Liveblog Archief woensdag 2 december 2020

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Ruwe Olievoorraden | Actueel: -0,679M Verwacht: -2,358M Vorige: -0,754M |

Markt snapshot Wall Street vandaag

TOP NEWS

• In world first, UK approves Pfizer-BioNTech COVID-19 vaccine

Britain approved Pfizer's COVID-19 vaccine, jumping ahead of the United States and Europe to become the West's first country to formally endorse a jab it said should reach the most vulnerable people early next week.

• U.S. House seen approving bill blocking Chinese firms from U.S. markets

The U.S. House of Representatives is expected to pass legislation this week that could prevent some Chinese companies from listing their shares on U.S. exchanges unless they adhere to U.S. auditing standards, congressional aides said.

• Salesforce to buy workplace app Slack in $27.7 billion deal

Salesforce.com has agreed to buy workplace messaging app Slack Technologies in a $27.7 billion deal, the biggest by the cloud-computing pioneer as it bets on an extended run for remote working and sharpens its rivalry with Microsoft.

• Biden says will not kill Phase 1 trade deal with China immediately -NYT

Joe Biden will not immediately cancel the Phase 1 trade agreement that President Donald Trump struck with China nor take steps to remove tariffs on Chinese exports, the New York Times quoted the U.S. president-elect as saying.

• EU tells Brexit negotiator: don't let deadline force a bad deal

The European Union's chief Brexit negotiator told member states' envoys that negotiations on a trade deal with Britain were reaching "a make-or-break moment", and they urged him not to be rushed into an unsatisfactory agreement.

BEFORE THE BELL

U.S. stock futures pulled back, a day after major indexes ended at record highs, though United Kingdom’s approval of Pfizer-BioNTech COVID-19 vaccine boosted the market sentiment. Investors also awaited a report on monthly private job creation that will provide fresh hints on the health of the economy. Asian equity markets ended little changed and fears surrounding a no-deal Brexit kept European shares muted. Gold rose to over a one-week high on hopes for an additional U.S. economic stimulus, while dollar steadied. Oil prices fell, as investors awaited decision from OPEC+ on output.

STOCKS TO WATCH

Results

• Box Inc (BOX). The company beat quarterly sales expectations on Tuesday as remote work and learning during the COVID-19 pandemic drove demand for its file-sharing services. Box, reported third-quarter revenue of $196 million, above analysts' estimates of $194.3 million, according to IBES data from Refinitiv. The content management platform reported a net loss of $5.3 million, or 3 cents per share, compared with a loss of $40.9 million, or 28 cents per share, a year earlier.

Deals Of The Day

• Roblox Corp (RBLX). The company said on Tuesday it had acquired the intellectual property assets of cognitive assessment start-up Imbellus to sharpen the U.S. online gaming platform's recruitment practices before a planned initial public offering (IPO).Imbellus develops simulation-based tests that measure human thought processes. The company, which was valued at $57.5 million in a 2018 private fundraising round, has talked publicly about its application as a substitute for standardized U.S. tests such as the SAT college entrance exam.

• Salesforce.com Inc (CRM) & Slack Technologies Inc (WORK). The company has agreed to buy the workplace messaging app Slack in a $27.7 billion deal, the biggest by the cloud-computing pioneer as it bets on an extended run for remote working and sharpens its rivalry with Microsoft. Slack shareholders will receive $26.79 in cash and 0.0776 shares of Salesforce common stock for each Slack share, or $45.5 per share based on Salesforce's closing price on Tuesday. The offer represents a premium of 54% since the first report emerged last week about the deal talks. Separately, Salesforce reported third-quarter revenue of $5.42 billion, beating analysts' estimate of $5.25 billion, according to IBES data from Refinitiv. Salesforce also said Chief Financial Officer Mark Hawkins would retire in January, and would be replaced by Chief Legal Officer Amy Weaver.

