Liveblog Archief woensdag 21 april 2021

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Ruwe Olievoorraden | Actueel: 0,594M Verwacht: -2,975M Vorige: -5,889M |

Markt snapshot Wall Street 21 april

TOP NEWS

• Halliburton profit rises as oilfield activity rebounds on higher crude prices

Halliburton reported a 6% rise in first-quarter adjusted profit from the previous three months, as a rebound in oil prices from pandemic lows fueled drilling activity and demand for oilfield services.

• Netflix subscriber growth slows after pandemic boom

Netflix said slower production of TV shows and movies during the pandemic hurt subscriber growth in the first quarter, sending shares of the world's largest streaming service down on Tuesday.

• Health insurer Anthem raises 2021 profit target on upbeat quarter

Anthem raised its profit target for 2021, as strength in its pharmacy benefits management business helped the U.S. health insurer beat first-quarter earnings estimates.

• FOCUS-How a sweetheart deal gives GameStop CEO a $179 million goodbye gift

Gamestop chief executive George Sherman can step down this summer with a $179 million windfall that dwarfs CEO salaries at many larger corporations thanks to a sweetheart deal that was turbocharged by this year's furious meme stock rally, compensation experts said.

• February freeze to hit refiners' earnings as investors look to demand

Refiners are expected to report big first-quarter losses after February's winter storm froze activity along the Gulf Coast, but as more Americans are vaccinated against COVID-19, analysts expect the industry's outlook to brighten as demand rebounds.

BEFORE THE BELL

U.S. stock index futures were little changed after Wall Street closed lower in the previous session as the surging global coronavirus infections hit travel-related stocks. European sharesrebounded on upbeat corporate earnings. Asian equities ended in the red as concerns about economic growth hurt investor sentiment. The dollar index and gold prices edged higher on safe-haven appeal. Oil dropped as increasing COVID-19 cases in India dented fuel demand outlook. Whirlpool and Chipotle are among the companies scheduled to report results after markets close.

STOCKS TO WATCH

Results

• Anthem Inc: The U.S. health insurer raised its profit target for 2021, as strength in its pharmacy benefits management business helped it beat first-quarter earnings estimates. The company now expects to record adjusted net profit of more than $25.10 per share in 2021, up from its previous forecast of over $24.50 per share. Excluding items, Anthem earned $7.01 per share in the quarter ended March 31, compared with analysts' average estimate of $6.51.

• ASML Holding NV: ASML, one of the biggest suppliers to semiconductor companies, reported a better-than-expected net income for the first quarter and raised its full-year sales forecast, citing strong demand amid a global computer chip shortage. The company now sees full year sales growth at 30%, up from its forecast of at least 10% in January. Sales in the first quarter were 4.36 billion euros. ASML company posted a quarterly net profit of 1.33 billion euros, while analysts had expected 1.08 billion euros, on revenue of 4.02 billion euros.

• Baker Hughes Co: The oilfield equipment and services provider's top boss reiterated he is "cautiously optimistic" about oil demand recovering this year from the coronavirus blow, echoing a view he shared on the company's last earnings call. The company reported a 40% fall in first-quarter adjusted profit, compared to the fourth, as the pandemic's hit on fuel demand lingers, weighing on demand for oilfield equipment and services lower. Baker Hughes said its adjusted operating income fell to $270 million in the three months ended March 31, from $462 million in the fourth quarter.

• CSX Corp: The U.S. railroad operator reported lower-than-expected quarterly profit on Tuesday after severe "polar vortex" winter storms, COVID-19 disruptions and fuel costs weighed on results. The company, which operates in the eastern United States, had first-quarter net earnings of $706 million, or 93 cents per share, down from $770 million, or $1.00 per share, a year earlier. Results from the latest quarter missed Wall Street's average estimate by 2 cents per share. Revenue fell 1% to $2.81 billion, led by declines in automotive, metals and equipment, chemicals and coal.

• Halliburton Co: The company reported a 6% rise in first-quarter adjusted profit from the previous three months, as a rebound in oil prices from pandemic lows fueled drilling activity and demand for oilfield services. Adjusted net income attributable to company rose to $170 million, or 19 cents per share, in the quarter ended March 31, from the $160 million, or 18 cents per share, in the fourth quarter.

