Liveblog Archief dinsdag 16 februari 2021

TA AEX en drie interessante grafieken

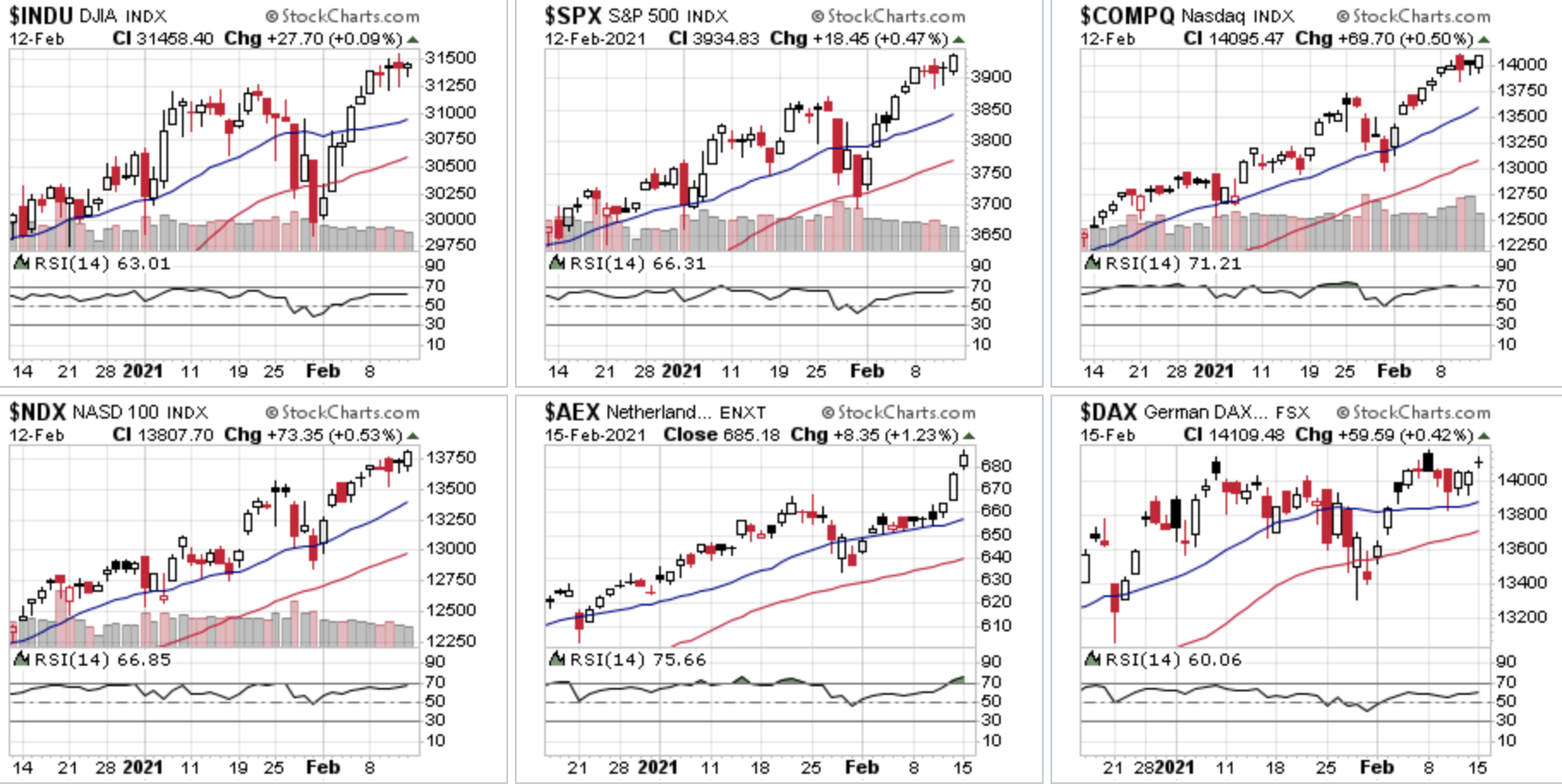

De AEX blijft verbazen, dus vandaag gaan we in ieder geval een blik werpen op de index. Daarnaast loop ik met u langs drie potentieel interessante grafieken. Grafieken om in de gaten te houden. Wellicht dat die in de (nabije) toekomst heel leuk gaan worden. Ik begin de column vandaag met…

Lees verder »Markt snapshot Wall Street vandaag

TOP NEWS

• Biden to pitch stimulus bill in Wisconsin, U.S. state hard hit by pandemic

U.S. President Joe Biden will travel to Wisconsin to press his case for a $1.9 trillion pandemic relief bill in the political battleground state that helped secure his victory in last year's presidential election.

• CVS Health quarterly sales rise 4% on pharmacy boost

CVS Health reported a 4% rise in fourth-quarter sales, helped in part by COVID-19 testing at its pharmacies.

• Goldman Sachs to launch digital investment platform in Marcus push

Goldman Sachs Group is launching a digital wealth-management platform that allocates and rebalances customers' wealth across portfolios of stocks and bonds.

• UK watchdog voices concern over $9.2 billion eBay-Adevinta deal

Britain's competition watchdog raised concerns over Adevinta's planned acquisition of U.S. e-commerce group eBay's classified ads business, sending the Norwegian company's shares down 4.3%.

• Bitcoin within a whisker of $50,000

Bitcoin hit a new record high $60 shy of $50,000, extending a sharp rally that has been mostly fuelled by big investors beginning to take digital assets seriously.

