Liveblog Archief dinsdag 23 maart 2021

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Nieuwe Woningen Verkoop (Feb) | Actueel: 775K Verwacht: 875K Vorige: 948K |

TA uit mijn "gevangenis"

Ik ga proberen een aantal lezers tevreden te stellen met verzoeknummers. Onder bij de reacties kunt u altijd een verzoek indienen en dan maar kijken of uw item in de analyses terug komt haha. Daarnaast kijk ik naar de AEX. De columns komen nog steeds uit Brazilië, uit mijn gevangenis, omdat de…

Lees verder »Markt snapshot Wall Street 23 maart

TOP NEWS

• Fed Chair Powell: U.S. economy looks to be strengthening

The U.S. economy is "much improved," Federal Reserve Chair Jerome Powell said on Monday, crediting Congress and the central bank both for providing "unprecedented" support, but at the same time warning that the recovery is still "far from complete."

• U.S. Treasury's Yellen sees post-COVID growth, possible full employment in 2022

U.S. Treasury Secretary Janet Yellen will tell U.S. lawmakers that she believes Americans will be met on the other side of the COVID-19 pandemic by a growing economy - and possibly full employment in 2022 - due to President Joe Biden's coronavirus stimulus package.

• U.S. health body questions AstraZeneca's COVID-19 vaccine trial data

AstraZeneca may have used "outdated information" in the results of a large-scale COVID-19 vaccine trial, a U.S. health agency said, casting fresh doubt on the shot, its potential U.S. rollout and plunging its developers, once again, into controversy.

• China's Tencent faces concessions to win green light for giant videogaming merger -sources

Chinese internet giant Tencent Holdings is having to offer concessions in a plan to merge the country's top two videogame live-streaming sites, Huya and DouYu, in order to resolve antitrust concerns, two people with knowledge of the matter told Reuters.

• U.S. travel industry seeks government roadmap to reopen borders this summer

Major U.S. airline and travel groups urged on Monday a partnership with the government to develop a plan to reopen international borders this summer, assuming COVID-19 vaccine and case counts continue along positive trends.

BEFORE THE BELL

Wall Street futures slipped while investors awaited testimonies from Fed Chair Jerome Powell and Treasury Secretary Janet Yellen for clues on the pace of economic recovery. European stocks were in the red, as a new wave of coronavirus infection and fresh lockdown in Germany raised fears of a slow economic recovery from the pandemic shock. Japan’s Nikkei fell tracking lacklustre performance in Chinese markets as investors locked in profit on a recent rally in some mainland firms. The dollarfirmed, while gold see-sawed in choppy trading. Oil prices fell on demand concerns. New home sales and current account numbers are due on the economic schedule later in the day.

STOCKS TO WATCH

Results

• Tencent Music Entertainment Group: The Chinese music streaming platform said it will create a joint venture record label with Warner Music in China, after reporting better-than-expected revenue on higher subscriptions in the fourth quarter. The company also signed an extended multi-year licensing agreement with the U.S. music label. Revenue rose 14.3% to 8.34 billion yuan in the quarter from a year earlier, beating estimates of 8.33 billion yuan. The sales were boosted by a 40.4% jump to 56 million paid subscribers in the company's online music service. Excluding items, the company earned 80 yuan per American Depository Share (ADS), missing analysts' average estimate of 81 yuan per ADS.

Deals Of The Day

• Apollo Global Management Inc & Synnex Corp: IT solutions firm Synnex said on Monday it will merge with peer Tech Data in a deal worth about $7.2 billion, including debt, creating one of the world's biggest IT distribution companies and sending Synnex's shares up. Synnex shareholders will own about 55% of the combined company, which expects to generate $57 billion in estimated annual revenue, while Apollo will own the rest and take four board seats after the deal closes in the second half of 2021. Apollo will receive 44 million shares of Synnex common stock, and the refinancing of existing Tech Data net debt and redeemable preferred shares of about $2.7 billion.

