Liveblog Archief vrijdag 5 maart 2021

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Niet-agrarische Loonlijsten (Feb) | Actueel: 379K Verwacht: 182K Vorige: 166K | ||||

| USA: Werkloosheidscijfer (Feb) | Actueel: 6,2% Verwacht: 6,3% Vorige: 6,3% |

Markt snapshot Wall Street 5 maart

TOP NEWS

• Debate to begin in U.S. Senate on Biden's $1.9 trillion COVID-19 relief bill

A sharply divided U.S. Senate will begin a contentious debate on Friday on a $1.9 trillion coronavirus aid bill that is President Joe Biden's first major legislative initiative, with Democrats pressing ahead without any Republican support.

• U.S. job growth likely regained steam in February

U.S. job growth likely accelerated in February as more services businesses reopened amid falling new COVID-19 cases, quickening vaccination rates and additional pandemic relief money from the government, putting the labor market recovery back on firmer footing and on course for further gains in the months ahead.

• Insurers rewrite business policies after pandemic legal tussles

U.S. insurers are strengthening language in policies that cover business losses to protect them from future claims related to the coronavirus pandemic or other widespread illnesses that disrupt operations, industry sources say.

• White House says closely tracking Microsoft's emergency patch

The White House is closely tracking an emergency patch Microsoft has released, U.S. national security adviser Jake Sullivan said, after an unknown hacking group recently broke into organizations using a flaw in the company's mail server software.

• Instacart mulls direct listing in snub to IPOs - sources

U.S. grocery delivery app Instacart is considering going public through a direct listing, concerned that it could leave money on the table through a traditional initial public offering (IPO), according to people familiar with the matter.

BEFORE THE BELL

U.S. stock index futures rose, as market participants awaited the crucial non-farm payrolls data for signs of economic recovery. Rising U.S. bond yields weighed on European equities, while Asian stocks ended in the red after Federal Reserve Chair Jerome Powell failed to soothe investor concerns over a surge in borrowing costs. A stronger dollar pushed gold prices down. Oil prices jumped, hitting their highest in nearly 14 months after OPEC and its allies agreed not to increase supply.

STOCKS TO WATCH

Results

• Broadcom Inc: Shares of the company fell on Thursday after the company reported chip sales slightly below Wall Street estimates, joining a growing list of chip industry peers hit by the global semiconductor shortage. Broadcom reported semiconductor solutions revenue of $4.90 billion for its fiscal first quarter ended Jan. 31, slightly below analyst estimates of $4.95 billion. On a conference call with investors, Broadcom Chief Executive Hock Tan said the company has seen customers putting in orders well in advance as the company's lead times have extended to as long as eight months. Broadcom forecast second-quarter revenue of about $6.5 billion, compared with analysts' estimates of $6.33 billion. Excluding items, the company earned $6.61 per share in the fiscal first quarter, beating analysts' estimate of $6.56 per share.

• Costco Wholesale Corp: The company missed analysts' estimates for second-quarter profit on Thursday, as the warehouse club operator spent more on employee benefits who worked through the COVID-19 pandemic and sanitizing its stores. Net income attributable to the company rose to $951 million, or $2.14 per share, in the second quarter ended Feb. 14, from $931 million, or $2.10 per share, a year earlier. Analysts were expecting a profit of $2.45 per share. Total revenue rose to $44.77 billion from $39.07, beating analysts' average estimate of $43.78 billion.

• Gap Inc: The apparel retailer on Thursday forecast a return to sales growth this year, as it expects sales at its Athleta brand to double in the next two years and the roll-out of COVID-19 vaccines to drive traffic at its stores. Athleta's sales surged 29% to more than a billion dollars in the fourth quarter and that is expected to reach $2 billion by 2023, Chief Executive Officer Sonia Syngal told analysts in a post-earnings conference call. Fiscal year 2021 net sales is expected to reflect mid- to high-teens growth, and Gap forecast earnings to be in the range of $1.20 per share to $1.35 per share. On a per share basis, Gap earned 28 cents per share in the fourth quarter, 10 cents more than expectations.

• Manchester United Plc: The company said its total revenue rose 2.6% in the last three months of 2020, helped by strength in broadcasting. "The rapid rollout of vaccines in the UK and beyond gives us confidence that we are now on a path towards normality, including the return of fans to stadia" Executive Vice Chairman Ed Woodward said on Thursday. Broadcasting revenue, the English Premier League soccer club's largest segment, rose 68% to 108.7 million pounds. The club said revenue for the three months ended Dec. 31 was 172.8 million pounds ($239.97 million) and profit was 63.9 million pounds.

