Liveblog Archief maandag 8 maart 2021

Markt snapshot Wall Street 8 maart

TOP NEWS

• Texas city-run and rural electric firms face bailout over storm crisis

Financial strains on Texas city-owned utilities, rural electric cooperatives and the grid operator has spurred calls for state aid and lured private equity firms into plans to fix multi-billion-dollar charges.

• Marathon fight to pass U.S. pandemic relief tests Democrats' majority

The battle to pass a COVID-19 relief bill demonstrated how hard things will be for U.S. President Joe Biden's Democrats in Congress, facing opposition from right and left as they try to score big wins with small majorities.

• U.S. House set to vote on bills to expand gun background checks

The U.S. House of Representatives is set to vote on Wednesday on a pair of bills to expand background checks before gun purchases, two years after a similar House effort failed to make it through the Senate.

• Panasonic to buy Blue Yonder for $6.5 billion in biggest deal since 2011 -Nikkei

Panasonic Corp will buy U.S. software firm Blue Yonder for $6.45 billion, the Nikkei reported, saying it was the Japanese electronics firm's biggest acquisition since 2011.

• General Electric shares burn bright on recovery bets

While the gyrations of so-called meme stocks have taken the spotlight, less trendy General Electric has been outperforming the market on bets a corporate turnaround and broader economic recovery will boost the manufacturing giant.

BEFORE THE BELLU.S. stock index futures fell as the passage of a $1.9 trillion COVID-19 relief package by the U.S. Senate lifted bond yields, sparked inflation concerns and pressured richly valued technology stocks. Shares of banks and automakers lifted European equities. Japanese shares ended lower on year-end positioning and China stocks fell on policy tightening fears. Gold prices retreated as the dollar firmed, denting bullion's appeal. Oil prices pared gains after earlier climbing above $70 a barrel for the first time since the COVID-19 pandemic began after attacks on Saudi Arabian oil facilities.

STOCKS TO WATCH

Results

Pearson PLC: The company's new boss set out his plan for the education group to grow beyond schools and colleges with a strategy to build a lifelong direct connection to consumers by helping workers to learn new skills and retrain. "What excites me about the potential with direct-to-consumer is in 2019 Pearson engaged with over 100 million learners globally, and within the U.S. college education system every year there's about 10 million students who utilise Pearson products," Chief Executive Andy Bird told reporters. To change its focus, Pearson will split its workforce of around 22,000 into five new divisions which will be supported by a Direct to Consumer group that will help to roll out digital capabilities across the company. The Citi analysts said the strategy update, provided with the 2020 results, looked like a more substantial overhaul than expected. Pearson's shares were up. Its 2020 results showed the impact from the pandemic, when schools were closed and exams cancelled, and a boost from online learning. The company reported a 10% drop in revenue and adjusted operating profit of 313 million pounds, down 46%.

Xpeng Inc: The Chinese electric vehicle maker said its net loss in the fourth quarter last year narrowed 42% compared with the same period in 2019, as EV sales increased in the world's biggest car market. New York-listed Xpeng said its net loss attributable to ordinary shareholders was 787.4 million yuan ($120.7 million) for the fourth quarter of 2020, compared with 1,354.6 million for the same period of 2019. In the final three months last year, revenue jumped 346% year-on-year to 2.85 billion yuan. It expects total revenue for the first quarter of 2021 to be approximately 2.6 billion yuan, up around 531% from the first quarter of 2020.

Deals of the Day

DuPont de Nemours Inc: DuPont said it would buy Laird Performance Materials for $2.3 billion from private equity firm Advent International, as it looks to expand its portfolio of advanced electronic materials. Electronics materials have been a growth area for DuPont as key markets including smart or autonomous vehicles, fifth generation telecommunications, artificial intelligence, internet of things, and high-performance computing gain traction. The industrial materials maker said it expects to realize about $60 million in pre-tax run-rate cost synergies by the end of 2024 with the majority realized in the first 18 months after the deal closes, which is expected in the third quarter of 2021. DuPont also said on Monday it approved a new $1.5 billion share buyback program.

NewHold Investment Corp: U.S. crowd-safety company Evolv Technology said on Sunday it is combining with the blank-check firm to go public in a deal that will value it at about $1.7 billion. Evolv is backed by investors including Microsoft co-founder Bill Gates and venture capital firm General Catalyst. The deal is expected to close in the second quarter, and the company expects to trade on the Nasdaq under the ticker "EVLV", according to the Wall Street Journal, which first reported the news. The company lists customers including Six Flags Entertainment Corp, New York City's Metropolitan Museum of Art, and the Lincoln Center.

