada. The pandemic has added to Tailored Brands' woes, as it had already been struggling with competition from fast-fashion brands and a shift to online shopping. First-quarter net sales for the retailer, which also owns men's clothing store Jos. A. Bank, plunged 60.4% as stores were closed due to coronavirus-led nationwide lockdowns. The company, however, said it expects sales to rebuild gradually during the remainder of the year, calling the operating environment highly uncertain.

• Tesla Inc (TSLA). The electric carmaker has received government approval to build Model 3 vehicles in China equipped with lithium iron phosphate (LFP) batteries, a document on Ministry of Industry and Information Technology website showed. Reuters exclusively reported in February that Tesla was in advanced talks to use LFP batteries from CATL that contain no cobalt - one of the most expensive metals in electric vehicle (EV) batteries - in cars made at its plant in China. The document does not provide the name of the battery maker. Tesla did not immediately respond to a request for comment.

• Tyson Foods Inc (TSN). The meatpacker said on Wednesday it was cooperating with the U.S. Department of Justice on a price-fixing investigation in the poultry industry, under a program that could protect the meat processor from criminal prosecution. Tyson, which was served with a subpoena in April 2019, said the formal grant under the DoJ's corporate leniency program would mean neither the company nor its employees will face criminal fines, jail time or prosecution. The news comes a week after the chief executive of poultry company Pilgrim's Pride was indicted along with three other current and former industry executives on charges of seeking to fix chicken prices in the United States.

• Unilever NV (UN) Unilever proposed collapsing its Anglo-Dutch legal structure into a single holding company based in Britain, nearly two years after shareholders sank an earlier plan to move its headquarters to the Netherlands. The proposed unification, which would unwind a dual-headed structure in place since 1930, aims to give the maker of Dove soap and Hellmann's mayonnaise more flexibility for mergers and acquisitions and reduce complexity, it said in a statement. The proposal, which resulted from an 18-month review, was accelerated in part by Unilever's decision to demerge its tea business this year. Unilever said that transaction would be harder under its current structure. This move, which requires 50% shareholder approval compared to 75% for the 2018 plan, is "our best tactical option," Unilever Chairman Nils Andersen told reporters.

• Walmart Inc (WMT). The retailer will stop keeping personal care products designed for people of color in locked display cases, the retailer said, after the practice drew flak online with many saying it suggested customers for these products cannot be trusted. "We have made the decision to discontinue placing multicultural hair care and beauty products in locked cases," the company said in an email statement on Wednesday. Walmart said the practice was in place in about a dozen of its 4,700 stores in the United States and the cases were in place to deter shoplifters from products such as electronics, automotive, cosmetics and other personal care products. The change in Walmart's policy was prompted by a June 8 CBS News report that a Walmart customer had complained of the practice being discriminatory against people of color, while visiting a store in the city of Denver.

• Walt Disney Co (DIS). The company plans to reopen the Disneyland Park and Disney California Adventure park on July 17, pending approval from state and local authorities. The theme parks based in Anaheim, California have been shut since March 14 to help curb the spread of the COVID-19 pandemic. Disney also plans to reopen its Grand Californian Hotel & Spa and Paradise Pier Hotel on July 23. The Disneyland Resort visitors will have to obtain a reservation for park entry in advance, the company said in a statement, as it aims to limit capacity in order to maintain physical distancing. Experiences like parades and night-time spectaculars that typically draw larger crowds, as well as character meet-and-greets will be temporarily unavailable, Disney said. Separately, U.S. TV network A&E has canceled a live documentary show on police officers in action, the latest media company to reassess their content amid widespread protests against law enforcement brutality on people of color in the country. "This is a critical time in our nation's history and we have made the decision to cease production on Live PD," A&E Networks, a joint venture between Hearst Communications and Walt Disney, said in a statement on Wednesday.

• Zoom Video Communications Inc (ZM). The company temporarily shut the account belonging to a group of U.S.-based Chinese activists after they held an event to commemorate the 31st anniversary of China's Tiananmen Square crackdown, the activists said. Humanitarian China said the event they held on May 31 was hosted by a paid account and was joined by over 250 people worldwide via video-conferencing platform Zoom, while more than 4,000 streamed it on social media, many of whom were from China. The account was shut on June 7, they said in a statement. Zoom confirmed the U.S.-based account had been suspended but had now been reactivated. "When a meeting is held across different countries, the participants within those countries are required to comply with their respective local laws," it said in an e-mailed statement.

