Liveblog Archief donderdag 5 augustus 2021

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Eerste Aanvragen Werkloosheidsvergoeding | Actueel: 385K Verwacht: 384K Vorige: 399K |

Markt snapshot Wall Street 5 augustus

TOP NEWS

• Moderna says its COVID-19 shot remains 93% effective 4-6 months after second dose

Moderna said its COVID-19 shot was about 93% effective four to six months after the second dose, showing hardly any change from the 94% efficacy reported in its original clinical trial.

• Cigna profit falls 16.4% on higher medical costs

Cigna reported a 16.4% fall in second-quarter profit, hurt by higher medical costs, and said it expects a negative earnings impact from COVID-19 of about $2.50 per share for 2021.

• Regeneron quarterly profit surges on COVID-19 antibody cocktail demand

Regeneron Pharmaceuticals reported a more than tripling of its quarterly profit, buoyed by robust demand for its COVID-19 antibody cocktail.

• Biden to set target for 50% EVs by 2030; industry backs goal

U.S. President Joe Biden will sign an executive order on Thursday setting a target to make half of all new vehicles sold in 2030 zero-emissions vehicles and propose new vehicle emissions rules to cut pollution through 2026, the White House said.

• Key Fed official sees rates liftoff in 2023 as policy debate heats up

The contours of debate within the U.S. central bank over when to dial back support for the economy burst into the open on Wednesday as a key architect of the Federal Reserve's new policy strategy said he feels the conditions for raising interest rates could be met by the end of 2022.

BEFORE THE BELLU.S. stock index futures rose ahead of data which will likely show fewer Americans filed for unemployment benefits last week, while investors also looked to a busy day of quarterly earnings reports. European stocks hit record highs, helped by strong earnings from Novo Nordisk and Siemens while Chinese shares were down, weighed by investors dumping companies that faced criticism in state media and could also portend more government crackdowns. Gold prices were on the back foot as an uptick in the dollar raised early tapering bets and dented demand for the safe-haven metal. Oil prices fell as more countries imposed fresh movement restrictions to counter a surge in COVID-19 cases, though Middle East tensions offered support.

STOCKS TO WATCH

Results• Aptiv Plc: The company raised its full-year sales and adjusted profit forecast, as the auto technology supplier expects to benefit from higher production of trucks and large SUVs loaded with its electronic features. The company raised 2021 net sales outlook to between $16.12 billion and $16.42 billion, from $15.13 billion to $15.73 billion forecast earlier. Aptiv also forecast adjusted net income per share of $3.63 to $3.87, up from its prior outlook of $3.35 per share to $3.85 per share. The company reported net income of $147 million, or 54 cents per share, for the second quarter, compared to a net loss of $369 million, or $1.43 per share, a year earlier when global vehicle production dropped 45%. Net sales rose to $3.81 billion from $1.96 billion.

• Cigna Corp: The health insurer reported a 16.4% fall in second-quarter profit, hurt by higher medical costs, and said it expects a negative earnings impact from COVID-19 of about $2.50 per share for 2021. Cigna raised the full-year forecast for negative earnings impact due to the pandemic from its previous outlook of about $1.25 per share, but stuck to its annual adjusted income from operations target of at least $20.20 per share. The company's medical care ratio, the amount spent on medical claims versus the income from premiums, worsened to 85.4% in the second quarter, from 70.5% a year earlier, compared with an estimate of 81.04%. Cigna said it now expects its medical care ratio for the full year to be between 83.0% and 84.0%, compared with its prior forecast of 81.0% to 82.0%. Net income attributable to shareholders fell to $1.47 billion, or $4.25 per share, in the quarter ended June 30, from $1.75 billion, or $4.73 per share, a year earlier.

• EOG Resources Inc, APA Corp & Marathon Oil Corp: The oil and gas producers topped Wall Street estimate for second-quarter profit on Wednesday, driven by higher crude prices. Marathon also raised its quarterly base dividend by 25% to 5 cents per share, the company's second consecutive increase. Marathon said it is raising the midpoint of its 2021 full-year U.S. oil-equivalent production guidance by 5,000 net barrels of oil equivalent per day (boed) while maintaining its capital expenditure guidance of $1 billion. EOG said its total production in the second quarter rose to 828,000 barrels of oil equivalent per day (boepd) from the previous quarter's 778,900 boepd. Its average crude oil prices in the reported quarter climbed about 14% to $66.12 per barrel sequentially. EOG's adjusted net income stood at $1.73 per share in the quarter ended June 30, beating estimate of $1.56. APA reported a profit of 70 cents per share, above estimates of 57 cents, while Marathon Oil's adjusted profit of 22 cents topped estimate of 18 cents.

• MercadoLibre Inc: The South American e-commerce giant on Wednesday beat analysts' estimates for quarterly revenue, as the region adapts to shopping largely online amid the pandemic. Net revenue for the second quarter ended June 30 jumped 93.9% to $1.70 billion, well above expectation of $1.48 billion. Revenue growth in Brazil and Mexico more than doubled, while in Argentina, where the company is based out of, it was 53%. Net income rose to $68.2 million, or $1.37 per share, from about $56 million, or $1.11 per share, a year earlier.

• Moderna Inc: The company said its COVID-19 shot was about 93% effective four to six months after the second dose, showing hardly any change from the 94% efficacy reported in its original clinical trial. Moderna posted second-quarter sales of $4.4 billion, slightly above an average estimate of $4.2 billion drawn from 10 analysts polled by Refinitiv. Its COVID-19 shot is the firm's first authorized product and sales were just $67 million in the same period last year. The company logged $2.78 billion in net income in the quarter or $6.46 a share, beating expectations of $2.46 billion or $5.96 a share.

