Liveblog Archief dinsdag 20 april 2021

Markt snapshot Wall Street 20 april

TOP NEWS

• J&J reports $100 million in vaccine sales as results top forecastsJohnson & Johnson beat expectations for quarterly revenue and profit and raised dividend payouts to shareholders, while reporting $100 million in sales for its COVID-19 vaccine, whose use was paused by U.S. regulators last week.

• DBS, StanChart weigh bids as Citi retreats from Asia consumer business - sources

Banks including DBS Group, Mitsubishi UFJ Financial Group, OCBC and Standard Chartered are set to bid for parts of Citigroup's consumer business in Asia, people with direct knowledge of the matter said.

• Texas police to demand Tesla crash data as Musk denies Autopilot use

Texas police will serve search warrants on Tesla to secure data from a fatal vehicle crash, a senior officer told Reuters on Monday, after CEO Elon Musk said company checks showed the car's Autopilot driver assistance system was not engaged.

• Canadian National to make $30 billion bid for Kansas City- WSJ

Canadian National Railway plans to make a $30 billion bid for railroad operator Kansas City Southern, the Wall Street Journal reported, citing people familiar with the matter.

• Why a U.S. hospital and oil company turned to facial recognition

Deployments of facial recognition from Israeli startup AnyVision show how the surveillance software has gained adoption across the United States even as regulatory and ethical debates about it rage.

BEFORE THE BELL

Wall Street futures slipped, as a spike in Treasury yields reignited inflation worries, while investors await earnings report from Netflix. The dollar was slightly higher. European stockseased, weighed by fall in UK tobacco companies shares. Asian equities settled down over worries of another lockdown. Oil prices jumped, supported by a disruption to Libyan exports and expectations of a drop in U.S. inventories. Gold prices edged higher.

STOCKS TO WATCH

Results

• International Business Machines Corp: The company recorded highest quarterly sales growth in more two years and beat Wall Street targets on Monday, boosted by its bets in the high-margin cloud computing business. Sales from its cloud computing services jumped 21% to $6.5 billion in the quarter. Total revenue rose nearly 1% to $17.73 billion in the quarter, beating analysts' average estimate of $17.35 billion. Net income fell to $955 million, or $1.06 per share, in the quarter ended March 31, from $1.18 billion, or $1.31 per share, a year earlier. Excluding items, the company earned $1.77 per share, beating market expectation of $1.63.

• Johnson & Johnson: The company, whose COVID-19 vaccine was put on pause last week to review reports of rare blood clots, reported $100 million in first-quarter sales of the shot and tightened its forecast for profits this year. The company now expects full-year adjusted profit of $9.42 to $9.57 per share from its prior forecast of $9.40 to $9.60 per share, after sales of its cancer drugs helped quarterly profit rise nearly 7%. Net earnings rose to $6.20 billion, or $2.32 per share, in the first quarter from $5.80 billion, or $2.17 per share, a year earlier. Separately, J&J is seeking to conduct a local clinical trial in India for its single-dose COVID-19 vaccine, which was paused in the United States last week on reports of rare blood clots.

• United Airlines Holdings Inc: The airline on Monday reported a bigger-than-expected $2.4 billion adjusted net loss for the first quarter, as fuel costs rose and the airline operated fewer flights amid continued weak demand due to the COVID-19 pandemic. Average fuel cost climbed nearly 30% to $1.74 per gallon in the quarter from the previous three months, while passenger traffic fell 52% compared to the same period in 2020. United Airlines said it expects fuel costs to rise by another 5% in the second quarter. United's adjusted net loss was about $2.40 billion for the first quarter, compared with analysts' average estimate for a loss of about $2.23 billion.

In Other News

• Alibaba Group Holding Ltd: China's market regulator is investigating a joint venture between e-commerce giant Alibaba and Minmetals Development, Minmetals said on Monday, amid a broad antitrust clampdown on internet firms. Minmetals said in a statement that it received a notice from the State Administration for Market Regulation in recent days about an investigation into the joint venture formed in 2015, in which Alibaba transferred its 44% stake to an unrelated firm in 2019.

