Liveblog Archief woensdag 9 februari 2022

US Markets: Rustig blijven handelen bij deze volatiele markt

Beste beleggers,

We blijven voorzichtig met onze keuzes en werken nog altijd met kleinere posities, door de volatiliteit kunnen we daar in deze markt prima mee overweg. De start van het nieuwe jaar hebben we in ieder geval niet gemist want er staat al een mooi resultaat, een goed begin is altijd mooi meegenomen. Veel hebben we in feite nog niet moeten doen, alleen een paar keer op een goed momentum instappen met kleine en dus veilige posities. Door de volatiliteit in deze markt kan dat makkelijk en kunnen we alles onder controle houden. Wat dat betreft blijf ik in ieder geval de beste mogelijkheden zoeken voor de leden.

Als u met de signalen ofwel de posities mee wilt doen dan kan dat door lid te worden, dan komt u meteen op onze verzendlijst te staan en krijgt u naast de dagelijkse updates ook de mail en SMS wanneer we een positie versturen.

U kunt zich inschrijven via de aanbieding die loopt tot 1 APRIL en dat voor €35, dan kunt u als we nieuwe posities opnemen meteen meedoen.

Ga naar de Tradershop en kies een abonnement, de link is https://www.usmarkets.nl/tradershop

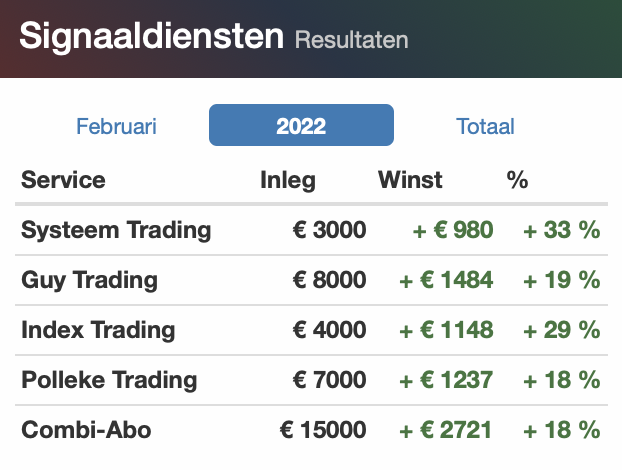

Zie hieronder het resultaat van deze maand en meteen ook het totaal voor dit jaar (2022)

Met vriendelijke groet,

Guy Boscart

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Ruwe Olievoorraden | Actueel: -4,756M Verwacht: 0,369M Vorige: -1,046M |

Markt snapshot Wall Street 9 februari

SoftBank says no stake sale plans linked to Alibaba U.S. filing

Japan's SoftBank Group said there was no link between Alibaba registering a U.S. share facility and any specific plans to sell down its stake in the Chinese e-commerce giant.

• European, U.S. regulators tell banks to prepare for Russian cyberattack threat

The European Central Bank is preparing banks for a possible Russian-sponsored cyber attack as tensions with Ukraine mount, two people with knowledge of the matter said, as the region braces for the financial fallout of any conflict.

• Fed denies release of correspondence on pandemic trades made by policymakers

The U.S. Federal Reserve, responding to a Freedom of Information Act request by Reuters, said there are about 60 pages of correspondence between its ethics officials and policymakers regarding financial transactions conducted during the pandemic year 2020.

• Treasury wants to stir up U.S. alcohol market to help smaller players

The U.S. Treasury Department flagged concerns about consolidation in the $250 billion annual U.S. alcohol market and outlined reforms it said could boost competition and save consumers hundreds of millions of dollars each year.

• New York pension fund to divest half its shale companies

New York's state pension fund will sell $238 million worth of stock and debt it holds across 21 shale oil and gas companies including Chesapeake Energy, Hess and Pioneer Natural Resources, saying they have not shown they are ready to move to a low-emissions economy.

BEFORE THE BELL

U.S. stock index futures rose ahead of the next round of earnings from companies like Walt Disney, Uber and Mattel, while awaiting a key inflation reading this week for cues on U.S. Federal Reserve's plans for tightening. European shares were up following strong corporate earnings. Japanese shares ended higher following an overnight tech-led rally on Wall Street. The dollar fell, while gold prices were little changed as investors await U.S. inflation data. Oil prices slipped on profit taking due to concerns of a possible rise in supplies from Iran despite industry data showing a surprise drop in U.S. oil inventories.