• Natura & Co Holding SA: The Brazilian cosmetics maker, owner of brands like Avon and The Body Shop, reported fourth quarter net profit of $31 million, topping a estimate of 89.4 million reais. The company attributed the rise in net profits from a year ago to increased revenue and cost controls. The company reported earnings before interest, taxes, depreciation and amortization (EBITDA) of 1.25 billion reais in the quarter, slightly undershooting Refinitiv's 1.29 billion reais estimate.

• YPF SA: The Argentine state-owned oil company on Thursday reported a 2020 fourth quarter net profit that reversed a trend of quarterly losses over the last year as the coronavirus pandemic hit the oil price. The company, which is spearheading development of the South American nation's huge Vaca Muerta shale fields, reported a net profit of $539 million in the fourth quarter and closed out 2020 with a total loss of $1.098 billion. "2020 was marked by the impact of the unexpected COVID-19 outbreak and the drop in oil prices," the firm said in a statement. "It was an extremely challenging year for the global oil and gas industry, and we were no exception."

Deals Of The Day

• Sustainable Opportunities Acquisition Corp: Canada's DeepGreen Metals Inc, which aims to produce metals for use in electric vehicle batteries through deep-sea mining, plans to go public in a merger with a special purpose acquisition company (SPAC). The deal with U.S.-based firm will value the combined entity at $2.9 billion and include a $330 million infusion from investors including Allseas Group SA, Maersk Supply Service and Glencore, DeepGreen said in a statement on Thursday. The merger is expected to be completed in the second quarter, it said. The combined entity will be called The Metals Company and will be listed under the ticker symbol "TMC".

In Other News

• Alphabet Inc: The company's YouTube has removed five channels of Myanmar's military-run television networks hosted on its platform in the wake of the coup in the Southeast Asian country. "We have terminated a number of channels and removed several videos from YouTube in accordance with our community guidelines and applicable laws," a Youtube spokeswoman said in a statement in response to a Reuters question. The channels taken down include the state network, MRTV, (Myanmar Radio and Television) as well as the military-owned Myawaddy Media, MWD Variety and MWD Myanmar, according to the U.S tech giant.

• Amazon.com Inc & Netflix Inc: Controversy in India over Amazon's political drama "Tandav" has put Bollywood and global video streaming giants on edge, prompting a closer scrutiny of scripts for possible offence to religious sentiments in a key growth market. Companies like Amazon's Prime Video and Netflix are inspecting planned shows and scripts, with some even deleting scenes that could be controversial, five Bollywood directors and producers, and two industry sources said. Amazon has decided to delay streaming a new season of a popular Hindi spy thriller, "The Family Man", which was to release last month, four of the sources told Reuters. While Amazon declined to comment, one of the sources said the delay was "a ripple effect of what happened with Tandav".

• Boeing Co: The company has approached a group of banks for a new $4 billion revolving credit facility, according to a person familiar with the matter, as the planemaker battles a prolonged slowdown in commercial air travel due to the COVID-19 pandemic. The U.S. jet manufacturer has the option to raise the size of the two-year credit facility to as much as $6 billion, the person said on Thursday. A Boeing spokesman declined to comment.

• CoStar Group Inc & CoreLogic Inc: The commercial real estate information provider said it had withdrawn its bid to buy CoreLogic after the U.S. property analytics company rebuffed its sweetened buyout offer of more than $7 billion earlier on Thursday.

• Ford Motor Co: The U.S. International Trade Commission on Thursday criticized the company for pursuing battery contracts with SK Innovation after evidence had emerged the South Korean electric vehicle (EV) battery maker misappropriated trade secrets from cross-town rival LG Chem. In a redacted version of its full 96-page opinion Thursday, the ITC questioned why the second largest U.S. automaker had continued to pursue battery contracts with SK Innovation "after SK's misconduct in this investigation had come to light." "There is no explanation in the record why Ford would choose to ignore or excuse SK's egregious misconduct," the ITC added. "The fault here belongs with SK, as well as with those, like Ford, who deliberately chose to continue to cultivate prospective business relationships predicated on SK's trade secret misappropriation." The ITC also rejected Ford's request to extend exemptions to Ford's unannounced new EVs.

