Liveblog Archief maandag 26 juli 2021

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Nieuwe Woningen Verkoop (Jun) | Actueel: 676K Verwacht: 800K Vorige: 724K |

Markt snapshot Wall Street 26 juli

TOP NEWS

• China's new private tutoring rules put billions of dollars at stake

China's sweeping new rules in private tutoring has left private education firms facing a significant business impact as Beijing steps up regulatory oversight of a $120 billion industry that investors had bet billions of dollars on in recent years.

• U.S. Senate could open infrastructure debate this week

The U.S. Senate could vote again this week on whether to begin debating a key piece of President Joe Biden's agenda, a $1.2 trillion bipartisan infrastructure plan to rebuild the nation's roads and bridges, if negotiators can finalize the details of the measure.

• Fed now facing twin inflation, growth risks as virus jumps and supply chains falter

A U.S. Federal Reserve divided over how to respond to fast-rising prices meets this week with the fresh complication of increased coronavirus infections and a global supply chain that, far from sorting out its problems, may be headed for more inflation-inducing trouble.

• Toymaker Hasbro revenue beats as TV, film business rebounds

Toymaker Hasbro beat quarterly revenue estimates as demand for its "Dungeons & Dragons" tabletop game rose and its film and television production business returned to growth after being largely shut down by the pandemic last year.

• PerkinElmer to buy antibodies maker BioLegend for about $5.3 billion

Medical diagnostic firm PerkinElmer said it would buy BioLegend, a privately held maker of reagents and antibodies used in medical research, for about $5.25 billion in a cash-and-stock deal.

BEFORE THE BELL

U.S. stock index futures slipped as locally listed Chinese firms tumbled on tighter regulations in the mainland, souring sentiment at the start of a week packed with tech earnings. European stocks eased and Japan’s Nikkei ended higher, catching the tailwind from a bounce in global peers on positive corporate earnings. Gold prices rose as a softer dollar and concerns that rising coronavirus cases could stall economic recovery lifted demand for the safe-haven metal. Oil prices fell on concerns about fuel demand as well as changes to import rules in China. Building permits and new home sales numbers are due on the U.S. economic schedule later in the day. Tesla is scheduled to report earnings after market.

STOCKS TO WATCH

Results

• Hasbro Inc: The toymaker beat quarterly revenue estimates as demand for its "Dungeons & Dragons" tabletop game rose and its film and television production business returned to growth after being largely shut down by the pandemic last year. Revenue in Hasbro's Entertainment segment, which includes "Peppa Pig" maker Entertainment One and other movie businesses, jumped 47%. The Monopoly maker's net revenue rose 54% to $1.32 billion in the three months ended June 27, beating analysts' average estimate of $1.16 billion, according to a Refinitiv IBES estimate. Hasbro reported adjusted net earnings of $145.4 million, or $1.05 per share in the second quarter, compared to $2.7 million, or 2 cents per share, a year earlier.

• Koninklijke Philips NV: The Dutch health technology company beat analysts' expectations with a jump in second-quarter core earnings to 532 million euros, boosted by its personal health and diagnosis businesses. Analysts had expected adjusted earnings before interest, taxes and amortisation (EBITA) to rise to 519 million euros, up from 390 million euros a year earlier. The group also announced a 1.5 billion euro share buyback set to start in the third quarter and take up to three years. Philips confirmed its 2021 sales growth forecast but narrowed down its profit margin expectations to the low end of its previous range.

• Ryanair Holdings PLC: The Irish airline nudged up its forecast for full-year traffic on strong summer bookings but said fares remained well below pre-pandemic levels as it reported a first-quarter net loss of 273 million euros. Ryanair, Europe's largest low-cost carrier, said it expected to fly between 90 and 100 million passengers in its financial year to end-March 2022, up from an earlier forecast of 80-100 million. At least 10 million passengers are expected in August and September, around 70% of pre-pandemic levels, Chief Financial Officer Neil Sorahan said. "We've been encouraged by closing bookings, over the past number of weeks, particularly since the European Digital COVID certificate has been rolled out," Sorahan said in a presentation to investors. "So on that basis we're now improving our traffic guidance."

Deals Of The Day

• Bridgetown 2 Holdings Ltd: Southeast Asian online realty company PropertyGuru on Friday agreed to go public through a merger with a blank-check firm backed by billionaires Richard Li and Peter Thiel, giving the combined company an equity value of about $1.78 billion. The deal with Bridgetown 2 Holdings, a special purpose acquisition company (SPAC), is expected to fetch proceeds of $431 million, including a private investment of $100 million from Baillie Gifford, Naya, REA Group, Akaris Global Partners, and one of Malaysia's largest asset managers. The combined company will be listed on the New York Stock Exchange once the deal is finalised, PropertyGuru said in a statement.