BEFORE THE BELL

U.S. stock index futures rose as investors were optimistic of new fiscal aid from Washington and progress in vaccinations would support recovery in the world's largest economy. European shares inched up after data showed euro zone economy fell less than initially estimated in the fourth quarter, while Asian equities ended in the green. The dollar weakened, while platinum prices retreated from a near 6-1/2-year peak. U.S. crude prices advanced on the back of a cold snap shutting wells in Texas, the biggest crude producing state in the United States.

STOCKS TO WATCH

Results

• BHP Group Ltd: The miner reported its best first-half profit in seven years and declared a record interim dividend, as top metals user China's strong appetite for iron ore to support its infrastructure push kept prices elevated. The company said in a statement it expects a continuation of strong Chinese demand in 2021, and recovery in the rest of the world's global crude steel production. The company declared an interim dividend of $1.01 per share, up from last year's payout of $0.65 per share. Its underlying profit from continuing operations for the six months ended Dec. 31 rose to $6.04 billion from $5.19 billion last year. It missed a consensus of $6.33 billion, however, from 17 analysts compiled by research firm Vuma Financial. BHP is expected to make an investment decision soon on its $5.3-$5.7 billion Jansen potash project in Canada and the Scarborough natural gas project off Western Australia, in which BHP will invest $1.4-1.9 billion.

• CVS Health Corp: The company reported a 4% rise in fourth-quarter sales, helped in part by COVID-19 testing at its pharmacies. However, the company's profit fell in the quarter ended Dec. 31, hurt by higher costs at its health insurance unit. CVS Health's net profit fell to 74 cents per share, in the reported quarter, from $1.33 per share, a year earlier. Sales rose to $69.55 billion from $66.89 billion. The company expects 2021 adjusted profit of between $7.39 to $7.55 per share, compared with analysts' estimates of $7.54 per share.

Deals Of The Day

• Cable One Inc: The cable service provider said it would buy the remaining stake in regional telecom firm Hargray Communications that it does not already own, in a deal valued at $2.2 billion. Cable One said the deal would help the company expand its presence into the Southeastern U.S. markets. The company previously owned a near 15% stake in Hargray, which provides telecommunications services in South Carolina, Georgia, Alabama and Florida. The deal is expected to close in the second quarter of this year and would realise about $45 million in estimated annual cost savings within three years of close, the companies said.

Moves

• Telefonaktiebolaget LM Ericsson: Industrial technology group Hexagon is launching a subsidiary focused on investing in the sustainable economy, and has picked Ericsson's Erik Josefsson as CEO of the new business, it said. Josefsson, former head of Advanced Industries at the telecoms gear-maker, will lead the subsidiary, called R-evolution, as it runs profit-driven investments in green-tech projects where Hexagon's technology can be applied. Hexagon said the first set of investments, focused on renewable energy, will involve the construction of cutting-edge solar farms, targeted at producing energy with 50,000 tonnes less CO2 equivalents per annum than the grid's residual mix.

• UBS Group AG: Piero Novelli is to leave his job as co-chief of UBS Group's investment bank to become chairman of stock exchange operator Euronext, leaving his colleague Robert Karofsky in sole charge of the division at the Swiss bank. Novelli, an Italian, is a high-profile dealmaker who advised on many big cross-border corporate mergers, including Whirlpool's purchase of Indesit, completed in 2014. Novelli's appointment was triggered by Euronext's acquisition of Borsa Italiana in October. As part of the deal, Euronext agreed to have an Italian representative sitting at its supervisory board while a second Italian candidate was meant to be proposed as an independent member of the supervisory board and become the chairman of the combined group.

In Other News

• Artisan Partners Asset Management Inc: The investment company, which is putting pressure on France's Danone to shake up its management amid criticism over weak returns, will meet several of its board members next week, a source close to the matter said. The source was speaking after French newspaper Le Journal du Dimanche said Artisan Partners would meet as early as Tuesday afternoon with Danone's lead independent board member-elect Gilles Schnepp, independent lead board director Michel Landel and possibly some other Danone board members. The move follows similar demands from activist investor Bluebell, which has not disclosed its holding but last month called on Danone Chairman and Chief Executive Emmanuel Faber to step down.

• Agora Inc: U.S. audio app Clubhouse said it is reviewing its data protection practices, after a report by the Stanford Internet Observatory said it contained security flaws that left users' data vulnerable to access by the Chinese government. The Stanford Internet Observatory said that it had confirmed that Chinese tech firm Agora supplied back-end infrastructure to Clubhouse, and that Agora would likely have access to users' raw audio, potentially providing access to the Chinese government. An Agora spokesman said the company had no comment on any relationship with Clubhouse, but that Agora does not have access to or store personal data, and does not route through China voice or video traffic generated from users outside China, including U.S. users.

• Alphabet Inc: Seven West Media became the country's first major news outlet to strike a licensing deal with Alphabet’s Google, as the government pushes ahead with a law that would force the internet giant to pay media companies for content. At an earnings announcement, Seven said it would supply content for Google's News Showcase platform. It did not disclose terms. "The negotiations with Google recognise the value of quality and original journalism throughout the country and, in particular, in regional areas," said Seven West Chairman Kerry Stokes in a statement. Google's Australia CEO Mel Silva said the U.S. company was "proud to support original, trusted, and quality journalism" by featuring Seven on its platform. Separately, Australia's political opposition will support proposed legislation that would force Alphabet's Google and Facebook to pay publishers and broadcasters for content, two sources briefed on the matter said.

• Amazon.com Inc: The online retail giant will start making its TV streaming device in India this year via a unit of Taiwanese contract manufacturer Foxconn, the company said. The Fire TV Stick will be made by Foxconn subsidiary Cloud Network Technology in the southern city of Chennai, marking Amazon's first foray into having one of its devices manufactured in India. Amazon said hundreds of thousands of Fire TV Sticks would be produced per year, helping it meet the demands of Indian customers. "Amazon will continuously evaluate scaling capacity to additional marketplaces/cities depending on the domestic demand," the company said in a blog post.

