Liveblog Archief maandag 19 april 2021

Markt snapshot Wall Street 19 april

TOP NEWS

• GameStop says CEO Sherman to resign; starts search for successorGameStop's George Sherman will step down as chief executive officer in the biggest shakeup at the video game retailer as it tries to shed its brick-and-mortar image and embrace an e-commerce model.

• Coca-Cola revenue rises past estimates on easing pandemic curbs

Coca-Cola trounced Wall Street estimates for quarterly revenue, fueled by strong demand for its beverages from the gradual reopening of restaurants and cinema theaters following accelerated vaccine rollouts.

• J&J, other drugmakers to face trial in California over claims they fueled opioid epidemicFour drugmakers are set to face trial in a lawsuit by several large counties in California that are seeking more than $50 billion over claims the companies helped fuel an opioid epidemic by deceptively marketing addictive painkillers. • China's Ant explores ways for Jack Ma to exit as Beijing piles pressure - sources

Ant Group is exploring options for founder Jack Ma to divest his stake in the financial technology giant and give up control, as meetings with Chinese regulators signalled to the company that the move could help draw a line under Beijing's scrutiny of its business, according to a source familiar with regulators' thinking and two people with close ties to the company. • Harley-Davidson boosts sales forecast as quarterly shipments rise

U.S. motorcycle maker Harley-Davidson reported a 10% rise in first-quarter revenue and raised it full-year forecast for sales growth, on the back of strong demand for its more profitable touring bikes.

BEFORE THE BELL

U.S. stock index futures eased after the S&P 500 and the Dow closed at record highs in the previous session, while investors geared up for quarterly earnings reports. Prospects of global economic recovery and strong earnings season lifted European stocks. Japan's Nikkei closed flat, in response to a global chip shortage and growing coronavirus fears. The dollar fell, after Federal Reserve reiterated that spike in inflation is likely to be temporary, while gold edged higher. Oil prices were lower, weighed by demand concerns.

STOCKS TO WATCH

Results

• Coca-Cola Co: The company trounced Wall Street estimates for quarterly revenue, fueled by strong demand for its beverages from the gradual reopening of restaurants and cinema theaters following accelerated vaccine rollouts. Net revenue rose to $9.02 billion in the first quarter, from $8.60 billion a year earlier, above analysts' average estimate of $8.63 billion.

• Harley-Davidson Inc: The U.S. motorcycle maker reported a 10% rise in first-quarter revenue and raised it full-year forecast for sales growth, on the back of strong demand for its more profitable touring bikes. The company's total revenue rose to $1.42 billion in the quarter ended March 28, from about $1.30 billion a year earlier. Harley, which has struggled to grow sales in the United States, its core market, said it now expects motorcycles business revenue to grow in the range of 30% to 35% in 2021, up from its prior estimate of growth between 20% and 25%.

Moves

• GameStop Corp: George Sherman will step down as chief executive officer in the biggest shakeup at the video game retailer as it tries to shed its brick-and-mortar image and embrace an e-commerce model. The company said Sherman would resign on or before July 31 and that it had started looking for a successor.

• Nutrien Ltd: The company said on Sunday that Mayo Schmidt has been appointed as the Canadian fertilizer maker's president and chief executive officer, effective immediately. Schmidt, who has served as chair of Nutrien's board since May 2019, succeeds Chuck Magro, who is stepping down from his management and board role at the company to pursue "new opportunities", the company said in a statement. Magro will be available until May 16 to facilitate a transition, it added.

In Other News

• Abbvie Inc, Endo International PLC, Johnson & Johnson & Teva Pharmaceutical Industries Ltd: The four drugmakers are set to face trial in a lawsuit by several large counties in California that are seeking more than $50 billion over claims the companies helped fuel an opioid epidemic by deceptively marketing addictive painkillers. The case against Johnson & Johnson, Teva, Endo and AbbVie's Allergan unit is one of the thousands of lawsuits by states and local governments seeking to hold pharmaceutical companies responsible for the drug crisis. Separately, Dr. Anthony Fauci on Sunday predicted that U.S. health regulators will end the temporary pause on distributing Johnson & Johnson's COVID-19 vaccine, adding he expects a decision could come as soon as Friday.

