Liveblog Archief woensdag 13 mei 2020

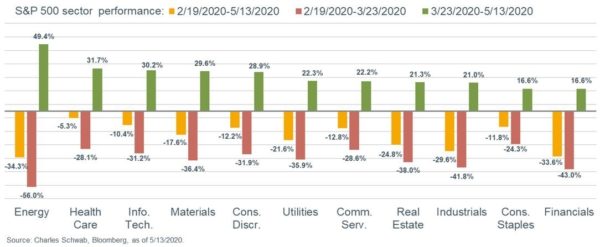

Een overzicht per sector en ook nog in 3 tijdframes, hoezo een volatiele markt ... !!!

momenteel totaal neutraal.......maar wat ik nu zie is gewoon het feit dat we met allen slechten zaaken denwelken we voor onzen neus zien voorbij passeeren.......wel wat ik waarneem is dat we gewoon reeds op 450 of laager moesten gestaan hebben......MAAR.......we staan te waauwelen op hoogeren niveaus.......shorters kunnen nu zeggen.......wat nie is kan koomen........maar........JUIST.....................................'t zijn toeren op den pensenkermis

momenteel totaal neutraal.......maar wat ik nu zie is gewoon het feit dat we met allen slechten zaaken denwelken we voor onzen neus zien voorbij passeeren.......wel wat ik waarneem is dat we gewoon reeds op 450 of laager moesten gestaan hebben......MAAR.......we staan te waauwelen op hoogeren niveaus.......shorters kunnen nu zeggen.......wat nie is kan koomen........maar........JUIST.....................................'t zijn toeren op den pensenkermis

op cnbc doen ze alsof hun neus bloed, alleen jim cramer is een doorzetter

op cnbc doen ze alsof hun neus bloed, alleen jim cramer is een doorzetter

Volatiliteit neemt weer toe, verkoopsignaal bij veel indices nu

We zien dat alle indices na een vreemde start op Wall Street toch verder in moeten leveren, de Nasdaq kon via een slotrally de schade nog beperken maar toch in 2 dagen tijd zien we er behoorlijk van vanaf gaan. Het kan zijn dat de draai werd ingezet dus moeten we geduldig blijven afwachten waar dit ons naartoe zal brengen. Vrijdag is er de 3e vrijdag van de maand en zullen er hier en daar wat expiraties komen (opties en futures) ... We doen rustig verder, blijven kalm handelen waar het kan en zoals ik al aangaf nemen we de tijd ...

Doe mee tot 1 JULI voor €39 ... https://www.usmarkets.nl/tradershop

Tot later ... Guy

Brent oil futures slipped 1.46% to $28.98 by 9:45 PM ET (2:45 AM GMT) but WTI futures gained 0.04% to $25.30.

1. Jobless Claims Expected to Dip From Last Week

2. Applied Materials to Report AMAT will report after the bell

3. More From the Fed Heads -.

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Ruwe Olievoorraden | Actueel: -0,745M Verwacht: 4,147M Vorige: 4,590M |

Een TA analyse uit de VS

DOW AND S&P 500 WEAKEN... Stock prices are continuing the pullback that began yesterday afternoon. And some short-term support levels...

Deze inhoud is alleen beschikbaar voor betalende leden.

Nasdaq probeert het weer, andere indices omlaag

Na de opening van Wall Street meteen lagere koersen maar de Nasdaq herpakt zich alweer stevig na de daling van gisteren en u kunt het al raden, het zijn weer de BIG-5 die het doen. We zien bij de AEX niet zoveel drang om hoger te geraken, de index blijft hangen rond de 512-515 waar de eerste steunzone wacht. Wel is het zo dat we moeten blijven opletten met het marktverloop, we zien teveel divergentie tussen sectoren en zoals ik al aangaf de BIG-5 die de kar volledig proberen te trekken. Gisteren hebben we al kunnen zien hoe snel het gaat als die in de uitverkoop worden gedaan.

