Liveblog Archief donderdag 6 mei 2021

TA Vopak, Alfen, AEX en nog een

Er waren drie reacties onder de column van afgelopen dinsdag, allen met verzoeken. Heeft u nu ook een verzoek, laat het onder bij de reacties weten en met een beetje geluk vindt u uw favoriet in deze column terug.Ik ga snel van start met vandaag onder andere Vopak en Alfen.Dames gaan voor, dus ik…

Lees verder »Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Eerste Aanvragen Werkloosheidsvergoeding | Actueel: 498K Verwacht: 540K Vorige: 590K |

Markt snapshot Wall Street 6 mei

TOP NEWS

• Global pharma shares slide as Biden backs COVID-19 vaccine IP waiver

Shares of drugmakers involved in the production of COVID-19 vaccines, including Pfizer and Moderna, fell, a day after U.S. President Joe Biden's plan to back intellectual property waivers on vaccines.

• Tesla developing platform to allow car owners in China data access

U.S. electric-vehicle maker Tesla said it was developing a platform for car owners in China that will allow them to access data generated by their vehicles.

• Regeneron quarterly profit rises 78% on Eylea strength

Regeneron Pharmaceuticals reported a 78% rise in first-quarter profit, helped by a robust recovery in demand for its eye drug Eylea and continued strength in sales of its eczema drug Dupixent.

• Results tally up billions in profit from Texas freeze for gas and power sellers

Natural gas suppliers, pipeline companies and banks that trade commodities have emerged as the biggest market winners from February's U.S. winter blast that roiled gas and power markets, according to more than two dozen interviews and quarterly earnings reports.

• COVID spreading in rural India; record daily rises in infections, deaths

Hopes that India's deadly second wave of COVID-19 was about to peak were swept away as it posted record daily infections and deaths and as the virus spread from cities to villages across the world's second-most populous nation.

BEFORE THE BELL

U.S. stock futures were higher, ahead of initial jobless claims data which is due for release later during the day. European shares were mixed. Japan's Nikkei jumped, as it reopened after a five-day holiday. The dollar fell, as investors awaited clues on when the Federal Reserve will dial back monetary stimulus, while gold strengthened. Rising COVID-19 infections in India pulled oil prices lower.

STOCKS TO WATCH

Results

• Albemarle Corp: The world's largest producer of lithium posted a quarterly profit on Wednesday that easily beat Wall Street's expectations on rising demand from the electric vehicle industry. The company reported first-quarter net income of $95.7 million, or 84 cents per share, compared with $107.2 million, or $1.01 per share, in the year-ago period. Excluding one-time items, Albemarle earned $1.10 per share. By that measure, analysts expected earnings of 80 cents per share.

• Allstate Corp: The company on Wednesday posted a first-quarter profit that beat analysts' estimates by nearly 60%, driven largely by investment income and its core insurance businesses. The company said adjusted earnings rose to $6.11 per share, well above average analysts' estimates of $3.88. Revenue rose 26% to $12.45 billion and catastrophe losses nearly tripled to $590 million in the quarter.

• Anheuser-Busch InBev: Carlos Brito, who built AB InBev into the world's biggest brewer during 15 years at the helm, will step down as CEO in July to be replaced by the group's North America boss as it shifts focus from acquisitions to boosting sales. The company separately reported first-quarter earnings ahead of expectations, even with lockdowns closing hospitality in much of Europe and a one-month alcohol sales ban in South Africa. Earnings before interest, tax, depreciation and amortisation (EBITDA) rose 14.2% on a like-for-like basis and removing the impact of currency translation to $4.27 billion, beating the 6.6% average forecast in a company-compiled poll.

• APA Corp & Marathon Oil Corp: The oil and gas producers beat Wall Street estimates for first-quarter profits on Wednesday, as COVID-19 vaccine rollouts and easing travel restrictions powered a rebound in oil prices. Marathon said first-quarter adjusted income stood at $166 million, or 21 cents per share, compared with a loss of $98 million, or 12 cents per share, in the fourth. This beat the average analyst estimate of 11 cents profit per share. APA posted an adjusted profit of 91 cents per share, topping estimate of 66 cents.

• ArcelorMittal SA: The world's largest steelmaker reported higher than expected first-quarter earnings after what it said was its strongest quarter in a decade. The Luxembourg-based company reported first-quarter core profit (EBITDA) of $3.24 billion, more than three times the $967 million a year earlier and higher than the $2.97 billion average forecast in a company poll.

