Liveblog Archief woensdag 24 maart 2021

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Ruwe Olievoorraden | Actueel: 1,912M Verwacht: -0,272M Vorige: 2,396M |

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Kern Duurzame Goederen Bestellingen (Maandelijks) (Feb) | Actueel: -0,9% Verwacht: 0,6% Vorige: 1,6% |

Markt snapshot Wall Street 24 maart

TOP NEWS

• Fed's Bullard sees inflation at 2.5% this year, easing only slightly in 2022

Inflation will hit 2.5% this year and not fall much in 2022, which the Federal Reserve should welcome as a way to reaffirm the central bank's inflation target, St. Louis Federal Reserve Bank President James Bullard said on Tuesday.

• China's Didi leans towards New York for IPO, eyes valuation of at least $100 billion -sources

China's top ride-hailing firm Didi Chuxing is leaning toward picking New York over Hong Kong for its initial public offering (IPO), eyeing a valuation of at least $100 billion via the float, two people with direct knowledge of the matter said.

• Silicon Valley firms in no hurry to open up offices despite easing of virus ban

Several of San Francisco Bay Area's largest technology companies including Twitter and Google plan to keep their offices largely closed for months more despite the government allowing them on Tuesday to be opened in a limited capacity.

• TSMC shares slide, as Taiwan plays down Intel's $20 bln expansion challenge

Taiwan Semiconductor Manufacturing Co shares fell after Intel announced a $20 billion plan to expand its advanced chip manufacturing capacity, even as Taiwan's economy minister sought to downplay the impact.

• Tesla can now be bought for bitcoin, Elon Musk says

Tesla customers can now buy its electric vehicles with bitcoin, its boss, Elon Musk, said on Wednesday, marking a significant step forward for the cryptocurrency's use in commerce.

BEFORE THE BELL

U.S. stock index futures rose while investors looked to business surveys for March and another day of testimonies from the top U.S. economic officials. European stocksslipped, as concerns about new lockdown measures overshadowed a surprise return to economic growth for the euro zone in March. Japan's Nikkei fell as renewed concerns about the return of coronavirus lockdowns in Europe dented hopes of an acceleration in the global economy. The dollar was in the green as concerns over a third COVID-19 wave in Europe, potential U.S. tax hikes and escalating tensions between the West and China sapped risk appetite. Gold prices rose as a pullback in U.S. Treasury yields lifted demand for the safe-haven metal. Oil rose after a ship ran aground in the Suez Canal raising supply concerns. On the economic schedule, durable goods and IHS Markit’s manufacturing and services PMI numbers are due later in the day.

STOCKS TO WATCH

Results

• GameStop Corp: The company said on Tuesday it may sell new shares as the U.S. video game retailer that led the Reddit rally of "meme stocks" looks to take advantage of a more-than-800% surge in its stock price since January. Shares of the brick-and-mortar retailer gyrated after hours and were last down, adding to a loss during the regular trading session. GameStop commented on the potential share offering in a regulatory filing for fourth-quarter earnings which showed a return to profitability, with 175% growth in e-commerce sales. Net sales fell to $2.12 billion. Adjusted net income rose to $90.7 million, or $1.34 per share, from $83.8 million, or $1.27 per share, a year earlier.

• Elbit Systems Ltd: The Israeli defence electronics firm said a jump in its order backlog should fuel further growth in 2021, after posting lower quarterly earnings hurt partly by a stronger shekel. Elbit's order backlog rose to $11 billion in 2020 from $10 billion in 2019, it said on Wednesday, with two-thirds of orders from outside Israel. "That definitely gives us a good feeling about the potential growth in revenues. I would say mid-single-digit growth is not out of the question," Chief Financial Officer Joseph Gaspar told Reuters, saying its defence business was not harmed much by the COVID-19 pandemic. Israel's largest defence contractor, which makes drones, pilot helmet displays and cyber security systems, last year earned $7.20 per diluted share excluding one-time items, up from $6.79 in 2019. Elbit declared a dividend of 44 cents per share for the fourth quarter, unchanged from the third quarter.