ANALYSIS

Possible Fed move to cap yield rise could further weaken U.S. dollar

The U.S. dollar would probably come under further pressure if the Federal Reserve adopts targets for U.S. Treasury yields that would limit their rise and ensure that interest rates remain near zero for some time.

ANALYSTS' RECOMMENDATION

• Carnival Corp (CCL). JPMorgan raises target price to $20 from $16, reflecting a reasonable, albeit slow, recovery in operations.

• Grubhub Inc (GRUB). Credit Suisse raises target price to $75 from $64, viewing the agreement with Just Eat to be acquired in an all-stock transaction as the likely outcome.

• Kroger Co (KR). Telsey Advisory Group raises target price to $41 from $39, expecting solid first-quarter results.

• Spirit AeroSystems Holdings Inc (SPR). Jefferies raises target price to $30 from $21, following the restart of Boeing 737 MAX production.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0830 Initial jobless claims: Expected 1,550,000; Prior 1,877,000

0830 Jobless claims 4-week average: Prior 2,284,000

0830 Continued jobless claims: Expected 20.000 mln; Prior 21.487 mln

0830 PPI final demand yy for May: Expected -1.2%; Prior -1.2%

0830 PPI final demand mm for May: Expected 0.1%; Prior -1.3%

0830 PPI exfood/energy yy for May: Expected 0.4%; Prior 0.6%

0830 PPI exfood/energy mm for May: Expected -0.1%; Prior -0.3%

0830 PPI ex food/energy/transport yy for May: Prior -0.3%

0830 PPI ex food/energy/transport mm for May: Prior -0.9%

COMPANIES REPORTING RESULTS

Adobe Inc (ADBE). Expected Q2 earnings of $2.33 per share

PVH Corp (PVH). Expected Q1 loss of $1.60 per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Dollar Tree Inc (DLTR). Annual Shareholders Meeting