• PerkinElmer Inc: The medical diagnostic firm said it would buy BioLegend, a privately held maker of reagents and antibodies used in medical research, for about $5.25 billion in a cash-and-stock deal. The deal, the largest ever for PerkinElmer, will allow the company to grow in areas such as clinical diagnostics and food safety testing, the diagnostic company said. PerkinElmer said it has bridge financing from Goldman Sachs Bank USA to cover the cash portion of the transaction. The company said the deal is expected to provide an estimated growth of $0.30 of adjusted earnings per share in the first full year following close and greater than $0.50 in the second year.

IPOs

• Duolingo Inc: The language learning app said it had raised the price target range for its initial public offering in the United States, in a sign there is high investor appetite for shares of Duolingo. The company said nearly 5.1 million shares will now be sold in the IPO at a price range between $95 and $100 each. It had previously set the range at $85 to $95 per share. Duolingo could raise up to $511 million in the IPO, and on a fully diluted basis, the company's value would be over $4.6 billion at the high end of the range. About 1.4 million shares would be sold by stockholders, proceeds from which would not go to the company. Goldman Sachs & Co and Allen & Company are the lead underwriters for the IPO. The company plans to list on Nasdaq under the symbol "DUOL".

In Other News

• Amazon.com Inc, Ford Motor Co & T. Rowe Price Group Inc: Electric car startup Rivian said on Friday it has closed a $2.5 billion fundraising round led by investors Amazon.com, Ford and T. Rowe Price. The announcement came the day after the California-based company said it was exploring building a second U.S. assembly plant. Reuters, citing unnamed sources, reported on Thursday that Rivian's planned plant, dubbed "Project Tera," will include battery cell production. “As we near the start of vehicle production, it’s vital that we keep looking forward and pushing through to Rivian’s next phase of growth,” Rivian Chief Executive R.J. Scaringe said in a statement. “This infusion of funds ... allows Rivian to scale new vehicle programs, expand our domestic facility footprint, and fuel international product rollout,” he added.

• AstraZeneca PLC, Pfizer Inc & BioNTech SE: A mixed vaccination of first AstraZeneca and then a Pfizer COVID-19 shot boosted neutralizing antibody levels by six times compared with two AstraZeneca doses, a study from South Korea showed. The study involved 499 medical workers - 100 receiving mixed doses, 200 taking two doses of the Pfizer/BioNTech shot and the remainder getting two AstraZeneca shots. All showed neutralizing antibodies, which prevent the virus from entering cells and replicating, and the result of the mixed schedule of vaccines showed similar amounts of neutralizing antibodies found from the group that received two Pfizer shots. Meanwhile, AstraZeneca said the European Medicines Agency recommended approving a medicine from its U.S.-based Alexion unit for treating a rare, deadly blood disorder in children and adolescents aged up to 18 years.

• Bank of America Corp: The bank's staff in most U.S. states no longer need to fill out health assessments to enter their offices from Monday, regardless of vaccination status, Business Insider reported on Friday, citing a leaked memo. The new guidance excludes employees working at the bank's offices in California, Nevada, Rhode Island, Virginia and the state of Washington because of state and local requirements in place, the memo said. Bank of America expects all of its vaccinated employees to return to the office after Labor Day in early September, and will then focus on developing plans to bring back unvaccinated workers to its sites, Chief Executive Officer Brian Moynihan told Bloomberg News in an interview last month.

• Boeing Co & Ryanair Holdings PLC: The airline could place a significant order for Boeing's MAX 10 aircraft this year but only if the price is right as the airline is not under any time pressure, its chief financial officer said. A large order from Ryanair, Boeing's largest European airline customer, would provide a major boost to the MAX, which was grounded for 20 months after two fatal crashes. "Maybe the back end of the year we will do something. Maybe not. It's all predicated on price," CFO Neil Sorahan told Reuters in an interview on the publication of the airline's results for its April-June quarter. "If the price is right, we're interested but it's a post FY26 time frame so we are under no time pressure there," he said, referring to the airline's financial year to March 31, 2026, when its current order ends.

