Liveblog Archief maandag 2 augustus 2021

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: ISM Productie Inkoopmanagersindex (PMI) (Jul) | Actueel: 59,5 Verwacht: 60,9 Vorige: 60,6 |

Markt snapshot Wall Street 2 augustus

TOP NEWS

• U.S. Senate works to push $1 trillion bipartisan infrastructure bill to passage

The U.S. Senate will try to complete work this week on a $1 trillion infrastructure investment bill that would bring long-awaited improvements to roads, bridges and mass-transit systems and deliver a rare bipartisan victory to President Joe Biden.

• Twitter's Dorsey leads $29 billion buyout of lending pioneer Afterpay

Square, the payments firm of Twitter co-founder Jack Dorsey, will purchase buy now, pay later (BNPL) pioneer Afterpay for $29 billion, creating a global transactions giant in the biggest buyout of an Australian firm.

• HSBC doubles profit, hints at share buybacks as bad loan fears ease

HSBC beat forecasts with first-half pretax profit that more than doubled from last year when it set aside $7 billion to cover pandemic-related bad loans.

• Parker to buy Meggitt in $8.8 billion aerospace and defence deal

Parker-Hannifin has agreed to buy its London-listed rival Meggitt for $8.8 billion, with the U.S. company offering commitments to maintain a strong UK presence for the defence and aerospace company.

• Pfizer and Moderna raise prices for COVID-19 vaccines in EU - FT

Pfizer and Moderna have raised the prices of their COVID-19 vaccines in their latest European Union supply contracts, the Financial Times reported on Sunday.

BEFORE THE BELL

U.S. stock index futures rose as a $1 trillion infrastructure bill unveiled by U.S. Senators raised hopes of more fiscal stimulus, while investors turned to manufacturing activity data, due later in the day, to gauge the pace of a domestic economic rebound. Strong earnings pushed European shares higher, after a recovery in Asian equities overnight. In currencies, the dollar index was down, hovering just above a one-month low, while the euro advanced. Oil prices were hit by concerns about Chinese demand. Gold prices slipped as improving risk appetite weighed on the safe-haven metal.

STOCKS TO WATCH

Results

• HSBC Holdings PLC: Europe's biggest bank beat forecasts with first-half pretax profit that more than doubled from last year when it set aside $7 billion to cover pandemic-related bad loans. Encouraged by an economic rebound in its two biggest markets of Hong Kong and Britain, HSBC reinstated dividend payments, flagged higher payouts in the future, and released $700 million that had been set aside as provisions. HSBC's pretax profit came in at $10.8 billion, higher than the $4.32 billion logged in the same period a year earlier and a consensus estimate of $9.45 billion compiled by the bank. Revenue fell 4% due to a low interest rate environment especially in Asia, where it makes most of its money, and a weaker performance from its investment bank compared to a strong first-half last year.

• Mitsubishi UFJ Financial Group Inc: Japan's largest lender by assets reported that first-quarter net profit doubled year on year as credit-related costs dropped sharply. MUFG, which owns about 20% of Wall Street investment bank Morgan Stanley, reported profit of 383.1 billion yen for the three months to June 30, against 183.5 billion yen a year earlier. The bank retained its full-year profit forecast of 850 billion yen. MUFG's credit-related costs in the first quarter came in at 5.1 billion yen, versus 145 billion yen in the same period last year. The lender had estimated 350 billion yen of credit-related costs for the current financial year which runs through March. In contrast, net interest income - mainly derived from its traditional lending business - came in at 496.9 billion yen for the quarter, marking a 5.9% on-year rise, as corporate clients rushed to borrow to overcome the pandemic fallout.

Deals Of The Day

• Parker-Hannifin Corp: The company has agreed to buy its London-listed rival Meggitt for 6.3 billion pounds, with commitments offered to maintain a strong UK presence for the defence and aerospace company. The 800-pence-a-share cash offer carries a 70.5% premium to Meggitt's closing price on Friday and compares with the stock's pre-COVID high of 701.8 pence. The takeover of Meggitt, which also operates in the energy sector, is the latest in a flurry of U.S. firms bidding for British companies, driven by cheap valuations due in part to the pandemic and Brexit. The deal also comes when the aviation industry is facing a severe downturn as the COVID-19 crisis disrupts travel demand. Meggitt lost 70% in market value in a span of two months as fears of the pandemic's impact on global economic growth reached fever pitch in March last year.