• GameStop Corp: Shares of Reddit-darling firm climbed on Thursday, rising more than 20% at one point in yet another unexplained move that left market watchers looking for a possible catalyst. The late afternoon rally in GameStop began roughly around the time that Cohen tweeted what appeared to be a screenshot with the puppet dog advertising mascot of Pets.com, a famous casualty of the dotcom bubble two decades ago. Cohen and GameStop had no comment on the tweet.

• JPMorgan Chase & Co: Commodities-related revenue at the world's 12 biggest investment banks surged by 85% last year compared to 2019 as oil and metals trading made further strong gains, consultancy Coalition said. Commodities revenue at the 12 banks climbed for a third successive year after several years of declines, hitting its lowest for more than a decade in 2017. "In metals, revenues from precious metals multiplied as investors sought safe havens from the volatile markets and uncertainty caused by the pandemic," Coalition said in a statement. One of the banks that Coalition tracks, JPMorgan, alone had earned record revenue of around $1 billion from trading, storing and financing precious metals to date in 2020, two sources familiar with the matter told Reuters in November.

• Microsoft Corp: The White House is closely tracking an emergency patch the company has released, U.S. national security adviser Jake Sullivan said on Thursday, after an unknown hacking group recently broke into organizations using a flaw in the company's mail server software. "We are closely tracking Microsoft’s emergency patch for previously unknown vulnerabilities in Exchange Server software and reports of potential compromises of U.S. think tanks and defense industrial base entities," Jake Sullivan, President Joe Biden's national security adviser, said on Twitter. "We encourage network owners to patch ASAP," he said. His tweet included a link to a notice by Microsoft of the security update.

• Oportun Financial Corp: A unit of the company was under investigation by the U.S. consumer watchdog regarding its legal collection practices from 2019 until 2021, the financial services firm said in a regulatory filing late Thursday. Oportun Inc, which received an investigation demand from the Consumer Financial Protection Bureau (CFPB) on March 3, said legal collection practices and hardship treatments offered by the company during the COVID-19 pandemic are now under the scanner. The parent company said its practices were in full compliance with the CFPB guidance. The CFPB did not immediately respond to Reuters request for a comment outside working hours.

• Sinovac Biotech Ltd: The company's COVID-19 vaccine may not trigger sufficient antibody responses against a new variant identified in Brazil, a small-sample lab study showed. Plasma samples taken from eight people vaccinated with Sinovac's CoronaVac failed to efficiently neutralize the P.1 lineage variant, or 20J/501Y.V3, researchers said in a paper published on Monday ahead of peer-review. "These results suggest that P.1 virus might escape from neutralizing antibodies induced by... CoronaVac," researchers at the University of São Paulo in Brazil, Washington University School of Medicine in the United States, and a few other institutions said in the paper.

• Stellantis NV: The company on Thursday announced distribution of the stake it still holds in auto parts maker Faurecia to its shareholders. Stellantis shareholders will decide on the distribution of the shares and up to $368.46 million raised from a previous equity sale in Faurecia, in a meeting on March 8, the group said in a statement.

• Takeda Pharmaceutical Co Ltd, Moderna Inc & Novavax Inc: The company said it had asked regulators to approve use of Moderna's COVID-19 vaccine on Friday, which would add a third option to Japan's vaccination programme. "Takeda commits to delivering Moderna’s COVID-19 vaccine candidate in Japan as soon as possible," Masayuki Imagawa, the head of its Japan vaccines business unit, said in a statement. Health Minister Norihisa Tamura told reporters that Japan would thoroughly test both the AstraZeneca and Moderna vaccines. "Once their safety is confirmed, we'll go into the approval process," he said, adding that the Moderna vaccine was essential for ensuring all Japanese are vaccinated. Takeda is also handling the approval process and domestic production of about 250 million doses of Novavax's vaccine, which entered clinical trials in Japan last month.

• Vistra Corp: The Texas electricity market faces "insurmountable distress" as more gas and service bills come due, power industry officials said on Thursday at a hearing into financial fallout from the state's February blackout. Vistra Corp., one of the largest utilities in Texas, forecast that buying natural gas at high prices triggered by the storm and selling power at fixed-rate prices will cut its profit by between $900 million and $1.3 billion, Vistra senior vice president Bill Quinn testified. Vistra's power plants ran between 20% and 30% below capacity because of a lack of natural gas, Quinn said. "Getting gas to them was a challenge," he said, noting all four of the utility's gas providers could not meet their fuel commitments.