• American Express Co: Federal investigators began probing the company’s small business and consumer cards sales practices in January, the company disclosed. Amex received a subpoena from the United States Attorney's Office for the Eastern District of New York regarding its small business cards sales practices, Amex said in a regulatory filing. The Consumer Financial Protection Bureau (CFPB) also demanded information on its sales practices related to consumers. "We are cooperating with all of these inquiries and have continued to enhance our controls related to our sales practices. We do not believe this matter will have a material adverse impact on our business or results of operations," Amex said.

• Apple Inc: Nissan Motor said it is not in talks with Apple, following a report that the iPhone maker approached the Japanese company in recent months about a tie-up for its autonomous car project. The Financial Times said the companies had had brief discussions that faltered over Nissan's reluctance to become an assembler for Apple-branded cars, adding that the talks had not advanced to senior management level. "We are not in talks with Apple," a Nissan spokeswoman said. "However, Nissan is always open to exploring collaborations and partnerships to accelerate industry transformation." The spokeswoman declined to comment further. Representatives for Apple were not immediately available for comment.

• AstraZeneca PLC: The World Health Organization (WHO) listed AstraZeneca and Oxford University's COVID-19 vaccine for emergency use, widening access to the relatively inexpensive shot in the developing world. "We now have all the pieces in place for the rapid distribution of vaccines. But we still need to scale up production," Tedros Adhanom Ghebreyesus, WHO Director-General, told a news briefing. "We continue to call for COVID19 vaccine developers to submit their dossiers to WHO for review at the same time as they submit them to regulators in high-income countries," he said.

• Bank of America Corp: The bank’s Chief Executive Officer Brian Moynihan's annual pay fell by about $2 million, or 7.5%, in 2020, a regulatory filing showed. Moynihan will receive $24.5 million for his work during the year, compared with $26.5 million in 2019, the bank said. His base salary was held flat at $1.5 million and the remainder was made up of incentive compensation. Profit tumbled 35% last year as the bank set aside billions of dollars in reserves for pandemic-fueled bad loans and low interested rates crimped revenue.

• BNY Mellon Corp, Mastercard Inc & Tesla Inc: A clear cryptocurrency regulatory regime is urgently needed as major companies like BNY Mellon, Mastercard and Tesla embrace the alternative asset class, a top Securities and Exchange Commission (SEC) official said. Hester Peirce, a Republican commissioner at the agency, also told Reuters in an interview that it was too soon to draw policy conclusions from a "Reddit Rally" in GameStop and other stocks, but it was "wonderful" that a new generation of investors was able to participate in the market. "It's not only that there have been calls for clarity for some time and that a new administration brings the chance to take a fresh look, but it also is a moment where it seems others in the marketplace are also taking a fresh look," she said.

• Bristol-Myers Squibb Co & Sanofi SA: A judge in Hawaii ordered Bristol-Myers Squibb and Sanofi to pay more than $834 million to the state for failing to warn non-white patients properly of health risks from its blood thinner Plavix. Judge Dean Ochiai in Honolulu concluded the companies engaged in unfair and deceptive business practices from 1998 to 2010 by failing to change the drug's label to warn doctors and patients despite knowing some of the risks. Hawaii Attorney General Clare Connors, whose office sued the companies in 2014, said the ruling "puts the pharmaceutical industry on notice that it will be held accountable for conduct that deceives the public and places profit above safety." Both the companies in a joint statement vowed to appeal, saying the decision was "unsupported by the law and at odds with the evidence at trial." They called Plavix safe and effective.

• Carlyle Group Inc: The company is set to win approval for an initial public offering (IPO) of Japan's WingArc1st Inc as early as Thursday, two people with knowledge of the matter said, its third attempt to list the software firm. A successful listing of WingArc1st, which develops and sells business software including cloud-based offerings, would be the first time an IPO that had failed twice in Tokyo was eventually completed. The Tokyo-based company is likely to list by mid-March with a market capitalisation of around 50 billion yen, the people said, declining to be identified as the information is not yet public. It was not clear how much of WingArc1st Carlyle aims to sell, nor the amount Carlyle aims to raise. Carlyle and the Tokyo Stock Exchange declined to comment on the matter. Separately, Carlyle has shortlisted rival private equity firms BC Partners and Apax in the sale of its majority stake in Portuguese plastic packaging maker Logoplaste worth up to 1.4 billion euros, people close to the matter said.

• Cenovus Energy Inc & Canadian Natural Resources Ltd: Canadian natural gas producers are bouncing back faster from the COVID-19 pandemic than battered U.S. shale firms, putting them in position to boost net gas exports to the United States for the first time in five years. Cenovus Energy has earmarked around C$65 million for increased drilling starting in the third quarter. "(It) will focus on high-return opportunities in a relatively robust natural gas price environment," chief executive Alex Pourbaix told analysts. Canadian Natural Resources, the country's biggest oil and gas producer, has said it hopes to grow natural gas output by 11% this year.

• Citigroup Inc: The U.S bank said that outgoing Chief Executive Officer Mike Corbat's compensation for 2020 would be $19 million, a 21% decrease from 2019, according to a regulatory filing. Company directors reduced Corbat's incentive pay for his failures to efficiently address the risk and control concerns of regulators, the bank said in a filing. Additionally, members of the board considered the bank’s 2019 operating performance, market levels of pay for the CEO role at peer institutions, and Corbat’s leadership while deciding his compensation, according to the filing. The total is comprised of $1.5 million in base salary and an incentive award of $17.5 million.