• Square Inc: The payments firm of Twitter co-founder Jack Dorsey, will purchase buy now, pay later (BNPL) pioneer Afterpay for $29 billion, creating a global transactions giant in the biggest buyout of an Australian firm. The takeover underscores the popularity of a business model that has upended consumer credit by charging merchants a fee to offer small point-of-sale loans which their shoppers repay in interest-free instalments, bypassing credit checks. The all-stock buyout would value the shares at A$126.21, the companies said in a joint statement on Monday. That means a payday of A$2.46 billion each for Afterpay's founders, Anthony Eisen and Nick Molnar. For Afterpay, the deal with Square delivers a large customer base in its main target market, the United States, where its fiscal 2021 sales nearly tripled to A$11.1 billion in constant currency terms.

Moves

• Credit Suisse Group AG: The Swiss bank has hired HSBC banker Orazio Tarda to bolster its financial services coverage and beef up its senior ranks after a swathe of departures, investigations and divisional reshuffles. Italian-born Tarda will become the Swiss lender's global co-head of fintech, according to a memo seen by Reuters, after leading HSBC's fintech franchise since 2018 in a career spanning 16 years at the bank. Tarda will also join Credit Suisse's client advisory group in Europe, the Middle East and Africa as part of the bank's efforts to increase M&A revenue and market share. A seasoned dealmaker who started his career at Lehman Brothers in 2001, Tarda has advised on a series of high profile payments transactions including Nexi's transformational mergers with Nets and SIA last year.

In Other News

• Alphabet Inc: Sky News Australia said on Sunday it has been temporarily suspended by the video-sharing site YouTube following the platform's review of content for compliance with its COVID-19 policies. "Sky News Australia acknowledges YouTube's right to enforce its policies and looks forward to continuing to publish its popular news and analysis content to its subscribers shortly," Sky News said in a statement on its website about the one-week suspension. YouTube, owned by Alphabet's Google, confirmed the suspension. "We apply our policies equally for everyone and in accordance with these policies and our long-standing strikes system, removed videos from and issued a strike to Sky News Australia's channel," a YouTube spokesperson said.

• BHP Group Ltd: The union of workers at the company's Escondida copper mine in Chile, the world's largest, said on Saturday it had voted to reject the company's final labor contract offer, prompting BHP to request government-mediated talks in a last-ditch effort to stave off a strike. The talks, once confirmed by authorities, will last for 5 to 10 days, according to Chilean labor law. If no agreement is reached, a strike would begin. The union said in a statement late on Saturday that 99.5% of those who voted had rejected the final contract offer and had approved a strike, suggesting a still wide gap between BHP and its workers despite nearly two months of talks. Negotiations at the sprawling northern Chile copper mine have been conducted in secret, leaving metals markets on edge. A prolonged strike by the mine's top workers' union would further constrict global supplies of copper and send already high prices even higher.

• Blackstone Group Inc & Hudson Pacific Properties Inc: The U.S. firms said they planned to create a major film, TV and digital production complex in Broxbourne, north of London, in the first overseas expansion of their Sunset Studios platform. Funds managed by the two companies had acquired a 91-acre site, 17 miles from central London, for 120 million pounds, they said on Sunday, adding that the total investment would be more than $975 million. Subject to planning permission, they said they would build a world-class film and television studio campus, creating more than 4,500 permanent jobs. Blackstone's head of real estate Europe James Seppala said the partners intended to deliver a studio facility that would help ensure that Britain continued to be a premier destination for production.