• Booking Holdings Inc: The company welcomed a rebound in travel demand in the United States and Britain as more people planned holidays after getting vaccinated, but Asia remained on the back foot as its health crisis worsened. First-quarter gross travel bookings fell 4% to $11.9 billion from the prior year. Excluding items, the company lost $5.26 per share, compared with analysts' estimates of a $5.87 loss per share.

• ING groep NV: The largest Dutch bank reported better-than-expected first quarter net profit of 1.01 billion euros on strong fee income and fewer bad loan provisions than a year earlier. Analysts had forecast net profit for the three months ended March 31 at 813 million euros. In the year-earlier period, ING made a profit of 670 million euros.

• Linde PLC: The world's largest industrial gases company hiked its 2021 earnings forecast, as a strong performance in its healthcare and electronics businesses helped it beat first quarter forecasts. The U.S.-German company, which supplies gases such as oxygen, nitrogen and hydrogen to factories and hospitals, now expects adjusted earnings per share up 17-19% year-on-year - compared with its previous forecast for 11-13% growth. Linde's overall earnings per share for January-March rose 32% to $2.49, beating analysts' average estimate of $2.26 and its own guidance.

• Magna International Inc: The Canadian auto parts maker reported a 136% rise in quarterly profit and raised its full-year revenue outlook, as strong demand for vehicles encouraged its customers to order more body structures, chassis and powertrains. Magna's revenue for the year is now expected to be between $40.2 billion and $41.8 billion, up from a previous forecast of $40.0 billion to $41.6 billion. Net income attributable to Magna rose to $615 million, or $2.03 per share, in the first quarter ended March 31, from $261 million, or 86 cents per share, a year earlier.

• MercadoLibre Inc: The company posted a larger quarterly loss on Wednesday, hit by a higher tax bill and weak margins, as the Argentine e-commerce giant boosts spending to respond to a surge in online shopping and digital payments in Latin America. Its net loss widened more than 61% to $34 million, or 68 cents per share, from a year earlier. Excluding income tax expenses, the company posted a net income of $9.5 million.

• MetLife Inc: The company said on Wednesday the worst of the pandemic was behind it after the U.S. insurer beat Wall Street estimates for first-quarter profit, with large investment gains cushioning the hit from coronavirus-related claims. The New York-based insurer's net investment income jumped nearly 74% to $5.31 billion on strong returns from private-equity investments. The company reported adjusted earnings of $2 billion, or $2.20 per share, for the first quarter ended March 31, from $1.45 billion, or $1.58 per share, a year earlier. Analysts on average had expected a profit of $1.53 per share.

• PayPal Holdings Inc: The company reported its strongest first quarter on record and beat profit estimates on Wednesday, with a coronavirus-driven shift to online shopping and digital transactions boosting payment volumes. San Jose, California-based PayPal processed a total of $285 billion in payments in the first quarter, up 50% from a year earlier, and added 14.5 million net new active customers. PayPal reported first-quarter net income of $1.22 per share, beating analysts' average estimates of $1.01 per share.

• Regeneron Pharmaceuticals Inc: The company reported a 78% rise in first-quarter profit, helped by a robust recovery in demand for its eye drug Eylea and continued strength in sales of its eczema drug Dupixent. Regeneron's net profit rose to $1.12 billion, or $10.09 per share, in the quarter ended March 31, from $625 million, or $5.43 per share, a year earlier. Sales rose to $2.53 billion from $1.83 billion.

• Uber Technologies Inc: The company signaled it would pay drivers more to get cars back on the road as the U.S. economy recovers from the pandemic and disclosed a $600 million charge to provide UK drivers with benefits, a sign of the potential costs if the United States requires more driver compensation. Uber posted an adjusted $359 million first-quarter loss before interest, taxes, depreciation and amortization - a metric that excludes one-time costs, including stock-based compensation, narrowing losses by nearly $100 million from the previous quarter. Analysts on average had expected the company to report an adjusted EBITDA loss of around $452 million.

In Other News

• Apollo Global Management Inc: Apollo has revised its offer to buy Australian betting firm Tabcorp's wagering and media business to A$3.5 billion, intensifying a bidding war with Britain's Entain. Tabcorp said Apollo's revised proposal involves a possible acquisition of its wagering and media business along with its gaming services unit for a combined value of A$4 billion. Alternatively, it has also proposed to acquire only the wagering and media business for A$3.5 billion.

• BioNTech SE, Moderna Inc, Novavax Inc & Pfizer Inc: Shares of drugmakers involved in the production of COVID-19 vaccines, including Pfizer and Moderna, fell, a day after U.S. President Joe Biden's plan to back intellectual property waivers on vaccines. Shares of Pfizer, Moderna, Novavax and U.S. shares of BioNTech were all down before the bell.