Moves

• Amazon.com Inc: The company on Tuesday appointed Salesforce.com executive Adam Selipsky to lead its high-margin cloud computing unit, Amazon Web Services. Seattle-based Amazon said Selipsky, one of the first VPs hired in AWS in 2005 who ran the cloud computing division's sales, marketing, and support for 11 years, will return to AWS on May 17. Selipsky became the CEO of Salesforce.com Inc's Tableau Software unit in 2016, and under his leadership the value of the division quadrupled in just a few years, Amazon said.

In Other News

• Alphabet Inc: Google said it had sealed agreements with various Italian publishers to offer access to some of their content on the U.S. tech giant's Showcase news platform. Google News Showcase is a global vehicle to pay news publishers for their content online and a new service that would allow partnering publishers to curate content and provide limited access to paywalled stories for users. The accord was signed with a number of Italian publishers, including RCS Mediagroup, which publishes daily Corriere della Sera as well as popular sports daily Gazzetta dello Sport, the publisher of financial daily Il Sole 24 ore, Caltagirone editore, which owns Rome-based paper Il Messaggero, and Monrif, which publishes local papers such as Il Giorno and La Nazione. To date, 13 Italian editorial companies have finalised agreements with Google, giving users access to content from 76 national and local papers. No financial details of the accord were disclosed.

• Alphabet Inc & Twitter Inc: Several of San Francisco Bay Area's largest technology companies including Twitter Inc and Google plan to keep their offices largely closed for months more despite the government allowing them on Tuesday to be opened in a limited capacity. Networking gear maker Cisco Systems Inc and file-storage service Dropbox Inc said their mandatory work from home policies would remain effect until June, while Box Inc said its reopening is still scheduled for September. Pinterest Inc is not eyeing a significant reopening until at least August, Alphabet Inc's Google until September and DocuSign Inc not before October. Twitter, Adobe Inc, PayPal Holdings Inc, Twilio Inc, Yelp Inc and Zoom Video Communications Inc also will stay closed despite what Breed and other local government officials described as a move to the "orange tier" from the "red tier" of California lockdown restrictions.

• America Movil SAB de CV: Mexican telecoms giant America Movil, controlled by the family of billionaire Carlos Slim, said on Tuesday it plans to set up a fund for the buyback of its shares worth 25 billion pesos. The fund would be used during the period of April 2021 to April 2022, America Movil said in a statement. America Movil will propose the cancellation of all the shares that it holds in its treasury at the time of the meetings, acquired as part of its own buyback program. The company will also propose to shareholders a dividend of 0.40 pesos per share, the statement said.

• BioNTech SE: The company said it was investigating a packaging issue in one production batch that has prompted a suspension of the use of its COVID-19 vaccine in Hong Kong and Macau. Hong Kong and Macau authorities on Wednesday halted the use of the product, citing defective packaging. BioNTech said on Wednesday the investigation is looking at the final production steps, including bottling into vials, known as fill and finish, re-packaging and handling at vaccination centers. It added that no other regions had been supplied with the batch.

• Boeing Co, Lockheed Martin Corp & Northrop Grumman Corp: The companies won separate contracts to design the next-generation interceptor for the U.S. missile defense network, the Pentagon announced on Tuesday. The Northrop deal is worth up to $3.9 billion and the Lockheed contract could be valued at up to $3.7 billion. The next-generation interceptor program could be worth as much as $10 billion to $12 billion over its lifetime as the contractor works to make the technology capable of defeating current ballistic missile threats and future technological advances from countries including North Korea and Iran.The new interceptors would be a part of the Ground-based Midcourse Defense (GMD) system, a network of radars, anti-ballistic missiles and other equipment designed to protect the United States from intercontinental ballistic missiles. Boeing, which had bid on the interceptor contract, was knocked out of the competition on Tuesday.

• BHP Group Ltd: The global miner, also a major gas supplier and user, urged rivals to step up trading in the Australian spot gas market and back a domestic price index to help keep government from intervening in the market. BHP is pressing for Australia's gas market - which the country's competition watchdog has called "dysfunctional" - to move away from opaque contract negotiations towards index-based deals. It made a similar push in the global iron ore market that led to the end of annual price-setting talks a decade ago. Spot trade has grown to around 15% of the eastern gas market, up from 5% in 2015, while the number of participants has grown to 37 from 20, BHP's head of energy, Sam Bartholomaeus, said at the Australian Domestic Gas Outlook conference. "We may not be able to emulate Henry Hub or large European gas markets ... but that doesn't mean we can't have a healthy spot market," he said. Seperately, England's Court of Appeal has denied permission for a 200,000-strong Brazilian claimant group to resurrect a 5.0 billion pound lawsuit against the mining giant over a devastating 2015 dam failure.

