Liveblog Archief donderdag 13 mei 2021

TA Analyse uit de VS: Downtrend bij Nasdaq blijft

THE NASDAQ REMAINS IN SHORT-TERM DOWNTREND... The tech-dominated Nasdaq market continues to show relative weakness. Chart 1 shows the Nasdaq...

Deze inhoud is alleen beschikbaar voor betalende leden.

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: PPI (Maandelijks) (Apr) | Actueel: 0,6% Verwacht: 0,3% Vorige: 1,0% | ||||

| USA: Eerste Aanvragen Werkloosheidsvergoeding | Actueel: 553K Verwacht: 490K Vorige: 566K |

Markt snapshot Wall Street 13 mei

TOP NEWS

• Tesla's Musk halts use of bitcoin for car purchases

Tesla will no longer accept bitcoin for car purchases, Chief Executive Elon Musk said on Wednesday, citing long-brewing environmental concerns for a swift reversal in the company's position on the cryptocurrency.

• Top U.S. fuel pipeline recovering from devastating ransomware attack

After a six-day outage, the top U.S. fuel pipeline moved some of the first millions of gallons of motor fuels to East Coast states after throwing off a crippling cyberattack.

• Boeing wins FAA OK for 737 MAX electrical fix, notifies airlines

Boeing on Wednesday won approval from U.S. regulators for a fix of an electrical grounding issue that had affected about 100 737 MAX airplanes, clearing the way for their quick return to service after flights were halted in early April, the planemaker said.

• More than 4,000 Indians die of COVID-19 for second straight day

India recorded more than 4,000 COVID-19 deaths for a second straight day, while infections stayed below 400,000 for a fourth day, although the virus has become rampant in rural areas where cases can go unreported due to a lack of testing.

• Fed privately presses big banks on risks from climate change

The U.S. Federal Reserve has asked lenders to start providing information on the measures they are taking to mitigate climate change-related risks to their balance sheets, according to four people with knowledge of the matter.

BEFORE THE BELL

U.S. stock futures fell, and world equities tumbled, tracking a selloff on Wall Street in the previous session, as a surprisingly large rise in U.S. consumer prices spooked investors. Gold slipped, weighed down by a steady dollar and rising Treasury yields. Oil prices dropped more than 2% as India's coronavirus crisis deepened and Colonial Pipeline resumed operations. Market attention now turns to weekly jobless claims numbers and producer price inflation data for April due for release later during the day.

STOCKS TO WATCH

Results

• Bumble Inc: The company forecast current-quarter revenue above estimates on Wednesday after beating expectations for the first, as more people turned to its online dating app to socialize while staying indoors during the COVID-19 pandemic. The owner of the dating app that requires women to make the first move said total paying users surged 30% in the first three months of the year to 2.8 million, driving a more than 40% jump in revenue. Bumble forecast current-quarter revenue between $175 million and $178 million, above analysts' estimates of $174.4 million. The company reported revenue of $170.7 million for the first quarter, beating estimates of $164.6 million.

• Canada Goose Holdings Inc: The company beat analysts' estimates for fourth-quarter revenue, helped by surging online sales and strong demand for the apparel maker's luxury parkas in China. Canada Goose's global e-commerce revenue jumped 123.2% in the quarter. Revenue rose to C$208.8 million from C$140.9 million a year earlier, beating analysts' estimates of C$164.8 million. Canada Goose also said it expects total revenue to exceed C$1 billion in fiscal 2022. Analysts on average were expecting revenue to soar 30.2% to C$1.12 billion.

• Sonos Inc: The connected speaker maker on Wednesday raised its annual sales forecast above Wall Street expectations as the company said it believes it can beat a global chip shortage to keep shipping products. In an interview with Reuters, CEO Patrick Spence said Sonos has direct relationships with its chip suppliers and started ramping up its orders for semiconductors last year. He said Sonos believes it can work through supply shortages to meet the new forecast and ship its Roam portable speaker. The Santa Barbara, California-based company forecast fiscal 2021 sales at a midpoint of $1.65 billion, above its prior forecast of $1.55 billion and above analyst expectations of $1.56 billion.

• ThredUp Inc: The online second-hand apparel retailer on Wednesday posted a bigger-than-expected quarterly loss in its first report as a public company and warned of clothing budgets remaining constrained even as the U.S. economy reopens. ThredUp's net loss widened to $16.2 million in the three months ended March, from $13.2 million a year earlier. On a pro-forma basis, the company lost 17 cents per share, bigger than the 16 cents loss analysts expected.