• Exxon Mobil Corp: The United Steelworkers union has requested that a federal mediator help resolve a 5-day-old lockout of about 650 workers at an Exxon oil refinery, said people familiar with the matter. Both sides in a labor dispute must agree to mediation. The USW has asked the Federal and Mediation and Conciliation Service (FMCS) to become involved, the people said. Exxon has not.

• GameStop Corp: Ratings agency S&P Global Ratings on Wednesday raised GameStop's credit rating by one notch, a critical step in the video retailer's transformation into an e-commerce company. S&P Global Ratings said in a note that it lifted GameStop's credit rating to "B" from "B-" and removed it from CreditWatch after the company issued $550 million in equity and redeemed all balance sheet debt.

• International Business Machines Corp: IBM introduced what it says is the world's first 2-nanonmeter chipmaking technology. The technology could be as much as 45% faster than the mainstream 7-nanometer chips in many of today's laptops and phones and up to 75% more power efficient, the company said. The technology likely will take several years to come to market.

• JPMorgan Chase & Co: Proxy adviser Institutional Shareholder Services on Wednesday recommended investors cast advisory votes in favor of the pay of JPMorgan CEO Jamie Dimon at the bank's annual meeting on May 18, but with a caveat. ISS said "cautionary support" for the pay of Dimon and other JPMorgan leaders is warranted and cited concerns about the use of discretion by the bank's compensation committee. The proxy adviser also recommended shareholders back all the bank's directors up for election despite opposition from climate activists.

• Marathon Petroleum Corp: An alkylation unit that leaked hydrofluoric acid on Tuesday at Marathon Petroleum's 585,000 barrel-per-day (bpd) Galveston Bay Refinery in Texas City, Texas, remained shut on Wednesday night, said sources familiar with plant operations. The 31,500 bpd alkylation unit 3 was shut after the leak on Tuesday afternoon, the sources said.

• Microsoft Corp: The company will allow commercial and public sector customers in the European Union to process and store all of their data in the region, a growing demand from some clients. The company will complete the implementation of all engineering work needed to execute the plan by the end of next year and it will apply to all its core cloud services – Azure, Microsoft 365, and Dynamics 365, the company said.

• Novavax Inc: The company's COVID-19 vaccine had efficacy of 51% against infections caused by the South African variant among people who were HIV negative, and 43% in a group that included people who were HIV positive, according to a new analysis published on Wednesday. The Novavax post-hoc analysis was published in the New England Journal of Medicine along with full data from the company's trial in South Africa, which included nearly 2,700 volunteers who had not been previously infected with the coronavirus.

• Rio Tinto Plc: A majority of the global miner's shareholders rejected its executive pay packages, in a backlash over its destruction last year of ancient rock shelters in Western Australia. Following the company's Australian annual meeting, Rio Tinto said more than 60% of votes cast by investors in the Anglo-Australian dual-listed company were against its remuneration report. "This constitutes a 'first strike'," the company said.

• Sanofi SA: The French healthcare group has entered into a three-year collaboration deal with leading U.S. university Stanford over developing research projects to focus on autoimmune diseases and inflammatory conditions. Sanofi, which is also working on projects to tackle COVID-19, and Stanford said in a joint statement that Sanofi would provide funding for the research.

• Tesla Inc: The electric vehicle maker said it was developing a platform for car owners in China that will allow them to access data generated by their vehicles. Tesla, which makes Model 3 sedans and Model Y sport-utility vehicles at its Shanghai factory, aims to launch the data platform this year, it said in a statement.

• UBS Group AG: Germany's Deutsche Boerse agreed to buy the remaining 49% stake in fund distribution platform Clearstream Fund Centre (CFC) from UBS for 390 million Swiss francs, the two companies said. Deutsche Boerse, which had bought 51% of CFC last year, said the transaction would complement previous deals in the investment funds industry, with the acquisitions of Citco Global Securities Services, Swisscanto Funds Centre and Ausmaq.

ANALYSIS

Facebook confronts human rights dilemma on political speech

Facebook oversight board's extension of former U.S. President Donald Trump's banishment from the social network failed to settle how it will balance political leaders' freedom of speech and its responsibility to make sure hateful rhetoric does not incite violence.

ANALYSTS' RECOMMENDATION

• Accolade Inc: D.A. Davidson raises target price to $60 from $55, to reflect the company’s upbeat fourth-quarter results and its intent to acquire PlushCare.

• Chiasma Inc: Jefferies cuts rating to hold from buy, after the company announced it is being purchased by Amryt Pharma in an all-stock transaction.

