Liveblog Archief donderdag 29 april 2021

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Voorlopige Huisverkopen (Maandelijks) (Mar) | Actueel: 1,9% Verwacht: 5,0% Vorige: -11,5% |

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: BBP (Kwartaal) (Q1) | Actueel: 6,4% Verwacht: 6,1% Vorige: 4,3% | ||||

| USA: Eerste Aanvragen Werkloosheidsvergoeding | Actueel: 553K Verwacht: 549K Vorige: 566K |

Markt snapshot Wall Street 29 april

TOP NEWS

• Government money seen powering U.S. economy in first quarter

U.S. economic growth likely accelerated in the first quarter, fueled by massive government aid to households and businesses, charting the course for what is expected to be the strongest performance this year in nearly four decades.

• Caterpillar profit rises as equipment demand picks up

Heavy equipment maker Caterpillar reported a rise in adjusted first-quarter profit, as equipment demand picked up after a pandemic-led slump last year.

• Biden pleads for unity, warns of Chinese threat, in speech to Congress

President Joe Biden proposed a sweeping new $1.8 trillion plan in a speech to a joint session of Congress on Wednesday, pleading with Republican lawmakers to work with him on divisive issues and to meet the stiff competition posed by China.

• McDonald's sales soar as consumers binge on chicken sandwiches

McDonald's smashed Wall Street estimates for comparable sales and returned to pre-pandemic levels of growth as more consumers, flush with stimulus cash, were drawn to its newly launched crispy chicken sandwiches.

• Apple soars past sales, profit targets with strong iPhone demand, warns of chip shortages

Apple on Wednesday posted sales and profits ahead of Wall Street expectations fueled by 5G iPhone upgrades but warned a global chip shortage could dent iPads and Mac sales by several billion dollars.

BEFORE THE BELL

Wall Street futures were higher after President Biden proposed an $1.8 trillion stimulus package and as strong results from Apple and Facebook boosted sentiment. Investors awaited the first-quarter GDP and weekly jobless claims data, which are expected later in the day. European shares were near record highs following a slew of upbeat corporate earnings. Asian equities ended in the green after the Federal Reserve said it was too early to consider rolling back emergency support for the economy. A stronger dollar weighed on the gold prices. Oil extended gains on bullish demand forecasts. Amazon.com, Twitter and Gilead are among the companies scheduled to report earnings after markets close.

STOCKS TO WATCH

Results

• Apple Inc: The company on Wednesday posted sales and profits ahead of Wall Street expectations fueled by 5G iPhone upgrades but warned a global chip shortage could dent iPads and Mac sales by several billion dollars. Apple Chief Executive Tim Cook said on an investor call that Apple avoided a chip shortage in the fiscal second quarter by burning through supply buffers. In the fiscal third quarter, the shortage could cost the company $3 billion to $4 billion in revenue, said Chief Financial Officer Luca Maestri. For the fiscal second quarter ended March 27, Apple said sales and profits were $89.6 billion and $1.40 per share, compared with estimates of $77.4 billion and 99 cents per share.

• Bristol Myers Squibb Co: The company reported lower-than-expected first-quarter profit as sales of its high margin cancer drugs Revlimid and Opdivo fell short of Wall Street estimates. Excluding one-time items, the New York-based drugmaker said it earned $3.95 billion in the quarter, or $1.74 a share, compared with $3.96 billion, or $1.72 a share, a year ago. Analysts on average expected $1.82 a share. Revenue in the quarter of $11.07 billion was basically in line with analysts' projections.

• Caterpillar Inc: The heavy equipment maker reported a rise in adjusted first-quarter profit, as equipment demand picked up after a pandemic-led slump last year. The company reported an adjusted profit of $2.87 per share in the quarter ended March 31, compared with $1.65 per share a year earlier. Total revenue rose 11.8% to $11.89 billion, above the average estimate of $11.09 billion, according to Refinitiv data.

• Continental Resources Inc: The U.S. shale producer raised its operating cash flow target for 2021 and reinstated its dividend on Wednesday as oil prices recovered from a pandemic-driven plunge last year. Continental now expects to generate $3.1 billion of cash flow from operations for 2021 if U.S. crude prices are at least $60 per barrel and gas prices hover around $2.75 per thousand cubic feet (mcf). Continental also reinstated quarterly dividend at $0.11 per share, which is double the quarterly dividend it paid in February 2020. Continental posted an adjusted profit of 77 cents per share, beating analysts' average estimate of 44 cents per share.

• EBay Inc: The company's second-quarter profit forecast came in below market expectations as it faces fierce competition from bigger rivals including Amazon for a slice of the pandemic-led online shopping boom. EBay said it expected current-quarter adjusted profit in the range of 91 cents to 96 cents per share, below an estimate of $1.02 per share. Its revenue rose 40% to $3.02 billion in the first quarter, beating expectations of $2.97 billion, thanks to the surge in online shopping during the COVID-19 crisis.

• Embraer SA: The planemaker said it had signed a firm order for 30 new E195-E2 jets, a milestone for the company after selling virtually no commercial planes so far during the coronavirus pandemic. Embraer also said it narrowed its losses to $90 million in the first quarter, compared to a loss of almost $300 million a year ago, thanks to higher deliveries of commercial aircraft as pandemic pressures ease.

• Equinor ASA: The company raised its dividend and posted a bigger-than-expected rise in first-quarter operating profit, boosted by higher oil and gas prices and massive one-off gains from its renewable energy business. The oil and gas company will pay a dividend of 15 cents per share for the quarter, up from 12 cents paid for the final three months of 2020. Adjusted profit before interest and tax rose to $5.47 billion in the quarter, from $2.05 billion in the year-ago period, exceeding the $5.3 billion predicted in a poll of 22 analysts compiled by Equinor.