• Lithia Motors Inc: The auto retailer topped Wall Street estimates for first-quarter profit as the auto retailer benefited from strong demand and higher vehicle prices. Net income was $156.2 million, or $5.81 per share, in the quarter ended March 31, compared with $46.2 million, or $1.97 per share, a year earlier. Total revenue surged 55% to $4.34 billion. Excluding items, the company earned $5.89 per share, compared with a Refinitiv IBES estimate of $4.76.

• Nasdaq Inc: The exchange operator reported a better-than-expected quarterly profit, boosted by strength in its trading business against a backdrop of high market volatility and a surge in initial public offerings. The company posted an adjusted net income of $1.96 per share for the first quarter ended March 31, compared to estimates of $1.74 per share. Revenue from Nasdaq's market services unit, its biggest business, jumped 20% to $338 million.

• Netflix Inc: The company said slower production of TV shows and movies during the pandemic hurt subscriber growth in the first quarter. Roughly 3.98 million people signed up for Netflix from January through March, below the 6.25 million average projection of analysts surveyed by Refinitiv. Netflix estimated it will add just 1 million new streaming customers in the second quarter. Analysts had expected a forecast of nearly 4.8 million. Excluding items, the company earned $3.75 per share in the first quarter, beating analyst estimates of $2.97 per share.

• Telefonaktiebolaget LM Ericsson: Sweden's Ericsson reported first-quarter core earnings above market estimates as strong 5G equipment sales offset a loss of royalty income due to a patent fight with Samsung Electronics. Quarterly adjusted operating earnings rose to 5.3 billion Swedish crowns from 4.6 billion crowns a year ago, beating the mean forecast of 5.0 billion crowns. Total revenue, which benefited from bans in several countries on the use of technology from China's Huawei, was 49.8 billion crowns, unchanged from last year due in part to currency headwinds. It missed estimates of 53.42 billion crowns.

IPOs

• UiPath Inc: The automation technology startup said on Tuesday it sold shares in its initial public offering (IPO) above its target range to raise $1.34 billion. The company said it priced 23.89 million shares at $56 per share. UiPath's shares are scheduled to start trading on Wednesday on the New York Stock Exchange under the symbol "PATH".

In Other News

• Amazon.com Inc: The company said it is rolling out biometric technology at its Whole Foods stores around Seattle starting on Wednesday, letting shoppers pay for items with a scan of their palm. The system, called Amazon One, lets customers associate a credit card with their palm print. It offers a contact-less alternative to cash and card payments, Amazon said.

• AstraZeneca PLC: Israel no longer wants AstraZeneca's COVID-19 vaccine and is exploring with the company whether a big shipment in the pipeline could be sent elsewhere, Israel's pandemic coordinator said. "We are trying to find the best solution. After all, we don't want (the vaccines) to get here and have to throw them into the trash," the official, Nachman Ash, told Army Radio, saying Israel's needs were being met by other suppliers.

• BHP Group Ltd: The world's largest listed miner said it expects annual iron ore production at the upper end of its forecast, although bad weather and planned maintenance at its operations in Western Australia sent third-quarter output nearly 2% lower. The miner expects overall production of the steelmaking ingredient at the top end of its 245 million tonnes (Mt) to 255 Mt forecast range.

• Boeing Co: The U.S. Transportation Department's Office of Inspector General said it will audit the Federal Aviation Administration's (FAA) November decision to unground the Boeing 737 MAX and other agency decisions. The new audit will examine the FAA’s actions following the two accidents, including the the agency's risk assessments, the grounding of the aircraft and the subsequent recertification, the inspector general's office said.

• Coinbase Global Inc: Deutsche Boerse said it would de-list the shares of the cryptocurrency exchange from its Xetra trading system and the Frankfurt stock exchange by end of Friday's trading session. "The reason for the de-listing is a missing reference data for these shares," Deutsche Boerse said, adding the de-listing would apply until further notice. When Coinbase trading started at Deutsche Boerse's platforms, a wrong reference code - a so-called LEI code - was used by mistake, Deutsche Boerse said. It was not clear whose mistake it was.