• Alphabet Inc: Translation tools from Alphabet's Google and other companies could be contributing to significant misunderstanding of legal terms with conflicting meanings such as "enjoin," according to research due to be presented at an academic workshop. Google's translation software turns an English sentence about a court enjoining violence, or banning it, into one in the Indian language of Kannada that implies the court ordered violence, according to the new study.

• Amazon.com Inc: Amazon's video game division has canceled an online role-playing game based on the fantasy series Lord of the Rings, which was announced in 2019, an Amazon spokeswoman said. The game had been in development at Amazon Game Studios alongside China-based Leyou Technologies Holdings, which was acquired by Chinese tech giant Tencent Holdings in December. The resulting contract negotiations led to a dispute between Amazon and Tencent that eventually caused the game's cancellation, Bloomberg reported earlier on Saturday, citing people familiar with the matter.

• Barrick Gold Corp: Kibali Goldmines SA, the Congolese joint venture of Barrick and AngloGold Ashanti, said its 10% shareholder Société Minière de Kilo-Moto (SOKIMO) had filed a financial claim against it in a Kinshasa commercial court. The Democratic Republic of Congo news website objectif-infos.cd published documents on Sunday showing state-owned SOKIMO filed proceedings on April 16 claiming Kibali owed SOKIMO $1.1138 billion dollars in unpaid dividends and other funds. Kibali said it had learned of this action on Sunday and described the claim as a second attempt by SOKIMO to "extort certain benefits from the company". Kibali said SOKIMO withdrew its first claim after it was "shown to be without foundation".

• Blackstone Group Inc & Oaktree Capital Group LLC: Oaktree has proposed funding a A$3 billion buyback by Australia's Crown Resorts of its founder's stake, setting up a clash with rival Blackstone for the troubled casino firm's future. Private equity giant Oaktree's offer of a "structured instrument" to help Crown buy back James Packer's 37% stake comes just a month after Blackstone lobbed an A$8 billion full takeover offer. Crown did not specify what Oaktree would receive under its proposal, which it said it was considering, along with Blackstone's offer. Separately, logistics real estate manager ESR Cayman Limited said it will join with Singaporean sovereign wealth fund GIC to buy an Australian portfolio from Blackstone for A$3.8 billion.

• Citigroup Inc: Citigroup plans to expand its investment banking business in China and will soon apply to set up local underwriting, sales and trading and futures trading businesses by the end of June, a person with direct knowledge of the matter told Reuters. The move comes after the U.S. bank revealed last week it would sell its retail banking assets in 13 markets, including mainland China. Citigroup's applications to regulators are being finalised and should be officially lodged shortly, the source said.

• Coinbase Global Inc: Coinbase Chief Executive Brian Armstrong sold about $292 million in shares in total during the cryptocurrency exchange's first day of trading on the Nasdaq in the past week, according to regulatory filings. Armstrong sold 749,999 shares in three batches at prices ranging from $381 to $410.40 per share for total proceeds of $291.8 million, the filings made with the U.S. Securities and Exchange Commission showed. Separately, Cathie Wood’s ARK funds bought more shares of cryptocurrency exchange Coinbase on Friday while selling shares of electric carmaker Tesla, according to the firm's daily trade summary.

• Credit Suisse Group AG: A pension fund filed a lawsuit against Credit Suisse on Friday in a U.S. court, accusing the Swiss bank of misleading investors and mismanaging risk exposure to high-risk clients, including Greensill Capital and Archegos Capital Management. The pension fund, City of St. Clair Shores Police & Fire Retirement System, based in St. Clair Shores, Michigan, filed the class action lawsuit in federal court in Manhattan, alleging violations of federal securities laws.