• KKR & Co Inc: Private equity firm Thoma Bravo said it has agreed to acquire workplace software firm Calabrio from the company. Terms of the deal were not disclosed but people familiar with the matter said the deal values Calabrio at more than $1 billion, including debt. KKR paid $200 million to acquire Calabrio in 2016. Calabrio grew its recurring revenue to nearly 80% of total revenue, up from just 30% about four years ago when it was acquired by KKR, Thomas Goodmanson, its chief executive officer said in an interview. Thoma Bravo is one the largest software-focused private equity firms with $77 billion in assets under management.

Moves

• California Resources Corp: The U.S. oil and gas producer said on Monday it had appointed interim chief executive officer Mark McFarland as the head, effective immediately. McFarland, who has served on the company's board since its emergence from bankruptcy in October 2020, was appointed interim CEO in December, following the departure of Todd Stevens. "Mac is stewarding ongoing efforts to reduce costs and optimize the operating portfolio with the core objective for CRC to become a lean and efficient operator producing robust cash flow," James Chapman, lead independent director, said. California Resources filed for Chapter 11 bankruptcy protection in July last year after defaulting on interest payments following a slump in oil prices.

In Other News

• Amazon.com Inc: The company is to cut its stake in British food delivery company Deliveroo to 11.5% in its upcoming initial public offering from 15.8% previously, according to a prospectus published by the company. According to the prospectus, Amazon is set to shed around 23.3 million shares as part of this, allowing the tech giant to raise between 90.87 million and 107.18 million pounds from the deal. Amazon raised its stake in Deliveroo to 16% last year in a deal that had to be cleared by the UK's competition watchdog, and participated in a $180 million private funding round in January that valued the firm at more than $7 billion.

• AstraZeneca Plc: The company may have used "outdated information" in the results of a large-scale COVID-19 vaccine trial, a U.S. health agency said, casting fresh doubt on the shot, its potential U.S. rollout and plunging its developers, once again, into controversy. The highly unusual rebuke from federal health officials comes just one day after interim data from the drugmaker showed better-than-expected results from the U.S. trial which had been seen as a scientific counter to concerns that have dogged the shot since late last year. The Data Safety Monitoring Board (DSMB), an independent committee overseeing the trial, has "expressed concern that AstraZeneca may have included outdated information from that trial, which may have provided an incomplete view of the efficacy data," the U.S. National Institute of Allergy and Infectious Diseases (NIAID) said in a statement released after midnight in the United States. Seperately, the European Commission's chief vaccine negotiator Sandra Gallina said the European Union will use all available means to secure COVID-19 vaccine produced by AstraZeneca.

• Baidu Inc & Bilibili Inc: The company shares have closed flat in their Hong Kong secondary listing debut, bucking a trend of first-day pops on the bourse, as investors were wary of a fundraising flurry in the city and questioned the search company's growth plans. The weakened mood towards Chinese technology offerings was reinforced with video site Bilibili raising a lower-than-expected $2.6 billion in its secondary listing. Baidu shares closed at HK$252 each which was in line with the price set for the Hong Kong listing which raised $3.1 billion. Baidu chairman and CEO Robin Li said the secondary listing was a homecoming for the company. "When Baidu got listed in Nasdaq...I said Nasdaq was only one of our stops. Baidu would come back to China eventually, because China is our root. Today, Baidu finally came back home," he told a ceremony in Beijing.

• Banco Bilbao Vizcaya Argentaria SA: The main risk in Turkey is forex, and BBVA is prepared to handle that, the Spanish bank's chief executive Onur Genc said, adding that it was invested in Turkey for the long term and the dismissal of the central bank chief would not affect that. Shares in BBVA, which makes around 14% of its profits in Turkey through its 49.9%-owned Turkish unit Garanti, lost 7.7% on Monday after the central bank's chief sacking. "The main risk that we see is foreign currencies. And that is the risk that we are managing. Turkey is an emerging market. We are prepared for that risk," Genc told a banking conference. BBVA has already been actively hedging on the foreign exchange markets to protect its earnings and capital from any potential headwind from Turkey.