• Wells Fargo & Co: The company said on Thursday it will give all employees up to 8 hours of paid time off to accommodate COVID-19 vaccine appointments, according to a memo seen by Reuters. "While we understand that choosing to be vaccinated is a personal decision, we encourage you to consider getting the vaccine when it's available to you," head of human resources David Galloreese said in the memo sent to all employees. The bank is also expanding its program to provide free coronavirus testing to employees. Starting Monday, employees at the bank's 25 largest hubs will have access to on-site testing while other employees reporting to the office can request that self-testing kits be sent to their home free of charge.

ANALYSIS

After weathering February storm, junk bonds count on Fed protection

Junk bonds, the only fixed-income segment still offering positive returns this year, will continue their outperformance, according to investor bets the U.S. Federal Reserve will eventually put its foot down and calm bond markets.

ANALYSTS' RECOMMENDATION

• Broadcom Inc: JPMorgan raises target price to $570 from $500, noting the company’s strong first-quarter results and a robust demand environment for coming quarters.

• Caterpillar Inc: Daiwa Capital Markets raises target price to $217 from $204, stating higher demand for the company’s mining equipments and strong free cash flow guidance.

• Costco Wholesale Corp: Jefferies cuts target price to $405 from $435, citing the company’s lower-than-expected results in its second quarter and higher expenses in coming quarters.

• Provident Financial Services Inc: RBC raises target price to $26 from $23, citing the company's higher net interest margin outlook and strong fee income.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0830 (approx.) Non-farm payrolls for Feb: Expected 182,000; Prior 49,000

0830 (approx.) Private payrolls for Feb: Expected 210,000; Prior 6,000

0830 (approx.) Manufacturing payrolls for Feb: Expected 18,000; Prior -10,000

0830 (approx.) Government payrolls for Feb: Prior 43,000

0830 (approx.) Unemployment rate for Feb: Expected 6.3%; Prior 6.3%

0830 (approx.) Average earnings mm for Feb: Expected 0.2%; Prior 0.2%

0830 (approx.) Average earnings yy for Feb: Expected 5.3%; Prior 5.4%

0830 (approx.) Average workweek hours for Feb: Expected 34.9 hrs; Prior 35.0 hrs

0830 (approx.) Labor force participation for Feb: Prior 61.4%

0830 (approx.) U6 underemployment for Feb: Prior 11.1%

0830 (approx.) International trade for Jan: Expected -$67.5 bln; Prior -$66.6 bln

0830 (approx.) Goods trade balance (R) for Jan: Prior -$83.74 bln

1500 Consumer credit for Jan: Expected $12.00 bln; Prior $9.73 bln

COMPANIES REPORTING RESULTS

No major S&P 500 companies are scheduled to report for the day.

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 GSX Techedu Inc: Q4 earnings conference call

EX-DIVIDENDS

Exelon Corp: Amount $0.38

FedEx Corp: Amount $0.65

First American Financial Corp: Amount $0.46

General Electric Co: Amount $0.01

Kansas City Southern: Amount $0.54

LyondellBasell Industries NV: Amount $1.05

Texas Pacific Land Corp: Amount $2.75

Wake-up call: Wall Street blijft behoorlijk van slag

Goedemorgen

Deze keer een daling bij alle indices op Wall Street, de Dow Jones en de Dow Transport verloren deze keer ook behoorlijk want de Dow Jones sluit 346 punten (-1,1%) later terwijl de Dow Transport 329 punten verloor (-2,4%). De SP 500 sloot donderdag 51 punten lager (-1,35%) terwijl de Nasdaq Composite 2,1% verloor en de Nasdaq 100 met 1,75% terug moest.

Europa moest ook inleveren al viel het op slotbasis mee bij de DAX die slechts 0,17% verloor, de CAC 40 sloot zelfs met een klein plusje terwijl de AEX index 0,85% lager moest vooral door het aandeel ASML dat 7% verloor en zwaar mee weegt. Iets wat ook opviel gisteren was de enorme sprong omhoog bij de olie, de Brent won 3 dollar en vanmorgen staat een vat Brent olie al op 68 dollar.

