Liveblog Archief vrijdag 21 augustus 2020

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Bestaande Huizenverkopen (Jul) | Actueel: 5,86M Verwacht: 5,38M Vorige: 4,70M |

Markt snapshot Wall Street vandaag

TOP NEWS

• Fearing shipping crunch, retailers set earliest-ever holiday sale plans

The coronavirus pandemic is upending the way U.S. consumers shop and the holidays will be no exception as major retailers and shippers roll out their earliest-ever shopping season.

• U.S., China differ over plans for Phase 1 trade deal talks

The Trump administration on Thursday declined to acknowledge any plans to meet with China over the Phase 1 trade deal after the commerce ministry in Beijing said bilateral talks would be held "in the coming days" to evaluate the agreement's progress.

• China's Pinduoduo reports bigger operating loss

China's Pinduoduo reported a bigger operating loss, as the e-commerce company incurred higher costs to maintain its cloud services and call center operations during the COVID-19 pandemic.

• Deere lifts full-year earnings forecast on resilient farm equipment demand

Deere lifted its full-year earnings forecast after a smaller-than-expected decline in quarterly profit, as the sector benefits from replacement demand and government stimulus.

• Top FDA official says would resign if agency rubber-stamps an unproven COVID-19 vaccine

A top U.S. health regulator who will help decide the fate of a coronavirus vaccine has vowed to resign if the Trump administration approves a vaccine before it is shown to be safe and effective, Reuters has learned.

BEFORE THE BELL

U.S. stock index futures ticked lower, a day after the tech-heavy Nasdaq closed at a record high, as investors awaited U.S. business surveys for more clues on the economy's health. Most global shares enjoyed cautious gains, but tepid economic data and lofty valuations reined in the advances. The dollar rose, while gold eased. Oil prices dipped on slow recovery in fuel demand.

STOCKS TO WATCH

Results

• Deere & Co (DE). The world's largest farm equipment maker, lifted its full-year earnings forecast after a smaller-than-expected decline in quarterly profit, as the sector benefits from replacement demand and government stimulus. The Moline, Illinois-based company said it now expects net income of about $2.25 billion for the full year, higher than $1.6 billion-$2 billion estimated earlier. For the quarter ended on Aug. 2, it reported earnings of $2.57 per share compared with $2.81 per share last year. Equipment sales during the quarter declined 12.4% year-on-year to $7.9 billion. Analysts surveyed by Refinitiv, on average, had expected earnings of $1.26 per share and equipment sales of $6.7 billion.

• Pinduoduo Inc (PDD). The Chinese e-commerce company reported a bigger operating loss, as the company incurred higher costs to maintain its cloud services and call center operations during the COVID-19 pandemic. The company's operating loss widened to 1.64 billion yuan from 1.49 billion yuan a year earlier. Revenue surged about 67% to 12.19 billion yuan in the second quarter.

Deals Of The Day

• Westpac Banking Corp (WBK). The company agreed to sell its vendor finance business to a U.S. private equity firm, as part of its strategy to focus on core banking operations and trim its portfolio of underperforming businesses. The unit, which supports third parties to fund small-scale equipment finance loans, would be sold to Angle Finance, a portfolio company of Cerberus Capital Management, Westpac said. Westpac did not specify the deal value, but said it expects a small accounting loss on the sale and negligible impact on the bank's balance sheet and capital ratios. The deal will result in the transfer of about A$500 million worth of Westpac's customer loans, and is expected to be completed by the end of April 2021.

In Other News

• Arcturus Therapeutics Holdings Inc (ARCT). The company is in discussions with about a dozen countries for supply deals of its coronavirus vaccine that is currently in early human testing, the company's chief executive officer told Reuters on Thursday. The company is talking to some countries in Europe, Latin America and Southeast Asia, as well as with several U.S. government agencies, CEO Joseph Payne said in an interview. There are "approximately a dozen countries that we're in conversations with," Payne said. The negotiations with other countries are focused on two "levers", Payne said: the number of doses involved and clinical trial support. "If there is a substantial number of doses, that is a lever of negotiation," he said.

