Liveblog Archief woensdag 4 augustus 2021

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Ruwe Olievoorraden | Actueel: 3,626M Verwacht: -3,102M Vorige: -4,089M |

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: ISM niet-verwerkende Industrie Index (Jul) | Actueel: 64,1 Verwacht: 60,5 Vorige: 60,1 |

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: ADP Werkgelegenheidswijziging buiten de Landbouw (Jul) | Actueel: 330K Verwacht: 695K Vorige: 680K |

Markt snapshot Wall Street 4 augustus

TOP NEWS

• CVS Health profit falls 6.5% on higher medical costs

CVS Health reported a 6.5% fall in quarterly profit, hit by higher costs at its health insurance unit as demand for non-COVID healthcare services normalized.

• Marathon Petroleum posts first adjusted profit since pandemic on fuel demand

Marathon Petroleum posted its first adjusted quarterly profit since the pandemic, boosted by a rebound in fuel demand.

• Toyota, Honda beat profit estimates but are wary of extended chip crunch

Toyota posted a record quarterly profit and Honda raised its annual profit estimate as pandemic-hit sales rebounded, but the automakers saw no end in sight to the global chip shortage.

• Sony posts record Q1 profit on pandemic demand for devices and content

Sony raised its earnings outlook after a record first-quarter operating profit helped by pandemic stay-at-home demand for PlayStation 5 consoles, TVs, music and movies.

• Auto parts maker BorgWarner beats profit estimates, lifts 2021 forecast

BorgWarner beat Wall Street estimates for quarterly profit on strong consumer demand for new vehicles, and raised its full-year profit forecast.

BEFORE THE BELL

U.S. stock index futures were little changed as investors awaited U.S. jobs data, including ADP National Employment Report, due later in the day, and Friday’s closely watched non-farm payroll numbers. Meanwhile, upbeat quarterly earnings continued to support European shares. Separately, a bounce back in tech shares lifted Chinese stocks up, while Japanese shares dipped on concerns about the rapid spread of the Delta coronavirus variant. In commodities, oil prices fell on demand worries, while gold prices ticked higher on a flat dollar.

STOCKS TO WATCH

Results

• Activision Blizzard Inc: The company forecast current-quarter adjusted revenue above estimates on Tuesday, as it expects demand for its popular franchises "Call of Duty" and "Candy Crush" to remain strong, sending its shares 4% higher in extended trading. Activision Blizzard said it expects robust performance from "Candy Crush" and "World of Warcraft" in the third quarter, complemented by the launch of the "Diablo II: Resurrected". It forecast quarterly adjusted revenue at $1.85 billion, compared with analysts' estimates of $1.81 billion. Activision Blizzard's raised full-year adjusted revenue forecast of $8.65 billion came in below estimates of $8.77 billion, according to analyst estimates. The company reported adjusted revenue of $1.92 billion for the second quarter ended June 30, slightly above expectations of $1.90 billion.

• Amgen Inc: The U.S. biotech company on Tuesday said its second-quarter revenue rose 5%, but recovery from the COVID-19 pandemic, which has limited patient interactions with healthcare providers, is expected to hit sales for the rest of 2021. The pandemic "has suppressed the volume of new patients starting treatment," the company said in a statement. Amgen's quarterly adjusted earnings, helped by share buybacks, rose 4% from a year earlier to $4.38 per share, beating the $4.10 forecast by Wall Street analysts. Revenue of $6.5 billion was in line with analyst estimates as an 8% increase in unit sales volumes was partially offset by a 5% drop in net selling prices. For the full year, Amgen said it still expects adjusted earnings of $16.00 to $17.00 per share on revenue of $25.8 billion to $26.6 billion.

• Banco Bradesco SA: Brazil's second-biggest lender on Tuesday reported a 63.2% rise in its second-quarter profit on lower loan-loss provisions, despite a hit in its insurance unit by the pandemic. Recurring net income, which excludes one-off items, came in at 6.319 billion reais, roughly in line with an estimate of 6.454 billion reais compiled by Refinitiv. Return on equity was at 17.6%. Despite the higher profits, the bank's insurance business, which includes life and health insurance plans, was hurt by Brazil's brutal second wave of COVID-19 in the second quarter. Gains within this unit fell 58.3% to 1.574 billion reais. The bank revised its full-year outlook for insurance results to a drop of between 15% and 20%.

• BorgWarner Inc: The auto parts maker beat Wall Street estimates for quarterly profit on strong consumer demand for new vehicles, and raised its full-year profit forecast. The company said it now expects 2021 adjusted earnings per share between $4.15 and $4.40, assuming no further production disruptions due to the pandemic, compared to a previous forecast of $4 to $4.35. Excluding items, BorgWarner earned $1.08 per share, compared to analysts' estimates of 81 cents. Net earnings attributable to the company was $247 million, or $1.03 per share, in the quarter ended June 30, compared to a loss of $98 million, or 47 cents per share, a year-earlier. Revenue surged 163.5% to $3.76 billion. Analysts on average were expecting $3.48 billion. The company also raised it's full-year sales forecast to between $15.2 billion and $15.6 billion, up from a prior range of $14.8 billion to $15.4 billion.

• CVS Health Corp: The company reported a 6.5% fall in quarterly profit, hit by higher costs at its health insurance unit as demand for non-COVID healthcare services normalized. CVS Health said its medical benefit ratio (MBR), the percentage of premiums paid for medical services, rose to 84.1% from 70.3% last year. Net income attributable to the company fell to $2.78 billion, or $2.10 per share, in the second quarter ended June 30, from $2.98 billion, or $2.26 per share, a year earlier. The company raised its adjusted profit per share outlook to $7.70 to $7.80, from $7.56 to $7.68 after it reported a 11.1% increase in quarterly revenue to $72.6 billion.