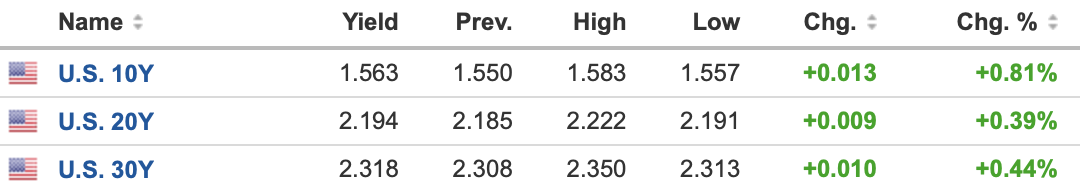

Stijgende rente op US obligaties:

De hoofdreden van de onrust en dus de terugval op Wall Street is dezelfde als vorige week, de rente op de obligaties loopt weer fors op in de VS. Ze staan weer rond de hoogste stand die vorige week ook even werd bereikt en dat neigt naar een uitbraak om alles nog hoger te zetten later deze maand. Verder zit het politiek bekeken nog niet helemaal goed in de VS, denk aan het steunpakket dat al vanaf vorig jaar onder de hamer ligt maar nog steeds niet is verzonden naar de mensen en bedrijven die erop zitten te wachten. Het gaat natuurlijk om een enorm bedrag van 1,9 biljoen dollar dat nu nog door de senaat moet zien te geraken. Er wordt gezegd dat zo'n enorm bedrag de inflatie verder zal aanwakkeren samen met hetgeen de FED doet wat betreft het opkopen van obligaties.

De hogere rentes zorgen er wel voor dat de daling vooral opvalt bij de TOP-8 aandelen, die gaan nu al een tijdje in de uitverkoop en dat zien we duidelijk aan het verloop van de Nasdaq.

In Europa zien we nog steeds dat vooral de DAX en de CAC 40 sterk blijven liggen terwijl Wall Street van slag geraakt door de stevig oplopende rente. De AEX daarentegen krijgt het wel moeilijker en geraakt amper meer vooruit, dat komt vooral door het aandeel ASML dat de index blijft sturen. Om een voorbeeld te geven verloor ASML gisteren (donderdag) €27 en dat is toch bijna 7%, door dat ASML zo zwaar weegt en. dus de AEX in het verlies duwt.

De rente hier in Europa volgt het verloop van de rente in de VS niet in ieder geval want die blijft negatief voorlopig tot de 15 jaars rente. Dat kan ook de reden zijn dat het er hier wat rustiger aan toe gaat al denk ik wel dat we later met de rente ook zullen volgen.

Let er wel op dat de volatiliteit naar mijn mening zal blijven aanhouden, het zal niet zomaar stoppen tot er een grote groep (helaas) nieuwe speculanten worden uitgedrukt. Het is vrijwel altijd zo, ze komen, ze proeven, ze krijgen dan op een gegeven moment behoorlijke klappen op de beurs door hun gretigheid en daarna verdwijnen ze weer. De hoofdreden is en blijft dat men gevangen wordt door hebzucht en men dus steeds meer wil omdat men maar 1 richting op kijkt en dat is omhoog.

Dit alles zorgt er in ieder geval wel voor dat de nodige volatiliteit op de markten blijft aanhouden en dat is natuurlijk al zo gedurende het afgelopen jaar. De markten weten steeds wel een item te vinden waarop men kan reageren, de ene keer positief de andere keer negatief. Zelf probeer ik me er zo goed als mogelijk doorheen te loodsen en op zich lukt me momenteel prima met de grote bewegingen die de huidige markt laat zien.

Eerste posities maart met winst gesloten:

Gisteren (donderdag) werd er een kleine long posities gesloten met winst, zo loopt het resultaat van deze maand MAART weer wat op en ziet dit jaar er tot nu toe prima uit voor alle abonnementen. Hieronder ziet u nog een overzicht wat betreft Trading en een aanbieding om mee te doen met onze signalen tot 1 MEI. Via de site en dan de Tradershop kunt u de posities met alle details zien staan.

De LIVEBLOG en Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

Euro, olie en goud:

De euro zien we nu rond de 1.195 dollar, de prijs van een vat Brent olie komt uit op 67,85 dollar terwijl een troy ounce goud nu op 1695 dollar staat.

Inter Market overzicht op slotbasis ...

Wordt nu lid tot 1 MEI voor €39 (nieuwe aanbieding):

Blijven schakelen tussen long en short blijft belangrijk de komende weken. Ook deze maand (maart) krijgen we genoeg kansen. Doe nu in ieder geval mee met de proef aanbieding voor nieuwe leden, die loopt tot 1 MEI en dat met een mooie korting !! ... €39 tot 1 MEI 2021 ... en voor Polleke €49 tot 1 MEI 2021 !!!