• Facebook Inc: The company will announce a series of products under the umbrella of "social audio", including its take on audio-chat app Clubhouse and a push into podcast discovery and distribution, Recode reported on Sunday. These plans include an audio version of Rooms, a video-conferencing product Facebook launched a year ago. The Clubhouse-like product will let groups of people listen to and interact with speakers on a virtual "stage", the report added. Facebook will also launch a product allowing its users to record brief voice messages and post them in their newsfeeds, and a podcast discovery product that will be connected with Spotify, according to the report, which cited sources.

• Goldman Sachs Group Inc: British digital bank Starling said that Goldman Sachs had invested 50 million pounds in the UK lender. The investment is an extension of Starling's oversubscribed 272 million pound funding round, valuing the bank in excess of 1.1 billion pounds, Starling said in a statement.

• Hartford Financial Services Group Inc: The insurer said on Friday it had agreed to a settlement with the Boy Scouts of America and would pay $650 million for sexual abuse claims associated with policies issued mostly in the 1970s. Under the agreement, the Boy Scouts and its local councils will release Hartford from any obligation under policies it issued, Hartford said. The Boy Scouts filed for Chapter 11 bankruptcy last February, amid a flood of lawsuits over allegations of child sexual abuse stretching back decades.

• Manchester United PLC: Shares in Italian soccer club Juventus and England's Manchester United jumped after they and 10 other top European clubs announced the formation of a breakaway Super League. The announcement of the Super League on Sunday was condemned by football authorities across Europe and by political leaders including the French president and British prime minister. As well as United, Premier League clubs Liverpool, Manchester City, Chelsea, Arsenal and Tottenham Hotspur have signed up to the plans. From Spain, Barcelona, Real Madrid and Atletico Madrid are joining. AC Milan and Inter Milan make up the trio from Italy along with Juventus. • Microsoft Corp: The company will invest $1 billion over the next five years in Malaysia as part of a new partnership programme with government agencies and local companies, the Southeast Asian nation's prime minister said. The announcement on what would be the U.S. tech giant's biggest investment in Malaysia comes after the country in February gave conditional approvals for Microsoft, Google, Amazon and state telecoms firm Telekom Malaysia to build and manage hyper-scale data centres and provide cloud services.

• Peloton Interactive Inc: The U.S. Consumer Product Safety Commission (CPSC) on Saturday warned consumers about the dangers of Peloton's treadmill Tread+ after reports of multiple incidents of small children and a pet being injured beneath the machines. "CPSC staff believes the Peloton Tread+ poses serious risks to children for abrasions, fractures, and death," the safety regulator said in a statement, adding that consumers with children should stop using the product immediately. Peloton in a response to the regulator's statement said it was "troubled by the CPSC's unilateral press release about the Peloton Tread+ because it is inaccurate and misleading."

• Pfizer Inc: The European Union has exercised an option to acquire an additional 100 million doses of BioNTech and Pfizer's COVID-19 vaccine, the two companies said. This brings the total number of doses to be delivered to the 27 EU members to 600 million in 2021, the companies said in a statement. Separately, the coronavirus variant discovered in South Africa can break through the protection provided by Pfizer and BioNTech's COVID-19 vaccine to some extent, a real-world data study in Israel found. However, the variant's prevalence in Israel is very low and the vaccine remains highly effective.

• Tesla Inc: Two men died after a Tesla vehicle, which was believed to be operating without anyone in the driver's seat, crashed into a tree on Saturday night north of Houston, authorities said. “There was no one in the driver’s seat," Sgt. Cinthya Umanzor of the Harris County Constable Precinct 4 said. The 2019 Tesla Model S was traveling at a high rate of speed, when it failed to negotiate a curve and went off the roadway, crashing to a tree and bursting into flames, local television station KHOU-TV said.

• Toyota Motor Corp: Japan's Toyota signalled a shift in its climate change stance, saying it would review its lobbying and be more transparent on what steps it is taking as it faces increased activist and investor pressure. Toyota "will review public policy engagement activities through our company and industry associations to confirm they are consistent with the long-term goals of the Paris Agreement," it said in a statement, adding that actions will be announced by the end of this year. The automaker also said it will "strive to provide more information so that our stakeholders can understand our effort to achieve carbon neutrality."