• Ecopetrol SA: Colombia's majority state-owned oil company's second-quarter net profit soared to 3.72 trillion pesos on Tuesday, boosted by strong sales, the company said on Tuesday, compared with 25 billion pesos in the year-earlier period. Earnings before interest, taxes, depreciation and amortization (EBITDA) rose to 9.43 trillion pesos, from 2 trillion pesos in the second quarter of 2020, Ecopetrol said. Net profit in the first half of the year rose to 6.8 trillion pesos, from 158 billion in the year-earlier period, while EBITDA for the first six months climbed to 17.6 trillion pesos, from 7.25 trillion pesos in the first six months of 2020. Total sales in the second quarter rose to 19.4 trillion pesos, from 8.44 trillion pesos a year earlier, Ecopetrol said. Production in the second quarter averaged 660,900 barrels of oil equivalent per day (boepd), down 2.5% year-on-year.

• Lyft Inc: The company posted an adjusted quarterly profit three months ahead of target on Tuesday, seizing on a leaner cost structure as rides rebounded, but it warned of ongoing driver shortages and the spread of the Delta coronavirus variant. The company reported adjusted earnings before interest, taxes, depreciation and amortization for the first time in its nine-year history, and said it would remain profitable on that basis going forward. The company slashed around $2.5 billion from its expenses in 2020, including through widespread layoffs. Second-quarter revenue came in at $765 million, above analyst estimates for $697 million. Ridership grew by more than 3.6 million from the first three months of the year to more than 17 million riders during the second quarter - a time when U.S. cities lifted pandemic-related restrictions and more Americans returned to the road.

• Marathon Petroleum Corp: The U.S. oil refiner posted its first adjusted quarterly profit since the pandemic, boosted by a rebound in fuel demand. Total throughput, the amount of crude processed, rose to 2.9 million barrels per day (bpd) from 2.6 million bpd in the first quarter, while refining and marketing margins rose 23% to $12.45 per barrel in the second quarter. Adjusted net earnings for the largest U.S. oil refiner stood at $437 million, or 67 cents per share, for the three months ended June 30, compared with a loss of $132 million, or 20 cents per share, in the first quarter.

• Match Group Inc: The company said on Tuesday the COVID-19 recovery in some of its "important" Asian markets was lagging behind the United States and Europe, sending its shares 4% lower after market despite a forecast for quarterly revenue above estimates. Match Group said it expects third-quarter revenue between $790 million and $805 million, above estimates of $766.4 million, as more users pay for its dating apps to connect with others both online and offline after pandemic curbs eased. In the second quarter, Match Group added 15 million payers, a recently introduced metric that includes all users who contributed to its revenue. Revenue per payer rose 10%. The Hinge and OkCupid owner's total revenue rose 27% to $707.8 million in the quarter ended June 30, beating estimates of about $691.1 million.

• Occidental Petroleum Corp & Devon Energy Corp: The U.S. oil and gas producers blew past Wall Street's profit expectations on Tuesday, as easing travel curbs and rising vaccinations boosted fuel demand and crude prices. Occidental said its total production from continuing operations rose to 1.2 million barrels of oil equivalent per day (boepd), 7.7% higher sequentially. The company's average price for worldwide crude oil rose to $60.05 per barrel from $55.65 barrel in the prior quarter. The oil and gas producer's adjusted profit attributable to common stockholders stood at $311 million, or 32 cents per share, for the three months ended June 30. Analysts had estimated 3 cents per share, according to estimates. Devon posted core earnings of 60 cents per share, beating an estimate of 52 cents per share. Devon also announced a fixed-plus-variable dividend of 49 cents per share, 44% higher than last quarter's payout, underscoring the energy industry's focus on shareholder returns over spending to expand production.

• Prudential Financial Inc: The U.S. insurer beat analysts' estimates for quarterly adjusted profit on Tuesday, as strong performance at the company's life and annuity units cushioned against weakness in its investment business. PGIM, Prudential's global investment management business, reported a 2.8% fall in adjusted operating income to $315 million in the second quarter ended June 30, while assets under management rose 8% to a record of $1.5 trillion. The company's U.S. individual life insurance segment posted an adjusted operating profit of $146 million, compared with a loss of $64 million a year earlier. Adjusted operating income at its annuity segment soared nearly 90% to $472 million. Total after-tax adjusted operating income rose to $1.51 billion, or $3.79 per share, from $740 million, or $1.85 per share, a year earlier.

• Sony Group Corp: The company raised its earnings outlook after a record first-quarter operating profit helped by pandemic stay-at-home demand for PlayStation 5 consoles, TVs, music and movies. Operating profit for the quarter ended June 30 rose to 280.1 billion yen from 221.7 billion yen a year earlier, topping the 207.96 billion expected by 10 analysts, data showed. It raised its profit forecast for the year through March 2022 to 980 billion yen from 930 billion, bringing it closer to the 1 billion yen average estimate from 25 analysts. In its financial division, Sony posted a 16.8 billion yen one-time loss resulting from an unauthorised fund transfer at a Bermuda subsidiary, SA Reinsurance, in May.