In Other News

AerCap Holdings NV & General Electric Co: The company is nearing a $30 billion-plus deal to combine its aircraft-leasing business with Ireland's AerCap Holdings NV, the Wall Street Journal reported on Sunday citing people familiar with the matter. Details of how the deal would be structured was not immediately known, but an announcement is expected Monday, assuming the talks don't fall apart, the WSJ said. GE said the company doesn't comment on rumor or speculation, while AerCap did not immediately respond to Reuters' request for comment.

Amazon.com Inc: A group of U.S. lawmakers visited the company's facility in Alabama on Friday to lend support to a growing push to unionize its workers, in what labor leaders and lawmakers called one of the most important union elections in United States history. "This is the most important election for the working class of this country in the 21st century," Rep. Levin said, addressing workers in Bessemer. "We just want what's owed to us," said Kevin Jackson, an Amazon worker at the Bessemer warehouse who attended the meetings. "We want a seat at the table." Amazon spokeswoman Heather Knox said she does not believe the RWDSU represents the majority of employees' views and that Amazon offered "some of the best jobs available everywhere we hire, and we encourage anyone to compare our total compensation package, health benefits, and workplace environment to any other company with similar jobs."

American Airlines Co & Boeing Co: The company said on Friday that a Boeing 737 MAX bound for New Jersey's Newark Liberty International Airport declared an emergency after the captain shut down one engine over a possible mechanical issue. American's Flight 2555 from Miami with 95 passengers and six crew landed safely at Newark without incident, the airline said. The possible issue was related to an engine oil pressure or volume indicator and not the result of anything related to the MCAS system linked to two fatal 737 MAX crashes in 2018 and 2019 that prompted the plane's 20-month grounding, it said. Boeing said it was aware of the American flight and the Federal Aviation Administration said it will investigate. American took delivery from Boeing of the jet involved in Friday's incident on Dec. 30, according to information on FlightAware.

AstraZeneca PLC: The European Union will urge the United States to permit the export of millions of doses of AstraZeneca's COVID-19 vaccine as it scrambles to bridge supply shortfalls, the Financial Times reported. "We trust that we can work together with the U.S. to ensure that vaccines produced or bottled in the U.S. for the fulfilment of vaccine producers' contractual obligations with the EU will be fully honoured,” the FT quoted the European Commission as saying. The European Commission and AstraZeneca were not immediately available for comment..

AT&T Inc: The U.S. Securities and Exchange Commission on Friday sued the company and three executives for allegedly disclosing nonpublic information to research analysts to avoid falling short of quarterly expectations in 2016. The SEC said investor relations executives Christopher Womack, Michael Black, and Kent Evans made private, one-on-one phone calls to analysts at approximately 20 firms, disclosing material nonpublic information in violation of securities laws. AT&T denied the allegations in a lengthy statement published online, noting: "Not only did AT&T publicly disclose this trend on multiple occasions before the analyst calls in question, but AT&T also made clear that the declining phone sales had no material impact on its earnings." The allegations would represent a violation of regulation that prohibits firms from disclosing significant information to securities analysts without sharing it with the public, the SEC said. The lawsuit was filed in Manhattan.

Banco Santander SA: One of the most public rows over a top job offer at Spainish firm is heading to court next Wednesday, pitting the bank against Andrea Orcel just weeks before the renowned dealmaker takes the helm at Italy's UniCredit. The case stems from Santander's decision two years ago to suddenly drop plans to make Orcel its CEO after a disagreement over his pay package. "It will be a trial where honour is expected to take centre stage," a source familiar with the case said. An out-of-court settlement between both parties can still be agreed before the ruling. Santander declined to make comments ahead of the court case while Orcel did not immediately reply to a request for comment that Reuters submitted through UniCredit.

BioNTech SE, Johnson & Johnson, and Pfizer Inc: Malaysia will buy additional doses of Pfizer-BioNTech's COVID-19 vaccine, bringing the total secured to 32 million, enough to cover half of its population, the country's science minister said. "All of the Pfizer vaccines secured so far are expected to be delivered by this year," science minister Khairy Jamaluddin said at a virtual news conference. Malaysia is also considering dropping negotiations to procure a single-dose vaccine from U.S. pharmaceutical firm Johnson & Johnson, in favour of a deal with Chinese company CanSino Biologics, which also requires only one dose, Khairy said. "This is a better option for us compared to Johnson & Johnson, where supplies are expected to arrive only in the fourth quarter of the year," he said.