De markt zit ook met de uitspraak van Powell die een zeer moeilijke periode verwacht voor de Amerikaanse economie, geen V-herstel dus maar hij zei er gelijk bij dat de FED indien nodig weer zal bijspringen en dan weet je het wel, beleggers worden gek als ze de term nieuwe hulp van de FED voorbij zien komen. Dat het slecht gaat maakt niet uit, wat betreft beleggers die de zaak niet zo goed begrijpen want als de economie nog langer in het slob zal zitten dan zal dat aan de bedrijfswinsten knabbelen en krijgen we nog hogere PE verhoudingen enz... De Nasdaq en dus die BIG-5 zullen op een gegeven ook moment fors moeten inleveren, daarom vergelijk ik het verloop van nu met dat van 1999-2000 waar het bij de TECH (de Nasdaq) ook niet op kon, voor wie het niet weet, de top lag op 5100 en ergens in 2001 ging de Nasdaq naar de pakweg 1500 punten terug ...

Verder, veel doe ik niet nu, de posities lopen, ze blijven binnen mijn range (winst-verlies) en wacht af. U kunt nog mee door lid te worden, nu tot 1 JULI voor €30 ... https://www.usmarkets.nl/tradershop

Tot straks ... Guy

Marktupdate Wall Street

TOP NEWS

• Fed's Powell to assess next phase of pandemic economy

Federal Reserve Chair Jerome Powell, having overseen the rapid creation of the central bank's massive network of pandemic-era programs, turns his attention Wednesday morning to where things stand on the cusp of what may be a risky reopening occurring disparately across the 50 U.S. states.

• Tesla's California fight heats up competition for jobs

Tesla Chief Executive Elon Musk's fight with local authorities over the reopening of its California plant has gotten the attention of those who scout sites for new factories and corporate offices, as well as economic development officials hungry for more jobs.

• Sony braces for lowest profit in four years, hit broadly by coronavirus

Sony expects operating profit to drop at least 30% this financial year to its lowest in four years as the company anticipates a hit to demand for its TVs, cameras and smartphone image sensors from the coronavirus outbreak.

• Trump pressures federal pension to halt planned Chinese stock purchases

The Trump administration is pressing an independent board charged with overseeing billions in federal retirement dollars to freeze plans to invest in Chinese companies that Washington suspects of abusing human rights or threatening U.S. security.

• Neiman Marcus creditor calls for deal with Saks Fifth Avenue-letter

Hedge fund Mudrick Capital Management asked Neiman Marcus Group's independent directors on Tuesday to explore a combination with rival department store chain Saks Fifth Avenue, challenging the company's plan to reorganize under bankruptcy protection.

BEFORE THE BELL

U.S. stock index futures were higher, while the dollar and gold were little changed, ahead of Federal Reserve Chairman Jerome Powell's speech, which will cover economic issues and may offer hints on whether negative rates are a viable policy option. European shares fell on persisting concerns around a potential second wave of COVID-19 cases. A rally in healthcare stocks boosted Chinese shares, while shares in Hong Kong and Japan closed lower. Oil prices pared losses, after falling earlier on demand concerns. Producer Price Index is scheduled to be released later in the day.

STOCKS TO WATCH

Results

• Sony Corp (SNE). The company expects operating profit to drop at least 30% this financial year to its lowest in four years as the company anticipates a hit to demand for its TVs, cameras and smartphone image sensors from the coronavirus outbreak. The electronics and entertainment company reported a 57% fall in operating profit for the January-March quarter to 35.45 billion yen, missing a 73.77 billion yen average of analyst estimates. The forecast profit of less than 600 billion yen would be the lowest since the year that ended in March 2017, when earthquakes knocked out factories in southern Japan that produce image sensors.

Deals Of The Day

• KKR & Co. Inc (KKR). Commonwealth Bank of Australia said it booked $970 million in provisions in the third quarter to cover future pandemic-related loan losses and that it had sold a majority stake in its wealth management unit to KKR. It added that the sale of a 55% stake in its Colonial First State wealth management business to private equity giant KKR for A$1.7 billion would increase that core capital ratio by up to 0.40% and is expected to completed in the first half of 2021.