• Apple Inc (AAPL) & New York Times Co (NYT). Major news publishers are seeking more favorable terms from the company on commissions the iPhone maker collects from them on payments made through its app store, according to a letter posted by a trade body on Thursday. Digital Content Next (DCN), which represents New York Times, the Washington Post, the Wall Street Journal and other publishers, posted the letter, addressed to Apple Chief Executive Officer Tim Cook, on its website. Apple, which usually takes a cut that ranges between 15% and 30% from news publishers for first-time subscriptions made through apps on the store, has a reduced rate for Amazon.com. News publishers should qualify for the same terms offered to Amazon for its Prime Video app on Apple's app store, DCN Chief Executive Officer Jason Kint suggested in Thursday's letter to Cook.

• AstraZeneca PLC (AZN), Moderna Inc (MRNA) & Pfizer Inc (PFE). A top U.S. health regulator who will help decide the fate of a coronavirus vaccine has vowed to resign if the Trump administration approves a vaccine before it is shown to be safe and effective, Reuters has learned. Peter Marks, director of the Food and Drug Administration's Center for Biologics Evaluation and Research, made the statement in response to concerns raised on a conference call late last week of government officials, pharmaceutical executives and academics who serve on a vaccine working group organized by the National Institutes of Health, according to three sources familiar with the matter. "You have to decide where your red line is, and that's my red line," he said. "I would feel obligated (to resign) because in doing so, I would indicate to the American public that there's something wrong." Large-scale clinical trials of the leading vaccine candidates from Moderna, Pfizer and AstraZeneca were launched in recent weeks. The FDA has scheduled a meeting of its advisory committee of outside experts on coronavirus vaccines on Oct. 22.

• Best Buy Co Inc (BBY), FedEx Corp (FDX), Kohl's Corp (KSS), Target Corp (TGT), United Parcel Service Inc (UPS) & Walmart Inc (WMT). The coronavirus pandemic is upending the way U.S. consumers shop and the holidays will be no exception as major retailers and shippers roll out their earliest-ever shopping season. Target, Best Buy and Kohl's have moved winter holiday promotions up to as early as October. They also joined rival Walmart in announcing store closures on Thanksgiving and plans to bypass the midnight Black Friday door-buster sales that traditionally mark the start of the holiday season but are incompatible with the pandemic's social distancing recommendations. Target CEO Brian Cornell said the retailer will stress same-day delivery and add thousands of items available via these services, including more gifts and essentials during the "very different holiday season." Same-day delivery takes strain off delivery firms like UPS and FedEx because it's done by "gig" drivers for companies like Shipt, DoorDash and Postmates.

• BHP Group (BHP). The largest workers union at Colombian coal mine Cerrejon said on Thursday its members voted overwhelmingly in support of strike action after contract negotiations between the two parties collapsed. Some 99% of votes were cast in favor of strike action, the Sintracarbon union said, after extended talks over contract negotiations ended without agreement almost two weeks ago. Despite the decision, Sintracarbon wants to continue talks in search of an agreement said union president, Igor Diaz, who requested the involvement of Colombia's labor ministry. Cerrejon, which is owned equally by BHP, Anglo American and Glencore said it respected the decision by workers but called on the union and workers to re-examine the offer.

• Boeing Co (BA). Transport Canada plans to conduct flight test activities for the validation of the company's grounded 737 MAX next week, the regulator told Reuters on Thursday, as part of global efforts to return the plane to service following two fatal crashes involving the model. Transport Canada is said to be the first non-U.S. regulator to conduct such activities, following test flights performed earlier this summer by the U.S. Federal Aviation Administration (FAA) which is tasked with certifying the aircraft. Canada's tests will be held at the U.S. planemaker's facilities in Washington State, according to two sources. The Canadian tests are part of the regulator's "independent review" on whether to validate proposed changes by Boeing to the aircraft, Transport Canada said. "These tests will validate key areas of the FAA certification," it said.