Coherent Inc, II-VI Inc & Lumentum Holdings Inc: The laser maker said it has determined optical components maker II-VI Inc's revised buyout offer valued at $6.2 billion superior to Lumentum Holdings' proposal, signaling a possible end to the bidding war. Under the revised terms of II-VI's offer, Coherent stockholders will receive a higher cash component of $170 and 1.0981 shares of II-VI common stock per share at the completion of the transaction. Coherent also said it intends to terminate its merger agreement with Lumentum if they do not receive a revised proposal from Lumentum by March 11. Bank of America and Credit Suisse are serving as financial advisers to Coherent, while Skadden, Arps, Slate, Meagher & Flom LLP are serving as legal advisers.

Credit Suisse Group AG & UBS Group AG: The Swiss bank will begin its appeal against a record $5.37 billion penalty levied by a French court for allegedly helping wealthy clients stash undeclared assets offshore. The case will be watched by banks across Europe, where fines for tax-related and other offences have historically been lower than in the United States. Swiss rival Credit Suisse is under investigation over whether it helped some 2,650 Belgians hide their accounts from tax authorities. Credit Suisse says it has strictly complied with all applicable laws. The appeals trial is set to run between March 8 and 24, although a verdict may not be delivered for at least a further three months. Any ruling can be appealed to France's Supreme Court.

dMY Technology Group III Inc: Quantum computing company IonQ Inc said it will go public through a merger with a blank-check firm in a deal that gives the combined company a pro-forma market capitalisation of $2 billion. The merger will provide IonQ with gross proceeds of $650 million, which includes a private investment of $350 million from private equity firms Silver Lake, Fidelity Management and Research, automaker Hyundai Motor Co and others. The company, a so-called special purpose acquisition company (SPAC), raised $275 million through an initial public offering in November last year.

Facebook Inc: A U.S. agency investigating the company for racial bias in hiring and promotions has designated the probe as "systemic," attorneys for three job applicants and a manager who claim the company discriminated against them told Reuters on Friday. A "systemic" probe means the agency, the Equal Employment Opportunity Commission, suspects company policies may be contributing to widespread discrimination. The EEOC has not brought allegations against Facebook. The agency declined to comment. Facebook spokesman Andy Stone declined to comment on the status of the probe or specific allegations but said that "it is essential to provide all employees with a respectful and safe working environment." Seperately, Russia accused Facebook of violating citizens' rights by blocking some media outlets' content in the latest standoff between a government and Big Tech.

Fox Corp & Walt Disney Co: Mexico's telecoms regulator said on Friday it has pushed back until May 1 its deadline for the sale of Fox Sports in Mexico as part of the terms of Walt Disney Co's acquisition of Twenty-First Century Fox Inc film and television assets. The Federal Telecommunications Institute (IFT) said it was postponing the deadline, which had been set to expire on Friday, for selling the Fox Sports channels because of the difficulty of completing the sale amid the COVID-19 pandemic. The regulator said the companies had requested the extension. The extension does not exempt the companies from complying with various conditions set for the transaction, including the upkeep and sale of Fox Sports in Mexico as a viable business, the IFT said in a statement. The divestiture process must conclude by May 7, the regulator added.

Johnson & Johnson: The president of France's Haute Autorite de Sante (HAS) health regulator said on Monday that France could approve the company's COVID-19 vaccine by the end of this week, in line with the timetable for its broader European Union approval. Dominique Le Guludec, president of the French HAS regulatory body, told LCI TV that France could approve the J&J COVID-19 vaccine by Friday or Saturday this week, once it got approval from the European Union's EMA drugs regulator.

Merck & Co Inc: The U.S. drugmaker said on Saturday the experimental antiviral drug molnupiravir it is developing with Ridgeback Bio showed a quicker reduction in infectious virus in its phase 2a study among participants with early COVID-19. "The secondary objective findings in this study, of a quicker decrease in infectious virus among individuals with early COVID-19 treated with molnupiravir, are promising," said William Fischer, Associate Professor of Medicine at the University of North Carolina School of Medicine, in a statement from the companies. The antiviral is being currently tested in a Phase 2/3 trial that is set to be completed in May. Merck decided to focus on therapeutics after its two COVID-19 vaccines failed to generate desired immune responses, prompting it to abandon the program in January.

