Liveblog Archief vrijdag 12 februari 2021

Markt snapshot Wall Street vandaag

TOP NEWS

• Biden to press for $1.9 trillion COVID relief plan with governors, mayors

U.S. President Joe Biden will meet with a bipartisan group of mayors and governors as he continues to push for approval of a $1.9 trillion coronavirus relief plan to bolster economic growth and help millions of unemployed workers.

• Trump's defense will make the case for his acquittal on inciting Capitol riot

Donald Trump's defense lawyers will make their case on Friday why the former president is not guilty of inciting last month's deadly riot at the U.S. Capitol, as the Senate races toward a final vote in his impeachment trial as soon as Saturday.

• U.S. House committee approves another $14 billion for pandemic-hit airlines

A U.S. House committee on Thursday approved a proposal to give airlines another $14 billion in payroll assistance as part of a broader COVID-19 relief package that is working its way through Congress.

• Australia to introduce landmark Google, Facebook legislation to parliament next week

Australia will next week introduce landmark legislation to force Alphabet's Google and Facebook to pay publishers and broadcasters for content, a senior government official said.

• Twitter suspends Project Veritas account over privacy violations

Twitter said on Thursday it suspended the account of conservative activist group Project Veritas for repeated violations of its private information policy, which prohibits sharing, or threatening to share others' private information without consent.

BEFORE THE BELL

Wall Street futures slipped as investors awaited for signs of progress towards more U.S. fiscal stimulus. European shares dipped, while Chinese stocks ended higher as upbeat inflation data indicated a recovery in the world's second-largest economy. The dollar rebounded pushing gold prices down. Oil prices dropped after OPEC lowered its demand forecast.

STOCKS TO WATCH

Results

• Affirm Holdings Inc: The company forecast weaker sales volume for the current quarter, signaling a slowdown in the pandemic-induced boom in online shopping that helped it narrow its loss in its first results as a publicly-traded company. The company said it expects third-quarter gross merchandise volume between $1.80 billion and $1.85 billion, lower than the $2.1 billion it reported for the previous three months. It reported a net loss attributable to common stockholders of $31.6 million, or 45 cents per share, compared with a loss of $44.2 million, or 92 cents per share, a year earlier.

• Expedia Group Inc: The online travel agency posted a bigger-than-expected quarterly loss on Thursday as bookings slumped following a global resurgence in COVID-19 infections and renewed lockdowns. "The fourth quarter brought signs of hope in the form of vaccine approvals, but rising cases across the globe and rolling shutdowns of various travel markets made an impact," said Chief Executive Peter Kern. Net loss attributable to the company was $412 million, or $2.89 per share, in the quarter, compared with a profit of $76 million, or 52 cents per share, a year earlier. Excluding items, the company lost $2.64 per share, compared with analysts' average estimate of a $1.99 loss per share.

• Walt Disney Co: The company swung to a surprise quarterly profit on Thursday, as "The Mandalorian" and "Soul" lifted its fast-growing streaming business, outweighing pandemic worries about its hobbled theme park operations. Investors overlooked a 53% decline in park revenue in the quarter and welcomed Disney+ streaming reaching 94.9 million subscribers. Including Hulu and ESPN+, Disney's paid streaming membership topped 146 million. The company posted earnings of 32 cents per share for October through December. Wall Street had expected a loss of 41 cents per share. Quarterly revenue fell to $16.25 billion from $20.88 billion a year earlier, but was still above analysts' average estimate of about $15.93 billion.

In Other News

• Alphabet Inc & Facebook Inc: Australia will next week introduce landmark legislation to force Alphabet's Google and Facebook to pay publishers and broadcasters for content, a senior government official said. The legislation, which Google says will be "unworkable", will make Australia the first country to require Facebook and Google to pay for news content. "The bill will now be considered by the parliament from the week commencing 15 February 2021," Treasurer Josh Frydenberg said in an emailed statement. The legislation is being closely watched around the world.

• American Airlines Group Inc & United Airlines Holdings Inc: A U.S. House committee on Thursday approved a proposal to give airlines another $14 billion in payroll assistance as part of a broader COVID-19 relief package that is working its way through Congress. It would be the third round of support for the pandemic-hit industry. American Airlines and United Airlines have warned of some 27,000 furloughs without an extension of the current package that expires on April 1. The House of Representatives Financial Services Committee on a 29-24 vote approved the $14 billion for airlines and $1 billion for contractors to cover payroll through September.