• Chevron Corp (CVX). Western Australia's industrial regulator has approved a plan by the company to shut two processing trains at its Gorgon liquefied natural gas (LNG) plant in Australia in stages in October and early next year. The company will shut Train 1 in early October and Train 3 in January 2021 for inspections on equipment in the units, the Department of Mines, Industry Regulation and Safety said. "Chevron has presented the department with comprehensive safety and technical information that supports an accelerated but staged inspection schedule combined with a range of other controls," the regulator said. Chevron said in a separate statement that repairs on Train 2 are progressing and it expects to restart the unit in early September. "Following the planned restart of Train 2 in September, Chevron plans to temporarily halt Train 1 production to inspect and, if necessary, undertake repairs to its propane heat exchangers," a spokesman said.

• Facebook Inc (FB). The social media company pushed for legislation that makes it easier for users to transfer photos and videos to a rival tech platform, in comments it sent to the Federal Trade Commission ahead of a hearing on the topic on Sept. 22. "The FTC often issues reports following these workshops ... I think their recommendations should include dedicated portability legislation," Bijan Madhani, privacy and public policy manager at Facebook told Reuters. Facebook supports a portability bill already doing the rounds in Congress called the Access Act from Democratic Senators Richard Blumenthal and Mark Warner, and Republican senator Josh Hawley. The bill is a good first step, Madhani said. Facebook has engaged with the lawmakers on it and will continue working with them, he added. Separately, an Indian parliamentary committee will question Facebook executives on how the social media giant regulates political content in the country, a panel member told Reuters, following controversy about its practices.

• General Electric Co (GE). The company said it has extended the employment agreement of Chief Executive Officer Lawrence Culp through August 2024. The company's board also approved a one-time equity performance grant to Culp. Culp, who was hired in 2018 to replace CEO John Flannery, has since focused on improving General Electric's free cash flow and cutting debt.

• Iamgold Corp (IAG). The company has delayed the sale process for its Sadiola gold mine in Mali because of political instability in the country, a spokeswoman said on Thursday. Mali President Ibrahim Boubacar Keita resigned on Tuesday and dissolved parliament hours after soldiers detained him at gunpoint and seized power in a coup. "We note that the only outstanding matter is the signature of the prevailing government authorities," Iamgold spokeswoman Indi Gopinathan said in an email. She did not provide an estimate on closing.

• Sinovac Biotech Ltd (SVA). The Chinese company has committed to provide up to 40 million coronavirus vaccine doses to Indonesia's government between November and March, a minister said, as the Southeast Asian nation seeks to secure its supply as cases rise unabated. "Indonesia sees a strong commitment from China's industries to forge partnerships and a strong commitment from its government to foster those partnerships," the country's Foreign Minister Retno Marsudi said late on Thursday via video.

• Toyota Motor Corp (TM). The company said its domestic vehicle production would be 1% higher than initially planned in September, as its plants resume output levels following a steep drop because of the COVID-19 pandemic. The company plans to produce roughly 2,300 more cars and trucks than its initial plan for around 230,000, Reuters calculations found. Vehicle production at the automaker is recovering at home and abroad since global output fell by more than half year-on-year in April and May, when plants were shuttered to prevent the spread of the novel coronavirus. Toyota declined to comment on global production plans for next month, but the company has said it expects global sales will be 15% lower in the July-September quarter from last year, and 5% lower in October-December.

ANALYSIS

COVID-19 era highlights U.S. 'black hole' compensation fund for pandemic vaccine injuries

A U.S. government program that compensates people who say they have been harmed by an emergency vaccine has paid out on fewer than 10% of claims, raising questions whether the process should be used to address any potential side effects from a coronavirus shot, according to some lawyers who have filed such claims.

ANALYSTS' RECOMMENDATION

• Advanced Micro Devices (AMD). Cowen and Company raises target price to $100 from $90, stating that CEO Dr. Lisa Su is focused on consistency in innovation, execution and growth.

• Estee Lauder Companies Inc (EL). JPMorgan establishes December 2021 target price of $180 from December 2021 target price of $156, saying that the announcement of the Post-COVID Business Acceleration Program (in addition to the ongoing cost measures) is a reflection of management’s commitment to reposition the business to remain a long-term share gainer in the global beauty market.