• Westpac Banking Corp (WBK). The Australian bank will sell its general insurance arm to German insurer Allianz for $535 million, it said, further trimming its portfolio to beef up capital and focus on local business. The price is equivalent to about eight to 12 times its earnings according to Credit Suisse and it would mean a small post-tax gain in fiscal 2021 from the sale, which Westpac says will boost its core capital by around 0.12%."The sale is entirely consistent with Westpac's strategy of reviewing and now exiting non-core activities," Goldman Sachs analysts said in a note.

In Other News

• Alibaba Group Holding Ltd (BABA), Pinduoduo Inc (PDD) & PetroChina Co Ltd (PTR). The U.S. House of Representatives is expected to pass legislation this week that could prevent some Chinese companies from listing their shares on U.S. exchanges unless they adhere to U.S. auditing standards, congressional aides said. The bill would give Chinese companies like Alibaba, tech firm Pinduoduo and oil giant PetroChina three years to comply with U.S. rules before being removed from U.S. markets. The House is scheduled to vote on Wednesday evening on "The Holding Foreign Companies Accountable Act," which bars securities of foreign companies from being listed on any U.S. exchange if they have failed to comply with the U.S. Public Accounting Oversight Board's audits for three years in a row.

• American Airlines Group Inc (AAL) & United Airlines Holdings Inc (UAL). Boeing's 737 MAX will make its first public demonstration flight with members of the media since being grounded over fatal crashes, as one of its biggest customers, American Airlines, seeks to prove it is safe for passengers. The flight from the airline's base in Dallas, Texas, to Tulsa, Oklahoma, comes weeks before the airline's first commercial flight on Dec. 29, and is part of a PR effort by the planemaker and airlines to rehabilitate the jet's image following a record 20-month ban. Separately, American Airlines and United Airlines said on Tuesday they halted non-stop flights to Shanghai from the United States and included Seoul on the route.

• Boeing Co (BA). The company said it had completed tests with five surrogate jets operating autonomously in a team in Australia, where it is developing an unmanned fighter-like jet designed to cooperate with manned aircraft. The 10 days of tests were part of the Boeing Airpower Teaming System programme, which has developed prototype "Loyal Wingman" aircraft with the Royal Australian Air Force that can carry weapons and shield manned fighter jets. The Loyal Wingman prototype is expected to make its first flight this year and Boeing sees mass production likely happening by the middle of the decade.

• ConocoPhillips (COP). The largest U.S. independent oil producer, said on Tuesday that it would lay off up to 500 Houston employees, about a fifth of its headquarters workforce, to match staffing with expected activity levels. Affected employees will be notified Feb. 1, about when ConocoPhillips expects to complete its $9.7 billion acquisition of U.S. shale producer Concho Resources Inc CXO.N. Employees who lose their jobs will receive severance pay and help finding new positions, it said. Administrative and oil-exploration jobs were identified as facing cuts when the Concho deal was disclosed in October. Executives have targeted $500 million in cost and capital savings through 2022.

• General Motors Co (GM), Toyota Motor Corp (TM) & Ford Motor Co (F). A group representing major automakers on Tuesday vowed to work with President-elect Joe Biden on efforts to reduce vehicle emissions even as the industry remains split over whether to let California set its own emission rules. John Bozzella, who heads the Alliance for Automotive Innovation representing General Motors, Volkswagen, Toyota, Ford and most major automakers, said the group "looks forward to engaging with the incoming Biden administration ... to advance the shared goals of reducing emissions and realizing the benefits of an electric future." "The long-term future of the auto industry is electric," Bozzella said in a statement after automakers held a virtual meeting Tuesday. "We are investing hundreds of billions to develop the products that will drive this electric future, and we are committed to working collaboratively."

• JD.com Inc (JD). The Chinese online retailer, delivery company SF Group and Carlyle are bidding for South Korean conglomerate CJ Group's China logistics business in a deal that could fetch over $1 billion, people familiar with the matter said. CJ Group has hired Morgan Stanley to run the sale of CJ Rokin Logistics Supply Chain, which it acquired in 2015 via CJ Logistics. The deal could value CJ Rokin at over $1.1 billion, with final bids due in January, two of the sources said.