• CureVac NV: Europe's drugs regulator said it had launched a real-time review of CureVac's COVID-19 vaccine to speed up potential approvals and bring more shots to the region reeling from a surge in infections. The human medicines committee of the European Medicines Agency (EMA) will review data from ongoing trials of the German biopharmaceutical firm's vaccine until there is enough clinical data for approval, the regulator said. The EMA said its decision to start the "rolling review" of the vaccine, CVnCoV, was based on its preliminary results from laboratory studies and early clinical studies in adults.

• PayPal Holdings Inc: The company is not likely to buy cryptocurrencies such as bitcoin, the payments processor's Chief Financial Officer John Rainey told CNBC on Thursday. "We're not going to invest corporate cash, probably, in sort of financial assets like that, but we want to capitalize on this growth opportunity that's in front of us" Rainey said in a CNBC interview. PayPal said in October it will allow U.S. customers to hold bitcoin and other virtual coins in its online wallet, and shop using cryptocurrencies at merchants on its network.

• Pfizer Inc: A government health panel approved Japan's first COVID-19 vaccine, made by Pfizer, NHK national television reported, as the country races to control a third wave of infections before the Olympic Games. Formal approval of the vaccine, batches of which arrived in Japan on Friday morning, will be given on Sunday by Japanese Health Minister Norihisa Tamura, according to media reports.

• Rio Tinto Plc: The company said it has provided expertise to its Guinean partner to help settle a dispute with local communities over resettlement for a bauxite mine. Guinean villagers in communities around the mine filed a complaint in 2019 with International Finance Corp, a global development institution linked to the World Bank, alleging contraventions by miner Compagnie des Bauxites de Guinée SA (CBG) of its commitments around resettlement and pollution. Rio said in a statement it had offered CBG a Guinea-based Africa specialist and a manager with experience on resettlement and human rights, to encourage it to work towards an outcome aligned with international standards. Rio, which has board representation on Halco and CBG as well as various shareholder oversight committees, said the two parties reached agreement in December 2020 on ground rules for the mediation process.

• Twitter Inc: The company said on Thursday it suspended the account of conservative activist group Project Veritas for repeated violations of its private information policy, which prohibits sharing, or threatening to share others' private information without consent. The social media company also temporarily locked the account of the group's founder, James O'Keefe, for violating the same policy, a Twitter spokeswoman said in a statement. Project Veritas said in a public Telegram post that the Tweet that led to the suspension was a video of one of their journalists asking Facebook's VP of integrity Guy Rosen a question about censorship.

FEATURE

Florida consumers 'flabbergasted' as property insurers push for double-digit rate hikes

Florida property insurers are jacking up rates by double-digit percentages, blaming the hikes on lingering damage from past hurricanes, a wave of litigation, and a law that encourages lawyers to sue by allowing courts to award them big fees.

ANALYSTS' RECOMMENDATION

• Kraft Heinz Co: Jefferies raises target price to $35 from $34, citing the company’s higher earnings per share forecast for 2021 and margin improvement.

• PayPal Holdings Inc: Canaccord Genuity raises target price to $315 from $306, stating the company’s higher long-term revenue growth outlook and margin expansion.

• Restaurant Brands International Inc: CIBC cuts target price to $68 from $69, stating the company’s weaker-than-expected earnings in its fourth quarter and higher operating expense.

• Tyson Foods Inc: JPMorgan raises target price to $73 from $70, citing the company’s higher EPS estimate for 2021 and improving global demand for its protein-based products.

• Walt Disney Co: Evercore ISI raises target price to $210 from $200, noting the company’s strong growth in its streaming business and higher earnings forecast.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

1000 U Mich Sentiment Preliminary for Feb: Expected 80.8; Prior 79.0

1000 U Mich Conditions Preliminary for Feb: Expected 88.0; Prior 86.7

1000 U Mich Expectations Preliminary for Feb: Expected 75.7; Prior 74.0

1000 (approx.) U Mich 1 year inflation preliminary for Feb: Prior 3.0%

1000 (approx.) U Mich 5-year inflation preliminary for Feb: Prior 2.7%

COMPANIES REPORTING RESULTS

Dominion Energy Inc: Expected Q4 earnings of 80 cents per share

Moody's Corp: Expected Q4 earnings of $1.97 per share

Newell Brands Inc: Expected Q4 earnings of 48 cents per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0830 Chemours Co: Q4 earnings conference call