0900 Lincoln National Corp (LNC). Annual Shareholders Meeting

0900 LogMeIn Inc (LOGM). Annual Shareholders Meeting

0930 Ameris Bancorp (ABCB). Annual Shareholders Meeting

0930 PRA Group Inc (PRAA). Annual Shareholders Meeting

1000 AMC Networks Inc (AMCX). Annual Shareholders Meeting

1000 Best Buy Co Inc (BBY). Annual Shareholders Meeting

1000 BGC Partners Inc (BGCP). Annual Shareholders Meeting

1000 EMCOR Group Inc (EME). Annual Shareholders Meeting

1000 EverQuote Inc (EVER). Annual Shareholders Meeting

1000 EVO Payments Inc (EVOP). Annual Shareholders Meeting

1000 Fleetcor Technologies Inc (FLT). Annual Shareholders Meeting

1000 John Wiley & Sons Inc (JWa). Q4 earnings conference call

1000 LivePerson Inc (LPSN). Annual Shareholders Meeting

1000 Omega Healthcare Investors Inc (OHI). Annual Shareholders Meeting

1000 Tricida Inc (TCDA). Annual Shareholders Meeting

1000 Vonage Holdings Corp (VG). Annual Shareholders Meeting

1000 Y-mAbs Therapeutics, Inc (YMAB). Annual Shareholders Meeting

1100 Ares Management Corp (ARES). Annual Shareholders Meeting

1100 LHC Group Inc (LHCG). Annual Shareholders Meeting

1200 Activision Blizzard Inc (ATVI). Annual Shareholders Meeting

1200 DaVita Inc (DVA). Annual Shareholders Meeting

1200 Gaming and Leisure Properties Inc (GLPI). Annual Shareholders Meeting

1200 Grand Canyon Education Inc (LOPE). Annual Shareholders Meeting

1200 Trupanion Inc (TRUP). Annual Shareholders Meeting

1300 Avalara Inc (AVLR). Annual Shareholders Meeting

1300 Datadog Inc (DDOG). Annual Shareholders Meeting

1300 Monolithic Power Systems Inc (MPWR). Annual Shareholders Meeting

1300 Western Alliance Bancorp (WAL). Annual Shareholders Meeting

1330 Kennedy-Wilson Holdings Inc (KW). Annual Shareholders Meeting

1330 WP Carey Inc (WPC). Annual Shareholders Meeting

1400 Semtech Corp (SMTC). Annual Shareholders Meeting

1700 Adobe Inc (ADBE). Q2 earnings conference call

1700 Salesforce.Com Inc (CRM). Annual Shareholders Meeting

1830 Splunk Inc (SPLK). Annual Shareholders Meeting

EX-DIVIDENDS

Albemarle Corp (ALB). Amount $0.38

Amerisafe Inc (AMSF). Amount $0.27

Ametek Inc (AME). Amount $0.18

Automatic Data Processing Inc (ADP). Amount $0.91

Big Lots Inc (BIG). Amount $0.30

Broadridge Financial Solutions Inc (BR). Amount $0.54

Crown Castle International Corp (CCI). Amount $1.20

CSG Systems International Inc (CSGS). Amount $0.23

EnerSys (ENS). Amount $0.17

Exponent Inc (EXPO). Amount $0.19

Fidelity National Information Services Inc (FIS). Amount $0.35

First Horizon National Corp (FHN). Amount $0.15

Gilead Sciences Inc (GILD). Amount $0.68

Global Payments Inc (GPN). Amount $0.19

Hanover Insurance Group Inc (THG). Amount $0.65

ICF International Inc (ICFI). Amount $0.14

Nasdaq Inc (NDAQ). Amount $0.49

Omnicom Group Inc (OMC). Amount $0.65

PolyOne Corp (POL). Amount $0.20

PulteGroup Inc (PHM). Amount $0.12

Schneider National Inc (SNDR). Amount $0.06

Steris plc (STE). Amount $0.37

Textron Inc (TXT). Amount $0.02

United Bankshares Inc (UBSI). Amount $0.35

Vishay Intertechnology Inc (VSH). Amount $0.09

WesBanco Inc (WSBC). Amount $0.32

Williams Companies Inc (WMB). Amount $0.40

Voor wat het waard is, de meter begint behoorlijk uit te slaan richting de Democraten in de VS, wordt voor Trump moeilijk zo te zien ... Voordeel, volgens mij beter voor de markt en de handel, nog een keer 4 jaar Trump en je krijgt weer van die moeilijke periodes op de beurs ...

Wake-up call: FED strooit verder maar krijgen nog geen inflatie

Goedemorgen

Een nieuw record bij de Nasdaq wederom door de FAANG's maar de traditionele aandelen krijgen klappen momenteel, zo verloor de Dow weer 300 punten maar de Nasdaq 100 won 130 punten. Best vreemd allemaal want stel je eens voor als Apple en Microsoft die beiden fors hoger sluiten ook in moeten leveren waar we nu zouden staan? Wel zijn beide aandelen zo ver doorgestegen dat er daar ook een correctie moet volgen want wees eens eerlijk, Apple stijgt 20 dollar in 2 dagen tijd terwijl de verkoop klappen krijgt en er nog geen nieuwe producten aankomen, hoe kun je dat plaatsen binnen het gehele plaatje? Apple staat al zo'n 20% boven de koers van januari zelfs ... Best vreemd en voor velen niet te bevatten, of komt er iets aan wat we niet weten?

