Liveblog Archief donderdag 14 januari 2021

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Eerste Aanvragen Werkloosheidsvergoeding | Actueel: 965K Verwacht: 795K Vorige: 784K |

TA Bitcoin, Silver, Brent Crude Oil en Alfen

Op deze donderdag komen er weer een aantal verzoeknummers voorbij, dit keer van lezers Helena en Polyglot. Helena wil haar favoriet Alfen zien en lezer polyglot verzocht om zilver, olie en Ballard Power Systems. Drie van de vier genoemde items laat ik terugkomen in de analyse van vandaag. Daarnaast…

Lees verder »Markt snapshot Wall Street vandaag

TOP NEWS

• Biden to unveil plan to pump $1.5 trillion into pandemic-hit economy

President-elect Joe Biden will unveil a stimulus package proposal designed to jump-start the economy during the coronavirus pandemic with an economic lifeline that could exceed $1.5 trillion and help minority communities.

• BlackRock profit beats expectations as assets reach record high

BlackRock reported a better-than-expected quarterly profit, as increased activity in financial markets resulted in higher fees and pushed its assets under management to record highs.

• Bitter Senate impeachment trial of Trump could bog down Biden's first days

The second impeachment of President Donald Trump by the U.S. House of Representatives, for inciting last week's deadly rampage at the Capitol, could set off a bitter Senate fight that entangles the early days of President-elect Joe Biden's term.

• Trump administration shelves planned investment ban on Alibaba, Tencent, Baidu -sources

The Trump administration has scrapped plans to blacklist Chinese tech giants Alibaba, Tencent and Baidu, four people familiar with the matter said, providing a brief reprieve to Beijing's top corporates amid a broader crackdown by Washington.

• Chesapeake Energy to emerge from bankruptcy court as a $5.13 billion enterprise

U.S. oil and gas producer Chesapeake Energy's Chapter 11 bankruptcy plan was approved by a U.S. judge on Wednesday, giving lenders control of the firm and ending a contentious trial.

BEFORE THE BELL

Futures tracking the S&P 500 and Dow inched higher as investors looked forward to President-elect Joe Biden's new coronavirus fiscal package plan to support the pandemic-battered economy, while also awaiting a reading on weekly jobless claims data. European shares rose as hopes of a large U.S. stimulus under incoming U.S. President Joe Biden and upbeat Chinese export data boosted sentiment. Japan's Nikkei closed higher helped by a rally in tech shares and better-than-expected core machinery orders. The dollar index was flat and gold prices edged lower. Oil prices dipped on demand concerns. Import and export prices numbers are also due on the U.S. economic calendar later in the day.

STOCKS TO WATCH

IPOs

• Affirm Holdings Inc: Shares of the company, founded by PayPal’s co-founder Max Levchin, almost doubled in their Nasdaq debut on Wednesday, valuing the U.S. provider of installment loans to online shoppers at over $23 billion. Affirm's shares ended their first day of trade at $97.24 apiece, a 98% pop from its IPO price of $49. It raised $1.2 billion in the offering, with its pricing coming in above the target range Affirm had set. "We have gotten to the point of the journey where we’re on the precipice of becoming a known brand among both the investor community, and consumers and merchants. Being publicly traded is helpful in that regard," Levchin said in a telephone interview.

• Petco Health and Wellness Company Inc: The pet retailer said on Wednesday it sold shares in its initial public offering at $18 apiece, above its target range, to raise about $816.5 million. Petco, which is owned by the Canada Pension Plan Investment Board (CPP Investments) and private equity firm CVC Capital Partners, had aimed to sell 48 million shares at a target range of $14 to $17 per share. The IPO, which values Petco at almost $4 billion, signals that investor appetite for new stocks remains robust following a stellar 2020, which was the strongest IPO market in two decades.

Results

• BlackRock Inc: The asset manager reported a better-than-expected quarterly profit, as increased activity in financial markets resulted in higher fees and pushed its assets under management to record highs. The company's adjusted net income of $10.18 per share in the fourth quarter topped Wall Street estimates of $9.14, according to Refinitiv IBES data. Assets under management grew to $8.68 trillion at the end of the quarter, from $7.43 trillion a year earlier. The company's total net inflows through the quarter were $126.93 billion, slightly lower than the $128.84 billion last year.