• Baker Hughes Co: The oilfield services firm is teaming up with Norway's Horisont Energi to explore the possibility of storing more than 100 million tonnes of carbon under the Barents Sea in the Arctic, the companies said. Baker Hughes and Horisont Energi will cooperate to develop carbon abatement technologies - which allow fossil fuels to be used with substantially reduced CO2 emissions - and to lower the cost and delivery time of carbon capture, transport and storage (CCTS), they said, after signing a memorandum of understanding. Cooperation will centre on the Polaris carbon storage project off the coast of northern Norway, which aims to store more than 100 million tonnes of CO2, or twice the Nordic country's annual greenhouse gas emissions. It is still at a concept phase, but the partners aim to start construction in the second half of 2022.

• BioNTech SE & Pfizer Inc: The company plans to tap the mRNA technology to make new vaccines for other viruses following the success of its COVID-19 shot, which was developed jointly with German partner BioNTech SE, the Wall Street Journal reported. The drugmaker said it was ready to pursue mRNA on its own following its experience in the past year working on the COVID-19 vaccine, the WSJ reported, citing an interview with Pfizer Chief Executive Officer Albert Bourla. It did not, however, disclose any details about the viruses it was targeting. Pfizer and BioNTech did not immediately respond to Reuters requests for comment.

• BlackRock Inc: The company said on Monday it is hiring a prominent law firm to conduct an internal review after a report in a trade publication detailed new employee complaints about the conduct of executives, including senior leader Mark Wiedman. BlackRock CEO Larry Fink said in a staffwide memo on Monday that the company is retaining the law firm Paul, Weiss to conduct a review, following the complaints and other incidents that have come to light in recent weeks. A copy of the memo was provided to Reuters by a company spokesman and is the latest in a series of penitent statements by the world's largest asset manager. Such incidents "should not happen at BlackRock," Fink wrote. A Paul, Weiss spokesperson did not immediately respond to a request for comment.

• Boeing Co: The company said it had entered into a $5.28 billion, two-year revolving credit agreement, as the U.S. planemaker contends with a prolonged slowdown in commercial air travel fueled by the COVID-19 pandemic. "We have no current plans to draw on our credit revolvers, as we continue to be confident that we have sufficient liquidity and are not planning to increase our debt levels," said Chief Financial Officer Greg Smith. The credit agreement is scheduled to end on March 19, 2023, Boeing said in a filing.

• Coherent Inc & Lumentum Holdings Inc: The optical fiber firm said it has raised its buyout offer for Coherent to about $7 billion, the latest in a three-way battle for the laser maker. Under the revised offer, Coherent shareholders would receive $230 in cash and 0.6724 of a Lumentum share for each share they own. Coherent was put into play after Lumentum, a supplier of 3D sensors used in Apple iPhone's Face ID, offered $5.7 billion for the company in January, triggering rival bids from MKS Instruments and II-VI last month.

• DouYu International Holdings Ltd & Huya Inc: Chinese internet giant Tencent Holdings Ltd is having to offer concessions in a plan to merge the country's top two videogame live-streaming sites in order to resolve antitrust concerns, two people with knowledge of the matter told Reuters. Tencent, China's No. 1 videogame and social media firm, first announced plans to merge Huya and DouYu last year in a tieup designed to streamline its stakes in the firms, estimated by data firm MobTech to have an 80% slice of a market already worth more than $3 billion and growing fast. But with regulators concerned the deal would give Tencent overwhelming dominance, it's willing to settle for approval subject to conditions, according to the people, who declined to be named due to the sensitivity of the matter. Tencent, Huya, DouYu and SAMR did not immediately respond to Reuters' requests for comment.

• eHealth Inc: Activist investor Starboard Value LP said on Monday that it nominated four directors to the board at the company only days after the insurer reached a settlement for two seats with another firm. Starboard, which owns 7% of eHealth, said in a regulatory filing that it feels the company's stock is undervalued, sending the stock price up nearly 5% in after-hours trading. Starboard nominated Peter Feld, a partner and the firm's research director, plus three others. EHealth said it has held discussions with Starboard and is "open minded." "The Board is reviewing Starboard’s nominees and will present its formal recommendation in due course," the company said in a statement.