Micro Focus International Plc: The IT firm said it would appeal a Texas jury verdict asking it to pay $172.5 million in damages to Wapp group in a patent litigation. In 2018, Wapp brought up the case against UK-based Micro Focus, on infringing claims of three patents in connection with Micro Focus' manufacture and sale of certain products in the ADM product line. "Micro Focus has received comprehensive and clear advice from its external counsel that it has a very strong case to appeal both the infringement verdict and the amount of the damages," the company said, adding that judge has discretion to increase the total damages awarded.

Microsoft Corp: More than 20,000 U.S. organizations have been compromised through a back door installed via recently patched flaws in the company's email software, a person familiar with the U.S. government's response said on Friday. The latest hack has left channels for remote access spread among credit unions, town governments and small businesses, according to records from the U.S. investigation. Tens of thousands of organizations in Asia and Europe are also affected, the records show. Microsoft, which had initially said the hacks consisted of "limited and targeted attacks," declined to comment on the scale of the problem on Friday but said it was working with government agencies and security companies to provide help to customers. Seperately, the White House urged computer network operators to take further steps to gauge whether their systems were targeted amid a hack of Microsoft Corp's Outlook email program, saying a recent software patch still left serious vulnerabilities.

Moderna Inc & Pfizer Inc: The United States has identified three online publications directed by Russia's intelligence services that it says are seeking to undermine COVID-19 vaccines produced by Pfizer and Moderna, a State Department spokeswoman said on Sunday. The outlets "spread many types of disinformation, including about both the Pfizer and Moderna vaccines, as well as international organizations, military conflicts, protests, and any divisive issue that they can exploit," the spokeswoman said. Russia's embassy in Washington did not immediately respond to a request for comment. Seperately, Moderna said on Saturday it has agreed to supply the Philippines government 13 million doses of its COVID-19 vaccine, with deliveries set to begin in mid-2021.

Royal Dutch Shelll Plc: Ecuador's state-owned oil company Petroecuador said on Saturday that it had awarded a tender to export some 1.44 million barrels of Oriente-grade crude to a unit of the company. Shell Western Supply and Trading presented the best offer of six companies that submitted bids, offering to pay a discount of $1.39 to West Texas Intermediate crude prices. Shell beat out offers by Norway's Equinor ASA, China's Petrochina International Co Ltd, U.S. refiner Phillips 66, trading company Trafigura Pte Ltd and Unipec America Inc, a unit of China's Sinopec, Petroecuador said. Shell will export the oil through for shipments of around 360,000 barrels each during the month of March, Petroecuador said.

Toyota Motor Corp: The company's first venture capital fund is investing in startups that help the Japanese automaker refine everyday processes by bringing sharper supply-chain management and robotics to the factory floor, a fund executive said. For instance Toyota, which has dozens of factories around the world, wants to be able to quickly share the lessons learned at one plant across other plants so that efficiencies are maximised, Jim Adler, the founding managing director of the fund, told Reuters in an interview. "If you look at cloud computing, for example, and cloud robotics, and fleet learning, when one robot learns something, the rest of the robots automatically learn that thing," he said. "Being between the outside world and the inside world of Toyota, we are this sort of semi-permeable membrane that brings outside influence into the company."

Twitter Inc: "just setting up my twttr" - the first ever tweet on the platform is up for sale after Twitter boss Jack Dorsey listed his famous post as a unique digital signature on a website for selling tweets as non-fungible tokens (NFTs). The post, sent from Dorsey's account in March of 2006, received offers on Friday that went as high as $88,888.88 within minutes of the Twitter co-founder tweeting a link to the listing on 'Valuables by Cent' - a tweets marketplace. Old offers for the tweet suggest that it was put for sale in December, but the listing gained more attention after Dorsey's tweet on Friday. The highest bid for the tweet stood at $ $2 million at 04:47 GMT on Saturday.

Virgin Galactic Holdings Inc: Venture investor Chamath Palihapitiya on Saturday confirmed in a tweet that he has freed up some capital by selling shares in Virgin Galactic Holdings Inc, for investing at scale without impacting his pace and strategic view. "I hated to do it but my balance sheet shrank by almost $2B this week," he mentioned in the tweet thread, adding a sad emoji. In the long tweet thread, mentioning about reviewing and remodeling of everything he invested in, Palihapitiya also clarified that he did not sell any shares of any other SPAC he launched. In an emailed statement through a spokesman on Friday, Palihapitiya said he would redirect the funds from the share sale toward a "large investment" focused on the fight against climate change. Virgin Galactic did not immediately respond to request for comment.