• Toyota Motor Corp & Honda Motor Co Ltd: Toyota posted a record quarterly profit and Honda raised its annual profit estimate as pandemic-hit sales rebounded, but the automakers saw no end in sight to the global chip shortage. Toyota stuck by its forecast made in May for an operating profit of 2.5 trillion yen for the current fiscal year, trailing an average forecast for a 2.88 trillion yen profit, according to analysts. Honda swung to a first-quarter operating profit that was double analyst expectations and raised its full-year forecast by 18% to an operating profit of 780 billion yen in the current financial year based on strong sales. Toyota's operating profit soared to 997.49 billion yen for the three months ended June 30 from the pandemic-hit first quarter of last year, and was higher than analysts' average estimate of 752 billion yen. Toyota maintained its forecast for 8.7 million vehicle sales in the current fiscal year, up from 7.65 million last year. Honda, Japan's No.2 automaker by sales, lowered its full-year auto sales forecast to 4.85 million vehicles from 5 million previously due to the chip shortage.

• XP Inc: The Brazilian broker reported a jump in adjusted second-quarter profit on Tuesday, as a rebound in economic growth from last year's pandemic-led slump helped attract more customers and boosted its assets under custody. The brokerage added about 3.14 million active customers in the quarter, a 33% jump from a year earlier, while assets under custody surged 88% to 817 billion reais. XP has continued to attract Brazilians from traditional banks who are seeking high returns as the country's benchmark rate remains in single digits, at 4.25%. The company's adjusted net income soared 83% to 1.03 billion reais in the quarter. Chief Executive Thiago Maffra, as part of his first result announcement as the top boss, said the company had initiatives in place to launch new services and take advantage of Brazil's fast growing financial sector.

Deals Of The Day

• Callon Petroleum Co: The oil and gas exploration company said it would buy assets in the Delaware Basin from Primexx Energy Partners for $788 million, as it seeks to expand its footprint in the westernmost shale field within the Permian. Callon will pay privately held Primexx $440 million in cash and issue about 9.2 million of its shares. The company's stock closed at $37.91 on Tuesday. It expects the deal to generate about 30% more free cash flow from the third quarter to the end of 2023, Callon said in a statement. Callon is slated to buy leasehold interests as well as the related oil, gas and infrastructure assets of Primexx and its affiliates, which will increase its position in the Delaware Basin to 11,000 net acres.

• Lumen Technologies Inc & Apollo Global Management Inc: Lumen said on Tuesday it would sell some of its telecom assets to Apollo in a deal valued at $7.5 billion. Apollo Funds will acquire some of Lumen's business in 20 U.S. states in a deal that is expected close in the second half of 2022. Lumen will retain its incumbent local exchange carrier assets in 16 states, as well as its national fiber routes and competitive local exchange carrier) networks, the company said. "Our investment will help accelerate the upgrade to fiber optic technologies, ... bring faster and more reliable internet service to many rural markets traditionally underserved by broadband providers," said Aaron Sobel, private equity partner at Apollo.

Moves

• Credit Suisse Group AG: The Swiss bank has hired Brett Ryman from Australian mid-tier lender Bank of Queensland as a director in its investment banking and capital markets group in Sydney, according to an internal memo seen by Reuters. Ryman, who led corporate development, including mergers and acquisitions, for BOQ and earlier was an investment banker with Citigroup in Sydney and Hong Kong, will join Credit Suisse Financial Institutions Group (FIG), the memo showed. He will start his role in November, working alongside Anthony Rose, Credit Suisse's FIG head in Australia.

In Other News

• Amazon.com Inc: The e-commerce giant started to offer its Brazilian Prime subscribers free one-day delivery in 50 cities, amid fierce market competition in Latin America's largest economy. The Amazon initiative, which already exists for Prime subscribers in markets across the United States, Canada and the United Kingdom, arrives two years after Prime was first launched in Brazil. Previously, Prime users in Brazil had access to free two-day shipping with the option of paying extra for one-day delivery. E-commerce competition is steep in Brazil, home to an estimated 105 million e-commerce shoppers. Amazon ranked fourth in the country in terms of monthly website visits, trailing behind regional and domestic competitors MercadoLibre, Americanas and SoftBank-backed OLX, according to a ranking compiled by payments company Ebanx.

• Apple Inc & Affirm Holdings Inc: Apple and Affirm's PayBright are planning to launch a "buy now, pay later" program for Apple device purchases in Canada, Bloomberg News reported, allowing people to pay for iPhone, Mac, and iPad over 12 to 24 months. Apple and Affirm plan to debut the program this month at Apple stores in Canada, Bloomberg reported, citing a message sent to Apple retail employees in the region. The service will let iPhone, Mac and iPad buyers in Canada pay for purchases over 12 or 24 months instead of in-full at the time of the transaction, according to the Bloomberg report. Apple did not immediately respond to a Reuters request for comment and Affirm declined to comment. Separately, Japan's Nikkei newspaper said Apple is working with more Chinese suppliers to produce its latest iPhones, as a tech feud stemming from a trade war with the United States prompts Beijing to strengthen domestic firms.

• AstraZeneca Plc, Pfizer Inc & Sinovac Biotech Ltd: Sinovac's COVID-19 vaccine was 58.5% effective in preventing symptomatic illness among millions of Chileans who received it between February and July, the Chilean health authorities said on Tuesday, while Pfizer's COVID-19 shot was 87.7% effective and AstraZeneca's was 68.7% effective. The data came in the latest "real world" data published by the Chilean authorities into the effectiveness among its population of a raft of COVID-19 vaccines. Chile began one of the world's fastest inoculation campaigns against COVID-19 in December, having now fully vaccinated more than 60% of its population, predominantly with Sinovac's CoronaVac. That vaccine was 86% effective in preventing hospitalization, 89.7% effective in preventing admission to intensive care units and 86% effective in preventing deaths within the population between February and July, health official Dr Rafael Araos said in a press conference on Tuesday.