• Petroleo Brasileiro SA Petrobras: The company beat second quarter profit estimates on Wednesday, as higher Brent prices, strong natural gas sales and relatively controlled expenses boosted the company's bottom line. It reported a quarterly net income of 42.855 billion reais, up from a loss in the same period last year and well above the Refinitiv consensus estimate of 30.7 billion reais. Earnings before interest, taxes, depreciation and amortization, or EBITDA, came in at 61.94 billion reais, up about 148% from the second quarter of 2020 - which was severely hit by COVID-19 lockdowns - and above the Refinitiv consensus estimate of 51.7 billion reais.

• Regeneron Pharmaceuticals Inc: The company reported a more than tripling of its quarterly profit, buoyed by robust demand for its COVID-19 antibody cocktail. The antibody therapy, REGEN-COV, has been authorized in the United States for treating non-hospitalized COVID-19 patients, and the company has signed supply agreements with the U.S. government worth millions. The company posted U.S. sales of $2.59 billion in the quarter for REGEN-COV, accounting for more than half of its total U.S. net product revenue. Regeneron recorded U.S. REGEN-COV sales of $262.2 million in the first quarter. Net profit rose to $3.1 billion, or $27.97 per share, in the second quarter ended June 30, from $897.3 million, or $7.61 per share, a year earlier.

• Thomson Reuters Corp: The company reported better-than-expected profit and revenue in the second quarter, helped by higher sales across its main divisions, and raised its revenue forecast for the year. Underscoring the upbeat outlook, fuelled by a recovering global economy, the global news and information company said it would buy back up to $1.2 billion of its shares. The parent company of Reuters News said revenues rose 9% to $1.53 billion, compared to expectations of $1.5 billion. Adjusted earnings per share of 48 cents also topped analyst expectations. Operating profit was down 14% to $316 million, reflecting one-time gains in the year-ago quarter.

• Uber Technologies Inc: The ride-hail and food delivery company reported widening losses as it spent more to entice drivers to return to its platform. Uber posted an adjusted $509 million second-quarter loss before interest, taxes, depreciation and amortization, - a metric that excludes one-time costs, including stock-based compensation - widening losses by nearly $150 million from the first quarter. Analysts on average had expected the company to report an adjusted EBITDA loss of around $324.5 million. Gross bookings during the second quarter reached an all-time high of nearly $22 billion, with more passengers returning for trips while food delivery orders also increased. Overall, the company reported second-quarter revenue of $3.9 billion, beating average analyst estimates of $3.75 billion.

• WPP Plc: The world's biggest advertising company has recovered to 2019 business levels a year ahead of plan as clients rush to benefit from a global economic recovery from the pandemic, driving quarterly revenue growth to a record high. The owner of the Ogilvy, Grey and GroupM agencies said underlying net sales surged 19.3% in the second quarter. That boosted the first-half total to 4.90 billion pounds, up 11% year-on-year and up 0.5% on 2019. WPP upgraded its full-year underlying sales forecast to growth of 9-10%, from a mid-single digit percentage previously, with a headline operating margin towards the upper end of its 13.5%-14.0% guidance range.

IPO

• Weber Inc: The company raised about $250 million in its initial public offering, which was less than half the amount it had planned to raise earlier. The grill maker priced its IPO of about 17.9 million shares at $14 a piece, it said in a statement. Weber last month had planned to sell 46.88 million shares at between $15 and $17 each, which would have helped it raise up to $797 million at a valuation of about $5 billion.

In Other News

• Novo Nordisk A/S: The pandemic is pushing more people to seek treatment for obesity, Novo Nordisk's top boss said, referring to strong sales of the newly launched drug, Wegovy, which helped the drugmaker raise its earnings forecast for the full year. Sales of prescriptions drugs to treat obesity have failed to take off in the past due to modest weight-loss effects. But newer drugs are proving to be more effective, prompting people with obesity to opt for treatments. Although Wegovy was launched just six weeks back, prescriptions for the treatment have already reached a similar level to Saxenda, Novo's other obesity drug that was launched in 2015, the company said.

• Pfizer Inc: Britain's competition watchdog is sticking with its view that Pfizer and Flynn Pharma broke the law by charging the country's public health service "unfairly high" prices for an epilepsy drug, after being asked to reassess a previous fine. The drugmakers made use of a loophole so that the capsules, called Epanutin before September 2012, were not subject to price regulation for branded drugs, the Competition and Markets Authority (CMA) found in its provisional review disclosed. In 2016, the CMA fined Pfizer and Flynn roughly 90 million pounds for hiking prices by as much as 2,600% to 67.50 pounds for a 100mg pack.

• Rio Tinto Plc: The GFG Alliance owned by commodities tycoon Sanjeev Gupta has settled disputes with Tata Steel and Rio Tinto, it said as it makes progress in refinancing after its main lender collapsed. Gupta Family Group (GFG) Alliance has been seeking fresh funding to rescue its cash-starved web of businesses in steel, aluminium and energy after supply chain finance company Greensill filed for insolvency in March. The deal with Tata brought to an end proceedings launched against several GFG units including Liberty Speciality Steels, GFG said without providing further details. In 2017 GFG bought Tata's UK speciality steel business for 100 million pounds and its pipe mills for an undisclosed sum. GFG said it had also settled a dispute with global mining group Rio Tinto over the acquisition of the Dunkirk aluminium smelter in 2018.