• General Motors Co: The company on Monday said it saw no reason to cut auto production in Brazil due to the worsening pandemic, striking a different tone to two other vehicle manufacturers who have curbed production, citing health concerns. "Our protocols have been shown to be efficient at preventing infection and internal surveys show that our workers feel safer in factories than they do in their own houses and communities," GM's Brazilian subsidiary said in a statement. "As a result, we do not see any reason that would lead us to alter our production schedule at this moment." Edson Rosso, a union representative at GM's plant in Gravataí, said employees had no complaints about how the automaker had handled health protocols for its workers.

• Jaws Spitfire Acquisition Corp: Velo3D, a 3D printing technology firm, is nearing a deal to go public at a valuation of $1.6 billion by merging with Jaws Spitfire Acquisition Corp, a blank-check firm that counts tennis star Serena Williams among its board directors, people familiar with the matter said on Monday. The deal, which could be announced as soon as Tuesday, is the latest example of a 3D printing company going public by merging with a special purpose acquisition company (SPAC), following similar deals announced in recent months by peers Markforged and Desktop Metal Inc. The merger has attracted $155 million from institutional investors including Baron Capital Group and Hedosophia in the form of a private investment in public equity (PIPE) transaction, sources added. The sources requested anonymity ahead of an official announcement. Velo3D and Jaws Spitfire Acquisition Corp declined to comment.

• Microsoft Corp: The company is in talks to buy messaging platform Discord Inc for more than $10 billion, Bloomberg News reported, citing people familiar with the matter. Discord has reached out to potential buyers and Microsoft is one of them, the report said, citing people familiar with the matter. One person said it was more likely to go public than sell itself. Earlier in the day, VentureBeat reported that Discord was exploring a sale and it was in final talks with a party. Microsoft declined to comment, while Discord did not immediately respond to Reuters request.

• Novartis AG: The comapny's Lu-PSMA-617 radioligand therapy helped improve survival for patients with advanced castration-resistant prostate cancer in a phase III study, the Swiss drugmaker said. "We intend to submit these data to regulatory authorities as soon as possible," the group's Head of Global Drug Development and Chief Medical Officer John Tsai said in a statement.

• Rio Tinto Plc: An Australian Aboriginal group on whose lands Rio Tinto mines for iron ore said that heritage reforms Rio announced lacked detail and that it had yet to see an improved approach to cultural heritage management. Rio Tinto outlined its plans to improve its heritage management practices, 10 months after it destroyed 46,000-year-old rock shelters at Juukan Gorge in Western Australia against the wishes of traditional owners, causing public outcry. Rio said it would form an Indigenous advisory group to help it better understand issues affecting Indigenous Australians, identify gaps in the company's current protocols and provide a clear pathway to best practice and re-establish trust over time. Tony Bevan, a director at Wintawari Guruma Aboriginal Corporation (WGAC), one of nine Aboriginal Corporations that have agreements with Rio, said in a statement that the miner had not provided them any details on the plans, which "came across as another big company marketing document".

INSIGHT

From pet food to video games: inside Ryan Cohen's GameStop obsession

After almost four months of phone calls and emails to GameStop complaining about the slow shipping of an order, New Jersey teacher Steven Titus received a late night call in early March - from a director on the video game retailer's board.

ANALYSTS' RECOMMENDATION

• Box Inc: D.A. Davidson raises target price to $25 from $18, reflecting a report that Box is exploring a sale following pressure from Starboard.

• Conduent Inc: Cowen and Company raises target price to $6.50 from $5.50, saying the company has shown much improved execution of its turnaround plan and it appears to be moving in the right direction.

