Liveblog Archief vrijdag 11 december 2020

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: PPI (Maandelijks) (Nov) | Actueel: 0,1% Verwacht: 0,2% Vorige: 0,3% |

Markt snapshot Wall Street vandaag

TOP NEWS

• UK Supreme Court enables $18.5 billion class action against Mastercard

A landmark UK Supreme Court ruling has allowed a $18.5 billion class action to proceed against Mastercard for allegedly overcharging more than 46 million people in Britain over a 15-year period.

• U.S. FDA advisers overwhelmingly back authorizing Pfizer COVID-19 vaccine

A panel of outside advisers to the U.S. Food and Drug Administration on Thursday voted overwhelmingly to endorse emergency use of Pfizer's coronavirus vaccine, paving the way for the agency to authorize the shot for a nation that has lost more than 285,000 lives to COVID-19.

• Sanofi and GSK delay COVID-19 vaccine, marking setback for global fight

Sanofi and GlaxoSmithKline said clinical trials of their COVID-19 vaccine showed an insufficient immune response in older people, delaying its launch to late next year and marking a setback in the global fight against the pandemic.

• Zurich, Farmers to buy MetLife U.S. motor, home insurance business for $3.94 billion

Zurich Insurance and Farmers Exchanges have agreed to buy MetLife's U.S. property and casualty business for $3.94 billion, the insurers said, after the COVID-19 pandemic made motor and home insurers more profitable.

• EU Commission chief sees more chance of no Brexit trade deal

Britain is more likely to leave the European Union's orbit on Dec. 31 without a trade deal than with an agreement, an EU official quoted the head of the European Commission as telling the bloc's 27 national leaders.

BEFORE THE BELL

Wall Street futures tumbled, in line with European stocks on worries over the economic impact of a resurgent COVID-19 pandemic, the fate of a Brexit trade deal and the stalled U.S. stimulus measures. Asian equities ended on a mixed note. The dollar edged up on safe-haven bet, whereas gold fell. Oil prices dropped as a jump in U.S. crude stockpiles hurt investor sentiment. Data on U.S. producer prices for November is scheduled for release later in the day.

STOCKS TO WATCH

Results

• Broadcom Inc (AVGO). The company on Thursday appointed its principal accounting officer, Kirsten Spears, as chief financial officer and forecast first-quarter revenue above estimates as key client Apple doubles down on 5G devices, driving demand for its chips. Chief Sales Officer Charlie Kawwas was also named chief operating officer. The company expects first-quarter revenue to be about $6.6 billion. Analysts on average were expecting $6.52 billion. For the fourth quarter, revenue rose 12% to $6.47 billion, above Wall Street estimates of $6.43 billion. Excluding items, the company reported a profit of $6.35 per share, topping analysts' expectations of $6.25.

• Costco Wholesale Corp (COST). The membership-only retail chain beat market estimates for first-quarter profit and revenue on Thursday as pandemic-wary consumers staying at home bought more groceries, liquor and electronics. Net income attributable to Costco soared 38% to $1.17 billion. Excluding items, it earned $2.30 per share. However, the company incurred a pre-tax expense of $212 million from COVID-19-related charges, and said it had extended higher wages for its workers through Jan. 3.Total revenue rose about 17% to $43.21 billion, versus a $42.42 billion estimate.

• Lululemon Athletica Inc (LULU). The company raised its holiday quarter revenue and profit forecasts on Thursday, as the COVID-19 pandemic induced popularity of home workouts boosted demand for athleisure apparel. Lululemon said it expects fourth-quarter revenue to rise by a mid-to-high teens percentage, compared to its prior forecast of a high single to low double-digit increase. Analysts estimate a 14.4% increase. Fourth-quarter adjusted earnings per share is expected to rise by mid-single-digits, up from a prior forecast of a modest decline. Net revenue rose 22% to $1.12 billion in the third quarter ended Nov. 1, beating analysts' average estimate of $1.02 billion. Excluding certain items, Lululemon earned $1.16 per share, beating estimates of 88 cents per share.