• Coca-Cola Co: The European bottling arm of Coca-Cola has sweetened its final, binding takeover offer for Australian counterpart Coca-Cola Amatil by 75 cents per share, reflecting a jump in the company's market value since an initial offer last year. Coca-Cola European Partners (CCEP) said it was raising the offer by 6% to A$13.5 per share, valuing the Australian company at A$9.93 billion. Coca-Cola has long outsourced its bottling operations to separate regional operators. It owns 31% of Amatil and 19% of CCEP, which is now by far the largest by revenue, serving 13 countries in Western Europe. While the deal would unite two companies that bottle and distribute Coca-Cola drinks, providing scale, operating efficiencies and a larger geographic spread, it also provides CCEP with a platform for further consolidation in Asia.

• ConocoPhillips: An appeals court has blocked construction of the company’s $2 billion-plus Willow crude oil project in Alaska, putting on hold plans for one of the biggest oil projects in North Slope history. The 9th Circuit Court of Appeals in a weekend order sided with environmental and Native plaintiffs who challenged the Trump administration's go-ahead for ConocoPhillips' Willow project. The injunction issued Saturday night bars ConocoPhillips from conducting winter gravel mining and gravel road-building for the project while the lawsuit is ongoing. The 9th Circuit Court order followed a Feb. 6 lower-court order that briefly paused construction. Both orders concluded that ConocoPhillips' gravel work would cause irreparable environmental harm.

• Constellation Brands Inc & Anheuser-Busch InBev NV: The Mexican arm of drinks company Anheuser-Busch InBev accused Constellation Brands in a lawsuit filed of breaching a deal on the use of the Corona brand name by applying it to a product other than beer. Constellation has used the name for its Corona Hard Seltzer, a sparkling water with alcohol and flavouring, one of several seltzer drinks that have become very popular in the United States. The case is the latest in an increasingly competitive and litigious U.S. brewing market. Grupo Modelo filed its suit in the U.S. district court of the southern district of New York on Monday, according to a court filing. Constellation said it was "very surprised" by the development and said Modelo's claims, including that its seltzer should not be classified as a beer, were without merit and were an attempt to restrain a strong competitor.

• eBay Inc: Britain's competition watchdog raised concerns over Adevinta's planned acquisition of U.S. e-commerce group eBay's classified ads business, sending the Norwegian company's shares down. The $9.2 billion deal announced in July would create the world's largest classifieds group, but Adevinta and eBay must first resolve the Competition and Markets Authority's concerns (CMA) to proceed with the takeover. "The CMA is concerned the merger could lead to a loss of competition between Shpock, Gumtree and eBay's marketplace, with only Facebook Marketplace remaining as a significant competitor," the CMA said in a statement. Adevinta and eBay will together propose legally binding solutions to resolve the regulator's concerns before the deadline of Feb. 23, Adevinta said.

• Facebook Inc & Twitter Inc: The chief executives of two companies are in talks with House of Representatives lawmakers to testify at a hearing as early as next month, Politico reported, citing people familiar with the plans. The exact focus of the hearing is not yet clear, the report said. Facebook has discussed making its chief executive, Mark Zuckerberg, available to appear before the House Energy and Commerce Committee, the report said, citing two people. Twitter and its chief, Jack Dorsey, have discussed the same, Politico said, citing one person. A firm date has not yet been set for hearing, but it could come as early as March, the report said, citing sources. Separately, Facebook is building a smartwatch that will let users send messages and also offer health and fitness features, The Information reported, citing people with direct knowledge of the device.

• GameStop Corp: The YouTube streamer known as Roaring Kitty, who helped drive a surge of interest in the company, will testify before a U.S. House panel on Thursday alongside top hedge fund managers. The House Financial Services Committee is examining how a flood of retail trading drove GameStop and other shares to extreme highs, squeezing hedge funds like Melvin Capital that had bet against it. The witness list was announced on Friday by Representative Maxine Waters and includes Keith Gill, who also goes by Roaring Kitty, Robinhood Chief Executive Vlad Tenev, Citadel CEO Kenneth Griffin, Melvin CEO Gabriel Plotkin and Reddit CEO Steve Huffman. The virtual hearing, entitled “Game Stopped? Who Wins and Loses When Short Sellers, Social Media, and Retail Investors Collide," will take place on Thursday at 12 p.m. ET (1700 GMT), according to the press release and will be livestreamed.

• General Motors Co: The automaker agreed to a $5.75 million settlement to resolve allegations it made false statements to California's largest pension system and other investors over its deadly ignition switch recalls. California Attorney General Xavier Becerra said the automaker concealed problems from investors related to faulty ignition switches linked to 124 deaths and 275 injuries. GM failed to build reserves for losses it knew were coming, Becerra said, which artificially inflated GM's stock price and caused the California Public Employees’ Retirement System or CalPERS to lose millions of dollars. GM said it was "pleased to have cooperated with the state of California to resolve this matter."

• Goldman Sachs Group Inc: The bank is launching a digital wealth-management platform that allocates and rebalances customers' wealth across portfolios of stocks and bonds. The low-cost platform, Marcus Invest, will allocate wealth based on models developed by the bank's investment-strategy group. Marcus Invest offers both individual and joint investment accounts, as well as three types of individual retirement accounts, the bank said. Customers can open an account with a minimum of $1,000 and Marcus Invest charges an annual advisory fee of 0.35%. In another news, Britain's financial watchdog said it has started fraud and insider dealing proceedings against two brothers, one who worked as a Goldman Sachs analyst, the other as a lawyer at Clifford Chance.

• Morgan Stanley: The company’s investment arm is weighing whether to add digital currency bitcoin to its list of possible bets, Bloomberg News reported, citing people with knowledge of the matter. Counterpoint Global, the $150 billion investing arm of Morgan Stanley Investment Management, is exploring whether the cryptocurrency would be a suitable option for its investors, the report added. Morgan Stanley declined to comment.