In Other News

• Alphabet Inc (GOOGL). Insurance company Brit and Google Cloud are together launching the first digital Lloyd's of London syndicate, accessible from anywhere and at any time. As commercial insurance market Lloyd's pushes its 99 syndicate members towards more digital trading in a move accelerated by the coronavirus pandemic, Brit plans to launch its Ki digital syndicate next year. Google Cloud will provide "enterprise grade" cloud technology to the syndicate, Brit's statement said.

• Amazon Inc (AMZN). The ecommerce giant plans to extend until May 18 the closure of its six French warehouses, which have been closed since April 16 after court rulings ordering the U.S. e-commerce giant to restrict deliveries during the coronavirus pandemic. Amazon said it was continuing to consult with staff representatives and was also reviewing their request to include an independent expert in the process.

• American Airlines Group Inc (AAL), Delta Air Lines Inc (DAL) & United Airlines Holdings Inc (UAL). The top three U.S. airlines have told their flight attendants not to force passengers to comply with their new policy requiring face coverings, just encourage them to do so, according to employee policies reviewed by Reuters. American Airlines, Delta Air Lines and United Airlines have told employees that they may deny boarding at the gate to anyone not wearing a face covering, and are providing masks to passengers who do not have them, the three carriers told Reuters.

• Boeing Co (BA). Embraer said Tuesday that its commercial jet deliveries slumped by more than half during the first three months of 2020 compared to a year ago, blaming the drop on preparations for its failed deal with Boeing. Embraer had hoped Boeing's planned takeover of its commercial plane division would bring much-needed marketing power to its midsize E2 jets, which have been praised for their fuel efficiency but have lagged in sales. But Boeing pulled out of the deal last month under disputed circumstances.

• Deutsche Bank AG (DB). German lender plans to pump at least $216.8 billion into so-called sustainable financing and investments by 2025, its first formal targets for doing so. The money will include loans provided by the bank, bonds placed on behalf of its clients and assets managed by its private bank. It does not include assets managed by its fund arm, DWS, it said on Tuesday.

• Exxon Mobil Corp (XOM). Institutional Shareholder Services recommended that investors cast advisory votes against splitting the chief executive and chairman roles at Exxon Mobil, in a report released by the influential proxy adviser late Tuesday. ISS wrote that the oil company's newly created position of lead independent director "appears at this time to be robust" despite a general favoring of an independent director as chairman. Exxon's annual meeting is scheduled for May 27. Meanwhile, British investor Legal & General said it would vote against re-electing the chair of Exxon Mobil, saying the U.S. oil giant had not done enough to tackle climate change.

• Intel Corp (INTC). Intel Capital, the venture arm of chipmaker Intel, has invested in two Chinese startups in the semiconductor sector, the company announced, as part of its latest batch of deals. ProPlus, one the Chinese startups Intel Capital has funded, makes EDA software that chip makers use to design their products before manufacturing them. Spectrum Materials, based in the southern Chinese province of Fujian, makes gases critical for semiconductor fabs to produce physical chips.

• Morgan Stanley (MS). A unit of Morgan Stanley agreed to pay a $5 million fine to settle U.S. Securities and Exchange Commission charges it misled retail investing clients about the costs of a "wrap fee" program, the regulator said on Tuesday. Wrap fee programs offer accounts in which clients pay asset-based fees meant to cover investment advice and brokerage services, including the execution of trades. The SEC said that while Morgan Stanley Smith Barney promised wrap fee clients a "transparent" fee structure, some managers sent most or all of their client trades to third party brokers, causing clients to pay extra fees they could not see.

• Occidental Petroleum Corp (OXY). The company is offering its employees voluntary buyouts over the next two weeks, according to a document seen by Reuters on Tuesday, citing the sharp decline in oil prices and the coronavirus pandemic for "severe dislocations" in its business. Interested employees can submit a resignation offer to Occidental through May 26, specifying the number of months of base salary that they will accept for voluntary separation, according to the document. Employees can amend or withdraw offers unless the company has already accepted them by then, the document said. Offers not accepted will expire automatically on June 12.