Walmart Inc: The company said on Friday it had appointed former AT&T Inc Chief Executive Officer Randall Stephenson to its board. Stephenson's addition, effective March 3, will expand the retailer's board to 12 members. Stephenson, 60, retired as AT&T's executive chairman in January this year, after a 38-year stint with the company and serving as its CEO. He has previously served as chairman of the Business Roundtable, a group of CEOs from some of the biggest U.S. companies that Walmart chief Doug McMillon currently leads.

Walt Disney Co: California health officials set new rules on Friday that would allow Disneyland and other theme parks, stadiums and outdoor entertainment venues to reopen as early as April 1, after a closure of nearly a year due to the coronavirus pandemic. Walt Disney Co's Anaheim-based Disneyland lies in the heart of Orange County, which like neighboring Los Angeles and San Diego counties, has remained purple for months, a designation that the prevalence of COVID-19 cases and infection rates are dangerously high. Friday's announcement means theme parks in red-zoned counties could reopen at 15% capacity on April 1. The less restrictive orange and yellow tiers would allow reopenings at 25% and 35% capacity, respectively. Ken Potrock, president of the Disneyland Resort, said in a statement that the decision meant "getting thousands of people back to work and greatly helping neighboring businesses and our entire community."

INSIGHT

Rush to bitcoin? Not so fast, say keepers of corporate coffers

When Elon Musk's Tesla became the biggest name to reveal it had added bitcoin to its coffers last month, many pundits were swift to call a corporate rush towards the booming cryptocurrency. Yet there's unlikely to be a concerted crypto charge any time soon, say many finance executives and accountants loath to risk balance sheets and reputations on a highly volatile and unpredictable asset that confounds convention.

ANALYSTS' RECOMMENDATION

• Apria Inc: Citigroup initiates coverage with buy rating and $26 price target, noting the company's efforts to diversify its revenue and payor mix away from direct government reimbursement and its position on shifting more care to home settings.

• Costco Wholesale Corp: Raymond James cuts price target to $375 from $405, citing second-quarter results that missed forecasts and weaker retail traffic that impacted sales.

• Imax Corp: JPMorgan raises price target to $24 from $13, noting that the company is well positioned to recover as its passionate customer base is likely to return to movies quickly once Hollywood supply ramps up.

• Ulta Beauty Inc: JPMorgan raises price target to $350 from $330, stating that it is one of the best COVID-19 recovery stocks in retail given the impact of the COVID-19 pandemic with a solid growth forecast in its upcoming earnings.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

1000 (approx.) Employment Trends for Feb: Prior 99.27

1000 (approx.) Wholesale inventory, R mm for Jan: Expected 1.3%; Prior 1.3%

1000 (approx.) Wholesale sales mm for Jan: Expected 1.4%; Prior 1.2%

COMPANIES REPORTING RESULTS

No major S&P 500 companies are scheduled to report for the day.

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 NIU Technologies: Q4 earnings conference call

0800 Xpeng Inc: Q4 earnings conference call

1030 RadNet Inc: Q4 earnings conference call

1100 RealPage Inc: Shareholders Meeting

1230 NantKwest Inc: Shareholders Meeting

1630 Avid Bioservices Inc: Q3 earnings conference call

1630 Castle Biosciences Inc: Q4 earnings conference call

1630 SI-BONE Inc: Q4 earnings conference call

1630 Syndax Pharmaceuticals Inc: Q4 earnings conference call

1700 ContextLogic Inc: Q4 earnings conference call

1700 Gohealth Inc: Q4 earnings conference call

1700 Stitch Fix Inc: Q2 earnings conference call

2000 17 Education & Technology Group Inc: Q4 earnings conference call

2000 Dada Nexus Ltd: Q4 earnings conference call

EXDIVIDENDS

Kontoor Brands Inc: Amount $0.40

Kronos Worldwide Inc: Amount $0.18

Old Republic International Corp: Amount $0.22

Public Service Enterprise Group Inc: Amount $0.51

Rocket Companies Inc: Amount $1.11

Stanley Black & Decker Inc: Amount $0.70

UniFirst Corp: Amount $0.25

Weingarten Realty Investors: Amount $0.30

Wake-up call: Opnieuw rentevrees? Tech lager, Dow hoger via futures

Goedemorgen

De futures laten ook vanmorgen de nodige beweging zien en de Nasdaq 100 future zakt opnieuw weg door dat de rente weer aan het oplopen is, de SP future volgt in mindere mate terwijl de Dow Jones future ongeveer vlak blijft liggen vanmorgen. Aan het begin van de nacht hebben we wel nog een stevige plus gezien als eerste reactie op de goedkeuring van het corona pakket in de VS, er komt dus 1,9 biljoen dollar vrij om de economie te ondersteunen.