• Dirtt Environmental Solutions Ltd: NBC cuts rating to sector perform from outperform, believing that the company may face COVID-related weakness for a few more quarters.

• Emerson Electric Co: RBC raises target price to $101 from $96, after the company reported strong second-quarter results and boosted FY2021 earnings guidance.

• General Motors Co: JPMorgan raises target price to $71 from $63, after the company reported stronger-than-expected first-quarter earnings.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0730 Challenger layoffs for Apr: Prior 30,603

0830 (approx.) Initial jobless claims: Expected 540,000; Prior 553,000

0830 (approx.) Jobless claims 4-week average: Prior 611,750

0830 (approx.) Continued jobless claims: Expected 3.620 mln; Prior 3.660 mln

0830 (approx.) Labor costs preliminary for Q1: Expected -0.8%; Prior 6.0%

0830 (approx.) Productivity preliminary for Q1: Expected 4.3%; Prior -4.2%

COMPANIES REPORTING RESULTS

AES Corp: Expected Q1 earnings of 30 cents per share

Alliant Energy Corp: Expected Q1 earnings of 68 cents per share

American International Group Inc: Expected Q1 earnings of 97 cents per share

Ball Corp: Expected Q1 earnings of 67 cents per share

Becton Dickinson and Co: Expected Q2 earnings of $3.04 per share

Consolidated Edison Inc: Expected Q1 earnings of $1.36 per share

DENTSPLY SIRONA Inc: Expected Q1 earnings of 56 cents per share

EOG Resources Inc: Expected Q1 earnings of $1.48 per share

Expedia Group Inc: Expected Q1 loss of $2.31 per share

Huntington Ingalls Industries Inc: Expected Q1 earnings of $2.63 per share

Iron Mountain Inc: Expected Q1 earnings of 25 cents per share

Kellogg Co: Expected Q1 earnings of 96 cents per share

Linde PLC: Expected Q1 earnings of $2.26 per share

Live Nation Entertainment Inc: Expected Q1 loss of $1.52 per share

Mckesson Corp: Expected Q4 earnings of $5.04 per share

Mettler-Toledo International Inc: Expected Q1 earnings of $5.61 per share

Monster Beverage Corp: Expected Q1 earnings of 61 cents per share

Motorola Solutions Inc: Expected Q1 earnings of $1.62 per share

News Corp: Expected Q3 earnings of 04 cents per share

NRG Energy Inc: Expected Q1 earnings of 13 cents per share

Penn National Gaming Inc: Expected Q1 earnings of 29 cents per share

PPL Corp: Expected Q1 earnings of 64 cents per share

Regency Centers Corp: Expected Q1 earnings of 17 cents per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Becton Dickinson and Co: Q2 earnings conference call