• Equinor ASA: Equinor has discovered more oil and gas at its Tyrihans field in the Norwegian Sea, the company said. The discovery contains between 19 million and 26 million barrels of oil equivalent (boe) of recoverable resources, which could be immediately put into production, it added.

• Facebook Inc: Instagram is rolling out a feature to prevent users from viewing possibly abusive messages by filtering offensive words, phrases and emojis on the photo-sharing app. The company said that along with the filter option for abusive direct messages, it will also make it harder for people blocked by users to circumvent and contact them through new accounts.

• Johnson & Johnson: European countries prepared to resume deliveries of Johnson & Johnson's COVID-19 vaccine and speed up the rollout after Europe's drug regulator backed the shot. Germany's health ministry said it would start deliveries to federal states for use in vaccination centres shortly, and that family doctors should receive the vaccine from week after next.

• JPMorgan Chase & Co: Sustainability ratings agency Standard Ethics said it had downgraded the corporate sustainability rating of JPMorgan Chase over its role in financing the European Super League. Standard Ethics, which ranks companies based on their performance on a range of environmental, social and governance-related measures said it was downgrading the bank to E+ from EE- on its rating system. It said the action amounted to a downgrade to "Non-compliant" versus the prior "Adequate.

• Moderna Inc: Moderna said on Tuesday it had secured a new COVID-19 vaccine supply agreement with Israel for 2022, under which the country has the option to buy doses of one of the company's variant-specific vaccine candidates. The announcement follows two earlier agreements between Israel and Moderna to supply a total of 10 million doses of the COVID-19 vaccine.

• Pfizer Inc: Brazil is in talks to buy another 100 million doses of Pfizer's COVID-19 vaccine, Communications Minister Fabio Faria said, as the country scrambles to procure more shots after a sluggish start to its vaccination program. "The negotiation started about 20 days ago and the (government) is seeking to speed up the process," he wrote on Twitter.

• Rio Tinto PLC: Australia's No.2 independent gas producer Santos said it had signed a natural gas supply deal with long-term buyer Rio Tinto. Under the deal, Santos said it would supply up to 15 petajoules (PJ) of natural gas to the global miner from later this year.

• Royal Dutch Shell PLC: Shell said it was conducting a feasibility study with partners to trial the use of hydrogen fuel cells for ships in Singapore, the first such move for the oil major. If successful, the trial will pave the way for cleaner, hydrogen-powered shipping, the company said, adding that its analysis points to hydrogen with fuel cells as the zero-emissions technology having the greatest potential to help the shipping sector achieve net-zero emissions by 2050.

• Stellantis NV: The carmaker said it would replace digital speedometers with more old-fashioned analogue ones in one of its Peugeot models, in a fallout from a global shortage of semiconductor chips that is roiling the auto industry. The change will only affect Peugeot 308 cars, among group brands that include Chrysler, Citroen and Jeep since France's PSA Group merged with Italian-American company Fiat-Chrysler this year to form Stellantis.

• Tesla Inc: The carmaker's vehicle registrations in California dropped marginally during the first quarter compared with last year, weighed down by a slump in Model 3 registrations, according to data from Cross-Sell, a research firm that collates title and registration data. California registrations for Tesla's Model 3 mass-market sedan fell 54% on a yearly basis to 8,060, while Tesla's Model Y compact crossover utility vehicle garnered 12,227 in the first quarter, Cross-Sell data showed on Tuesday. Separately, one of the two victims killed in Texas at the weekend in the crash of a Tesla car believed to operate without a driver was William Varner, a doctor, his employer said on Tuesday.

ANALYSIS

Faux meat growth doubts give market food for thought on Impossible

A cooling of the U.S. stock market's taste for plant-based meat makers has raised doubts among some investors and analysts about Impossible Foods' plans to achieve a $10 billion flotation.

ANALYSTS' RECOMMENDATION

• J2 Global Inc: D.A. Davidson raises price target to $160 from $130 after the company announced plans to spin-off its cloud fax business.

• Netflix Inc: Evercore ISI cuts price target to $655 from $665 after the company reported less than expected subscriber growth in the first quarter.

• Philip Morris International Inc: Cowen and Company raises price target to $108 from $100 to reflect stronger profitability, driven by IQOS mix.