• Tribune Publishing Co: Swiss billionaire Hansjoerg Wyss has decided to drop out of a group that was bidding for Tribune, the New York Times and Bloomberg News reported on Saturday. The decision was made in recent days after Wyss' associates examined the Tribune's finances as part of a due diligence process, according to the NYT report, which cited people with knowledge of the matter. Wyss had come to believe it would be difficult for him to realize his ambition of transforming The Chicago Tribune, the paper he was most interested in, into a national publication, the New York Times said.

• Trip.com Group Ltd: The company's shares rose from their issue price in their Hong Kong debut, as its chairman bet on a recovery in domestic travel in major countries this year but warned a pick up in international business would take longer. The China-headquartered travel group - which also operates UK-based online search and booking websites Skyscanner and Travelfusion - had sold its Hong Kong shares at HK$268 apiece to raise $1.09 billion in the secondary listing.

INSIGHTU.S. banks deploy AI to monitor customers, workers amid tech backlash

Several U.S. banks have started deploying camera software that can analyze customer preferences, monitor workers and spot people sleeping near ATMs, even as they remain wary about possible backlash over increased surveillance, more than a dozen banking and technology sources told Reuters.

ANALYSTS' RECOMMENDATION

• Abercrombie & Fitch Co: JPMorgan raises target price to $44 from $37, saying that the company's products have improved materially with fashion denim at core selling, along with a pattern of younger consumers going out shopping more than the older population.

• Kilroy Realty Corp: JPMorgan raises target price to $70 from $65, following the sale of The Exchange before its first-quarter earnings.

• Lava Therapeutics NV: Jefferies initiates with buy rating, seeing the potential in gamma delta T cells, which is used in cancer treatments based on immune cells.

ECONOMIC EVENTS

No economic indicators are scheduled for release.

COMPANIES REPORTING RESULTS

International Business Machines Corp: Expected Q1 earnings of $1.63 per share

Prologis Inc: Expected Q1 earnings of 41 cents per share

United Airlines Holdings Inc: Expected Q1 loss of $7.05 per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Carrier Global Corp: Annual Shareholders Meeting

0830 Coca-Cola Co: Q1 earnings conference call

1000 Old National Bancorp: Q1 earnings conference call

1000 ServisFirst Bancshares Inc: Annual Shareholders Meeting

1100 M&T Bank Corp: Q1 earnings conference call

1200 NIC Inc: Shareholders Meeting

1200 Prologis Inc: Q1 earnings conference call

1500 Valley National Bancorp: Annual Shareholders Meeting

1700 International Business Machines Corp: Q1 earnings conference call

1715 ServisFirst Bancshares Inc: Q1 earnings conference call

1730 Zions Bancorporation NA: Q1 earnings conference call

EX-DIVIDENDS

Atlas Corp: Amount $0.12

B. Riley Financial Inc: Amount $0.42

Lagere opening maar mogelijk weer divergenties

Vanmorgen lagere futures in Europa, op Wall Street zien we de Dow en SP future wat lager terwijl de Nasdaq future vlak tot iets hoger staat. Wederom via de indicatie een divergentie tussen de Nasdaq en de Dow Jones. Vrijdag wisten zowel de Dow Jones, de SP 500 en de Nasdaq 100 nog een nieuw record ofwel hoogste slot ooit neer te zetten. Blijf letten op de SOX index die duidelijk achter blijft op de rest gedurende de afgelopen week.