In Other News

• Alibaba Group Holding Ltd & Baidu Inc: The Trump administration has scrapped plans to blacklist Chinese tech giants Alibaba, Tencent and Baidu, four people familiar with the matter said, providing a brief reprieve to Beijing's top corporates amid a broader crackdown by Washington. Washington nonetheless plans to move forward this week with a bid to add as many as nine other Chinese companies to the list, one of the people said. The abrupt decision throws into stark relief the deep divisions within the Trump administration on China policy, even as Trump seeks to lock President-elect Joe Biden into aggressive postures against the world's second-largest economy.

• Alphabet Inc: Google has removed lending apps aimed at consumers in India from Play Store in an attempt to safeguard users, it said in a blog post. "We have reviewed hundreds of personal loan apps in India, based on flags submitted by users and government agencies," Suzanne Frey, Vice President, Product, Android Security and Privacy said in the post. A recent investigation by Reuters found at least 10 lending apps on Play Store breached Google's rules on loan repayment lengths aimed at protecting vulnerable borrowers. It also found that a number of the lending apps also flouted central bank regulations aimed at protecting borrowers. Google did not elaborate on the number of apps that had been taken down.

• Amazon.com Inc: Connecticut is investigating Amazon.com for potential anti-competitive behavior in its business selling digital books, the state's attorney general said on Wednesday. The probe is one of many into the e-commerce platform's business practices. Amazon is also under investigation by the attorneys general in New York, California and Washington state and the Federal Trade Commission. In other news, Parler, a social media outlet favored by some supporters of U.S. President Donald Trump, urged a court Wednesday to order Amazon.com to put it back online. • Chesapeake Energy Corp: The U.S. oil and gas producer’s Chapter 11 bankruptcy plan was approved by a U.S. judge on Wednesday, giving lenders control of the firm and ending a contentious trial. Chesapeake will emerge from bankruptcy with about $3 billion in new financing, a $7 billion reduction in debt, and $1.7 billion cut from gas processing and pipeline costs. Investors who committed last spring to back the restructuring as energy tumbled stand to benefit enormously. A rebound in energy prices raised Chesapeake's value to about $5.13 billion, the judge hearing the case said.

• Citigroup Inc: The company said on Wednesday it has created a single wealth management business, Citi global wealth, to deliver products and services to clients from the affluent segment, as well as ultra-high net worth individuals. The new unit, formed by combining wealth management teams in global consumer banking and the institutional clients group, will be led by Jim O'Donnell and will include the Citi private bank and Citi personal wealth management. Citi, which reshuffled the leadership for its U.S. consumer bank on Tuesday, will also get a new chief executive officer in February when Jane Fraser will take over from Michael Corbat.

• Facebook Inc: WhatsApp is battling mistrust globally after it updated its privacy policy to let it share some user data with parent Facebook and other group firms, and the backlash risks thwarting its ambitions in its biggest market, India. Though WhatsApp has yet to see mass uninstalls of its app in India, users concerned about privacy are increasingly downloading rival apps such as Signal and Telegram, research firms say, propelling them higher on the download charts and putting those apps ahead of their ubiquitous rival in India for the first time. The company said its privacy policy update "does not affect the privacy of your messages with your friends and family in any way". WhatsApp has also said that the changes to the privacy policy are only related to users' interactions with businesses. When asked for comment, WhatsApp referred Reuters to its published statements on privacy.

• KKR & Co: The investment firm said it had closed its first fund targeting real estate investments in Asia Pacific at $1.7 billion. The announcement comes days after KKR closed its inaugural Asia infrastructure fund, as the private equity powerhouse expands its platforms in the region. John Pattar, KKR head of real estate Asia, told Reuters the new fund would focus on Asia's urbanization trends, corporate carve-outs of non-core real estate assets in Japan and also take-private opportunities in markets including Australia, Singapore and Japan.

• PayPal Holding Inc: The company has become the first foreign operator with 100% control of a payment platform in China, according to Chinese government data, as the U.S. fintech giant eyes a bigger foothold in a booming market for online payments. PayPal acquired the 30% stake it doesn't already own in China's GoPay, formally known as Guofubao Information Technology Co., on Dec. 31, 2020, according to shareholder data from the National Enterprise Credit Information Publicity System. Financial details weren't disclosed in the data. The stake purchase came a year after PayPal bought a 70% stake in GoPay for an undisclosed amount,then becoming the first foreign company licensed to provide online payment services in China.