• Tesla Inc: The company’s chair Robyn Denholm sold more than $22 million worth of shares in the electric-car maker after exercising stock options, according to a filing with the U.S. Securities and Exchange Commission (SEC). Denholm sold 31,250 shares at weighted average prices ranging from $703 to $726.200 in transactions that took place on Aug. 2, according to the filing from Wednesday.

• Williams Companies Inc: The company said on Wednesday it had reached an agreement with Shell Offshore and Chevron USA to provide offshore natural gas gathering and crude oil transportation services for the Whale development project. The agreement also includes Williams to provide onshore natural gas processing services for the Whale development located about 10 miles from the Shell-operated Perdido host facility.

• Yelp Inc: The review website added new features through which businesses can ask for proof of vaccination when customers visit, a measure it has taken as the Delta variant of the coronavirus rapidly spreads in the United States. Users will be able to filter businesses by two new attributes - "proof of vaccination required" and "all staff fully vaccinated" - when searching for local businesses and restaurants.

ANALYSIS

Sanofi's COVID-19 vaccine setback, drug pipeline cast long shadow

Pharmaceutical company Sanofi remains under pressure to launch new drugs and overcome setbacks in the COVID-19 vaccine race, despite a $3.2 billion deal to tighten its grip on promising mRNA technology.

ANALYSTS' RECOMMENDATION

• CVS Health Corp: RBC cuts target price to $97 from $101, citing strong second-quarter results while the company continues to gain momentum with its integrated model and its position as a consumer-oriented healthcare company.

• Emerson Electric Co: Credit Suisse raises target price to $108 from $103, following third-quarter earnings that beat analyst estimates, helped by a strategy to use capital to diversify and accelerate organic sales growth.

• Etsy Inc: Evercore ISI cuts target price to $215 from $240, following mixed second-quarter earnings that were below estimates, as the company struggles to deal with the impact of the COVID-19 pandemic.

• Kraft Heinz Co: JPMorgan cuts target price to $38 from $42, after the company reported second-quarter earnings which saw it miss organic sales estimates, reduce its free cash flow and step-up its inflation outlook for the second half of the year.

• Uber Technologies Inc: Evercore ISI cuts target price to $70 from $74, following mixed second-quarter results that saw the company rolling back driver incentives while its Take Rate was lower than expected.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0730 Challenger layoffs for July: Prior 20,476

0830 (approx.) International trade for June: Expected -$74.1 bln; Prior -$71.2 bln

0830 (approx.) Goods trade balance (R) for June: Prior -$91.21 bln

0830 (approx.) Initial jobless claims: Expected 384,000; Prior 400,000

0830 (approx.) Jobless claims four-week average: Prior 394,500

0830 (approx.) Continued jobless claims: Expected 3.260 mln; Prior 3.269 mln

COMPANIES REPORTING RESULTS

Alliant Energy Corp: Expected Q2 earnings of 56 cents per share

Ameren Corp: Expected Q2 earnings of 78 cents per share

American International Group Inc: Expected Q2 earnings of $1.20 per share

Apache Corp: Expected Q2 earnings of 80 cents per share

Consolidated Edison Inc: Expected Q2 earnings of 62 cents per share

Corteva Inc: Expected Q2 earnings of $1.26 per share

Expedia Group Inc: Expected Q2 loss of 65 cents per share

Huntington Ingalls Industries Inc: Expected Q2 earnings of $2.51 per share

Illumina Inc: Expected Q2 earnings of $1.36 per share

International Flavors & Fragrances Inc: Expected Q2 earnings of $1.49 per share

Iron Mountain Inc: Expected Q2 earnings of 35 cents per share

Kellogg Co: Expected Q2 earnings of $1.03 per share

Monster Beverage Corp: Expected Q2 earnings of 68 cents per share

Motorola Solutions Inc: Expected Q2 earnings of $1.92 per share

News Corp: Expected Q4 earnings of 04 cents per share

Parker-Hannifin Corp: Expected Q4 earnings of $4.33 per share

Pinnacle West Capital Corp: Expected Q2 earnings of $1.65 per share

PPL Corp: Expected Q2 earnings of 24 cents per share

Regency Centers Corp: Expected Q2 earnings of 29 cents per share

Resmed Inc: Expected Q4 earnings of $1.30 per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 ABIOMED Inc: Q1 earnings conference call