STOCKS TO WATCH

Results

• Bunge Ltd: The global farm commodities trader reported a 17.1% rise in fourth-quarter adjusted profit, bolstered by strength in its core agribusiness as well as refined and specialty oils segments. Bunge's results offer the latest look into how multinational grain companies have weathered shifts in demand and supply chain disruptions caused by the COVID-19 pandemic. Bunge expects 2022 adjusted earnings of at least $9.50 per share, which the company said would be the second-highest operational performance in the its recent history. The St. Louis, Missouri-based company posted adjusted net income of $533 million, or $3.49 per share, in the quarter ended Dec. 31, compared with $455 million or $3.05 per share, a year earlier. Revenue totaled $16.68 billion, up from $12.61 billion a year earlier.

• Chipotle Mexican Grill Inc: The company beat Wall Street estimates for quarterly profits and comparable sales on Tuesday as higher demand and prices for its burritos and rice bowls helped the restaurant chain shrug off a knock from the Omicron variant. "We continue to see pressure on wages. We want to make sure that we continue to be competitive on that front," Chief Executive Officer Brian Niccol said during an earnings call. "Our restaurants are staffed better than they were pre-COVID." Chipotle's move to introduce order-ahead drive-through lanes at more locations, as well as new menu items including smoked brisket, also helped cushion the blow. The chain reported adjusted earnings per share of $5.58 versus estimates of $5.25. The burrito chain's comparable sales rose 15.2% in the fourth quarter ended Dec. 31, while analysts polled by Refinitiv expected 14.8% growth. The company forecast comparable restaurant sales growth in the range of mid-to-high single digits in the current quarter, compared with estimates of 7.6% growth.

• CVS Health Corp: The company's quarterly profit rose 34.2%, helped by Omicron-spurred demand for COVID-19 tests and vaccinations. The company administered over 8 million COVID-19 tests and more than 20 million coronavirus vaccines across the U.S. during the quarter, CVS said. Net income attributable to the company's shareholders rose to $1.31 billion, or 98 cents per share, in the fourth quarter ended Dec. 31, from $973 million, or 75 cents per share, a year earlier. Revenue rose 10% to $76.60 billion.

• GlaxoSmithKline PLC: Britain's GSK forecast growth in 2022 after racking up 1.4 billion pounds in COVID-related sales in 2021, beating quarterly forecasts in its first earnings report since rejecting Unilever's bid for its consumer arm. The results underscore a comeback for GSK in the race to help fight the COVID-19 pandemic after it failed to bring a vaccine to the market so far. The spin off of the consumer venture with Pfizer has also put the future in focus as boss Emma Walmsley faces pressure from activist investors. The company said sales in 2022, after the spin-off of its consumer arm, were expected to grow 5% to 7% and adjusted operating profit to grow 12% to 14%. That includes the boost from a settlement with Gilead but not sales of its COVID-19 products. Adjusted earnings for the group stood at 25.6 pence per share for the three months to Dec. 31, while turnover rose 13% to 9.53 billion pounds at constant currency rates, topping a consensus of 23.8 pence apiece on sales of 9.49 billion pounds.

• Lyft Inc: Lyft's first full-year adjusted profit and a spike in pricey airport trips were overshadowed by a drop in ridership due to Omicron, which management on Tuesday warned would persist into the first quarter and drag down profit. Lyft said it expected first-quarter revenue of between $800 million and $850 million, a decline of up to $170 million compared with the last quarter of 2021. Analysts on average forecast first-quarter revenue of $984 million. Lyft also said it expected to report significantly lower adjusted earnings before interest, taxes, depreciation and amortization, a measure that excludes one-time costs, primarily stock-based compensation, in the first quarter. Executives, including newly appointed Chief Financial Officer Elaine Paul, prepared investors for between $5 million and $15 million in first-quarter adjusted EBITDA, compared with the nearly $75 million in the fourth quarter. On a net basis, Lyft still lost $1 billion in 2021, although that was narrower than the $1.8 billion loss of 2020.