• China Online Education Group: Beijing's market regulator has fined three private tutoring firms for acts such as false advertising, running unlicensed schools and illegal pricing, state media reported. The three schools - Xueda Education, ABC Foreign Language School and 51talk - were fined a total of 1.92 million yuan, the Beijing Youth Daily newspaper reported. 51talk is also known as China Online Education Group. China last month took aim at its $120 billion private tutoring sector by issuing sweeping rules that bar for-profit after-school tutoring in core school subjects, in an effort to boost the birth rate by lowering family living costs. The new rules threaten to decimate the industry and triggered a heavy sell off in the shares of tutoring companies when they were first announced.

• Discovery Inc: The U.S.-based broadcaster is holding informal discussions about a potential takeover bid for Britain's state-owned Channel 4 television broadcaster, The Telegraph reported on Saturday. The potential bid process is being managed by UK Government Investments, the paper reported, adding that a deal was not expected to be completed until the middle of next year. Discovery did not immediately respond to a request for comment. Britain's government on July 6 announced a consultation on the sale of Channel 4, and it was considering changes to the operating model of the broadcaster, including its ownership, remit and obligations. Rival UK broadcasters ITV and Comcast's Sky are also exploring a bid for Channel 4, Telegraph reported.

• Johnson & Johnson: The drugmaker said it was still in talks with the Indian government over its COVID-19 vaccine after the country's drug regulator announced the company had pulled its proposal seeking an accelerated approval for local trials. India had, in May, scrapped local trials for "well-established" foreign coronavirus vaccines as it tried to hasten vaccination rollouts to fight a second wave of infections. The Indian junior health minister said last week that a team had been formed to engage with vaccine makers. "This team is in continuous dialogue with Pfizer, Moderna and Johnson & Johnson to discuss and address various issues including the issue of indemnity," Bharati Pravin Pawar had said.

• Moderna Inc & Pfizer Inc: The drugmakers have raised the prices of their COVID-19 vaccines in their latest European Union supply contracts, the Financial Times reported on Sunday. The new price for the Pfizer shot was 19.50 euros against 15.50 euros previously, the newspaper said, citing portions of the contracts seen. The price of a Moderna vaccine was $25.50 a dose, the contracts show, up from about 19 euros in the first procurement deal but lower than the previously agreed $28.50 because the order had grown, the report said, citing one official close to the matter. Pfizer declined to comment on the contract with the European Commission, citing confidentiality. "Beyond the redacted contract(s) published by the EC, the content remains confidential and so we won't be commenting," the company said.

• Rio Tinto PLC: The company is set to ship a pilot lithium processing plant to Serbia from Melbourne in the coming weeks, the culmination of a decade's research to catapult the world's largest iron ore miner into battery minerals. The work, undertaken at a science hub on the outskirts of Melbourne, has found a way to economically extract lithium from jadarite, a mineral that has only been found in a Serbian valley. Four 40-foot shipping containers of equipment will leave in coming weeks before a nine-week sail and onward river journey. Construction is expected to begin early next year, subject to environmental approvals, with the first production from 2026. The mine is expected to produce enough lithium to power one million electric vehicles. It will also produce boric acid, used in ceramics and batteries, and sodium sulphate, used in detergents.

• Takeda Pharmaceutical Co Ltd: Japan's largest drugmaker said it will record a provision of about $574.56 million in its financial statements for the first quarter to reflect a decision by Ireland's tax appeals body relating to tax assessment received by company's unit on a break fee. Takeda said it received "a decision by the Irish Tax Appeals Commission on July 30, 2021 to uphold the Irish Revenue Commissioners' position related to the treatment of a break fee received by Shire plc in October 2014 from AbbVie Inc,". "First Quarter FY2021 reported IRFS-based financial results will be updated to reflect the impact of the decision with no impact on core and underlying financial results," it said, adding that it will refile the revised information by Aug. 6. The company said it plans to challenge this outcome through all available legal means including appealing the decision to the Irish courts.