De markt momenteel:

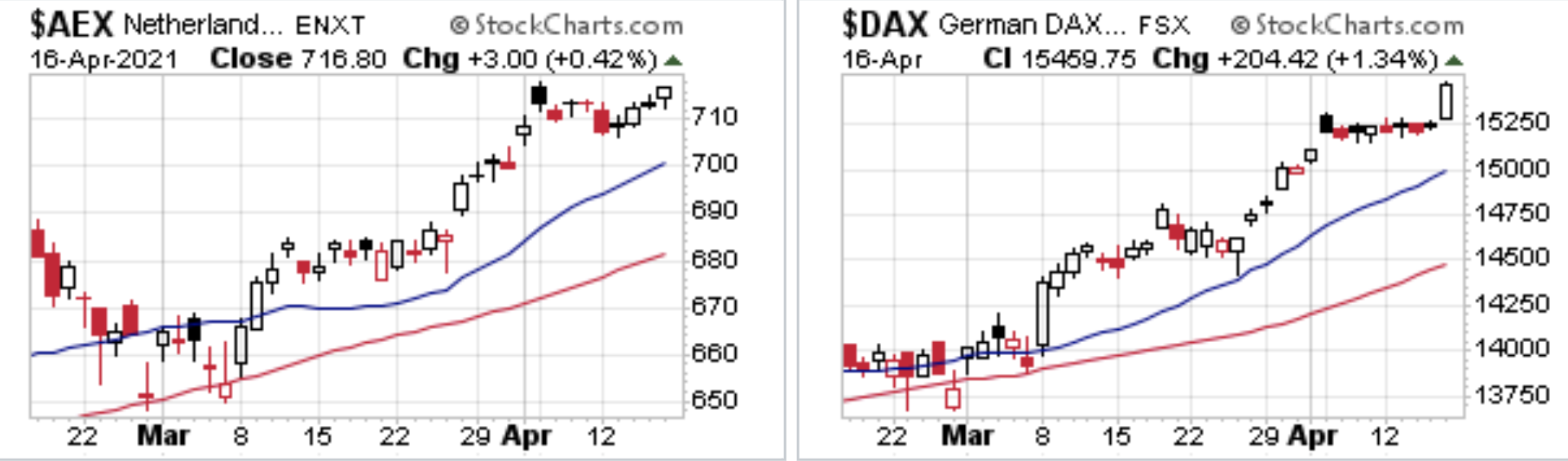

Als we nog een keer op weekbasis het verloop nakijken dan zien we winst voor de AEX, de DAX en de CAC 40. De AEX won 3,5 punten (+0,5%) terwijl de DAX vooral door de uitbraak boven de 15.300 punten vrijdag 225 punten (+1,5%) hoger geraakte bekeken over de gehele week. De CAC 40 index won 117 punten (+1,9%). Nieuwe records in Europa de afgelopen week bij zowel de DAX, de CAC 40 en de AEX index.

Op Wall Street ook winst de afgelopen week met 152 punten winst voor de Nasdaq (+1,1%) terwijl de Nasdaq 100 het met een winst van 197 punten nog iets beter deed (+1,45%). De Nasdaq 100 zet een nieuw record neer, de Nasdaq geraakt daar nog net niet. Verder een nieuw record en een mooie weekwinst voor de S&P 500 index, de index wint 57 punten (+1,4%) terwijl we de Dow Jones met 400 punten (+1,2%) winst ook een nieuw record neer zien zetten.

Veel records afgelopen vrijdag zoals u merkt maar ik zie ook wat zaken die echt opvallen, de Dow Transport index wint op weekbasis slechts 1 punt (+0,01%) terwijl de net zo belangrijke index binnen een cyclus de SOX (semi-conductor index) 42 punten verlies (-1,25%) moet toestaan de afgelopen week.