• Microsoft Corp & SolarWinds Corp: A hacking campaign that used a U.S. tech company as a springboard to compromise a raft of U.S. government agencies is "the largest and most sophisticated attack the world has ever seen," Microsoft President Brad Smith said. The operation, which was identified in December and that the U.S. government has said was likely orchestrated by Russia, breached software made by SolarWinds, giving hackers access to thousands of companies and government offices that used its products. "I think from a software engineering perspective, it's probably fair to say that this is the largest and most sophisticated attack the world has ever seen," Smith said during an interview that aired on Sunday on the CBS program "60 Minutes." "When we analyzed everything that we saw at Microsoft, we asked ourselves how many engineers have probably worked on these attacks. And the answer we came to was, well, certainly more than 1,000," Smith said.

• Nvidia Corp: The U.S. Federal Trade Commission has opened an in-depth probe into Nvidia Corp's agreement to acquire Arm Ltd, Bloomberg reported, citing a source. The FTC has sent information demands to third parties, according to Bloomberg. The FTC and Nvidia did not respond to requests for comment outside regular working hours. In addition to the FTC probe, Alphabet, Qualcomm and Microsoft have complained to U.S. antitrust regulators about the deal, the report added, citing people familiar with the process.

• Peridot Acquisition Corp: Li-Cycle Corp said it will go public through a merger with blank-check acquisition company Peridot Acquisition in a deal valuing the recycler of lithium-ion batteries at $1.67 billion. The initial public offering is a bet on the growing need to recycle used batteries as well increasing demand for lithium-ion power sources for emerging products like electric vehicles. The merger is expected to provide Li-Cycle around $615 million in additional funding, which it plans to use to build more facilities to recycle and repurpose batteries. Peridot will provide $300 million, with the rest coming from a private investment in public equity, or PIPE, transaction.

• Rio Tinto Plc: The miner has agreed to explore production of a low-carbon steel feedstock in Canada, the company said, as part of its strategy to reduce carbon emissions. The miner said it has signed a memorandum of understanding with Luxembourg-based engineering firm Paul Wurth S.A. and German steelmaker SHS-Stahl-Holding-Saar GmbH & Co. KGaA. The companies will explore the viability of transforming iron ore pellets into low-carbon hot briquetted iron (HBI), a low-carbon steel feedstock, using green hydrogen generated from hydro-electricity in Canada, Rio said. Separately, a federal judge said he would not stop the U.S. Forest Service from transferring government-owned land in Arizona to the company for its Resolution Copper project, denying a request from Native Americans who said the land has religious and cultural import.

• Sanofi SA & Translate Bio Inc: A COVID-19 vaccine candidate developed by Sanofi and Translate Bio "will not be ready this year," the French drugmaker's chief executive told Le Journal du Dimanche newspaper. "This vaccine will not be ready this year, but it could be of use at a later stage all the more if the fight against variants was to continue," Paul Hudson was quoted as saying. The CEO gave no other details. Officials at Sanofi were not available for comment. The news could mark another blow for Sanofi, already embattled with a delay for another COVID-19 vaccine candidate it hopes to bring to patients.

• Stellantis NV: The company has extended until Tuesdaya production freeze at its Melfi plant in southern Italy, citing persistent shortages of semiconductors. Stellantis said in a statement it had decided to completely suspend activity at the Melfi plant, where it produces the Renegade and Compass Jeep models and Fiat's 500X, on Monday and Tuesday and on Feb. 22-23. That followed a last-minute notification from a supplier last week that it could not provide "electronic devices due to the lack of semiconductors", it said. "This confirms the current phase of pandemic uncertainty at a global level, with the consequent need to adjust production programs on a daily basis," Stellantis said.

• Tesla Inc: The company will set up an electric-car manufacturing unit in the southern Indian state of Karnataka, according to a government document seen by Reuters. "The U.S. firm Tesla will be opening an electric car manufacturing unit in Karnataka," the state government said in a brief statement. The statement was part of a broader document outlining the highlights of India's budget to its people in the local language of Kannada. Tesla and the office of Karnataka state chief minister did not immediately respond to Reuters' request for comments.

• Tata Motors Ltd: Jaguar Land Rover's luxury Jaguar brand will be entirely electric by 2025 and the carmaker will launch e-models of its entire lineup by 2030, it said, as it joined a global race to develop zero-emission vehicles. JLR, owned by India's Tata Motors, said its Land Rover brand will launch six pure electric models over the next five years, with the first one coming in 2024. JLR said it will keep all three of its British plants open as it electrifies its range. "It's time to re-imagine the next chapter for both brands," Chief Executive Thierry Bollore said. JLR said its electric plans for Jaguar would be centred at its Solihull plant, but dropped plans to build the XJ, the brand's flagship full-size car, at its Castle Bromwich facility in central England.

• Toyota Motor Corp: The carmaker said it will temporarily suspend vehicle production on 14 lines at nine group factories in Japan due to an earthquake that hit Japan's northeast last week. Domestic factories in five prefectures, including Aichi, Iwate and Fukuoka, will halt productions between Wednesday and Saturday, some for as long as four days. The factories produce models varying from Lexus cars to Harrier SUVs. While the earthquake had no significant impact on Toyota's factories, it affected some of the automaker's suppliers, causing a delay in parts supply,a spokesman said. The company did not disclose the number of affected vehicles.