Zo te zien dus ook vandaag weer een volatiele sessie? Voorbeurs ziet het er wel zo uit met de futures die al behoorlijk in beweging zijn. Door het pakket van Biden dat werd goedgekeurd gaf ik al aan dat er weer vrees kan komen voor inflatie en dat merken we meteen aan de rente in de VS die weer oploopt vanmorgen. Er zijn nog geen grote volumes maar later op de dag toch weer iets om in de gaten te houden.

Vrijdag was er al een enorm volatiele sessie bij vooral de Nasdaq, er zijn maanden in het geheel -u leest het goed- dat de Nasdaq zo'n bewegingen niet eens kan halen. Een overzicht van vrijdag wat betreft de Nasdaq, eerst in de ochtend terug tot 12.300 dan herstel tot 12.475 daarna naar 12.350 gevolgd door een nieuwe rally tot 12.630 net voor de opening. Na de opening terug tot 12.200 gevolgd door nog maar eens een rally richting het slot op 12.700 punten.

Het is maar een samenvatting maar wel eentje voor in de boeken denk ik dan. Als u alles even bij elkaar optelt (aantal punten per beweging) dan kom je uit op 1500 punten, het is nogal wat, ik ben blij dat ik me niet heb laten verleiden om een positie op te nemen vrijdag want anders waren we denk ik wel uitgestopt in welke richting dan ook !!! Als u vrijdag de markt niet zou hebben gevolgd dan kunt u op zich weinig zien op de grafiek want de index sloot in de plus (+197 punten) en lijkt er niks aan de hand.

Opletten op dat soort dagen belangrijk:

Het is toch iets om duidelijk te maken dat je de vingers behoorlijk goed kon verbranden vrijdag door wat te doen of door je open te stellen van risico. Soms moet je op de handen zitten en de markt alleen maar bekijken, door te wachten kan er vandaag of morgen wel eens een nieuwe kans voorbij komen om wat te doen met 1 of 2 indices maar niet overhaast te werk gaan in deze fase. Dat zien het wel zodra het momentum er goed uitziet.

Als coach is het niet alleen mijn taak om signalen te versturen, te handelen, het is ook mijn taak om voorzichtig te blijven en waar dat beter is de leden uit de markt houden zoals dat vrijdag het geval was. Door het dagverloop van vrijdag even te bespreken via de inleiding van deze update (de Nasdaq) krijgt u mogelijk een veel beter beeld waarom ik het even niet wist en het duidelijk een 50-50 situatie was.

Markt overzicht vrijdag:

Europa moest vrijdag zelfs inleveren omdat rond het slot hier Wall Street nog negatief stond, het momentum lag dus slecht hier in Europa. De AEX verloor dan ook 3,8 punten (-0,6%), de DAX deed het wat slechter met 135 punten verlies (-1%). In Frankrijk ook een lager slot, de CAC 40 verloor 48 punten (-0,8%).

Op Wall Street hebben we een zeer volatiele week achter de rug vooral door de forse bewegingen bij de rente, de rente liep behoorlijk op in de loop van de week om vrijdag op de hoogste stand sinds begin januari 2020 te sluiten. Toch wisten de indices na een volatiele sessie in de plus te sluiten, in feite hebben we de afgelopen week 2 zeer positieve sessies en 3 negatieve waar vooral de Nasdaq klappen kreeg.

Vrijdag een positieve dag met de Dow Jones die 572 punten hoger sloot, de S&P 500 won 73,5 punten terwijl de Nasdaq 197 punten winst boekt. De Nasdaq 100 won zelfs 205 punten vrijdag.

Iets wat ook al 2 dagen na elkaar opvalt is het verloop van de olie, een vat Brent olie staat vrijdag op slotbasis al op 69,6 dollar.

Week overzicht markten:

De AEX kon op weekbasis nog een plus van 2,6 punten overhouden wat goed is voor +0,4%, de DAX won ook want de index bleef sterk liggen de gehele week, de DAX won uiteindelijk 135 punten ofwel +1% op weekbasis. Kijken we naar Frankrijk dan zien we daar een mooie plus op weekbasis van 80 punten bij de CAC 40 wat goed is voor +1,4%.

Op Wall Street zien we op weekbasis dan toch door de sessie van vrijdag een plus bij de Dow Jones +564 punten (+1,85%), in mindere mate wist de S&P 500 vooral door de sterke sessie van vrijdag een plus van 31 punten uit te halen (+0,8%). Bij de Dow Transport index zien we de grootste plus, deze index won 297 punten ofwel +2,25%.