• Facebook Inc: The company beat Wall Street expectations for both quarterly revenue and profit on Wednesday but warned that growth later this year could "significantly" decline as new Apple privacy policies will make it more difficult to target ads. Total revenue, which primarily consists of ad sales, hit $26.17 billion in the first quarter ended March 31, beating analysts' average estimate of $23.67 billion. Net income for the first quarter came in at $9.5 billion, or $3.30 per share, compared with $4.9 billion, or $1.71 per share, a year earlier. Analysts had expected a profit of $2.37 per share. Facebook said it expects the iPhone privacy change to impact the second quarter, but third- and fourth-quarter revenue growth could slow sequentially.

• Ford Motor Co: The automaker on Wednesday reported a strong quarterly profit, but warned that the global semiconductor chip shortage will slash production in the second quarter by 50%, before bottoming out and then improving through the year. The automaker said the global semiconductor shortage would cost it about $2.5 billion and about 1.1 million units of lost production in 2021. Ford said its net income of $3.3 billion was the best since 2011, and adjusted pre-tax profit was a record $4.8 billion. The company said the chip shortage will slash full-year earnings before interest and taxes to $5.5 billion-$6.5 billion.

• Logitech International SA: Logitech reported better-than-expected full-year sales as the computer peripherals maker benefited from the work-from-home trend during the COVID-19 pandemic. The company reported full-year sales of $5.25 billion for the year to March 31, increasing by 74% in constant currencies, better than the 63% increase forecast by the company in February. During its fourth quarter, sales rose 116.6% to $1.54 billion.

• McDonald's Corp: The company smashed Wall Street estimates for comparable sales and returned to pre-pandemic levels of growth as more consumers, flush with stimulus cash, were drawn to its newly launched crispy chicken sandwiches. First-quarter global comparable sales growth of 7.5% also surpassed pre-pandemic 2019 levels, with many countries, including the United States, easing restrictions on dining out, Chief Executive Officer Chris Kempczinski said. Those numbers trounced expectations of a 4.71% growth. Net income rose to $1.54 billion, or $2.05 per share, for the first quarter ended March 31 from $1.11 billion, or $1.47 per share, a year earlier. Revenue rose 9% to $5.12 billion, above estimates of $5.03 billion.

• Merck & Co Inc: The company reported a 1.2% fall in quarterly profit, hurt by a drop in visits to the doctor's office because of a resurgence in COVID-19 cases at the beginning of the year in the United States. The company said sales took an about $600 million hit due to lower visits to the doctors' office due to the pandemic. Net earnings fell to $3.18 billion, or $1.25 per share, in the first-quarter ended March 31, from $3.22 billion, or $1.26 per share, a year ago.

• NatWest Group PLC: The company would move its headquarters out of Scotland in the event of a vote in favour of independence, its CEO Alison Rose said, only days before parliamentary elections there. "In the event that there was independence for Scotland our balance sheet would be too big for an independent Scottish economy. And so we would move our registered headquarters, in the event of independence, to London," Rose told reporters. Meanwhile, NatWest reported a pre-tax profit of 946 million pounds, almost double an average of analyst forecasts. The bank made a 519 million pound pre-tax profit in the same period last year.

• Nokia Oyj: The Finnish telecom network equipment maker showed how its new strategy was driving growth in sales of network and 5G equipment, helping to boost first-quarter revenue and profit. Quarterly revenue rose 3% to 5.08 billion euros, beating a consensus figure of 4.72 billion. Sales at Nokia's network infrastructure business, which includes optical and fixed network products, rose 28% to 1.73 billion euros, helped by demand from enterprise customers. Quarterly profit rose to 5 euro cents per share while adjusted profit was 7 euro cents per share. Analysts had expected 1 euro cent.

• Northrop Grumman Corp: The company raised its full-year sales and earnings outlook as the U.S. weapon maker's quarterly results topped estimates, helped by higher demand for F-35 fighter jet parts and missile-warning radars. Northrop said it now expects full-year adjusted earnings per share between $24 and $24.50, up from its prior range of $23.15 to $23.65, and above analysts' average estimate of $23.65. Excluding the sale of its IT services business, Northrop earned $6.57 per share in the quarter, up from $5.15 per share, a year earlier, topping analysts' average estimate of $5.48 per share. Total sales rose 6% to $9.16 billion, beating Wall Street's estimate of $8.53 billion.

• PBF Energy Inc: The U.S. refiner said its adjusted loss narrowed for the three months ended March from the previous quarter, as the mass rollout of COVID-19 vaccines helped drive a recovery in fuel demand and economic growth. The Parsippany, New Jersey-based refiner said adjusted loss narrowed to $315.5 million, or $2.61 per share, in the reported quarter ended March 31, from $547.4 million, or $4.53, in the previous quarter.

• Qualcomm Inc: The company on Wednesday forecast current-quarter sales and adjusted profits above Wall Street estimates, with executives saying they see supply constraints easing as smartphone buyers upgrade to 5G and former Huawei customers migrate to Qualcomm-chip phones. Qualcomm forecast adjusted profits with a midpoint of $1.65 per share on revenue with a midpoint of $7.5 billion for its fiscal third quarter ending in June, compared with analysts' expectations of $1.52 per share on $7.11 billion. For the fiscal second quarter ended March 28, Qualcomm had adjusted earnings of $1.90 per share on sales of $7.93 billion, compared with analysts' estimates of $1.67 per share on $7.62 billion.

• Royal Dutch Shell PLC: The energy company’s profits leapt to $3.23 billion in the first three months of the year and the company raised its dividend as planned but warned that the outlook remained uncertain due to the coronavirus pandemic. Shell's adjusted earnings were above an average analyst forecast of $3.125 billion and also ahead of earnings of $2.9 billion last year, boosted by assets sales as well as higher oil and liquefied natural gas prices, it said. The Anglo-Dutch company raised its dividend by 4% as planned. Shell's cash flow from operations rose to $8.3 billion from $6.3 billion, helping to reduce its debt to $71.3 billion.

• STMicroelectronics NV: Shares of the Franco-Italian chipmaker bounced back in early trading after boss Jean-Marc Chery signalled sustained demand from the smartphone industry. STMicro said it now expected full-year revenues to be around $12.1 billion, a threshold it had postponed to 2023. STMicro reported first-quarter net revenues of $3.02 billion, beating an estimate of $2.92 billion. The group's gross margin of 39% for the period exceeded its own expectations. It sees net revenues of about $2.9 billion and a gross margin of about 39.5% in the second quarter.