• Uber Inc: The ridesharing company called on EU regulators to recognise the value of independent contracts in job creation as they consider new rules to protect gig economy workers. The company has been criticised for classifying its drivers as independent contractors rather than employees entitled to rights, such as a minimum wage, paid holidays and rest breaks. "This standard (for platform work) needs to recognise the value of independent work, and be grounded in principles drivers and couriers say are most important to them," Uber CEO Dara Khosrowshahi said. He said workers should have flexibility and control over when and where they want to work and that any changes should apply to the sector and not just one company. Separately, Britain's Supreme Court will announce a decision on Feb. 19 in a case regarding workers' rights at taxi app Uber that could have ramifications for millions of others earning a living in the gig economy.

INSIGHT

150 years of spills: Philadelphia refinery cleanup highlights toxic legacy of fossil fuels

Wearing blue hard hats, white hazmat suits and respirator masks, workers carted away bags of debris on a recent morning from a sprawling and now-defunct oil refinery once operated by Philadelphia Energy Solutions (PES). Other laborers ripped asbestos from the guts of an old boiler house, part of a massive demolition and redevelopment of the plant, which closed in 2019 after a series of explosions at the facility.

ANALYSTS' RECOMMENDATION

• Analog Devices Inc: RBC raises target price to $180 from $174, stating the company's higher estimates for 2021 and strong demand from auto and industrial sector.

• Microsoft Corp: Wedbush raises target price to $300 from $285, citing higher growth prospects for the company's cloud services with growing semi-remote workforce for the foreseeable future.

• Molson Coors Beverage Co: JPMorgan cuts target price to $45 from $48, citing the company's lower revenue in the fourth-quarter.

• Shopify Inc: Susquehanna raises target price to $1,300 from $950, saying payments business would drive the company's revenue growth for the next few years.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0830 NY Fed Manufacturing for Feb: Expected 6.0; Prior 3.5

COMPANIES REPORTING RESULTS

Agilent Technologies Inc (A). Expected Q1 earnings of 89 cents per share

Allegion PLC (ALLE). Expected Q4 earnings of $1.19 per share

American International Group Inc (AIG). Expected Q4 earnings of 93 cents per share

Devon Energy Corp (DVN). Expected Q4 earnings of 03 cents per share

Ecolab Inc (ECL). Expected Q4 earnings of $1.25 per share

Eversource Energy (ES). Expected Q4 earnings of 85 cents per share

Expeditors International of Washington Inc (EXPD). Expected Q4 earnings of $1.07 per share

IPG Photonics Corp (IPGP). Expected Q4 earnings of 98 cents per share

Occidental Petroleum Corp (OXY). Expected Q4 loss of 59 cents per share

Vulcan Materials Co (VMC). Expected Q4 earnings of 98 cents per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 CVS Health Corp (CVS). Q4 earnings conference call

0800 Advance Auto Parts Inc (AAP). Q4 earnings conference call

0800 Palantir Technologies Inc (PLTR). Q4 earnings conference call

0830 Bruker Corp (BRKR). Q4 earnings conference call

0830 Zoetis Inc (ZTS). Q4 earnings conference call

0830 Black Knight Inc (BKI). Q4 earnings conference call

0900 Service Corporation International (SCI). Q4 earnings conference call

0900 Medpace Holdings Inc (MEDP). Q4 earnings conference call

0900 IAA Inc (IAA). Q4 earnings conference call

0930 TransUnion (TRU). Q4 earnings conference call

1000 AutoNation Inc (AN). Q4 earnings conference call

1000 IPG Photonics Corp (IPGP). Q4 earnings conference call

1000 US Foods Holding Corp (USFD). Q4 earnings conference call

1100 Louisiana-Pacific Corp (LPX). Q4 earnings conference call

1100 Vulcan Materials Co (VMC). Q4 earnings conference call

1230 MGM Growth Properties LLC (MGP). Q4 earnings conference call

1300 Ecolab Inc (ECL). Q4 earnings conference call

1630 Agilent Technologies Inc (A). Q1 earnings conference call

1700 Boyd Gaming Corp (BYD). Q4 earnings conference call

1700 Lattice Semiconductor Corp (LSCC). Q4 earnings conference call

1700 TriNet Group Inc (TNET). Q4 earnings conference call

1700 Exact Sciences Corp (EXAS). Q4 earnings conference call

1700 RingCentral Inc (RNG). Q4 earnings conference call

EX-DIVIDENDS

Aflac Inc (AFL). Amount $0.33

Capital One Financial Corp (COF). Amount $0.40

Chevron Corp (CVX). Amount $1.29

Consolidated Edison Inc (ED). Amount $0.77

D.R. Horton Inc (DHI). Amount $0.20

Marathon Oil Corp (MRO). Amount $0.03

Marathon Petroleum Corp (MPC). Amount $0.58

Schlumberger NV (SLB). Amount $0.12

Target Corp (TGT). Amount $0.68

Vrijdag liep de rente al fors op, vandaag zet die stijging door. Inflatie dan uiteindelijk opgemerkt? Inflatie hoger, dan moet de rente omhoog om die te bestrijden. Toch een nieuwe situatie voor de newbies die het allemaal nog moeten ontdekken en vooral denken dat de markten niet meer omlaag kunnen ...

AEX vooruit maar met de rem erop vanaf nu?

De AEX zet de opmars voort maar geraak nu op een punt waar werkelijk alles op overbought staat. Vooral enkele zwaargewichten zorgen ervoor dat de index uit zijn voegen barst. We wachten daar op zich al heel lang op maar wat niet gezond is momenteel komt door dat de stijging niet door alle sectoren…

Lees verder »Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| DEU: Duitse ZEW Economisch Sentiment (Feb) | Actueel: 71,2 Verwacht: 59,6 Vorige: 61,8 |

Wake-up call: Wat is de markt vandaag van plan?