In Other News

• Alphabet Inc: Italy's competition regulator has fined Google 102 million euros for excluding an e-mobility app developed by Enel from the U.S. tech giant's Android system. For more than two years, Google has not allowed Enel's JuicePass to operate on Android Auto - a system that allows apps to be used safely in cars - unfairly curtailing its use while favouring Google Maps, the regulator said. Separately, the chief financial officer of Alphabet's self-driving unit Waymo is following its chief executive out the door, the company said on Wednesday.

• Apple Inc: The company on Wednesday said Antonio García Martínez, a former Facebook product manager who joined Apple recently to work in its advertising business, is no longer with the company. García Martínez, who came to Silicon Valley after a stint on Wall Street, wrote the 2016 book "Chaos Monkeys" about his time in the technology industry. He joined Apple as a product engineer in Apple's advertising platform business in April, according to his LinkedIn page. Technology news publication The Verge reported on Wednesday that more than 2,000 Apple employees had signed an internal petition sent to the company's leaders with concerns about what the petition writers described as sexist and racist views in the book and whether Apple had followed its own rules in hiring García Martínez. Apple said García Martínez is no longer at the company but gave no further details.

• BHP Group PLC, Rio Tinto PLC & Vale SA: The world's top three iron ore miners launched a competition to crowdsource efficient ways to deliver power to battery-electric haulage truck fleets as they strive to cut greenhouse gas emissions. The "Charge on Innovation Challenge", run by BHP, Rio Tinto and Vale with Australian mining services body Austmine, is looking for fast-charging concepts that would deliver around 400 kilowatt-hours (kWh) of electricity to truck fleets at remote mine sites.

• Boeing Co: The company on Wednesday won approval from U.S. regulators for a fix of an electrical grounding issue that had affected about 100 737 MAX airplanes, clearing the way for their quick return to service after flights were halted in early April, the planemaker said. An FAA official confirmed that the agency had approved the service bulletins and associated instructions. Boeing sent two bulletins to air carriers on Wednesday on the fixes.

• Citigroup Inc: The company has set a target to hire 1,000 wealth professionals in Hong Kong in the next five years, as it seeks to grow its Asian client assets under management by $150 billion following a record year, a statement from the U.S bank said. The recruitment campaign has already started, with 75 private bankers and relationship managers hired so far in 2021 to build on the $310 billion Asian assets under management to date. The headcount target will include 550 new private bankers and relationship managers by 2025, the statement said.

• Facebook Inc: Digital currency group Diem Association, formerly known as Facebook's Libra project, plans to launch a U.S. dollar stablecoin as it scales back its global ambitions to focus on the United States, the group said on Wednesday. The association, which comprises 26 financial firms and non-profits, said it was relocating its main operations from Switzerland to the United States and withdrawing its payment system license application with the Swiss financial regulator. Diem Networks U.S., a unit of the Deim Association, will run a blockchain-based payment system that allows real-time transfer of Diem stablecoins and will register as a money services business with the U.S. Department of the Treasury's Financial Crimes Enforcement Network, the group said.

• General Motors Co: Mexico on Wednesday said it would begin a review of labor practices at a General Motors plant in central Mexico after a formal complaint from the office of the U.S. Trade Representative (USTR). Mexico's economy and labor ministries said in a statement they had received the USTR's request for the Mexican government to "conduct a review of the alleged denial of rights to workers at the General Motors plant in Silao, Guanajuato."

• Genworth Financal Inc: The insurer said it had deferred the initial public offering of its mortgage insurance unit, Enact Holdings, due to significant trading volatility in the sector. "Genworth's Board of Directors determined that current market pricing for the planned offering does not accurately reflect Enact's value," Genworth Chief Executive Officer Tom McInerney, said. McInerney said Genworth will continue to evaluate its options as market conditions develop.

• JPMorgan Chase & Co, U.S. Bancorp & Wells Fargo & Co: These and and other banks plan to share data on customers' deposit accounts to extend credit to people who have traditionally been barred from getting them, the Wall Street Journal reported. The plan, part of a government-backed initiative, will factor in information from applicants' checking or savings accounts at other financial institutions to increase their chances of approval for getting credit cards, the report said, citing people familiar with the matter.