• Telefonaktiebolaget LM Ericsson: The Swedish company won a 3% share in a joint 5G radio contract from China Telecom and China Unicom, according to sources familiar with the matter. Nokia, which was expected to take away Ericsson's market share in China, did not receive any share, according to a tender document published by the Chinese companies. While the tender document doesn't disclose the percentage wins, Huawei and ZTE were expected to have cornered a major share of the contracts, followed by state-owned Datang Telecom. Ericsson, which had warned that it would lose market share in China due to the ban of Chinese equipment suppliers in Sweden, saw its share in China Mobile drop to 2% from 11% last year, while Nokia got 4% of the contracts announced in July.

• Twitter Inc: The social networking company said on Friday it will launch a competition for computer researchers and hackers to identify biases in its image-cropping algorithm, after a group of researchers previously found the algorithm tended to exclude Black people and men. The competition is part of a wider effort across the tech industry to ensure artificial intelligence technologies act ethically. The company said in a blog post that the bounty competition was aimed at identifying "potential harms of this algorithm beyond what we identified ourselves." Twitter released publicly the computer code that decides how images are cropped in the Twitter feed, and said on Friday participants are asked to find how the algorithm could cause harm, such as stereotyping or denigrating any group of people. The winners will receive cash prizes ranging from $500 to $3,500 and will be invited to present their work at a workshop hosted by Twitter at DEF CON in August, one of largest hacker conferences held annually in Las Vegas.

• Walt Disney Co: The company said on Friday it was making vaccination mandatory for all its on-site salaried and non-union hourly employees in the United States, as the highly infectious Delta COVID-19 variant drives a resurgence in cases. "Employees who aren't already vaccinated and are working on-site will have 60 days from today to complete their protocols and any employees still working from home will need to provide verification of vaccination prior to their return, with certain limited exceptions," Disney said. The company also said all the newly hired employees will be required to be fully vaccinated before beginning their employment.

• Zoom Video Communications Inc: The company agreed to pay $85 million and bolster its security practices to settle a lawsuit claiming it violated users' privacy rights by sharing personal data with Facebook, Google and LinkedIn, and letting hackers disrupt Zoom meetings in a practice called Zoombombing. Subscribers in the proposed class action would be eligible for 15% refunds on their core subscriptions or $25, whichever is larger, while others could receive up to $15. Zoom agreed to security measures including alerting users when meeting hosts or other participants use third-party apps in meetings, and to provide specialized training to employees on privacy and data handling. The San Jose-based company denied wrongdoing in agreeing to settle.

FOCUS

The robot apocalypse is hard to find in America's small and mid-sized factories

When researchers from the Massachusetts Institute of Technology visited Rich Gent's machine shop here to see how automation was spreading to America's small and medium-sized factories, they expected to find robots. They did not.

ANALYSTS' RECOMMENDATION

• AbbVie Inc: Mizuho raises target price to $131 from $128, after the company delivered strong second-quarter, with sales and earnings above expectations.

• Aon Plc: Piper Sandler raises target price to $276 from $260, citing the company's upbeat second-quarter results.

• Capri Holdings Ltd: Credit Suisse raises target price to $63 from $62, after the company posted strong first-quarter results and raised its forecasts.

• Cerner Corp: Piper Sandler raises target price to $88 from $85, factoring the company's positive second-quarter results and a favorable outlook.

• Charter Communications Inc: JPMorgan raises target price to $855 from $750, saying the company is well positioned given huge broadband demand, significant speed advantages in most markets, and growth opportunities including mobile and edge-outs.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0945 Markit Manufacturing PMI final for July: Prior 63.1