• Toyota Motor Corp & Honda Motor Co Ltd: Toyota Motor and Honda Motor were upbeat about their full-year profit prospects as tight vehicle supplies caused by a chip shortage allowed Japan's two biggest automakers to charge their customers more. The Japanese carmakers are also benefiting from a weaker yen that raised the yen value of their overseas earnings. Toyota and Honda like other car makers are cutting output because they cannot find enough semiconductors amid COVID-related supply chain disruptions and competition for the key component from other industries, such as electronics. Toyota stuck with its full-year profit forecast of 2.8 trillion yen, while Honda upgraded its operating profit forecast for the year to March 31 by 21% to 800 billion yen. Toyota's 784.4 billion yen operating profit for the three months to Dec. 31 was higher than an average forecast of 716.8 billion yen based on the estimates from nine analysts, Refinitiv data shows. Meanwhile, Honda reported 229 billion yen in operating profit for the quarter, also above an average forecast of 166.2 billion yen based on estimates from nine analysts, Refinitiv data shows.

• Yum Brands Inc: The KFC-parent reported quarterly comparable sales that beat Wall Street estimates, boosted by robust demand for its tacos and fried chicken as people venture out to eat after the easing of COVID-19 restrictions. To attract returning customers, Yum has launched special menu offerings, including a crispy chicken sandwich taco at Taco Bell, a Detroit-style pizza at Pizza Hut and a plant-based imitation of its fried chicken at KFC. Comparable sales in the fourth quarter jumped 5% for the company, which also owns Pizza Hut and Taco Bell chains. Analysts polled by Refinitiv were expecting a 4.5% increase. Same-store sales at its KFC restaurants rose 5%, while that of Taco Bell increased 8%. Analysts were expecting them to increase 4.1% and 6.1%, respectively. Earnings per share rose to $1.11 from $1.08.

In Other News

• Alibaba Group Holding Ltd: Japan's SoftBank Group said there was no link between Alibaba registering a U.S. share facility and any specific plans to sell down its stake in the Chinese e-commerce giant. "The registration of the ADR conversion facility, including its size, is not tied to any specific future transaction by SBG," SoftBank said in a statement to Reuters. SoftBank has previously used its Alibaba shares as collateral for loans and trimmed its stake using derivatives to capture upside from any rise in the company's stock price. After Alibaba last week filed to register an additional 1 billion American Depository Shares (ADS), Citigroup analysts had said this might "suggest potential selling intention by SoftBank". In a fresh research note on Wednesday, Citi said Alibaba might have registered in advance a large number of ADS to support future plans of shareholders to convert the company's Hong Kong stocks to those listed in New York. SoftBank Chief Executive Masayoshi Son told analysts he was "surprised" and had not requested the Alibaba filing, a person familiar with the matter said on condition of anonymity.

• Boeing Co: A U.S. judge on Tuesday dismissed two charges against a former chief technical pilot for Boeing accused of deceiving federal regulators evaluating the company's 737 MAX jet, but rejected a request to dismiss the other four counts. U.S. District Judge Reed O'Connor in Texas granted part of the request of lawyers for former Boeing technical pilot Mark Forkner, dismissing two fraud counts alleging Forkner made materially false communications concerning a key airplane software feature called Maneuvering Characteristics Augmentation System (MCAS). O'Connor ruled Tuesday the two charges could not proceed because they must involve a tangible airplane part -- rather than the MCAS software feature. "MCAS is intangible computer code in the aircraft’s flight control software," O'Connor wrote. "MCAS is not an 'aircraft part." O'Connor rejected a request to dismiss the other four counts which allege wire fraud. The Justice Department said on Tuesday in a separate filing that it has not charged Forkner "with causing the crashes of Lion Air Flight 610 or Ethiopian Airlines Flight 302 and that it does not intend to argue that he caused them."

• General Motors Co: The company plans to increase production of electric trucks and Cadillac sport utility vehicles this year by more than six times the previously planned output, according to information shared with suppliers. GM Chief Executive Mary Barra told investors last week the automaker intended to accelerate production of electric vehicles, aiming to deliver 400,000 EVs in North America during 2022 and 2023. New details shared with suppliers indicate GM intends to increase production of its electric trucks and a new battery-powered Cadillac SUV to a total of 46,000 vehicles this year, up from a previous plan to build just 7,000 of those vehicles this year, according to information shared with suppliers. GM is also expected to re-start production of its Chevrolet Bolt EVs. The Bolt line has been idled as GM replaces batteries in existing Bolts under a recall.