• Sterling Bancorp: Hovde Group cuts rating to market perform from outperform after the company announced a merger of equals with Webster.

• Travelers Companies Inc: JPMorgan raises price target to $150 from $145 following the company’s first-quarter results that exceeded expectations.

ECONOMIC EVENTS

No economic indicators are scheduled for release.

COMPANIES REPORTING RESULTS

Chipotle Mexican Grill Inc: Expected Q1 earnings of $4.89 per share

Crown Castle International Corp: Expected Q1 earnings of 53 cents per share

Discover Financial Services: Expected Q1 earnings of $2.82 per share

Equifax Inc: Expected Q1 earnings of $1.53 per share

Globe Life Inc: Expected Q1 earnings of $1.62 per share

Kinder Morgan Inc: Expected Q1 earnings of 24 cents per share

Lam Research Corp: Expected Q3 earnings of $6.61 per share

Las Vegas Sands Corp: Expected Q1 loss of 26 cents per share

Nextera Energy Inc: Expected Q1 earnings of 60 cents per share

Robert Half International Inc: Expected Q1 earnings of 79 cents per share

Verizon Communications Inc: Expected Q1 earnings of $1.29 per share

Whirlpool Corp: Expected Q1 earnings of $5.41 per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Baker Hughes Co: Q1 earnings conference call