• Johnson & Johnson (JNJ). The company said late Tuesday that health regulators in Europe and Canada had started a real-time review of its COVID-19 vaccine candidate after preliminary results showed that the shot triggered the production of antibodies and immune cells against the virus. The European Medicines Agency said the review would go on until enough evidence was available for a formal marketing authorisation application for the vaccine, which is being developed by the U.S. company's Janssen unit. "Janssen will continue to work with Health Canada to complete the rolling review process and to facilitate an approval when appropriate," J&J said.

• Pfizer Inc (PFE) & BioNTech SE (BNTX). Britain approved Pfizer's COVID-19 vaccine, jumping ahead of the United States and Europe to become the West's first country to formally endorse a jab it said should reach the most vulnerable people early next week. Britain's Medicines and Healthcare products Regulatory Agency (MHRA) granted emergency use approval to the Pfizer-BioNTech vaccine, which they say is 95% effective in preventing illness, in record time - just 23 days since Pfizer published the first data from its final stage clinical trial. But the breakneck speed at which approval was given drew criticism from Brussels where, in an unusually blunt statement, the European Union's drugs regulator said its longer procedure to approve vaccines was more appropriate as it was based on more evidence and required more checks. "No corners have been cut," MHRA chief June Raine said in a televised briefing from Downing Street, adding that the first data on the vaccine had been received in June and undergone a rigorous analysis to international standards.

• Virgin Galactic Holdings Inc (SPCE). The space tourism company said on Tuesday it had set a new test-flight window opening on Dec. 11, after pausing preparations last month due to COVID-19 restrictions imposed by New Mexico. The company said the rocket-powered test flight would also carry payloads for NASA as part of a contract announced on Monday. The flight will test elements of the spacecraft's customer cabin, stabilizers and flight controls during boost. Virgin Galactic is aiming to obtain a commercial operating license from the U.S. Federal Aviation Administration after conducting a certain number of test flights.

• Walmart Inc (WMT). The company said it would lift the $35 minimum order value that subscribers of its loyalty service had to meet for next-day or two-day shipping, as the retailer gears up for a holiday season dominated by online shopping. The change, starting Friday, only applies to items on the retailer's website such as toys, appliances and clothing, the company said, adding that groceries, which are delivered from stores, will still have the $35 minimum."We just thought that now, in advance of the holidays, given where we are with the state of the pandemic, now is the absolute right time to have free shipping with no minimum," Janey Whiteside, chief customer officer at Walmart, told Reuters.

COLUMN

Skipping a year and landing in 2021: Mike Dolan

Part of the reason major investors seem slightly weary about their rosy market outlooks for 2021 is that they have been talking about and planning for little else since March. It's like the markets effectively skipped over 2020 on a bridge provided by central banks and governments and have been gradually pricing a policy and vaccine-supported rebound ever since. Both are meeting forecasts so far.

ANALYSTS' RECOMMENDATION

• Asana Inc (ASAN). Piper Sandler raises target price to $33 from $25, citing the company’s potential to become an indirect beneficiary of digital tailwinds after it unveiled new and expanded integrations last month with Microsoft Teams, Slack, Jira, and Zoom Video.

• Hewlett Packard Enterprise Co (HPE). Credit Suisse raises target price to $10 from $9, after the company reported better-than-expected fourth-quarter results.

• Micron Technology Inc (MU). Piper Sandler raises target price to $65 from $45, after the company provided an updated outlook for its November quarter, raising its revenue forecast and gross margin guidance.

• NetApp Inc (NTAP). Credit Suisse raises target price to $65 from $54, after the company reported strong second-quarter results.