• Odonate Therapeutics Inc: Jefferies cuts rating to hold from buy, after the company announced the discontinuation of its lead and sole asset, tesetaxel.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0800 (approx.) Building permits R number for Feb : Prior 1.682 mln

0800 (approx.) Building permits R change mm for Feb : Prior -10.8%

0830 (approx.) Current account for Q4: Expected -$189.9 bln; Prior -$178.5 bln

1000 (approx.) New home sales-units for Feb: Expected 0.875 mln; Prior 0.923 mln

1000 (approx.) New home sales change mm for Feb: Expected -6.5%; Prior 4.3%

1000 (approx.) Rich Fed Composite Index for Mar: Prior 14

1000 (approx.) Rich Fed, Services Index for Mar: Prior -6

1000 (approx.) Rich Fed Manufacturing Shipments for Mar: Prior 12

COMPANIES REPORTING RESULTS

Adobe Inc: Expected Q1 earnings of $2.78 per share

IHS Markit Ltd: Expected Q1 earnings of 70 cents per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Douyu International Holdings Ltd: Q4 earnings conference call

0930 Raven Industries Inc: Q4 earnings conference call

1100 Neogen Corp: Q3 earnings conference call

1100 Waddell & Reed Financial Inc: Annual Shareholders Meeting

1600 Energy Fuels Inc: Q4 earnings conference call

1630 Bionano Genomics Inc: Q4 earnings conference call

1630 At Home Group Inc: Q4 earnings conference call

1645 AAR Corp: Q3 earnings conference call

1700 Adobe Inc: Q1 earnings conference call

1700 GameStop Corp: Q4 earnings conference call

1800 Golden Nugget Online Gaming Inc: Q4 earnings conference call

EX-DIVIDENDS

There are no major exdivs for the day.

Ochtend update: Nasdaq start week sterk, AEX richting volgende weerstand

Goedemorgen

De indicatie vanmorgen laat zien dat we iets lager kunnen openen maar veel zal het niet zijn, trouwens weten we nu al bekeken over de afgelopen weken dat dit snel kan worden ingehaald na de opening ofwel na 09:00. In ieder geval was het gisteren ook zo, de AEX begon 4 punten lager maar in een snel tempo werd dat verlies ingehaald en sloot de index alsnog positief. Bij de DAX hetzelfde, na een mindere start toch een plus op slotbasis.

Wat opviel gisteren was dat de Nasdaq ofwel alle tech aandelen het goed deden, ook hier bij ons met ASML dat €13 hoger wist af te sluiten en de AEX behoorlijk hielp richting winst. De tech indices op Wall Street zetten dan ook een belangrijke stap richting een nieuwe poging om de toppen op te zoeken. Verder deden de Dow Jones en de S&P 500 het ook prima en blijven de records in zicht.

Verloop markt maandag:

Als we naar Europa kijken dan zien we wat herstel maandag, de AEX geraakt 2,5 punten hoger terwijl de DAX 36 punten winst boekt. De Franse CAC 40 verloor dan weer 30 punten. Op Wall Street start de week sterk met een plus van 103 punten voor de Dow Jones, de S&P 500 wint 27 punten terwijl de Nasdaq met een winst van 162 punten de dag afsluit. De Nasdaq 100 haalt zelfs 218 punten winst terwijl de SOX index 66 punten hoger sluit waardoor deze index het best presteerde op Wall Street.

Op zich is er nu bij alle indices die we intensief volgen in feite technisch nog niets aan de hand, op Wall Street blijven de Dow Jones en de S&P 500 op recordjacht terwijl hier in Europa de indices op koers blijven om hun hoogste standen weer op te zoeken. Wat opviel gisteren is dat de Nasdaq er weer zin in krijgt want gisteren werd er technisch een belangrijke stap omhoog gemaakt. Het gat richting weer nieuwe records wordt zo meteen een stuk kleiner maar er zijn nog een aantal sterke dagen daarvoor nodig. Om bij de AEX een nieuw record neer te zetten moeten we nog zo'n 20 punten hoger zien te geraken. De DAX blijft vrij dicht bij de hoogste stand ooit bereikt en dat was vorige week nog zo.

Via de abonnementen heb ik daar een strategie voor in ieder geval, doe mee met de posities door lid te worden via de proef aanbieding tot 1 JUNI ...