• L Brands Inc (LB). Evercore ISI raises target price to $32 from $15, impressed by the staying power of Bath & Body Works during the pandemic.

• Thermo Fischer Scientific Inc (TMO). Credit Suisse raises target price to $425 from $405, citing an encouraging third-quarter guidance, which calls for a 15% rise in organic growth.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0945 Markit Composite Flash PMI for Aug: Prior 50.3

0945 Markit Manufacturing PMI Flash for Aug: Expected 51.9; Prior 50.9

0945 Markit Services PMI Flash for Aug: Expected 51.0; Prior 50.0

1000 Existing home sales for Jul: Expected 5.38 mln; Prior 4.72 mln

1000 Existing home sales percentage change for Jul: Expected 14.7%; Prior 20.7%

COMPANIES REPORTING RESULTS

No majore companies are scheduled to report.

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0730 Pinduoduo Inc (PDD). Q2 earnings conference call

1000 Deere & Co (DE). Q3 earnings conference call

EXDIVIDENDS

3M Co (MMM). Amount $1.47

Atmos Energy Corp (ATO). Amount $0.57

MKS Instruments Inc (MKSI). Amount $0.20

NortonLifeLock Inc (NLOK). Amount $0.12

Tractor Supply Co (TSCO). Amount $0.40

United Parcel Service Inc (UPS). Amount $1.01

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| DEU: Duitse Productie Inkoopmanagersindex (PMI) (Aug) | Actueel: 53,0 Verwacht: 52,5 Vorige: 51,0 |

TA - Twee kansen in de Dow Jones

Veel aandelen op de Amerikaanse markt laten recordstanden zien. Toch probeer ik de interessante achterblijvers en kwaliteitsaandelen met groeipotentie eruit te pikken. Sommige voor de korte termijn en andere om lekker op de plank te leggen en er na een langere tijd weer naar te kijken. Vandaag…

Lees verder »Wake-up call: Hoop op vaccin en Nasdaq hoogvliegers doen Wall Street draaien

Goedemorgen

Het was weer zo'n dag, Apple nog 10 dollar duurder, de koers van Tesla naar 2000 dollar en de andere uit de TOP-5 ofwel de "BIG TECHS" trekken de markt verder omhoog naar nieuwe records. De BIG-5 is nu al 25% van de S&P 500, over de Nasdaq 100 zullen we het maar niet hebben maar met Tesla en Nvidia erbij zitten we daar al op 53%, dus 7 aandelen uit deze index bepalen nu voor 53% het gewicht, het verloop. De andere 93 aandelen zijn dus 47% van de index waard. Let op, dat blijft enorm belangrijk zodra de BUBBEL uiteen barst, dan krijg je hetzelfde effect als nu maar dan omlaag en door het zware gewicht, en de veel grotere impact die een daling met zich meebrengt sta je met de Nasdaq en de Nasdaq 100 in no-time vele procenten lager.

Eerder zei ik al dat we niet gaan moeten opkijken van 10-15-20 en zelfs 25% eraf binnen een paar weken tijd zodra men ze in de uitverkoop doen. Want laten we eerlijk zijn, is Apple wel 2 biljoen dollar waard? In deze tijd? Of laten we het anders zeggen, staat Apple er nu zoveel beter voor dan aan het begin van dit jaar, of eind vorig jaar? Mogelijk wel iets maar ik betwijfel het, alleen de koers is wel bijna verdubbeld nu. Neem dat mee in uw visie op de markten, denk na waar we staan, denk aan 1999-2000 en 2007-2008, en vooral hoe het toen afliep ... Apple staat nu op een PE van 37, Microsoft ook, verder doet Tesla het nu al met een PE van 1050, Amazon al rond de 125 ...