1000 (approx.) Construction spending mm for June: Expected 0.4%; Prior -0.3%

1000 ISM Manufacturing PMI for July: Expected 60.9; Prior 60.6

1000 ISM Manufacturing Prices Paid for July: Prior 92.1

1000 ISM Manufacturing Employment Index for July: Prior 49.9

1000 ISM Manufacturing New Orders Index for July: Prior 66.0

COMPANIES REPORTING RESULTS

American Water Works Company Inc: Expected Q2 earnings of $1.08 per share

Arista Networks Inc: Expected Q2 earnings of $2.54 per share

Diamondback Energy Inc: Expected Q2 earnings of $2.19 per share

Eastman Chemical Co: Expected Q2 earnings of $2.33 per share

Leggett & Platt Inc: Expected Q2 earnings of 54 cents per share

Mosaic Co: Expected Q2 earnings of 98 cents per share

NXP Semiconductors NV: Expected Q2 earnings of $2.31 per share

Pioneer Natural Resources Co: Expected Q2 earnings of $2.56 per share

Realty Income Corp: Expected Q2 earnings of 37 cents per share

SBA Communications Corp: Expected Q2 earnings of 68 cents per share

Simon Property Group Inc: Expected Q2 earnings of $1.01 per share

Take-Two Interactive Software Inc: Expected Q1 earnings of 90 cents per share

Williams Companies Inc: Expected Q2 earnings of 28 cents per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Global Payments Inc: Q2 earnings conference call

0830 TG Therapeutics Inc: Q2 earnings conference call

0900 CNA Financial Corp: Q2 earnings conference call

0900 ON Semiconductor Corp: Q2 earnings conference call

0900 Hayward Holdings Inc: Q2 earnings conference call

1000 Loews Corp: Q2 earnings conference call

1100 Timken Co: Q2 earnings conference call

1630 Woodward Inc: Q3 earnings conference call

1630 Take-Two Interactive Software Inc: Q1 earnings conference call

1630 Bruker Corp: Q2 earnings conference call

1630 Varonis Systems Inc: Q2 earnings conference call

1630 Arista Networks Inc: Q2 earnings conference call

1630 Freshpet Inc: Q2 earnings conference call

1630 ZoomInfo Technologies Inc: Q2 earnings conference call

1700 Trex Company Inc: Q2 earnings conference call

1700 Simon Property Group Inc: Q2 earnings conference call

1700 Columbia Sportswear Co: Q2 earnings conference call

1700 BWX Technologies Inc: Q2 earnings conference call

1700 Ultragenyx Pharmaceutical Inc: Q2 earnings conference call

1700 SBA Communications Corp: Q2 earnings conference call

1700 Reynolds Consumer Products Inc: Q2 earnings conference call

EXDIVIDENDS

Conagra Brands Inc: Amount $0.31

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| DEU: Duitse Productie Inkoopmanagersindex (PMI) (Jul) | Actueel: 65,9 Verwacht: 65,6 Vorige: 65,1 |

TA - Beweging op komst (AEX aandelen)

ASR Zowel ASR als Nationale Nederlanden laten de afgelopen beursweken een ietwat twijfelend koersverloop zien. Beleggers leken opzoek naar bedrijven welke baat hebben bij een stijgende rente. In het geval van deze financials lijkt de zoektocht aan kracht te verliezen. In april werd de…

Lees verder »Herstel na terugval van vrijdag, weer rond de topzone nu

Vanmorgen hogere futures, ook Azië kende een sterke sessie en het is de eerste sessie van de nieuwe maand. Vrijdag nog een moeilijke dag, vandaag als we de futures volgen wordt alles weer weg gewerkt en staan we weer rond de toppen. Zo blijft het best moeilijk om deze markt goed te beoordelen want staan we rond een top die langer blijft staan? Of geraken we nog wat hoger vanaf hier? Wel is het zo dat de AEX, de S&P 500 en de Dow Jones een redelijk zware weerstand aan het testen zijn nu.

Update 2 augustus:

Wall Street kreeg het wat moeilijker afgelopen vrijdag maar vanmorgen zien we een herstel via de futures die een hogere opening aangeven, het gaat om 0,5% zo te zien vanmorgen. Het is de eerste sessie van de nieuwe maand en we merken dat de meeste indices weer richting hun toppen willen geraken. Dan komt de weerstand bij enkele belangrijke indices in beeld en het is de vraag wat er gaat gebeuren na de opening van Wall Street. De niveaus die we in de gaten moeten houden zijn onder andere bij de S&P 500 de 4425-4430 punten, bij de Dow Jones wacht de top rond de 35.150-35.190 punten en bij de Nasdaq zien we de top rond de 14.850 punten uitkomen.