• Alphabet Inc & Apple Inc: Senior executives with Alphabet's Google and Apple will testify on Wednesday about antitrust concerns related to their app stores along with executives of three companies which rely on those online stores, the leaders of the Senate Judiciary Committee's antitrust panel said. The hearing will include Google Government Affairs Senior Director Wilson White and Apple's Chief Compliance Officer Kyle Andeer as well as Spotify's Chief Legal Officer Horacio Gutierrez, Match Group's Chief Legal Officer Jared Sine and Kirsten Daru, general counsel for Tile.

• Boeing Co: Dubai Aerospace Enterprise (DAE) announced an order for 15 Boeing 737 MAX 8 jets, signalling an end to the aircraft leasing giant's pricing standoff with planemakers. The order, worth $1.8 billion at list prices, though discounts are common, also signals a further show of confidence in the narrow-body jet that until recently was banned worldwide.

• BP PLC: Police in China's southern Guangdong province have detained several people, including two senior staff of a BP joint venture, in connection with an investigation into suspected illicit fuel trading, three people said. The detentions come after Guangdong, China's largest fuel consuming province, launched in February an investigation into suspected illicit trading between 2018 and 2020 of light cycle oil (LCO), a refinery by-product widely used to blend into diesel, said one of the sources.

• Caesars Entertainment Inc: Bookmaker William Hill said a British court had approved its takeover by U.S.-based casino operator Caesars, despite concerns raised by minority shareholder HBK about disclosures around the deal. HBK had opposed the scheme of arrangement for the 2.9-billion-pound deal, saying the terms of an existing joint venture between the two firms were not adequately disclosed by William Hill last year.

• Citigroup Inc: Banks including DBS Group, Mitsubishi UFJ Financial Group, OCBC and Standard Chartered are set to bid for parts of Citigroup's consumer business in Asia, people with direct knowledge of the matter told Reuters. The sale process will start within a couple of weeks, the people added, declining to be named as they were not authorised to speak to media.

• Coinbase Global Inc: Options on Coinbase are set to start trading on Nasdaq options exchanges from Tuesday, less than a week after the cryptocurrency exchange went public, a representative for the exchange said. The launch of the equity options on the stock will offer a new way for investors to bet on the fortunes of Coinbase, which recently went public in a high-profile debut on the Nasdaq that briefly valued it at more than $100 billion.

• Exxon Mobil Corp: The company on Monday floated a proposal for a public-private carbon storage project that would collect planet-warming carbon dioxide emissions from U.S. petrochemical plants and bury them in deep under the Gulf of Mexico. The plan would require "$100 billion or more" from companies and government agencies to store 50 million metric tons of CO2 by 2030, with capacity potentially doubling by 2040, Joe Blommaert, president of Exxon's Low Carbon Solutions business, said in an interview.

• Kansas City Southern: Canadian National Railway plans to make a $30 billion bid for railroad operator Kansas City Southern, the Wall Street Journal reported, citing people familiar with the matter. Canadian National plans to offer $325 for each Kansas City Southern share, including $200 a share in cash and 1.059 Canadian National shares, the report said. The offer represents about a 20% premium to Canadian Pacific Railway Ltd's March offer of $275 a share for Kansas City Southern, WSJ said.

• PayPal Holdings Inc: Venmo, the peer-to-peer payment service owned by PayPal, said it has started allowing users to buy, hold and sell cryptocurrencies on its app, a step that could inspire more mainstream adoption of the asset class. Venmo users will be able to buy bitcoin, ethereum, litecoin and bitcoin cash for as little as $1 and publish transactions on the app's feed, the company said.

• Pfizer Inc: Thailand is seeking between five and 10 million doses of Pfizer and BioNTech's coronavirus vaccine, its prime minister said, as the government seeks to shore-up supplies while battling its fastest-spreading outbreak so far. "We're still waiting for quotations and terms and conditions," Prime Minister Prayuth Chan-ocha told reporters, adding the targeted delivery period for the Pfizer-BioNtech vaccines was July to year-end.