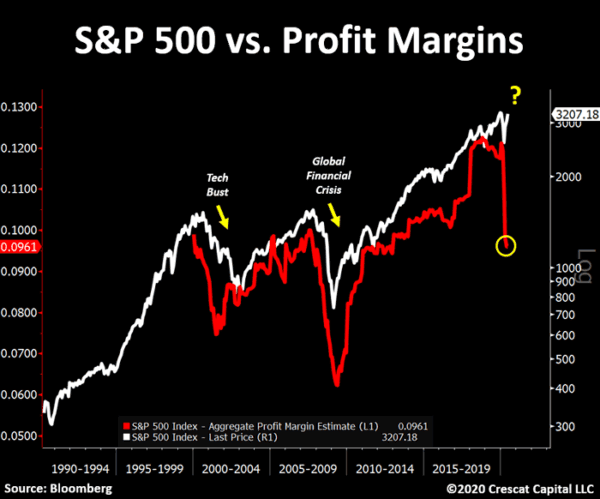

Verder zien we aan de cijfers dat er eerder deflatie komt dan inflatie, dat wil zeggen dat de consument de uitgaven op zijn minst uitstelt op dit moment en dat is iets wat men niet wil zien na een crisis maar wat wel het logische gevolg is van een periode waar we ons nu in bevinden. Kijk, de centrale banken hebben al duizenden miljarden de markt ingepompt maar dat geld komt dus niet op de juiste plaats terecht en dat beangstigd mij behoorlijk, de kloof tussen zoals we dat noemen Wall Street en Main Street groeit alleen maar. Geen goed nieuws want om een goeie en gezonde markt te krijgen moet je beiden bedelen, een goeie markt en buying power voor de consument, vooral dat laatste ontbreekt en kan zorgen voor een lange periode van een soort koop staking. Als men niet koopt dan zal de inflatie verder in de problemen komen en zullen grote bedrijven minder winst maken waardoor hun waardering alleen maar zal oplopen door dat de markten niet corrigeren. We zitten bij de S&P 500 al met een waardering van boven de 22 (PE ofwel KW), als de beurs doorstijgt en de uitgaven blijven beperkt door de consument dan kun je in een snel tempo naar waarderingen groeien van boven de 30 zolang de beurzen niet inleveren. Let wel, ik heb het over Wall Street, hier in Europa zitten we niet zo hoog qwa waardering maar toch, ook hier moeten we opletten uiteraard want ook hier zal de consument wel langer dan een jaar opletten en eerder sparen dan uitgeven.

Dan zegt men TINA, ofwel er is geen alternatief voor het spaargeld dan het op de beurs plaatsen maar wat dan met die waarderingen? Als een brood €3 kost om een voorbeeld te geven dan ga je er toch ook geen €5 voor betalen bij wijze van spreken? Dat bedoel ik mee te geven, er is wel sprake van TINA maar aan de andere kant stop je dan geld in iets met het risico dat je er fors op gaat verliezen door dat je er veel te veel voor gaat betalen. Blijf dus opletten in deze markt en geloof niet zomaar dat je ten koste van alles in de beurs moet stappen. Dat kan later nog wel als de prijzen eerlijker zijn. Denk eraan dat wat er tussen februari en maart gebeurde zo weer kan gebeuren en dan sta je daar te kijken en denk je jeetje, waarom wou ik ook even een Robin Hood spelen? Want vergeet niet, de recente stijging komt voor een heel groot deel door de Robin Hood's die al lang hebben gewacht om in te stappen en dachten dat de afgelopen correctie de kans werd om All-in te gaan op de beurs. Dat kun je merken aan die FAANG's, het is zoals ik al aangaf amper te begrijpen, ook Tesla hoort daarbij, boven de 1000 dollar gisteren, niet te bevatten dit allemaal maar wel iets wat er gaande is.

Lange termijn beleggingen? Wat nu te doen? Ofwel je blijft zitten en je kunt heel wat stress bewaren mocht CRASH#2 op gang komen, die verwacht ik echt wel, of je zegt ik ga parkeren en bekijk het allemaal we even vanaf de zijlijn en later zal ik wel weer instappen als de situatie weer wat tot rust komt en de consument weer wat te vertellen heeft. Niks moet, het is uw geld, het zijn uw keuzes maar aan de andere kant, probeer de juiste keuzes te maken in dit totaal divergerende landschap ...

Wat Trading betreft, pfff wat een moeilijke fase om de juiste keuzes te maken, dat kan voorkomen maar aan de andere kant, als het weer doorzakt hetgeen ik verwacht, dan wil ik erbij zijn en voor een langere periode ... Meedoen kan door lid te worden tot 1 AUGUSTUS, ook hier uw eigen keuze, wel met een bedrag waar u mee wil handelen, zeker niet met al uw geld. Trading is leuk, spannend en uitdagend maar het moet te dragen zijn dus met een inleg die je kunt missen. Wel verwacht ik veel van de posities die ik kies de komende tijd ... Wordt lid en doe mee, €39 tot 1 AUGUSTUS nu dus, schrijf u in via de link https://www.usmarkets.nl/tradershop

Tot straks ... Guy

En vooral niet vergeten, de index loopt of liep fors op de afgelopen weken maar de winstverwachtingen zakken gewoon verder door ... Wat is logisch momenteel? De slimme handelaar, profs en de grote fund managers die weer aan het afbouwen zijn? Of gaan we beginnen te geloven in de Robin Hood's?