• Oracle Corp (ORCL). The company beat Wall Street estimates for second-quarter profit and revenue on Thursday, as remote work trends boosted cloud product and software licensing sales. Net income rose to $2.44 billion, or 80 cents per share, in the second quarter ended November 30, from $2.31 billion, or 69 cents per share, a year earlier. Excluding items, Oracle earned $1.06 per share, topping market expectations of $1 per share. Total revenues rose 2% to $9.8 billion. Analyst's were expecting revenue of $9.79 billion.

Deals Of The Day

• MetLife Inc (MET). Zurich Insurance and Farmers Exchanges have agreed to buy MetLife's U.S. property and casualty business for $3.94 billion, the insurers said, after the COVID-19 pandemic made motor and home insurers more profitable. The Swiss insurer will contribute $2.43 billion to the deal through its Farmers Group Inc (FGI) unit, while the Farmers Exchanges will contribute $1.51 billion, Zurich said. The MetLife business to be acquired includes 2.4 million policies, $3.6 billion of net written premiums in 2019 and 3,500 employees, Zurich said. Zurich said it wanted to fund FGI's portion of the deal through a roughly equal combination of internal resources and hybrid debt. Completion of the transaction is subject to regulatory approvals and is anticipated to occur in the second quarter of 2021.

IPOs

• Certara Inc (CERT). The drug development consultancy said on Thursday it sold shares in its initial public offering at $23 apiece, above its target range, to raise about $670 million. The IPO valued Certara, which is owned by Stockholm-based private equity firm EQT, at $3.5 billion. Certara said it sold 29.1 million shares after it had aimed to sell 24.4 million shares at a target price range of $19-$22 each. Certara's revenue rose to $178.9 million for the nine months ended September from $154.7 million last year. The company recorded profit of $5.1 million compared with a loss of $2.9 million last year. Shares in Certara are due to begin trading on Nasdaq on Friday under the symbol "CERT."

Moves

• Ferrari NV (RACE) & Philip Morris International Inc (PM). Ferrari Chief Executive Officer Louis Camilleri has retired citing personal reasons after being in the role for nearly two and a half years and Chairman John Elkann will lead the company on an interim basis, the luxury automaker said on Thursday. Camilleri's decision to step down came after the executive suffered health problems, which made it necessary to hospitalize him for COVID-19 in recent weeks, a company source said. He is now recovering at home but his illness was not the cause of his decision to retire, the source added. Camilleri also retired as executive chairman of Philip Morris International, the Marlboro maker said separately. Ferrari's board is identifying a permanent successor to Camilleri, it said in a statement, giving no further details.

In Other News

• Airbnb Inc (ABNB). The company hosts who were allowed to invest in the home-sharing firm's $3.5 billion initial public offering more than doubled their money in a few hours on Thursday, a windfall that otherwise would only have been reaped by Wall Street's elite. While the vast majority of the newly issued shares went to big mutual funds and other institutional investors, Airbnb reserved $238 million worth of stock for its hosts, according to company filings. It was not clear how many hosts participated in the IPO and snapped up some of the 3.5 million shares allocated to them, though one source familiar with the matter said the demand outstripped supply.

• Alibaba Group Holding Ltd (BABA), NetEase Inc (NTES) & JD.com Inc (JD). Global fund managers are reducing their holdings in U.S-listed Chinese companies such as Alibaba, Netease and JD.com as risks grow they will be forced off American exchanges, switching instead into shares of the companies listed in Hong Kong. "It's always something you're aware of as a potential risk. Now that risk is really becoming a reality," said Brian Bandsma, a New York-based portfolio manager at Vontobel Asset Management. Bandsma said he has started moving positions in American Depositary Receipts of Chinese companies toward Hong Kong. There are two paths, he says, and he's taking a slower, but less costly route. But "if we see the risk becoming more immediate, we can convert very quickly," he said.

