Liveblog Archief maandag 4 mei 2020

Markt zoekt wat, het oog van de storm noem ik dat

Lagere start vanmorgen, Europa lager omdat we dicht waren vrijdag maar we zien dat Wall Street er alles aan doet om in de plus te geraken met natuurlijk veelvraat Nasdaq voorop. Voor mij was het een moment om de short posities op Wall Street te sluiten met de eerste winst voor deze maand (MEI), we starten dus goed, op naar de volgende positie en die komt er nog deze week. We blijven voorzichtig, kijken uit naar wat de markt van plan is, houden de posities klein en maken vooral gebruik van de volatiliteit. De bedoeling is om met Trading het zo voorzichtig mogelijk te doen in deze markt en vooral om waar de mogelijkheden er zijn die te pakken ...

Ook met de aandelen portefeuille werd er winst gemaakt op 2 posities, die werden begin vorige week opgenomen.

We zien wel wat de markt gaat doen vanavond, de luxe is dat we nu bij Trading CASH zitten en weer wat kunnen uitzoeken voor morgen of woensdag ... Meedoen kan door lid te worden via de aanbieding die loopt tot 1 JULI voor €39 ...

Schrijf u in via de link https://www.usmarkets.nl/tradershop

Er is ook nog meer dan de signalen, de posities ... Ik probeer mijn leden waar nodig te begeleiden in deze moeilijke markt ... Wie weet tot later, en als nieuw lid ...

Tot straks ... Guy

Pffff. Acties bedoelde ik

Pffff. Acties bedoelde ik

Klasse actied Guy.

Klasse actied Guy.

Market snapshot USA

TOP NEWS

• Trump administration pushing to rip global supply chains from China -officials

The Trump administration is "turbocharging" an initiative to remove global industrial supply chains from China as it weighs new tariffs to punish Beijing for its handling of the coronavirus outbreak, according to officials familiar with U.S. planning.

• J. Crew files for bankruptcy as preppy retailer succumbs to COVID-19 fallout

J. Crew Group Inc filed for bankruptcy protection with a plan to hand over control to lenders, adding to a list of brick-and-mortar retailers pushed to the brink by widespread store closures in response to the COVID-19 pandemic.

• Pandemic slams global factories, activity sinks to new lows

Factory activity was ravaged across the world in April, business surveys showed, and the outlook looked bleak as government lockdowns to contain the new coronavirus pandemic froze global production and slashed demand.

• Uber closes Eats operations in eight smaller markets

Uber said it was closing down its Uber Eats operations in eight markets because they did not offer a clear route to becoming the number one or number two online food delivery operator, its stated aim for its Eats business.

• U.S. arms makers and medical device firms team up to make ventilators

U.S. weapons makers have teamed up with medical device companies to increase the supply of ventilators that can be used to combat the coronavirus pandemic, people working on the project said.

BEFORE THE BELL

U.S. stock futures fell along with European shares as U.S.-China tensions flared up again over the origin of the coronavirus, while gold advanced. In Asian stock markets, with China and Japan on holiday, Hong Kong shares dipped the most in six weeks. Crude prices slipped on worries that a global oil glut may persist. The dollar rose against most major currencies. Data on factory orders is scheduled on economic calendar. American International Group is slated to post its earnings after market close.

STOCKS TO WATCH

Results

• Berkshire Hathaway Inc (BRKa). Warren Buffett's Berkshire is being hit hard by the coronavirus pandemic, posting a record quarterly net loss of nearly $50 billion on Saturday and saying performance is suffering in several major operating businesses. Berkshire released results before its annual meeting, where Buffett said Berkshire in April sold its "entire positions" in the four largest U.S. airlines. Berkshire said it bought only a net $1.8 billion of stocks in the first quarter. It also said it repurchased $1.7 billion of its own stock, but that was less than in the prior quarter. Berkshire's first-quarter net loss was $49.75 billion, or $30,653 per Class A share, reflecting $54.52 billion of losses on stock and other investments. Net earnings were $21.66 billion, or $13,209 per share, a year earlier. Quarterly operating profit, which Buffett considers a better performance measure, rose 6% to $5.87 billion, or about $3,624 per Class A share, from $5.56 billion, or about $3,388 per share.