• Pfizer Inc: The Philippines' Food and Drug Administration has authorised for emergency use the COVID-19 vaccine developed by Pfizer and BioNTech, the first to be approved in the country, which has among the most coronavirus cases in Asia. FDA head Rolando Enrique Domingo said the Pfizer-BioNTech vaccine, which has shown a 95% success rate, could be effective in preventing COVID-19, with which nearly half a million people in the Philippines have been infected. "The benefit of using vaccine outweighs the known and potential risks," he told a briefing, adding "no specific safety concerns were identified."

• Tesla Inc: The National Highway Traffic Safety Administration (NHTSA) on Wednesday asked Tesla to recall 158,000 Model S and Model X vehicles over media control unit (MCU) failures that could pose safety risks by leading to touchscreen displays not working. The auto safety agency made the unusual request in a formal letter to Tesla after upgrading a safety probe in November, saying it had tentatively concluded the 2012-2018 Model S and 2016-2018 Model X vehicles "contain a defect related to motor vehicle safety." Tesla did not immediately respond to a request for comment but it must respond to NHTSA by Jan. 27. If it does not agree it must provide the agency "with a full explanation of its decision."

• Twitter Inc: The company’s Chief Executive Jack Dorsey said on Wednesday that banning President Donald Trump from its social media platform after last week's violence at the U.S. Capitol was the "right decision," but said it sets a dangerous precedent. San Francisco-based Twitter last week removed Trump's account, which had 88 million followers, citing the risk of further violence following the storming of the Capitol by supporters of the president. "Having to take these actions fragment the public conversation," Dorsey said on Twitter. "They divide us. They limit the potential for clarification, redemption, and learning. And sets a precedent I feel is dangerous: the power an individual or corporation has over a part of the global public conversation."

• Vipshop Holdings Ltd: China's markets regulator said it has launched a probe into companies linked to online discount retailer Vipshop over possible unfair competition. The entities targeted are Vipshop (China) Co Ltd and Guangzhou Vipshop E-Commerce Co Ltd, the regulator said in a statement, without elaborating on the probe. Vipshop will cooperate with the regulators' investigation, the company said on its official Weibo account. The State Administration of Market Regulation (SAMR) said at the time it had taken the decision after it received consumer complaints over the companies' pricing strategies related to Nov. 11 shopping events.

• Wells Fargo & Co: The company’s Chief Executive Charlie Scharf will give investors more details on his long-awaited turnaround plan for the scandal-plagued bank this week. Although Wall Street expects Wells Fargo to report a 38% profit decline on Friday against the backdrop of the coronavirus pandemic, investors have become more bullish in anticipation of details about expansive cost-cutting plans. Wells Fargo shares have jumped 45% since Scharf teased a strategic update in October, outperforming JPMorgan Chase and Bank of America.

ANALYSIS

Sanctions-hit Chinese firms surge as global buyers swoop in

Asian and European investors are snatching up discounted Chinese stocks hit by a U.S. investment ban, finding bargains as giant American funds bail out and shrugging off concerns that the sanctions could hurt the companies' prospects.

ANALYSTS' RECOMMENDATION

• Aligos Therapeutics Inc: Jefferies raises target price to $42 from $30, based on higher probabilities of success for Aligos Hepatitis B Combination Therapy.

• American Eagle Outfitters Inc: Jefferies raises target price to $27 from $22, reflecting accelerated growth from its brand Aerie and growing e-commerce business.

• Antero Resources Corp: JPMorgan raises target price to $8 from $6, citing robust export trends and recovering domestic demand along with improving Natural Gas Liquids fundamentals.

• DuPont Inc: JPMorgan cuts rating to neutral from overweight, citing a questionable growth story and limited balance sheet optionality.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0830 (approx.) Import prices mm for Dec: Expected 0.7%; Prior 0.1%

0830 (approx.) Export prices mm for Dec: Expected 0.4%; Prior 0.6%

0830 (approx.) Import prices yy for Dec: Prior -1.0%

0830 Initial jobless claims: Expected 795,000; Prior 787,000

0830 Jobless claims 4-week average: Prior 818,750

0830 Continued jobless claims: Expected 5.061 mln; Prior 5.072 mln

COMPANIES REPORTING RESULTS

Delta Air Lines Inc: Expected Q4 loss of $2.50 per share

First Republic Bank: Expected Q4 earnings of $1.52 per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