• Rio Tinto Ltd: The global miner reported lower quarterly iron ore output as wet weather and labour shortages impacted its mine and port operations in Western Australia. Above average wet weather in the mines and workforce availability disrupted maintenance during the quarter, Rio said, while Tropical Cyclone Seroja impacted operations in April. Production for the quarter stood at 76.4 million tonnes, down 2% from the same period last year.

• Sinovac Biotech Ltd: Sinovac has supplied 260 million doses of its COVID-19 vaccine globally, with over 60% supplied to countries outside China, the company's chief executive Yin Weidong said. The company is producing more than 6 million doses of COVID-19 vaccine per day, Yin said at the annual Boao Forum for Asia, the region's answer to Davos.

• Tesla Inc: Texas police will serve search warrants on Tesla on Tuesday to secure data from a fatal vehicle crash, a senior officer told Reuters on Monday, after CEO Elon Musk said company checks showed the car's Autopilot driver assistance system was not engaged. Mark Herman, Harris County Constable Precinct 4, said evidence including witness statements clearly indicated there was nobody in the driver's seat of the Model S when it crashed into a tree, killing two people, on Saturday night.

• Vale SA: Iron ore production at Brazil's Vale fell sharply in the first quarter on a sequential basis, but rose compared to the same period a year ago, buoyed by the ramp-up of multiple key mine complexes. In a Monday securities filing, the company reported quarterly production of 68.045 million tonnes, up 14.2% from the first quarter last year, but down 19.5% from the fourth quarter.

PREVIEWInvestors turn to growth stocks' results after strong earnings start

On the heels of blockbuster earnings from major U.S. banks, investors are focused on whether an upcoming batch of earnings from major technology-related companies can sustain the season's early momentum.

ANALYSTS' RECOMMENDATION

• Alignment Healthcare Inc: Piper Sandler initiates coverage with overweight rating, as a result of a model that delivers high quality, cost-effective care with strong member satisfaction and technology deployment that shows potential in its scalability.

• Boston Beer Company Inc: Evercore ISI raises price target to $1500 from $1300, supported by strong sales, increase in household penetration and purchase frequency.

• Morgan Stanley: Credit Suisse raises price target to $98 from $95, following the company's solid first-quarter results and record flows in wealth management.

ECONOMIC EVENTS

No economic indicators are scheduled for release.

COMPANIES REPORTING RESULTS

Abbott Laboratories: Expected Q1 earnings of $1.27 per share

CSX Corp: Expected Q1 earnings of 95 cents per share

Edwards Lifesciences Corp: Expected Q1 earnings of 47 cents per share

Intuitive Surgical Inc: Expected Q1 earnings of $2.63 per share

Lockheed Martin Corp: Expected Q1 earnings of $6.31 per share

Netflix Inc: Expected Q1 earnings of $2.97 per share

W. R. Berkley Corp: Expected Q1 earnings of 81 cents per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Asbury Automotive Group Inc: Annual Shareholders Meeting