In Other News

• Alphabet Inc (GOOGL). More people stayed home in Brazil, Japan and Singapore in April as those countries' novel coronavirus cases surged, while people in the United States and Australia returned to parks and jobs as infection rates flattened, data from Google show. The latest weekly update of aggregated travel patterns Google collected from its users' phones pointed to increased disobedience with lockdown orders in place since March but rising compliance with those issued last month.

• Amazon.com Inc (AMZN) & Target Corp (TGT). Some workers at Amazon.com, Target and Instacart Inc staged protests and sick-outs on Friday to demand a safer work environment and better pay during the coronavirus outbreak. The protests were the latest by workers deemed essential in the pandemic who risk their lives working in warehouses and grocery stores. They argue that employers have fallen short in providing for their safety while making record sales. Their demands include hazard pay and the shuttering of facilities with confirmed coronavirus cases. Workers at Target and Instacart are also requesting protective equipment like masks.

• Berkshire Hathaway Inc (BRK), American Airlines Co (AAL), Delta Air Lines Inc (DAL), Southwest Airlines Co (LUV) & United Airlines Holdings Inc (UAL). The conglomerate sold its entire stakes in the four largest U.S. airlines in April, Chairman Warren Buffett said Saturday at the company's annual meeting, saying "the world has changed" for the aviation industry. Berkshire had held sizeable positions in the airlines, including an 11% stake in Delta Air Lines, 10% of American Airlines, 10% of Southwest Airlines and 9% of United Airlines at the end of 2019, according to its annual report and company filings. Buffett said the airline industry's outlook rapidly changed. Separately, Buffett on Saturday said the United States' capacity to withstand crises provides a silver lining as it combats the coronavirus, even as he acknowledged that the global pandemic could significantly damage the economy and his investments.

• Comcast Corp (CMCSA). The company owned NBCUniversal is evaluating a significant reduction of staff across its portfolio of media and entertainment properties as part of a cost-cutting effort, the Wall Street Journal reported on Friday, citing people familiar with the matter. Discussions began this week regarding cost-cutting measures, including layoffs, according to the report.

• GCP Applied Technologies Inc (GCP). The company said on Friday that its largest investor had wanted to take control of GCP's board itself before backing activist investor Starboard Value, which also wants to replace most GCP directors. That investor, Standard Industries Inc and its affiliated entity 40 North Management LLC, which together own 24.4% of GCP's stock, asked to appoint six of nine directors at GCP, the company said in a presentation. A spokesman for 40 North said, "The statement GCP made in their SEC filing that we asked for control of the board is false." Four directors would have come from the investor group and the other two would have been Starboard nominees, GCP said in the presentation. Starboard, which is pushing ahead with a proxy fight this year, was handed two GCP board seats last year.

• General Motors Co (GM). The company's South Korean unit plans to sharply cut output this month at a factory producing its new Trailblazer sport-utility vehicle (SUV), as the coronavirus outbreak weighs on its U.S. exports and also disrupts parts supplies. GM Korea is responsible for supplying some of GM's small SUVs to the U.S. market to meet a consumer shift away from sedans. GM Korea will run its BP1 plant in Incheon, near Seoul, for seven business days this month and idle it for the remaining 11, showed its internal production plan seen by Reuters. A spokeswoman said the automaker has suspended the line until May 5 due to the virus impact on parts procurement and U.S. sales, and that its production plan for the rest of May is subject to change. Meanwhile, the company is is not a target in the Justice Department's investigation into corruption within the United Auto Workers union, the U.S. Attorney's Office in Detroit said on Friday. Separately, the automaker's sales in China saw double-digit year-on-year growth in April, its two local ventures said on Sunday, as the world's biggest auto market recovers from the coronavirus.

• Intel Corp (INTC). The chipmaker is in advanced talks to acquire Israeli public transit app developer Moovit for $1 billion, financial news website Calcalist reported on Sunday.Moovit has raised $133 million from investors including Intel, BMW iVentures and Sequoia Capital. Calcalist reported that people with knowledge of the talks, who spoke on condition of anonymity, said the deal is very close to being signed.