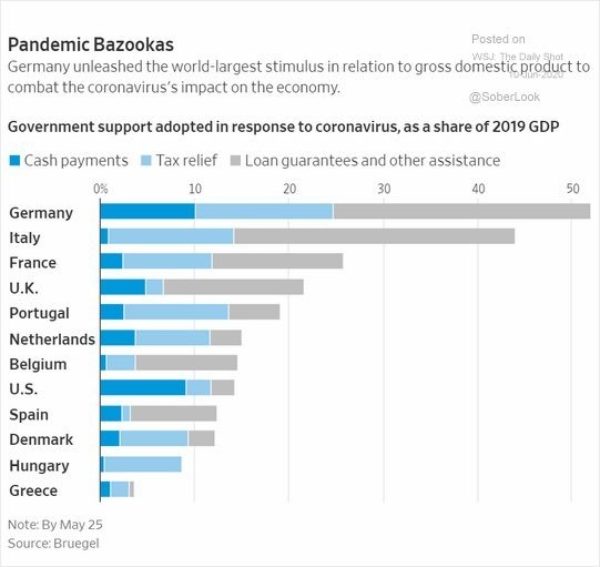

De Bazookas in Europa, je begrijpt wel wat ik bedoel, het geld dat erbij moest omdat alles stil kwam te liggen. De Duitsers lijken de meeste vuurkracht te hebben zo te zien, Nederland en België zitten in het midden ... Maar dat het geld kost lijkt me duidelijk, wie zal dat betalen later?

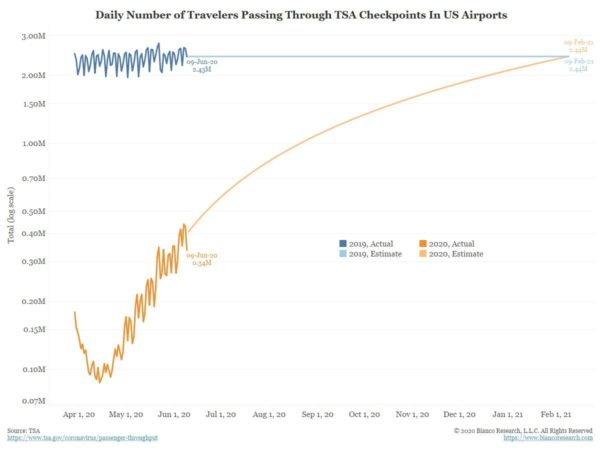

Vliegverkeer komt weer op gang maar het zal nog een tijd duren voor alles weer wordt zoals het was ziet u via deze grafiek ...

Markt snapshot vandaag Europa

GLOBAL TOP NEWS

The U.S. Federal Reserve on Wednesday signaled it plans years of extraordinary support for an economyfacing a torturous slog back from the coronavirus pandemic, with policymakers projecting the economy to shrink 6.5% in 2020 and the unemployment rate to be 9.3% at year's end.

Total U.S. coronavirus cases surpassed 2 million on Wednesday, according to a Reuters tally, as health officials urge anyone who took part in massive protests for racial justice to get tested.

George Floyd's younger brother took his grief to the U.S. Congress on Wednesday with an impassioned plea that lawmakers not let his brother's death be in vain, lamenting that he "didn't deserve to die over $20" in a what he called a lynching.

EUROPEAN COMPANY NEWS

European food-ordering firm Just Eat Takeaway.com said on Wednesday it had agreed to buy U.S. peer Grubhub in an all-stock deal that, if completed, would create the world's largest food delivery company outside China.

Fiat Chrysler and Peugeot maker PSA face a lengthy EU antitrust investigation after declining to offer concessions to allay EU antitrust concerns about their planned $50 billion merger, people familiar with the matter said on Wednesday.

Lufthansa admitted on Wednesday that the positions of up to 26,000 employees are surplus to requirements, suggesting many more jobs will be cut at the German carrier than a figure of more than 10,000 flagged a few weeks ago.

TODAY'S COMPANY ANNOUNCEMENTS

Alfa Financial Software Holdings PLC Annual Shareholders Meeting

Angler Gaming PLC Annual Shareholders Meeting

B&M European Value Retail SA Full Year 2020 Earnings Call

Babcock International Group PLC Full Year 2020 Earnings Release

Bacanora Lithium PLC Annual Shareholders Meeting

Banca Popolare di Sondrio ScpA Annual Shareholders Meeting

Betsson AB Annual Shareholders Meeting

Bilendi SA Annual Shareholders Meeting

Churchill China PLC Annual Shareholders Meeting

CMC Markets PLC Full Year 2020 Earnings Call

Coats Group PLC Annual Shareholders Meeting

Corero Network Security PLC Annual Shareholders Meeting

CRISPR Therapeutics AG Annual Shareholders Meeting

Dignity PLC Annual Shareholders Meeting

Double Bond Pharmaceutical International AB (publ) Annual Shareholders Meeting

Ecoslops SA Annual Shareholders Meeting

Endo International PLC Annual Shareholders Meeting

Fair Oaks Income Ltd Annual Shareholders Meeting

Flughafen Zuerich AG Annual Shareholders Meeting

Fonciere 7 Investissement SA Annual Shareholders Meeting

Fyber NV Annual Shareholders Meeting

Genfit SA Annual Shareholders Meeting

Gevelot SA Annual Shareholders Meeting

Immobiliare Grande Distribuzione SIIQ SpA Annual Shareholders Meeting

Ingenico Group SA Annual Shareholders Meeting

Invesco Perpetual UK Smaller Companies Investment Trust PLC Annual Shareholders Meeting