0800 Boston Scientific Corp: Annual Shareholders Meeting

0800 CenterPoint Energy Inc: Q1 earnings conference call

0800 Charles River Laboratories International Inc: Annual Shareholders Meeting

0800 Clearway Energy Inc: Q1 earnings conference call

0800 DigitalOcean Holdings Inc: Q1 earnings conference call

0800 Epam Systems Inc: Q1 earnings conference call

0800 Equitable Holdings Inc: Q1 earnings conference call

0800 Intellia Therapeutics Inc: Q1 earnings conference call

0800 Mettler-Toledo International Inc: Annual Shareholders Meeting

0800 Moderna Inc: Q1 earnings conference call

0800 Nielsen Holdings PLC: Q1 earnings conference call

0800 Tapestry Inc: Q3 earnings conference call

0800 Unum Group: Q1 earnings conference call

0800 Vontier Corp: Q1 earnings conference call

0800 Wayfair Inc: Q1 earnings conference call

0830 ANSYS Inc: Q1 earnings conference call

0830 Black Knight Inc: Q1 earnings conference call

0830 Cardinal Health Inc: Q3 earnings conference call

0830 DENTSPLY SIRONA Inc: Q1 earnings conference call

0830 Fidelity National Information Services Inc: Q1 earnings conference call

0830 Fiverr International Ltd: Q1 earnings conference call

0830 IAC/Interactivecorp: Q1 earnings conference call

0830 Iron Mountain Inc: Q1 earnings conference call

0830 Marriott Vacations Worldwide Corp: Q1 earnings conference call

0830 Q2 Holdings Inc: Q1 earnings conference call

0830 Regeneron Pharmaceuticals Inc: Q1 earnings conference call

0830 Shift4 Payments Inc: Q1 earnings conference call

0830 Tempur Sealy International Inc: Annual Shareholders Meeting

0830 ViacomCBS Inc: Q1 earnings conference call

0830 Zoetis Inc: Q1 earnings conference call

0900 AES Corp: Q1 earnings conference call

0900 Albemarle Corp: Q1 earnings conference call

0900 Allstate Corp: Q1 earnings conference call

0900 Bio-Techne Corp: Q3 earnings conference call

0900 Builders FirstSource Inc: Q1 earnings conference call

0900 CLARIVATE PLC: Annual Shareholders Meeting

0900 Evergy Inc: Q1 earnings conference call

0900 FMC Corp: Q1 earnings conference call

0900 Huntington Ingalls Industries Inc: Q1 earnings conference call

0900 II-VI Inc: Q3 earnings conference call

0900 LHC Group Inc: Q1 earnings conference call

0900 Marathon Oil Corp: Q1 earnings conference call

0900 Maximus Inc: Q2 earnings conference call

0900 MetLife Inc: Q1 earnings conference call

0900 NRG Energy Inc: Q1 earnings conference call

0900 OGE Energy Corp: Q1 earnings conference call

0900 Penn National Gaming Inc: Q1 earnings conference call

0900 Quanta Services Inc: Q1 earnings conference call

0900 Tenet Healthcare Corp: Annual Shareholders Meeting

0900 Terminix Global Holdings Inc: Q1 earnings conference call

0900 TopBuild Corp: Q1 earnings conference call

0900 Trex Company Inc: Annual Shareholders Meeting

0900 UGI Corp: Q2 earnings conference call

0900 United Rentals Inc: Annual Shareholders Meeting

0930 Archer-Daniels-Midland Co: Annual Shareholders Meeting

0930 Equifax Inc: Annual Shareholders Meeting

0930 Kellogg Co: Q1 earnings conference call

0930 Spirit Realty Capital Inc: Q1 earnings conference call

1000 Acadia Healthcare Company Inc: Annual Shareholders Meeting

1000 Alcoa Corp: Annual Shareholders Meeting

1000 Atmos Energy Corp: Q2 earnings conference call

1000 Capital One Financial Corp: Annual Shareholders Meeting

1000 CF Industries Holdings Inc: Q1 earnings conference call

1000 CMC Materials Inc: Q2 earnings conference call

1000 Curtiss-Wright Corp: Q1 earnings conference call

1000 DCP Midstream LP: Q1 earnings conference call

1000 EQT Corp: Q1 earnings conference call

1000 Howmet Aerospace Inc: Q1 earnings conference call

1000 Lincoln National Corp: Q1 earnings conference call

1000 Linde PLC: Q1 earnings conference call

1000 MGIC Investment Corp: Q1 earnings conference call

1000 Molina Healthcare Inc: Annual Shareholders Meeting

1000 Owl Rock Capital Corp: Q1 earnings conference call

1000 Primerica Inc: Q1 earnings conference call

1000 Rayonier Inc: Q1 earnings conference call

1000 Wesco International Inc: Q1 earnings conference call

1030 Ecolab Inc: Annual Shareholders Meeting

1100 Ameren Corp: Annual Shareholders Meeting

1100 AMETEK Inc: Annual Shareholders Meeting

1100 APA Corp (US): Q1 earnings conference call

1100 Ball Corp: Q1 earnings conference call

1100 Cimarex Energy Co: Q1 earnings conference call

1100 Essential Utilities Inc: Q1 earnings conference call

1100 Kraft Heinz Co: Annual Shareholders Meeting

1100 PPL Corp: Q1 earnings conference call