• Liberty Global Plc (LBTYA). Shares in Spain's Telefonica rose to post the only strong gains on an otherwise almost entirely red Madrid index, after the company confirmed it was in talks with billionaire John Malone's Liberty Global over a possible merger of their respective businesses in Britain. The two have started a negotiation process to merge Telefonica's British mobile operator O2 and Liberty's Virgin Media network company, the Spanish company said in a stock market filing. Two sources familiar with the matter told Reuters on Friday that talks were ongoing.

• News Corp (NWSA). David Rhodes, the former president of CBS News who started his career at Fox News, is returning to Rupert Murdoch's News Corp to help the company's News UK operations in the video business, a source familiar with the matter said. Rhodes left CBS News last year. The source confirmed a report in the New York Times, which said that Rhodes' return stoked speculation he could play a role at Fox News.

• Tesla Inc (TSLA). The U.S. electric carmaker has applied for a licence to supply electricity in the United Kingdom, The Telegraph reported on Saturday. The purpose of the licence from the energy regulator may be to introduce the company's Autobidder platform, the report said, citing a company source. The application did not make clear why Tesla has applied for the licence, The Telegraph reported. Having built a significant battery business in recent years, the carmaker is now preparing to enter the British market with its technology, the paper said, citing industry sources.

• Uber Technologies Inc (UBER). The company said it was closing down its Uber Eats operations in eight markets because they did not offer a clear route to becoming the number one or number two online food delivery operator, its stated aim for its Eats business. "We have made the decision to discontinue Uber Eats in Czech Republic, Egypt, Honduras, Romania, Saudi Arabia, Ukraine, and Uruguay, and to wind down the Eats app and transition operations to Careem in UAE," a Uber spokesman said. Uber said the discontinued and transferred markets represented 1% of Eats gross bookings and 4% of Eats adjusted core earnings losses in Q1 2020. Meanwhile, the company was ordered by a U.S. judge on Friday to face a lawsuit claiming its illegal predatory pricing and other anticompetitive practices stifled competition, and drove rival Sidecar Technologies Inc out of business.

PREVIEW

Disney, hit hard by coronavirus, to face Wall Street questions on impact on company

Walt Disney Co's acquisitions spree that included swallowing much of Rupert Murdoch's 21st Century Fox last year, and a reputation for operational excellence, turned the company into the world's most powerful entertainment machine. That girth has now made it the most vulnerable among media companies during the global coronavirus pandemic. On Tuesday, Wall Street will assess the level of damage and look for signs of a bottom.

ANALYSTS' RECOMMENDATION

• AbbVie Inc (ABBV). Mizuho raises target price to $101 from $100, following the company’s strong Q1 results.

• Charter Communications Inc (CHTR). JPMorgan raises target price to $575 from $550, based on the company’s solid EBITDA growth coupled with substantial capital returns.

• Chevron Corp (CVX). Credit Suisse raises target price to $100 from $81, citing the company’s strong Q1 EPS beat on higher production and better margins on refined products.

• Estee Lauder Companies Inc (EL). D.A. Davidson raises price target to $150 from $143, based on the company’s lower opex and a faster pace of sales recovery.

• Exxon Mobil Corp (XOM). Credit Suisse raises target price to $45 from $37, factoring the company’s better cost performance.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0945 ISM-New York Index for Apr: Prior 849.3

0945 ISM New York Business Conditions for Apr: Prior 12.9

1000 Durables ex-defense, R mm for Mar: Prior -15.8%

1000 Durable goods, R mm for Mar: Prior -14.4%

1000 Factory orders mm for Mar: Expected -9.8%; Prior 0.0%

1000 Durables ex-transport R mm for Mar: Prior -0.2%

1000 Nondefense cap ex-air R mm for Mar: Prior 0.1%

1000 Factory ex-transport mm for Mar: Prior -0.9%

COMPANIES REPORTING RESULTS

American International Group Inc (AIG). Expected Q1 earnings of 50 cents per share

Diamondback Energy Inc (FANG). Expected Q1 earnings of ₹ 1.03 cents per share

Jack Henry & Associates Inc (JKHY). Expected Q3 earnings of 87 cents per share

Leggett & Platt Inc (LEG). Expected Q1 earnings of 50 cents per share

Mohawk Industries Inc (MHK). Expected Q1 loss of 40 cents per share

Mosaic Co (MOS). Expected Q1 earnings of 78 cents per share

Public Service Enterprise Group Inc (PEG). Expected Q1 earnings of ₹ 1.86 cents per share

