Liveblog Archief woensdag 30 september 2020

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Ruwe Olievoorraden | Actueel: -1,980M Verwacht: 1,569M Vorige: -1,639M |

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Voorlopige Huisverkopen (Maandelijks) (Aug) | Actueel: 8,8% Verwacht: 3,2% Vorige: 5,9% |

Markt snapshot Wall Street vandaag

TOP NEWS

• Insults and interruptions mar first Trump-Biden debate

President Donald Trump and Democratic rival Joe Biden battled fiercely over Trump's record on the coronavirus pandemic, healthcare and the economy in a chaotic and bad-tempered first debate marked by personal insults and Trump's repeated interruptions.

• China preparing an antitrust investigation into Google -sources

China is preparing to launch an antitrust probe into Alphabet's Google, looking into allegations it has leveraged the dominance of its Android mobile operating system to stifle competition, two people familiar with the matter said.

• Caesars to buy William Hill for $3.7 billion in sports-betting drive

U.S. casino operator Caesars Entertainment agreed to buy British-based gambling group William Hill for $3.7 billion to expand in the fast-growing U.S. sports-betting market.

• U.S. Treasury says it has closed loans to seven major airlines

The U.S. Treasury said on Tuesday it had closed loans to seven large airlines hit hard by the coronavirus pandemic and urged Congress to save tens of thousands of airline jobs by extending billions in payroll assistance.

• Disney to lay off about 28,000 parks unit employees due to coronavirus hit

Walt Disney said on Tuesday it will lay off roughly 28,000 employees, mostly at its U.S. theme parks, where attendance has been crushed by the coronavirus pandemic, especially in California where Disneyland remains closed.

BEFORE THE BELLWall Street futures, European and Japanese shares fell, after a chaotic first U.S. presidential debate and rising COVID-19 cases turned investors cautious. Gold slipped as the dollar benefited from caution that crept into financial markets. Oil prices dipped on concerns over fuel demand. Data due on the U.S. economic schedule include gross domestic product, personal consumption expenditure, the ADP national employment report, pending home sales and Chicago purchasing managers' index.

STOCKS TO WATCH

Results

• Micron Technology Inc (MU). The company has not yet obtained new licenses needed to sell its memory chips to China's Huawei Technologies, which will cut its sales over the next two quarters, company executives said on Tuesday. Micron said it had previously obtained licenses from the U.S. government to sell chips for mobile phones and servers from its factories outside the United States to Huawei, which has been the target of U.S. restrictions on chip sales since last year. Huawei accounted for about $600 million of Micron's $6.06 billion in sales for the fiscal fourth quarter, or just under 10%. Net income attributable to the company rose to $988 million, or 87 cents per share, in the last quarter, from $561 million, or 49 cents per share, a year earlier. Excluding items, Micron earned $1.08 per share, beating analysts' estimates of 99 cents.

Deals Of The Day

• Caesars Entertainment Inc (CZR). The U.S. casino operator agreed to buy British-based gambling group William Hill for $3.7 billion to expand in the fast-growing U.S. sports-betting market. The U.S. group, owner of Las Vegas's Caesars Palace, intends to sell William Hill's non-U.S. operations, including more than 1,400 UK betting shops, and said it would integrate the U.S. business into Caesars with few, if any, job losses. It could sell the UK assets to private equity group Apollo, sources told Reuters this week, and if that failed, launch an auction process.

• Pfizer Inc (PFE). CStone Pharmaceuticals said a unit of Pfizer had agreed to buy a 9.9% stake for $200 million, as the Hong Kong-listed biopharmaceutical firm seeks to improve the commercialisation of its products. Pfizer Corporation had agreed to buy 115.93 million new shares of China-based CStone at HK$13.37 apiece, representing 43.8% premium over the closing price of HK$9.30 on Tuesday. CStone, which focuses on immuno-oncology medicines, said it had granted a Pfizer unit an exclusive licence to commercialise CS1001 in mainland China.

In Other News

• Alaska Airlines Inc (ALK), American Airlines Group Inc (AAL), JetBlue Airways Corp (JBLU), SkyWest Inc (SKYW), & United Airlines Holdings Inc (UAL). The U.S. Treasury said on Tuesday it had closed loans to seven large airlines hit hard by the coronavirus pandemic and urged Congress to save tens of thousands of airline jobs by extending billions in payroll assistance. The Treasury said in a statement the seven carriers were Alaska Airlines, American Airlines, Frontier Airlines, JetBlue Airways, Hawaiian Airlines, SkyWest Airlines and United Airlines. Airlines and unions were still heavily lobbying Congress ahead of a Wednesday deadline for a new $25 billion bailout to keep workers on the payroll for another six months, but industry officials acknowledge they face an uphill battle with just hours left.