1100 Targa Resources Corp: Q1 earnings conference call

1100 Tractor Supply Co: Annual Shareholders Meeting

1130 Coherent Inc: Annual Shareholders Meeting

1130 Eastman Chemical Co: Annual Shareholders Meeting

1200 American Homes 4 Rent: Annual Shareholders Meeting

1200 Encompass Health Corp: Annual Shareholders Meeting

1200 Middleby Corp: Q1 earnings conference call

1200 Royal Gold Inc: Q3 earnings conference call

1200 STORE Capital Corp: Q1 earnings conference call

1200 TCF Financial Corp: Annual Shareholders Meeting

1230 Duke Energy Corp: Annual Shareholders Meeting

1300 Arrow Electronics Inc: Q1 earnings conference call

1300 Curtiss-Wright Corp: Annual Shareholders Meeting

1330 VEREIT Inc: Q1 earnings conference call

1400 CH Robinson Worldwide Inc: Annual Shareholders Meeting

1400 Mdu Resources Group Inc: Q1 earnings conference call

1430 WEC Energy Group Inc: Annual Shareholders Meeting

1500 RLI Corp: Annual Shareholders Meeting

1600 Alaska Air Group Inc: Annual Shareholders Meeting

1600 Boyd Gaming Corp: Annual Shareholders Meeting

1600 Cadence Design Systems Inc: Annual Shareholders Meeting

1630 Air Lease Corp: Q1 earnings conference call

1630 Bill.com Holdings Inc: Q3 earnings conference call

1630 Expedia Group Inc: Q1 earnings conference call

1630 Fox Factory Holding Corp: Q1 earnings conference call

1630 Guardant Health Inc: Q1 earnings conference call

1630 Insulet Corp: Q1 earnings conference call

1630 Mckesson Corp: Q4 earnings conference call

1630 Natera Inc: Q1 earnings conference call

1630 Planet Fitness Inc: Q1 earnings conference call

1630 Twist Bioscience Corp: Q2 earnings conference call

1645 Progyny Inc: Q1 earnings conference call

1700 Acceleron Pharma Inc: Q1 earnings conference call

1700 Altair Engineering Inc: Q1 earnings conference call

1700 Appian Corp: Q1 earnings conference call

1700 Avalara Inc: Q1 earnings conference call

1700 Axon Enterprise Inc: Q1 earnings conference call

1700 Beyond Meat Inc: Q1 earnings conference call

1700 Blackline Inc: Q1 earnings conference call

1700 Cable One Inc: Q1 earnings conference call

1700 CDK Global Inc: Q3 earnings conference call

1700 Certara Inc: Q1 earnings conference call

1700 Cloudflare Inc: Q1 earnings conference call

1700 Cognex Corp: Q1 earnings conference call

1700 Datadog Inc: Q1 earnings conference call

1700 Dropbox Inc: Q1 earnings conference call

1700 Energy Transfer LP: Q1 earnings conference call

1700 Exelixis Inc: Q1 earnings conference call

1700 Floor & Decor Holdings Inc: Q1 earnings conference call

1700 Live Nation Entertainment Inc: Q1 earnings conference call

1700 Mettler-Toledo International Inc: Q1 earnings conference call

1700 Microchip Technology Inc: Q4 earnings conference call

1700 Monster Beverage Corp: Q1 earnings conference call

1700 Motorola Solutions Inc: Q1 earnings conference call

1700 Mp Materials Corp: Q1 earnings conference call

1700 News Corp: Q3 earnings conference call

1700 Peloton Interactive Inc: Q3 earnings conference call

1700 Quidel Corp: Q1 earnings conference call

1700 Roku Inc: Q1 earnings conference call

1700 Square Inc: Q1 earnings conference call

1700 Synaptics Inc: Q3 earnings conference call

1700 Teradata Corp: Q1 earnings conference call

1700 Universal Display Corp: Q1 earnings conference call

1730 Carvana Co: Q1 earnings conference call

1730 Paylocity Holding Corp: Q3 earnings conference call

EX-DIVIDENDS

CIT Group Inc: Amount $0.35

CMS Energy Corp: Amount $0.43

FirstEnergy Corp: Amount $0.39

Intel Corp: Amount $0.34

J B Hunt Transport Services Inc: Amount $0.30

Lamb Weston Holdings Inc: Amount $0.23

Levi Strauss & Co: Amount $0.06

Lithia Motors Inc: Amount $0.35

New York Community Bancorp Inc: Amount $0.17

Norfolk Southern Corp: Amount $0.99

Parker-Hannifin Corp: Amount $1.03

Pfizer Inc: Amount $0.39

Pinnacle Financial Partners Inc: Amount $0.18

Sirius XM Holdings Inc: Amount $0.01

Walmart Inc: Amount $0.55

Wells Fargo & Co: Amount $0.10

Westinghouse Air Brake Technologies Corp: Amount $0.12

Stevige rebound Europa, Nasdaq weer wat lager

Goedemorgen

Gisteren een stevige rebound in Europa met vooral de AEX en de DAX die meer dan 2% hoger weten te sluiten. Beide indices hadden nog wat op te halen na de stevige terugval van dinsdag omdat tegen het slot op Wall Street de schade werd beperkt met zelfs een positief slot bij de Dow Jones (dinsdag). Gisteren werd er zelfs weer een nieuw record neergezet bij de Dow Jones maar de divergenties blijven opvallen omdat de Nasdaq weer tegengesteld bewoog ten opzichte van de traditionele indexen.