• Mizuho Financial Group Inc: The Japan's third largest bank by assets said it would stop financing new thermal coal mining projects from June 1, as global investors and environmental groups urge banks to unload coal-related exposure. While Mizuho had previously said it would not lend funds for 'mountaintop removal', a technique that involves using explosives to expose coal seams, it is haulting financing any project for thermal coal mining, according to its updated policy. The bank didn't mention metallurgical coal.

• Moderna Inc: Australia is in talks with Moderna to establish domestic manufacturing of messenger ribonucleic acid vaccines such as the company's COVID-19 vaccine, Prime Minister Scott Morrison said. "Onshore manufacturing would ensure a secure, long-term supply of Moderna's mRNA-based vaccines against COVID-19, including variants, and for potential future pandemics," Morrison said in a statement.

• Pfizer Inc: U.S. President Joe Biden on Wednesday urged parents to get their children vaccinated after a government advisory panel authorized the Pfizer's COVID-19 vaccine for children aged 12 to 15. "Now that vaccine is authorized for ages 12 and up, and I encourage their parents to make sure they get the shot," Biden said. "This is one more giant step on our fight against the pandemic." Separately, India's most populous state of Uttar Pradesh will spend up to $1 billion to buy COVID-19 shots and held early talks this week with companies such as Pfizer and the local distributor of Russia's Sputnik V, a state official said.

• Royal Dutch Shell PLC: The company's investor RWC said it planned to back a climate-related shareholder proposal put forward at the company's annual meeting by activist group Follow This. RWC said the company's energy transition plans were not ambitious enough, lacked detail and did not put the company on a path to align with the goals of the Paris Agreement within the next decade.

• Taiwan Semiconductor Manufacturing Co Ltd: The world's biggest contract chipmaker said some of its facilities experienced a "brief power dip" after an island-wider power outage, raising concerns that a global chip shortage could worsen. It was not immediately clear how much TSMC's chip production has been impacted by the power outage and whether other chipmakers in the island, a key link in the global electronics supply chain, suffered production damage. "Certain TSMC's facilities experienced a brief power dip in the afternoon of May 13 due to an outage at the Hsinta Thermal Power Plant," TSMC said in a statement. "Electricity is currently being supplied as normal. TSMC has taken emergency response measures and prepared generators to minimize potential impact."

• Tesla Inc: The company will no longer accept bitcoin for car purchases, Chief Executive Elon Musk said on Wednesday, citing long-brewing environmental concerns for a swift reversal in the company's position on the cryptocurrency. Some Tesla investors, along with environmentalists, have been increasingly critical about the way bitcoin is "mined" using vast amounts of electricity generated with fossil fuels. Musk said on Wednesday he backed that concern, especially the use of "coal, which has the worst emissions of any fuel." "Cryptocurrency is a good idea on many levels and we believe it has a promising future, but this cannot come at great cost to the environment," he tweeted.

ANALYSIS

What U.S. inflation signs would cause Fed to change course?

A bigger-than-expected increase in U.S. consumer prices has put investors on high alert for more signs of inflationary pressure that could tilt the Federal Reserve toward raising interest rates.

ANALYSTS' RECOMMENDATION

• American Well Corp: Cowen and Company cuts target price to $29 from $35, after the company reported mixed first-quarter results.

• Bumble Inc: JPMorgan cuts target price to $55 from $60, saying that the company’s first-quarter results were strong but below their expectations.

• Chipotle Mexican Grill Inc: Piper Sandler raises target price to $2,100 from $2,000, believing that company’s shares are the dominant large cap growth investment option within restaurants.

• L Brands Inc: Barclays raises target price to $82 from $66, after the company released its preliminary first-quarter results and raised guidance for adjusted earnings.

• Paysign Inc: Ladenburg Thalmann raises rating to neutral from sell, saying the company’s renewed guidance points to an expected revenue recovery in 2022.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0830 (approx.) Initial jobless claims: Expected 490,000; Prior 498,000

0830 (approx.) Jobless claims 4-week average: Prior 560,000

0830 (approx.) Continued jobless claims: Expected 3.655 mln; Prior 3.690 mln

0830 (approx.) PPI Machine Manufacturing for Apr: Prior 144.3

0830 (approx.) PPI final demand yy for Apr: Expected 5.9%; Prior 4.2%

0830 (approx.) PPI final demand mm for Apr: Expected 0.3%; Prior 1.0%

0830 (approx.) PPI ex food/energy yy for Apr: Expected 3.7%; Prior 3.1%

0830 (approx.) PPI ex food/energy mm for Apr: Expected 0.4%; Prior 0.7%

0830 (approx.) PPI ex food/energy/transport yy for Apr: Prior 3.1%

0830 (approx.) PPI ex food/energy/transport mm for Apr: Prior 0.6%

COMPANIES REPORTING RESULTS

No major S&P 500 companies are scheduled to report for the day.