• Textron Inc: The business jets maker raised its full-year profit forecast on improving demand for commercial helicopters and business jets following a rebound in economic growth. Textron expects 2021 adjusted earnings per share of between $2.80 and $3, up from a previous forecast of $2.70 to $2.90. The company's net income rose to $171 million, or 75 cents per share, in the first quarter, from $50 million, or 22 cents per share, a year earlier.

• Thermo Fisher Scientific Inc: The company posted better-than-expected quarterly earnings as the medical device maker saw a near tripling in sales at its life sciences unit, which helps make raw materials used in COVID-19 vaccines. Excluding items, the company earned $7.21 per share in the quarter, above Wall Street expectations of $6.45 per share. The company said net income rose to $2.34 billion, or $5.88 per share, for the three months to April 3, from $788 million, or $1.97 per share, a year earlier. Thermo Fisher's quarterly revenue rose 59% to $9.91 billion, above a consensus estimate of $9.72 billion.

• Total SE: The French energy group posted first-quarter earnings close to levels from before the coronavirus pandemic, as higher oil and gas prices boosted its trading business and it increased electricity production. Total reported an adjusted net income of $3 billion for January-March, up 69% year-on-year, and 9% above first-quarter 2019 levels. Total said it expected to generate some $24 billion in debt-adjusted cash flow in 2021, based on hydrocarbon prices remaining at first-quarter levels, with Brent crude at $60 a barrel, and European refining margins of $10-$15 per tonne. The group maintained a stable interim dividend of 0.66 euros per share against first quarter earnings.

• Unilever PLC: The company announced a 3 billion euro share buyback and said it was confident of hitting sales targets this year, after demand from home cooks and China helped it to beat first-quarter sales expectations. Underlying sales jumped 5.7% in the three months to the end of March, topping analysts' average forecast of 3.9%, according to a company supplied consensus. The company said it was confident of delivering full-year underlying sales growth within its mid-term target range of 3-5%, with the first half around the top of the range.

IPOs:

Endeavor Group Holdings Inc: The owner of the Ultimate Fighting Championship (UFC) said on Wednesday it sold shares in an initial public offering (IPO) at the high end of the target range to raise $511.2 million. Endeavor priced 21.3 million shares at $24 per share. The company had previously priced the shares at $23 to $24 each. The IPO values Endeavor at $10.31 billion. The company will list on the New York Stock Exchange on Thursday under the symbol "EDR."

Deals Of The Day

• Yandex NV: The company said it had agreed to buy mid-sized bank Acropol for 1.1 billion roubles, a move that will secure a banking licence for the Russian internet company so that it can develop financial services. Yandex said it had bought Acropol, ranked Russia's 330th largest bank in terms of assets as of April 1, to obtain a banking licence.

In Other News

• Amazon.com Inc: Evidence submitted by a retail union that raised objections to Amazon's conduct at this month's union election in Alabama "could be grounds for overturning the vote", the National Labor Relations Board said on Wednesday. The NLRB will hold a hearing on May 7 to consider objections filed by the Retail Wholesale and Department Store Union (RWDSU), which failed to secure enough votes from Amazon warehouse workers to form a union. The vote count announced on April 9 showed that workers at Amazon's Bessemer, Alabama, warehouse rejected the union by a more than 2-to-1 margin.

• AT&T Inc: WarnerMedia is planning to price an advertising-supported version of its HBO Max video streaming service, set to launch in June, at $9.99 per month, CNBC reported on Wednesday, citing people familiar with the matter. WarnerMedia declined to comment on the new pricing plan for its service with advertisements.

• Baidu Inc: The company will launch paid driverless robotaxi services in Beijing from May 2, the Chinese tech giant said, making it the among the first companies in the country to offer autonomous driving robotaxi services to paying users. Baidu's driverless Apollo Robotaxi, to be launched in the Chinese capital's Shougang Park, will operate without a safety driver behind the steering wheel, the company said, adding that users can hail and pay for a robotaxi ride through the Apollo Go App.

• BioNTech SE & Pfizer Inc: BioNTech expects results by September from trials testing the COVID-19 vaccine that it and Pfizer have developed in babies as young as six months old, German magazine Spiegel cited the company's CEO as saying. "In July, the first results could be available for the five to 12 year olds, in September for the younger children," BioNTech Chief Executive Ugur Sahin told Spiegel. He added it takes about four to six weeks to evaluate the data.

• Carlyle Group Inc: The company said its first quarter after-tax distributable earnings rose 23% year-on-year, driven by strong growth in asset sales from its private equity business that was partly offset by a decline in its credit unit. Carlyle reported after-tax distributable earnings of $215 million, up from $175 million in the previous year. That translated to after-tax distributable earnings per share of 58 cents, higher than the 52 cents that Wall Street analysts estimated on average.

• Cboe Global Markets Inc: Chicago-based Cboe said it would launch its delayed equity derivatives trading hub in Amsterdam in September, the latest move by financial markets to base their European footprint in the Dutch capital after Brexit. Cboe, already one of the biggest pan-European share trading platforms with operations in London and Amsterdam, said ABN AMRO Clearing, Goldman Sachs and Morgan Stanley had signed up to participate.

• Chevron Corp: The company on Wednesday raised its quarterly dividend by 5 cents to $1.34 per share as prices for oil and gas tick up on the back of vaccine rollouts and increased travel demand.

• Exxon Mobil Corp: The company and the United Steelworkers union (USW) have agreed to an orderly transfer of the company's Beaumont, Texas, refinery to temporary workers if a threatened lockout begins on Saturday, according to people familiar with the talks. Exxon told refinery workers in an email that it wants the union to hold a vote on its latest offer, according to an email viewed by Reuters. It has declined to hold further talks without the vote, the people said.