0800 Comerica Inc: Q1 earnings conference call

0800 Whirlpool Corp: Annual Shareholders Meeting

0800 Xerox Holdings Corp: Q1 earnings conference call

0830 Carnival Corp: Annual Shareholders Meeting

0830 Coca-Cola Co: Annual Shareholders Meeting

0830 F.N.B. Corp: Q1 earnings conference call

0830 Iridium Communications Inc: Q1 earnings conference call

0830 Johnson & Johnson: Q1 earnings conference call

0830 ManpowerGroup Inc: Q1 earnings conference call

0830 Omnicom Group Inc: Q1 earnings conference call

0830 Procter & Gamble Co: Q3 earnings conference call

0830 Synovus Financial Corp: Q1 earnings conference call

0900 American Electric Power Company Inc: Annual Shareholders Meeting

0900 Churchill Downs Inc: Annual Shareholders Meeting

0900 Crown Holdings Inc: Q1 earnings conference call

0900 Fifth Third Bancorp: Q1 earnings conference call

0900 Harley-Davidson Inc: Q1 earnings conference call

0900 Harsco Corp: Annual Shareholders Meeting

0900 Parsons Corp: Annual Shareholders Meeting

0900 Philip Morris International Inc: Q1 earnings conference call

0900 Travelers Companies Inc: Q1 earnings conference call

0930 Abbott Laboratories: Q1 earnings conference call

0930 Erie Indemnity Co: Annual Shareholders Meeting

0930 Moody's Corp: Annual Shareholders Meeting

0930 Pinnacle Financial Partners Inc: Q1 earnings conference call

1000 American Campus Communities Inc: Q1 earnings conference call

1000 AutoNation Inc: Q1 earnings conference call

1000 Bank of America Corp: Annual Shareholders Meeting

1000 Boeing Co: Annual Shareholders Meeting

1000 Dover Corp: Q1 earnings conference call

1000 Hexcel Corp: Q1 earnings conference call

1000 KeyCorp: Q1 earnings conference call

1000 Simmons First National Corp: Q1 earnings conference call

1000 Steel Dynamics Inc: Q1 earnings conference call

1030 United Airlines Holdings Inc: Q1 earnings conference call

1100 Badger Meter Inc: Q1 earnings conference call

1100 Equity LifeStyle Properties Inc: Q1 earnings conference call

1100 GATX Corp: Q1 earnings conference call

1100 Kontoor Brands Inc: Annual Shareholders Meeting

1100 Liberty Oilfield Services Inc: Annual Shareholders Meeting

1100 Lockheed Martin Corp: Q1 earnings conference call

1100 M&T Bank Corp: Annual Shareholders Meeting

1100 Prosperity Bancshares Inc: Annual Shareholders Meeting

1100 Shenandoah Telecommunications Co: Annual Shareholders Meeting

1100 Silvergate Capital Corp: Q1 earnings conference call

1100 Wintrust Financial Corp: Q1 earnings conference call

1200 Adobe Inc: Annual Shareholders Meeting

1200 NCR Corp: Annual Shareholders Meeting

1200 Pinnacle Financial Partners Inc: Annual Shareholders Meeting

1200 U.S. Bancorp: Annual Shareholders Meeting

1300 Concentrix Corp: Annual Shareholders Meeting

1300 Public Service Enterprise Group Inc: Annual Shareholders Meeting

1330 Nextera Energy Partners LP: Annual Shareholders Meeting

1430 PS Business Parks Inc: Annual Shareholders Meeting

1630 CSX Corp: Q1 earnings conference call

1630 Interactive Brokers Group Inc: Q1 earnings conference call

1630 Intuitive Surgical Inc: Q1 earnings conference call

1700 Forestar Group Inc: Q2 earnings conference call

1700 Hancock Whitney Corp: Q1 earnings conference call

1700 Stride Inc: Q3 earnings conference call

1700 Umpqua Holdings Corp: Annual Shareholders Meeting

1700 W. R. Berkley Corp: Q1 earnings conference call

1730 Edwards Lifesciences Corp: Q1 earnings conference call

1800 Netflix Inc: Q1 earnings conference call

EX-DIVIDENDS

Clorox Co: Amount $1.11

Colgate-Palmolive Co: Amount $0.45

Eagle Bancorp Inc: Amount $0.25

Greenbrier Companies Inc: Amount $0.27

Lennar Corp: Amount $0.25

Lowe's Companies Inc: Amount $0.60

West Pharmaceutical Services Inc: Amount $0.17

Zoetis Inc: Amount $0.25

Wake-up call: Markt stapje terug, nu het vervolg afwachten

De start van de week was niet conform gewoonte want alle indices laten verlies zien, op maandag krijgen we meestal een extra bonus erbij wat betreft de markten. Vanmorgen probeert alles zich wat te herpakken maar veel is het niet, wel blijven de toppen niet ver zodat het opnieuw testen ervan een kwestie blijft van 1 a 2 goeie dagen. Wel zien we de SOX index verder inleveren, ook de Dow Transport blijft zwak in vergelijking met de rest.