• Boeing Co: Brazil's Gol Linhas Aéreas Inteligentes has signed an agreement to buy 28 Boeing 737 MAX-8 aircraft that will replace 23 of its 737-800 NGs through the end of 2022, the airline said in a securities filing on Tuesday. Gol said the new planes will reduce unit costs by 8% next year and are expected to generate about $200 million in cash equity gains. Gol is Boeing's main South American customer and one of the largest customers for the 737 aircraft in the world, the airline said. "Gol has done a remarkable job of managing the impacts from the COVID-19 pandemic and is well-positioned to return to its growth trajectory," said Ricardo Cavero, Boeing vice president of sales for Latin America and the Caribbean.

• CVR Energy Inc: The Carl Icahn-owned company is pausing plans to produce around 7,000 barrels per day of renewable diesel at its Wynnewood, Oklahoma, refinery due to high feedstock prices, it said on Tuesday. "Renewable diesel feedstock prices have increased considerably, particularly for refined, bleached and deodorized soybean oil to a level where the economics do not make sense for us to complete the conversion at this time," said CVR Chief Executive David Lamp. He attributed the spike in feedstocks in part to the startup of new renewable diesel plants in the United States. CVR is planning to build a pre-treatment unit, expected to be complete in the third quarter of 2022, to be used for bean oil when the plant does start producing renewable fuels.

• Lazard Ltd: The investment bank is raising pay for its junior financial-advisory analysts in the United States, matching the salaries at some other major U.S. banks, a spokesperson for the company confirmed on Tuesday. Lazard's first-year analysts will be paid at least $100,000, while second- and third-year analysts will earn $110,000. Investment banks have raised the pay for newer associates this summer to take the edge off heavy workloads in a year of unprecedented deal-making. Citigroup, Morgan Stanley, UBS Group and Deutsche Bank have increased pay for their first-year analysts by about $15,000 to roughly $100,000.

• Lockheed Martin Corp: The Security and aerospace company said on Tuesday it would cut its pension liabilities by about $4.9 billion and revised down its forecast for the full-year due to actuarial losses it expects to incur. The U.S. weapons maker has purchased group annuity contracts from Athene and will transfer pension obligations and related plan assets for about 18,000 U.S. retirees and beneficiaries to the retirement services provider. Lockheed will take a non-cash charge related to actuarial losses of about $1.7 billion in the third quarter. The contracts were purchased using assets from Lockheed's master retirement trust and no additional funding was used, said the company. Separately, the company said on Tuesday it is searching for a new chief financial officer after Kenneth Possenriede resigned from the post due to personal reasons.

• Piedmont Lithium Inc: The company expects to receive state regulatory approval for its proposed North Carolina lithium project and have it fully funded by mid-2022, its chief executive said on Tuesday. Piedmont's project would be among the largest U.S. lithium mines and a key domestic source of the white metal for electric vehicle batteries. But some local North Carolina officials have voiced concerns about its environmental impact and said they may block or delay it. To fund the $840 million project, Phillips said Piedmont expects to rely on a U.S. Department of Energy loan and an outside investor who could take a stake in up to half of the project "and hopefully pay a big price for that. If they don't, we won't bring in a partner."

• Pfizer Inc & BioNTech SE: The chair of Thailand's Thonburi Healthcare Group (THG) said on Wednesday that a deal to import 20 million doses of the Pfizer-BioNTech COVID-19 vaccine was unlikely to happen, despite his earlier claims that a deal was close. Thailand is battling its biggest COVID-19 outbreak yet, and has been racing to secure vaccines. Last month, THG Chairman Boon Vanasin said talks to clinch a deal with BioNTech was nearing conclusion, but both Pfizer and BioNTench said they were not in talks with THG. "Our problem is that we are unable to import it because it has to come through a government agency," Boon said during a televised interview with the MCOT television station. Separately, the U.S. Food and Drug Administration is aiming to give full approval for the Pfizer COVID vaccine by early September, the New York Times reported on Tuesday, citing people involved in the effort.

• Willis Towers Watson Plc: The insurance broker said on Tuesday it is weighing strategic alternatives for its reinsurance unit, Willis Re, days after a planned sale to rival Arthur J. Gallagher fell through. Willis and broker Aon had planned to merge to create the world's largest insurance broker, topping current leader Marsh & McLennan. As part of the merger, European regulators demanded the sale of Willis Re to preserve competition, and Gallagher had agreed to buy it and other assets for about $3.6 billion. Opposition from the U.S. Department of Justice, however, caused Aon and Willis Towers Watson to walk away from the merger last week, which scotched the concession sales.

FOCUS

Chesapeake Energy’s future muddied by executive departures, strategy shifts

When U.S. oil and gas producer Chesapeake Energy emerged from bankruptcy in February, it touted to investors a clean balance sheet, a new board of directors and a promise to restrain spending. Since then, the company has endured a senior management shakeup and, according to two sources familiar with the matter, its interim CEO has told employees that the company is eyeing acquisitions that could help double its size.

ANALYSTS' RECOMMENDATION

• Akamai Technologies Inc: JPMorgan raises target price to $128 from $120, citing the company’s strong growth in security business.

• ConocoPhillips: Truist Securities raises target price to $78 from $77, after the company suggested it would continue to generate strong shareholder returns consisting of solid stock buybacks and dividends along with continued debt repayment.

• Eli Lilly and Co: Mizuho raises target price to $279 from $250, factoring the company’s overall solid second-quarter performance.

• Lyft Inc: Jefferies raises target price to $78 from $75, citing the company’s second-quarter revenue beat on good demand recovery.