0800 Becton Dickinson and Co: Q3 earnings conference call

0800 CenterPoint Energy Inc: Q2 earnings conference call

0800 Change Healthcare Inc: Q1 earnings conference call

0800 Datadog Inc: Q2 earnings conference call

0800 DigitalOcean Holdings Inc: Q2 earnings conference call

0800 Epam Systems Inc: Q2 earnings conference call

0800 Equitable Holdings Inc: Q2 earnings conference call

0800 Evergy Inc: Q2 earnings conference call

0800 Intellia Therapeutics Inc: Q2 earnings conference call

0800 Lemonade Inc: Q2 earnings conference call

0800 Moderna Inc: Q2 earnings conference call

0800 Multiplan Corp: Q2 earnings conference call

0800 New Fortress Energy Inc: Q2 earnings conference call

0800 Vistra Corp: Q2 earnings conference call

0800 Wayfair Inc: Q2 earnings conference call

0800 Yeti Holdings Inc: Q2 earnings conference call

0830 agilon health Inc: Q2 earnings conference call

0830 Allegro Microsystems Inc: Annual Shareholders Meeting

0830 Angi Inc: Q2 earnings conference call

0830 ANSYS Inc: Q2 earnings conference call

0830 Black Knight Inc: Q2 earnings conference call

0830 Cardinal Health Inc: Q4 earnings conference call

0830 Cigna Corp: Q2 earnings conference call

0830 DENTSPLY SIRONA Inc: Q2 earnings conference call

0830 Fiverr International Ltd: Q2 earnings conference call

0830 IAC/Interactivecorp: Q2 earnings conference call

0830 Iron Mountain Inc: Q2 earnings conference call

0830 Q2 Holdings Inc: Q2 earnings conference call

0830 Regeneron Pharmaceuticals Inc: Q2 earnings conference call

0830 Shift4 Payments Inc: Q2 earnings conference call

0830 ViacomCBS Inc: Q2 earnings conference call

0830 Westrock Co: Q3 earnings conference call

0830 Zoetis Inc: Q2 earnings conference call

0900 AES Corp: Q2 earnings conference call

0900 Albemarle Corp: Q2 earnings conference call

0900 Allstate Corp: Q2 earnings conference call

0900 Bio-Techne Corp: Q4 earnings conference call

0900 Builders FirstSource Inc: Q2 earnings conference call

0900 Huntington Ingalls Industries Inc: Q2 earnings conference call

0900 Lamar Advertising Co: Q2 earnings conference call

0900 LHC Group Inc: Q2 earnings conference call

0900 Marathon Oil Corp: Q2 earnings conference call

0900 Maximus Inc: Q3 earnings conference call

0900 MetLife Inc: Q2 earnings conference call

0900 NRG Energy Inc: Q2 earnings conference call

0900 OGE Energy Corp: Q2 earnings conference call

0900 Penn National Gaming Inc: Q2 earnings conference call

0900 Quanta Services Inc: Q2 earnings conference call

0900 Terminix Global Holdings Inc: Q2 earnings conference call

0900 UGI Corp: Q3 earnings conference call

0900 Valvoline Inc: Q3 earnings conference call

0900 Watts Water Technologies Inc: Q2 earnings conference call

0930 Kellogg Co: Q2 earnings conference call

1000 Advanced Drainage Systems Inc: Q1 earnings conference call

1000 Atmos Energy Corp: Q3 earnings conference call

1000 Berry Global Group Inc: Q3 earnings conference call

1000 Choice Hotels International Inc: Q2 earnings conference call

1000 DCP Midstream LP: Q2 earnings conference call

1000 Duke Energy Corp: Q2 earnings conference call

1000 EOG Resources Inc: Q2 earnings conference call

1000 HanesBrands Inc: Q2 earnings conference call

1000 Howard Hughes Corp: Q2 earnings conference call

1000 Lincoln National Corp: Q2 earnings conference call

1000 MGIC Investment Corp: Q2 earnings conference call

1000 Owl Rock Capital Corp: Q2 earnings conference call

1000 Rayonier Inc: Q2 earnings conference call

1000 Wesco International Inc: Q2 earnings conference call

1100 Amedisys Inc: Q2 earnings conference call

1100 Amerco: Q1 earnings conference call

1100 APA Corp (US): Q2 earnings conference call

1100 Ball Corp: Q2 earnings conference call

1100 Cimarex Energy Co: Q2 earnings conference call

1100 Essential Utilities Inc: Q2 earnings conference call

1100 Parker-Hannifin Corp: Q4 earnings conference call

1100 PPL Corp: Q2 earnings conference call