• Cboe Global Markets Inc: The company said it would launch Europe's newest derivatives market on Sept. 6 in Amsterdam, taking on entrenched rivals like Deutsche Boerse and Euronext. Chicago-based Cboe said it had received reglatory approval from Dutch regulators to launch Cboe Europe Derivatives that would trade equity futures and options, with transactions cleared by its own clearing house EuroCCP. "The regulatory approval for a competitive and pan-European marketplace for equity derivatives is expected to accelerate the momentum we are seeing from market participants for an efficient market designed to address their needs," Cboe Netherlands President Ade Cordell said in a statement.

• Comcast Corp: NBC's broadcast of the Tokyo Olympic Games opening ceremony drew 16.7 million viewers, the smallest U.S. television audience for the event in the past 33 years, according to preliminary data from Comcast-owned NBCUniversal on Saturday. Across all platforms, including NBCOlympics.com and the NBC Sports app, 17 million people watched the ceremony, NBCUniversal said in an email. The streaming audience on those platforms grew 76% from the 2018 PyeongChang opening ceremony and 72% from the 2016 Rio opener, reflecting a change in viewing habits. The Tokyo opener TV audience declined 37% from 2016, when 26.5 million people watched the Rio de Janeiro Games opener, and 59% from 2012, when 40.7 million people watched the London ceremony.

• Credit Suisse Group AG: The Swiss bank has reached an out-of-court settlement with former star banker Iqbal Khan over allegations of spying that led to the resignation of the Chief Executive Tidjane Thiam, a spokesperson for Credit Suisse said on Sunday. "Everybody involved has agreed to settle and this matter is now closed," Simone Meier said, confirming a report in Swiss newspaper NZZ am Sonntag. The agreement, details of which have not been disclosed, ends a dispute that rocked the normally sedate world of Swiss banking when allegations of corporate espionage involving Credit Suisse emerged in September 2019.

• Exxon Mobil Corp: China has begun building a $1 billion natural gas import and storage base in the southern coastal province of Guangdong, a project in which the U.S. energy major is advancing discussion with partners for a joint investment. "ExxonMobil is progressing project discussions with potential partners," a Beijing-based company representative said, without giving further details. The new terminal, situated at Huidong county of Huizhou city, has a designed annual receiving capacity of 4 million tonnes under phase-one investment estimated to cost 6.636 billion yuan, Xinhua said. China's state economic planner, the National Development and Reform Commission, gave the greenlight for the project in early-July, the report added.

• General Motors Co & Ford Motor Co: GM and its Cruise robo-taxi subsidiary have filed a lawsuit to stop Ford from using the name "BlueCruise" to market its hands-free driving technology, the companies said on Saturday. In a statement released shortly after midnight Detroit time, GM said Ford's use of the BlueCruise name infringed on GM's Super Cruise trademark, as well as Cruise's trademark. "While GM had hoped to resolve the trademark infringement matter with Ford amicably, we were left with no choice but to vigorously defend our brands and protect the equity our products and technology have earned over several years in the market," GM said in its statement. In the lawsuit, filed on Friday, GM said the automakers had held "protracted discussions" over the matter but failed to resolve the dispute. GM is claiming trademark infringement and unfair competition in the lawsuit. Ford called the lawsuit, filed in federal court in California, "meritless and frivolous".

• Johnson & Johnson: South Africa's Aspen Pharmacare will supply the first batch of Johnson & Johnson COVID-19 vaccine to the country from July 26, the drugmaker said. It will be the first set of vaccines to be manufactured in the country from active pharmaceutical ingredients (API) - substances used to make the final drug product - sourced from Europe, Aspen said. Aspen, which has been contracted by J&J to manufacture the vaccines in South Africa in a process called 'fill and finish', had been sourcing APIs from the Baltimore plant and was asked to destroy 2 million doses as part of the finding of the FDA. The supplies will also be distributed to other African countries under the African Vaccine Acquisition Task Team under which J&J has committed to supply 220 million doses of the single shot vaccine, Aspen said.

• Lithium Americas Corp: A U.S. federal judge has ruled that Lithium Americas may conduct excavation work at its Thacker Pass lithium mine site in Nevada, denying a request from environmentalists who said the digging could harm sage grouse and other wildlife. The ruling marked a rare win for a U.S. critical minerals project as environmental groups increasingly pressure courts and regulators to block mining projects, even if they produce metals key to building electric vehicles. Chief Judge Miranda Du of the federal court in Reno, Nevada, said late on Friday that the digging - needed to determine whether the land holds historical import for Native Americans - may proceed while she determines the broader question of whether former President Donald Trump's administration erred when it approved the project in January. Du said she will try to publish her decision by early 2022.