Kijken we naar Europa dan wacht de top bij de AEX rond de 759 punten, bij de DAX rond de 15.810 punten. Bij de CAC 40 zien we de top uitkomen rond de 6685-6690 punten. Ook hier is het een kwestie van amper 0,5 tot 1% hoger voor de toppen worden aangetikt. De draai naar omlaag van afgelopen vrijdag was niet echt stevig genoeg om de toppen achter te laten. Aan de andere kant zien we ook de nodige weerstand wachten rond de topzone bij alle 3 deze indices.

Hoe presteren de belangrijkste indices vrijdag?

De Dow Jones verloor vrijdag 149 punten en komt weer onder de 35.000 punten (34.935) uit, de index krijgt het moeilijk om echt door die 35.000 punten te blijven en door te trekken tot ver erboven. Ook de S&P 500 verloor 24 punten om onder de topzone te blijven, de index bleef wat hangen aan de bovenkant ofwel de zone 4420-4425 punten maar door de weerstand geraakt de index er niet doorheen. De tech indices lagen er vrijdag de gehele sessie slecht bij maar ze sluiten niet rond de laagste stand van de dag af. De Nasdaq verloor 105 punten terwijl de Nasdaq 100 een verlies van 88 punten laat zien, de daling kwam vooral door dat Amazon fors moest inleveren.

Dat men weer voor andere sectoren binnen de Nasdaq ging kiezen viel meteen op via de SOX index waar we een plus van 0,7% zien vrijdag. Het blijft dus huppelen van het ene naar het andere, beleggers nemen niet eens de tijd om even op de handen te zitten en te wachten op een grotere correctie. Verder zien we dat de Dow Transport index 0,1% lager sluit.

Op weekbasis verloor de S&P-16,5 punten, de Dow Jones sluit de week af met 126 punten verlies. De Nasdaq verloor 164 punten terwijl de Nasdaq 100 met 152 verlies de week afsluit. Daarentegen ha de SOX index een sterke week met 76 punten winst. De Dow Transport index kende weer een slechte week met 295 punten verlies.

Europa moest ook wat inleveren, de AEX liet 4 punten liggen terwijl de DAX 96 punten lager sluit. De sessie was wel volatiel want de AEX stond even op -7 punten en herstelde zich daarna tot dat er een plus van 2 punten stond. Richting het slot verloor de index weer om dus negatief af te sluiten. De Franse CAC 40 verloor vrijdag 21 punten. De AEX en de CAC 40 blijven sterk en aan de bovenkant hangen, de DAX daarentegen doet het minder goed en blijft duidelijk hangen rondom die steun/weerstandszone 15.500-15.550 punten. De DAX ziet er dus minder goed uit op technisch vlak.

Op weekbasis wint de AEX 5 punten na een volatiel verloop en vooral een sterk verloop op woensdag en donderdag, de DAX daarentegen moest inleveren, de index verloor over de gehele week bekeken 125 punten. De CAC 40 wist 44 punten winst te boeken op weekbasis.

Dinsdag wat winst genomen, JULI sluiten we goed af:

Meedoen met US Markets Trading kan uiteraard door lid te worden, dinsdag heb ik winst genomen op de posities die open stonden zodat het resultaat er goed uitziet voor de maand juli. Ik blijf rustig en hou me aan het plan voor de komende periode, rustig naar kansen zoeken en waar het kan wat posities opnemen. Als u de signalen wilt ontvangen wordt dan vandaag nog lid via de nieuwe aanbieding voor €35 die loopt tot 1 oktober ...

Hieronder ziet u het resultaat voor de maand JULI en dat is nu voor de 8e maand op rij dat we winst behalen via alle signaaldiensten. Bij Guy Trading kijk ik ook naar wat aandelen waar er wat mee kan worden gedaan. Schrijf u dus op tijd in, ik zal snel weer een momentum kiezen om in te stappen met een paar posities op indexen.