1100 RBC Bearings Inc: Q1 earnings conference call

1100 Targa Resources Corp: Q2 earnings conference call

1200 Pinnacle West Capital Corp: Q2 earnings conference call

1200 Sempra Energy: Q2 earnings conference call

1200 STORE Capital Corp: Q2 earnings conference call

1300 Arrow Electronics Inc: Q2 earnings conference call

1300 Innovative Industrial Properties Inc: Q2 earnings conference call

1400 Mdu Resources Group Inc: Q2 earnings conference call

1630 Air Lease Corp: Q2 earnings conference call

1630 Albertsons Companies Inc: Annual Shareholders Meeting

1630 Arrowhead Pharmaceuticals Inc: Q3 earnings conference call

1630 Brooks Automation Inc: Q3 earnings conference call

1630 Confluent Inc: Q2 earnings conference call

1630 Expedia Group Inc: Q2 earnings conference call

1630 Fox Factory Holding Corp: Q2 earnings conference call

1630 Guardant Health Inc: Q2 earnings conference call

1630 Insulet Corp: Q2 earnings conference call

1630 Natera Inc: Q2 earnings conference call

1630 Novavax Inc: Q2 earnings conference call

1630 Plug Power Inc: Q2 earnings conference call

1630 Redfin Corp: Q2 earnings conference call

1630 Resmed Inc: Q4 earnings conference call

1630 Trupanion Inc: Q2 earnings conference call

1645 Progyny Inc: Q2 earnings conference call

1700 Acceleron Pharma Inc: Q2 earnings conference call

1700 Altair Engineering Inc: Q2 earnings conference call

1700 AMN Healthcare Services Inc: Q2 earnings conference call

1700 Apollo Medical Holdings Inc: Q2 earnings conference call

1700 Appian Corp: Q2 earnings conference call

1700 Avalara Inc: Q2 earnings conference call

1700 Axon Enterprise Inc: Q2 earnings conference call

1700 Beyond Meat Inc: Q2 earnings conference call

1700 Bigcommerce Holdings Inc: Q2 earnings conference call

1700 Blackline Inc: Q2 earnings conference call

1700 Cloudflare Inc: Q2 earnings conference call

1700 Cognex Corp: Q2 earnings conference call

1700 Dropbox Inc: Q2 earnings conference call

1700 Exelixis Inc: Q2 earnings conference call

1700 FireEye Inc: Q2 earnings conference call

1700 Floor & Decor Holdings Inc: Q2 earnings conference call

1700 Hannon Armstrong Sustainable Infrastructure Capital Inc: Q2 earnings conference call

1700 Illumina Inc: Q2 earnings conference call

1700 Monster Beverage Corp: Q2 earnings conference call

1700 Motorola Solutions Inc: Q2 earnings conference call

1700 Mp Materials Corp: Q2 earnings conference call

1700 News Corp: Q4 earnings conference call

1700 Quidel Corp: Q2 earnings conference call

1700 Sunrun Inc: Q2 earnings conference call

1700 Switch Inc: Q2 earnings conference call

1700 Synaptics Inc: Q4 earnings conference call

1700 Teradata Corp: Q2 earnings conference call

1700 TuSimple Holdings Inc: Q2 earnings conference call

1700 Universal Display Corp: Q2 earnings conference call

1700 Virgin Galactic Holdings Inc: Q2 earnings conference call

1700 Zillow Group Inc: Q2 earnings conference call

1700 Zynga Inc: Q2 earnings conference call

1730 Carvana Co: Q2 earnings conference call

1730 Paylocity Holding Corp: Q4 earnings conference call

1800 Procore Technologies Inc: Q2 earnings conference call

EX-DIVIDENDS

Affiliated Managers Group Inc: Amount $0.01

CMS Energy Corp: Amount $0.43

FirstEnergy Corp: Amount $0.39

Howmet Aerospace Inc: Amount $0.02

Intel Corp: Amount $0.34

J B Hunt Transport Services Inc: Amount $0.30

Lamb Weston Holdings Inc: Amount $0.23

New York Community Bancorp Inc: Amount $0.17

Pinnacle Financial Partners Inc: Amount $0.18

Sirius XM Holdings Inc: Amount $0.01

Wells Fargo & Co: Amount $0.20

TA CAC40, S&P, AEX, ASR en Ahold

We gaan naar vijf grafieken kijken. Er zullen drie indices voorbij komen waarvan een op verzoek. Daarnaast heb ik er dan nog twee aandelen bij gepakt, beide uit de AEX. Laten we maar van wal steken.Ik begin deze column met de AEX: De AEX komt vaak voorbij in deze column, dat is geen verrassing.…