• Alphabet Inc (GOOGL). China is preparing to launch an antitrust probe into Google, looking into allegations it has leveraged the dominance of its Android mobile operating system to stifle competition, two people familiar with the matter said. The case was proposed by telecommunications equipment giant Huawei Technologies last year and has been submitted by the country's top market regulator to the State Council's antitrust committee for review, they added. A decision on whether to proceed with a formal investigation may come as soon as October and could be affected by the state of China's relationship with the United States, one of the people said.

• Alibaba Group Holding Ltd (BABA). The Chinese tech giant's cloud unit expects to be profitable within 2021, a senior executive said. Maggie Wu, chief financial officer of Alibaba, made the remarks at an livestreamed investor day event. The company, a dominant player in China's cloud market, is fending off challenge from domestic rival Tencent which is also trying to capture cloud business opportunities.

• Amazon.com Inc (AMZN), Facebook Inc (FB), Apple Inc (APPL) & Alphabet Inc (GOOGL). The U.S. House of Representatives Judiciary Committee's antitrust subcommittee is expected to release a much-anticipated report into antitrust allegations against four of America's largest tech companies as soon as Monday, according to a source with direct knowledge of the matter. The chief executives of four of the world's largest tech companies, Amazon.com, Facebook, Apple and Alphabet's Google, testified before the panel in July. The House antitrust subcommittee plans to hold a hearing on Friday on proposals to strengthen antitrust laws and restore online competition as it nears the release of this long-awaited report on Big Tech.

• Apple Inc (AAPL). The company on Tuesday granted CEO Tim Cook 333,987 restricted stock units, with a possibility to earn as many as 667,974 more if he hits performance targets, in the executive's first stock grant since 2011. “Tim has brought unparalleled innovation and focus to his role as CEO and demonstrated what it means to lead with values and integrity," Apple's board of directors said in a statement. Cook is in the ninth year of his 10-year grant from 2011. Each restricted stock unit conveys the right to one common share when it vests.

• Boeing Co (BA). Federal Aviation Administration (FAA) Chief Steve Dickson is due to conduct a two-hour evaluation flight at the controls of a 737 MAX, a key milestone for the jet to win approval to resume flying after two fatal crashes. Dickson, a former military and commercial pilot, and other FAA and Boeing pilots are due to take off around 9 a.m. PDT (1600 GMT) from King County International Airport - also known as Boeing Field - in the Seattle area and land around 11 a.m. (1800 GMT).

• Blackstone Group Inc (BX). The private equity firm has sold its 36% shareholding in Rothesay Life to existing shareholders Singapore fund GIC and U.S. insurer MassMutual, the UK insurer and annuity provider said. The stake sale, which values Rothesay Life at $7.37 billion, sees GIC and MassMutual each take on a 49% stake in the company, Rothesay Life said. The three firms have been shareholders in Rothesay Life, which insures defined benefit, or final salary pension schemes, since 2013.

• CureVac NV (CVAC). The company said on Tuesday it has started a mid-stage study testing its experimental coronavirus vaccine and plans to begin a decisive global trial with about 30,000 volunteers in the fourth quarter. CureVac has dosed the first patient with its experimental COVID-19 vaccine in the trial taking place in Peru and Panama and expects data on older adults in the fourth quarter.

• Facebook Inc (FB). The company is tapping Alex Schultz, a company veteran who runs product growth, analytics and internationalization at the social media giant, as its new chief marketing officer. Schultz, a former eBay employee, said in a Facebook post that he would replace Antonio Lucio as marketing chief. Lucio left Facebook earlier this month, according to his LinkedIn account.

• Oasis Petroleum Inc (OAS). The company filed for Chapter 11 bankruptcy protection, the latest U.S. shale producer to seek court-aided restructuring as the energy industry reels from an unprecedented crash in oil prices caused by the COVID-19 pandemic. The company listed assets and liabilities in the range of $1 billion to $10 billion, according to a court filing. Oasis said it secured $450 million in debtor-in-possession financing and expects to cut debt by $1.8 billion through the restructuring. It had long-term debt of $2.76 billion with just $77.4 million in cash and cash equivalents as of June 30.