De nieuwe aanbieding loopt tot 1 OKTOBER en dat voor €35 (Polleke Trading €45 en COMBI-Trading voor €75). Inschrijven kan via de link https://www.usmarkets.nl/tradershop

Hieronder het resultaat van deze maand (JULI) en dit jaar (2021):

Marktoverzicht:

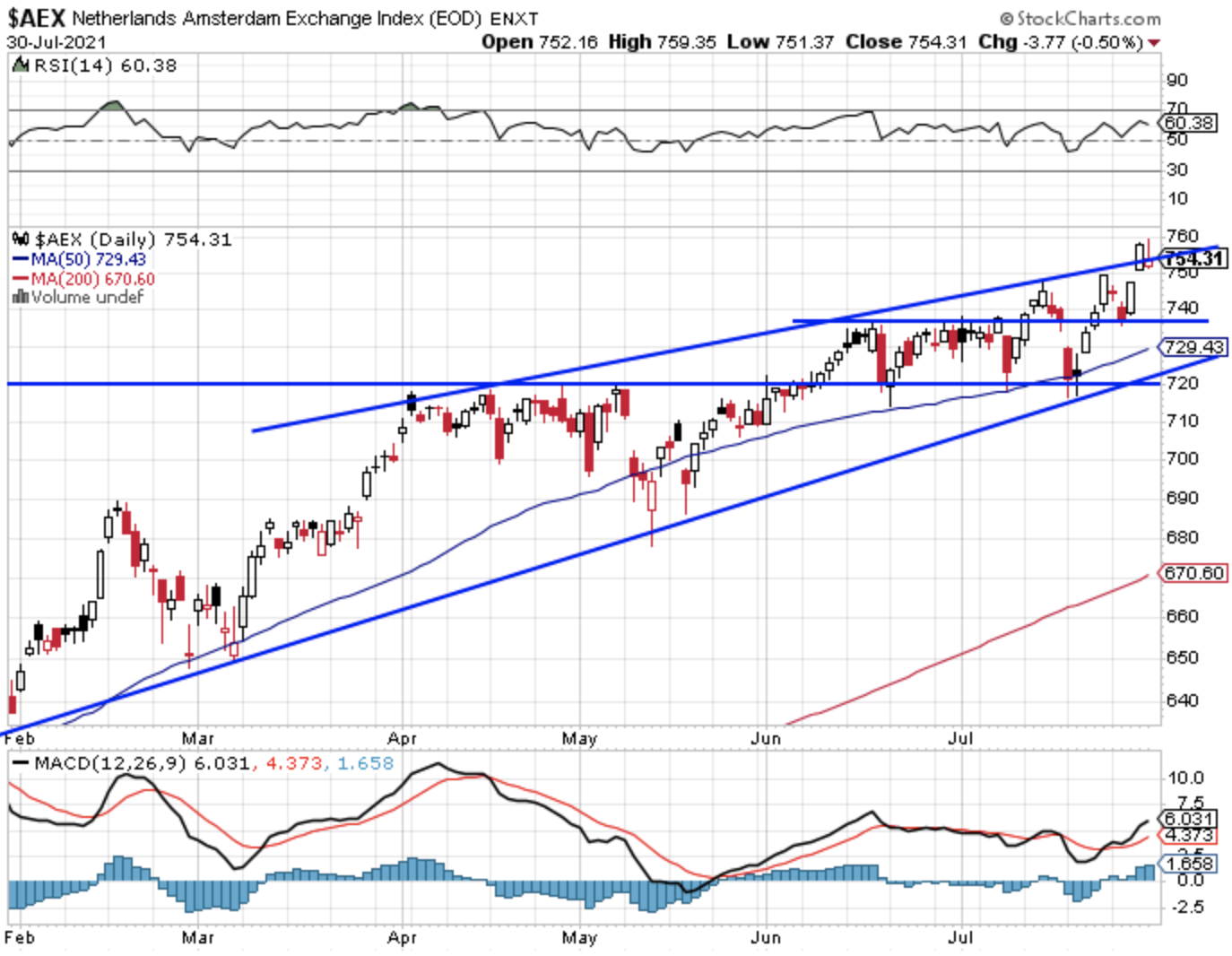

Technische conditie AEX:

De AEX moet wat inleveren maar er werd wel een hogere top neergezet vrijdag zodat het absolute record bij de AEX nu uitkomt op 759,35 punten. De index moet daarna terug en sluit met bijna 4 punten verlies. Zo zien we de AEX weer onder de lijn over de toppen en komt de index weer binnen het oplopende trendkanaal terecht na de overshoot van donderdag.