• Marriott International Inc: JPMorgan raises target price to $149 from $140, following this company’s solid second-quarter operating results.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0815 (approx.) ADP national employment for July: Expected 695,000; Prior 692,000

0945 Markit Composite PMI final for July: Prior 59.7

0945 Markit Services PMI final for July: Prior 59.8

1000 ISM N-Manufacturing PMI for July: Expected 60.5; Prior 60.1

1000 ISM N-Manufacturing Business Activity for July: Expected 60.6; Prior 60.4

1000 ISM N-Manufacturing Employment Index for July: Prior 49.3

1000 ISM N-Manufacturing New Orders Index for July: Prior 62.1

1000 ISM N-Manufacturing Price Paid Index for July: Prior 79.5

COMPANIES REPORTING RESULTS

Albemarle Corp: Expected Q2 earnings of 84 cents per share

Allstate Corp: Expected Q2 earnings of $3.17 per share

ANSYS Inc: Expected Q2 earnings of $1.56 per share

Atmos Energy Corp: Expected Q3 earnings of 72 cents per share

Booking Holdings Inc: Expected Q2 loss of $2.04 per share

DXC Technology Co: Expected Q1 earnings of 74 cents per share

Electronic Arts Inc: Expected Q1 earnings of 67 cents per share

EOG Resources Inc: Expected Q2 earnings of $1.56 per share

ETSY Inc: Expected Q2 earnings of 63 cents per share

Fleetcor Technologies Inc: Expected Q2 earnings of $2.94 per share

Fox Corp: Expected Q4 earnings of 58 cents per share

General Motors Co: Expected Q2 earnings of $2.23 per share

Lincoln National Corp: Expected Q2 earnings of $2.42 per share

Marathon Oil Corp: Expected Q2 earnings of 18 cents per share

Mckesson Corp: Expected Q1 earnings of $4.15 per share

MetLife Inc: Expected Q2 earnings of $1.62 per share

MGM Resorts International: Expected Q2 loss of 30 cents per share

Qorvo Inc: Expected Q1 earnings of $2.45 per share

Royal Caribbean Cruises Ltd: Expected Q2 loss of $4.39 per share

Trimble Inc: Expected Q2 earnings of 60 cents per share

Vulcan Materials Co: Expected Q2 earnings of $1.66 per share

Western Digital Corp: Expected Q4 earnings of $1.51 per share

Western Union Co: Expected Q2 earnings of 48 cents per share

Wynn Resorts Ltd: Expected Q2 loss of $1.61 per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0730 Quaker Chemical Corp: Q2 earnings conference call