• Tesla Inc (TSLA). The automaker's Chief Executive Elon Musk's fight with local authorities over the reopening of its California plant has gotten the attention of those who scout sites for new factories and corporate offices, as well as economic development officials hungry for more jobs. Since the disagreement between Tesla and Alameda County gained national attention, officials from such states as Texas, Nevada, Georgia, Utah and Oklahoma have pitched Musk about considering their state. Analysts estimate it would take Tesla 12 to 18 months to move production. Meanwhile, U.S. President Donald Trump on Tuesday urged that the automaker be allowed to reopen its electric vehicle assembly plant in California, joining CEO Elon Musk's bid to defy county officials who have ordered it to remain closed.

GRAPHIC

Resurgent Wall Street disconnected from reality on the ground

With the U.S. economy facing its potentially deepest economic decline in nearly a century, Wall Street is pulling further and further ahead from Main Street. Trillions of dollars of fiscal and monetary stimulus to dampen the impact of the coronavirus pandemic on the U.S. economy and financial markets have sent stocks soaring off their lows, while the worst of the fallout on growth and employment has yet to be felt.

ANALYSTS' RECOMMENDATION

• Allstate Corp (ALL). KBW raises target price to $106 from $104, reflecting the company’s Q1 outperformance.

• B&G Foods Inc (BGS). Piper Sandler raises rating to overweight from neutral, citing the company’s meal-oriented portfolio that stands to gain share from restaurants, and has modest foodservice exposure.

• Continental Resources Inc (CLR). MKM Partners cuts target price to $20 from $21, factoring the company’s lower long-term capital spending outlook.

• Dynatrace Inc (DT). Needham raises target price to $38 from $36, saying the company’s business appears relatively insulated from macroeconomic conditions.

• PNC Financial Services Group (PNC). Stephens raises rating to overweight from equal-weight, to reflect the announced sale of the company's 22% economic interest in BlackRock.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0830 PPI final demand yy for Apr: Expected -0.2%; Prior 0.7%

0830 PPI final demand mm for Apr: Expected -0.5%; Prior -0.2%

0830 PPI ex-food/energy yy for Apr: Expected 0.9%; Prior 1.4%

0830 PPI ex-food/energy mm for Apr: Expected 0.0%; Prior 0.2%

0830 PPI ex-food/energy/transport yy for Apr: Prior 1.0%

0830 PPI ex-food/energy/transport mm for Apr: Prior -0.2%

COMPANIES REPORTING RESULTS

Cisco Systems Inc (CSCO). Expected Q3 earnings of 69 cents per share

Steris plc (STE). Expected Q4 earnings of $1.58 cents per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Repligen Corp (RGEN). Annual Shareholders Meeting

0900 Iron Mountain Inc (IRM). Annual Shareholders Meeting

0900 Laboratory Corporation of America Holdings (LH). Annual Shareholders Meeting

0900 PPL Corp (PPL). Annual Shareholders Meeting

0900 Service Corporation International (SCI). Annual Shareholders Meeting

0930 HollyFrontier Corp (HFC). Annual Shareholders Meeting

1000 American Water Works Company Inc (AWK). Annual Shareholders Meeting

1000 Arrow Electronics Inc (ARW). Annual Shareholders Meeting

1000 Dunkin' Brands Group Inc (DNKN). Annual Shareholders Meeting

1000 Mondelez International Inc (MDLZ). Annual Shareholders Meeting

1100 American International Group Inc (AIG). Annual Shareholders Meeting

1100 Kinder Morgan Inc (KMI). Annual Shareholders Meeting

1100 S&P Global Inc (SPGI). Annual Shareholders Meeting

1100 Xylem Inc (XYL). Annual Shareholders Meeting

1630 Cisco Systems Inc (CSCO). Q3 earnings conference call

1730 Alexion Pharmaceuticals Inc (ALXN). Annual Shareholders Meeting

EXDIVIDENDS

Cabot Oil & Gas Corp (COG). Amount $0.10

Diamondback Energy Inc (FANG). Amount $0.37

Duke Realty Corp (DRE). Amount $0.23

ResMed Inc (RMD). Amount $0.39

Stanley Black & Decker Inc (SWT). Amount $1.31

Valero Energy Corp (VLO). Amount $0.98

Visa Inc (V). Amount $0.30

WEC Energy Group Inc (WEC). Amount $0.63

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: PPI (Maandelijks) (Apr) | Actueel: -1,3% Verwacht: -0,5% Vorige: -0,2% |