Johnson Matthey PLC Full Year 2020 Earnings Call

Kalray SA Annual Shareholders Meeting

Konecranes Abp Annual Shareholders Meeting

Latecoere SA Annual Shareholders Meeting

Metsa Board Oyj Annual Shareholders Meeting

Moncler SpA Annual Shareholders Meeting

Naked Wines PLC Full Year 2020 Earnings Release

NB Global Floating Rate Income Fund Ltd Annual Shareholders Meeting

Neovacs SA Annual Shareholders Meeting

Open Orphan PLC Shareholders Meeting

Oxford Immunotec Global PLC Annual Shareholders Meeting

Parity Group PLC Annual Shareholders Meeting

RAK Petroleum PLC Annual Shareholders Meeting

Rubis SCA Annual Shareholders Meeting (French)

Saint Jean Groupe Annual Shareholders Meeting

Soitec SA Full Year 2020 Earnings Call

Sonova Holding AG Annual Shareholders Meeting

Sopheon PLC Annual Shareholders Meeting

Syncona Ltd Full Year 2020 Earnings Call

Talktalk Telecom Group PLC Full Year 2020 Earnings Call

TCECUR Sweden AB (publ) Annual Shareholders Meeting

Time Out Group PLC Shareholders Meeting

Tradegate AG Wertpapierhandelsbank Annual Shareholders Meeting

Umida Group AB (publ) Annual Shareholders Meeting

Verneuil Finance SA Annual Shareholders Meeting

VR Education Holdings PLC Shareholders Meeting

WM Morrison Supermarkets PLC Annual Shareholders Meeting

Xeros Technology Group PLC Annual Shareholders Meeting

ECONOMIC EVENTS (All times GMT)

0530 France Non-Farm Payrolls Rev for Q1: Prior -2.3%

0730 Sweden House Prices for May: Prior 1%

0730 Sweden CPI mm for May: Expected 0.4%; Prior -0.3%

0730 Sweden CPI yy for May: Expected -0.4%; Prior -0.4%

0730 Sweden CPIF mm for May: Expected 0.3%; Prior -0.3%

0730 Sweden CPIF yy for May: Expected -0.4%; Prior -0.4%

0730 Sweden CPI NSA for May: Prior 332.90

0730 Sweden CPIF Ex Energy mm for May: Prior 0.1%

0730 Sweden CPIF Ex Energy yy for May: Expected 0.8%; Prior 1.0%

0800 Italy Industrial Output mm SA for April: Expected -24.0%; Prior -28.4%

0800 Italy Industrial Output yy WDA for April: Expected -40.0%; Prior -29.3%

1100 Germany TR IPSOS PCSI for June: Prior 45.89

1100 France TR IPSOS PCSI for June: Prior 38.77

1100 United Kingdom TR IPSOS PCSI for June: Prior 42.31

1100 Italy TR IPSOS PCSI for June: Prior 32.08

1100 Spain TR IPSOS PCSI for June: Prior 30.52

1100 Sweden TR IPSOS PCSI for June: Prior 48.53

1100 Belgium TR IPSOS PCSI for June: Prior 37.91

Marktoverzicht vroege ochtend

Vanmorgen een eerste indruk, we zien de markt verder wegzakken en zo ontstaat de mogelijkheid dat de Dow Jones een 3e dag op rij kan gaan verliezen ... De Nasdaq blijft sterk liggen momenteel en moet de draai nog maken, mogelijk start die vandaag al zie ik bij de Nasdaq futures nog altijd een stand boven de 10.000 punten ...

Nikkei 🔴⬇️

Hang Seng 🔴⬇️

Dow future 🔴⬇️

Nasdaq future 🔴⬇️

DAX future 🔴⬇️

Olie 🔴⬇️

Goud 🟢⬆️

Tot straks ... Guy