Realty Income Corp (O). Expected Q1 loss of 22 cents per share

Skyworks Solutions Inc (SWKS). Expected Q2 earnings of 44 cents per share

Tyson Foods Inc (TSN). Expected Q2 earnings of 33 cents per share

Unum Group (UNM). Expected Q1 earnings of ₹ 1.02 cents per share

Varian Medical Systems Inc (VAR). Expected Q2 earnings of 84 cents per share

Williams Companies Inc (WMB). Expected Q1 earnings of 89 cents per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Clarivate Analytics PLC (CCC). Q1 earnings conference call

0900 Tyson Foods Inc (TSN). Q2 earnings conference call

1000 Aflac Inc (AFL). Annual Shareholders Meeting

1000 CNA Financial Corp (CNA). Q1 earnings conference call

1000 Westinghouse Air Brake Technologies Corp (WAB). Q1 earnings conference call

1030 National Retail Properties Inc (NNN). Q1 earnings conference call

1100 Eli Lilly and Co (LLY). Annual Shareholders Meeting

1100 Loews Corp (L). Q1 earnings conference call

1100 Public Service Enterprise Group Inc (PEG). Q1 earnings conference call

1100 Westlake Chemical Corp (WLK). Q1 earnings conference call

1200 Sempra Energy (SRE). Q1 earnings conference call

1400 WEC Energy Group Inc (WEC). Q1 earnings conference call

1630 Chegg Inc (CHGG). Q1 earnings conference call

1630 Five9 Inc (FIVN). Q1 earnings conference call

1630 Skyworks Solutions Inc (SWKS). Q2 earnings conference call

1630 Varian Medical Systems Inc (VAR). Q2 earnings conference call

Wat betekent dit voor de handel? :-O

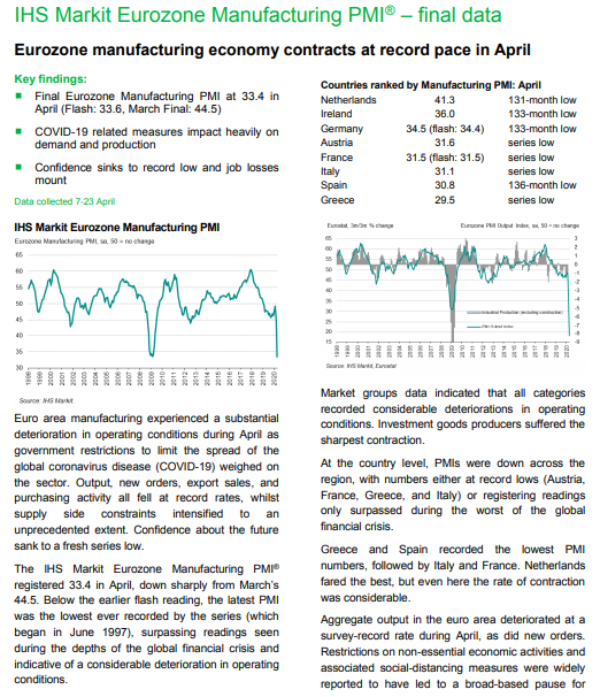

Ook in de belangrijke landen in Azië krijgt de PMI een dreun van jewelste, overal zien we een keiharde terugval voor de maand april ...

groeten wouter

De PMI cijfers voor de maand april zijn binnen, een overzicht waar Nederland er het best uitkomt, Griekenland het slechtst ...

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| DEU: Duitse Productie Inkoopmanagersindex (PMI) (Apr) | Actueel: 34,5 Verwacht: 34,4 Vorige: 45,4 |

Wake-up call: Maand mei start met dalingen en moddergooien

Goedemorgen

Weer een weekend achter de rug, het enige wat anders voelt is dat de beurzen niet open zijn, voor de rest moeten we hetzelfde patroon volgen als door de week, niet even ergens naartoe, geen ontspannen bezoek aan een restaurant of een borrel drinken met wat vrienden in de kroeg. Niet op bezoek bij mijn ouders die eenzaam tijdens de laatste fase van hun leven dit nog moeten meemaken en nog meer van die dingen, die zult u ook doorstaan, vooral als je even tijdens een momentje nadenkt waar we op dit moment staan met de maatschappij. Hopelijk komt er heel snel een oplossing, een vaccin want hoe lang kunnen de veel mensen (ouderen) dit nog volhouden met deze eenzaamheid, deze frustrerende periode?