De markt momenteel:

Dat de markt even een stapje terug doet lijkt me meer dan normaal maar het wil natuurlijk niet zeggen dat het voorbij hoeft te zijn met de sterke fase ofwel de rally die al een tijdje loopt. Voor dat het zo ver is zullen de indices minder divergentie moeten vertonen en zal alles een goeie 2 tot 3% onder de toppen moeten staan. We merken wel dat enkele pioniers van de rally ofwel de sectoren die de rally voor een groot deel hebben aangewakkerd het nu veel minder goed doen. Dan kijk ik vooral naar de SOX index, de Dow Transport index en nu toch ook de Russel 2000 index (small-caps) die niet echt meer de power van eerder laten zien.

Gisteren kwamen er wel wat cijfers die goed werden ontvangen, vooral IBM deed het nabeurs goed want het aandeel won nabeurs 3%.

Olieprijs:

De olieprijs sluit wat hoger en stijgt ook vanmorgen weer wat, een vat Brent olie kost nu 67,75 dollar. De olie zit weer in een sterke fase want ook vorige week behaalde de olie al meer dan 6%. Aan de andere kant herinneren we ons ook nog 20 april 2020 uiteraard, het was de dag dat de olie negatief ging en zelfs een niveau haalde van -37,63 dollar. Zie hieronder de afbeelding. Om u nog maar eens duidelijk te maken met welke markt we momenteel te maken hebben, het onmogelijke wordt vaak mogelijk. Ook nu zien we bepaalde dingen die je haast voor onmogelijk zag amper een jaar of 2-3 geleden.