0800 EQT Corp: Annual Shareholders Meeting

0800 Nasdaq Inc: Q1 earnings conference call

0830 Anthem Inc: Q1 earnings conference call

0830 Dana Inc: Annual Shareholders Meeting

0830 Healthcare Services Group Inc: Q1 earnings conference call

0830 UFP Industries Inc: Annual Shareholders Meeting

0830 Verizon Communications Inc: Q1 earnings conference call

0900 Halliburton Co: Q1 earnings conference call

0900 Nextera Energy Inc: Q1 earnings conference call

0900 Nextera Energy Partners LP: Q1 earnings conference call

0900 ODP Corp: Annual Shareholders Meeting

0900 Sherwin-Williams Co: Annual Shareholders Meeting

0930 First Horizon Corp (Tennessee): Q1 earnings conference call

1000 BOK Financial Corp: Q1 earnings conference call

1000 Fulton Financial Corp: Q1 earnings conference call

1000 Lithia Motors Inc: Q1 earnings conference call

1000 Regions Financial Corp: Annual Shareholders Meeting

1000 Signature Bank: Q1 earnings conference call

1000 Synovus Financial Corp: Annual Shareholders Meeting

1000 Tenet Healthcare Corp: Q1 earnings conference call

1030 Commerce Bancshares Inc: Annual Shareholders Meeting

1100 First Midwest Bancorp Inc: Q1 earnings conference call

1100 Northwest Bancshares Inc: Annual Shareholders Meeting

1100 Premier Financial Corp (Ohio): Q1 earnings conference call

1100 Sonoco Products Co: Annual Shareholders Meeting

1100 United Community Banks Inc: Q1 earnings conference call

1130 Hancock Whitney Corp: Annual Shareholders Meeting

1200 WesBanco Inc: Annual Shareholders Meeting

1300 AMN Healthcare Services Inc: Annual Shareholders Meeting

1300 Tri Pointe Homes Inc (Delaware): Annual Shareholders Meeting

1330 Levi Strauss & Co: Annual Shareholders Meeting

1400 First Hawaiian Inc: Annual Shareholders Meeting

1400 Huntington Bancshares Inc: Annual Shareholders Meeting

1400 Preferred Bank: Q1 earnings conference call

1600 Calavo Growers Inc: Annual Shareholders Meeting

1630 Chipotle Mexican Grill Inc: Q1 earnings conference call

1630 Kinder Morgan Inc: Q1 earnings conference call

1630 Las Vegas Sands Corp: Q1 earnings conference call

1630 SEI Investments Co: Q1 earnings conference call

1630 Texas Capital Bancshares Inc: Q1 earnings conference call

1630 UFP Industries Inc: Q1 earnings conference call

1700 Lam Research Corp: Q3 earnings conference call

1700 Netgear Inc: Q1 earnings conference call

1700 Qualtrics International Inc: Q1 earnings conference call

1700 Robert Half International Inc: Q1 earnings conference call

1700 Sleep Number Corp: Q1 earnings conference call

EX-DIVIDENDS

Apache Corp: Amount $0.02

HB Fuller Co: Amount $0.16

LTC Properties Inc: Amount $0.19

Stevige draai omlaag lijkt te starten maar we blijven opletten

Goedemorgen

De markt lijkt nu dan toch weg te lopen van de recordzone waar we een week of 2 mee te maken hadden. Zowel Wall Street als Europa moesten weer inleveren, Europa verloor rond de 1,5% terwijl Wall Street tussen de 0,75% en 1% lager moest. Vanmorgen zien we nog niet echt herstel, de AEX zal wat hoger van start gaan zo te zien door ASML dat zwaar meeweegt maar de DAX blijft ongeveer gelijk. Verder zien we dat de futures op Wall Street iets lager staan.

De cijfers van ASML vielen beter dan werd verwacht vanmorgen, zo werd de doelstelling weer wat verhoogd terwijl men ook meer winst wist te behalen. ASML kan rond de €10 hoger openen zo te zien voorbeurs, de vraag is of dat de gehele dag zo zal blijven? Gisteren nabeurs op Wall Street kwam er wel een tegenvaller bij een van de FAANG aandelen, Netflix kon de verwachtingen bij lange na niet halen door dat het aantal nieuwe abonnees veel lager uitkwam dan vorig jaar tijdens het eerste kwartaal. Het aandeel Netflix daalde nabeurs 11%.

De markt momenteel:

Dat de markt even een stapje terug doet lijkt me meer dan normaal maar het wil natuurlijk nog lang niet zeggen dat de uptrend meteen zal ophouden te bestaan. Daarvoor zal er nog een procent of 2 meer vanaf moeten als ik naar de grafieken kijk. Wat dan ook belangrijk zal zijn is dat de indices minder divergentie moeten vertonen. We merken hoe dan ook dat al vanaf vorige week er enkele pioniers ofwel de sectoren die de kar trokken aan het begin van de rally het nu al een week of 2 minder goed doen. Dan kijk ik vooral naar de SOX index, de Dow Transport index en nu toch ook de Russel 2000 index (small-caps) die niet echt meer de power van eerder laten zien.

Resultaat dit jaar verloopt naar wens maar rustig:

De eerste 3 maanden dit jaar werden positief afgerond en met december erbij komen we nu uit op 4 maanden na elkaar dat er winst werd behaald via de signalen. Dat moest voorzichtig gebeuren want ik hou in het achterhoofd rekening met het scenario wat ik net aangaf, over een aanstaande grote correctie over de gehele markt. Niettemin blijf ik rustig verder opbouwen wat betreft de posities.

Deze manier van werken wil ik hoe dan ook proberen aan te houden, het handelen onder de huidige omstandigheden krijg ik steeds beter onder controle en ik probeer met kleine posities zo als goed mogelijk te werken voor de leden. Onderaan deze update ziet u nog een overzicht met hoe de maand maart werd afgerond en hoe we er dit jaar voor staan wat betreft het resultaat via de signalen die we naar onze leden versturen.

LET OP !! Vanaf vandaag een nieuwe aanbieding die loopt vanaf nu tot 1 JULI voor €39 (Polleke Trading €49) ... Via de site en dan de Tradershop kunt zich inschrijven en daar kunt u als lid de lopende posities met alle details altijd inzien. Ga naar de Tradershop en schrijf u meteen in ... https://www.usmarkets.nl/tradershop

Technische conditie Wall Street:

Wat betreft Wall Street zien we verzwakking via de charts en nu voor het eerst sinds een wat langere periode ook bij de 3 grote indices. De Nasdaq, de Nasdaq 100, de S&P 500 en de Dow Jones. Het eerste doel wordt denk ik nu het 20-daags gemiddelde, later de steun rond het 50-daags gemiddelde dat al in beeld komt bij enkele indexen. Zoals ik al aangaf blijven de SOX index en de Russel 2000 index zwak presteren want ook gisteren verloren beide indexen weer meer dan de traditionele indexen.