Zelf probeer ik me te vermaken met vooral het bezig blijven met van alles en nog wat maar het dagelijkse patroon is teveel hetzelfde in deze tijden, er zit amper variatie in en dat is juist hetgeen we missen. Uiteraard zijn er mensen die houden van een zelfde patroon elke dag maar wat mezelf betreft wil ik niet graag van tevoren weten wat ik morgen ga doen. Ik hou van de verrassingen in het leven. Ook mis ik de korte breaks tussendoor om even naar Frankrijk te gaan, vrienden te bezoeken enz ... Maar goed, we bijten op de tanden en gaan door, we hebben de spanning van de beurs nog en dat is in ieder geval niet saai te noemen de afgelopen periode en het zal niet veel anders worden de komende periode ...

De futures staan vanmorgen in ieder geval lager, en dat zint Trump niet zo merk ik, in de plaats van zich bezig te houden met de nuttige zaken zit hij zich een ongeluk te Twitteren met zaken waarvan ik denk of je dat nu moet doen. Hij staat achter in de peilingen ten opzichte van Joe Biden maar noemt het FAKE-nieuws, hij spuwt vuur richting China en dreigt ermee om de Trade-deal af te blazen en nieuwe grotere tarieven te heffen, ook legt hij de schuld van de pandemie richting China waar ze veel meer zouden weten over wat er aan de hand is. Wat zou die man doen de gehele dag? Opstaan, Twitteren, TV-kijken om te zien wat ze over hem zeggen en dan opnieuw Twitteren dat het allemaal FAKE-nieuws is? Daarna een persconferentie geven die 1 a 2 uur duurt en dreigen richting richting wie er hem in de weg zit. De schuld vooral op een ander afschuiven, zeggen dat de VS snel weer aan het werk moet en dat het aantal doden meevalt tot nu toe ... Daarna gaan eten ... weer TV kijken, nog een keer Twitteren en dan gaan slapen ... Zou zo maar kunnen ... Maar goed, het blijft een vreemde en gevaarlijke man, dan vooral zijn karaktertrekken ...

De beurzen reageren vanmorgen vooral op het volgende, eerst het feit dat de grote 5 nu al met cijfers zijn gekomen en we nu wat in een vacuüm terecht gaan komen wat betreft bedrijfsresultaten, er is al veel voorbij gekomen en het blijkt dat het op zich prima ging door dat de eerste 2 maanden van Q1 nog redelijk normaal verliepen, pas in maart volgden die lockdowns elkaar in snel tempo op. Wat men nu denkt is hoe Q2 zal verlopen en vooral hoe lang het nog gaat duren. Verder is er ook de vraag hoeveel bedrijven het niet zullen redden, vooral de middenstand en de retail in de straat (zonder internet verkoop). En mocht alles weer opstarten, hoe zal de consument zich herpakken? Kan ook een tijdje duren zoiets, kan maanden duren voor we ons gedrag weer terug krijgen van voor deze fase. De economie komt wel weer op gang, maar het zal een trage diesel worden, niet een Ferrari die meteen op gang komt zodra je het gas indrukt. En we zitten nog met Trump die nu om zich heen begint te schoppen, dat zal de gemoederen ook niet ten goede komen ... De start van de 2e golf omlaag lijkt dus te zijn begonnen, ik ben benieuwd wat die gaat brengen deze week en de komende weken. We blijven voorzichtig, handelen waar het kan, zoeken naar kansen.

Via de LIVEBLOG zal ik iedereen wel informeren waar het nodig is, ook de leden zal ik met informatie en posities coachen waar nodig ... We zitten al sinds donderdag in wat kleine short posities, de maand MEI start dus al goed maar ik moet nog een goed moment zien te vinden om de posities te sluiten ... Meedoen kan, er loopt een aanbieding tot 1 JULI voor €39 ofwel 2 maanden volgen en signalen ontvangen. Het is niet zo dat ik u bombardeer met signalen, dat is niet nodig, reken op 1 tot 2 signalen per week in deze markt ...