Opvallende divergenties:

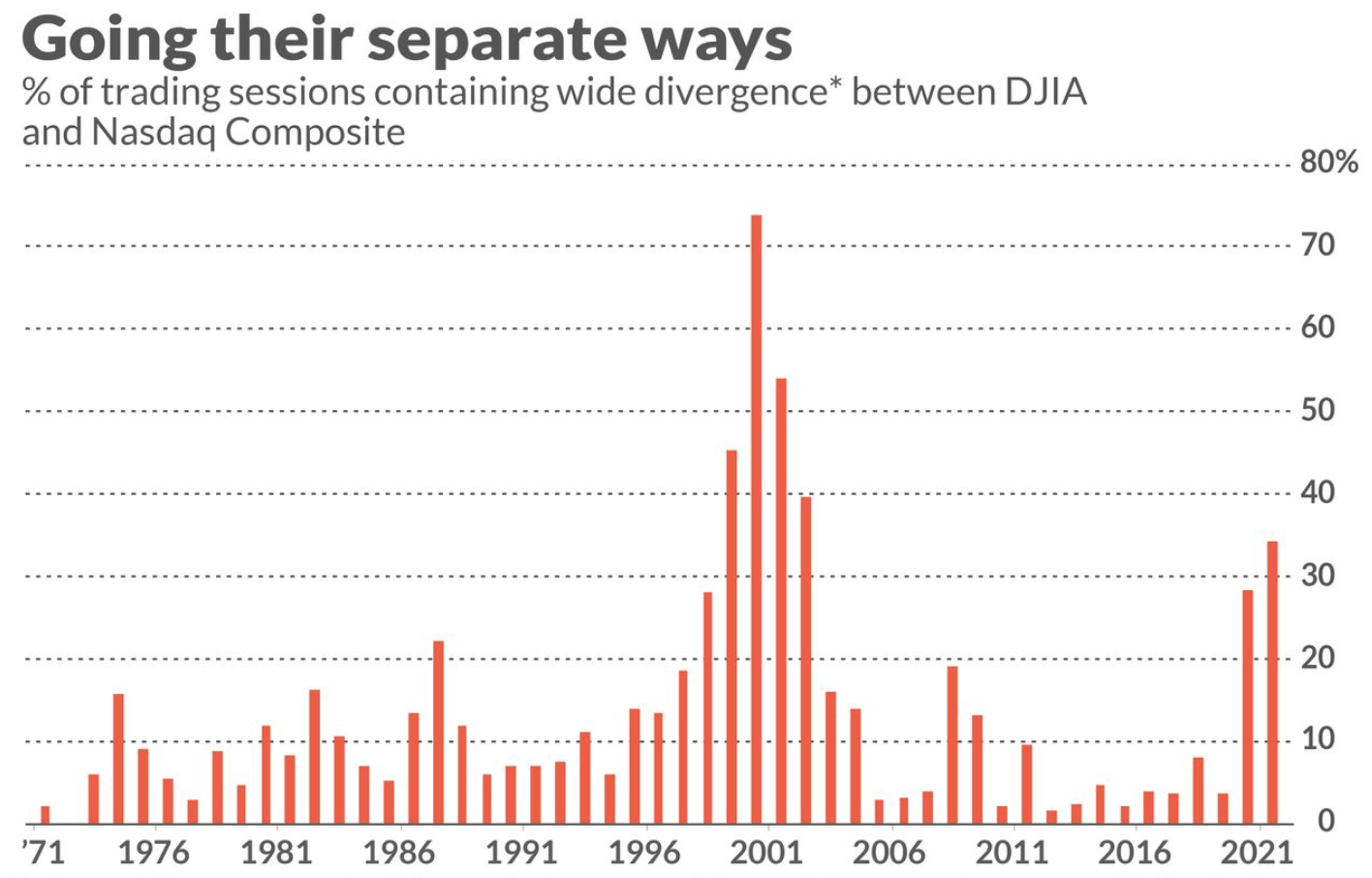

Aan de andere kant is het ook zo dat we op Wall Street en ook tussen de verschillende regio's enorme divergenties zien en dat nu toch al een lange tijd na elkaar. Hieronder ziet u via een grafiek dat het niet vaak voorkomt maar als het voorkomt (vanaf begin jaren '70) iedere keer voorkwam net voor dat er een grote correctie kwam. De situatie wordt met de dag gevaarlijker als je het mij vraagt. We zien dat er niveaus worden bereikt die er ook waren in 2000-2001, u weet wel, net voor dat de Nasdaq met 85% omlaag moest nadien.