• Intel Corp: The company's CEO Pat Gelsinger will visit Israel next week following talks this Friday in Brussels with European Commissioner Thierry Breton, a company spokeswoman said. The spokeswoman referred to a report in Israeli newspaper Haaretz, which said that Gelsinger during his visit would announce the establishment of a $200 million chip development campus and hire 1,000 new staff.

• Moderna Inc: The company said it is boosting manufacturing capacity for its COVID-19 vaccine and expects to make up to 3 billion doses in 2022, more than twice its previous forecast. It also said it is increasing its expectations for 2021 vaccine production to between 800 million and 1 billion shots, raising the bottom of its range from 700 million. Separately, Contract drug manufacturer Lonza will double its production capacity in Switzerland for Moderna's COVID-19 vaccine, helping boost the U.S. drugmaker's output to as many as 3 billion doses in 2022.

• Newmont Corp: A First Nation group in Canada's British Columbia province has put Newmont on notice that it is unlikely to gain buy-in for a gold and copper project, amid concern that mining will encroach on a local town. The pushback by the Tahltan First Nation carries extra weight due to the group's outsized influence in its territory, in contrast to similar groups who oppose mining elsewhere. That authority may complicate efforts by U.S.-based Newmont to develop its early-stage Tatogga project, acquired in March in a $311 million buyout of GT Gold.

• Nio Inc: The electric vehicle maker has started construction of an industry park project with China's eastern city of Hefei, the firm said on Tuesday. The EV industry park is expected to have a manufacturing capacity of 1 million cars a year.

• Stellantis NV: The automaker will halt production at its Melfi plant in southern Italy from May 3 to May 10 because of low demand triggered by the COVID-19 crisis and semiconductor shortages, the UILM union said. UILM's Marco Lomio said the main reason for the stoppage was the semiconductor shortages. A spokesman for Stellantis said the stoppage was due to both the semiconductor issue and weak market demand, adding that Melfi's more than 7,000 workers would be put on a furlough scheme for the period.

• Uber technologies Inc: The ride-hailing app said it aims to sign up an additional 20,000 more drivers in Britain as the lifting of COVID-19 restrictions boosts demand. "As cities open up and people start moving again, we are encouraging 20,000 new drivers to sign up," said Northern and Eastern Europe boss Jamie Heywood.

• Velodyne Lidar Inc: Faraday Future has selected Velodyne as an exclusive supplier for its flagship luxury electric car FF 91, which is due to be launched next year, the sensor maker said. San Jose, California-based Velodyne, an early entrant into the lidar market, said Faraday's FF 91 cars would use the Velarray H800 lidar sensors to power their autonomous driving system.

• Verizon Communications Inc: The company is exploring a sale of its media assets, including Yahoo and AOL, the Wall Street Journal reported on Wednesday, citing people familiar with the matter. The sales process, which includes private equity firm Apollo Global Management, could yield a price of $4 billion to $5 billion, report said.

ANALYSIS

U.S. Fed tames taper talk, but investors look for clues in coming months

Investors have received some reassurance that the Federal Reserve will not imminently reduce its support of the U.S. economic recovery, but they expect the Fed to provide more concrete clues on a tapering of bond purchases in the months ahead.

ANALYSTS' RECOMMENDATION

• Apple Inc: Cowen and Company raises target price to $180 from $153 after the company reported better than expected second-quarter results.

• Avery Dennison Corp: JPMorgan raises rating to neutral from underweight, saying the company’s trading multiple has benefitted from the focus of investors on its strongly growing RFID and intelligent labels franchise.

• Boston Scientific Corp: Needham raises target price to $50 from $46 after the company’s first-quarter revenue and EPS beat estimates and management raised the lower end of its 2021 revenue and EPS guidance given improving trends.

• Cree Inc: JPMorgan cuts rating to underweight from neutral after the company reported a mixed fourth-quarter guidance.

• Facebook Inc: Baird raises target price to $340 from $320, saying the company’s first-quarter results were broadly positive with upside to revenues and profit margins.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0830 (approx.) GDP advance for Q1: Expected 6.1%; Prior 4.3%