• Moderna Inc: South Korea said it has been informed by Moderna of an unspecified production issue involving its COVID-19 vaccine, as the country expands its inoculation campaign for people aged 55-59 amid a fourth wave of infections. It was not immediately clear what the production issue is, how much and long shipment will be impacted and whether other countries will be also affected by the problem. "Moderna has informed that it has a production issue," health official Park Jin-young told a briefing, adding that consultations are being held to figure out details. "We're mobilising all available administrative and diplomatic capabilities to establish facts and devise countermeasures," Park said.

• RBC Bearings Inc & ABB Ltd: RBC Bearings is in advanced talks to buy the power transmission unit of Swiss industrial giant ABB, Bloomberg reported on Sunday. The report comes days after ABB's Chief Executive Bjorn Rosengren said an announcement on the sale of the unit, known as Dodge, would be made in the next few weeks. Dodge is valued at between $2.5 billion and $3 billion and a deal between the ABB and Oxford, Connecticut-based RBC Bearings could be reached as soon as this week, Bloomberg reported, citing people familiar with the matter.

• Rio Tinto PLC: Canadian union Unifor said on Sunday about 900 workers had started strike action at global miner Rio Tinto's operations in the western Canadian province of British Columbia. Unifor issued a 72-hour strike notice on Wednesday after nearly seven weeks of unproductive talks over proposed changes to workers' retirement benefits and unresolved grievances. In an emailed statement to Reuters, a spokesperson for the miner said that the union refused the company’s proposal to request the intervention of a mediator. "Rio Tinto has made every effort to reach a mutually beneficial agreement through negotiating with Unifor over the past seven weeks, and will continue to do so," the company said in the statement.

• SPX Flow Inc & Ingersoll Rand Inc: SPX Flow said it would explore strategic alternatives, including a sale or merger of the company, after the industrial pumps and valves maker rejected Ingersoll Rand's sweetened $3.59 billion buyout bid last week. SPX, which makes components for machinery used by industries such as food and beverages, had rejected Ingersoll's proposal, saying it undervalued the company. Ingersoll raised its offer in June to $85 per share from its first bid to buy SPX in May at $81.50 apiece."The board concluded that (Ingersoll's) proposals did not adequately value the company in light of the board's confidence in the potential for increased profit margins and growth," SPX said in a statement.

• Taiwan Semiconductor Manufacturing Co Ltd: The chipmaker said that it was too early to say whether it will build factories in Germany and that talks were in early stages, as the EU seeks to reduce chip imports amid a supply shortage. The European Commission had held discussions with global chip giants, including Intel and TSMC, as the EU seeks to boost semiconductor production and shield itself from shocks in the global supply chain. Taiwan and TSMC, the world's largest contract chip manufacturer, have become central in efforts to resolve the pandemic-induced chip shortage that has forced automakers to cut production and hurt manufacturers of smartphones, laptops and even appliances. "We are currently doing reviews on Germany seriously, but it's still in very early stages," TSMC chairman Mark Liu told an annual shareholder meeting when asked about building chip fabrication plants in the EU country. "We continue to communicate with our major clients in Germany to see whether this is most important and effective for our clients," he said. "It's too early to say."

• TAL Education Group, Gaotu Techedu Inc & New Oriental Education & Technology Group Inc: China's sweeping new rules in private tutoring has left private education firms facing a significant business impact as Beijing steps up regulatory oversight of a $120 billion industry that investors had bet billions of dollars on in recent years. The new rules released on Friday bars for-profit tutoring in core school subjects in an effort to boost the country's birth rate by lowering family living costs. Under the new rules, all institutions offering tutoring on the school curriculum will be registered as non-profit organisations, and no new licences will be granted, according to an official document. U.S.-listed TAL Education said on Sunday it expected the new rules to have "material adverse impact on its after-school tutoring services ... which in turn may adversely affect" its operations and prospects. Gaotu Techedu, New Oriental Education & Technology Group, Koolearn Technology, Scholar Education, and China Beststudy Education made similar statements. The new rules will result in existing online tutoring firms being subjected to extra scrutiny and after-school tutoring will be prohibited during weekends, public holidays and school vacations, the document said.