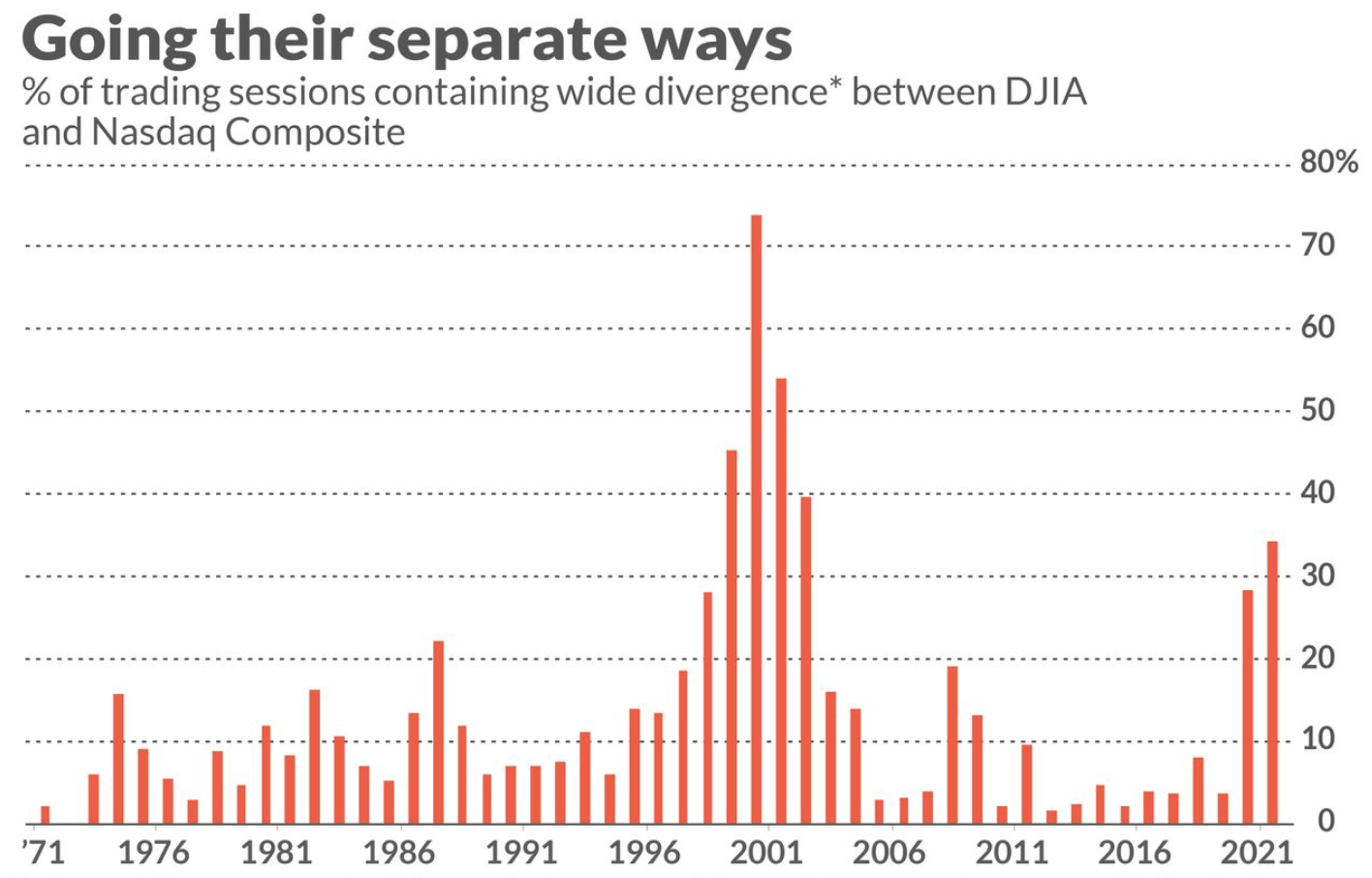

Opvallende divergenties:

Aan de andere kant is het ook zo dat we op Wall Street en ook tussen de verschillende regio's enorme divergenties zien en dat nu toch al een lange tijd na elkaar. Hieronder ziet u via een grafiek dat het niet vaak voorkomt maar als het voorkomt (vanaf begin jaren '70) er telkens wel een grote correctie op volgde. De situatie wordt met de dag gevaarlijker als u het mij vraagt. We zien bij de opeenvolgende divergenties die er nu zijn niveaus worden bereikt die er ook waren in 2000-2001, u weet wel ... dat was net voordat de Nasdaq met 85% omlaag moest.

Het gaat om de divergentie tussen de Dow Jones en de Nasdaq ofwel tussen de traditionele en de nieuwe economie.

Resultaat dit jaar verloopt naar wens maar rustig:

De eerste 3 maanden dit jaar werden positief afgerond en met december erbij komen we nu uit op 4 maanden na elkaar dat er winst werd behaald via de signalen. Dat moest voorzichtig gebeuren want ik hou in het achterhoofd rekening met het scenario wat ik net aangaf, over een aanstaande grote correctie over de gehele markt. Niettemin blijf ik rustig verder opbouwen wat betreft de posities.

Deze manier van werken wil ik hoe dan ook proberen aan te houden, het handelen onder de huidige omstandigheden krijg ik steeds beter onder controle en ik probeer met kleine posities zo als goed mogelijk te werken voor de leden. Onderaan deze update ziet u nog een overzicht met hoe de maand maart werd afgerond en hoe we er dit jaar voor staan wat betreft het resultaat via de signalen die we naar onze leden versturen.

LET OP !! Vanaf vandaag een nieuwe aanbieding die loopt vanaf nu tot 1 JULI voor €39 (Polleke Trading €49) ... Via de site en dan de Tradershop kunt zich inschrijven en daar kunt u als lid de lopende posities met alle details altijd inzien. Ga naar de Tradershop en schrijf u meteen in ... https://www.usmarkets.nl/tradershop

Technische conditie Wall Street:

Wat betreft Wall Street wat terugval over de gehele lijn, wel blijven de toppen niet ver weg uiteraard. Opvallend is dat enkele belangrijke indices het nu laten afweten en dat is opvallend omdat ze eerder de voorlopers van de rally waren. Zoals ik al aangaf zijn dat de SOX (semi-conductor index), de Dow Transport index en de Russel 2000 (Small-Caps).