• Regeneron Pharmaceuticals Inc (REGN). The company on Tuesday said its experimental two-antibody cocktail reduced viral levels and improved symptoms in non-hospitalized COVID-19 patients, enhancing its chances of becoming a treatment for the disease that has killed over a million people worldwide. "We hope these data will support an EUA" (emergency use authorization) from the U.S. Food and Drug Administration, Regeneron Chief Scientific Officer George Yancopoulos said on a conference call. The FDA can authorize emergency use of a drug before completing its review for a formal approval.

• Royal Dutch Shell PLC (RDSa). The company announced plans to cut up to 9,000 jobs, or over 10% of its workforce, as part of a major overhaul to shift the oil and gas giant to low-carbon energy. Shell, which had 83,000 employees at the end of 2019, said that the reorganisation will lead to additional annual savings of around $2 billion to $2.5 billion by 2022 beyond cost cuts of $3 to $4 billion announced earlier this year. The company said it expected to cut 7,000 to 9,000 jobs by the end of 2022, including some 1,500 people who have agreed to take voluntary redundancy this year.

• Salesforce.com Inc (CRM). The company said it has adapted some of its business software to help healthcare organizations and government entities distribute vaccines for the novel coronavirus once they become available.

The company said the offering, called Work.com for Vaccines, will help cities, states and health-care groups track vaccine inventory levels, create online appointment portals and track how patients fare after being vaccinated. Salesforce.com's efforts build on tools rolled out in May aimed at modifying the company's business software to help governments make re-opening decisions based on public health data and carry out contact tracing and other tasks related to the pandemic.

• Uber Technologies Inc (UBER) & Lyft Inc (LYFT). The Seattle City Council passed a minimum pay standard for drivers for companies like Uber and Lyft on Tuesday. Under the ordinance, effective January, the drivers will now earn at least $16.39 per hour - the minimum wage in Seattle for companies with more than 500 employees. Seattle's law, modeled after a similar regulation in New York City, aims to reduce the amount of time drivers spend "cruising" without a passenger by paying drivers more during those times.

• Walt Disney Co (DIS). The company said on Tuesday it will lay off roughly 28,000 employees, mostly at its U.S. theme parks, where attendance has been crushed by the coronavirus pandemic, especially in California where Disneyland remains closed. About two-thirds of the laid-off employees will be part-time workers, the company said in a statement. "We have made the very difficult decision to begin the process of reducing our workforce at our Parks, Experiences and Products segment at all levels," Josh D'Amaro, chairman of the parks unit, said in a statement.

POLL

U.S. housing market to remain a bright spot in a weak economy

U.S. house prices will continue to surge well into next year and beyond, outpacing inflation and the overall economy, a Reuters poll of property analysts found, making it a bright spot against an otherwise gloomy economic backdrop.

ANALYSTS' RECOMMENDATION

•IHS Markit Ltd (INFO). Jefferies raises target price to $85 from $71, stating the company can do sustainable mid-single-digit plus organic growth in longer term.

•Micron Technology Inc (MU). RBC cuts target price to $57 from $60, saying the guidance for November quarter was lighter-than-expected, driven by the loss of revenue to Huawei going to zero due to new restrictions.

•Penn National Gaming Inc (PENN). JPMorgan raises target price to $83 from $62, saying the company’s launch of the Barstool Sports betting app in Pennsylvania is encouraging and it stands to get higher value from U.S. sports betting and iGaming opportunities.

•Sunnova Energy International Inc (NOVA). JPMorgan raises target price to $34 from $29, stating the company is well positioned to gain share within the high-growth U.S. residential rooftop solar market, with potential for additional upside from energy storage.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0815 (approx.) ADP national employment for Sep: Expected 650,000; Prior 428,000

0830 Corporate profits revised for Q2: Prior -11.8%

0830 GDP final for Q2: Expected -31.7%; Prior -31.7%

0830 GDP sales final for Q2: Prior -28.5%

0830 GDP cons spending final for Q2: Prior -34.1%

0830 GDP deflator final for Q2: Expected -2.0%; Prior -2.3%

0830 Core PCE prices final for Q2: Expected -1.0%; Prior -1.0%

0830 PCE prices final for Q2: Prior -1.8%

0945 (approx.) Chicago PMI for Sep: Expected 52.0; Prior 51.2

1000 Pending home sales index for Aug: Prior 122.1

1000 Pending home sales change mm for Aug: Expected 3.4%; Prior 5.9%

COMPANIES REPORTING RESULTS

No major S&P 500 companies are scheduled to report.