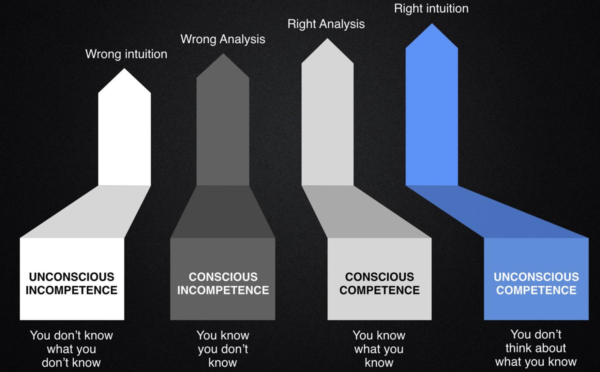

Om op termijn te slagen als beurshandelaar (Trader) zul je toch deze 4 fases moeten door zien te komen ... Een coach kan altijd de nodige hulp bieden uiteraard, de beurs is geen gok kast, het is een proces dat je onder de knie moet zien te krijgen met vallen en opstaan ...

De grootste positie hier is een obligatie uitgegeven wordt door Altice.

Altice realiseerde vorig jaar $1,9 miljard winst voor belastingen en heeft $24,2 miljard schulden op de balans staan

Van die $1,9 miljard aan winst, gaat $1,5 miljard rechtstreeks naar rentebetalingen.

Dit bedrijf heeft meer dan 12 keer zoveel schulden dan winst.

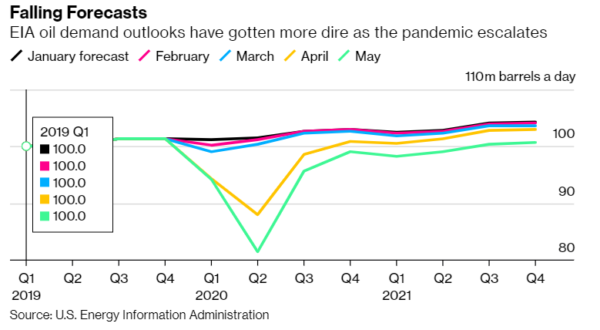

Hier een overzicht met de verwachtingen voor de olie tot eind volgend jaar (2021)

TA AEX en Galapagos

Vandaag blijf ik dichtbij huis met een analyse van de AEX en het aandeel Galapagos.In de analyse van maandag heeft u kunnen zien dat de AEX achterblijft qua herstel t.o.v. de Dow, S&P en Nasdaq. Vandaag ga ik nader in op "onze" index. Ik heb hier de weekgrafiek en u ziet tijdens de daling een...

Lees verder »Wake-up call: Wall Street draait omlaag, Nasdaq doet volop mee

Goedemorgen

Een stevige daling gisteren op Wall Street waar nu ook de Nasdaq mee doet, ook "The Big 5" moesten eraan geloven deze keer alleen weten we nog niet of het een vervolg zal krijgen vandaag en de rest van de week. Europa kon nog niet meedoen zoals u merkt, toen we hier op slot gingen was er nog niks te zien van de draai op Wall Street die pas later op de avond kwam. Wel is het zo dat de opening rond de 512-513 zal uitkomen wat betreft de AEX, een bekende steunzone die we al een paar keer hebben aangetikt de afgelopen week wacht rond de 500-505 punten. Bij de DAX moeten we ook afwachten nu, steun rond de 10.500 en de 10.300 punten.