• Credit Suisse Group AG: The company is exiting its domestic wealth management business in Austria and referring a portion of its wealthy clients to Liechtensteinische Landesbank while others will be served abroad, it said. "Following a thorough analysis of its wealth management operations in Austria, Credit Suisse has decided to serve Austria-booked (ultra high net worth) clients from Luxembourg going forward and is referring its local (high net worth) clients to Liechtensteinische Landesbank (Österreich) AG," it said in a statement. The transition is expected to begin in the second quarter, the Swiss bank said.

• Equinor ASA: The company and partners Vaar Energi, Idemitsu Petroleum and Neptune Energy have made the biggest oil discovery this year to date on the Norwegian continental shelf, Equinor said. The discovery near the Fram field in the North Sea is estimated to hold between 75 million and 120 million barrels of recoverable oil equivalent, Equinor said in a statement. The find was "significant", Equinor said, and will likely be linked up to nearby oil platforms for production. "With discoveries in four of four prospects in the Fram area during the past 18 months, we have proven volumes that in total will create considerable value for society," said Nick Ashton, Equinor's senior vice president for exploration in Norway.

• Honda Motor Co Ltd: The company said on Tuesday it will extend production suspensions at some North American plants into the week of March 29 due to various supply chain issues. Honda cited "impact from COVID-19, congestion at various ports, the microchip shortage and severe winter weather" for the production cuts. The global shortage of semiconductor chips is hitting production around the world. Meanwhile, demand for chips surged from the consumer electronics industry as people worked from home and played video games. Now carmakers must compete for chips.

• Intel Corp: The company will greatly expand its advanced chip manufacturing capacity as the new chief executive announced plans to spend as much as $20 billion to build two factories in Arizona and to open up its factories to outside customers. The move by CEO Pat Gelsinger on Tuesday aims to restore Intel's reputation after technological missteps. Intel will use those factories to make its own chips but also open them to outside customers in what is called a "foundry" business model in the chip industry. "We are absolutely committed to leading process technology capabilities at scale for the industry, and for our customers," Gelsigner said, adding that Intel has lined up customers for the new factories but could not disclose their names. Plans by Intel Corp to greatly expand its advanced chip manufacturing capacity will add 1,600 jobs at its Irish plant, one of the largest ever single job announcements by a multinational company in Ireland.

• Phillips 66: The Independent U.S. refiner is eliminating 75 jobs at its Bartlesville, Oklahoma, operations center, according to a local newspaper report. Phillips 66 is cutting 60 jobs held by employees and 15 held by contractors to transfer the work they perform in procurement and finance to an outside company, the Bartlesville Examiner-Enterprise reported, citing a statement from the company. Phillips 66 did not reply to a request for comment from Reuters. Phillips 66, based in Houston, uses outside companies to perform similar work at other locations, according to the report. Some of the employees will move into other positions at the company and the rest will have their employment terminated.

• Ryanair Holding PLC: The company is reasonably confident that Britons will be taking holidays in Europe in June, July and August, defying gloom in the sector as COVID-19 cases rise in some holiday destinations. "We're reasonably confident that there will be unrestricted holiday travel for British families going to European beach resorts," Ryanair's Group Chief Executive Michael O'Leary told Sky News. The Irish low cost airline, Europe's biggest, also said it was adding 26 new routes to destinations in Greece, Portugal and Spain from the UK. "I think there's a reasonable prospect, higher than 50%, of the UK families will be holidaying in June, July and August, in theory, in Spain, Greece and Portugal as normal."