0830 (approx.) GDP sales advance for Q1: Prior 2.9%

0830 (approx.) GDP consumer spending advance for Q1: Prior 2.3%

0830 (approx.) GDP deflator advance for Q1: Expected 2.5%; Prior 1.9%

0830 (approx.) Core PCE prices advance for Q1: Expected 2.4%; Prior 1.3%

0830 (approx.) PCE prices advance for Q1: Prior 1.5%

0830 (approx.) Initial jobless claims: Expected 549,000; Prior 547,000

0830 (approx.) Jobless claims 4-week average: Prior 651,000

0830 (approx.) Continued jobless claims: Expected 3.614 mln; Prior 3.674 mln

1000 Pending Homes Index for Mar: Prior 110.3

1000 Pending sales change mm for Mar: Expected 5.0%; Prior -10.6%

COMPANIES REPORTING RESULTS

Amazon.com Inc: Expected Q1 earnings of $9.54 per share

American Tower Corp: Expected Q1 earnings of $1.27 per share

Arthur J Gallagher & Co: Expected Q1 earnings of $1.84 per share

Bio Rad Laboratories Inc: Expected Q1 earnings of $3 per share

Cabot Oil & Gas Corp: Expected Q1 earnings of 35 cents per share

Carrier Global Corp: Expected Q1 earnings of 37 cents per share

CMS Energy Corp: Expected Q1 earnings of $1.13 per share

DaVita Inc: Expected Q1 earnings of $1.80 per share

Dexcom Inc: Expected Q1 earnings of 30 cents per share

Domino's Pizza Inc: Expected Q1 earnings of $2.94 per share

Eastman Chemical Co: Expected Q1 earnings of $2.04 per share

Fortinet Inc: Expected Q1 earnings of 74 cents per share

Fortive Corp: Expected Q1 earnings of 60 cents per share

Fortune Brands Home & Security Inc: Expected Q1 earnings of $1.04 per share

Generac Holdings Inc: Expected Q1 earnings of $1.87 per share

Gilead Sciences Inc: Expected Q1 earnings of $2.09 per share

Intercontinental Exchange Inc: Expected Q1 earnings of $1.30 per share

International Paper Co: Expected Q1 earnings of 62 cents per share

KLA Corp: Expected Q3 earnings of $3.62 per share

Mastercard Inc: Expected Q1 earnings of $1.57 per share

Mohawk Industries Inc: Expected Q1 earnings of $2.81 per share

Parker-Hannifin Corp: Expected Q3 earnings of $3.78 per share

Royal Caribbean Cruises Ltd: Expected Q1 loss of $4.62 per share

Skyworks Solutions Inc: Expected Q2 earnings of $2.35 per share

Southern Co: Expected Q1 earnings of 83 cents per share

Teleflex Inc: Expected Q1 earnings of $2.42 per share

Twitter Inc: Expected Q1 earnings of 14 cents per share

Vertex Pharmaceuticals Inc: Expected Q1 earnings of $2.69 per share

Western Digital Corp: Expected Q3 earnings of 68 cents per share

Westinghouse Air Brake Technologies Corp: Expected Q1 earnings of 86 cents per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Abiomed Inc: Q4 earnings conference call