Ook vandaag zal het een moeilijke sessie worden, zet de daling door of krijgen we weer herstel op Wall Street. Van beide gedachten kunnen we uitgaan in deze fase, er zal eerst een gedachten switch moeten komen voor we opnieuw de bodems van maart gaan opzoeken hetgeen ik nog altijd verwacht na de lange en stevige bear market rally. Het is niet iets wat simpel verloopt, je zit met de realisten in de markt maar je zit meteen ook met avonturiers die vaak niet goed weten hoe de markt in elkaar zit. En er zijn ook nieuwe beleggers die nog nooit een bear markt hebben meegemaakt, die komen op Wall Street terecht en kopen de populaire aandelen tegen elke prijs. Dat hebben we kunnen zien de afgelopen weken, ook dat blijft een groot gevaar met de huidige conditie van de markt ...

Blijf alert, blijf vooral ook rustig, om hier te kunnen scoren moet je weten waar je mee bezig bent ... Daarom probeer ik de leden ook zo goed als mogelijk te coachen in deze moeilijke fase via deze LIVEBLOG en met posities waar dat kan ...

Meedoen kan door lid te worden via de aanbieding voor €39 tot 1 JULI ... Inschrijven kan via https://www.usmarkets.nl/tradershop

Tot straks ... Guy

De neergang gisteren in US met 2 procent is vaak een goede indicatie voor een verdere daling. Ik speel hier op in; short dow/nas. Heb jullie tips gevolgd. Short apple,micro,asml (welke het logischerwijs leuk doen) en zit short arcelor (al twee dagen, nu strakke stop loss om winst veilig te stellen) Daarnaast eerste pluk OCI lange termijn gekocht, sl 5.2.

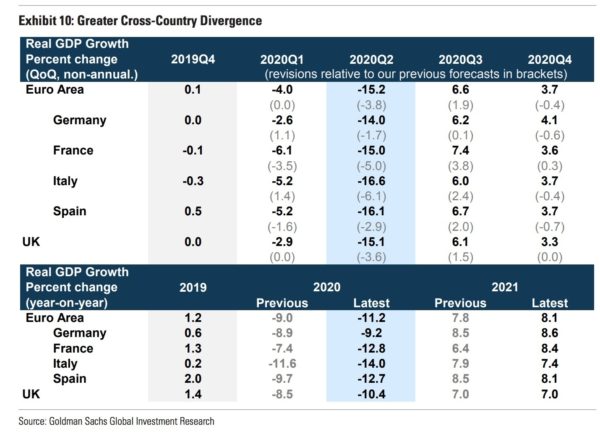

Verwachting economie dit jaar en volgend jaar met hier en daar wat recente aanpassingen. Q2 wordt dus echt slecht, daarna herstel zo te zien ...

Markt snapshot vandaag Europa

GLOBAL TOP NEWS

Britain extended its job retention scheme - the centrepiece of its attempts to cushion the coronavirus hit to the economy - by four months on Tuesday but told employers they would have to help meet its huge cost from August.

The Trump administration is pressing an independent board charged with overseeing billions in federal retirement dollars to freeze plans to invest in Chinese companies that Washington suspects of abusing human rights or threatening U.S. security.

Democrats in the U.S. House of Representatives on Tuesday unveiled a $3 trillion-plus coronavirus relief package with funding for states, businesses, food support and families, only to see the measure flatly rejected by Senate Republicans.

EUROPEAN COMPANY NEWS

The European Union executive will recommend that border restrictions be gradually lifted and travel stalled by the coronavirus pandemic allowed to restart in order to revive tourism, a major industry across the 27-country bloc.

Alstom is sticking to the terms of its previously agreed deal to buy the rail division of Canada's Bombardier for up to 6.2 billion euros, despite a hit to its earnings from the coronavirus crisis.

French insurer Covea has walked away from its planned $9 billion purchase of PartnerRe, the Bermuda-based reinsurer owned by Exor, the holding firm of Italy's Agnelli family, saying it could no longer buy under the terms of their agreement.