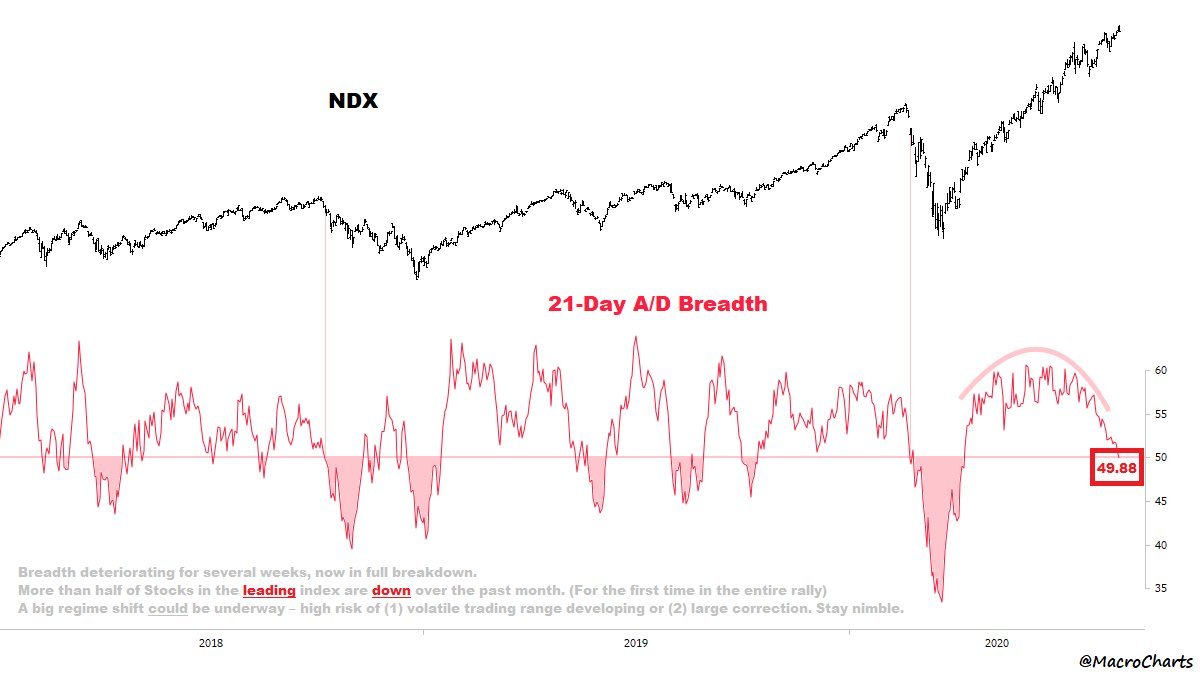

Zoals ik al aangaf verzwakt de Nasdaq 100 hoe dan ook al in de breedte en dat al enkele weken, dat toont eigenlijk al aan dat er iets groots aan zit te komen in de negatieve zin. Meer dan de helft van de aandelen binnen deze leidende TECH index zijn de afgelopen maand gedaald. Er zou een grote tradingrange kunnen ontstaan maar meer voor de hand ligt dan toch dat er een zeer grote correctie op komst is. Daarom deze grafiek erbij ...

Verder reageerde de markt gisteren na een slechte start vrij snel op nieuwe dat Pfizer met een vaccin op schema ligt om de testfase af te ronden in oktober. Pfizer en zijn Duitse partner BioN Tech melden dat het vaccin een kandidaat is met de minste bijwerkingen. Het is een van de weinige experimentele vaccins die over de gehele wereld het eindstadium bereikt wat betreft het testen. Nieuws over een vaccin doet de markten telkens positief reageren uiteraard ...

De posities die lopen komen in de winst via de signalen, men kan nog meer door lid te worden in ieder geval. Dat kan nu tot 1 NOVEMBER via de nieuwe aanbieding voor €39 ...

Schrijf u vandaag nog in via de link https://www.usmarkets.nl/tradershop

Guy Boscart

Markt snapshot vandaag Europa

GLOBAL TOP NEWS

Joe Biden vowed to heal a country battered by a deadly pandemic and an economic catastrophe by uniting all Americans, while warning that President Donald Trump would go on stoking hatred and fear if elected to another four-year term.

The Trump administration on Thursday declined to acknowledge any plans to meet with China over the Phase 1 trade deal after the commerce ministry in Beijing said bilateral talks would be held "in the coming days" to evaluate the agreement's progress.