0800 Clarivate PLC: Q1 earnings conference call

0800 Colfax Corp: Q1 earnings conference call

0800 Ingersoll Rand Inc: Q1 earnings conference call

0800 Keurig Dr Pepper Inc: Q1 earnings conference call

0800 LKQ Corp: Q1 earnings conference call

0800 Merck & Co Inc: Q1 earnings conference call

0800 Molina Healthcare Inc: Q1 earnings conference call

0800 Syneos Health Inc: Q1 earnings conference call

0800 Teleflex Inc: Q1 earnings conference call

0800 Tempur Sealy International Inc: Q1 earnings conference call

0800 Textron Inc: Q1 earnings conference call

0815 Citrix Systems Inc: Q1 earnings conference call

0815 Raymond James Financial Inc: Q2 earnings conference call

0830 Alliance Data Systems Corp: Q1 earnings conference call

0830 Alnylam Pharmaceuticals Inc: Q1 earnings conference call

0830 American Tower Corp: Q1 earnings conference call

0830 Baxter International Inc: Q1 earnings conference call

0830 Blueprint Medicines Corp: Q1 earnings conference call

0830 Carlyle Group Inc: Q1 earnings conference call

0830 Caterpillar Inc: Q1 earnings conference call

0830 CBRE Group Inc: Q1 earnings conference call

0830 Comcast Corp: Q1 earnings conference call

0830 Element Solutions Inc: Q1 earnings conference call

0830 Goldman Sachs Group Inc: Annual Shareholders Meeting

0830 Hershey Co: Q1 earnings conference call

0830 Intercontinental Exchange Inc: Q1 earnings conference call

0830 KBR Inc: Q1 earnings conference call

0830 Kimco Realty Corp: Q1 earnings conference call

0830 Mcdonald's Corp: Q1 earnings conference call

0830 MSA Safety Inc: Q1 earnings conference call

0830 S&P Global Inc: Q1 earnings conference call

0830 Solarwinds Corp: Q1 earnings conference call

0830 Thermo Fisher Scientific Inc: Q1 earnings conference call

0830 Westinghouse Air Brake Technologies Corp: Q1 earnings conference call

0830 Wyndham Hotels & Resorts Inc: Q1 earnings conference call

0900 Aflac Inc: Q1 earnings conference call

0900 Altria Group Inc: Q1 earnings conference call

0900 Annaly Capital Management Inc: Q1 earnings conference call

0900 Bristol-Myers Squibb Co: Q1 earnings conference call

0900 Cabot Oil & Gas Corp: Annual Shareholders Meeting

0900 Carrier Global Corp: Q1 earnings conference call

0900 Clearway Energy Inc: Annual Shareholders Meeting

0900 Euronet Worldwide Inc: Q1 earnings conference call

0900 FTI Consulting Inc: Q1 earnings conference call

0900 Global Payments Inc: Annual Shareholders Meeting

0900 Inspire Medical Systems Inc: Annual Shareholders Meeting

0900 Kraft Heinz Co: Q1 earnings conference call

0900 Laboratory Corporation of America Holdings: Q1 earnings conference call

0900 Mastercard Inc: Q1 earnings conference call

0900 Northrop Grumman Corp: Q1 earnings conference call

0900 NRG Energy Inc: Annual Shareholders Meeting

0900 Pilgrims Pride Corp: Q1 earnings conference call

0900 Royal Caribbean Cruises Ltd: Q1 earnings conference call

0900 Stericycle Inc: Q1 earnings conference call

0900 Valvoline Inc: Q2 earnings conference call

0900 Welltower Inc: Q1 earnings conference call

0900 West Pharmaceutical Services Inc: Q1 earnings conference call

0930 CMS Energy Corp: Q1 earnings conference call

0930 Markel Corp: Q1 earnings conference call

0930 Tradeweb Markets Inc: Q1 earnings conference call

1000 A. O. Smith Corp: Q1 earnings conference call

1000 AGCO Corp: Q1 earnings conference call

1000 Ashland Global Holdings Inc.: Q2 earnings conference call

1000 Church & Dwight Co Inc: Q1 earnings conference call

1000 Domino's Pizza Inc: Q1 earnings conference call

1000 Entegris Inc: Annual Shareholders Meeting

1000 Generac Holdings Inc: Q1 earnings conference call

1000 Genuine Parts Co: Annual Shareholders Meeting

1000 International Paper Co: Q1 earnings conference call

1000 Kimberly-Clark Corp: Annual Shareholders Meeting

1000 Mid-America Apartment Communities Inc: Q1 earnings conference call

1000 Newmont Corporation: Q1 earnings conference call

1000 nVent Electric PLC: Q1 earnings conference call

1000 Polaris Inc: Annual Shareholders Meeting

1000 Selective Insurance Group Inc: Q1 earnings conference call

1000 South State Corp: Q1 earnings conference call

1000 Tyler Technologies Inc: Q1 earnings conference call

1000 WEX Inc: Q1 earnings conference call

1000 Xcel Energy Inc: Q1 earnings conference call

1030 EMCOR Group Inc: Q1 earnings conference call

1100 Amedisys Inc: Q1 earnings conference call

1100 Brunswick Corp: Q1 earnings conference call

1100 Cincinnati Financial Corp: Q1 earnings conference call

1100 CyrusOne Inc: Q1 earnings conference call

1100 DISH Network Corp: Q1 earnings conference call

1100 Globe Life Inc: Annual Shareholders Meeting

1100 Huntington Ingalls Industries Inc: Annual Shareholders Meeting

1100 Invitation Homes Inc: Q1 earnings conference call

1100 MGIC Investment Corp: Annual Shareholders Meeting

1100 Molson Coors Beverage Co: Q1 earnings conference call

1100 O'Reilly Automotive Inc: Q1 earnings conference call

1100 Ovintiv Inc: Q1 earnings conference call

1100 Parker-Hannifin Corp: Q3 earnings conference call

1100 PG&E Corp: Q1 earnings conference call

1100 Select Medical Holdings Corp: Annual Shareholders Meeting

1100 Tetra Tech Inc: Q2 earnings conference call

1100 United Rentals Inc: Q1 earnings conference call

1100 Valley National Bancorp: Q1 earnings conference call

1130 Lithia Motors Inc: Annual Shareholders Meeting

1200 Ares Management Corp: Q1 earnings conference call

1200 Church & Dwight Co Inc: Annual Shareholders Meeting

1200 Continental Resources Inc: Q1 earnings conference call

1200 CoreSite Realty Corp: Q1 earnings conference call

1200 Corning Inc: Annual Shareholders Meeting

1200 Public Storage: Q1 earnings conference call

1200 Valero Energy Corp: Annual Shareholders Meeting

1230 Snap-On Inc: Annual Shareholders Meeting

1300 Avalonbay Communities Inc: Q1 earnings conference call

1300 Extra Space Storage Inc: Q1 earnings conference call

1300 Kilroy Realty Corp: Q1 earnings conference call

1300 Southern Co: Q1 earnings conference call

1330 Magellan Midstream Partners LP: Q1 earnings conference call

1400 Cullen/Frost Bankers Inc: Q1 earnings conference call

1500 Duke Realty Corp: Q1 earnings conference call

1500 EOG Resources Inc: Annual Shareholders Meeting

1630 Biomarin Pharmaceutical Inc: Q1 earnings conference call

1630 DexCom Inc: Q1 earnings conference call

1630 Exponent Inc: Q1 earnings conference call

1630 First Solar Inc: Q1 earnings conference call

1630 Five9 Inc: Q1 earnings conference call

1630 Fortinet Inc: Q1 earnings conference call

1630 Fortune Brands Home & Security Inc: Q1 earnings conference call

1630 Gilead Sciences Inc: Q1 earnings conference call

1630 Idacorp Inc: Q1 earnings conference call

1630 Omnicell Inc: Q1 earnings conference call

1630 Pacific Biosciences of California Inc: Q1 earnings conference call

1630 Power Integrations Inc: Q1 earnings conference call

1630 Prologis Inc: Annual Shareholders Meeting

1630 Resmed Inc: Q3 earnings conference call

1630 Seagen Inc: Q1 earnings conference call

1630 Skyworks Solutions Inc: Q2 earnings conference call

1630 Western Digital Corp: Q3 earnings conference call

1700 Cirrus Logic Inc: Q4 earnings conference call

1700 Columbia Sportswear Co: Q1 earnings conference call

1700 Credit Acceptance Corp: Q1 earnings conference call

1700 DaVita Inc: Q1 earnings conference call

1700 Kemper Corp: Q1 earnings conference call

1700 KLA Corp: Q3 earnings conference call

1700 LPL Financial Holdings Inc: Q1 earnings conference call

1700 MicroStrategy Inc: Q1 earnings conference call

1700 National Instruments Corp: Q1 earnings conference call

1700 Texas Roadhouse Inc: Q1 earnings conference call

1700 Zendesk Inc: Q1 earnings conference call

1715 Arthur J Gallagher & Co: Q1 earnings conference call

1730 Amazon.com Inc: Q1 earnings conference call

1730 Fortive Corp: Q1 earnings conference call

1730 Vertex Pharmaceuticals Inc: Q1 earnings conference call

1800 Bio Rad Laboratories Inc: Q1 earnings conference call

1800 Twitter Inc: Q1 earnings conference call

2000 Nio Inc: Q1 earnings conference call

EXDIVIDENDS

A. O. Smith Corp: Amount $0.26

AES Corp: Amount $0.15

AGNC Investment Corp: Amount $0.12

Alliant Energy Corp: Amount $0.40

Ally Financial Inc: Amount $0.19

Conagra Brands Inc: Amount $0.27

Costco Wholesale Corp: Amount $0.79

Kinder Morgan Inc: Amount $0.27

Morgan Stanley: Amount $0.35

National Retail Properties Inc: Amount $0.52

NiSource Inc: Amount $0.22

SL Green Realty Corp: Amount $0.30

STAG Industrial Inc: Amount $0.12

Sterling Bancorp: Amount $0.07

Targa Resources Corp: Amount $0.10

Unum Group: Amount $0.28

TA ex-dividend Flow Traders en PostNL

Onder de analyse van dinsdag staat een interessante reactie. Wat doe ik met een aandeel dat ex-dividend gaat? Dit en nog veel meer komt vandaag aan bod in de column. We gaan snel van start.In de column van afgelopen dinsdag vroeg ik of u wellicht een index of een aandeel graag voorbij zag komen. Er…

Lees verder »Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| DEU: Duitse Werkloosheidswijziging (Apr) | Actueel: 9K Verwacht: -10K Vorige: -6K |

Apple voldoet ruim, FED blijft hetzelfde

Goedemorgen

Gisteren was het een dag vol met cijfers en met de FED die kwam met een statement. Verder mocht President Biden het Congres toespreken over zijn eerste 100 dagen en zijn plannen die eraan zitten te komen. Wat duidelijk is, hij smijt met miljarden, nog niet eerder hebben we een President gezien die in zijn eerste 100 dagen al 6000 miljard uit wil geven. De eerste 1900 miljard waren er om de mensen een corona uitkering te geven, de tweede 2300 miljard zou er komen voor de infrastructuur en nu wil hij er nog 1800 miljard tegenaan gooien om het onderwijs en de druk op de gezinnen te verminderen (opvang en steun). Op die manier wil hij ook een enorm aantal nieuwe banen scheppen zodat er amper nog werkloosheid blijft.