Steun nu eerst de 749 punten met later de zone 736-738 punten als steun want we zien daar de oude toppen uitkomen. Later steun net onder de 730 punten, daarna de reeks recente bodems tussen de 717 en de 720 punten. De valse uitbraak van donderdag zou voor de AEX wel eens een top kunnen aangeven, we gaan het de komende week merken maar veel blijft afhangen van wat Wall Street zal gaan doen.

Weerstand zien we nu rond de topzone 758-760 punten, bij een uitbraak kansen richting de 768 en de 775 punten maar of het zal lukken om tot daar te geraken op de korte termijn moeten we afwachten.

Technische conditie DAX:

De DAX blijft spelen met de belangrijke grens 15.500-15.550 punten en die blijft als een soort magneet werken in beide richtingen. De index moest er vrijdag weer onder maar we zien richting het slot dat de DAX er net boven weet te sluiten. De steun blijft daardoor nog altijd de 15.500-15.550 punten zone, later zien we de 15.400 en de 15.300 punten als steun. Weerstand wordt nu de 15.650 punten met later de topzone rond de 15.800 punten. Bij de DAX ziet alles er wel wat zwakker uit dan bij andere indices, we zien een soort topvorming maar in deze markt is er niks zeker. De indicatoren zien er ook maar matig uit.

S&P 500 analyse:

De S&P 500 die bijna weer een record neer wist te zetten donderdag moet inleveren vrijdag, de index sluit net onder de 4400 punten en geraakt zo weer wat weg van de topzone 4420-4425 punten. Op de chart zien we toch wat verzwakking omdat de weerstandslijn de index voorlopig tegen blijft houden, er staan wat toppen rondom die 4420-4425 punten. Steun zien we nu eerst rond de 4390 punten, later komen de 4355 en de 4325 punten in beeld als steun. Verder zien we dat de oplopende steunlijn samen met het 50-daags gemiddelde nu rond de 4285-4290 punten uitkomen, later nog de 4250 punten als steun door de vorige toppen die we zien in mei en juni. De komende week maar eens bekijken of de index de draai richting de belangrijke steunpunten door zal zetten, aan de andere kant blijven de toppen ook niet ver weg.

Weerstand zien we rond de topzone die rond de 4420-4425 punten, later komt de 4450 punten als weerstand in beeld maar dan alleen bij een snelle uitbraak tot boven de zware weerstand.

Analyse Nasdaq:

De Nasdaq sluit 105 punten lager vrijdag na dat Amazon een forse daling liet zien en dat aandeel weegt zwaar mee. Ook de andere TOP-5 aandelen moesten wat inleveren al viel dat mee. De Nasdaq sluit zo weer onder de lijn over de toppen en test het 20-daags gemiddelde. We zien een dubbele top nu, de kans is groot dat de index de komende week terug moet richting de 14.400 punten waar we de eerste belangrijke steun zien uitkomen. Later komen de vorige toppen van eerder dit jaar weer in beeld, deze steun wacht rond de 14.210 punten.

De topzone rond de 14.800-14.825 punten blijft de eerste en redelijk zware weerstand. Bij een uitbraak mocht die er komen zien we rond de 14.900 en de 15.000 punten weerstand. De index laat wel wat verzwakking zien via die dubbele top en via de indicatoren die wat aan het verzwakken zijn.

Euro, olie en goud:

De euro zien we nu rond de 1,187 dollar, de prijs van een vat Brent olie komt uit op 74,15 dollar terwijl een troy ounce goud nu op 1812 dollar staat.

De LIVEBLOG en Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

Met vriendelijke groet,

Guy Boscart