0800 Assurant Inc: Q2 earnings conference call

0800 CVS Health Corp: Q2 earnings conference call

0800 New York Times Co: Q2 earnings conference call

0800 SiteOne Landscape Supply Inc: Q2 earnings conference call

0800 Unum Group: Q2 earnings conference call

0830 AmerisourceBergen Corp: Q3 earnings conference call

0830 Apollo Global Management Inc: Q2 earnings conference call

0830 Avis Budget Group Inc: Q2 earnings conference call

0830 CDW Corp: Q2 earnings conference call

0830 Match Group Inc: Q2 earnings conference call

0830 Playtika Holding Corp: Q2 earnings conference call

0830 TTEC Holdings Inc: Q2 earnings conference call

0830 Verisk Analytics Inc: Q2 earnings conference call

0830 Virtu Financial Inc: Q2 earnings conference call

0900 Borgwarner Inc: Q2 earnings conference call

0900 Clean Harbors Inc: Q2 earnings conference call

0900 FMC Corp: Q2 earnings conference call

0900 Jones Lang LaSalle Inc: Q2 earnings conference call

0900 Kraft Heinz Co: Q2 earnings conference call

0900 Life Storage Inc: Q2 earnings conference call

0900 Nexstar Media Group Inc: Q2 earnings conference call

0900 Scotts Miracle-Gro Co: Q3 earnings conference call

0900 United Therapeutics Corp: Q2 earnings conference call

0930 Charles River Laboratories International Inc: Q2 earnings conference call

0930 Emerson Electric Co: Q3 earnings conference call

0930 Markel Corp: Q2 earnings conference call

0930 MPLX LP: Q2 earnings conference call

0930 Progressive Corp: Q2 earnings conference call

0930 Spirit Realty Capital Inc: Q2 earnings conference call

1000 Curtiss-Wright Corp: Q2 earnings conference call

1000 Exelon Corp: Q2 earnings conference call

1000 General Motors Co: Q2 earnings conference call

1000 Howmet Aerospace Inc: Q2 earnings conference call

1000 Hyatt Hotels Corp: Q2 earnings conference call

1000 New York Community Bancorp Inc: Shareholders Meeting

1000 Reinsurance Group of America Inc: Q2 earnings conference call

1000 Royal Caribbean Cruises Ltd: Q2 earnings conference call

1100 Devon Energy Corp: Q2 earnings conference call

1100 Entergy Corp: Q2 earnings conference call

1100 Healthpeak Properties Inc: Q2 earnings conference call

1100 Host Hotels & Resorts Inc: Q2 earnings conference call

1100 Marathon Petroleum Corp: Q2 earnings conference call

1100 NiSource Inc: Q2 earnings conference call

1100 ONEOK Inc: Q2 earnings conference call

1100 Prudential Financial Inc: Q2 earnings conference call

1100 Spirit AeroSystems Holdings Inc: Q2 earnings conference call

1100 Vulcan Materials Co: Q2 earnings conference call

1130 American Financial Group Inc: Q2 earnings conference call

1130 eXp World Holdings Inc: Q2 earnings conference call

1130 Ionis Pharmaceuticals Inc: Q2 earnings conference call

1200 Fidelity National Financial Inc: Q2 earnings conference call

1200 Public Storage: Q2 earnings conference call

1230 Nuveen Amt-Free Quality Municipal Income Fund: Annual Shareholders Meeting

1300 Occidental Petroleum Corp: Q2 earnings conference call

1400 Douglas Emmett Inc: Q2 earnings conference call

1400 Xilinx Inc: Annual Shareholders Meeting

1615 Wynn Resorts Ltd: Q2 earnings conference call

1630 10X Genomics Inc: Q2 earnings conference call

1630 Adaptive Biotechnologies Corp: Q2 earnings conference call

1630 Booking Holdings Inc: Q2 earnings conference call

1630 Fox Corp: Q4 earnings conference call

1630 Globus Medical Inc: Q2 earnings conference call

1630 HubSpot Inc: Q2 earnings conference call

1630 Leslie's Inc: Q3 earnings conference call

1630 Mckesson Corp: Q1 earnings conference call

1630 Nevro Corp: Q2 earnings conference call

1630 Rapid7 Inc: Q2 earnings conference call

1630 Revolve Group Inc: Q2 earnings conference call

1630 Sarepta Therapeutics Inc: Q2 earnings conference call

1630 STAAR Surgical Co: Q2 earnings conference call

1630 Tandem Diabetes Care Inc: Q2 earnings conference call

1630 Uber Technologies Inc: Q2 earnings conference call

1630 Western Digital Corp: Q4 earnings conference call

1630 Western Union Co: Q2 earnings conference call

1700 ADT Inc: Q2 earnings conference call

1700 Amdocs Ltd: Q3 earnings conference call

1700 Bright Horizons Family Solutions Inc: Q2 earnings conference call

1700 Ceridian HCM Holding Inc: Q2 earnings conference call

1700 DXC Technology Co: Q1 earnings conference call

1700 Electronic Arts Inc: Q1 earnings conference call

1700 ETSY Inc: Q2 earnings conference call

1700 Fastly Inc: Q2 earnings conference call

1700 Fate Therapeutics Inc: Q2 earnings conference call

1700 Fleetcor Technologies Inc: Q2 earnings conference call

1700 GoDaddy Inc: Q2 earnings conference call

1700 MGM Resorts International: Q2 earnings conference call

1700 Ortho Clinical Diagnostics Holdings PLC: Q2 earnings conference call

1700 Qorvo Inc: Q1 earnings conference call

1700 Roku Inc: Q2 earnings conference call

1700 Trimble Inc: Q2 earnings conference call

EX-DIVIDENDS

Armstrong World Industries Inc: Amount $0.21

Crown Holdings Inc: Amount $0.20

Idacorp Inc: Amount $0.71

Valero Energy Corp: Amount $0.98

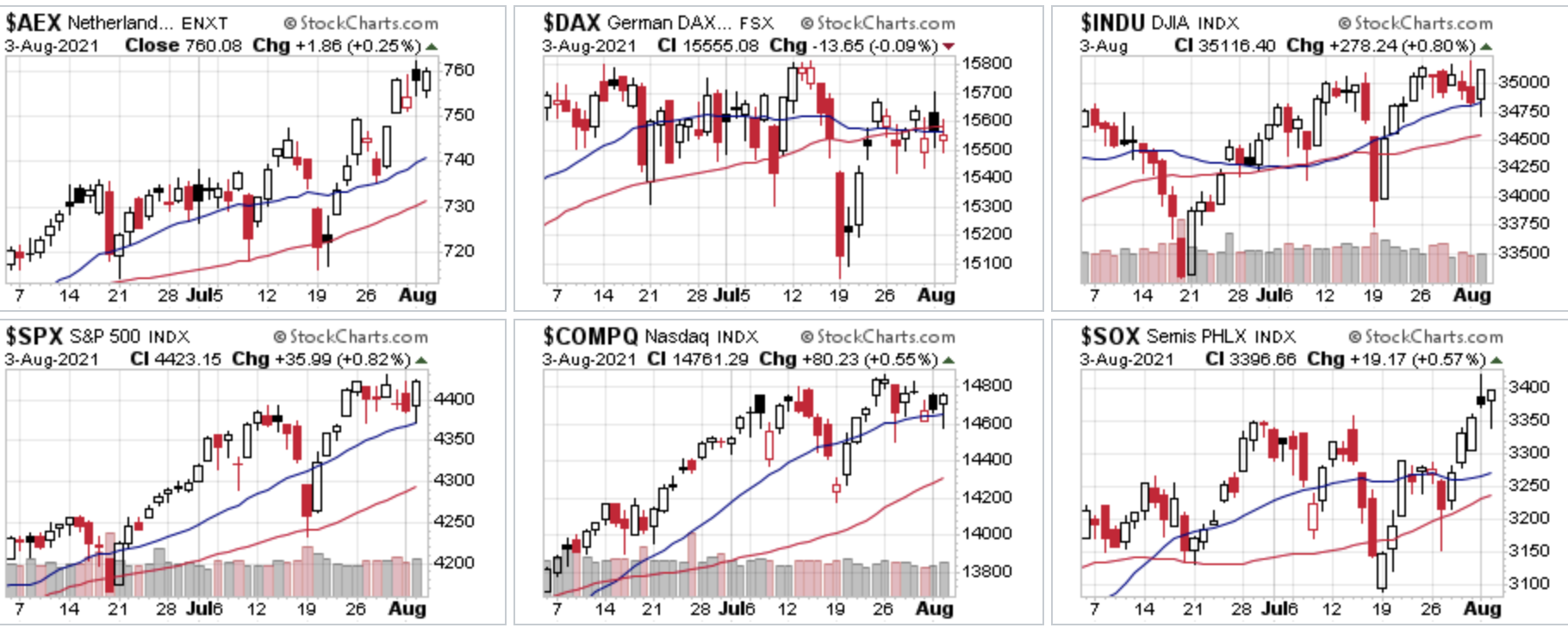

Records bij de SP 500, de AEX en CAC40

De sessie begon zwak maar richting het slot kwam er een rally op gang met net een record voor de SP 500 en bijna records voor de Dow Jones en de Nasdaq. In Europa zetten de AEX en de CAC 40 wel weer een record neer. Wel zien we nu behoorlijk wat weerstand op Wall Street, de AEX en de CAC zitten in een vrije zone maar het blijft opletten uiteraard.