• Taiwan Semiconductor Manufacturing Co Ltd: The company shares fell after Intel Corp announced a $20 billion plan to expand its advanced chip manufacturing capacity, even as Taiwan's economy minister sought to downplay the impact. Intel said it will build two factories in Arizona and open its plants to outside customers, directly challenging the two other companies in the world that can make the most advanced chips - TSMC, and Samsung Electronics Co Ltd. Shares in TSMC, the world's largest contract chip manufacturer with clients including Apple Inc and Qualcomm Inc, fell. TSMC, in a statement sent to Reuters, said: "Intel is our long-time customer and we do not comment on individual customers". Under the deal, Toyota will acquire 39 million treasury shares in Isuzu, worth 42.8 billion yen ($393.89 million), taking a 4.6% stake, the automakers said. Toyota and Isuzu in 2018 dissolved a previous, 12-year capital tie-up that had focused on diesel engines.

• Tesla Inc: The company's customers can now buy its electric vehicles with bitcoin, its boss, Elon Musk, said, marking a significant step forward for the cryptocurrency's use in commerce. "You can now buy a Tesla with bitcoin," Musk said on Twitter, adding that the option would be available outside the United States later this year. Musk said bitcoin paid to Tesla would not be converted into traditional currency, but he gave few other details on how the bitcoin payments would be processed. The company was using "internal & open source software", he said. Most mainstream companies that allow customers to pay with bitcoin typically use specialist payment processors that convert the cryptocurrency into, say, dollars and send the sum to the company.

• Total SE: The company will restart construction at its $20 billion liquefied natural gas development in Mozambique after the government increased security, the French energy firm said. It said on Wednesday this had now been implemented, allowing for the "gradual remobilisation" of the project's workforce and a resumption of construction work. "The government of Mozambique has declared the area within a 25 km perimeter surrounding the Mozambique LNG project as a special security area," Total said in a statement. It added that other measures including the reinforcement of security infrastructure and strengthening of Mozambique's security forces had also been implemented.

• Toyota Motor Corp: The company and Isuzu Motors Ltd announced a capital alliance, reviving a partnership to bolster their competitive edge in connected, commercial vehicles. Toyota truck unit Hino Motors Ltd will join in the pact to jointly develop small commercial trucks of the future, including connected vehicles and fuel cell technologies, the automakers said. Under the deal, Toyota will acquire 39 million treasury shares in Isuzu, worth 42.8 billion yen, taking a 4.6% stake, the automakers said. Toyota and Isuzu in 2018 dissolved a previous, 12-year capital tie-up that had focused on diesel engines. "We had tried to jointly develop small diesel engines together... but we didn't really identify specific projects much, and we decided to split and find our own ways," Toyota Motor President Akio Toyoda told a news conference.

• Walmart Inc: Shares in Carrefour edged higher after the French supermarket retailer said it would buy Grupo BIG in a deal that values Brazil's third-biggest food retailer at about $1.3 billion. The deal is the first significant acquisition by the French food retailer since a possible takeover by Couche-Tard unravelled in January after opposition from the French government. Carrefour will buy BIG, which operates 387 stores and generated sales of 24.9 billion reals in 2020, from Walmart and investment firm Advent International. "Our Group is on the offensive," Carrefour Chairman and Chief Executive Alexandre Bompard said in a statement.

• Wells Fargo & Co: The bank will sell its corporate trust business to Australia's Computershare for $750 million, the two companies said on Wednesday, as the Wall Street lender shifts its focus to core operations. As part of the deal terms, about 2,000 employees of Wells Fargo's Corporate Trust Services (CTS) business will be transferred to Computershare, which offers investor services such as share registry. "This transaction is consistent with Wells Fargo's strategy of focusing on businesses that are core to our consumer and corporate clients," said David Marks, head of commercial capital. To help fund the deal, Melbourne-based Computershare announced a A$835 million entitlement offer. The company expects the deal to add to its earnings per share by at least 15% on a full-year 2021 pro forma basis.

• Westpac Banking Corp: The bank is considering whether to spin-off its New Zealand unit in response to changing local capital norms, it said, as the country's regulator ordered it to raise its cash holdings until it improves its risk governance. The bank's statement came after the Reserve Bank of New Zealand (RBNZ) said Westpac NZ had, for years, operated outside of its own risk settings for technology, and would have to get two independent reviews to address concerns around its poor risk governance. Westpac operates one of New Zealand's Big Four lenders dominating that market, with its New Zealand unit accounting for A$656 million in net profit for the group in the year to September 2020, its accounts show. "Westpac NZ is a valuable part of the Westpac Group and has been for over 160 years," Westpac said in a statement to the exchange.