Schrijf u in via de link ... https://www.usmarkets.nl/tradershop

Tot straks ... Guy

Markt snapshot Europa vandaag

GLOBAL TOP NEWS

U.S. President Donald Trump said on Sunday he now believes as many as 100,000 Americans could die in the coronavirus pandemic, after the death toll passed his earlier estimates, but said he was confident a vaccine would be developed by the year's end.

Secretary of State Mike Pompeo said on Sunday there was "a significant amount of evidence" that the new coronavirus emerged from a Chinese laboratory, but did not dispute U.S. intelligence agencies' conclusion that it was not man-made.

The British government had a contingency plan for Prime Minister Boris Johnson's death as he battled COVID-19 in intensive care last month, he said in an interview with The Sun newspaper.

EUROPEAN COMPANY NEWS

Norwegian Air said on Sunday it had secured support from enough bondholders for a $1.2 billion debt-for-equity swap, a vital step in helping it survive the coronavirus crisis.

Roche has won emergency approval from the U.S. Food and Drug Administration for an antibody test to determine whether people have ever been infected with the coronavirus, the Swiss drugmaker said on Sunday.

Lufthansa is hopeful its bailout talks with the German government can be concluded soon, the airline's board told staff in a letter seen by Reuters, adding that it is also considering alternatives such as creditor protection.

TODAY'S COMPANY ANNOUNCEMENTS

Anglo African Oil & Gas PLC Shareholders Meeting

Bpost SA Q1 2020 Earnings Release

Eltel AB Annual Shareholders Meeting

Endesa SA Q1 2020 Earnings Release

Ferrari NV Q1 2020 Earnings Call

Fingerprint Cards AB Q1 2020 Earnings Call

freenet AG Q1 2020 Earnings Call

Gunsynd PLC Shareholders Meeting

Honye Financial Services Ltd Annual Shareholders Meeting

Imerys SA Annual Shareholders Meeting

Intelligent Ultrasound Group PLC Shareholders Meeting

Kloeckner & Co SE Q1 2020 Earnings Call

Liberbank SA Q1 2020 Earnings Call

Nolato AB Annual Shareholders Meeting

Nordic Waterproofing Holding A/S Q1 2020 Earnings Call

PostNL NV Q1 2020 Earnings Call

Rightmove PLC Annual Shareholders Meeting

Sabaf SpA Annual Shareholders Meeting

Stabilus SA Q2 2020 Earnings Call

Tomra Systems ASA Annual Shareholders Meeting

Traton SE Q1 2020 Earnings Call

Unicaja Banco SA Q1 2020 Earnings Call

Vastned Retail Belgium NV Q1 2020 Earnings Release

ECONOMIC EVENTS (All times GMT)

0630 (approx.) Sweden Manufacturing PMI for Apr: Prior 43.2

0700 (approx.) Netherlands Manufacturing PMI for Apr: Prior 50.5

0715 Spain Manufacturing PMI for Apr: Expected 34.0; Prior 45.7

0730 Switzerland Manufacturing PMI for Apr: Expected 34.6; Prior 43.7

0745 Italy Markit/IHS Manufacturing PMI for Apr: Expected 30.0; Prior 40.3

0750 France Markit Manufacturing PMI for Apr: Expected 31.5; Prior 31.5

0755 Germany Markit/BME Manufacturing PMI for Apr: Expected 34.4; Prior 34.4

0800 Greece Manufacturing PMI for Apr: Prior 42.5

0800 Euro Zone Markit Manufacturing Final PMI for Apr: Expected 33.6; Prior 33.6

0830 (approx.) Euro Zone Sentix Index for May: Expected -33.5; Prior -42.9

De handelsoorlog komt weer naar voren ...

Een van de eerste headlines die we zien vandaag is dat Trump China weer begint aan te vallen, en andersom ...

*TRUMP SAYS IF CHINA DOES NOT BUY U.S GOODS, U.S WILL END THE TRADE DEAL

*TRUMP SAYS CHINA WOULD FACE TARIFFS AS AN ULTIMATE PUNISHMENT

Tot straks ... Guy