• Meta Platforms Inc: Facebook parent said on Tuesday it had filed a joint lawsuit with digital banking company Chime against two Nigeria-based individuals who engaged in phishing attacks to deceive people and gain access to their online financial accounts. The lawsuit, which is the first joint complaint between Meta and a financial services company, alleged that the defendants used Facebook and Instagram accounts to impersonate Chime and lure people to fake branded phishing websites with the aim of obtaining their Chime account login information and withdrawing funds. In the suit, which was filed in the U.S. District Court for the Northern District of California, Meta said the defendants used a network of computers to control more than 800 impersonating Instagram accounts and five Facebook accounts, in order to conceal their activity and evade technical enforcement measures.

• Nikola Corp: Nikola's supply-chain department is "intact" and it continues to hire, the electric-truck maker said on Tuesday, in response to a report that it had hit pause on hiring amid executive exits. "The supply chain department has been intentionally strengthened with new and existing leadership," the company said in a statement. "Nikola is focusing its efforts on getting its first BEVs and FCEVs to market and continues to hire strategically for critical roles." Electrek had reported that the company had lost almost its entire supply-chain leadership over the last few months and had put a hiring freeze in place. Matthew Jenkins, director of supply chain and purchasing; Mike Chaffins, global head of supply chain; and Mike Gallagher, director of purchasing had all left the company, according to the report. Nikola, which delivered its first batch of trucks in December, is facing allegations of overstating the capabilities of its electric- and hydrogen-powered trucks.

• Tesla Inc: The electric-car maker said the California Department of Fair Employment and Housing (DFEH) intends to file a lawsuit against the company alleging systematic racial discrimination and harassment. The lawsuit appears to be focused on alleged misconduct at its factory in Fremont, California, between 2015 and 2019, Tesla said in a statement. The company said it will ask the court to pause the case once the state's civil rights regulator files its lawsuit. Despite several requests, Tesla said, the regulator declined to provide the company with the specific allegations or the factual bases for its lawsuit. In the past, the department has investigated claims by employees who believe they were discriminated against or harassed, but did not find any misconduct, Tesla said. The company has been fighting a series of lawsuits over allegations of racial discrimination and sexual harassment. Separately, Tesla is recalling 26,681 vehicles in the United States because a software error may result in windshield defrosting problems, the National Highway Traffic Safety Administration (NHTSA) said.

FOCUS

Facebook, Instagram are hot spots for fake Louis Vuitton, Gucci and Chanel

Facebook owner Meta Platforms is struggling to stop counterfeiters from pushing fake luxury goods from Gucci to Chanel across its social media apps, according to research and interviews, as the company barrels into ecommerce. Its platforms have emerged as hot spots for counterfeit offenders who exploit their range of social and private messaging tools to reach users, according to interviews with academics, industry groups and counterfeit investigators, who likened brands' attempts at policing services like Facebook, Instagram and WhatsApp as a game of "whack-a-mole."

ANALYSTS' RECOMMENDATION

• Amgen Inc: Jefferies raises target price to $280 from $266, appreciating the long-term guidance provided by the company.

• Chipotle Mexican Grill Inc: Cowen and Company cuts target price to $1950 from $2250, saying the company is not immune from the industry’s inflation pressures.

• DuPont de Nemours Inc: Credit Suisse raises target price to $100 from $95, after the company’s fourth quarter EPS beat estimates.

• Lyft Inc: Jefferies cuts target price to $45 from $50, following significant negative impact on the company’s ride volume from Omicron in January.