The European Union has so far rebuffed British calls for talks on a deal to allow London to send unwanted migrants back to Europe from 2021, and could use the issue as potential leverage in wider Brexit negotiations, diplomats and officials said.

EUROPEAN COMPANY NEWS

German drugs and pesticides group Bayer said on Thursday it will pay around $1.6 billion to settle the majority of U.S. claims involving its Essure birth-control device.

Activist fund Amber Capital on Thursday called on French publishing and media group Lagardere to hold a shareholder meeting, its latest bid to trigger a board shake-up as a battle between the firm's top investors intensifies.

A U.S. judge on Thursday dismissed portions of a U.S. Securities and Exchange Commission lawsuit accusing Volkswagen of defrauding American investors in connection with the automaker's diesel emissions scandal.

TODAY'S COMPANY ANNOUNCEMENTS

Adams PLC Annual Shareholders Meeting

Af Gruppen ASA Q2 2020 Earnings Release

Aumann AG Annual Shareholders Meeting

Bitcoin Group SE Annual Shareholders Meeting

Boozt AB Q2 2020 Earnings Call

Dof ASA Q2 2020 Earnings Call

Flughafen Zuerich AG HY 2020 Earnings Release

Gerry Weber International AG Q2 2020 Earnings Release

Infront ASA Q2 2020 Earnings Call

Kingspan Group PLC HY 2020 Earnings Release

Mekonomen AB Q2 2020 Earnings Release

Rockwool International A/S Q2 2020 Earnings Call

VR Education Holdings PLC Annual Shareholders Meeting

ECONOMIC EVENTS (All times GMT)

0600 (approx.) United Kingdom PSNB Ex Banks for Jul: Expected 29.450 bln GBP; Prior 35.526 bln GBP

0600 (approx.) United Kingdom PSNB for Jul: Expected 29.300 bln GBP; Prior 34.801 bln GBP

0600 (approx.) United Kingdom PSNCR for Jul: Prior 44.033 bln GBP

0600 (approx.) United Kingdom Retail Sales mm for Jul: Expected 2.0%; Prior 13.9%

0600 (approx.) United Kingdom Retail Sales Ex-Fuel mm for Jul: Expected 0.2%; Prior 13.5%

0600 (approx.) United Kingdom Retail Sales yy for Jul: Expected 0.0%; Prior -1.6%

0600 (approx.) United Kingdom Retail Sales Ex-Fuel yy for Jul: Expected 1.5%; Prior 1.7%

0715 France Markit Manufacturing Flash PMI for Aug: Expected 53.7; Prior 52.4

0715 France Markit Services Flash PMI for Aug: Expected 56.3; Prior 57.3

0715 France Markit Composite Flash PMI for Aug: Expected 57.2; Prior 57.3

0730 Germany Markit Manufacturing Flash PMI for Aug: Expected 52.5; Prior 51.0

0730 Germany Markit Services Flash PMI for Aug: Expected 55.1; Prior 55.6

0730 Germany Markit Composite Flash PMI for Aug: Expected 55.0; Prior 55.3

0730 Sweden Capacity Utilization qq SA for Q2: Prior -0.2%

0800 Euro Zone Markit Manufacturing Flash PMI for Aug: Expected 52.9; Prior 51.8

0800 Euro Zone Markit Services Flash PMI for Aug: Expected 54.5; Prior 54.7

0800 Euro Zone Markit Composite Flash PMI for Aug: Expected 54.9; Prior 54.9

0830 United Kingdom Flash Composite PMI for Aug: Expected 57.1; Prior 57.0

0830 United Kingdom Flash Manufacturing PMI for Aug: Expected 53.8; Prior 53.3

0830 United Kingdom Flash Services PMI for Aug: Expected 57.0; Prior 56.5

0900 Belgium Consumer Confidence Index for Aug: Prior -20

1000 United Kingdom CBI Trends - Orders for Aug: Expected -35; Prior -46

1400 Euro Zone Consumer Confidence Flash for Aug: Expected -15.0; Prior -15.0