• AMC Entertainment Holdings Inc (AMC). The movie theater operator said it would issue shares to investment firm Mudrick Capital Management LP for a $100 million investment as it looks to prop up its finances to stave off a possible bankruptcy. The company said it would need at least $750 million of additional liquidity to fund its cash requirements through next year.

• AstraZeneca PLC (AZN). The drugmaker will start clinical trials to test a combination of its experimental COVID-19 vaccine with Russia's Sputnik V shot aimed at boosting the efficacy of the British drugmaker's vaccine, Russia's sovereign wealth fund said. Trials will start by the end of the year, said the RDIF wealth fund, which has funded Sputnik V, named after the Soviet-era satellite that triggered the space race. In a statement, AstraZeneca said it was considering how it could assess combinations of different vaccines, and would soon begin exploring with Russia's Gamaleya Institute, which developed Sputnik V, whether two common cold virus-based vaccines could be successfully combined.

• Facebook Inc (FB). Australian buy-now-pay-later firm Zip said it signed a deal with Facebook to allow small- and medium-sized companies to use its payment service for advertising on the social media giant's platform. The option, which is currently being tested, will be offered to Australian companies and rolled out in stages. "Partnering with Facebook is an important step not only in the expansion of Zip Business, but in helping small business owners capitalise on recent growth in the ecommerce sector," said Peter Gray, Zip's co-founder and chief operating officer. Separately, Cybersecurity investigators at Facebook have traced a hacking group long suspected of spying on behalf of the Vietnamese government to an IT company in Ho Chi Minh City.

• Forum Merger III Corp (FIII). Electric Last Mile Solutions (ELMS) said it has agreed to go public through a reverse merger with the blank-check company in a deal that values the U.S. electric commercial vehicle maker at $1.4 billion. The deal will provide ELMS with $379 million in gross proceeds, including $155 million from such private investors as BNP Paribas Asset Management and Jennison Associates. It is expected to close in the first quarter and the company will trade on Nasdaq under the symbol "ELMS." ELMS, based in Auburn Hills, Michigan, plans to launch a small Class 1 delivery van - the UD-1 - in the third quarter of 2021, followed by a larger Class 3 truck in late 2022.

• Goldman Sachs Group Inc (GS) & JPMorgan Chase & Co (JPM). U.S. online job marketplace ZipRecruiter has hired Goldman Sachs and JPMorgan Chase to lead preparations for an initial public offering (IPO), people familiar with the matter said on Thursday. ZipRecruiter is eying a valuation of between $3 billion and $5 billion in the IPO, which could come in the first half of 2021, the sources said, cautioning that the valuation and timing are subject to market conditions. It was valued at $1.5 billion in a fundraising round in 2018.

• KKR & Co (KKR). Private equity firms Sequoia Capital and KKR are leading ByteDance's latest funding round that will value the Chinese tech giant and TikTok owner at $180 billion, two people familiar with the matter said. The funding round, which aims to raise $2 billion and would make it the world's most valuable financing round in the private market, is drawing to a close after kicking off about a month ago, the two people said.

• Lockheed Martin Corp (LMT). The maker of the F-35 stealth jet will join a project led by Mitsubishi Heavy Industries (MHI) to build a new fighter plane that Japan's air force is expected to field by the mid 2030s, The Nikkei newspaper reported. The new fighter, which is known as the F-3 or F-X and is expected to cost around $40 billion, will replace Japan's F-2, which was jointly developed by MHI and Lockheed more than two decades ago.

• Mastercard Inc (MA). A landmark UK Supreme Court ruling has allowed a $18.5 billion class action to proceed against Mastercard for allegedly overcharging more than 46 million people in Britain over a 15-year period. The complex case, brought after Mastercard lost an appeal against a 2007 European Commission ruling that its fees were anti-competitive, could entitle adults in Britain to 300 pounds each if it is successful. The court dismissed a Mastercard appeal, setting the scene for Britain's first mass consumer claim brought under a new legal regime and establishing a standard for a string of other stalled class actions. "Mastercard has been a sustained competition law breaker, imposing excessive card transaction charges over a prolonged period in a way it must have known would impose an invisible tax on UK consumers," said Walter Merricks, a lawyer who is leading the action.