• Salesforce.com Inc (CRM). Piper Sandler cuts target price to $278 from $285, believing that the company’s acquisition of Slack Technologies will overshadow solid third quarter results.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0815 (approx.) ADP national employment for Nov: Expected 410,000; Prior 365,000

0945 ISM-New York Index for Nov: Prior 814.8

0945 ISM New York Business Conditions for Nov: Prior 65.1

COMPANIES REPORTING RESULTS

PVH Corp (PVH). Expected Q3 earnings of 24 cents per share

Synopsys Inc (SNPS). Expected Q4 earnings of $1.58 cents per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 New Frontier Health Corp (NFH). Q3 earnings conference call

1000 Patterson Companies Inc (PDCO). Q2 earnings conference call

1100 Microsoft Corp (MSFT). Annual Shareholders Meeting

1530 Prospect Capital Corp (PSEC). Annual Shareholders Meeting

1630 Splunk Inc (SPLK). Q3 earnings conference call

1630 Five Below Inc (FIVE). Q3 earnings conference call

1630 Zscaler Inc (ZS). Q1 earnings conference call

1645 Guess? Inc (GES). Q3 earnings conference call

1700 Semtech Corp (SMTC). Q3 earnings conference call

1700 Synopsys Inc (SNPS). Q4 earnings conference call

1700 Okta Inc (OKTA). Q3 earnings conference call

1700 Snowflake Inc. (SNOW). Q3 earnings conference call

1700 Elastic NV (ESTC). Q2 earnings conference call

1700 Crowdstrike Holdings Inc (CRWD). Q3 earnings conference call

2000 GreenTree Hospitality Group Ltd (GHG). Q3 earnings conference call

EX-DIVIDENDS

Avista Corp (AVA). Amount $0.40

CSG Systems International Inc (CSGS). Amount $0.23

F.N.B. Corp (FNB). Amount $0.12

Halliburton Co (HAL). Amount $0.04

Home Depot Inc (HD). Amount $1.50

Linde PLC (LIN). Amount $0.96

Mosaic Co (MOS). Amount $0.05

Qualcomm Inc (QCOM). Amount $0.65

Shutterstock Inc (SSTK). Amount $0.17

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: ADP Werkgelegenheidswijziging buiten de Landbouw (Nov) | Actueel: 307K Verwacht: 410K Vorige: 404K |

Wake-up call: Nasdaq record, Dow blijft onder de 30K

Goedemorgen

Een sessie waar de tech aandelen weer werden gekocht, ook andere indices deden het goed maar dan in mindere mate. Vanmorgen zien we dat de futures wat moeten inleveren zodat de Dow Jones richting de slotstand van maandag zakt voorbeurs. De AEX en de DAX deden het gisteren ook redelijk, beiden winnen dinsdag zodat de AEX weer rond de 611-612 uitkomt, de DAX rond de 13.400 punten. De belangrijke indices in Azië sluiten nagenoeg vlak vanmorgen ...