Aan de negatieve kant zitten de technologie indexen, de Nasdaq Composite verloor 272 punten (-2,05%) terwijl de Nasdaq 100 met 241 punten terug moest (-1,9%). De chip index ofwel de Semi-conductor index verloor maar liefst 147 punten (-4,8%).

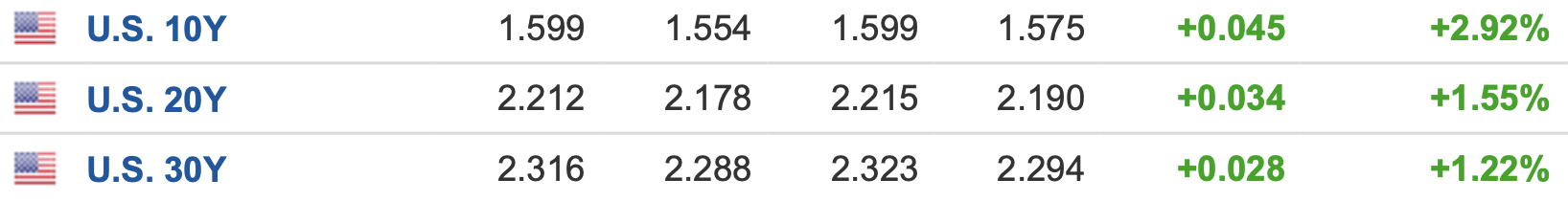

Stijgende rente op US obligaties:

Verder valt het verloop van de rente weer op vandaag, de 10-jaars rente gaat al naar 1,6% terwijl de 30-jaars rente naar 2,316% oploopt vanmorgen terwijl Wall Street nog open moet later op de dag. Blijf het verloop van de rente in de gaten houden, dat kan zeker nog een tijdje voor onrust zorgen.

De hogere rentes zorgen ervoor dat de daling vooral opvalt bij de TOP-8 aandelen, die gaan nu al een tijdje in de uitverkoop en dat merken we duidelijk aan het verloop van de Nasdaq.

De rente hier in Europa volgt het verloop van de rente in de VS deels, hier ook een stijging maar we zitten over het algemeen nog steeds (tot de 15 jaars rente) met een negatieve rente. Dat kan ook de reden zijn dat het er hier wat rustiger aan toe gaat al denk ik wel dat we later ook zullen volgen in de positieve richting al kan het wel langer duren.

Volatiliteit zal aanhouden:

Let er wel op dat de volatiliteit naar mijn mening zal aanhouden, het zal niet zomaar stoppen tot er een behoorlijk grote groep (helaas) nieuwe speculanten zullen afhaken ofwel zullen moeten afhaken. Het is vrijwel altijd zo, ze komen, ze proeven, ze winnen fors en krijgen dan op een gegeven moment behoorlijke klappen op de beurs door hun gretigheid en daarna verdwijnen ze helaas weer. De hoofdreden is en blijft dat men gevangen wordt door hebzucht en men dus steeds meer wil omdat men maar 1 richting op kijkt en dat is omhoog. Onthou dit goed, het komt telkens weer terug dit gedrag en ik kan het weten want ik loop al mee sinds 1985 ongeveer. Heb dus een paar rondjes gretigheid en hebzucht mee mogen maken.

Dit alles zorgt er in ieder geval wel voor dat de volatiliteit op de markten blijft aanhouden en dat is natuurlijk al zo gedurende het afgelopen jaar. De markten ofwel de speculanten weten telkens wel weer een item te vinden waarop men kan reageren, de ene keer positief de andere keer negatief.

Zelf probeer ik me er zo goed als mogelijk doorheen te loodsen en op zich lukt me momenteel prima met de grote bewegingen die de huidige markten laten zien.

Eerste posities maart met winst gesloten:

Donderdag werd er een kleine long posities gesloten met winst, zo loopt het resultaat van deze maand MAART weer wat op en ziet dit jaar er tot nu toe prima uit voor alle abonnementen. Hieronder ziet u nog een overzicht wat betreft Trading en een aanbieding om mee te doen met onze signalen tot 1 MEI. Via de site en dan de Tradershop kunt u de posities met alle details zien staan. https://www.usmarkets.nl/tradershop

De LIVEBLOG en Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

Euro, olie en goud:

De euro zien we nu rond de 1.1885 dollar, de prijs van een vat Brent olie komt uit op 70,4 dollar terwijl een troy ounce goud nu op 1695 dollar staat.

Inter Market overzicht op slotbasis ...