• Pfizer Inc (PFE) & BioNTech SE (BNTX). A panel of outside advisers to the U.S. Food and Drug Administration on Thursday voted overwhelmingly to endorse emergency use of Pfizer's coronavirus vaccine, paving the way for the agency to authorize the shot for a nation that has lost more than 285,000 lives to COVID-19. The FDA is widely expected to authorize emergency use in days. Distribution and inoculations in the United States are expected to begin almost immediately thereafter. The committee voted 17-4 that the known benefits of the vaccine outweighed the risks of taking the shot for individuals 16 and older, with 1 member of the panel abstaining. Pfizer had asked that the two-dose vaccine be approved for use in people aged 16 to 85. Several advisory panel members discussed whether 16 and 17 year olds should be included in the recommendation. In the end, they voted on the question as put them by the FDA, which included 16 to 17 year olds. Separately, an advisory committee for Mexican health regulator Cofepris will review Pfizer's COVID-19 vaccine application, a health official said.

• Sanofi SA (SNY) & GlaxoSmithKline plc (GSK). The companies said clinical trials of their COVID-19 vaccine showed an insufficient immune response in older people, delaying its launch to late next year and marking a setback in the global fight against the pandemic. The two companies said they planned to start another study next February, hoping to come up with a more effective vaccine by the end of 2021. Sanofi said the results from Phase I/II trials showed "an immune response comparable to patients who recovered from COVID-19 in adults aged 18 to 49 years, but a low immune response in older adults likely due to an insufficient concentration of the antigen". Phase III studies were expected to start this month. However Sanofi said it would instead launch a phase 2b study in February.

• Telefonaktiebolaget LM Ericsson (ERIC). The company has filed a lawsuit in the United States against Samsung in a dispute over royalty payments and patent licences, sending Ericsson's shares sharply lower as it warned the quarrel could hit earnings. Delayed royalty payments and potential legal costs could reduce Ericsson's operating income by 1-1.5 billion Swedish crowns per quarter beginning in the first quarter of 2021, the telecoms equipment maker said. Royalties from its patent portfolio are expected to account for about a third of Ericsson's forecast 29 billion crowns of operating profit in 2021, and this lawsuit could cut earnings by around 20% per quarter, said Liberum analyst Janardan Menon.

ANALYSIS

World watches as first-mover Britain probes adverse reactions to Pfizer vaccine

Britain hailed “V-Day” when it became the first country to roll out the Pfizer-BioNTech COVID-19 vaccine. Yet, as first mover, it has also become the first to report cases of adverse reactions, allowing other nations to watch and learn.

ANALYSTS' RECOMMENDATION

• Abbvie Inc (ABBV). Cowen and Company raises price target to $120 from $105, saying the company has a promising new product lineup and pipeline that might be unappreciated and could support the long term.

• Adobe Inc (ADBE). Credit Suisse raises price target to $575 from $560, reflecting the company's upbeat fourth-quarter results, with revenue and cash flow better than expectations given strong execution and end market demand.

• Broadcom Inc (AVGO). JPMorgan raises price target to $500 from $420, after the company delivered solid fourth-quarter results and a strong dividend raise as anticipated.

• Costco Wholesale Corp (COST). RBC raises price target to $439 from $419, citing the company's strong sales growth and good margin performance in the first-quarter.