0830 Flowers Foods Inc: Q4 earnings conference call

0830 j2 Global Inc: Q4 earnings conference call

0830 Newell Brands Inc: Q4 earnings conference call

0830 Proto Labs Inc: Q4 earnings conference call

1000 Brixmor Property Group Inc: Q4 earnings conference call

1000 Cousins Properties Inc: Q4 earnings conference call

1000 Dominion Energy Inc: Q4 earnings conference call

1000 Huntsman Corp: Q4 earnings conference call

1000 Lincoln Electric Holdings Inc: Q4 earnings conference call

1000 WP Carey Inc: Q4 earnings conference call

1100 Mohawk Industries Inc: Q4 earnings conference call

1130 Moody's Corp: Q4 earnings conference call

1200 Regency Centers Corp: Q4 earnings conference call

EX-DIVIDENDS

AGCO Corp: Amount $0.16

Bunge Ltd: Amount $0.50

CF Industries Holdings Inc: Amount $0.30

Church & Dwight Co Inc: Amount $0.25

Cimarex Energy Co: Amount $0.22

Duke Realty Corp: Amount $0.25

Invesco Ltd: Amount $0.15

Prudential Financial Inc: Amount $1.15

Rockwell Automation Inc: Amount $1.07

Southern Co: Amount $0.64

Ubiquiti Inc: Amount $0.40

Wake-up call: Markten op zoek naar duidelijke richting

Goedemorgen

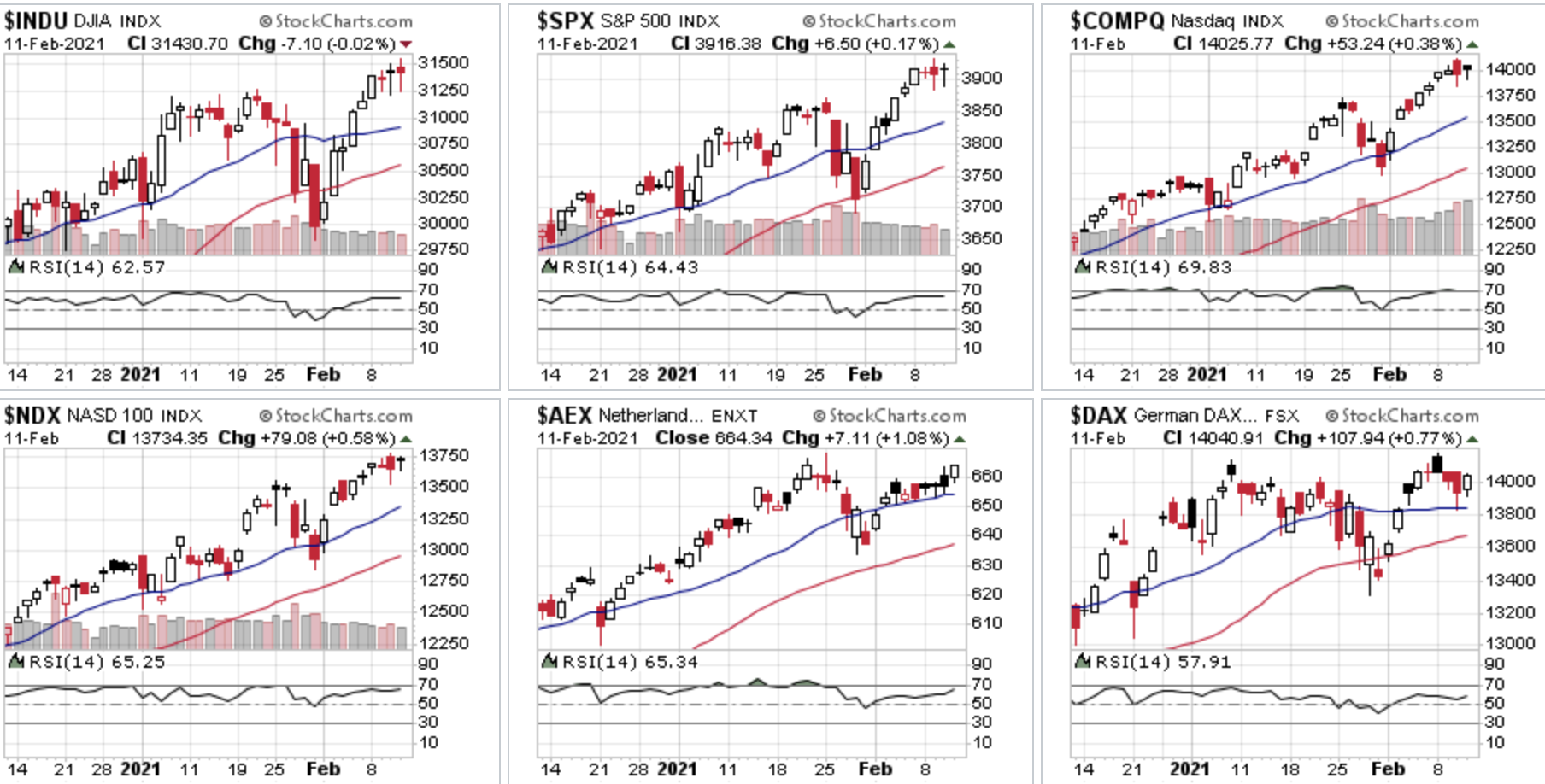

Vanmorgen zien we de markt wat inleveren via de futures, zowel hier in Europa als op Wall Street staan de indicaties wat lager. Gisteren nog wel nieuwe records bij de Nasdaq, de Nasdaq 100 en de SP 500, de Dow Jones haalde dat net niet want de index sloot iets lager om zo net geen nieuw record neer te zetten. We zitten al een goeie 2 weken met records op Wall Street, de positieve flow daar blijft aanhouden.

De AEX kende trouwens ook een sterke dag, vooral door ASML dat weer eens fors hoger eindigde met een nieuw record, de AEX sloot 7 punten hoger om zo net onder de top die rond de 666 uitkomt te sluiten. De DAX liet na een paar mindere dagen herstel zien, de index won gisteren 108 punten en komt zo weer boven de 14.000 punten (14.041) uit.

Via de indicaties voorbeurs kunnen de AEX en de DAX iets lager openen, de DAX een puntje of 20, de AEX zal ook iets lager starten volgens de indicaties. Wel kleine minnetjes tot nu toe, straks als de markt open gaat maar eens kijken hoe het verder verloopt en of Wall Street inderdaad even een stap terug wil.