Technisch oogt het dus wat minder goed nu maar het is nog niet zo dat er een definitieve draai te zien is. Er is ook binnen de uptrend nog niets aan de hand maar we moeten wel beginnen met op te letten. Eens de indices het niet meer lukt om nieuwe toppen en in dit geval dus records neer te zetten kan het wel eens de start worden van een langere fase met lagere koersen.

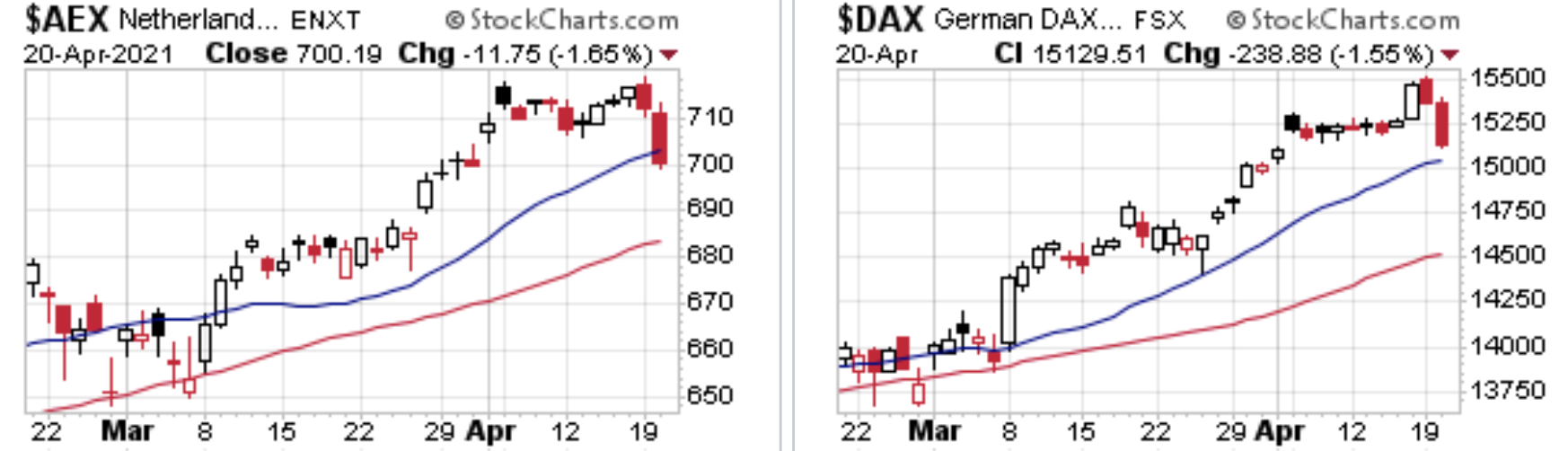

Technische conditie AEX en DAX:

AEX index:

Bij de AEX wordt het nu opletten want de index kon nog maar net boven de 700 punten sluiten. De eerste steun moest eraan geloven, we letten nu op de laatste top van dit jaar die rond de 688-690 punten wacht. Zoals ik eerder al aangaf is die zone veel belangrijker dan de zone 702-703 punten. Met de wind in de zeilen via ASML vandaag zal de AEX wel weer hoger starten, we moeten daarna zien of het kan doorzetten.

Weerstand nu de 708-710 punten, later de 712-715 zone, de 718 en de 725 punten. Steun nu de 702-702 na de opening, later de belangrijke zone 688-690 punten.

DAX index:

De DAX moest weer terug tot onder de 15.300 punten zodat de uitbraak vals blijkt te zijn. Weerstand nu uiteraard weer die 15.300 punten, later de zone rond de 15.500 punten waar we de topzone zien uitkomen nu.

De richtpunten omlaag worden nu eerst de 15.000 en de 14.900 punten, later de 14.750 en de 14.500 punten. Dan moet de markt een echte top neer hebben gezet gevolgd door een grotere daling tot de onderkan van het oplopende trendkanaal. Na de daling van gisteren komt de DAX nu heel dicht bij het 20-daags gemiddelde.