De andere en grotere indices op Wall Street blijven dus dicht bij hun toppen hangen en er valt daarover nog niet zoveel te zeggen. Technisch blijft alles dus op recordjacht zodat de korte, mid-lange en lange termijn trend nog altijd positief blijft. Aan de andere kant staan de indicatoren zeer hoog. We merken dat er weinig kopers overblijven maar er zijn dus ook nog te weinig verkopers te vinden momenteel.

Wel blijven vooral letten op de gemiddelde waardering, bij de S&P 500 zitten we nu al op 42.39 keer de winst (gemiddeld).

Technische conditie AEX en DAX:

AEX index:

Bij de AEX zien we maandag een terugval van 5 punten met een slot op 712 punten, pas later toen Wall Street verder moest inleveren ging de AEX future ook verder omlaag zodat we mogelijk wat lager gaan openen vandaag.

Steun nu eerst de zone 708-710 punten, later blijft de oude top rond de 702-703 punten uiteraard een doel. Een beter beeld krijg ik rond de laatste echte top van de index die we rond de 688-690 punten zien uitkomen. We blijven vooral verder kijken naar de ontwikkelingen op Wall Street. Weerstand nu eerst de zone 712-715 met later de 718 en de 725 punten.

DAX index:

De DAX moest ook wat terug maandag, we zien steun rond de 15.300 en de 15.150-15.200 punten. Vrijwel alle indices, dus ook de DAX, blijven hoe dan ook rijp voor een grotere correctie alleen is het wachten op het moment dat die op gang komt.

De richtpunten omhoog worden nu de 15.500 punten, de 15.700 en de 15.850 punten.

Euro, olie en goud:

De euro zien we nu rond de 1.206 dollar, de prijs van een vat Brent olie komt uit op 67,75 dollar terwijl een troy ounce goud nu op 1772 dollar staat.

De LIVEBLOG en Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

Inter Market overzicht op slotbasis ...

LET OP !! Vanaf vandaag een nieuwe aanbieding die loopt vanaf nu tot 1 JULI voor €39 (Polleke Trading €49) ... Via de site en dan de Tradershop kunt zich inschrijven en daar kunt u als lid de lopende posities met alle details altijd inzien. Ga naar de Tradershop en schrijf u meteen in ... https://www.usmarkets.nl/tradershop

Met vriendelijke groet,

Guy Boscart

TA AEX, KBC, VW en meer

Op deze vroege dinsdagochtend ga ik zes grafieken met u bekijken. Het merendeel zijn verzoeken van lezers. Ik voeg er zelf de AEX aan toe. Laten we maar direct met het eerste aandeel beginnen.Het eerste aandeel is een Duits aandeel en is op verzoek van lezeres helene. De koers van het aandeel…

Lees verder »Markt snapshot Europa 20 april

MARKET VIEW

Financial spreadbetters expect London's FTSE to open 15 points lower at 7,005, Frankfurt's DAX to open 69 points lower at 15,391 and Paris' CAC to open 9 points higher at 6,296.

Japanese shares fell sharply, weighed down by worries that possible reintroduction of COVID-19 emergency measures in the country's biggest cities would slow the economic recovery.

Oil prices rose as a weaker U.S. dollar supported commodities and on expectations that crude inventories fell in the United States, the world's biggest oil user, though rising coronavirus cases in Asia capped gains.

GLOBAL TOP NEWS

Chinese President Xi Jinping said that the global governance system should be made more equitable and fair, and that rules set by one country or some nations cannot be imposed on others.

U.S. President Joe Biden met on Monday with a bipartisan group of lawmakers who have all served as governors or mayors, as the White House seeks a deal on his more than $2 trillion jobs and infrastructure proposal.

Southeast Asian countries will discuss the crisis in Myanmar at a summit in Jakarta on Saturday, the ASEAN bloc's secretariat said, after the European Union imposed its toughest sanctions yet on the junta that seized power there on Feb. 1.

EUROPEAN COMPANY NEWS

A Milan court on Monday rejected a multibillion-euro damage request by Mediaset in a case stemming from the failed sale of the Italian broadcaster's pay-TV arm to French media giant Vivendi, a court document showed.