Er was niet veel nieuws donderdag, wel viel het aantal aangevraagde uitkeringen tegen en werd het cijfer van de week ervoor negatief bijgesteld. Verder waren beleggers nog tevreden over de uitspraken van FED-voorzitter Jerome Powell die deze week nog meer eens benadrukte dat de centrale bank de economie in ieder geval zo lang dat nodig is zal blijven ondersteunen. Verder blijven beleggers rekenen op het Amerikaans steunpakket dat Biden erdoor wil krijgen.

De EU kwam met nieuwe economische vooruitzichten, na opnieuw een moeilijke periode door de 2e golf en de recessie die erbij kwam vorig jaar verwacht men nu vanaf de lente een duidelijk herstel van de economie. Dan zijn we nog lang niet waar we waren begin vorig jaar maar dan zal de curve omkeren verwacht men. Dit jaar verwacht men in ieder geval een groei van 3,8% in Europa.

Hoe vreemd het ook lijkt te zijn in deze tijden blijven de sterke bedrijfscijfers het sentiment mede bepalen, en vergeet het verloop van de BIG-7 bedrijven niet, ze presteren het nog steeds om vrijwel elke dag nog een stapje hoger te geraken zonder een noemenswaardige correctie tussendoor. Dat de aandelen momenteel gemiddeld meer dan voldoende gewaardeerd zijn weten we, om dat pad te vervolgen zullen de cijfers ook later dit jaar alle verwachtingen moeten verslaan en dat wordt nogal een uitdaging. De markt schreeuwt dan wel om een grotere correctie. en dat weten we, maar die moet er wel een keer komen. Zie hieronder een korte samenvatting waarom ik denk dat we in het oog van de storm zitten momenteel ...

Koers winst verhoudingen Wall Street en weging TOP-7:

Blijf vooral letten op de torenhoge koers-winst verhoudingen die de Nasdaq en dan vooral ook bij de grote 7 momenteel laten zien, de gemiddelde KW op de S&P 500 staat sinds gisteren op 39,87 en dus een fractie onder de 40. Om u een beeld te geven waar deze KW op stond in februari 2020 net voor de crisis begon op 26. Aan u om te beoordelen of waar we nu op staan gezond is? Let wel, als er naar het gemiddelde van de afgelopen jaren wordt gekeken dan ligt de KW rond de 18 ...