Update 4 augustus:

Vooral de AEX en de CAC 40 deden het goed dinsdag, wel eerst een daling bij de AEX door dat ASML even €12 lager begon maar dat werd helemaal weer ingehaald richting het slot. De AEX wist bijna 2 punten hoger te sluiten. De CAC 40 bleef in de plus de gehele sessie, de index zet dan ook weer een record neer. De hoogste slotstand bij de AEX zien we nu op 760 punten, het recordslot bij de CAC 40 komt uit op 6724 punten. De DAX kan weer niet volgen en sluit de sessie af met een klein verlies.

Op Wall Street een record voor de S&P 500, de Dow Jones en de Nasdaq komen er weer heel dicht bij nu. De Dow moest eerst even wat inleveren maar draaide met bijna 400 punten vanaf de bodem om zo net onder de hoogste stand ooit te sluiten. De S&P 500 komt na een winst van 36 punten exact op hetzelfde punt uit als 26 juli. Het scheelt een fractie en we kunnen nu wachten op een nieuw record vandaag. Bij de andere indices kunnen de records in ieder geval wel getest worden vandaag maar daar wacht wel de nodige weerstand.

De sterke bedrijfsresultaten blijven het optimisme bij beleggers aanwakkeren en de kleinste DIP (zoals gisteren) wordt opgekocht. Fund managers verwachten dat de stimulering door centrale banken en economische groeicijfers de aandelenkoersen verder kunnen opstuwen. De bedrijfs resultaten vallen doorgaans hoger uit dan het gemiddelde verwachting van de analisten, maar voor het tweede kwartaal op rij zijn ze nu hoger dan de hoogste ramingen van analisten en dat komt niet vaak voor. Aan de andere kant is het ook niet zo dat de bomen tot in de hemel gaan groeien en zeker niet met de waarderingen ofwel verwachtingen die we nu zien.

Tegenover de positieve stemming bij beleggers staan er ook de nodige zorgen over de mogelijke economische impact van de deltavariant van het virus die nu overal opduikt en zorgen rondom de regelgeving in China.

Dinsdag wat winst genomen, JULI sluiten we goed af:

Meedoen met US Markets Trading kan uiteraard door lid te worden, dinsdag heb ik winst genomen op de posities die open stonden zodat het resultaat er goed uitziet voor de maand juli. Ik blijf rustig en hou me aan het plan voor de komende periode, rustig naar kansen zoeken en waar het kan wat posities opnemen. Als u de signalen wilt ontvangen wordt dan vandaag nog lid via de nieuwe aanbieding voor €35 die loopt tot 1 oktober ...

Hieronder ziet u het resultaat voor de maand JULI en dat is nu voor de 8e maand op rij dat we winst behalen via alle signaaldiensten. Bij Guy Trading kijk ik ook naar wat aandelen waar er wat mee kan worden gedaan. Schrijf u dus op tijd in, ik zal snel weer een momentum kiezen om in te stappen met een paar posities op indexen.

De nieuwe aanbieding loopt tot 1 OKTOBER en dat voor €35 (Polleke Trading €45 en COMBI-Trading voor €75). Inschrijven kan via de link https://www.usmarkets.nl/tradershop

Hieronder het resultaat van deze maand (JULI) en dit jaar (2021):

Marktoverzicht:

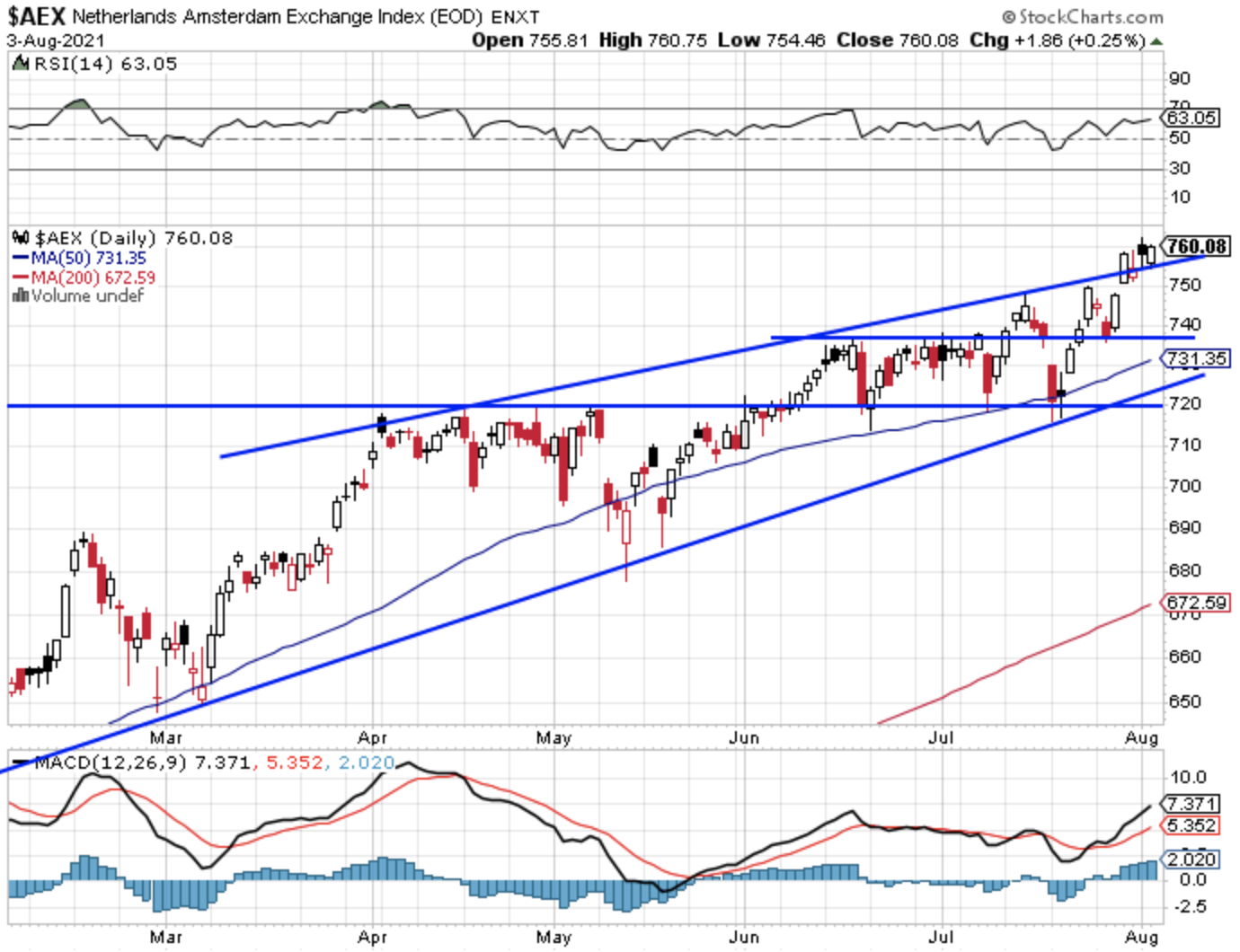

Technische conditie AEX:

De AEX zet opnieuw een hogere top neer met een recordslot op 760 punten. Het absolute record bij de AEX werd neergezet op 762,19 punten, de index sluit dinsdag wel weer 2 punten hoger. Zo zien we dat de AEX rondom die toplijn blijft hangen en het blijft het de vraag of de index verder door kan breken. Veel zal afhangen van hoe de andere markten zoals Wall Street zich zullen gedragen de komende dagen.

Steun nu eerst de 749-750 punten met later de zone 736-738 punten als steun want we zien daar de oude toppen uitkomen. Later steun net onder de 730 punten, daarna de reeks recente bodems tussen de 717 en de 720 punten.

Weerstand zien we nu rond de topzone 760-762 punten, bij een uitbraak kansen richting de 768 en de 775 punten maar of het zal lukken om tot daar te geraken op de korte termijn moeten we afwachten.

Technische conditie DAX:

De DAX blijft spelen met de belangrijke grens 15.500-15.550 punten en deze zone blijft als een soort magneet werken in beide richtingen. De index moest er gisteren opnieuw even naartoe maar we zien richting het slot dat de DAX er ook deze keer net boven weet te sluiten. De steun blijft daardoor nog altijd de 15.500-15.550 punten zone, later zien we de 15.400 en de 15.300 punten als steun.

Weerstand wordt nu de 15.650-15.700 punten met later de topzone rond de 15.800 punten. Bij de DAX ziet alles er wel wat zwakker uit dan bij andere indices, we zien een soort topvorming maar in deze markt is er niks zeker. De indicatoren liggen er ook maar matig bij.

S&P 500 analyse:

De S&P 500 moet na een mindere start even wat inleveren maar door de rally later op de dag sluipt de index omhoog tot net een nieuw record bij de topzone 4420-4425 punten. Op de chart zien we daar in ieder geval de weerstandslijn die index voorlopig tegen kan houden de komende sessies, we zien nogal wat toppen uitkomen rondom die 4420-4425 punten.

Steun zien we nu eerst rond de 4380 punten, later komen de 4355 en de 4325 punten in beeld als steun. Verder zien we dat de oplopende steunlijn samen met het 50-daags gemiddelde nu rond de 4285-4290 punten uitkomen, later nog de 4250 punten als steun door de vorige toppen die we zien in mei en juni.

Weerstand zien we rond de topzone die rond de 4420-4425 punten, later komt de 4450 punten als weerstand in beeld maar dan alleen bij een snelle uitbraak tot boven de zware weerstand.

Analyse Nasdaq:

De Nasdaq herpakt zich richting de topzone waar we nog altijd een dubbele top zien uitkomen. De kans is groot dat de index deze topzone zal gaan testen, we zijn er bijna nu. De topzone rond de 14.800-14.825 punten blijft de eerste en redelijk zware weerstand. Bij een uitbraak mocht die er komen zien we rond de 14.900 en de 15.000 punten weerstand.

Steun nu eerst de 14.600 punten, later de 14.400 en de oude toppen rond de 14.210 punten. Het 50-daags gemiddelde zien we nu rond de 14.310 punten uitkomen.

Euro, olie en goud:

De euro zien we nu rond de 1,187 dollar, de prijs van een vat Brent olie komt uit op 72,4 dollar terwijl een troy ounce goud nu op 1816 dollar staat.

De LIVEBLOG en Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

Met vriendelijke groet,

Guy Boscart