• Lululemon Athletica Inc (LULU). JPMorgan raises price target to $442 from $415, saying the company's third-quarter results illustrated its strong brand underscored by robust e-commerce growth.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0830 (approx.) PPI final demand yy for Nov: Expected 0.8%; Prior 0.5%

0830 (approx.) PPI final demand mm for Nov: Expected 0.2%; Prior 0.3%

0830 (approx.) PPI ex-food/energy yy for Nov: Expected 1.5%; Prior 1.1%

0830 (approx.) PPI ex-food/energy mm for Nov: Expected 0.2%; Prior 0.1%

0830 (approx.) PPI ex-food/energy/transport yy for Nov: Prior 0.8%

0830 (approx.) PPI ex-food/energy/transport mm for Nov: Prior 0.2%

1000 U Michigan Sentiment Preliminary for Dec: Expected 76.5; Prior 76.9

1000 U Michigan Conditions Preliminary for Dec: Expected 87.0; Prior 87.0

1000 U Michigan Expectations Preliminary for Dec: Expected 71.0; Prior 70.5

1000 (approx.) U Michigan 1-year inflation preliminary for Dec: Prior 2.8%

1000 (approx.) U Michigan 5-year inflation preliminary for Dec: Prior 2.5%

COMPANIES REPORTING RESULTS

No major S&P 500 companies are scheduled to report for the day.

CORPORATE EVENTS (All timings in U.S. Eastern Time)

1000 Construction Partners Inc (ROAD). Q4 earnings conference call

1200 Nutanix Inc (NTNX). Annual Shareholders Meeting

EXDIVIDENDS

American International Group Inc (AIG). Amount $0.32

CH Robinson Worldwide Inc (CHRW). Amount $0.51

Cognex Corp (CGNX). Amount $2.00

Community Bank System Inc (CBU). Amount $0.42

FedEx Corp (FDX). Amount $0.65

Fidelity National Information Services Inc (FIS). Amount $0.35

First Citizens BancShares Inc (Delaware) (FCNCA). Amount $0.47

John Bean Technologies Corp (JBT). Amount $0.10

Marten Transport Ltd (MRTN). Amount $0.04

Spirit AeroSystems Holdings Inc (SPR). Amount $0.0

Wake-up call: AirBNB IPO door het dak, verder een rustige sessie

Goedemorgen,

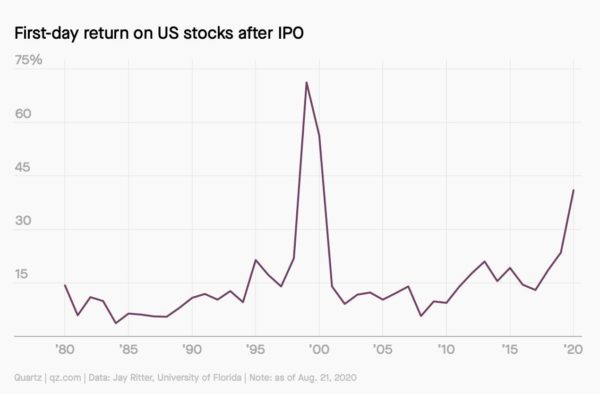

Hebt u het kunnen volgen gisteren? AirBNB ging naar de beurs en werd meteen 110 miljard dollar waard na de notering, tegen het slot was dat nog bijna 90 miljard. Woensdag werd DoorDash al 65 miljard waard na de eerste dag op de beurs. Dat zijn gewoon dezelfde toestanden als eind jaren '90 toen de IPO's je om de oren vlogen met extreme prijzen na de eerste dag. Hoe zal dat allemaal aflopen? Wie nu nog niet ziet dat er iets gaande is op de financiële markten moet echt wel oogkleppen op hebben vrees ik.

Let op, ik verwijt niemand iets, iedereen wint op de beurs momenteel, ik niet want zelf anticipeer ik al op een daling die er gaat komen (en die komt er hoe dan ook), dan moet ik maneuvreren en aanpassingen doen waar dat moet maar zodra de markt draait verwacht ik dat onze kassa zal rinkelen en we klaar staan om een hele goeie periode mee te pakken wat betreft de handel. Dus ofwel blijf lid, of wordt lid en zeker in 2021. Het is zo'n duidelijke deja-vu wat we nu doormaken dat het zelfs grappig aan het worden is om te zien hoe men op de onbekende paarden aan het wedden is. Nogmaals, neem me niet kwalijk dat ik hier niet aan mee doe, ik wacht op mijn moment dat eraan zit te komen.