• Peloton Interactive Inc: Oppenheimer raises target price to $45 from $40, citing the company’s decision to make changes in management to ensure right-size and growth.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

1000 (approx.) Wholesale inventory, R mm for Dec : Expected 2.1%; Prior 2.1%

1000 (approx.) Wholesale sales mm for Dec : Expected 1.2%; Prior 1.3%

1100 (approx.) Refinitiv IPSOS PCSI for Feb : Prior 56.07

COMPANIES REPORTING RESULTS

Ceridian HCM Holding Inc: Expected Q4 earnings of 3 cents per share

Equifax Inc: Expected Q4 earnings of $1.81 per share

Everest Re Group Ltd: Expected Q4 earnings of $8.92 per share

Fox Corp: Expected Q2 earnings of 3 cents per share

International Flavors & Fragrances Inc: Expected Q4 earnings of $1.04 per share

Lumen Technologies Inc: Expected Q4 earnings of 53 cents per share

MGM Resorts International: Expected Q4 earnings of 2 cents per share

Motorola Solutions Inc: Expected Q4 earnings of $2.74 per share

O'Reilly Automotive Inc: Expected Q4 earnings of $6.05 per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Assurant Inc: Q4 earnings conference call

0800 Bunge Ltd: Q4 earnings conference call

0800 CVS Health Corp: Q4 earnings conference call

0800 Reynolds Consumer Products Inc: Q4 earnings conference call

0800 Trimble Inc: Q4 earnings conference call

0815 Yum! Brands Inc: Q4 earnings conference call

0830 CDW Corp: Q4 earnings conference call

0830 CME Group Inc: Q4 earnings conference call

0830 Fox Corp: Q2 earnings conference call

0830 XPO Logistics Inc: Q4 earnings conference call

0845 Jack Henry & Associates Inc: Q2 earnings conference call

0900 Atmos Energy Corp: Q1 earnings conference call

0900 Crown Holdings Inc: Q4 earnings conference call

0900 FMC Corp: Q4 earnings conference call

0900 II-VI Inc: Q2 earnings conference call

0900 Performance Food Group Co: Q2 earnings conference call

0900 Valvoline Inc: Q1 earnings conference call

1000 Atmos Energy Corp: Annual Shareholders Meeting

1000 Lithia Motors Inc: Q4 earnings conference call

1000 Steris plc: Q3 earnings conference call

1000 Vonage Holdings Corp: Shareholders Meeting

1000 Voya Financial Inc: Q4 earnings conference call

1030 National Retail Properties Inc: Q4 earnings conference call

1100 Ares Capital Corp: Q4 earnings conference call

1100 Eastgroup Properties Inc: Q4 earnings conference call

1100 Healthpeak Properties Inc: Q4 earnings conference call

1300 Mcafee Corp: Shareholders Meeting

1300 UDR Inc: Q4 earnings conference call

1400 Douglas Emmett Inc: Q4 earnings conference call

1400 Penske Automotive Group Inc: Q4 earnings conference call

1630 ASGN Inc: Q4 earnings conference call

1630 Rapid7 Inc: Q4 earnings conference call

1630 Seagen Inc: Q4 earnings conference call

1630 Walt Disney Co: Q1 earnings conference call

1700 Ceridian HCM Holding Inc: Q4 earnings conference call

1700 Envista Holdings Corp: Q4 earnings conference call

1700 Lumen Technologies Inc: Q4 earnings conference call

1700 Mattel Inc: Q4 earnings conference call

1700 MGM Resorts International: Q4 earnings conference call

1700 Motorola Solutions Inc: Q4 earnings conference call

1700 Plains All American Pipeline LP: Q4 earnings conference call

1700 Twilio Inc: Q4 earnings conference call

1700 Uber Technologies Inc: Q4 earnings conference call

EX-DIVIDENDS

American Electric Power Company Inc: Amount $0.78

Exxon Mobil Corp: Amount $0.88

Penske Automotive Group Inc: Amount $0.47

Resmed Inc: Amount $0.42

Rollins Inc: Amount $0.10

S&P Global Inc: Amount $0.77

Synchrony Financial: Amount $0.22

TJX Companies Inc: Amount $0.26

Wintrust Financial Corp: Amount $0.34

Indices zoeken hun weerstand op, vandaag opletten dus

Goedemorgen,

Een sterke sessie op Wall Street met opnieuw de nodige beweging gedurende de dag, uiteindelijk sluiten alle indices positief af en komen zo weer dicht bij hun belangrijke weerstand uit. Zowel Europa als Wall Street kunnen vandaag hoger openen gezien de stand van de futures, later vandaag zien we wel hoe Wall Street zal omgaan met de weerstand waar de indices nu op uitkomen. Wel blijven opletten voor een nieuwe draai naar omlaag, die komt er vaak ongemerkt en vooral onverwacht. De volatiliteit blijft parten spelen en forse uitslagen in beide richtingen blijven elkaar snel opvolgen.