Resultaat dit jaar 2021 verloopt naar wens:

Onderaan deze update ziet u nog een overzicht tot nu toe wat betreft de signalen die we naar de leden versturen en dat vanaf begin dit jaar. Verder ziet u de nieuwe aanbieding om mee te doen met onze signalen tot 1 JUNI. Via de site en dan de Tradershop kunt u als lid de lopende posities met alle details altijd inzien via https://www.usmarkets.nl/tradershop

Inflatie en rente:

De 10 jaar rente in de VS zakt vanmorgen tot rond de 1,673% zie ook de afbeelding hieronder. De rente in Duitsland zien we vanmorgen ook wat inleveren tot rond de -0,321%.

De LIVEBLOG en Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

Indicatie markt:

Als ik het verloop van de indices bekijk dan zien we dat er weer wat kracht in de markt komt na de correctie van afgelopen donderdag en vrijdag. Dat wil zeggen dat de indices nog altijd in hun opgaande beweging blijven en dan vooral de meer traditionele indices zoals de Dow Jones, de S&P 500 en de Dow Transport. Wel is het zo dat nu ook de Nasdaq, de Nasdaq 100 en de SOX index uitbreken en mogelijk de weg zijn ingeslagen om opnieuw richting hun record door te stoten na de correctie van ongeveer 12%.

Hier in Europa zijn dat vooral de DAX en de CAC 40 die dicht bij hun hoogste stand of records blijven hangen zodat er maar weinig nodig is om nieuwe hoogtepunten te bereiken. Wat dat betreft kan ik niet verder dan er rekening mee te houden dat er de komende dagen opnieuw een poging op gang kan komen richting nieuwe toppen. De DAX zit hoe dan ook nog in een sterke flow met nieuwe records tot midden vorige week. Ook wat betreft Europa moeten we zolang de records binnen handbereik blijven omhoog kijken, daarom heb ik al met wat kleine long posities geanticipeerd op een herstel eind vorige week.

Analyse Nasdaq:

We kunnen nu zowaar 2 steunlijnen zien en meteen vallen ook de 3 hogere bodems op, let er wel op dat de Nasdaq het de afgelopen weken moeilijk kreeg na een lange reeks met records door dat de rente opliep. Dat feit werd waarschijnlijk aangegrepen om een correctie op te zetten die voor een terugval van 12% zorgde, de vraag is nu of dat daadwerkelijk ook zorgt voor een nieuwe bodem bij de Nasdaq, dus rond de 12.400 punten. De rebound nu is in ieder geval al meer dan 50% van de totale correctie vanaf de top tot de bodem en op zich kunnen we dat positief noemen. Als de index ook deze week met een plus kan sluiten dan zit er weer een rit richting de top in de komende weken. Reken erop dat de markt amper wacht en dat het snel kan gaan.

De opzet ziet er dus sterk uit, we zien die hogere bodems en dat sterke herstel van de afgelopen 2 weken duidelijk op de grafiek. Als de Nasdaq tot boven de 13.500 punten geraakt dan voorzie ik een aanval op de topzone en kunnen we richting nieuwe records. Weerstand zien we door de rode lijn over de toppen, na een aanval op het record zou die lijn weer een doel kunnen worden.

Weekgrafiek Nasdaq Composite:

Technische conditie markt:

Wat betreft Wall Street ziet het er technisch nog altijd sterk uit want anders blijven nieuwe records niet binnen handbereik. Pas als de indices 2 tot 3% onder die records komen te staan kan het voor een tijdje over en uit zijn hetgeen we hebben gezien bij de tech indices. De Dow Jones, de S&P 500 blijven nog ruim boven hun 20-MA en 50-MA (MA = daags gemiddelde) en staan nu al een hele lange periode boven hun 200-MA.

De technologie indices (de Nasdaq, de Nasdaq 100 en de SOX index) lijken duidelijk te herstellen nu en zeker nadat ze door hun 50-daags gemiddelde zijn gebroken. En gisteren (maandag) zien we zelfs al een test tot op hun 20-daags gemiddelde maar dat was voorlopig een te zware hindernis. De opzet is wel zo dat die weerstand vandaag opnieuw kan worden getest en door de hogere bodems van de afgelopen dagen wel eens kan worden doorbroken. We krijgen dus een paar belangrijke dagen wat betreft de technologie sector, ik ben benieuwd of ze gaan uitbreken want dan ligt de weg open richting de top.