CORPORATE EVENTS (All timings in U.S. Eastern Time)

1000 South State Corp (SSB). Annual Shareholders Meeting

1100 Enerpac Tool Group Corp (EPAC). Q4 earnings conference call

EX-DIVIDENDS

ABM Industries Inc (ABM). Amount $0.18

Air Products and Chemicals Inc (APD). Amount $1.34

Cardinal Health Inc (CAH). Amount $0.48

CubeSmart (CUBE). Amount $0.33

Curtiss-Wright Corp (CW). Amount $0.17

Encompass Health Corp (EHC). Amount $0.28

Equity Commonwealth (EQC). Amount $3.50

ESCO Technologies Inc (ESE). Amount $0.08

Ingredion Inc (INGR). Amount $0.64

Lennox International Inc (LII). Amount $0.77

National General Holdings Corp (NGHC). Amount $0.05

Pegasystems Inc (PEGA). Amount $0.03

Quanta Services Inc (PWR). Amount $0.05

Raymond James Financial Inc (RJF). Amount $0.37

Realty Income Corp (O). Amount $0.23

Republic Services Inc (RSG). Amount $0.42

ServisFirst Bancshares Inc (SFBS). Amount $0.17

Simpson Manufacturing Co Inc (SSD). Amount $0.23

State Street Corp (STT). Amount $0.52

Two Harbors Investment Corp (TWO). Amount $0.14

Ventas Inc (VTR). Amount $0.45

Wolverine World Wide Inc (WWW). Amount $0.10

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: BBP (Kwartaal) (Q2) | Actueel: -31,4% Verwacht: -31,7% Vorige: -5,0% |

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: ADP Werkgelegenheidswijziging buiten de Landbouw (Sep) | Actueel: 749K Verwacht: 650K Vorige: 428K |

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| DEU: Duitse Werkloosheidswijziging (Sep) | Actueel: -8K Verwacht: -8K Vorige: -9K |

TA - Nederlandse financials zakken weg

Er breken weer onzekere tijden aan nu de Corona maatregelen aangescherpt worden. Dit komt de AEX, welke al flink aan het sluimeren was, niet ten goede. Vandaag bekijken we een aantal Nederlandse financials omdat zij langzaam maar zeker weg beginnen te glijden.AEX In mijn column van…

Lees verder »Wake-up call: Trump vs Biden, straatdebat maar in feite logisch, futures lager

Goedemorgen

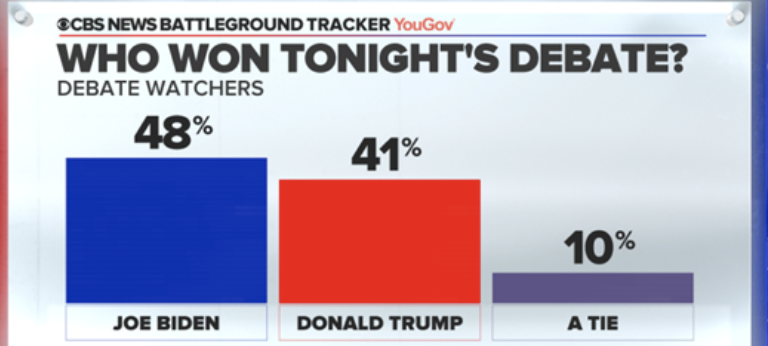

Iedereen zat te wachten op het eerste debat tussen Trump en Biden, Trump zou. hem afmaken maar dat lukte hem niet deze keer. Biden vocht terug met dezelfde taal als Trump en liet zich niet doen, tenminste hetgeen ik erover heb gelezen want zelf koos ik ervoor om te genieten van mijn nachtrust. Volgens de peilingen won Biden zelfs met 48% tegenover 41% voor Trump. Biden kwam er dus goed uit en zal er zelfvertrouwen uithalen denk ik. De leiding bij het debat kwam zelfs van de Trump nieuwszender FOX, dat maakt zijn nederlaag alleen maar groter mijn inziens.

Maar goed, het zegt nog niks natuurlijk en er volgen er nog 2 in oktober, de regels zullen wel anders worden want niemand heeft nog zin in een laag bij de grond debat, logisch want hetgeen Trump deed was onder de gordel zegt CNN, wat moet Biden dan doen? Het accepteren en zich de grond laten inboren? Maar goed, dat was het belangrijkste moment van de week, dat ligt nu achter ons en Biden won en staat nog steeds behoorlijk voor in de peilingen ...