Marktoverzicht:

Tot gisteren vertoonde de markt wat vermoeidheid en op slotbasis zien we over het algemeen wat verlies, alleen de DAX en de CAC 40 wisten om 17:30 nog positief af te sluiten. Vlakke toppen is wat we kunnen zien op de grafieken, er gebeurde de afgelopen dagen amper wat op de beurzen. De vlakke toppen zien we bij de DAX, de AEX, de S&P 500 en nu lijkt dat ook op te vallen bij de Dow Jones.

Er komt nu normaal gezien een sterke beweging na deze consolidatie, ofwel omhoog ofwel omlaag op de korte termijn. Vanmorgen zien we via de futures wel wat herstel op Wall Street, vooral de S&P 500 index samen met de Nasdaq 100 trekken door maar ik zie nog steeds geen duidelijkheid of de markt nu uit zal breken omhoog of niet.

Dat de markt nu al klaar lijkt te staan om te corrigeren lijkt me via de indicatoren redelijk duidelijk maar het moet wel nog gebeuren en tot nu toe wil men nog niks toegeven. Hoe dan ook is dat de markt rond deze niveaus uiteindelijk een grotere correctie kan inzetten. Let op, zoals ik al vakar aangeef kan het wel zijn dat het er technisch bekeken slecht uitziet maar dat wil nog niet zeggen dat de markt meteen ook deze indicatie zal volgen. Het zou niet voor de eerste keer zijn dat we er vrij zeker van zijn dat er een bepaalde beweging op gang kan komen maar dat het uiteindelijk niet zo was. Maar nogmaals, de indicatoren zien er in ieder geval niet al te best uit.

Cijfers Amazon vandaag:

We letten vandaag op de cijfers van Amazon nabeurs, na Apple en Facebook gisteren, Microsoft en Alphabet (Google) dinsdag en Tesla maandag hebben we dan na vanavond de BIG-5 + Tesla gehad.

Strategie nieuwe posities:

Om posities omhoog op te nemen moet je hier wel durf tonen maar het is niet zo dat ze geen kansen meer bieden. Aan de andere kant lijkt het mij nog meer logisch om strategisch short posities uit te kiezen met een ruime stoploss maar ook dat blijft nu met al die cijfers en de FED moeilijk zodat ik besloten heb om even te wachten. Voor short posities zie ik eerlijk gezegd wat meer kansen op de kortere termijn.

Voor de leden zal ik wel een en ander uitzoeken de komende sessies, op dit moment zitten we nog zonder posities omdat het nu wat te onduidelijk is. Alles op zijn tijd, u kunt uiteraard door lid te worden mee met de posities die ik per mail en SMS stuur naar de leden.