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Arrival Group SA: Q1 earnings conference call

0800 Bilibili Inc: Q1 earnings conference call

0800 CVS Health Corp: Annual Shareholders Meeting

0800 United Parcel Service Inc: Annual Shareholders Meeting

0800 Xpeng Inc: Q1 earnings conference call

0800 Yeti Holdings Inc: Q1 earnings conference call

0830 Ford Motor Co: Annual Shareholders Meeting

0830 KeyCorp: Annual Shareholders Meeting

0830 Norfolk Southern Corp: Annual Shareholders Meeting

0900 Avient Corp: Annual Shareholders Meeting

0900 Chart Industries Inc: Annual Shareholders Meeting

0900 FLIR Systems Inc: Shareholders Meeting

0900 JetBlue Airways Corp: Annual Shareholders Meeting

0900 Manhattan Associates Inc: Annual Shareholders Meeting

0900 Sotera Health Co: Q1 earnings conference call

0900 Texas Roadhouse Inc: Annual Shareholders Meeting

0900 Union Pacific Corp: Annual Shareholders Meeting

1000 Axalta Coating Systems Ltd: Annual Shareholders Meeting

1000 Azek Company Inc: Q2 earnings conference call

1000 Cboe Global Markets Inc: Annual Shareholders Meeting

1000 Henry Schein Inc: Annual Shareholders Meeting

1000 Nucor Corp: Annual Shareholders Meeting

1000 O'Reilly Automotive Inc: Annual Shareholders Meeting

1000 SBA Communications Corp: Annual Shareholders Meeting

1000 Under Armour Inc: Annual Shareholders Meeting

1000 Verizon Communications Inc: Annual Shareholders Meeting

1100 Alteryx Inc: Annual Shareholders Meeting

1100 Avantor Inc: Annual Shareholders Meeting

1100 Juniper Networks Inc: Annual Shareholders Meeting

1130 Intel Corp: Annual Shareholders Meeting

1145 Martin Marietta Materials Inc: Annual Shareholders Meeting

1200 Blackline Inc: Annual Shareholders Meeting

1200 Repligen Corp: Annual Shareholders Meeting

1200 Teledyne Technologies Inc: Shareholders Meeting

1300 Invesco Ltd: Annual Shareholders Meeting

1330 Travel + Leisure Co: Annual Shareholders Meeting

1400 Las Vegas Sands Corp: Annual Shareholders Meeting

1430 Charles Schwab Corp: Annual Shareholders Meeting

1500 Novanta Inc: Annual Shareholders Meeting

1630 Farfetch Ltd: Q1 earnings conference call

1630 Walt Disney Co: Q2 earnings conference call

1700 Abcellera Biologics Inc: Q1 earnings conference call

1700 ACV Auctions Inc: Q1 earnings conference call

1700 Airbnb Inc: Q1 earnings conference call

1700 Coinbase Global Inc: Q1 earnings conference call

1700 DoorDash Inc: Q1 earnings conference call

1700 Goodrx Holdings Inc: Q1 earnings conference call

1730 Luminar Technologies Inc: Q1 earnings conference call

2030 Tuya Inc: Q1 earnings conference call

EX-DIVIDENDS

AGCO Corp: Amount $0.20

Alliance Data Systems Corp: Amount $0.21

Charles Schwab Corp: Amount $0.18

Church & Dwight Co Inc: Amount $0.25

Cimarex Energy Co: Amount $0.27

Cintas Corp: Amount $0.75

ConocoPhillips: Amount $0.43

Corteva Inc: Amount $0.13

Duke Energy Corp: Amount $0.96

Duke Realty Corp: Amount $0.25

Eli Lilly and Co: Amount $0.85

Emerson Electric Co: Amount $0.50

Essential Utilities Inc: Amount $0.25

Exelon Corp: Amount $0.38