Het gaat om de divergentie tussen de Dow Jones en de Nasdaq ofwel tussen de traditionele en de nieuwe economie.

Resultaat dit jaar verloopt naar wens maar rustig:

De eerste 3 maanden dit jaar werden positief afgerond en met december erbij komen we nu uit op 4 maanden na elkaar dat er winst werd behaald via de signalen. Dat moest voorzichtig gebeuren want ik hou in het achterhoofd rekening met het scenario wat ik net aangaf, over een aanstaande grote correctie over de gehele markt. Niettemin blijf ik rustig verder opbouwen wat betreft de posities.

Deze manier van werken wil ik hoe dan ook proberen aan te houden, het handelen onder de huidige omstandigheden krijg ik steeds beter onder controle en ik probeer met kleine posities zo als goed mogelijk te werken voor de leden. Onderaan deze update ziet u nog een overzicht met hoe de maand maart werd afgerond en hoe we er dit jaar voor staan wat betreft het resultaat via de signalen die we naar onze leden versturen.

LET OP !! Vanaf vandaag een nieuwe aanbieding die loopt vanaf nu tot 1 JULI voor €39 (Polleke Trading €49) ... Via de site en dan de Tradershop kunt zich inschrijven en daar kunt u als lid de lopende posities met alle details altijd inzien. Ga naar de Tradershop en schrijf u meteen in ... https://www.usmarkets.nl/tradershop

Technische conditie Wall Street:

Wat betreft Wall Street nieuwe record bij de S&P 500, de Dow Jones en de Nasdaq 100. Voor de Nasdaq zat er net geen nieuw record in maar komt nu wel heel dicht bij de hoogste stand ooit. Aan de andere kant zien we de SOX index en de Dow Transport al een paar dagen twijfelen over het vervolg.

De indices op Wall Street blijven dus dicht bij hun toppen of zetten zoals u ziet nog nieuwe toppen neer, technisch blijft alles dus op recordjacht zodat de korte, mid-lange en lange termijn trend positief blijft. Aan de andere kant staan de indicatoren zeer hoog. We merken dat er weinig kopers overblijven maar er zijn dus ook weinig verkopers te vinden momenteel.

Wel blijven letten op de gemiddelde waardering, bij de S&P 500 zitten we nu al op 42.6 keer de winst (gemiddeld).

Technische conditie AEX en DAX:

AEX index:

Bij de AEX blijft hangen boven de oude top maar krijgt toch wat moeite om echt fors door te trekken omhoog. Weerstand voor de AEX index nu eerst de 718 punten. Verder mocht de bull markt het op de heupen krijgen doelen rond de 725 en de 735 punten al dat ligt nu een behoorlijk stuk verder weg na de recente terugval.

Steun nu eerst de zone 708-710 punten, later blijft de oude top rond de 702-703 punten uiteraard een doel. Een beter beeld krijg ik rond de laatste echte top van de index die we rond de 688-690 punten zien uitkomen. We blijven vooral verder kijken naar de ontwikkelingen op Wall Street waar nu de eerste kwartaalcijfers binnen stromen, nu maar eens zien hoe de markten daar verder op gaan reageren de komende 2-3 weken want er komen nu ook een paar kanonnen voorbij volgende week.

DAX index:

De DAX deed het goed vrijdag en wist uit te breken boven die lange reeks vlakke toppen. Er moest hoe dan ook snel een uitbraak komen, dat is logisch alleen wisten we niet of dat omhoog of omlaag zou zijn? De spike omhoog van vrijdag kan natuurlijk een "BULL TRAP" worden, dat zien we begin volgende week wel.

De volgende richtpunten omhoog worden nu de 15.500 punten, de 15.700 en de 15.850 punten. Vrijwel alle indices, dus ook de DAX, blijven hoe dan ook rijp voor een grotere correctie alleen is het wachten op het moment dat die op gang komt. Steun zien we nu rond de 15.300, de 15.150-15.200 punten. Het 20- en 50-MA liggen nu wel heel ver onder de koers, ook de indicatoren blijven zeer hoog nu.