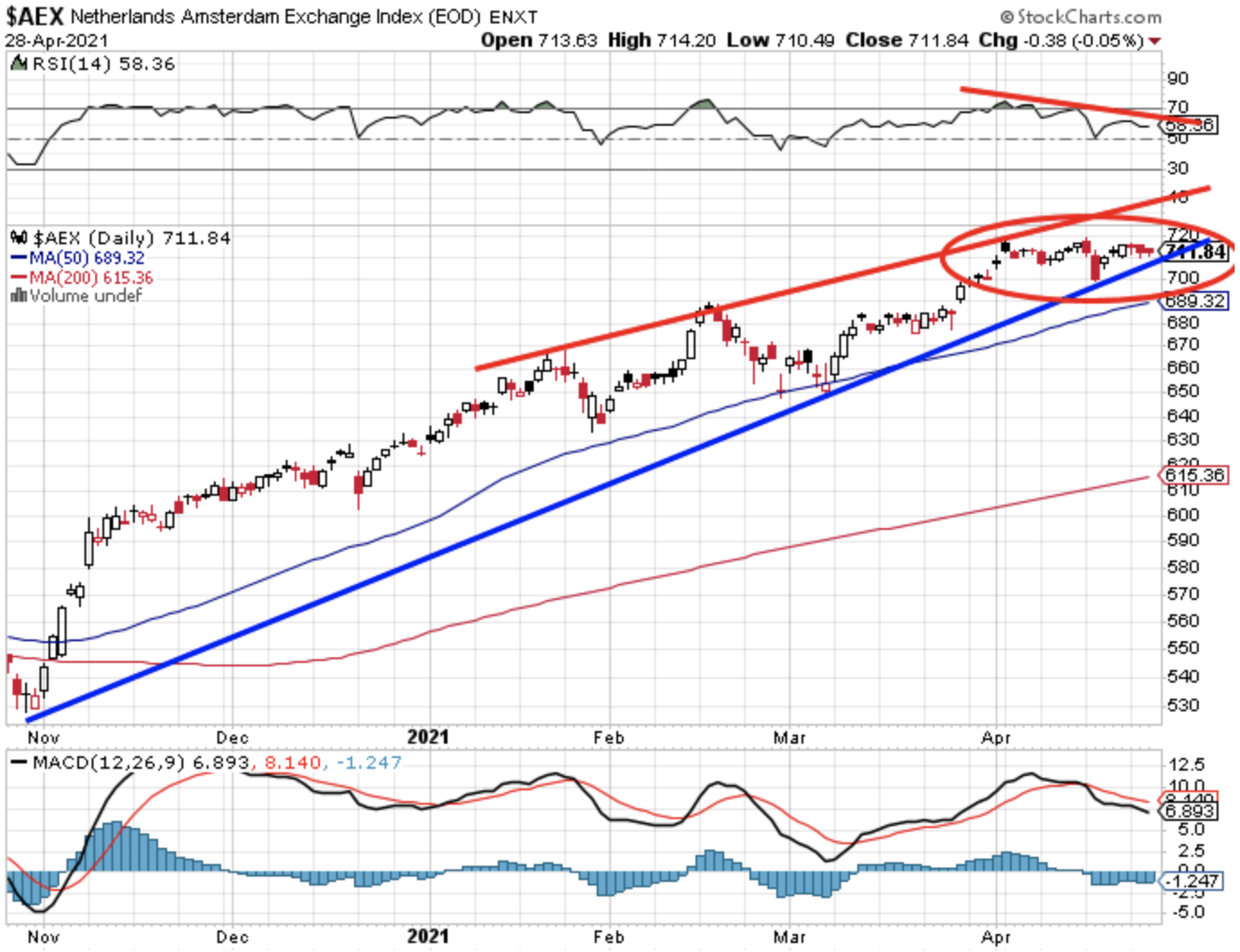

Technische conditie AEX en DAX:

De AEX ziet u via een chart hieronder, ik zie zowel bij de indicatoren als bij het koersverloop door het ontbreken van een nieuwe top verzwakking optreden. Wel blijft de weerstand nu eerst de 715 en meteen daarna de 718 punten, pas later mocht de index uitbreken kansen tot 725 of zelfs 735 punten. Of de index het nog in zich heeft om uit te breken betwijfel ik maar we moeten er altijd wel rekening mee houden.

Steun nu de 712, de 708, de 702-703 en later de 688-690 punten zone waar de meest recente top en zware weerstand wacht. De komende week maar eens heel goed kijken en vooral overwegen wat we met de AEX index kunnen doen. Let daarbij vooral op de zone 708-710 punten. Ik heb wel een mooi plan in gedachte de komende dagen. Ook bij enkele andere indices zie ik kansen maar we moeten geduld hebben voor we echt wat kunnen gaan doen.

De DAX kwam na een uitbraak die vals blijft te zijn weer terug naar de range 15.100-15.300 punten, zo blijkt maar weer eens dat de stevige uitbraak eind vorige week te voorbarig was. Een valse move ofwel een "BULL TRAP" zoals we dat ook noemen. De DAX zit dus weer in de slopende range 15.100-15.300 punten. Weerstand nu de 15.300 en de top die werd gezet rond de 15.500 punten. Steun nu die 15.150, de 15.000, de 14.850 en de 14.750 punten. Ik denk dat we moeten opletten met de DAX de komende dagen, er staat denk ik iets te gebeuren met deze index.

S&P 500 analyse:

Op Wall Street blijft alles dicht bij de toppen en dus rondom de recordstand hetgeen we ook zien bij de S&P 500, via die de grafiek hieronder kunt u de reeks toppen zonder dat er een uitbraak komt duidelijk zien zodat alles onzeker blijft. Het testen van de top ofwel de recordstand of er iets boven geraken dat lukt nog wel maar echt fors uitbreken zit er blijkbaar niet meer in voorlopig. Net als bij de meeste indices moeten we ook voor wat betreft Wall Street en dus bij deze S&P 500 index op onze goede blijven in welke richting dan ook.

Dat de indicatoren verzwakken zoals dat duidelijk te zien is via de chart hieronder en de waarderingen zeer hoog zijn moeten we er maar bij nemen voorlopig. Verder valt het ook op dat de index een behoorlijk eind boven de belangrijke MA's staat. Het 50-MA zien we rond de 3992 punten, het 200-MA rond de 3645 punten. De gemiddelde waardering komt vrijdag op slotbasis uit op 42.6 keer de winst. Er branden genoeg rode lichten nu, dus opletten. Ook op de beurs is het niet zo dat de bomen tot in de hemel groeien.

Resultaat dit jaar verloopt naar wens maar rustig:

Deze maand heb ik nog niet veel kunnen doen, we staan dan ook nagenoeg vlak tot nu toe voor de lopende maand april. De eerste 3 maanden dit jaar waren in ieder geval positief en met december vorig jaar erbij komen we uit op 4 maanden na elkaar dat er winst werd behaald via de signalen. Het handelen moet nog altijd voorzichtig gebeuren want ik hou in het achterhoofd rekening met een aanstaande grote correctie over de gehele markt. Niettemin blijf ik rustig verder opbouwen wat betreft de posities. We moeten ook niet constant in de markt zitten in deze fase, er komt vrij snel wel een periode aan waar dat wel zal kunnen maar nog even wat geduld tot dat moment.

Deze manier van werken wil ik hoe dan ook proberen aan te houden, het handelen onder de huidige omstandigheden krijg ik steeds beter onder controle en ik probeer met kleine posities zo als goed mogelijk te werken voor de leden. Onderaan deze update ziet u nog een overzicht met hoe de maand maart werd afgerond en hoe we er dit jaar voor staan wat betreft het resultaat via de signalen die we naar onze leden versturen.

LET OP !! Vanaf vandaag een nieuwe aanbieding die loopt vanaf nu tot 1 JULI voor €39 (Polleke Trading €49) ... Via de site en dan de Tradershop kunt zich inschrijven en daar kunt u als lid de lopende posities met alle details altijd inzien. Ga naar de Tradershop en schrijf u meteen in ... https://www.usmarkets.nl/tradershop

Euro, olie en goud:

De euro zien we nu rond de 1.213 dollar, de prijs van een vat Brent olie komt uit op 67 dollar terwijl een troy ounce goud nu op 1785 dollar staat.

De LIVEBLOG en Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

LET OP !! Vanaf vandaag een nieuwe aanbieding die loopt vanaf nu tot 1 JULI voor €39 (Polleke Trading €49)... Via de site en dan de Tradershop kunt zich inschrijven en daar kunt u als lid de lopende posities met alle details altijd inzien. Ga naar de Tradershop en schrijf u meteen in ... https://www.usmarkets.nl/tradershop

Met vriendelijke groet,

Guy Boscart