INSIGHT

In Amazon union election, votes cast by some ineligible ex-employees could swing outcome

Although Emily Stone's employment at an Amazon.comwarehouse ended on Feb. 1, she still received a ballot for her former company's union election in the weeks following her departure and a text asking her to vote no.

ANALYSTS' RECOMMENDATION

• Adobe Inc: Jefferies raises target price to $610 from $600, after the company delivered a strong beat in all 3 cloud segments.

• GameStop Corp: Wedbush raises target price to $29 from $16, saying the company is well-positioned to be a primary beneficiary of the new console launches, and remaining quite optimistic that it will return to profitability by FY21.

• Nike Inc: Cowen and Company cuts target price to $163 from $173, reflecting modelling challenges across the sector and saying Q4 guidance feels fairly conservative.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0830 (approx.) Durable goods for Feb: Expected 0.8%; Prior 3.4%

0830 (approx.) Durables ex-transport for Feb: Expected 0.6%; Prior 1.3%

0830 (approx.) Durables ex-defense mm for Feb: Prior 2.3%

0830 (approx.) Nondefense cap ex-air for Feb: Expected 0.5%; Prior 0.4%

0945 Markit Composite Flash PMI for Mar: Prior 59.5

0945 Markit Manufacturing PMI Flash for Mar: Expected 59.3; Prior 58.6

0945 Markit Services PMI Flash for Mar: Expected 60.0; Prior 59.8

COMPANIES REPORTING RESULTS

No major S&P 500 companies are scheduled to report.

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Cerevel Therapeutics Holdings Inc: Q4 earnings conference call

0830 APi Group Corp: Q4 earnings conference call

0830 Steelcase Inc: Q4 earnings conference call

0830 Vital Farms Inc: Q4 earnings conference call

0900 General Mills Inc: Q3 earnings conference call

1000 ABM Industries Inc: Annual Shareholders Meeting

1000 Winnebago Industries Inc: Q2 earnings conference call

1100 Enerpac Tool Group Corp: Q2 earnings conference call

1400 Worthington Industries Inc: Q3 earnings conference call

1700 American Well Corp: Q4 earnings conference call

1700 KB Home: Q1 earnings conference call

1700 Montrose Environmental Group Inc: Q4 earnings conference call

1700 QAD Inc: Q4 earnings conference call

1700 RH: Q4 earnings conference call

EX-DIVIDENDS

Altria Group Inc: Amount $0.86

Covanta Holding Corp: Amount $0.08

Getty Realty Corp: Amount $0.39

Portland General Electric Co: Amount $0.40

Sempra Energy: Amount $1.10

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| DEU: Duitse Productie Inkoopmanagersindex (PMI) (Mar) | Actueel: 66,6 Verwacht: 60,8 Vorige: 60,7 |

Ochtend-update: Even stapje terug, Nasdaq met kansen

Goeiemorgen

Na nog maar een persconferentie met de berichtgeving dat we nog langer thuis moeten blijven en met vandaag ook nieuws uit België waar men rekening moet houden met een strenge lockdown kunnen we ons weer gaan richten op hoe we deze periode gaan doorkomen. Wat duurt het allemaal lang en als je dan ziet dat Engeland en de VS zoveel voorlopen met alles, zo wordt je snel gefrustreerd van de handelscapaciteiten hier in Europa. Zeker als je dan ook hoort dat er 3 keer zoveel wordt geproduceerd in Europa en wordt uitgevoerd naar landen buiten onze regio.

Enfin, het is wat het is, maar het blijft vreemd dit alles en veel ondernemers krijgen zo tik na tik en kunnen niet anders dan luisteren naar wat onze bestuurders zeggen. Het beste is om het thuis zo warm mogelijk te maken, het gezellig te houden en de dingen te doen die we wel kunnen en vooral mogen doen. Voor ons gaat dat nog al is het zeker niet leuk, maar voor tieners en jongeren tussen de 18 en 25 zeer lastig, zeker als je de kans niet krijgt om een partner te zoeken, die groep zal het nog moeilijk krijgen maar volgens mij begrijpen sommige bestuurders dat niet eens.