Het lijkt dus allemaal zo makkelijk, geen rente dus koop aandelen, het maakt niet uit wat ze kosten, hoe ze gewaardeerd zijn en vooral of ze nu bekend zijn of niet. Er zijn zeker nog bedrijven die het normaal doen maar helaas werden die ook al verdubbeld in prijs ten opzichte van pakweg 2-3-4 maanden geleden. Zie ook Shell als we een voorbeeld moeten nemen, degelijk aandeel, was voor €10 te koop een lange tijd, nu staat het al op €16, dat is al 60% meer dan kort geleden. En zo zijn er meer voorbeelden, denk aan Boeing, Caterpillar en nog meer voorbeelden zijn er op te noemen. Maar goed, het is zoals het is op dit moment, het zal eerder gaan over het vervolg. We zitten met heel wat luchtkastelen nu, dat weet u bewust of onbewust ook wel. Deze markt draait op hoop en verlangen, we gaan het zien waar en wanneer deze BUBBEL uit elkaar spat.

Wat ik wel merk is dat die IPO's vaak achteraan in de rij staan in het verleden, dat is meestal de apotheose van een BUBBEL markt, nogmaals remember 1999-2000, voor de Belgen denk nu vooral eens terug aan Lernhout ans Hauspie, voor ons hier in Nederland denk eens terug aan bijvoorbeeld World Online, Versatel, UPC en KPN Quest om er een paar te noemen. En denk eraan, er zijn heel veel nieuwe beleggers die daar niks van weten uiteraard, de oude garde weet EXACT wat ik hiermee bedoel. Voor de nieuwe volgers, ga op onderzoek uit en vraag u af of je nu dat risico wil lopen ...

Doe ermee wat u wilt, maar als je ziet dat men denkt dat AirBNB enkele weken geleden zo'n 20 miljard dollar zou moeten opbrengen, met later al de start prijs optrekt naar 50 miljard dollar beurswaarde en op de dag zelf beleggers er al 110 miljard voor willen neertellen dan is er iets helemaal mis ...!!

Voorbeurs zien we de AEX 1 punt lager, de DAX staat 15 punten in de min via de futures. Wall Street laat een kleine daling zien bij Nasdaq 100 future, de S&P en de Dow future staan nagenoeg vlak.

Euro, olie en goud:

De euro zien we nu rond de 1.215 dollar, de prijs van een vat Brent olie zien we op 50,6 dollar terwijl een troy ounce goud nu op 1837 dollar staat.

Posities en strategie:

We hebben posities open staan bij de signaaldiensten, die kunt u nog opnemen door lid te worden. We bouwen dus posities op voor als de markt de grote draai maakt en die komt eraan, ik verwacht dat we dan mogelijk voor een tijdje kunnen blijven zitten. Waar nodig zal ik schakelen, de posities lichter maken of uitbreiden. Wat betreft 2021 zie ik zeker genoeg mooie kansen om er wat betreft het handelen een mooi jaar van te maken ...

U kunt mij en dus @USMarkets uiteraard ook volgen via onze Twitter account, ga naar ... https://twitter.com/USMarkets waar ik tussentijds wat charts over de markt en sentiment plaats, ook opvallende beursfeiten komen er vaak langs !

Maak nu gebruik van de aanbieding op US Markets Trading:

Zoals ik al aangaf sta hoe dan ook klaar om goed uit te pakken in 2021 wat betreft Trading, lid worden is nu dus belangrijk om alles optimaal te volgen.

Doe nu mee via de proef aanbieding voor €39 tot 1 FEBRUARI. Dan pakt u december mee en de start van 2021 meteen ook. Polleke Trading is dan €49 ... Schrijf u vandaag nog in via de link https://www.usmarkets.nl/tradershop en dan staat u meteen op de lijst, en ontvangt u de updates en signalen !!