Update woensdag 9 februari:

De belangrijkste indices op Wall Street sluiten dinsdag hoger, na een aarzelende start stappen beleggers in nadat men bedrijfswinsten blijven afwegen tegen de naderende monetaire verkrapping door de centrale banken. Het blijft zoeken naar de juiste mix in deze fase, over het algemeen zijn de cijfers goed buiten enkele uitschuivers hier en daar zowel in de positieve als in de negatieve zin.

De Dow Jones sloot 372 punten ofwel 1,05% hoger terwijl de S&P 500 een winst boekt van 0,85%. De Nasdaq Composite steeg met 179 punten ofwel 1,3% vooral door een sterke dag voor de Big Tech aandelen die het heel goed deden. Zelfs toen de rente weer opliep kon het de sector niet onder druk zetten. De 10-jaars rente bereikte dinsdag de 1,95% en zet zo weer een nieuw hoogtepunt neer bekeken over de afgelopen periode.

Ondanks de recente volatiliteit in de markt zien we dat de S&P 500 momenteel een nettowinstmarge van 12,4% genereert nu ongeveer 54% van de bedrijven hun resultaten over het 4e kwartaal hebben gerapporteerd. Tot nu toe overtreft dat cijfer zelfs de pre-pandemische piek van 12% over het 3e kwartaal van 2018. Toch zien beleggers ook in dat de gemengde resultaten over het 4e kwartaal van Amerikaanse technologie reuzen vraagtekens oproepen, daar zat nogal wat verschil in. Verder let men erop dat de FED klaar staat om de monetaire voorwaarden aan te scherpen want er komt hoe dan ook snel een renteverhoging aan, in maart zal dat al gebeuren.

Beleggers zullen beide zaken zeker op de radar houden de komende periode, dat Microsoft, Apple, Amazon en Alphabet het goed doen werd duidelijk vorige week maar men weet ook wel dat er in korte tijd veel kan veranderen. Hoe zal men het vorige kwartaal weten te overtreffen? Het wordt denk ik zeer moeilijk om dat tempo vast te houden en dat was juist hetgeen we hebben gezien bij Meta (Facebook), Netflix en Tesla die fors moesten inleveren de afgelopen weken. Er komen deze week nog wat belangrijke bedrijven met cijfers, dan zie ik vooral Disney en Coca-Cola uit de Dow Jones als belangrijk.

Om even samen te vatten hoe de markt er nu voorstaat zien we dat er tijdens de eerste paar weken van dit jaar vooral meer werd gekeken naar de macro-economische cijfers waarbij vooral de inflatie een grote rol speelde waardoor er nu zeker snel een renteverhoging komt door de FED. Aan de andere kant nemen sinds een week of 2 de over het algemeen sterke kwartaalcijfers het over. Wel denk ik dat de economische perikelen snel weer parten gaan spelen gezien de 10 jaars rente nog altijd verder oploopt en dat maakt de tech sector kwetsbaar.

Europa blijft net als Wall Street zoeken naar richting, de AEX bereikt de 755 punten weer op slotbasis terwijl de DAX nog wat achterblijft met nu 15.242 punten op slotbasis. Wel zullen de AEX en de DAX vandaag hoger openen. Eerst zien of beide indices deze hogere opening kunnen volhouden en we kijken dan vooral naar de opening van Wall Street vanmiddag.

Zelf zal ik deze week rustig blijven uitkijken naar nieuwe mogelijkheden en waar het kan zal ik instappen met wat kleine posities voor de leden. Meedoen kan door lid te worden, dan kunt u in ieder geval de keuzes die ik maak volgen naar eigen inzicht.

De signaaldiensten:

Afgelopen donderdag werden de short posities gesloten met een mooie winst zodat we in ieder geval goed aan de maand februari beginnen. Wat betreft dit jaar (2022) staan alle abonnementen al op een mooie plus zodat de start van het jaar goed is en dat zonder veel risico te nemen.