Neem ik die TOP-7 er dan even bij dan zien we dat deze aandelen rond de 25% van de totale S&P 500 voor hun rekening nemen en bijna de helft (48%) van de Nasdaq bevatten, de weging bedoel ik daarmee. U zal begrijpen dat als er een correctie komt op deze 7 aandelen van pakweg 10-15% of zelfs 20% dat de grote en bepalende indices een behoorlijke correctie gaan doormaken. Dat moment komt steeds dichterbij, hou er dus rekening mee. Het gaat bij het huidige verloop van de markt in het bijzonder over deze 7 aandelen en dat zijn Apple, Microsoft, Google, Tesla, Amazon, Facebook en Nvidia.

Deze week wat kleine posities opgenomen:

Deze maand heb ik tot nu toe nog niet zoveel kunnen doen, wel hier en daar wat kleine posities kunnen afsluiten en we staan op winst deze maand en dit jaar (2021). Nu zitten we nog met wat kleine posities in de markt, die kunnen nog opgenomen worden uiteraard.

De markt bereikt wel duidelijk de bovenkant van de bekende WIG waar er eerder telkens winstnemingen op gang kwamen ... Wel blijf ik uiteraard voorzichtig en handel ik nog steeds met kleine aantallen bij de huidige marktomstandigheden.

De LIVEBLOG en. Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

Euro, olie en goud:

De euro zien we nu rond de 1.212 dollar, de prijs van een vat Brent olie komt uit op 60,7 dollar terwijl een troy ounce goud nu op 1819 dollar staat.

Inter Market overzicht op slotbasis ...

We gaan wat strategische posities opnemen:

Zodra u lid wordt ontvangt u de signalen en kunt u meteen als er posities open staan zien welke dat zijn via onze Tradershop op de website. Ik probeer ook in deze markt zo goed als dat kan om te gaan met de posities, wel is mijn verwachting dat de markt volatiel zal blijven de komende periode. Dat zal kansen bieden maar het vraagt ook om goed met de posities om te gaan zodra die lopen.

Blijven schakelen tussen long en short blijft daarbij belangrijk de komende weken. Ook deze maand komen er nog genoeg kansen, we zitten nu met wat kleine posities in de markt.

Doe nu in ieder geval mee met de proef aanbieding voor nieuwe leden, die loopt tot 1 APRIL en dat met een mooie korting !! ... €39 tot 1 APRIL 2021 ... en voor Polleke €49 tot 1 APRIL 2021 !!!

Schrijf u in voor Systeem Trading (€39 tot 1 APRIL)

Schrijf u in voor Index Trading (€39 tot 1 APRIL)

Schrijf u in voor Guy Trading (€39 tot 1 APRIL)

Schrijf u in voor Polleke Trading (€49 tot 1 APRIL)

Schrijf u in voor de Aandelen portefeuille (€30 tot 1 APRIL)

Schrijf u in voor COMBI TRADING (€79 tot 1 APRIL)

Hieronder het resultaat tot nu toe dit jaar (2021) ...

Met vriendelijke groet,

Guy Boscart

Markt snapshot Europa vandaag

GLOBAL TOP NEWS

U.S. President Joe Biden and his Chinese counterpart Xi Jinping held their first phone call as leaders and appeared at odds on most issues, even as Xi warned that confrontation would be a "disaster" for both nations.

Supporters of ousted Myanmar leader Aung San Suu Kyi called for tougher international action against the new junta after Washington announced a first round of sanctions following six days of pro-democracy demonstrations.

Members of Italy's 5-Star Movement voted on Thursday to back Prime Minister designate Mario Draghi, opening the way for the former European Central Bank chief to take office at the head of a broad government of national unity.

EUROPEAN COMPANY NEWS

Amsterdam has displaced London as Europe's biggest share trading centre after Britain left the European Union's single market, and picked up a chunk of UK derivatives business along the way, according to data published on Thursday.

New York-based municipal bond insurer MBIA's unit MBIA Insurance Corp entered an agreement to settle a litigation it filed in 2009 against lender Credit Suisse and certain affiliated entities over property debt in the United States.

AstraZeneca's COVID-19 vaccine is not perfect, but will have a big impact on the pandemic, its chief executive predicted on Thursday, as the drugmaker pledged to double output by April and the African Union gave its backing for the shot.