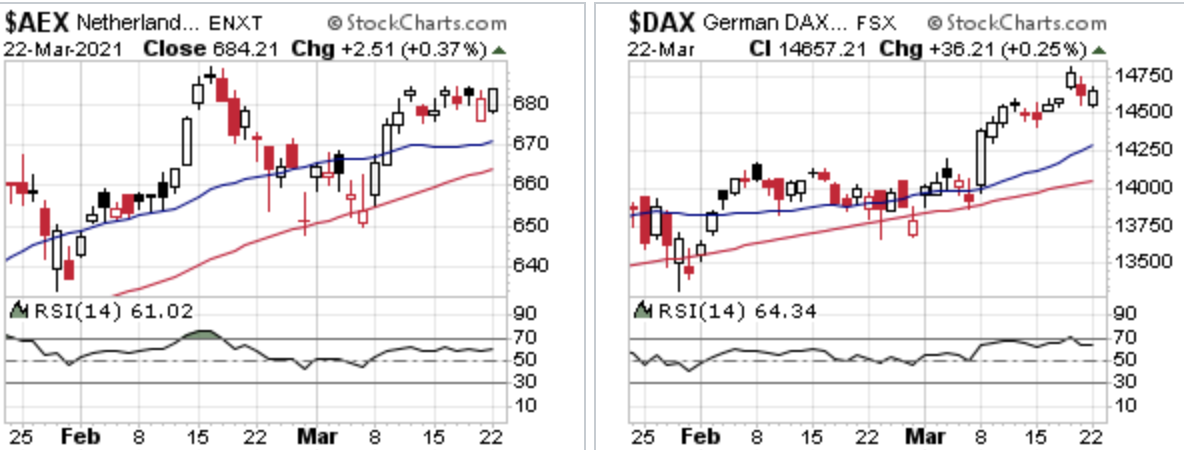

Ook Europa blijft sterk liggen, de indices die we volgen, zowel de AEX en de DAX staan ruim boven hun 20-MA en 50-MA zoals u kunt zien op de afbeelding hieronder. De DAX blijft ook dicht bij de recordstand en de AEX moet nu boven de 688 punten zien te geraken om dan de oversteek richting het record rond de 702 punten te maken. Voor de AEX komt er nu mogelijk een mooie fase aan als de stijging door kan zetten. De trend bij de DAX blijft op alle fronten omhoog gericht zoals u kunt zien op de grafiek hieronder.

Inter Market overzicht op slotbasis ...

Euro, olie en goud:

De euro zien we nu rond de 1.1925 dollar, de prijs van een vat Brent olie komt uit op 64 dollar terwijl een troy ounce goud nu op 1737 dollar staat.

Nu lid worden tot 1 JUNI voor €39?

Blijven schakelen tussen long en short blijft belangrijk de komende weken. Ook deze maand (maart) krijgen we genoeg kansen. Doe nu in ieder geval mee met de proef aanbieding voor nieuwe leden, die loopt tot 1 JUNI en dat met een mooie korting !! ... €39 tot 1 JUNI 2021 ... en voor Polleke €49 tot 1 JUNI 2021 !!! https://www.usmarkets.nl/tradershop

Schrijf u in voor Systeem Trading (€39 tot 1 JUNI)

Schrijf u in voor Index Trading (€39 tot 1 JUNI)

Schrijf u in voor Guy Trading (€39 tot 1 JUNI)

Schrijf u in voor Polleke Trading (€49 tot 1 JUNI)

Schrijf u in voor de Aandelen portefeuille (€30 tot 1 JUNI)

Schrijf u in voor COMBI TRADING (€79 tot 1 JUNI)

Hieronder het resultaat tot nu toe dit jaar (2021) ...

Met vriendelijke groet,

Guy Boscart

Markt snapshot Europa 23 maart

GLOBAL TOP NEWS

Germany is extending its lockdown until April 18 and calling on citizens to stay at home for five days over the Easter holidays to try to break a third wave of the COVID-19 pandemic, Chancellor Angela Merkel said.