First Citizens BancShares Inc (Delaware): Amount $0.47

Honeywell International Inc: Amount $0.93

J M Smucker Co: Amount $0.90

Jabil Inc: Amount $0.08

Kroger Co: Amount $0.18

Maximus Inc: Amount $0.28

MSCI Inc: Amount $0.78

Nexstar Media Group Inc: Amount $0.70

Oshkosh Corp: Amount $0.33

South State Corp: Amount $0.47

Teleflex Inc: Amount $0.34

Truist Financial Corp: Amount $0.45

Visa Inc: Amount $0.32

WEC Energy Group Inc: Amount $0.67

Western Alliance Bancorp: Amount $0.25

Wall Street weer stevig onderuit, Europa bleef vrij kalm

Goeiemorgen

De 3 tot 5% daling hebben we te pakken nu, de Nasdaq en de Nasdaq 100 zitten al in de volgende fase van 5 tot 8%. Het viel gisteren en dinsdag al op dat alles gezamenlijk omlaag gaat zodat we op Wall Street op dagbasis even van die vervelende divergentie af zijn. Dat wil niet zeggen dat die er niet meer is want als we naar de regio's kijken (Europa-Wall Street) dan was er wel een behoorlijke divergentie. We gaan het merken de komende dagen, komt die weer terug of hebben we een tijdelijke bodem te pakken en kan Wall Street met een herstel beginnen na die slechte dagen?

Verwachting vandaag:

Europa reageert nog wat op de stevige terugval van Wall Street van woensdag, een lagere indicatie via de futures zie ik vanmorgen. Europa is vandaag gewoon open, excuus voor gisteren toen ik aangaf dat we een vrije dag zouden krijgen vandaag, vroeger was dat wel het geval 😂😂 ..

Met het weekend voor de deur en het gedrag van de markt vraagt wel om verstandig te blijven en even de markt zijn gang te laten gaan. Wel is het zo dat gezien de afgelopen correcties het heel snel kan gaan als er een draai komt. Dat maakt het ook zo moeilijk maar soms moet je durf tonen. Wat ik wil is even de markt volgen en waar het kan zal ik wel wat doen. Het zou best zo kunnen zijn dat we de bodems van gisteren nog even terug testen om daarna ofwel door te zakken of te herstellen. Voorlopig zitten we zonder posities, als u mee wilt doen dan kunt u nu gebruik maken van de scherpe aanbieding, dat is voor €25 tot 1 JULI ... Inschrijven kan via https://www.usmarkets.nl/tradershop

Resultaat dit jaar verloopt naar wens maar we blijven rustig:

Eind vorige week en maandag heb ik wat short posities kunnen opbouwen die dinsdag tijdens de daling werden verkocht met winst. Zo staan we deze maand op een mooie winst en ook bekeken over dit jaar (2021) loopt alles prima. We bouwen gestaag verder en ik verwacht dat we nog wat kunnen doen de komende sessies. Morgen of maandag kunnen we mogelijk wat doen.

Wordt nu dus lid en volg de signalen, er komen nog hele leuke kansen dit jaar omdat ik de nodige volatiliteit verwacht op beurzen ... Zie hieronder het resultaat van deze maand per abonnement.

LET OP !! Maak nu gebruik van de aanbieding die loopt tot 1 JULI voor €25 (Polleke Trading €35)... Via de site en dan de Tradershop kunt zich inschrijven en daar kunt u als lid meteen ook de lopende posities met alle details inzien. Ga naar de Tradershop en schrijf u meteen in ... https://www.usmarkets.nl/tradershop

Technische ontwikkeling markt:

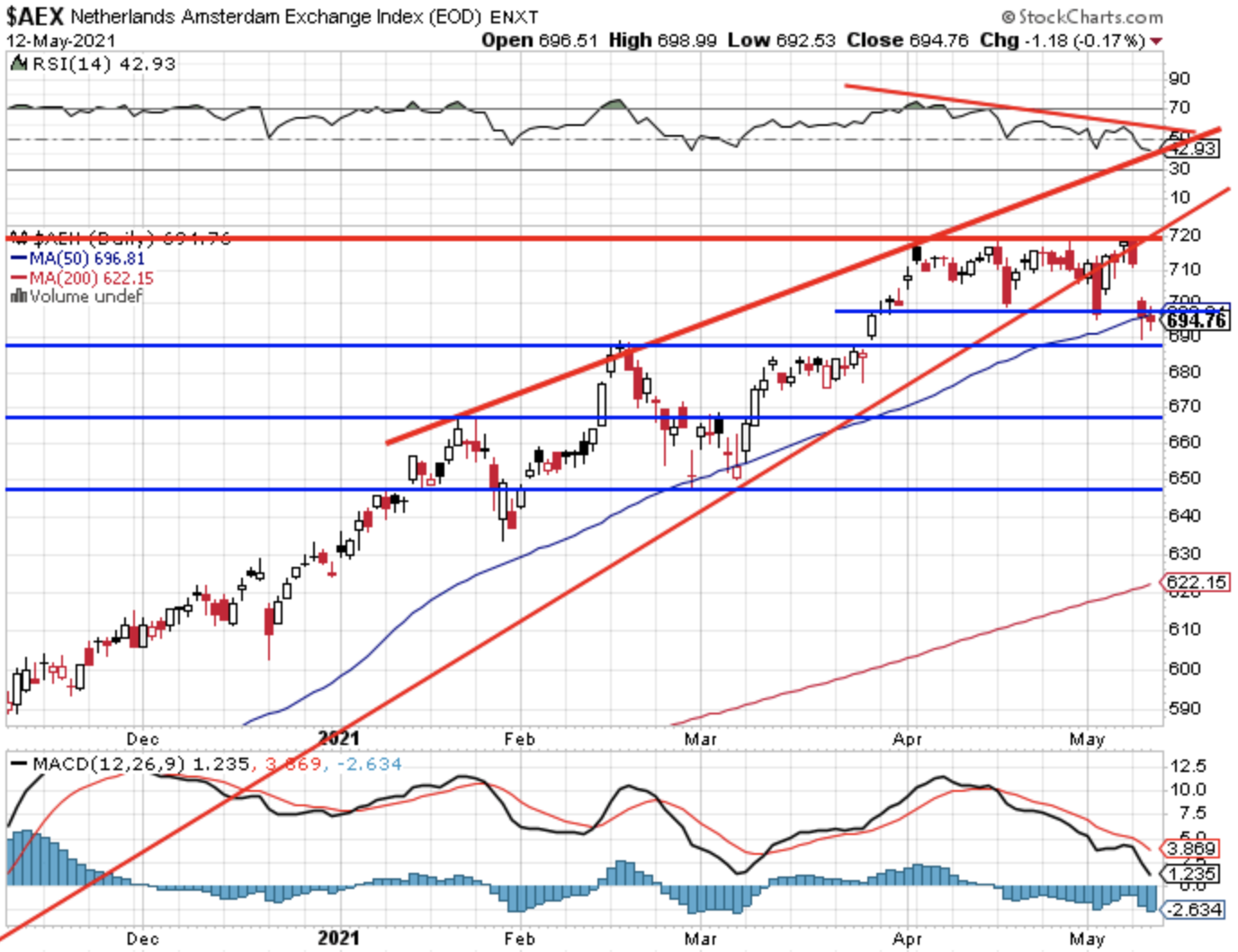

Technisch bekeken zou een en ander nu op een belangrijke steun terecht zijn gekomen, de ene index dan wel de andere krijgt het wel moeilijk en dan zijn dat vooral de technologie indexen zoals de Nasdaq, de Nasdaq 100 en vooral de SOX die heel diep terug zakt en zelfs tot onder de bodem van maart. De S&P 500 sluit op het 50-MA terwijl de Dow Jones er nu nog iets boven staat. De AEX en de DAX kunnen dat 50-MA ook nog vast houden al wordt het bij de AEX nu opletten. Bij de DAX zie ik een raar verloop en het lijkt erop dat men het daar even niet meer weet en vooral kijkt naar een herstel op Wall Street om dan weer aan te haken naar omhoog. De komende sessies worden dan belangrijk, mogelijk kunnen we zodra het wat rustiger wordt wat kleine LONG posities opnemen.

Overzicht markt:

Technische conditie AEX en DAX:

De AEX blijft voorlopig boven de belangrijke zone 688-690 punten ofwel de toppen van februari en maart hetgeen belangrijk is voor het vervolg. Zo simpel is het puur technisch bekeken, gelukkig trok de AEX zich deze keer niet veel aan van wat er op Wall Street gebeurd gisteren want de daling daar was fors. De bodem van dinsdag blijft nu belangrijk en die zien we rond die steun 688-690 punten dus er was al een test van de sterke steun.