1000 Delta Air Lines Inc: Q4 earnings conference call

1000 Endurance International Group Holdings Inc: Shareholders Meeting

1000 First Republic Bank: Q4 earnings conference call

1200 Micron Technology Inc: Annual Shareholders Meeting

1700 Progress Software Corp: Q4 earnings conference call

EX-DIVIDENDS

Abbott Laboratories: Amount $0.45

Abbvie Inc: Amount $1.30

American Financial Group Inc: Amount $0.50

Arcosa: Amount $0.05

Bank Ozk: Amount $0.27

City Holding Co: Amount $0.58

Compass Diversified Holdings: Amount $0.36

EOG Resources Inc: Amount $0.37

Foot Locker Inc: Amount $0.15

General Dynamics Corp: Amount $1.10

Life Storage Inc: Amount $1.11

McGrath RentCorp: Amount $0.42

Methode Electronics Inc: Amount $0.11

Mid-America Apartment Communities Inc: Amount $1.02

Oxford Industries Inc: Amount $0.25

Patterson Companies Inc: Amount $0.26

Quaker Chemical Corp: Amount $0.39

RPM International Inc: Amount $0.38

Science Applications International Corp: Amount $0.37

Trinity Industries Inc: Amount $0.21

Watsco Inc: Amount $1.77

WD-40 Co: Amount $0.67

Wake-up call: Markt blijft binnen de grote WIG hangen

Goedemorgen

De verwachting van de markt vanmorgen, een blik op de WIG die we zien en de komende kwartaalcijfers. De markt blijft in ieder geval sterk liggen, vrijwel alle indices komen weer bij de bovenkant uit hetgeen we zien op de grafieken. Het is wachten op een grotere beweging nu, het is moeilijk om aan te geven welke kant die op zal gaan. Technisch bekeken zou je uitgaan van een correctie maar het kan ook vanaf een hoger niveau ...

De DAX laat via de futures een plus van 40 punten zien terwijl de CAC 40 een punt of 15 hoger kan openen. Woensdag eindigden de beurzen in Europa overwegend iets in de plus na een vrij rustige sessie waar beleggers vooral wachten op de kwartaalcijfers en nieuws over nieuwe overheidssteun in de VS zodra Trump het Witte Huis moet verlaten. Gisteren kreeg Trump zelfs een 2e afzettingsprocedure aan zijn broek, nooit eerder kreeg een president daar mee te maken ...

Waar men ook steeds op let is dat we nog lang niet van het virus af zijn, het is nogal wat om het vaccin bij iedereen te krijgen en dan moeten er geen tegenslagen bij komen aangezien er nu al tal van mutaties opduiken. Men beseft dat de weg naar een wereld zonder COVID-19 nog lang kan zijn.

Verder lijkt het erop dat de markt vooral wacht op de plannen van de nieuwe president Joe Biden, hij wil biljoenen dollars uitgeven om de pandemie in te dammen en zo meteen ook een impuls te geven aan de economie. Wat Biden van plan is weten we nog niet exact, pas als hij het Witte Huis betreed komt er meer nieuws daarover maar zijn plannen zijn in ieder geval groot volgens de verwachtingen.

We zitten met de meeste beurzen nog altijd in de bekende WIG omhoog, niet met overdreven stijgingen en ook de dalingen blijven binnen de lijnen zodat men vaak iets hoger winst neemt en wat eerder de DIP opkoopt. Momenteel kijkt men niet zo naar de prijs van een aandeel, het is eerder het sentiment dat men volgt en dus tegen elke prijs mee wil doen met de markt. Dat komt omdat we met een vreemde MIX zitten momenteel, je hebt de nieuwe intredende belegger/speculant die nog nooit iets heeft meegemaakt wat lijkt op hetgeen we nu zien terwijl je aan de andere kant de ervaren belegger/speculant hebt die wel weet hoe dit kan aflopen met een markt als deze. De nieuwe groep koopt zich tot over de nek vol met aandelen en leent er zelfs massaal voor, de oude garde blijft voorzichtig en doet in feite amper mee met de huidige gekte.

Zelf behoor ik ook tot die laatste groep, ik blijf hoe dan ook voorzichtig ook al beperkt me dat bij het vangen van een grote vis. Met mijn lange termijn beleggingen zit ik al een tijdje op CASH, ik win niets maar als de markt een grote schuiver maakt verlies ik ook niks. Om nu te kopen lijkt me niet het moment, dat is mijn mening en dus ook mijn visie ...