Goedemorgen

Vandaag doet Wall Street weer mee vandaag na een pauze, gisteren kon de AEX doortrekken tot dicht bij de 685 punten waardoor de recordstand plots wel heel dicht komt. Zelf had ik het totaal niet verwacht geef ik toe maar het staat er wel, die 685 punten dus. Ook de DAX ging wat vooruit maar deze index doet bij lange na niet zo gek als wat wat we bij de AEX zien nu. De Franse CAC 40 doet het plots ook goed met de 5800 al in zicht. De futures staan vanmorgen wat hoger, die op Wall Street laten ongeveer hetzelfde zien als gisteren waardoor de opening ongeveer 0,6% hoger aangeeft ten opzichte van afgelopen vrijdag, op zich niet al te veel.

Dan nog wat weetjes, In een interview zei Stacey Cunningham, de president van de New York Stock Exchange reageerde op enkele vermeldingen dat de markten momenteel op een casino beginnen te lijken, ze verwierp deze vergelijking. De markten zijn geen casino want ze worden sterk gereguleerd en er wordt streng op toegezien. We runnen een markt die investeerders kansen biedt om mee te investeren in de bedrijven waarin ze geloven.

Wat wel zo is momenteel is dat er veel oude rotten in het vak daar totaal anders over denken want iedereen weet, of zou moeten weten, dat de markt zich momenteel hoe we het ook willen ervaren in een BUBBEL bevindt waar er momenteel amper verkopers te vinden zijn terwijl veel bedrijven zijn die in een gevaarlijke situatie zitten. En de weging van de TOP-7 of laten we zeggen de TOP-10 is veel te groot geworden het afgelopen jaar. Dus nee er komt geen CRASH zegt nu zeker 90 tot 95% van de beleggers, we gaan het zien maar het blijft vreemd allemaal.

Aan de andere kant gaf een academisch onderzoek aan dat de aandelenhandel en het traditioneel gokken nogal wat met elkaar gemeen hebben en dan vooral de daghandel die volop terug is momenteel. In januari werd er een artikel gepubliceerd dat aangeeft dat er 3,5 keer meer kansspelen zijn op aandelenmarkten dan op meer traditionele locaties zoals casino's en loterijen. Het is een publicatie maar als ik dan kijk naar wat er allemaal voorbij kwam de afgelopen weken dan ga je toch vragen stellen rondom de huidige gang van zaken. Maar aan de andere kant zal het een keer goed mis gaan op de beurs en dat moment komt er veel sneller aan dan velen zich kunnen voorstellen.

Ik blijf vooral kijken naar hoe de markt er momenteel voorstaat en hoe die qwa waarde in elkaar zit. Ook technisch zie ik overal moeilijkheden ontstaan behalve bij de AEX die dan wel weer een andere zware weerstand opzoekt momenteel. Verder staat alles bovenaan in de bekende WIG, de vraag is hoeveel ruimte er nog overblijft en waar de draai er zal komen. Normaal gezien komt er een draai net als de vorige keren dat de indices bovenaan in de WIG stonden, maar de meer voor de hand liggende vraag is en blijft of die steun het deze keer kan houden? Dus er komt zeer waarschijnlijk een terugval van 2 tot 3% maar als het doorzakt groeit de kans op een 8 tot 12% daling. Het gevaar zit hem nu in het naar buiten willen via dezelfde deur als er onrust komt, de bekende flessenhals ...

Koers winst verhoudingen Wall Street en weging TOP-7:

Blijf vooral letten op de torenhoge koers-winst verhoudingen die de Nasdaq en dan vooral ook bij de grote 7 momenteel laten zien, de gemiddelde KW op de S&P 500 staat sinds gisteren op 40,06. Om u een beeld te geven waar deze KW op stond in februari 2020 net voor de crisis begon op 26. Aan u om te beoordelen of waar we nu op staan gezond is? Let wel, als er naar het gemiddelde van de afgelopen jaren wordt gekeken dan ligt de KW rond de 18 ...

Neem ik die TOP-7 er dan even bij dan zien we dat deze aandelen rond de 25% van de totale S&P 500 voor hun rekening nemen en bijna de helft (48%) van de Nasdaq bevatten, de weging bedoel ik daarmee. U zal begrijpen dat als er een correctie komt op deze 7 aandelen van pakweg 10-15% of zelfs 20% dat de grote en bepalende indices een behoorlijke correctie gaan doormaken. Dat moment komt steeds dichterbij, hou er dus rekening mee. Het gaat bij het huidige verloop van de markt in het bijzonder over deze 7 aandelen en dat zijn Apple, Microsoft, Google, Tesla, Amazon, Facebook en Nvidia.

Gedurende de afgelopen week wat kleine posities opgenomen:

Deze maand heb ik tot nu toe nog niet zoveel kunnen doen, wel hier en daar wat kleine posities kunnen afsluiten en we staan op winst deze maand en dit jaar (2021). Nu zitten we nog met wat kleine posities in de markt, die kunnen nog opgenomen worden uiteraard.

De markt bereikt wel duidelijk de bovenkant van de bekende WIG waar er eerder telkens winstnemingen op gang kwamen ... Wel blijf ik uiteraard voorzichtig en handel ik nog steeds met kleine aantallen bij de huidige marktomstandigheden.

De LIVEBLOG en. Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

Euro, olie en goud:

De euro zien we nu rond de 1.213 dollar, de prijs van een vat Brent olie komt uit op 63,45 dollar terwijl een troy ounce goud nu op 1820 dollar staat.

Inter Market overzicht op slotbasis ...

We hebben wat strategische posities open staan:

Zodra u lid wordt ontvangt u de signalen en kunt u meteen als er posities open staan zien welke dat zijn via onze Tradershop op de website. Ik probeer ook in deze markt zo goed als dat kan om te gaan met de posities, wel is mijn verwachting dat de markt volatiel zal blijven de komende periode. Dat zal kansen bieden maar het vraagt ook om goed met de posities om te gaan zodra die lopen.