Schrijf u in voor Systeem Trading (€39 tot 1 MEI)

Schrijf u in voor Index Trading (€39 tot 1 MEI)

Schrijf u in voor Guy Trading (€39 tot 1 MEI)

Schrijf u in voor Polleke Trading (€49 tot 1 MEI)

Schrijf u in voor de Aandelen portefeuille (€30 tot 1 MEI)

Schrijf u in voor COMBI TRADING (€79 tot 1 MEI)

Hieronder het resultaat maand Maart (2021) ...

Hieronder het resultaat tot nu toe dit jaar (2021) ...

Met vriendelijke groet,

Guy Boscart

Markt snapshot Europa 5 maart

GLOBAL TOP NEWS

The United States on Thursday agreed to a four-month suspension of retaliatory tariffs imposed on British goods such as Scotch whisky over a long-running aircraft subsidy row, with both sides pledging to use the time to resolve the dispute.

China set a modest annual economic growth target, at above 6%, and pledged to create more jobs in cities than last year, as the world's second-biggest economy planned a careful course out of a year disrupted by the effects of COVID-19.

U.S. Federal Reserve Chair Jerome Powell on Thursday repeated his pledge to keep credit loose and flowing until Americans are back to work, rebutting investors who have openly doubted he can stick to that promise once the pandemic passes and the economy surges on its own.

EUROPEAN COMPANY NEWS

Australia has asked the European Commission to review a decision by Italy to block a shipment of AstraZeneca's COVID-19 vaccine, while stressing the missing doses would not affect the rollout of Australia's inoculation programme.

Lufthansa may permanently ground more jets to emerge leaner from the coronavirus pandemic, the German airline group said on Thursday, as it reported a record 6.7 billion euro loss for 2020.

The Auditing Association of German Banks registered complaints about Greensill Bank with Germany's financial watchdog BaFin in early 2020, a spokesman told Reuters on Thursday.

TODAY'S COMPANY ANNOUNCEMENTS

AIB Group plc FY 2020 Earnings Release

Argo Blockchain PLC Shareholders Meeting

Blackrock World Mining Trust PLC FY 2020 Earnings Release

Cellectis SA Q4 2020 Earnings Call

CGG SA FY 2020 Earnings Call

ConvaTec Group PLC FY 2020 Earnings Release

Corbion NV FY 2020 Earnings Call

Dassault Aviation SA FY 2020 Earnings Call

Demant A/S Annual Shareholders Meeting

Essentra PLC FY 2020 Earnings Release

Freelance.com SA Shareholders Meeting

Gofore Oyj FY 2020 Earnings Call

London Stock Exchange Group PLC FY 2020 Earnings Release

Mila Resources PLC Annual Shareholders Meeting

Playa Hotels & Resorts NV Q4 2020 Earnings Call

Schouw & Co A/S FY 2020 Earnings Call

SFS Group AG FY 2020 Earnings Call

Stockmann Oyj Abp Q4 2020 Earnings Release

Verneuil Finance SA Annual Shareholders Meeting

ECONOMIC EVENTS (All times GMT)

0700 Germany Industrial Orders mm for Jan: Expected 0.7%; Prior -1.9%

0700 Germany Manufacturing O/P Current Price SA for Jan: Prior 6.1%

0700 Germany Consumer Goods SA for Jan: Prior 115.3

0745 France Current Account for Jan: Prior -1.2 bln EUR

0745 France Current Account - Balance NSA for Jan: Prior 2.16 bln EUR

0745 France Reserve Assets Total for Feb: Prior 1,89,807 mln EUR

0745 France Trade Balance SA for Jan: Prior -3.39 bln EUR

0745 France Imports for Jan: Prior 42.65 bln EUR

0745 France Exports for Jan: Prior 39.25 bln EUR

0800 Switzerland Forex Reserves for Feb: Prior 8,96,149.00 mln CHF

0800 Austria GDP Growth qq Final for Q4: Prior -4.3%

0800 Austria Wholesale Prices NSA mm for Feb: Prior 2.1%

0800 Austria Wholesale Prices NSA yy for Feb: Prior -0.1%

0830 United Kingdom Halifax House Prices mm for Feb: Expected 0.0%; Prior -0.3%

0830 United Kingdom Halifax House Prices yy for Feb: Expected 4.55%; Prior 5.40%

0830 Sweden Current Account qq for Q4: Prior 67.4 bln SEK

0900 Italy Retail Sales SA mm for Jan: Prior 2.50%

0900 Italy Retail Sales NSA yy for Jan: Prior -3.10%