Met vriendelijke groet,

Guy Boscart

Gisteren had ik het al over de gekte van IPO's op Wall Street, deze grafiek laat u zien dat we in dezelfde soort BUBBEL moeten zitten als in 1998-1999 waar toen ook dit soort taferelen zich afspeelden !!! Let wel, toen waren er veel meer IPO's en vooral via de tech sector, velen zijn daarna met 90-95% terug gevallen ... of ze bestaan niet eens meer ...

Markt snapshot Europa vandaag

GLOBAL TOP NEWS

British Prime Minister Boris Johnson said on Thursday there was "a strong possibility" Britain and the EU would fail to strike a new trade deal, but vowed to do whatever he could to avoid a tumultuous split in three weeks.

A panel of outside advisers to the U.S. Food and Drug Administration on Thursday voted overwhelmingly to endorse emergency use of Pfizer's coronavirus vaccine, paving the way for the agency to authorize the shot for a nation that has lost more than 285,000 lives to COVID-19.

A U.S. Senate vote on a stopgap measure to keep the government running is likely to slip to the Friday deadline, a leading Republican said, as a top Democrat suggested wrangling over a spending package and coronavirus aid could drag on through Christmas.

EUROPEAN COMPANY NEWS

Ferrari Chief Executive Officer Louis Camilleri has retired citing personal reasons after being in the role for nearly two and a half years and Chairman John Elkann will lead the company on an interim basis, the luxury automaker said on Thursday.

With prospects for a post-Brexit trade deal with the EU looking precarious, Britain's retail industry repeated a warning that shoppers faced higher food prices from next year if new tariffs were imposed in the absence of an agreement.

Italy's Banco BPM and BPER Banca are considering a possible merger with a view to reaching a deal in the first half of 2021, three sources familiar with the matter said.

TODAY'S COMPANY ANNOUNCEMENTS

Bellway PLC Annual Shareholders Meeting

Bigben Interactive SA Shareholders Meeting

Carl Zeiss Meditec AG Q4 2020 Earnings Call

Diagnostic Medical Systems SA Annual Shareholders Meeting

Friwo AG Annual Shareholders Meeting

Marlowe PLC Annual Shareholders Meeting

Medtronic PLC Annual Shareholders Meeting

Polar Capital Technology Trust PLC HY 2021 Earnings Call

Ramsay Generale de Sante SA Annual Shareholders Meeting

ReNeuron Group PLC Annual Shareholders Meeting

Samse SA Annual Shareholders Meeting

Schroder Oriental Income Fund Ltd Annual Shareholders Meeting

The Social Chain AG Annual Shareholders Meeting

UMT United Mobility Technology AG Annual Shareholders Meeting

UP Global Sourcing Holdings PLC Annual Shareholders Meeting

Vilmorin & Cie SA Annual Shareholders Meeting

Westmount Energy Ltd Annual Shareholders Meeting

ECONOMIC EVENTS (All times GMT)

0700 (approx.) Germany CPI Final mm for Nov: Expected -0.8%; Prior -0.8%

0700 (approx.) Germany CPI Final yy for Nov: Expected -0.3%; Prior -0.3%

0700 (approx.) Germany HICP Final mm for Nov: Expected -1.0%; Prior -1.0%

0700 (approx.) Germany HICP Final yy for Nov: Expected -0.7%; Prior -0.7%

0700 (approx.) Germany CPI Final NSA for Nov: Prior 105.9

0800 Spain CPI mm Final NSA for Nov: Expected 0.2%; Prior 0.2%

0800 Spain CPI yy Final NSA for Nov: Expected -0.8%; Prior -0.8%

0800 Spain HICP Final mm for Nov: Expected 0.1%; Prior 0.1%

0800 Spain HICP Final yy for Nov: Expected -0.9%; Prior -0.9%

0800 Spain Core CPI yy for Nov: Prior 0.3%

0800 (approx.) Spain CPI Final NSA for Nov: Prior 104.473

0900 Italy Industrial Output mm SA for Oct: Expected 1.0%; Prior -5.6%

0900 Italy Industrial Output yy WDA for Oct: Expected -4.3%; Prior -5.1%