Word nu lid tot 1 MEI voor €39 (nieuwe aanbieding):

Blijven schakelen tussen long en short blijft belangrijk de komende weken. Ook deze maand (maart) krijgen we genoeg kansen. Doe nu in ieder geval mee met de proef aanbieding voor nieuwe leden, die loopt tot 1 MEI en dat met een mooie korting !! ... €39 tot 1 MEI 2021 ... en voor Polleke €49 tot 1 MEI 2021 !!! https://www.usmarkets.nl/tradershop

Schrijf u in voor Systeem Trading (€39 tot 1 MEI)

Schrijf u in voor Index Trading (€39 tot 1 MEI)

Schrijf u in voor Guy Trading (€39 tot 1 MEI)

Schrijf u in voor Polleke Trading (€49 tot 1 MEI)

Schrijf u in voor de Aandelen portefeuille (€30 tot 1 MEI)

Schrijf u in voor COMBI TRADING (€79 tot 1 MEI)

Hieronder het resultaat maand Maart (2021) ...

Hieronder het resultaat tot nu toe dit jaar (2021) ...

Met vriendelijke groet,

Guy Boscart

TA - Alfen, Prosus, Philips en Unilever

Alfen De Electric Vehicle bubbel lijkt leeg te lopen, Alfen wordt hierdoor ook meegesleept. Begrijp mij niet verkeerd, veel bedrijven binnen deze sector gaan een mooie toekomst tegemoet. Dit neemt niet weg dat mede door hype de koersen te snel zijn opgelopen. De fundamentele onderbouwing…

Lees verder »Markt snapshot Europa 8 maart

GLOBAL TOP NEWS

Meghan, the wife of Prince Harry, accused the British royal family of racism, lying and pushing her to the brink of suicide, in an explosive televised interview that looks set to shake the monarchy to its core.

Yemen's Houthi forces fired drones and missiles at the heart of Saudi Arabia's oil industry on Sunday, including a Saudi Aramco facility at Ras Tanura vital to petroleum exports, in what Riyadh called a failed assault on global energy security.

The European Union should shake off its ill will and build a good relationship with Britain as sovereign equals, Britain's top EU adviser David Frost said on Sunday, promising to stand up for the country's interests.

EUROPEAN COMPANY NEWS

French billionaire Olivier Dassault was killed on Sunday in a helicopter crash, a police source said, with President Emmanuel Macron paying tribute to the 69-year old conservative politician.

Austrian authorities have suspended inoculations with a batch of AstraZeneca's COVID-19 vaccine as a precaution while investigating the death of one person and the illness of another after the shots, a health agency said on Sunday.

Veolia said on Sunday it would announce a proposal later this week that it hoped would positively end the conflict with French waste and water management firm Suez.

TODAY'S COMPANY ANNOUNCEMENTS

Abcam PLC HY 2021 Earnings Call

Avadel Pharmaceuticals PLC Q4 2020 Earnings Release

bet-at-home.com AG Q4 2020 Earnings Release

Chamberlin PLC Shareholders Meeting

Chrysalis Investments Ltd Annual Shareholders Meeting

Compagnia Immobiliare Azionaria SpA Shareholders Meeting

Direct Line Insurance Group PLC FY 2020 Earnings Release

Geodrill Ltd Q4 2020 Earnings Call

Network International Holdings PLC FY 2020 Earnings Call

Phoenix Group Holdings PLC FY 2020 Earnings Call

RHI Magnesita NV FY 2020 Earnings Call

Seche Environnement SA FY 2020 Earnings Release

Spineway SA Annual Shareholders Meeting

Stentys SA Shareholders Meeting

ECONOMIC EVENTS (All times GMT)

0530 Sweden SEB Housing Price for Mar: Prior 57.0%

0530 Sweden SEB Housing Price Inc for Mar: Prior 64.0%

0530 Sweden SEB Housing Price Dec for Mar: Prior 7.0%

0645 Switzerland Unemployment Rate Unadjusted for Feb: Prior 3.7%

0645 Switzerland Unemployment Rate Adjusted for Feb: Expected 3.6%; Prior 3.5%

0700 Germany Industrial Output mm for Jan: Expected 0.2%; Prior 0.0%

0700 Germany Industrial Production yy SA for Jan: Prior -0.70%

0700 Norway Manufacturing Output mm for Jan: Prior -0.2%

0800 Spain Industrial Output Cal Adjusted yy for Jan: Expected -0.7%; Prior -0.6%

0930 Euro Zone Sentix Index for Mar: Expected 1.9; Prior -0.2