The United States, the European Union, Britain and Canada imposed sanctions on Chinese officials on Monday for human rights abuses in Xinjiang, the first such coordinated Western action against Beijing under new U.S. President Joe Biden.

President Joe Biden will be briefed by advisers this week on infrastructure, climate and jobs proposals being considered by the White House that could collectively cost as much as $4 trillion, according to people familiar with discussions.

EUROPEAN COMPANY NEWS

British drugmaker AstraZeneca may have included outdated information from its COVID-19 vaccine clinical trial, the U.S. National Institute of Allergy and Infectious Diseases (NIAID) said.

Miner Rio Tinto said it will form an Indigenous advisory group to identify gaps in current protocols for managing Indigenous culture in Australia, nearly a year after destruction of an important heritage site for a mine.

Credit Agricole Italia said on Monday that Italian market regulator Consob has cleared the publication of the investor document detailing its offer to buy rival Creval, paving the way for the launch of the bid.

TODAY'S COMPANY ANNOUNCEMENTS

Alliance Pharma PLC FY 2020 Earnings Call

AP Moeller - Maersk A/S Annual Shareholders Meeting

Arrow Global Group PLC FY 2020 Earnings Call

Bankia SA Annual Shareholders Meeting

Cargotec Corp Annual Shareholders Meeting

Crest Nicholson Holdings PLC Annual Shareholders Meeting

Cts Eventim AG & Co KgaA Q4 2020 Earnings Release

Dfds AS Annual Shareholders Meeting

DP Eurasia NV FY 2020 Earnings Call

Elementis PLC FY 2020 Earnings Call

Fermiere du Casino Municipal Cannes SA Annual Shareholders Meeting

Graines Voltz SA Annual Shareholders Meeting

H Lundbeck A/S Annual Shareholders Meeting

Hydro Hotel Eastbourne PLC Annual Shareholders Meeting

IHS Markit Ltd Q1 2021 Earnings Call

Jyske Bank A/S Annual Shareholders Meeting

Nemetschek SE Q4 2020 Earnings Release

Nordex SE FY 2020 Earnings Call

Randstad NV Annual Shareholders Meeting

Schindler Holding AG Annual Shareholders Meeting

SGS SA Annual Shareholders Meeting

Standard Life Private Equity Trust PLC Annual Shareholders Meeting

Stentys SA Annual Shareholders Meeting

Swiss Prime Site AG Annual Shareholders Meeting

Titan Cement International SA FY 2020 Earnings Call

TitanMet SpA Shareholders Meeting

Valmet Oyj Annual Shareholders Meeting

Wynnstay Group PLC Annual Shareholders Meeting

YouGov PLC HY 2021 Earnings Call

ECONOMIC EVENTS (All times GMT)

0530 Netherlands Consumer Confidence Adjusted for Mar: Prior -19

0530 Netherlands Consumer Spending Volume for Jan: Prior -11.9%

0700 (approx.) United Kingdom Claimant Count Unemployment Change for Feb: Prior -20,000

0700 (approx.) United Kingdom ILO Unemployment Rate for Jan: Expected 5.2%; Prior 5.1%

0700 (approx.) United Kingdom Employment Change for Jan: Expected -167,000; Prior -114,000

0700 (approx.) United Kingdom Average Week Earnings 3M yy for Jan: Expected 4.9%; Prior 4.7%

0700 (approx.) United Kingdom Average Earnings (Ex-Bonus) for Jan: Expected 4.4%; Prior 4.1%

0800 (approx.) Spain Overnight Stays for Feb: Prior 23,93,440

0900 (approx.) Italy Industrial Orders mm SA for Jan: Prior 1.7%

0900 (approx.) Italy Industrial Orders yy NSA for Jan: Prior 7.0%

0900 (approx.) Italy Industrial Sales mm SA for Jan: Prior 1.0%

0900 (approx.) Italy Industrial Sales yy WDA for Jan: Prior -0.5%

1100 United Kingdom CBI Trends - Orders for Mar: Expected -20; Prior -24