Genoeg erover, we gaan kijken naar wat de markt van plan is vandaag en de rest van de week. De beurzen zitten al lang voorbij de huidige economische fase, de markt zit al in de post pandemie fase ofwel in de fase waar we weer vrij zijn en kunnen doen wat we willen. Dat is ook de reden dat alles er zo bullish bijligt momenteel, ook al kwam er gisteren (dinsdag) een terugval na een redelijke start. Technisch dus nog weinig aan de hand voorlopig of we moeten echt 2 tot 3% onder de toppen staan en zo ver is het nog niet. Sterker nog, de Nasdaq is zich nog aan het herpakken al kwam er wel een stop rond het 20-daags gemiddelde. De Dow en de S&P 500 verloren gisteren wat meer, wel blijft de topzone nog in beeld als doel mocht de markt weer aantrekken. Het kan en ik denk dat het allemaal snel zal gaan eens er richting wordt gekozen.

Via de abonnementen heb ik daar een strategie voor in ieder geval, doe mee met de posities door lid te worden via de proef aanbieding tot 1 JUNI ...

Resultaat dit jaar 2021 verloopt naar wens:

Onderaan deze update ziet u nog een overzicht tot nu toe wat betreft de signalen die we naar de leden versturen en dat vanaf begin dit jaar. Verder ziet u de nieuwe aanbieding om mee te doen met onze signalen tot 1 JUNI. Via de site en dan de Tradershop kunt u als lid de lopende posities met alle details altijd inzien via https://www.usmarkets.nl/tradershop

Inflatie en rente:

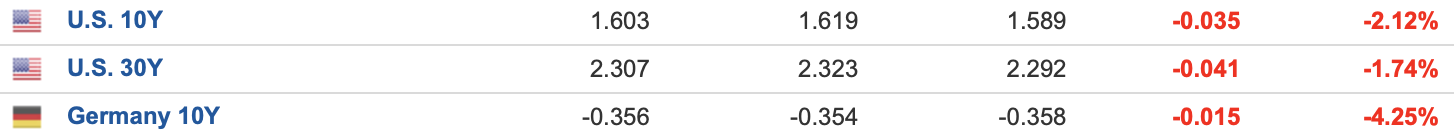

De 10 jaar rente in de VS zakt vanmorgen tot rond de 1,6% zie ook de afbeelding hieronder. De rente in Duitsland zien we vanmorgen ook wat inleveren tot rond de -0,356%.

De LIVEBLOG en Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

Indicatie markt:

De indices zitten nog altijd in hun opgaande beweging al kwam er gisteren even een terugval op gang bij de meer traditionele indices zoals de Dow Jones, de S&P 500 en de Dow Transport. De Nasdaq en de SOX index verloren ook meer dan 1%. Een terugval over de gehele markt deze keer maar dag bleef bij ongeveer 1% bij de Nasdaq, de Dow Jones en de S&P 500, de SOX index en de Dow Transport verloren meer (2 tot 3%). In ieder geval over de gehele lijn wat correctie na de sterke sessie van maandag.