• United Airlines Holdings Inc: The airline wants the federal government to step in to address congestion problems at Newark Liberty International Airport as a runway repair project that began July 6 causes headaches for many summer travelers. United Chief Executive Scott Kirby asked Transportation Secretary Pete Buttigieg and Federal Aviation Administration (FAA) chief Steve Dickson "to temporarily and proportionally reduce the number of operations per hour at Newark while airport capacity is constrained by runway construction." In the July 15 letter, which has not been previously reported, Kirby said that during a six-day period in July "the average number of (Newark) flight cancellations by all airlines was more than 100 flights per day" which placed a "severe strain on employees and operations." Kirby asked FAA to "bring together all relevant parties to reduce the number of flights per hour temporarily and proportionally during July, August, and September." An FAA spokeswoman said the agency is "reviewing the letter and will respond directly to" United.

• Virgin Galactic Holdings Inc: Former chief executive officer of Virgin Galactic, George Whitesides, will fly to space on the aerospace company's next test spaceflight, CNBC reported on Friday. Richard Branson, the billionaire founder of Virgin Galactic, flew to space earlier this month, beating Amazon.com's Jeff Bezos to the final frontier. Branson announced the news about Whitesides during a party in New Mexico on July 11, following his own spaceflight, the report said. Lori Garver, a former deputy administrator of NASA was present at the party and told CNBC that Branson said, "George will be leading our next flight."

• Westpac Banking Corp: Papua New Guinea's competition regulator has rejected Kina Securities' A$420 million proposed stake acquisition in Westpac's Pacific operations, Australia's No. 2 lender said. PNG's Independent Consumer and Competition Commission (ICCC) raised concerns that the deal would not result in "benefits that outweigh detriments to public" and would lessen competition in the country's market, Kina said in a separate statement. Westpac said both parties were reviewing the regulator's draft and would make further submissions to ICCC before it takes a final decision on the deal in September.

ANALYSIS

Tesla's plans for batteries, China scrutinized as Musk drops features

Tesla has weathered the pandemic and supply chain crisis better than many of its rivals, achieving record deliveries last quarter. But Chief Executive Elon Musk faces pressure to deliver on breakthrough batteries and new factories and models, which are late.

ANALYSTS' RECOMMENDATION

• Gentex Corp: JPMorgan cuts target price to $34 from $37, reflecting the company’s softer second-quarter results.

• Hewlett Packard Enterprise Co: Evercore ISI raises rating to outperform and raises target price to $20 from $16, saying the stock is positioned to outperform in a substantial manner and the low multiple provides a healthy level of downside protection.

• Microsoft Inc: Jefferies raises target price to $335 from $310, saying fourth-quarter expectations are achievable, supported by the company's diverse portfolio including Azure and Teams driving upselling.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0800 (approx.) Building permits R number for June: Prior 1.598 mln

0800 (approx.) Building permits R change mm for June: Prior -5.1%

1000 (approx.) New home sales-units for June: Expected 0.800 mln; Prior 0.769 mln

1000 (approx.) New home sales change mm for June: Expected 3.5%; Prior -5.9%

1030 (approx.) Dallas Fed Manufacturing Business Index for July: Prior 31.10

COMPANIES REPORTING RESULTS

Ameriprise Financial Inc: Expected Q2 earnings of $5.22 per share

Cadence Design Systems Inc: Expected Q2 earnings of 76 cents per share

F5 Networks Inc: Expected Q3 earnings of $2.46 per share

Lockheed Martin Corp: Expected Q2 earnings of $6.53 per share

Otis Worldwide Corp: Expected Q2 earnings of 72 cents per share

Packaging Corp of America: Expected Q2 earnings of $1.78 per share

Tesla Inc: Expected Q2 earnings of 98 cents per share

Universal Health Services Inc: Expected Q2 earnings of $2.70 per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Linde PLC: Annual Shareholders Meeting

0830 Hasbro Inc: Q2 earnings conference call

0830 Otis Worldwide Corp: Q2 earnings conference call

0930 Lennox International Inc: Q2 earnings conference call

1000 RPM International Inc: Q4 earnings conference call

1100 Lockheed Martin Corp: Q2 earnings conference call

1630 F5 Networks Inc: Q3 earnings conference call

1700 Amkor Technology Inc: Q2 earnings conference call

1700 Amyris Inc: Shareholders Meeting

1700 Cadence Design Systems Inc: Q2 earnings conference call

1700 Simpson Manufacturing Co Inc: Q2 earnings conference call

1700 TriNet Group Inc: Q2 earnings conference call

1730 Tesla Inc: Q2 earnings conference call

EX-DIVIDENDS

Bank of New York Mellon Corp: Amount $0.34

Cooper Companies Inc: Amount $0.03

Fastenal Co: Amount $0.28

TA - Een greep uit AMX

ABN Amro ABN was al sinds oktober bezig met een stevige opwaartse trend (zie blauwe trendlijn). Rond mei van dit jaar werden de eerste haperingen zichtbaar. De koers vertoonde korte neerwaartse uitschieters waarbij de MA-20 / MA-50 getest of gebroken werden. Daarbovenop kwam nog een ‘death…