Deze maand zal ik er alles aan doen om waar het kan mooie posities uit te kiezen. Nog steeds met kleine aantallen en met 2 of maximaal 3 posities gelijktijdig.

Meedoen met onze signalen kan nu via de aanbieding die loopt tot 1 april 2022. Schrijf u nu snel in tot 1 APRIL voor €35. Ga meteen naar onze Tradershop en kies uw abonnement via de link https://www.usmarkets.nl/tradershop

Marktoverzicht:

Wall Street sluit hoger en we zien dat zowel de Dow Jones, de Nasdaq en de S&P 500 rond hun belangrijke weerstand uitkomen, ook de SOX index staat nu op een belangrijk punt. Gisteren gaf ik nog aan dat we moesten opletten voor een draai omlaag maar vandaag is het belangrijk om te bekijken wat de indices rond hun cruciale punten gaan doen. Komt er een doorbraak dan is de kans groot dat er een vervolg omhoog komt. Het is dus moeilijk te zeggen nu, eigenlijk liggen beide mogelijkheden voor de hand dus erop inzetten wordt moeilijk tot we weten hoe het vervolg zal lopen de komende sessies.

Ook Europa zoekt de weerstand op, de AEX zien we rond de belangrijke 755 punten uitkomen nu, een doorbraak omhoog maakt de weg vrij richting de 770-772 punten waar de index vorige week nog terecht kwam. De DAX kan snel naar de 15.500 punten, bij een uitbraak moeten we weer rekening houden met een vervolg omhoog richting de 15.810 punten.