Marktoverzicht:

Er kwam dus een forse opleving woensdag, veel valt daar niet over te zeggen en zeker al niet door de twijfels die we momenteel zien op de beurzen. Die twijfels zien we vooral door dat beleggers niet goed meer weten waar ze hun geld moeten beleggen want het ene moment gaat het naar de grote tech aandelen terwijl er de dag erop wordt gekozen voor de veilige sectoren zoals de banken, de cyclische en industriële bedrijven. Veel meer dan een signaal dat men het even niet meer weet kan ik er niet uithalen, het kan vandaag of morgen weer net andersom zijn. Aan het verloop van de rente zal het ook niet echt liggen momenteel want die echt grote bewegingen liggen nu een beetje achter ons. We blijven wel met belangstelling kijken naar de markten want het blijven interessante tijden op de beurs.

Overzicht markt:

LET OP !! Maak nu gebruik van de aanbieding die loopt tot 1 JULI voor €39 (Polleke Trading €49)... Via de site en dan de Tradershop kunt zich inschrijven en daar kunt u als lid meteen ook de lopende posities met alle details inzien. Ga naar de Tradershop en schrijf u meteen in ... https://www.usmarkets.nl/tradershop

Technische conditie AEX en DAX:

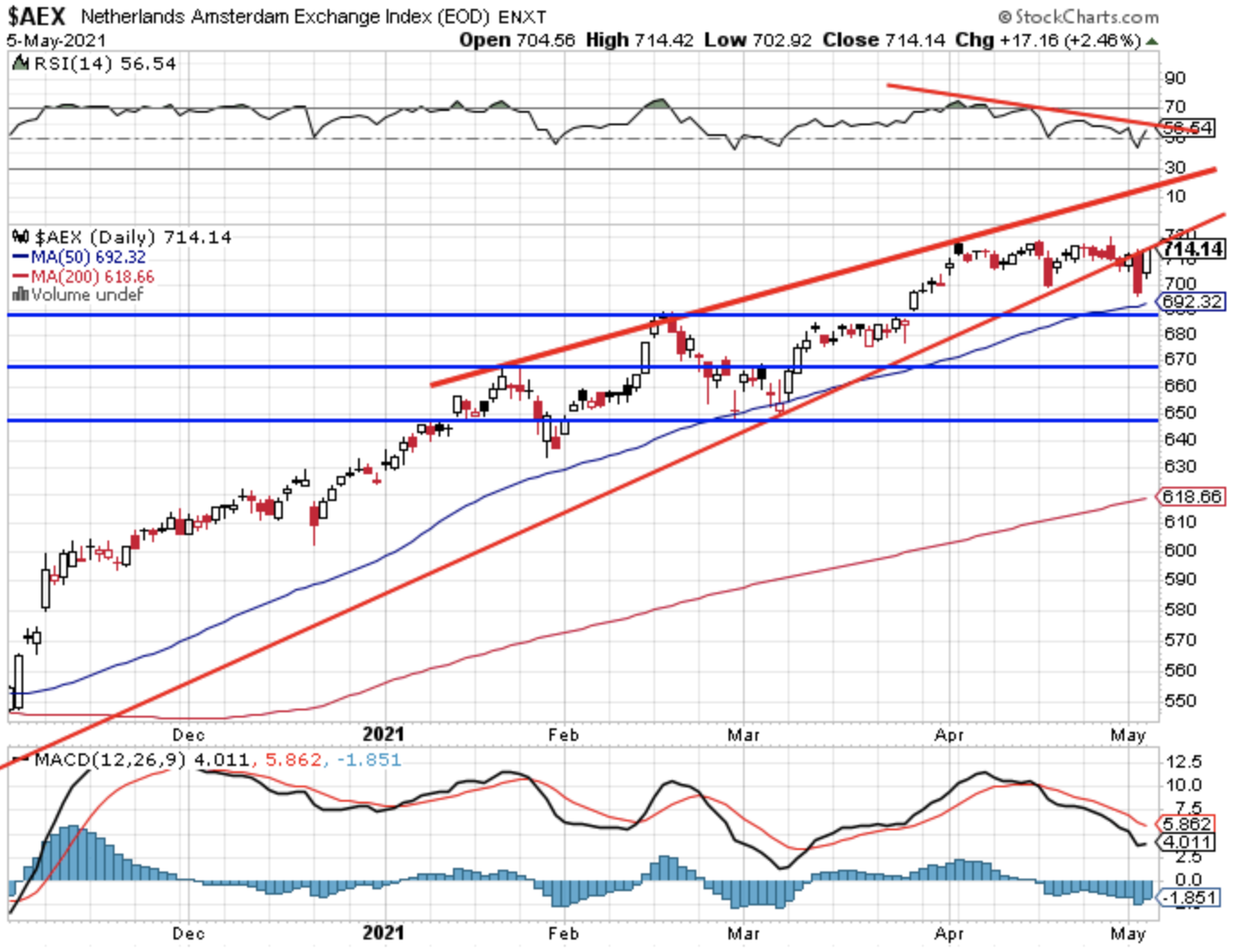

De AEX kreeg het dinsdag even behoorlijk lastig met het slot onder de 700 punten maar een dag later werd alles goed gemaakt met 17 punten winst. De index geraakt zo weer dicht bij de topzone waar we een zware weerstand zien uitkomen. Let nu op de 715 en de topzone rond de 718 punten. Mocht de index uitbreken dan ligt er rond de 725 en de 735 punten weerstand.

Steun nu de 712, de 708, de 702-703 en de bodem van dinsdag rond de 698 punten. Later een belangrijk steun niveau wat ik gisteren in feite had verwacht rond de 688-690 punten.

Ik zal de komende sessies zeker bekijken wat ik met de AEX kan gaan doen.

De DAX herstelt behoorlijk na de diepe duik van dinsdag, de index kwam toen ver onder de steun terecht en het zag er niet goed uit. De DAX herpakt zich met meer dan 300 punten zodat de index terug in de veilige zone 15.100-15.300 punten uitkomt. De eerste steun wordt nu weer die 15.100 punten met later de 15.000, de 14.850 en de 14.760 punten..

Weerstand wordt nu de 15.200 en 15.300 punten met daarboven de top rond de 15.500 punten. De negatieve doorbraak van dinsdag bij de DAX zag er in ieder geval niet best uit voor het vervolg, blijf dus opletten maar dag geef ik al een tijdje aan.

Ik zal de komende sessies zeker bekijken wat ik met de DAX kan gaan doen.