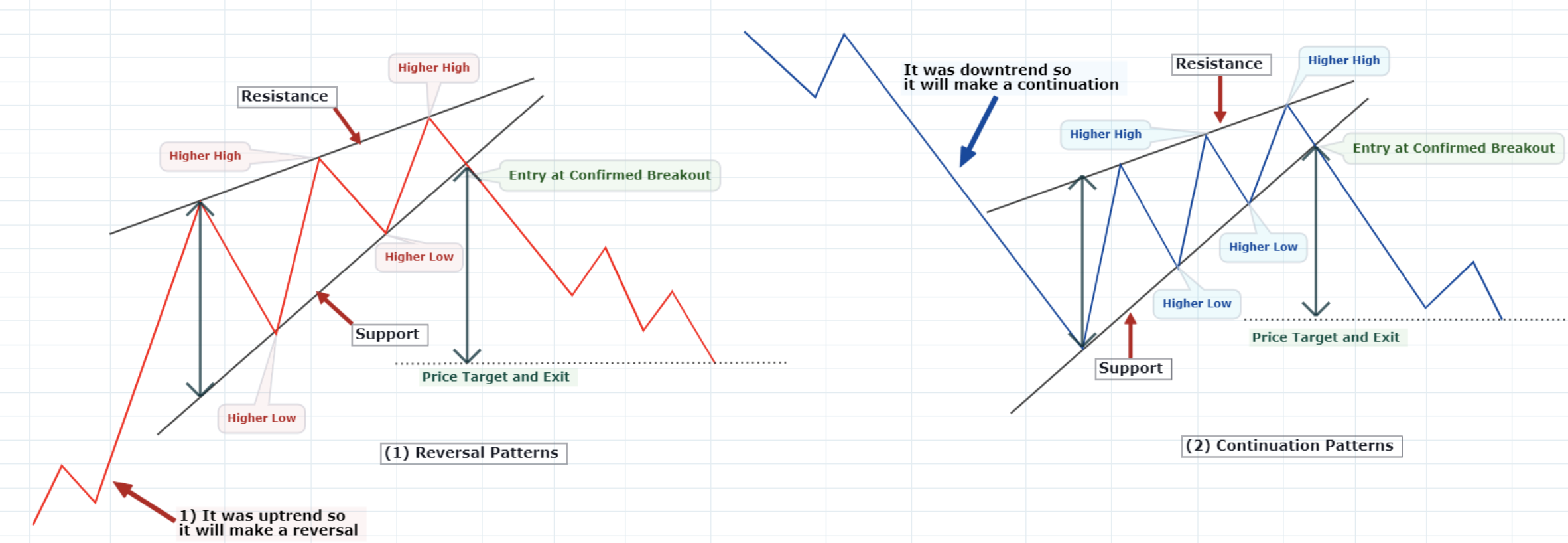

Wat is een WIG?

Zie de grafiek hieronder, in de meeste gevallen valt een prijs na een tijdje uit de WIG en dan in de negatieve richting. Let wel, ik zeg in de meeste gevallen want er zijn natuurlijk ook uitzonderingen maar dan zet ik het procentueel op 25-30% dat het andersom gaat. Wat er ook mogelijk is, de markt gaat gestaag door omhoog en breekt uit om daarna een nieuwe WIG op te bouwen, iets wat we tussen 2010 en 2012 hebben gezien. Maar er komt hoe dan ook een eind aan deze beweging, die is niet eindeloos. Bij vrijwel alle indices zien we een WIG zoals u bij de eerste figuur hieronder ziet. Dat bij de AEX, de DAX, de Dow Jones, de SP 500 en de Nasdaq ...

Dan nog even wat Semi-conductor nieuws:

Taiwan Semi-conductor Manufacturing Company kwam met goeie cijfers vanmorgen, TSMC zag in Q4 de resultaten verder aantrekken. Binnen deze sector doet ASML het ook nogal goed hetgeen de AEX verder vooruit helpt, ASML won gisteren weer €4 en sluit op €422,8. Ook Intel viel weer eens op gisteren, het aandeel won 7% na het bericht dat de CEO Bob Swan vertrekt. Dat was een van de eisen van een grote aandeelhouder (Third Point) die grote veranderingen wil zien. Intel liet meteen ook weten dat de verwachtingen goed zijn voor dit jaar.