Lees verder »Top 5 bedrijven en FED deze week, volatiliteit zal aanhouden

We starten een nieuwe week, de laatste van de maand en eentje met nogal wat nieuws rondom de economie en bedrijfscijfers want de FED komt woensdag met een vergadering over de rente en een persconferentie. Ook komen Apple, Amazon, Microsoft, Tesla, Facebook en Alphabet met hun cijfers over Q2. Vandaag komt Tesla al met cijfers, morgen staan er 3 grote toppers op het programma met Apple, Alphabet en Microsoft. De futures staan vanmorgen wat lager na de records van afgelopen vrijdag, men verwacht wat winstnemingen zo te zien.

Update 26 juli:

De laatste week van de maand zal zo te zien meteen ook weer voor de nodige volatiliteit kunnen zorgen met wat er op het programma staat deze week. Vanavond al cijfers van Tesla en morgen komen Apple, Microsoft en Alphabet met hun cijfers terwijl alle 3 deze aandelen rond hun hoogste koers ooit staan en samen al meer dan 6500 miljard dollar aan beurswaarde hebben. Woensdag komt dan Facebook met cijfers en donderdag is Amazon aan de beurt.

We kijken uiteraard ook uit naar wat de FED te melden heeft woensdag, eerst de beslissing rondom de rente en het opkoop programma dat nog steeds op volle toeren draait. Later woensdag rond 20:30 een persconferentie met FED voorzitter Powell. Wat zal hij melden over de inflatie, over het opkoop programma en over de economie.

Verder zien we dat er enkele indices tegen hun plafond stuiten, dat is duidelijk te zien bij de AEX en de S&P 500 index. Van de AEX heb ik zondag een analyse gemaakt waar u dat duidelijk kunt zien, ga naar https://www.usmarkets.nl/techn... om deze analyse te bekijken.

We handelen uiteraard ook op de indexen en vrijdag heb ik al wat posities opgenomen, u kunt meedoen zodra u zich inschrijft via de aanbieding die loopt tot 1 oktober voor €35 ... Ga naar https://www.usmarkets.nl/tradershop