Euro, olie en goud:

De euro zien we nu rond de 1.203 dollar, de prijs van een vat Brent olie komt uit op 66,2 dollar terwijl een troy ounce goud nu op 1785 dollar staat.

De LIVEBLOG en Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

Inter Market overzicht op slotbasis ...

LET OP !! Vanaf vandaag een nieuwe aanbieding die loopt vanaf nu tot 1 JULI voor €39 (Polleke Trading €49) ... Via de site en dan de Tradershop kunt zich inschrijven en daar kunt u als lid de lopende posities met alle details altijd inzien. Ga naar de Tradershop en schrijf u meteen in ... https://www.usmarkets.nl/tradershop

Met vriendelijke groet,

Guy Boscart

Markt snapshot Europa 21 april

MARKET VIEW

Financial spreadbetters expect London's FTSE to open 6 points lower at 6,854, Frankfurt's DAX to open 7 points higher at 15,136 and Paris' CAC to open 6 points lower at 6,159.

Asian shares and U.S. stock futures fell as concern about a resurgence of coronavirus cases in some countries cast doubt on the strength of global growth and demand for crude oil.

Oil prices fell for a second day on concerns that soaring COVID-19 cases in India will drive down fuel demand in the world's third biggest oil importer.

GLOBAL TOP NEWS

Johnson & Johnson said on Tuesday it will resume rolling out its COVID-19 vaccine in Europe after the region's medical regulator said the benefits of the shot outweigh the risk of very rare, potentially lethal blood clots.

Former Minneapolis police officer Derek Chauvin was convicted on Tuesday of murdering George Floyd, a milestone in the fraught racial history of the United States and a rebuke of law enforcement's treatment of Black Americans.

The U.S. economy is going to temporarily see "a little higher" inflation this year as the recovery strengthens and supply constraints push up prices in some sectors, but the Federal Reserve is committed to limiting any overshoot, Fed Chair Jerome Powell said in an April 8 letter to Senator Rick Scott.

EUROPEAN COMPANY NEWS

The United States of America and the Federal Retirement Thrift Investment Board have filed a lawsuit against Danske Bank and its former CEO in the Copenhagen city court, according to the attorney representing the parties.

Italy's Eni is considering spinning off oil and gas operations in West Africa and the Middle East into new joint ventures to help reduce debt and fund its shift to low-carbon energy, according to company and industry sources.

Investment funds Ardian and Global Infrastructure Partners will not participate in the deal to create a new French water company after the takeover of Suez by its bigger rival Veolia, Ardian Infrastructure and GIP chief Mathias Burghardt told Reuters on Tuesday.