Er is zoals u merkt meer dan genoeg ruimte omlaag voor wat betreft de DAX voor dat de index echt in de problemen komt.

Euro, olie en goud:

De euro zien we nu rond de 1.1965 dollar, de prijs van een vat Brent olie komt uit op 66,5 dollar terwijl een troy ounce goud nu op 1775 dollar staat.

De LIVEBLOG en Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

Inter Market overzicht op slotbasis ...

LET OP !! Vanaf vandaag een nieuwe aanbieding die loopt vanaf nu tot 1 JULI voor €39 (Polleke Trading €49) ... Via de site en dan de Tradershop kunt zich inschrijven en daar kunt u als lid de lopende posities met alle details altijd inzien. Ga naar de Tradershop en schrijf u meteen in ... https://www.usmarkets.nl/tradershop

Met vriendelijke groet,

Guy Boscart

TA - Apple, Alibaba, Plug Power en Virgin Galactic

Apple Apple beweegt de afgelopen 9 maanden zijwaarts. De range ligt tussen de 107 — 138 USD. Begin januari wist de koers welgeteld 3 handelsdagen opwaarts uit te breken, een ‘false move’ dus. Het vertrouwen was even weg met verkoopdruk als gevolg. Er werd pas steun gevonden op 116…

Lees verder »Markt snapshot Europa 19 april

MARKET VIEW

Financial spreadbetters expect London's FTSE to open 2 points lower at 7,018, Frankfurt's DAX to open 28 points higher at 15,488 and Paris' CAC to open 20 points higher at 6,307.

Asian shares hovered near 1-1/2 week highs helped by expectations monetary policy will remain accommodative the world over, while COVID-19 vaccine rollouts help ease fears of another dangerous wave of coronavirus infections.

Oil prices were lower as rising coronavirus infections in India and other countries prompted concerns that stronger measures to contain the pandemic will hit economic activity, along with demand for commodities such as crude.

GLOBAL TOP NEWS

Italy risks missing an April 30 deadline for submitting a final version of its Recovery Plan to the European Commission because Brussels is not satisfied with several aspects of the drafts presented so far, two sources close to the matter said.

Japan's exports posted their strongest growth in more than three years in March, led by a surge in China-bound shipments, in a sign the economic recovery from last year's deep coronavirus slump remains intact.

Ant Group is exploring options for founder Jack Ma to divest his stake in the financial technology giant and give up control, as meetings with Chinese regulators signaled to the company that the move could help draw a line under Beijing's scrutiny of its business, according to a source familiar with regulators' thinking and two people with close ties to the company.

EUROPEAN COMPANY NEWS

Swedish carmaker Volvo Cars said it has signed an agreement to provide cars to the autonomous driving technology unit of China's top ride-hailing firm, Didi Chuxing, for its self-driving test fleet.

German automaker BMW is aiming for a quarter of its sales in China to be pure battery electric vehicles by 2025, its China chief Jochen Goller said.

The Canadian province of Ontario will begin offering AstraZeneca's COVID-19 vaccine on Tuesday to people turning 40 or older this year, according to a government source.

TODAY'S COMPANY ANNOUNCEMENTS

Astaldi SpA Annual Shareholders Meeting

Banca Piccolo Credito Valtellinese SpA Annual Shareholders Meeting

Fenix Entertainment SpA Annual Shareholders Meeting

Franchi Umberto Marmi SpA Annual Shareholders Meeting

Iervolino Entertainment SpA Annual Shareholders Meeting

Portobello SpA Annual Shareholders Meeting

Risanamento SpA Annual Shareholders Meeting

ECONOMIC EVENTS (All times GMT)

0900 (approx.) Euro Zone Construction Output mm for Feb: Prior 0.83%

0900 (approx.) Euro Zone Current Account NSA for Feb: Prior 5.8 bln EUR

0900 Euro Zone Current Account SA for Feb: Prior 30.50 bln EUR