Blijven schakelen tussen long en short blijft daarbij belangrijk de komende weken. Ook deze maand komen er nog genoeg kansen, we zitten nu met wat kleine posities in de markt.

Doe nu in ieder geval mee met de proef aanbieding voor nieuwe leden, die loopt tot 1 APRIL en dat met een mooie korting !! ... €39 tot 1 APRIL 2021 ... en voor Polleke €49 tot 1 APRIL 2021 !!!

Schrijf u in voor Systeem Trading (€39 tot 1 APRIL)

Schrijf u in voor Index Trading (€39 tot 1 APRIL)

Schrijf u in voor Guy Trading (€39 tot 1 APRIL)

Schrijf u in voor Polleke Trading (€49 tot 1 APRIL)

Schrijf u in voor de Aandelen portefeuille (€30 tot 1 APRIL)

Schrijf u in voor COMBI TRADING (€79 tot 1 APRIL)

Hieronder het resultaat tot nu toe dit jaar (2021) ...

Met vriendelijke groet,

Guy Boscart

Markt snapshot Europa vandaag

GLOBAL TOP NEWS

The World Health Organization on Monday listed AstraZeneca and Oxford University's COVID-19 vaccine for emergency use, widening access to the relatively inexpensive shot in the developing world.

The euro zone is likely to decide between March and May when and how governments would start tapering support to their economies as vaccination campaigns allow the lifting of pandemic lockdowns and economic activity picks up, top euro zone officials said on Monday.

Bank of Japan Governor Haruhiko Kuroda said the recent stock price rally reflected market optimism over the global economic outlook, brushing aside views its ultra-loose monetary policy was fuelling an asset price bubble.

EUROPEAN COMPANY NEWS

BHP reported its best first-half profit in seven years and declared a record interim dividend, as top metals user China's strong appetite for iron ore to support its infrastructure push kept prices elevated.

Norway's oil industry employers struck a wage bargain with the Safe labour union, preventing a strike at the Mongstad crude terminal and shutdowns of major offshore oil and gas fields, Safe told Reuters.

Italy has given a green light to the takeover bid Credit Agricole Italia plans to make for small lender Credito Valtellinese (Creval), the French bank's Italian arm said on Monday.

TODAY'S COMPANY ANNOUNCEMENTS

Allegion PLC Q4 2020 Earnings Call

Ambea AB (publ) Q4 2020 Earnings Release

Ardagh Group SA Q4 2020 Earnings Call

Baronsmead Second Venture Trust PLC Annual Shareholders Meeting

Basilea Pharmaceutica AG FY 2020 Earnings Call

BHP Group PLC HY 2021 Earnings Call

BMO Capital and Income Investment Trust PLC Annual Shareholders Meeting

Fingerprint Cards AB Q4 2020 Earnings Release

Glencore PLC FY 2020 Earnings Release

Ice Group ASA Q4 2020 Earnings Call

Kerry Group PLC FY 2020 Earnings Release

Koninklijke DSM NV Q4 2020 Earnings Release

Liberty Global PLC Q4 2020 Earnings Call

Lime Technologies AB (publ) FY 2020 Earnings Call

Magseis Fairfield ASA Q4 2020 Earnings Call

Mercialys SA FY 2020 Earnings Call

Metropole Television SA FY 2020 Earnings Call

Metso Outotec Corp Q4 2020 Earnings Release

Nordic Mining ASA Q4 2020 Earnings Call

Norway Royal Salmon ASA Q4 2020 Earnings Release

Pan African Resources PLC HY 2021 Earnings Call

Petra Diamonds Ltd HY 2021 Earnings Call

Safe Bulkers Inc Q4 2020 Earnings Call

Self Storage Group ASA Q4 2020 Earnings Call

Straumann Holding AG FY 2020 Earnings Release

Vicat SA FY 2020 Earnings Call

Wihlborgs Fastigheter AB Q4 2020 Earnings Release

Yandex NV Q4 2020 Earnings Call

ECONOMIC EVENTS (All times GMT)

0630 France ILO Unemployment Rate for Q4: Expected 9.0%; Prior 9.0%

0830 Netherlands Consumer Spending Volume for Dec: Prior -6.5%

0830 Netherlands GDP Preliminary SA qq for Q4: Expected 0.2%; Prior 7.8%

0830 Netherlands GDP Preliminary NSA yy for Q4: Expected -2.4%; Prior -2.5%

0830 Netherlands Trade Balance for Dec: Prior 5.974 bln EUR

0830 Sweden Industrial Inventories qq for Q4: Prior -5.3 bln SEK

0900 (approx.) Italy Flash Trade Balance Non-EU for Jan: Prior 7.91 bln EUR

0900 (approx.) Italy Trade Balance EU for Dec: Prior 0.088 bln EUR

0900 (approx.) Italy Global Trade Balance for Dec: Prior 6.766 bln EUR

1000 Germany ZEW Economic Sentiment for Feb: Expected 59.6; Prior 61.8

1000 Germany ZEW Current Conditions for Feb: Expected -67.0; Prior -66.4

1000 (approx.) Euro Zone Employment Overall Flash for Q4: Prior 157,386,500

1000 Euro Zone Employment Flash yy for Q4: Expected -2.2%; Prior -2.3%

1000 Euro Zone Employment Flash qq for Q4: Expected 0.1%; Prior 1.0%

1000 Euro Zone GDP Flash Estimate qq for Q4: Expected -0.7%; Prior -0.7%

1000 Euro Zone GDP Flash Estimate yy for Q4: Expected -5.1%; Prior -5.1%

1000 (approx.) Euro Zone ZEW Survey Expectations for Feb: Prior 58.3