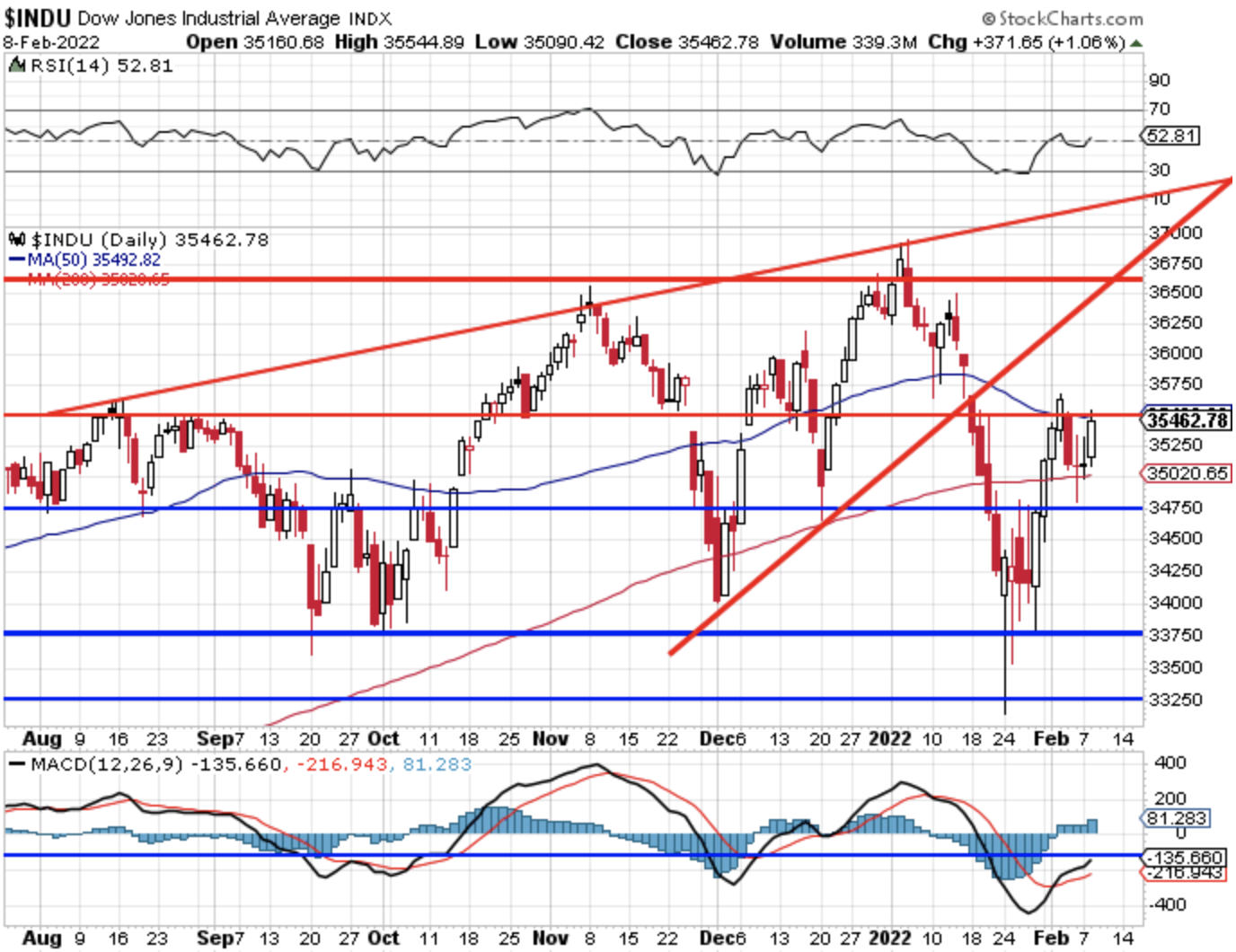

Dow Jones:

De Dow Jones herpakt zich opnieuw richting de weerstand die we rond de 35.500 punten zien uitkomen. Pas boven die 35.500 punten kansen richting de 36.000 punten en hoger, wel wordt dat denk ik moeilijker maar in deze markt weten we nooit.

Steun nu in eerste instantie rond de 35.000-35.100 punten, later steun rond de 34.750 en de 34.200-34.250 punten.

AEX index:

De AEX bleef vlak dinsdag en rond de 755 punten hangen waar we de bekende steun/weerstand zien uitkomen. Even stond de AEX rond de 758 punten waar nu de volgende weerstand wacht. Later zien we de 770-772 punten als richtpunt omhoog maar dan moet wel alles meezitten de komende dagen.

Steun nu de zone rondom de 755 punten, later de 750 en de 745 punten als steun met daaronder snel de bodem rond de 735 punten.

DAX index:

De DAX liet wat herstel zien de afgelopen dagen maar het blijft matig en zwak, na de daling van afgelopen vrijdag heeft de DAX technisch bekeken schade opgelopen. Steun blijft vooral de zone 14.900-15.000 punten, later pas rond de 14.500 punten weer steun. Weerstand nu eerst de 15.300-15.350 en de 15.500 punten, later de bekende 15.810 punten als weerstand.

Nasdaq Composite:

De Nasdaq herpakt zich goed en stoomt zelfs meteen door tot net onder de belangrijke 14.210 punten waar we de bekende weerstand zien uitkomen. Of de Nasdaq verder door kan stoten tot ver boven deze weerstand moeten we afwachten, eerst maar eens bekijken hoe de komende dagen zullen verlopen. De Nasdaq ziet er nog altijd zwakjes uit.

Weerstand zien we eerst rond de 14.210 punten, de bekende zone die we al lang in de gaten houden. Pas echt boven die 14.210 punten kan de Nasdaq in een positieve flow geraken maar dan moet de index wel meerdere dagen boven deze zone uitkomen. Steun zien we nu rond de 14.000 punten, later de 13.800-13.850 punten en de 13.750 punten als steun.

Overzicht resultaat dit jaar (2021):

De winst voor dit jaar en deze maand (februari) ziet u via de tabel hieronder, de maand januari werd met een mooie winst afgerond en we starten februari in ieder geval ook goed. Deze maand verwacht ik zeker snel weer nieuwe kansen, wordt op tijd lid via de aanbieding, dan ontvangt u meteen onze signalen en doet u mee met de posities.

Meedoen met onze signalen kan nu via de aanbieding die loopt tot 1 april 2022. Schrijf u nu snel in tot 1 APRIL voor €35. Ga meteen naar onze Tradershop en kies uw abonnement via de link https://www.usmarkets.nl/tradershop

Overzicht resultaten dit jaar (2022)

Met vriendelijke groet,

Guy Boscart