Weerstand nu de 698 met daar net boven de oude top rond de 702-703 punten, als de index daar weer boven geraakt weerstand rond de 708, de 712 en de topzone rond de 718-719 punten. De AEX staat daar nu zo'n 24 punten onder ofwel iets meer dan 3%. Vergeleken met de Dow Jones, de DAX en de S&P 500 vergelijkbaar ofwel ongeveer in die mate. De komende sessies worden dus belangrijk want veel indices bereiken zoals ik al aangaf een belangrijke steunzone nu. We blijven rustig naar kansen zoeken maar voorzichtig en nog altijd het best met kleine posities.

De DAX bleef sterk liggen deze keer en wist zelfs met een plus de sessie af te sluiten, we komen we van de 15.400 punten terug deze week maar vergeleken met Wall Street valt het allemaal mee tot nu toe. Dat wil niet zeggen dat de DAX vrij spel omhoog krijgt maar aan de andere kant moeten we wel heel goed opletten met wat het vervolg wordt nu. Ik heb het de hele tijd al over de divergenties in de markt, divergentie tussen de sectoren en de regio's, gisteren was dat duidelijk een regio verhaal want op Wall Street ging deze keer alles omlaag en was er voor een keer geen sector rotatie.

De DAX blijft dus boven de 15.000 punten voorlopig, steun nu die 15.000 en de bodem van vorige week rond de 14.850 punten. Onder die 14.850 punten kan het wel versnellen omlaag maar we hebben nog een houvast voorlopig bij de DAX. We zien ook lagere toppen via de grafiek hieronder en de indicatoren zien er nog steeds niet goed uit. Weerstand nu eerst de 15.300 en de 15.400 punten, later de top rond de 15.500 punten.

S&P 500 analyse:

Op Wall Street moest alles behoorlijk inleveren, zowel traditioneel als de tech. We zien ook bij alle indices een breuk omlaag wat niet goed is voor het vervolg. De S&P 500 zakt terug tot de steunlijn onder de bodems en daar zien we meteen ook het 50-MA uitkomen. Een belangrijke steun waar de index nu op leunt. De index staat al zo 175 punten onder de top en dat is toch al goed voor 3% ongeveer. Hetzelfde zien we bij de Dow Jones die ook al een terugval van ruim 3% laat zien. We zitten nu in die 3 tot 5% correctiefase bij de traditionele indices ofwel sectoren. Bij de Nasdaq is de daling groter, daar al ruim 8% onder de top zodat de fase 5 tot 8% al is ingegaan en de signalen veel meer op rood staan. De Nasdaq staat nu ook al ruim onder het 50-daags gemiddelde en lijkt onderweg naar de bodems van maart en zelfs richting het 200-MA.

Kijken we naar de S&P 500 dan zien we dat de bodem van vorige week rond de 4120 punten werd doorbroken, steun nu die 4060 punten waar zoals ik al aangaf de lijn onder de bodems en het 50-MA uitkomen. Onder deze steun wordt het moeilijker en moeilijker zodat we er niet van moeten opkijken als de index onder de 4000 punten zakt. Zo ver is het nog niet maar het wordt spannend nu. Weerstand nu de bodem van vorige week rond de 4120-4125 punten, eerst maar eens zien of de index daar weer boven geraakt. Later weerstand rond de 4175 en de 4200 punten, daarna de top rond de 4235-4240 punten.

Euro, olie en goud:

De euro zien we nu rond de 1.2075 dollar, de prijs van een vat Brent olie komt uit op 68,5 dollar terwijl een troy ounce goud nu op 1816 dollar staat.

De LIVEBLOG en Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

LET OP !! Maak nu gebruik van de aanbieding die loopt tot 1 JULI voor €25 (Polleke Trading €35)... Via de site en dan de Tradershop kunt zich inschrijven en daar kunt u als lid meteen ook de lopende posities met alle details inzien. Ga naar de Tradershop en schrijf u meteen in ... https://www.usmarkets.nl/tradershop

Hieronder de resultaten van dit jaar (2021):

Met vriendelijke groet,

Guy Boscart

TA "een mooi rijtje"

Met een mooi rijtje bedoel ik dat ik deze donderdag naar een aantal klinkende namen kijk. Wat dacht u van DSM, de AEX, Philips, de Nasdaq. Dan noem ik ze niet eens allemaal, want ik kijk ook naar Prosus en Just Eat Takeaway. Vamos!Laten we maar in Amerika beginnen, dan hebben we dat maar…

Lees verder »