Lees verder »Wall Street wat omlaag, AEX weer sterk door ASML

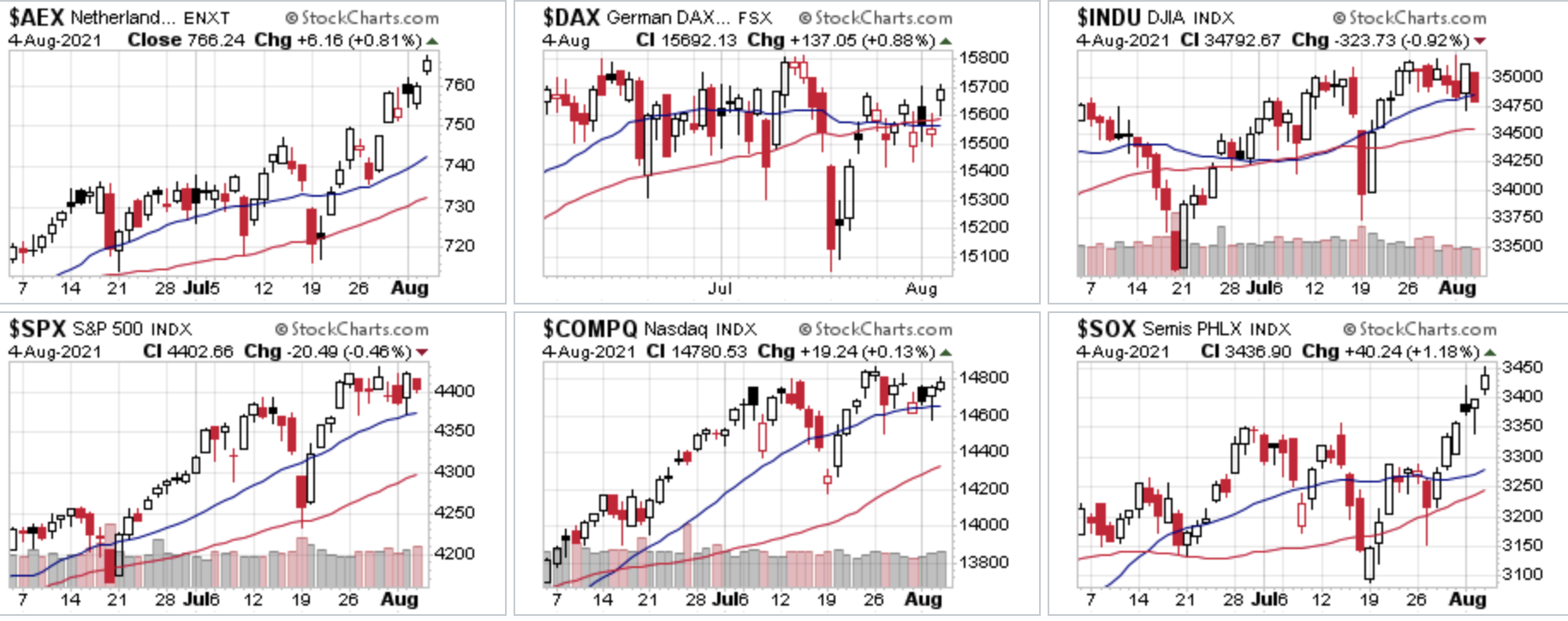

Wall Street verdeeld met de nodige divergenties, Europa lag er sterk bij met de AEX en de CAC 40 die nieuwe records neerzetten. Ook de SOX index zet een nieuw record neer op Wall Street. De Dow Jones en de Dow Transport leveren veel in. De cijfers over de werkgelegenheid vielen tegen en dat was vooral de reden dat de traditionele indices moesten inleveren.

Update 5 augustus:

Vooral de AEX en de CAC 40 vallen op door dat beiden opnieuw een record neerzetten, de DAX wist deze keer goed te volgen maar blijft nog een eind achter hier in Europa. Bij de AEX zien we de lat nu op 767,39 punten uitkomen bij de CAC 40 ligt de lat op 6766,6 punten. De DAX zal eerst tot boven de 15.810 punten moeten geraken om nieuwe records neer te zetten. Europa lag er woensdag dus goed bij en blijft op zoek naar een top die voor een tijdje kan blijven staan. Technisch ligt de DAX er nog maar matig bij, de AEX en de CAC 40 liggen er daarentegen sterk bij.

Op Wall Street zien we een ander verloop woensdag, de Dow Jones verloor zelfs 324 punten, de S&P 500 moest 20 punten inleveren terwijl de Nasdaq met 19 punten winst nog net positief afsluit. Verder zien we dat de SOX verder doorstoomt met een winst van 40 punten en een nieuw record neerzet terwijl de Dow Transport index 342 punten verloor (-2,35%). We zien nogal wat divergentie tussen de indices op Wall Street, dinsdag nog samen richting hun records maar woensdag haken er meteen weer enkele indices af en nam de Dow Jones samen met de Dow Transport de leiding tijdens de daling.

Er waren slechte cijfers over de werkgelegenheid binnen de particuliere sector, er werd slechts ongeveer de helft van de banen toegevoegd dan wat de economen in juli hadden verwacht. Dat maakt de bezorgdheid groter over een vertraging van het economische herstel van de pandemie. Er kwamen in juli 330.000 banen bij in de particuliere sector en dus veel minder dan de 653.000 die er werden verwacht.

Aandeel Robinhood wint 50,41%

Het platform van de meme-aandelen als Gamestop en AMC dat recent zelf op de beurs kwam lijkt nu het nieuwe meme-aandeel bij uitstek te worden. De gratis handels-app zag dat de handel woensdagochtend even stil werd gelegd nadat het aandeel in de vroege handel met meer dan 70% opliep tot 85 dollar ofwel meer dan 120% hoger dan de IPO-debuutprijs van vorige week donderdag. Het aandeel sloot de dag af met 50% winst op 70,39 dollar. De snelle bewegingen zonder dat er nieuws kwam rondom het bedrijf komt door de enorme uitbarsting van interesse via de sociale media kanalen waardoor het de kwalificatie krijgt van een full-meme aandeel. Het gedrag komt via Gamestop en AMC overwaaien en het is juist de dienstverlener bij uitstek zelf die het stokje overneemt.

Maand JULI sluiten we goed af:

Meedoen met US Markets Trading kan uiteraard door lid te worden, dinsdag heb ik winst genomen op de posities die open stonden zodat het resultaat er goed uitziet voor de maand juli. Ik blijf rustig en hou me aan het plan voor de komende periode, rustig naar kansen zoeken en waar het kan wat posities opnemen. Als u de signalen wilt ontvangen wordt dan vandaag nog lid via de nieuwe aanbieding voor €35 die loopt tot 1 oktober ...

Hieronder ziet u het resultaat voor de maand JULI en dat is nu voor de 8e maand op rij dat we winst behalen via alle signaaldiensten. Bij Guy Trading kijk ik ook naar wat aandelen waar er wat mee kan worden gedaan. Schrijf u dus op tijd in, ik zal snel weer een momentum kiezen om in te stappen met een paar posities op indexen.

De nieuwe aanbieding loopt tot 1 OKTOBER en dat voor €35 (Polleke Trading €45 en COMBI-Trading voor €75). Inschrijven kan via de link https://www.usmarkets.nl/tradershop

Hieronder het resultaat van deze maand (JULI) en dit jaar (2021):

Marktoverzicht:

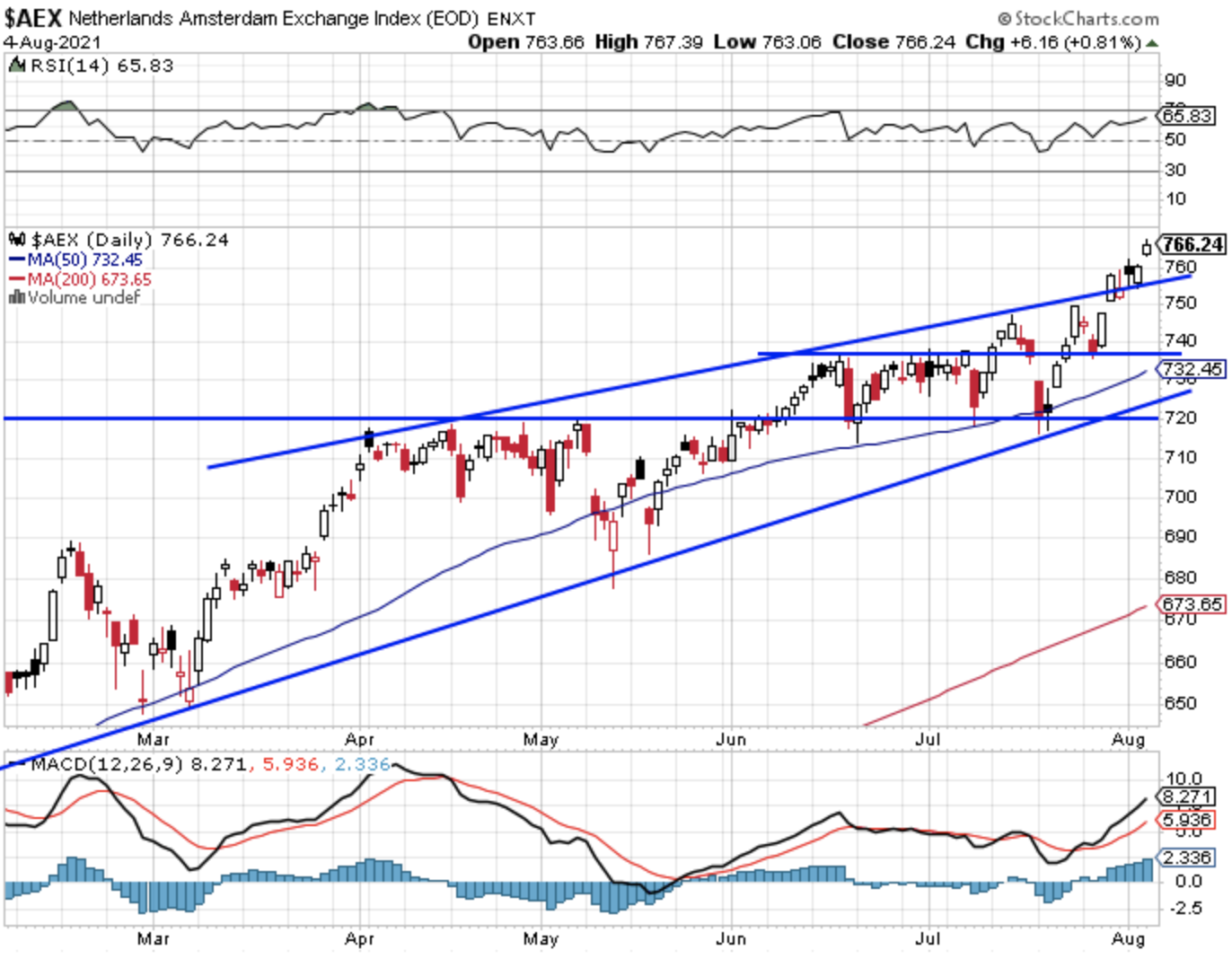

Technische conditie AEX:

De AEX zet opnieuw een hogere top neer met een recordslot op 766,24 punten en een absoluut record op 767,38 punten. De index sluit woensdag 6 punten hoger. Zo zien we dat de AEX nu toch al ver boven de lijn over de toppen uitkomt. Eerst dacht ik aan een valse move buiten de grens maar nu moeten we toch gaan uitkijken of de index door kan trekken richting nog hogere toppen met telkens nieuwe records. De vraag daarbij blijft het aandeel ASML want van een correctie wil dat aandeel niet weten en bereikt al een koers van €670. Verder zal er veel afhangen van hoe de andere markten zoals Wall Street zich zullen gedragen de komende dagen al hebben we daar niet zoveel van gemerkt gisteren.

Steun blijft nu eerst de 749-750 punten met later de zone 736-738 punten want we zien daar de oude toppen uitkomen. Later steun net onder de 730 punten, daarna de reeks recente bodems tussen de 717 en de 720 punten. Denk eraan dat het snel kan gaan en zeker als de markt zich zal corrigeren en zodra ASML met een soort acceleratie omlaag zal volgen. Zeker als de tech aandelen het een keer opgeven en daarbij ook de SOX index.

Weerstand zien we nu rond de 768-670 punten, bij een verdere uitbraak kansen richting de 775 punten en de 785 punten.

Technische conditie DAX:

De DAX komt nu een eind boven de belangrijke grens 15.500-15.550 punten maar deze zone blijft als een soort magneet werken in beide richtingen. De steun blijft daardoor nog altijd de 15.500-15.550 punten zone, later zien we de 15.400 en de 15.300 punten als steun.

Weerstand wordt nu de 15.700 punten met later de topzone rond de 15.800 punten. Bij de DAX ziet alles er wel wat zwakker uit dan bij de AEX en de CAC 40 en het is de vraag of de DAX verder zal gaan inhalen of de andere indices naar omlaag komen. We zitten in een moeilijke fase met naar mijn mening veel te veel divergenties op alle vlakken.