TODAY'S COMPANY ANNOUNCEMENTS

1&1 Drillisch AG Q1 2020 Earnings Call

AAK AB Annual Shareholders Meeting

ABN Amro Bank NV Q1 2020 Earnings Release

Acea SpA Q1 2020 Earnings Call

Addtech AB Q4 2020 Earnings Release

ADVA Optical Networking SE Annual Shareholders Meeting

Ageas SA Q1 2020 Earnings Release

Alcon AG Q1 2020 Earnings Call

Ambea AB Q1 2020 Earnings Release

AP Moeller - Maersk A/S Q1 2020 Earnings Call

Banca IFIS SpA Q1 2020 Earnings Call

Beghelli SpA Annual Shareholders Meeting

Bpost SA Annual Shareholders Meeting

Burford Capital Ltd Annual Shareholders Meeting

Cardtronics PLC Annual Shareholders Meeting

Cementir Holding NV Q1 2020 Earnings Call

Cineworld Group PLC Annual Shareholders Meeting

Cofinimmo SA Annual Shareholders Meeting

Commerzbank AG Q1 2020 Earnings Call

Compugroup Medical SE Annual Shareholders Meeting

Corporacion Financiera Alba SA Q1 2020 Earnings Release

Credit Agricole SA Annual Shareholders Meeting

Deutsche Beteiligungs AG HY 2020 Earnings Call

Deutsche Pfandbriefbank AG Q1 2020 Earnings Call

Deutsche Wohnen SE Q1 2020 Earnings Call

Dialight PLC Annual Shareholders Meeting

DiaSorin SpA Q1 2020 Earnings Call

DKSH Holding AG Annual Shareholders Meeting

Edap Tms SA Q1 2020 Earnings Release

Encavis AG Annual Shareholders Meeting

Endeavour Mining Corp Q1 2020 Earnings Call

Eni SpA Annual Shareholders Meeting

Epic Gas Ltd Q1 2020 Earnings Call

Falck Renewables SpA Q1 2020 Earnings Call

Fjord1 ASA Q1 2020 Earnings Call

Fluidra SA Q1 2020 Earnings Call

Foxtons Group PLC Annual Shareholders Meeting

Geodrill Ltd Q1 2020 Earnings Call

Hera SpA Q1 2020 Earnings Call

Inmobiliaria Colonial SOCIMI SA Q1 2020 Earnings Release

Interpump Group SpA Q1 2020 Earnings Call

Jacquet Metal Service SA Q1 2020 Earnings Release

Jeronimo Martins SGPS SA Q1 2020 Earnings Release

Kenmare Resources PLC Annual Shareholders Meeting

Komplett Bank ASA Q1 2020 Earnings Release

Leonardo SpA Annual Shareholders Meeting

Leoni AG Q1 2020 Earnings Call

Marna Beteiligungen AG Annual Shareholders Meeting

Marshalls PLC Annual Shareholders Meeting

Mediaset SpA Q1 2020 Earnings Call

Meyer Burger Technology AG Annual Shareholders Meeting

Momentum Group AB FY 2020 Earnings Call

Mondo TV SpA Annual Shareholders Meeting

Mowi ASA Q1 2020 Earnings Release

Navios Maritime Partners LP Q1 2020 Earnings Call

Nexam Chemical Holding AB Annual Shareholders Meeting

Nexans SA Annual Shareholders Meeting

NKT A/S Q1 2020 Earnings Call

NV Bekaert SA Annual Shareholders Meeting

Opus Group AB Annual Shareholders Meeting

Pirelli & C SpA Q1 2020 Earnings Call

PNE AG Q1 2020 Earnings Call

Poste Italiane SpA Q1 2020 Earnings Call

Raketech Group Holding PLC Q1 2020 Earnings Release

Rentokil Initial PLC Annual Shareholders Meeting

Sage Group PLC HY 2020 Earnings Call

Salzgitter AG Q1 2020 Earnings Release

Shelf Drilling Ltd Q1 2020 Earnings Call

Sparebank 1 Nord-Norge Q1 2020 Earnings Release

Spirax-Sarco Engineering PLC Annual Shareholders Meeting