S&P 500 analyse:

Op Wall Street nog altijd behoorlijk wat twijfels maar hoe hadden we het anders verwacht, er kwam dinsdag een daling op gang die vrijwel helemaal werd goed gemaakt, vooral de Dow Jones doet. het goed en sluit opnieuw af bij de topzone en zet net een nieuw record neer. Ook de Dow Transport index zet net nog een nieuw record neer op slotbasis. Hoe dan ook zien we wederom divergentie tussen de traditionele en technologie sectoren, het valt op dat het iets is dat maar blijft duren ook al krijgen we af en toe een voorproefje van hoe de markt snel terug kan vallen.

De S&P 500 waar de BIG-5 bedrijven zwaar meewegen hangt er een beetje tussen momenteel zodat deze index zich nog altijd binnen een range beweegt. Let nu vooral op de bodemzone in de buurt van de 4120 punten waar we dus een belangrijke steun zien uitkomen. Later wordt het meteen de 4000-4005 punten waar we steun zien en dat ligt ver onder de stand van nu (4168 punten).

Weerstand blijft de topzone rond de 4220-4225 punten, ook niet ver boven de slotkoers maar wel een moeilijke zone zien we aan het verloop van de afgelopen 2-3 weken. Blijf zeer alert op deze index en dus op heel Wall Street ...

Ik zal de komende sessies zeker bekijken wat ik met de indexen op Wall Street kan doen.

Resultaat dit jaar verloopt naar wens maar we blijven rustig:

De eerste resultaten van de maand mei zijn een feit, maandag werden er wat kleine posities opgenomen die dinsdag tijdens de stevige terugval werden verkocht met een mooie winst. Zo staat er al een positief resultaat voor de maand mei, ook bekeken vanaf begin dit jaar loopt de winst rustig op. We blijven op de goeie weg en dat wil ik graag volhouden uiteraard. Wordt nu dus lid en volg de signalen, er komen nog hele leuke kansen dit jaar omdat ik de nodige volatiliteit verwacht op beurzen ...

Euro, olie en goud:

De euro zien we nu rond de 1.20 dollar, de prijs van een vat Brent olie komt uit op 69,2 dollar terwijl een troy ounce goud nu op 1791 dollar staat.

De LIVEBLOG en Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

LET OP !! Maak nu gebruik van de aanbieding die loopt tot 1 JULI voor €39 (Polleke Trading €49)... Via de site en dan de Tradershop kunt zich inschrijven en daar kunt u als lid meteen ook de lopende posities met alle details inzien. Ga naar de Tradershop en schrijf u meteen in ... https://www.usmarkets.nl/tradershop

Hieronder de resultaten van deze maand (mei) en dit jaar (2021)

Met vriendelijke groet,

Guy Boscart