Creval on Monday said the higher takeover price offered by Credit Agricole to buy the Italian lender was still inadequate, in a blow to the French group's plan to expand in its biggest market outside France.

Broadcasters who have spent billions of dollars to screen Champions League soccer have condemned the plan by top European clubs to form a breakaway Super League as a threat to the future of the game that will not succeed.

TODAY'S COMPANY ANNOUNCEMENTS

4Sc AG Q1 2021 Earnings Call

Aberdeen Emerging Markets Investment Company Ltd Annual Shareholders Meeting

American Shipping Company ASA Annual Shareholders Meeting

ASM International NV Q1 2021 Earnings Release

Associated British Foods PLC HY 2021 Earnings Call

Audioboom Group PLC Annual Shareholders Meeting

Avanza Bank Holding AB Q1 2021 Earnings Release

Banca Carige SpA Cassa di Risparmio di Genova e Imperia Annual Shareholders Meeting

Banco Bilbao Vizcaya Argentaria SA Annual Shareholders Meeting

Basware Oyj Q1 2021 Earnings Release

BE Group AB (publ) Q1 2021 Earnings Release

Breedon Group PLC Annual Shareholders Meeting

Bufab AB (publ) Q1 2021 Earnings Release

Byggmax Group AB Q1 2021 Earnings Release

Carel Industries SpA Annual Shareholders Meeting

Carnival PLC Annual Shareholders Meeting

Colas SA Annual Shareholders Meeting

Covivio SA Annual Shareholders Meeting

DeA Capital SpA Annual Shareholders Meeting

Enagas SA Q1 2021 Earnings Call

Getinge AB Q1 2021 Earnings Release & Annual Shareholders Meeting

GlobalData PLC Annual Shareholders Meeting

Infrastrutture Wireless Italiane SpA Annual Shareholders Meeting

Italgas SpA Annual Shareholders Meeting

L'Oreal SA Annual Shareholders Meeting

Metropole Television SA Annual Shareholders Meeting

Nordic Semiconductor ASA Q1 2021 Earnings Call

Petrofac Ltd FY 2020 Earnings Call

Porvair PLC Annual Shareholders Meeting

PostNL NV Annual Shareholders Meeting

Recordati Industria Chimica e Farmaceutica SpA Annual Shareholders Meeting

Saes Getters SpA Annual Shareholders Meeting

Sandvik AB Q1 2021 Earnings Release

Scatec ASA Annual Shareholders Meeting

Servizi Italia SpA Annual Shareholders Meeting

Sika AG Annual Shareholders Meeting

Softec SpA Annual Shareholders Meeting

Temenos AG Q1 2021 Earnings Call

Time Out Group PLC Shareholders Meeting

Verbund AG Annual Shareholders Meeting

Vianini SpA Annual Shareholders Meeting

Vontobel Holding AG Annual Shareholders Meeting

ECONOMIC EVENTS (All times GMT)

0600 (approx.) Germany Producer Prices mm for Mar: Expected 0.6%; Prior 0.7%

0600 (approx.) Germany Producer Prices yy for Mar: Expected 3.3%; Prior 1.9%

0600 (approx.) United Kingdom Claimant Count Unemployment Change for Mar: Prior 86,600

0600 (approx.) United Kingdom ILO Unemployment Rate for Feb: Expected 5.1%; Prior 5.0%

0600 (approx.) United Kingdom Employment Change for Feb: Expected -150,000; Prior -147,000

0600 (approx.) United Kingdom Average Week Earnings 3M yy for Feb: Expected 4.8%; Prior 4.8%

0600 (approx.) United Kingdom Average Earnings (Ex-Bonus) for Feb: Expected 4.2%; Prior 4.2%

DEBT AUCTIONS

Germany - Reopening of 2-year government debt auction.

Spain - Reopening of 3-month and 9-month government debt auctions.

Switzerland - Reopening of 3-month government debt auction.

United Kingdom - Reopening of 3-year government debt auction