TODAY'S COMPANY ANNOUNCEMENTS

ABN Amro Bank NV Annual Shareholders Meeting

Accell Group NV Annual Shareholders Meeting

Adecoagro SA Annual Shareholders Meeting

Akzo Nobel NV Q1 2021 Earnings Call

ASM International NV Q1 2021 Earnings Call

ASML Holding NV Q1 2021 Earnings Call

Bankinter SA Annual Shareholders Meeting

Basilea Pharmaceutica AG Annual Shareholders Meeting

Beijer Electronics Group AB Q1 2021 Earnings Release

BioArctic AB Q1 2021 Earnings Release

Biome Technologies PLC Annual Shareholders Meeting

Bper Banca SpA Annual Shareholders Meeting

Brunello Cucinelli SpA Q1 2021 Earnings Call

Bunzl PLC Annual Shareholders Meeting

Castellum AB Q1 2021 Earnings Release

Cementir Holding NV Annual Shareholders Meeting

Colipays Reunion SA Annual Shareholders Meeting

Core Laboratories NV Q1 2021 Earnings Release

CTT Correios de Portugal SA Annual Shareholders Meeting

De' Longhi SpA Annual Shareholders Meeting

Deutsche Boerse AG Q1 2021 Earnings Release

Drax Group PLC Annual Shareholders Meeting

Dukemount Capital PLC Annual Shareholders Meeting

Eiffage SA Annual Shareholders Meeting

Elisa Oyj Q1 2021 Earnings Release

Entreparticuliers.Com SA Annual Shareholders Meeting

Fine Foods & Pharmaceuticals NTM SpA Annual Shareholders Meeting

Fingerprint Cards AB Q1 2021 Earnings Call

Georg Fischer AG Annual Shareholders Meeting

Hunting PLC Annual Shareholders Meeting

Immofinanz AG FY 2020 Earnings Release

Industrivarden AB Annual Shareholders Meeting

Italian Wine Brands SpA Annual Shareholders Meeting

Italmobiliare SpA Annual Shareholders Meeting

Karo Pharma AB Q1 2021 Earnings Release & Annual Shareholders Meeting

Kier Group PLC HY 2021 Earnings Release

Kitron ASA Q1 2021 Earnings Call

Koninklijke Vopak NV Annual Shareholders Meeting

MR Bricolage SA Annual Shareholders Meeting

MTU Aero Engines AG Annual Shareholders Meeting

Navios Maritime Holdings Inc Q4 2020 Earnings Call

Nelly Group AB (publ) Q1 2021 Earnings Release

NOS SGPS SA Annual Shareholders Meeting

Ocean Yield ASA Annual Shareholders Meeting

Orange Belgium SA Q1 2021 Earnings Call

PGS ASA Annual Shareholders Meeting

Proximus NV Annual Shareholders Meeting

QBNK Holding AB (publ) Annual Shareholders Meeting

Randstad NV Q1 2021 Earnings Call

Sanlorenzo SpA Annual Shareholders Meeting

Sartorius AG Q1 2021 Earnings Call

Sartorius Stedim Biotech SA Q1 2021 Earnings Call

Serco Group PLC Annual Shareholders Meeting

Slottsviken Fastighetsaktiebolag (publ) Annual Shareholders Meeting

Svenska Handelsbanken AB Q1 2021 Earnings Call

TE Connectivity Ltd Q2 2021 Earnings Call

Telefonaktiebolaget LM Ericsson Q1 2021 Earnings Call

Tod's SpA Annual Shareholders Meeting

Wallenius Wilhelmsen ASA Annual Shareholders Meeting

Warehouses de Pauw NV Q1 2021 Earnings Call

Xvivo Perfusion AB Q1 2021 Earnings Call

ECONOMIC EVENTS (All times GMT)

0600 (approx.) United Kingdom Core CPI mm for Mar: Expected 0.3%; Prior 0.0%

0600 (approx.) United Kingdom Core CPI yy for Mar: Expected 1.1%; Prior 0.9%

0600 (approx.) United Kingdom CPI mm for Mar: Expected 0.3%; Prior 0.1%

0600 (approx.) United Kingdom CPI yy for Mar: Expected 0.8%; Prior 0.4%

0600 (approx.) United Kingdom RPI mm for Mar: Expected 0.3%; Prior 0.5%

0600 (approx.) United Kingdom RPI yy for Mar: Expected 1.6%; Prior 1.4%

0600 (approx.) United Kingdom RPI-X (Retail Prices) mm for Mar: Prior 0.5%

0600 (approx.) United Kingdom RPI-X yy for Mar: Prior 1.6%

0600 (approx.) United Kingdom RPI Index for Mar: Prior 296.0

0600 (approx.) United Kingdom CPI NSA for Mar: Prior 109.1

0600 (approx.) United Kingdom PPI Input Prices mm NSA for Mar: Expected 0.6%; Prior 0.6%

0600 (approx.) United Kingdom PPI Input Prices yy NSA for Mar: Expected 4.4%; Prior 2.6%

0600 (approx.) United Kingdom PPI Output Prices mm NSA for Mar: Expected 0.3%; Prior 0.6%

0600 (approx.) United Kingdom PPI Output Prices yy NSA for Mar: Expected 1.7%; Prior 0.9%

0600 (approx.) United Kingdom PPI Core Output mm NSA for Mar: Prior 0.1%

0600 (approx.) United Kingdom PPI Core Output yy NSA for Mar: Prior 1.4%

0700 (approx.) Switzerland M3 for Mar: Prior 1,148,259 mln CHF

DEBT AUCTIONS

Germany - Reopening of 10-year government debt auction.

Portugal - Reopening of 3-month and 11-month government debt auctions.

Sweden - Reopening of 3-year and 10-year government debt auctions.

United Kingdom - Reopening of 14-year government debt auction.