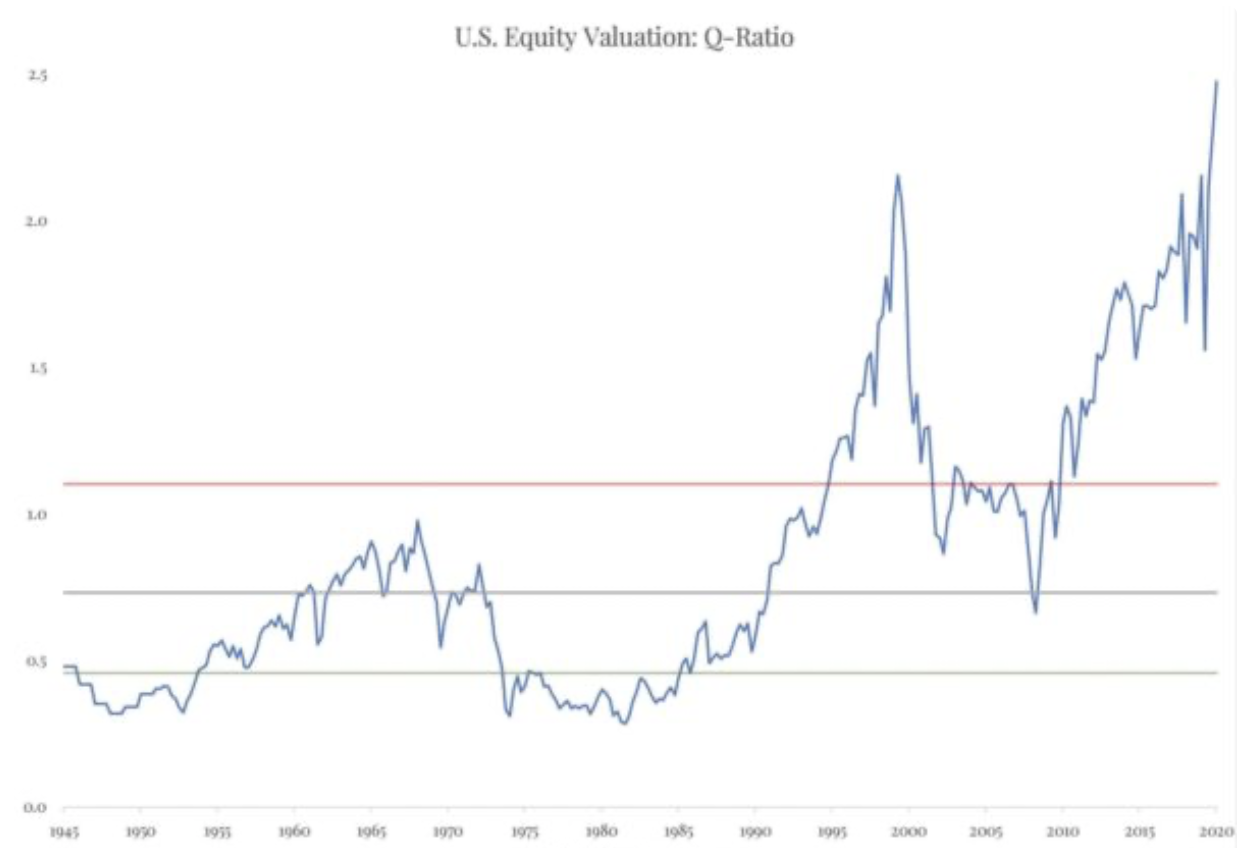

Wat betreft de markt weten we dat alles zeer duur wordt gekocht, gisteren heb ik dat nog via de LIVEBLOG laten zien, ook op Twitter liet ik een grafiek zien. Hieronder ziet u die in ieder geval nog een keer, de waardering van de markt staat al fors hoger dan toen in 2000 bij de bekende technologie bubbel toen. Nu zien we dat meer sectoren hetzelfde verloop laten zien zodat we momenteel met een groot probleem zitten wat betreft de PE waarden vergeleken met de winst en de winst verwachting. (zie grafiek hieronder)

Hoe de dag zal verlopen is moeilijk te zeggen met de koopwoede die er nu is, wel lijkt het me duidelijk dat wie nu de aandelen zo duur inkoop zeker nog veel lagere koersen zal zien in 2021. Maandag heb ik al kunnen zien dat als er een verkoopgolf op gang komt die extreem snel gaat en de indices in een uur tijd 1 tot 2% lager staan. Als het moment komt dat de DIP dan niet wordt opgekocht dan zijn we vertrokken voor veel lagere koersen. Bij 4 tot 5% daling zullen er al heel snel margin calls komen via de speculanten die tot ver boven hun mogelijkheden in de markt zitten. Dat moment komt er hoe dan ook aan, alleen kan ik onmogelijk aangeven waar en wanneer dat op gang komt. Maar nogmaals, we zitten er heel dicht bij nu.

Uiteraard is 90 tot 95% nu bullish, er wordt volgens mij niet eens gekeken naar de hoge waarderingen, men negeert het volop. Het enige wat we weten is dat de markten nog niet eerder zo duur zijn geweest. En let op, dat is niet zo voor alle sectoren maar de sectoren die er wel mee te maken hebben zullen er mee te maken krijgen en de rest wordt dan zoals altijd mee getrokken in de correctie, de grote correctie. Mocht het zo zijn dat er geen correctie komt dan zitten we met een bubbel die niet eerder zo werd opgeblazen als nu het geval is. Opletten dus, ik kan het alleen maar melden, ervoor waarschuwen.