De futures reageerden eerst nog positief rondom de confrontatie maar later zien we toch een gevoelig verlies, alles staat meer dan 1% lager terwijl we gisteren al een matige sessie kregen met verliezen. Straks de opening hier in Europa waar de futures ook al wat lager staan voorbeurs.

De indices op Wall Street neigen om weer onder het 50-MA terecht te komen zodat het verkoopsignaal nog geldig blijft op Wall Street. De Nasdaq kwam er dus even boven deze week en sloot er gisteren nog steeds net boven maar gezien de standen van de futures en de ruim 1% lagere indicaties vanmorgen staan we er snel na de opening als het zo blijft weer onder. De SP 500 en de Dow Jones hebben dat 50-daags gemiddelde wel aangetikt maar konden daar niet boven sluiten zodat deze 2 indices over de gehele lijn negatief bleven. Als de markt verder omlaag trekt dan moeten we rekening gaan houden met minimaal een hertest van de bodems of zelfs nieuwe bodems. Later deze week zal dat duidelijk worden.

Voorlopig hou ik de strategie aan, wachten op het momentum om te beslissen wat er met de posities die openstaan moet gebeuren, er zit zeker nog potentie in en zeker bij een hertest van de bodems of bij het maken van nieuwe bodems hetgeen we nog moeten afwachten.

Wat kunnen we doen wat betreft nieuwe posities:

We zitten in de markt met wat short posities die ik met deze daling nog even wil aanhouden. De maand verloopt tot nu toe goed en we staan overal op winst. Er komen zeker meer kansen aan de komende periode, daar ben ik van overtuigd gezien het verloop van de markt momenteel. U kunt als lid meteen meedoen met de posities die ik uitstuur, lid worden kan via de aanbieding die loopt tot 1 DECEMBER voor €39 ...

Om u in te schrijven ga meteen naar de link https://www.usmarkets.nl/tradershop en dan staat u vandaag nog op de lijst ...

Marktoverzicht slotstanden dinsdag:

Guy Boscart

Markt snapshot Europa vandaag

GLOBAL TOP NEWS

Republican President Donald Trump and Democratic rival Joe Biden battled fiercely over Trump's leadership on the coronavirus pandemic, the economy and the integrity of November's election in a chaotic first debate on Tuesday marked by personal insults, name calling and Trump's repeated interruptions.

Britain's House of Commons approved legislation on Tuesday that gives ministers the power to break its divorce deal with the European Union, despite the threat of legal action from Brussels and unrest within the governing Conservative Party.

China's factory activity extended solid growth in September, twin surveys showed, as the nation's crucial exports engine revved up on improving overseas demand and underlined a steady economic recovery from the coronavirus shock.

EUROPEAN COMPANY NEWS

Infrastructure group Atlantia said it was open to resuming talks on the sale of its motorway unit Autostrade per l'Italia to Italian state lender CDP, provided the transaction respected market conditions and the rights of its shareholders.

Germany's CureVac said on Tuesday it has started a mid-stage study testing its experimental coronavirus vaccine and plans to begin a decisive global trial with about 30,000 volunteers in the fourth quarter.

A court in El Salvador has ordered $227 million of assets of the Italian company Astaldi be frozen amid judicial proceedings against the construction company, the attorney general's office said on Tuesday.

TODAY'S COMPANY ANNOUNCEMENTS

Active Energy Group PLC Annual Shareholders Meeting

Archos SA Annual Shareholders Meeting

Blue Solutions SA Annual Shareholders Meeting

Chenavari Capital Solutions Ltd Annual Shareholders Meeting

City of London Group PLC Annual Shareholders Meeting

Creightons PLC Annual Shareholders Meeting

Draegerwerk AG & Co KGaA Annual Shareholders Meeting (German)