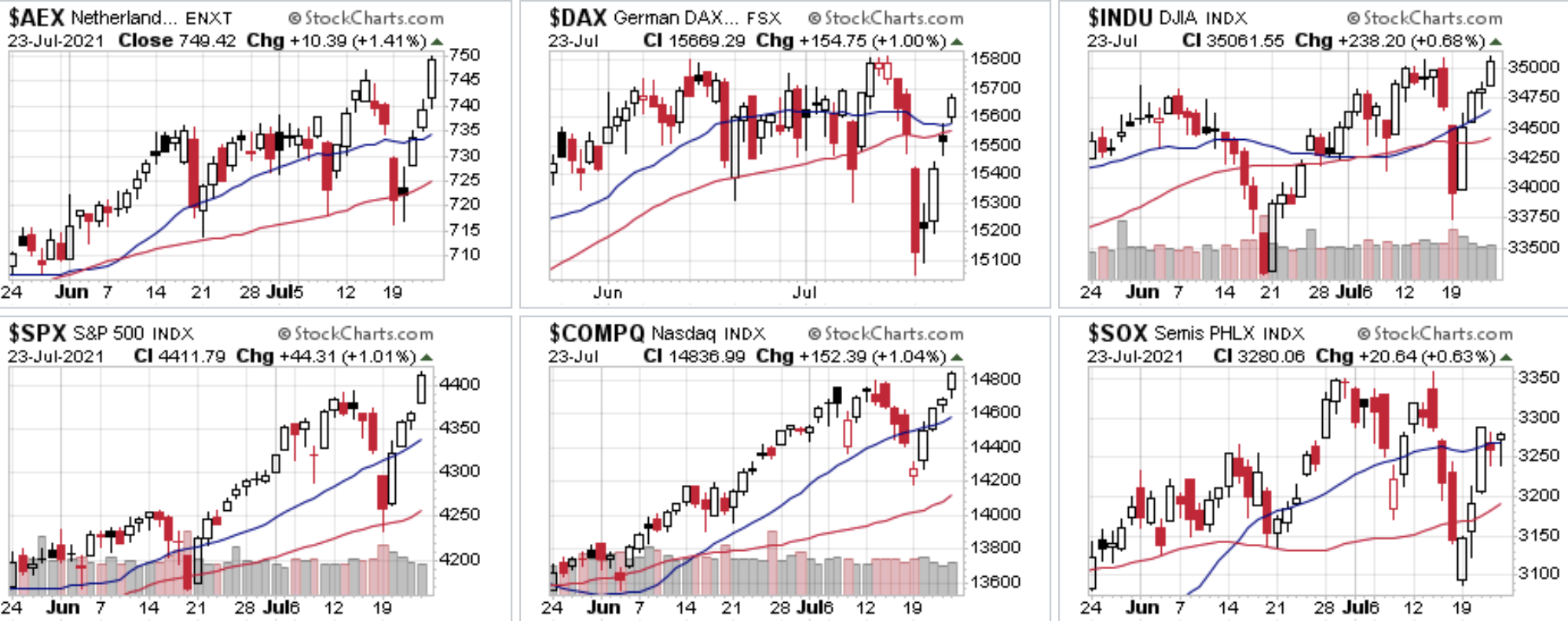

Overzicht slot vorige week vrijdag:

Een sterk slot van de week met records bij de Dow Jones, de S&P 500, de Nasdaq en de AEX index, de DAX deed het ook goed maar bleef nog ruim onder de hoogste stand ooit. Vooral Wall Street kwam met een sterke rebound vanaf de diepe bodems van maandag heel sterk de week uit, ook de AEX herpakt zich heel sterk en dat kwam door ASML dat al 3 dagen op rij met een stevige plus weet te sluiten, gemiddeld meer dan 20 euro per dag erbij. De AEX sluit dan ook op een nieuw record dat op 749,5 punten uitkomt. Ook de Dow Jones zet een nieuw record neer op 35.061 punten, de S&P 500 zet het record neer op 4412 punten terwijl de Nasdaq het record op 14.837 punten zet. De Nasdaq 100 geraakt zelfs tot 15.112 punten.

Mijlpaal Dow Jones:

Na een zesde aanval om de 35.000 punten te doorbreken was het voor de Dow Jones vrijdag raak om voor het eerst boven deze grotendeels symbolische mijlpaal te sluiten. Een nieuw record en dat bij alle grote indices op Wall Street na dat we maandag toch even behoorlijk wat lager stonden, de Dow Jones tikte zelfs even de 33.740 punten aan als laagste punt. De index sluit de week daar zo'n 1300 punten boven na een enorme buy-the-dip-rebound. De Dow eindigde vrijdag met een winst van 238 punten, ofwel 0,7% op 35.061 punten en dat is meteen het nieuwe recordslot, het echte record stond op 10 mei op 35.091 punten maar dat werd vrijdag ook minimaal doorbroken met de hoogste stand ooit die nu uitkomt op 35.094 punten.

Om nog even naar de Dow-mijlpalen te kijken, ze zijn grotendeels symbolisch maar ze bepalen wel de krantenkoppen en kunnen daardoor het sentiment retail beleggers een soort boost geven. Die 35.000 is dus weer een van die symbolische mijlpalen voor de markt en dat als je even bedenkt dat de index 15 maanden geleden nog tot onder de 20.000 daalde tijdens een grote sell-off. Verder duurde het maar 165 handelsdagen om van een slot boven de 30.000 naar een slot boven de 35.000 te geraken en dat is de snelste stijging van 5.000 punten ooit al moeten we ook inzien dat het procentueel wat minder is dan als je van 20.000 naar 25.000 gaat of van 25.000 naar 30.000.

Records Dow, S&P 500, Nasdaq, Nasdaq 100 en de AEX:

Alle belangrijkste indexen eindigden vrijdag op een nieuw record, de opleving werd vooral toegeschreven aan afnemende zorgen over de economische impact van de verspreiding van de delta-coronavirus variant en positieve bedrijfswinsten. Verder schuift men de zorgen om de inflatie even aan de kant en kijkt men maar even niet naar de waarderingen die nog altijd veel te hoog blijven.