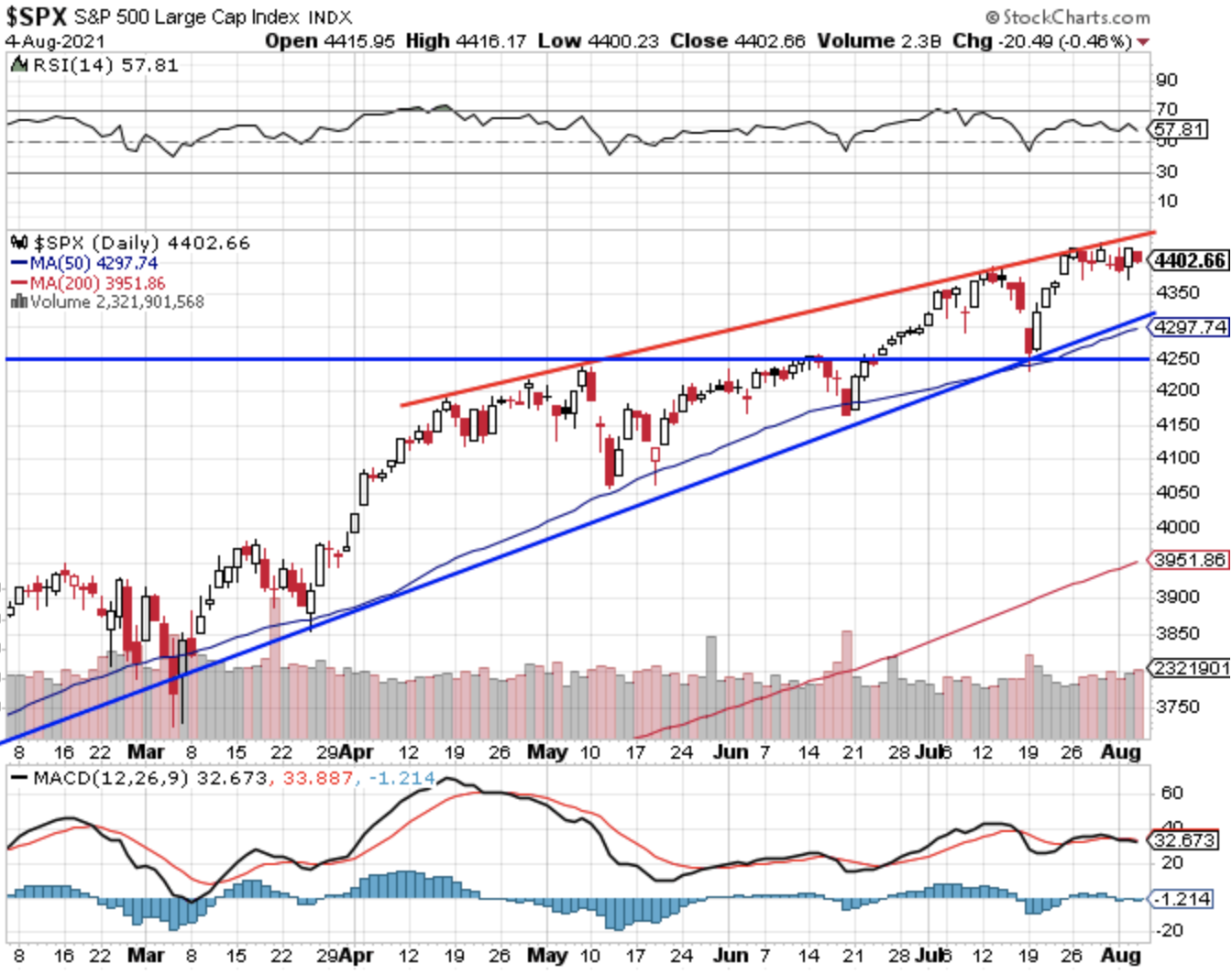

S&P 500 analyse:

De S&P 500 moet weer inleveren woensdag, 20 punten eraf zodat we met die dubbele test van de top blijven zitten. De index kan nog net boven de 4400 punten sluiten, de topzone zien we rond de 4420-4425 punten uitkomen.

Steun zien we nu eerst rond de 4380 punten, later komen de 4355 en de 4325 punten in beeld als steun. Verder zien we dat de oplopende steunlijn samen met het 50-daags gemiddelde nu rond de 4295-4300 punten uitkomen. Later nog de 4250 punten als steun door de vorige toppen die we zien in mei en juni.

Weerstand zien we rond de topzone die rond de 4420-4425 punten, later komt de 4450 punten als weerstand in beeld maar dan alleen bij een snelle uitbraak tot boven de zware weerstand.

Analyse Nasdaq:

De Nasdaq blijft dicht bij de topzone hangen waar we een zware weerstand zien uitkomen met een reeks toppen. De kans is groot dat de index deze topzone en dus de hoogste stand ooit zal gaan testen, we zijn er al bijna (top 14.863). De topzone rond de 14.860 punten blijft de eerste en meteen ook de redelijk zware weerstand. Bij een uitbraak mocht die er komen zien we rond de 14.925 en de 15.000 punten weerstand.

Steun nu eerst de 14.600 punten, later de 14.400 en de oude toppen rond de 14.210 punten. Het 50-daags gemiddelde zien we nu rond de 14.335 punten uitkomen.

Euro, olie en goud:

De euro zien we nu rond de 1,184 dollar, de prijs van een vat Brent olie komt uit op 70,6 dollar terwijl een troy ounce goud nu op 1814 dollar staat.

De LIVEBLOG en Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

Met vriendelijke groet,

Guy Boscart