Stock Spirits Group PLC Interim 2020 Earnings Release

Swedish Orphan Biovitrum AB Annual Shareholders Meeting

Terna Rete Elettrica Nazionale SpA Q1 2020 Earnings Call

TGS NOPEC Geophysical Company ASA Q1 2020 Earnings Release

TP ICAP PLC Annual Shareholders Meeting

Tritax Big Box Reit PLC Annual Shareholders Meeting

Tui AG HY 2020 Earnings Release

Ultra Electronics Holdings PLC Annual Shareholders Meeting

United Internet AG Q1 2020 Earnings Call

Valiant Holding AG Annual Shareholders Meeting

Vallourec SA Q1 2020 Earnings Release

Verallia Deutschland AG Annual Shareholders Meeting

Verbund AG Q1 2020 Earnings Release

Vesuvius PLC Annual Shareholders Meeting

Voltalia SA Annual Shareholders Meeting

Xeros Technology Group PLC Shareholders Meeting

ECONOMIC EVENTS (All times GMT)

0600 United Kingdom Business Investment qq Prelim for Q1: Expected -2.5%; Prior -0.5%

0600 United Kingdom Business Investment yy Prelim for Q1: Prior 1.8%

0600 (approx.) United Kingdom GDP Est 3M/3M for March: Expected -2.6%; Prior 0.1%

0600 United Kingdom GDP Estimate mm for March: Expected -8.0%; Prior -0.1%

0600 United Kingdom GDP Estimate yy for March: Expected -7.2%; Prior 0.3%

0600 United Kingdom Services mm for March: Expected -8.0%; Prior 0.0%

0600 United Kingdom Services yy for March: Expected -6.1%; Prior 1.1%

0600 United Kingdom Industrial Output mm for March: Expected -5.6%; Prior 0.1%

0600 United Kingdom Industrial Output yy for March: Expected -9.3%; Prior -2.8%

0600 United Kingdom Manufacturing Output mm for March: Expected -6.0%; Prior 0.5%

0600 United Kingdom Manufacturing Output yy for March: Expected -10.4%; Prior -3.9%

0600 United Kingdom Construction O/P Vol mm for March: Expected -7.1%; Prior -1.7%

0600 United Kingdom Construction O/P Vol yy for March: Expected -8.2%; Prior -2.7%

0600 United Kingdom Goods Trade Balance for March: Expected -10.000 bln GBP; Prior -11.487 bln GBP

0600 United Kingdom Goods Trade Balance Non-EU for March: Expected -4.000 bln GBP; Prior -5.573 bln GBP

0600 United Kingdom GDP Prelim qq for Q1: Expected -2.5%; Prior 0.0%

0600 United Kingdom GDP Prelim yy for Q1: Expected -2.1%; Prior 1.1%

0730 (approx.) Sweden CPI mm for April: Expected 0.0%; Prior -0.2%

0730 (approx.) Sweden CPI yy for April: Expected 0.0%; Prior 0.6%

0730 (approx.) Sweden CPIF mm for April: Expected 0.0%; Prior -0.2%

0730 (approx.) Sweden CPIF yy for April: Expected 0.0%; Prior 0.6%

0730 (approx.) Sweden CPI NSA for April: Prior 333.91

0730 (approx.) Sweden CPIF Ex Energy mm for April: Expected 0.4%; Prior 0.2%

0730 (approx.) Sweden CPIF Ex Energy yy for April: Expected 1.3%; Prior 1.5%

0900 Euro Zone Industrial Production mm for March: Expected -12.1%; Prior -0.1%

0900 Euro Zone Industrial Production yy for March: Expected -12.4%; Prior -1.9%

1000 (approx.) Portugal CPI mm for April: Prior 0.6%

1000 (approx.) Portugal CPI yy for April: Prior 0.0%

1000 (approx.) Portugal CPI NSA for April: Prior 104.040

2301 United Kingdom RICS Housing Survey for April: Expected -38; Prior 11