Zelf ga ik op deze niveaus in ieder geval niet kopen, ik denk er niet aan ... We bouwen posities op voor wanneer het gaat dalen, en ik denk eraan om er in ieder geval voor een tijdje in te blijven zitten. Wat betreft 2021 dan zien ik zeker mooie kansen om er een goed jaar van te maken ...

U kunt mij en dus @USMarkets uiteraard ook volgen via onze Twitter account, ga naar ... https://twitter.com/USMarkets waar ik tussentijds wat charts over de markt en sentiment plaats, ook opvallende beursfeiten komen er vaak langs !

Euro, olie en goud:

De euro zien we nu rond de 1.206 dollar, de prijs van een vat Brent olie staat op 47,1 dollar terwijl een troy ounce goud nu terugvalt tot 1815 dollar. Let op de euro die duidelijk tot boven de 1,20 dollar uitkomt !

Maak nu gebruik van de aanbieding op US Markets Trading:

Denk eraan, ik sta hoe dan ook klaar om me te herpakken in 2021 wat mijn jaar zal worden wat betreft Trading, lid worden is dus belangrijk om alles optimaal te volgen.

Doe nu mee via de proef aanbieding voor €39 tot 1 FEBRUARI. Dan pakt u december mee en de start van 2021 meteen ook. Polleke Trading is dan €49 ... Schrijf u vandaag nog in via de link https://www.usmarkets.nl/tradershop en dan staat u meteen op de lijst, en ontvangt u de updates en signalen meteen !!

Met vriendelijke groet,

Guy Boscart

Markt snapshot Europa vandaag

GLOBAL TOP NEWS

U.S. Attorney General William Barr said on Tuesday the Justice Department has found no evidence of widespread voter fraud in last month's election, even as President Donald Trump kept up his flailing legal efforts to reverse his defeat.

Top U.S. health officials announced plans on Tuesday to begin vaccinating Americans against the coronavirus as early as mid-December, as nationwide deaths hit the highest number for a single day in six months.

Salesforce.com Inc has agreed to buy workplace messaging app Slack Technologies Inc in a $27.7 billion deal, the biggest by the cloud-computing pioneer as it bets on an extended run for remote working and sharpens its rivalry with Microsoft.

EUROPEAN COMPANY NEWS

British department store group Debenhams is set to close all its UK shops after 242 years in business, putting 12,000 jobs at risk in the country's second major corporate failure in as many days.

Autostrade per l'Italia said on Tuesday it had raised 1.25 billion euros in a bond sale, marking a debt market return after more than three years for Atlantia's motorway business.

Hungarian low-cost airline Wizz Air is expanding in Norway to take advantage of a shift towards domestic tourism caused by the COVID-19 pandemic, the airline's chief executive said on Tuesday.

TODAY'S COMPANY ANNOUNCEMENTS

Blackrock Greater Europe Investment Trust PLC Annual Shareholders Meeting

Navios Maritime Acquisition Corp Q3 2020 Earnings Call

STV Group PLC Shareholders Meeting

ECONOMIC EVENTS (All times GMT)

0700 (approx.) Germany Retail Sales mm Real for Oct: Expected 1.2%; Prior -2.2%

0700 (approx.) Germany Retail Sales yy Real for Oct: Expected 5.9%; Prior 6.5%

0730 Switzerland CPI mm for Nov: Expected -0.1%; Prior 0.0%

0730 Switzerland CPI yy for Nov: Expected -0.5%; Prior -0.6%

0900 Italy Unemployment Rate for Oct: Expected 9.9%; Prior 9.6%

1000 Euro Zone Producer Prices mm for Oct: Expected 0.2%; Prior 0.3%

1000 Euro Zone Producer Prices yy for Oct: Expected -2.4%; Prior -2.4%

1000 Euro Zone Unemployment Rate for Oct: Expected 8.4%; Prior 8.3%