EO2 SA Annual Shareholders Meeting

Etablissementen Franz Colruyt NV Annual Shareholders Meeting

Generix Group SA Annual Shareholders Meeting

Genfit SA HY 2020 Earnings Release

Groupe Plus Values SA Annual Shareholders Meeting

HML Holdings PLC Annual Shareholders Meeting

Hot Rocks Investments PLC Annual Shareholders Meeting

Infoclip SA Annual Shareholders Meeting

IntegraFin Holdings plc Shareholders Meeting

Liontrust Asset Management PLC Shareholders Meeting

Marlowe PLC Annual Shareholders Meeting

Mobile Tornado Group PLC Annual Shareholders Meeting

Motif Bio PLC Annual Shareholders Meeting

Nobina AB (publ) Q2 2021 Earnings Release

Panthera Resources PLC Annual Shareholders Meeting

Pennpetro Energy PLC Annual Shareholders Meeting

PHSC PLC Annual Shareholders Meeting

Powerhouse Energy Group PLC Annual Shareholders Meeting

Prismaflex International SA Annual Shareholders Meeting

Purplebricks Group PLC Annual Shareholders Meeting

Renishaw PLC Annual Shareholders Meeting

San Leon Energy PLC Annual Shareholders Meeting

Scholium Group PLC Annual Shareholders Meeting

Simo International SA Annual Shareholders Meeting

Studio Retail Group PLC Annual Shareholders Meeting

Tekmar Group PLC Annual Shareholders Meeting

Televista SA Annual Shareholders Meeting

Thespac SpA Shareholders Meeting

TPSH SA Annual Shareholders Meeting

Vivoryon Therapeutics AG Annual Shareholders Meeting

Volkswagen AG Annual Shareholders Meeting

Weya SA Annual Shareholders Meeting

Wild Bunch AG Annual Shareholders Meeting

Wolford AG Annual Shareholders Meeting

Works co uk PLC Annual Shareholders Meeting

ECONOMIC EVENTS (All times GMT)

0600 Germany Import prices mm for Aug: Expected 0.0%; Prior 0.3%

0600 Germany Import prices yy for Aug: Expected -4.1%; Prior -4.6%

0600 Germany Retail sales real mm for Aug: Expected 0.5%; Prior -0.9%

0600 Germany Retail sales real yy for Aug: Expected 4.2%; Prior 4.2%

0600 United Kingdom GDP qq for Q2: Expected -20.4%; Prior -20.4%

0600 United Kingdom GDP yy for Q2: Expected -21.7%; Prior -21.7%

0600 United Kingdom Business investment qq for Q2: Prior -31.4%

0600 United Kingdom Business investment yy for Q2: Prior -31.3%

0600 United Kingdom Current account for Q2: Expected -0.4 billion GBP; Prior -21.1 billion GBP

0600 United Kingdom Nationwide house price mm for Sep: Expected 0.5%; Prior 2.0%

0600 United Kingdom Nationwide house price yy for Sep: Expected 4.5%; Prior 3.7%

0645 France Consumer spending mm for Aug: Expected -0.2%; Prior 0.5%

0645 France CPI (EU Norm) preliminary yy for Sep: Expected 0.3%; Prior 0.2%

0645 France CPI (EU Norm) preliminary mm for Sep: Prior -0.1%

0645 France CPI preliminary yy NSA for Sep: Prior 0.2%

0645 France CPI preliminary mm NSA for Sep: Prior -0.1%

0645 France Producer prices mm for Aug: Prior 0.4%

0645 France Producer prices yy for Aug: Prior -2.6%

0700 Switzerland KOF Indicator for Sep: Expected 106.0; Prior 110.2

0700 Switzerland Official Reserves Assets for Aug: Prior 913,103.46 million CHF

0700 Austria PPI mm for Aug: Prior 0.1%

0700 Austria PPI yy for Aug: Prior -2.1%

0800 Germany BB State CPI mm for Sep: Prior -0.5%

0800 Germany BB State CPI yy for Sep: Prior -0.4%

0800 Spain Current account balance for July: Prior 2.04 billion EUR

0800 Switzerland Investor sentiment for Sep: Prior 45.6

0830 Portugal CPI flash mm for Sep: Prior -0.3%

0830 Portugal CPI flash yy for Sep: Prior 0.0%

0855 Germany Unemployment change SA for Sep: Expected -8k; Prior -9k

0855 Germany Unemployment total NSA for Sep: Prior 2.955 million

0855 Germany Unemployment rate SA for Sep: Expected 6.4%; Prior 6.4%

0855 Germany Unemployment total SA for Sep: Prior 2.915 million

0900 Italy Consumer price preliminary mm for Sep: Expected -0.5%; Prior 0.3%

0900 Italy Consumer price preliminary yy for Sep: Expected -0.4%; Prior -0.5%

0900 Italy CPI (EU Norm) preliminary mm for Sep: Expected 1.4%; Prior -1.3%

0900 Italy CPI (EU Norm) preliminary yy for Sep: Expected -0.4%; Prior -0.5%

0900 Italy CPI NSA for Sep: Prior 103.0

1000 Portugal Unemployment rate for Aug: Prior 8.10%