TODAY'S COMPANY ANNOUNCEMENTS

Af Gruppen ASA Q4 2020 Earnings Release

Aker Carbon Capture AS Q4 2020 Earnings Call

Applied Graphene Materials PLC Shareholders Meeting

B2holding ASA Q4 2020 Earnings Call

Boliden AB Q4 2020 Earnings Release

Bravida Holding AB Q4 2020 Earnings Call

Dios Fastigheter AB FY 2020 Earnings Call

Duni AB Q4 2020 Earnings Release

Enento Group Plc Q4 2020 Earnings Release

Entra ASA Q4 2020 Earnings Call

Eutelsat Communications SA HY 2021 Earnings Call

Flow Traders NV FY 2020 Earnings Release

Garo AB FY 2020 Earnings Call

Infront ASA Q4 2020 Earnings Call

ING Groep NV Q4 2020 Earnings Release

Interpump Group SpA FY 2020 Earnings Call

Intertrust NV FY 2020 Earnings Release

Investment AB Latour Q4 2020 Earnings Release

L'Oreal SA FY 2020 Earnings Call

Maersk Drilling A/S FY 2020 Earnings Call

MaltaPost plc Annual Shareholders Meeting

Medicover AB Q4 2020 Earnings Call

Mekonomen AB Q4 2020 Earnings Release

Norsk Hydro ASA Q4 2020 Earnings Release

Osmozis SAS Annual Shareholders Meeting

Q-Free ASA Q4 2020 Earnings Call

Red Rock Resources PLC Annual Shareholders Meeting

Remote Monitored Systems PLC Annual Shareholders Meeting

Schibsted ASA Q4 2020 Earnings Release

Techstep ASA Q4 2020 Earnings Release

Tikkurila Oyj FY 2020 Earnings Release

Tokmanni Group Corp FY 2020 Earnings Call

Unipol Gruppo SpA and UnipolSai Assicurazioni SpA Preliminary 2020 Earnings Call

Veidekke ASA Q4 2020 Earnings Release

Verkkokauppa.com Oyj FY 2020 Earnings Call

Victrex PLC Annual Shareholders Meeting

Volue AS Q4 2020 Earnings Release

Wereldhave NV FY 2020 Earnings Call

Worldwide Healthcare Trust PLC Shareholders Meeting

ECONOMIC EVENTS (All times GMT)

0700 (approx.) United Kingdom Business Investment qq Preliminary for Q4: Prior 9.4%0700 (approx.) United Kingdom Business Investment yy Preliminary for Q4: Prior -19.2%0700 (approx.) United Kingdom GDP Estimate 3M/3M for December: Expected 0.5%; Prior 4.1%0700 (approx.) United Kingdom GDP Estimate mm for December: Expected 1.0%; Prior -2.6%0700 (approx.) United Kingdom GDP Estimate yy for December: Expected -8.0%; Prior -8.9%0700 (approx.) United Kingdom Services mm for December: Expected 1.0%; Prior -3.4%0700 (approx.) United Kingdom Services yy for December: Expected -9.5%; Prior -10.2%0700 (approx.) United Kingdom Industrial Output mm for December: Expected 0.5%; Prior -0.1%0700 (approx.) United Kingdom Industrial Output yy for December: Expected -3.8%; Prior -4.7%0700 (approx.) United Kingdom Manufacturing Output mm for December: Expected 0.6%; Prior 0.7%0700 (approx.) United Kingdom Manufacturing Output yy for December: Expected -3.3%; Prior -3.8%0700 (approx.) United Kingdom Construction O/P Vol mm for December: Expected 0.5%; Prior 1.9%0700 (approx.) United Kingdom Construction O/P Vol yy for December: Expected -0.2%; Prior -1.4%0700 (approx.) United Kingdom Goods Trade Balance GBP for December: Expected -15 bln GBP; Prior -16.012 bln GBP0700 (approx.) United Kingdom Goods Trade Balance Non-EU for December: Prior -8.012 bln GBP0700 United Kingdom GDP Preliminary qq for Q4: Expected 0.5%; Prior 16.0%0700 United Kingdom GDP Preliminary yy for Q4: Expected -8.1%; Prior -8.6%0730 Switzerland CPI mm for January: Expected 0.0%; Prior -0.1%0730 Switzerland CPI yy for January: Expected -0.6%; Prior -0.8%0730 (approx.) Switzerland CPI NSA for January: Prior 100.90800 Spain CPI mm Final NSA for January: Expected 0.1%; Prior 0.1%0800 Spain CPI yy Final NSA for January: Expected 0.6%; Prior 0.6%0800 Spain HICP Final mm for January: Expected -0.3%; Prior -0.3%0800 Spain HICP Final yy for January: Expected 0.6%; Prior 0.6%0800 Spain Core CPI yy for January: Prior 0.1%0800 (approx.) Spain CPI Final NSA for January: Prior 104.800