U kunt mij en dus @USMarkets uiteraard ook volgen via onze Twitter account, ga naar ... https://twitter.com/USMarkets waar ik tussentijds wat charts over de markt en sentiment plaats, ook opvallende beursfeiten komen er vaak langs !

Euro, olie en goud:

De euro zien we nu rond de 1.215 dollar, de prijs van een vat Brent olie komt uit op 55,95 dollar terwijl een troy ounce goud nu op 1840 dollar staat. De Bitcoin herpakt zich na enkele dolle dagen, nu moet je 38.000 dollar neertellen voor 1 Bitcoin ...

Strategische posities:

Wat betreft de posities waar ik tussendoor koop en verkoop blijft er wat betreft de indices nog 1 kleine positie open als een soort rode draad. Dinsdag werd er winst genomen op de Nasdaq positie, gisteren werd er nog een positie met een minimaal verlies gesloten (DAX). Wat ik wil is weer uitbouwen zodra een index weer de bovenkant van de WIG opzoekt, dan stuur ik uiteraard een mail en een SMS naar de leden.

Zodra u lid wordt ontvangt u de signalen en kunt u meteen de lopende posities inzien via onze Tradershop op de website. Ik probeer in ieder geval zo goed als dat kan om met de markt mee te gaan, wel is het zo dat de markt volatiel blijft voorlopig en die kan zelfs nog wat gaan toenemen. Wat ik moet doen is in ieder geval blijven schakelen tussen long en short.

In de loop van de dag krijgen de leden weer een update over de strategie en mijn bevindingen over de markt kort samengevat. Ook zou het kunnen dat er een positie bij komt via een signaal dat ik in de loop van de sessie verstuur ...

Maak nu gebruik van de proef aanbieding:

Mis in ieder geval de start van 2021 niet want er komen hoe dan ook hele mooie kansen ... Via deze aanbieding ... €39 tot 1 MAART 2021 ... Polleke €49 tot 1 MAART 2021 !!!

Systeem Trading (€39 tot 1 MAART)

Index Trading (€39 tot 1 MAART)

Polleke Trading (€49 tot 1 MAART)

Aandelen portefeuille (€30 tot 1 MAART)

COMBI TRADING (€79 tot 1 MAART)

Tussenstand deze maand januari 2021:

Resultaat afgelopen maand december 2020:

Met vriendelijke groet,

Guy Boscart

Markt snapshot Europa vandaag

GLOBAL TOP NEWS

Donald Trump on Wednesday became the first president in U.S. history to be impeached twice, as 10 of his fellow Republicans joined Democrats in the House of Representatives to charge him with inciting an insurrection in last week's violent rampage in the Capitol.

President-elect Joe Biden will press Congress to deliver immediate pandemic "rescue" efforts before turning to broader "recovery" measures like healthcare and infrastructure, the incoming administration's top economic adviser said on Wednesday.

Britain will trigger safeguard measures in a divorce deal with the European Union if there are "serious problems" in supplying supermarkets in Northern Ireland, Prime Minister Boris Johnson said on Wednesday.

EUROPEAN COMPANY NEWS

A near $20 billion takeover approach for European retailer Carrefour by Canadian convenience-store operator Alimentation Couche-Tard ran into early opposition as the French government raised concerns about food sovereignty and job security at one of its largest employers.

French carmaker Renault's new Chief Executive Luca de Meo is set for his first major test with a strategy reset aimed at lifting margins at the loss-making firm, and which is likely to focus on fewer, more profitable models.

Egypt is reviewing a final agreement with Germany's Siemens to develop a $23 billion, 1,000-km high-speed electric railway network, Egypt's presidency said on Wednesday.

TODAY'S COMPANY ANNOUNCEMENTS

AA PLC Shareholders Meeting

Chr Hansen Holding A/S Q1 2021 Earnings Release

HELLA GmbH & Co KGaA Q2 2021 Earnings Release

JPMorgan Japanese Investment Trust PLC Annual Shareholders Meeting

Realites SA Shareholders Meeting

Suedzucker AG Q3 2021 Earnings Release

ECONOMIC EVENTS (All times GMT)0530 Netherlands Trade Balance for Nov: Prior 7.765 bln EUR0830 Sweden House Prices for Dec: Prior 4%0900 (approx.) Germany Full Year GDP for 2020: Expected -5.1%; Prior 0.6%