We hebben trouwens wel een rare week achter de rug, de laatste keer dat de Dow op een maandag met ten minste 2% daalde en op de vrijdag van die week op een record sloot was in augustus 1991. Dat was ook de laatste keer dat de S&P 500 daalde met 1,5 % op een maandag en op een nieuw record afsluit op vrijdag. Bij de Nasdaq Composite kwam het nog nooit eerder voor dat de index met 1% daalde op een maandag en dan de week afsloot op een nieuw record.

Zoals ik al aangaf moeten we met wat posities scherp zien in te stappen op wat indices en vrijdag heb ik al wat kleine posities kunnen opnemen om en nabij de recordstanden. Er kunnen er nog 1 of 2 bijkomen begin volgende week maar ik blijf wel met lage aantallen werken in deze fase. Zodra het kan zal ik een signaal versturen naar de leden, de posities van vrijdag kunt u nog opnemen uiteraard na dat u lid wordt.

Doelen bereikt, de posities mooi afgerond:

Meedoen met US Markets Trading kan uiteraard door lid te worden, maandag heb ik op tijd winst genomen op alle posities die open stonden zodat we deze maand al met een mooie winst staan. Ik blijf rustig en hou me aan het plan voor de komende periode, rustig kansen zoeken en waar het kan wat posities opnemen. Als u de signalen wilt ontvangen wordt dan vandaag nog lid via de nieuwe aanbieding voor €35 die loopt tot 1 oktober ...

Zo ziet u hieronder dat de eerste resultaten voor deze maand JULI er nu bij staan. Ook deze maand halen we dus met voorzichtig handelen een mooi resultaat, u kunt nu meedoen met de nieuwe posities die er aan zitten te komen in de loop van deze week door lid te worden via de nieuwe aanbieding. Bij Guy Trading kijk ik ook naar wat aandelen waar er wat mee kan worden gedaan. Schrijf u dus op tijd in, ik zal in ieder geval het momentum kiezen om in te stappen.

Bij Systeem Trading ziet u hieronder hoe de 7 maanden dit jaar verlopen, u ziet dat elke maand positief werd afgerond.

De nieuwe aanbieding loopt tot 1 OKTOBER en dat voor €35 (Polleke Trading €45 en COMBI-Trading voor €75). Inschrijven kan via de link https://www.usmarkets.nl/tradershop

Hieronder het resultaat van deze maand (JULI) en dit jaar (2021):

Marktoverzicht:

Technische conditie AEX:

De AEX geraakt boven de recordstand en sluit op een zucht van de 750 punten, de index tikt nu wel de lijn over de toppen aan en dat kan ervoor zorgen dat de index een top heeft bereikt. Boven die 750 punten letten we in het vrije gebied als weerstand op de 760 en de 770 punten. Steun nu de top van vorige week rond de 747 punten, later de 736 en de 728 punten als steun. De AEX werd vooral gesteun door de koers explosie van ASML de afgelopen dagen.

Technische conditie DAX:

De DAX herpakt zich ook maar geraakt niet tot een nieuw record, wel werd de horde 15.500-15.550 punten doorbroken en achter gelaten. De eerste weerstand wordt hoe dan ook de top rond de 15.800 punten. Steun blijft de zone 15.500-15.550 punten met later de 15.300 en de 15.150 punten.

S&P 500 analyse:

De S&P 500 breekt boven de vorige toppen van begin deze maand, die zien we rond de 4390-4395 punten uitkomen en dat wordt dan ook de eerste steun. De index bereikt wel de lijn over de toppen en dat zou normaal gezien voor weerstand moeten zorgen, laten we zeggen tussen de 4410 en de 4420 punten toch een behoorlijke hindernis. Steun dus de 4390-4395 punten, later de 4350 en de 4300 punten. Het kan de komende week wel eens belangrijk worden voor het vervolg.

Analyse Nasdaq:

De Nasdaq zet een record neer boven de toppen van begin deze maand, de vraag is nu of er een nieuwe reeks volgt de komende week. Weerstand nu de 15.000 punten als we een mijlpaal nemen, daarboven ligt het open en kijken we naar de 15.250 en verder. Steun nu de vorige toppen rond de 14.800 punten, later de 14.580 en de 14.400 met daaronder de oude toppen rond de 14.200 punten.

Euro, olie en goud:

De euro zien we nu rond de 1,178 dollar, de prijs van een vat Brent olie komt uit op 72,7 dollar terwijl een troy ounce goud nu op 1809 dollar staat.

De LIVEBLOG en Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

Met vriendelijke groet,

Guy Boscart