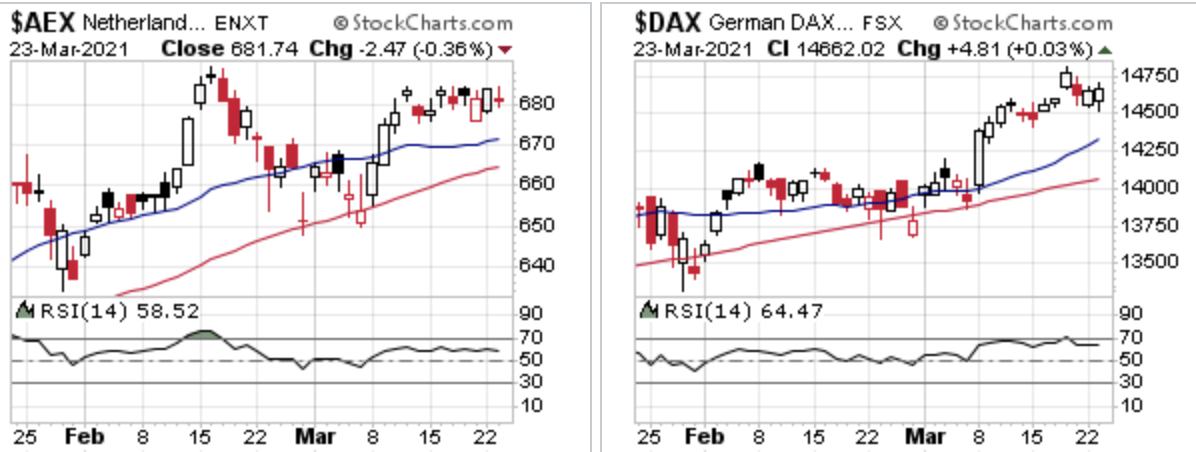

Hier in Europa zien we de DAX iets hoger dinsdag terwijl de CAC 40 en de AEX wat moesten inleveren. Wel blijven alle 3 deze indices dicht bij hun hoogste stand van dit jaar of hun record. Er is in ieder geval maar weinig nodig om nieuwe hoogtepunten op te zoeken. Wat dat betreft kan ik niet verder dan er rekening mee te houden dat er de komende dagen opnieuw een poging op gang kan komen richting nieuwe toppen.

De DAX zit hoe dan ook nog in een sterke flow met nieuwe records tot midden vorige week. Ook wat betreft Europa moeten we zolang de records binnen handbereik blijven omhoog kijken, daarom heb ik al met wat kleine long posities geanticipeerd op een herstel eind vorige week.

Technische conditie markt:

Wat betreft Wall Street ziet het er technisch nog altijd sterk uit want anders blijven nieuwe records niet binnen handbereik. Pas als de indices 2 tot 3% onder die records komen te staan kan het voor een tijdje over en uit zijn hetgeen we hebben gezien bij de tech indices. De Dow Jones, de S&P 500 staan nog steeds ruim boven hun 20-MA en 50-MA (MA = daags gemiddelde) en staan nu al een lange periode boven hun 200-MA.

De technologie indices (de Nasdaq, de Nasdaq 100 en de SOX index) laten herstel zien en zeker nadat ze eind vorige week door hun 50-daags gemiddelde zijn gebroken. En kwam maandag tijdens de sterke sessie zelfs al een test tot op het 20-daags gemiddelde maar dat was voorlopig een te zware hindernis. De opzet is wel zo dat die weerstand nu opnieuw een doel wordt en mogelijk door de hogere bodems van de afgelopen dagen wel eens voor een uitbraak kan zorgen bij zowel de Nasdaq als bij de Nasdaq 100. We zien vanmorgen via de futures opnieuw wat herstel, het aandeel Intel kondigde aan om fors te investeren in nieuwe chip fabrieken wat de sector graag ziet.

Ook Europa blijft sterk liggen, de indices die we volgen, zowel de AEX en de DAX staan ruim boven hun 20-MA en 50-MA zoals u kunt zien op de afbeelding hieronder. De DAX blijft ook dicht bij de recordstand en de AEX moet nu boven de 688 punten zien te geraken om dan de oversteek richting het record rond de 702 punten te maken. Voor de AEX komt er nu mogelijk een mooie fase aan als de stijging door kan zetten. De trend bij de DAX blijft op alle fronten omhoog gericht zoals u kunt zien op de grafiek hieronder.

Inter Market overzicht op slotbasis ...

Euro, olie en goud:

De euro zien we nu rond de 1.185 dollar, de prijs van een vat Brent olie komt uit op 61,5 dollar terwijl een troy ounce goud nu op 1729 dollar staat.

Nu lid worden tot 1 JUNI voor €39?

Blijven schakelen tussen long en short blijft belangrijk de komende weken. Ook deze maand (maart) krijgen we genoeg kansen. Doe nu in ieder geval mee met de proef aanbieding voor nieuwe leden, die loopt tot 1 JUNI en dat met een mooie korting !! ...

Nu tot 1 JUNI 2021 voor €39 ... en voor Polleke €49 tot 1 JUNI 2021 !!! https://www.usmarkets.nl/tradershop

Schrijf u in voor Systeem Trading (€39 tot 1 JUNI)

Schrijf u in voor Index Trading (€39 tot 1 JUNI)

Schrijf u in voor Guy Trading (€39 tot 1 JUNI)

Schrijf u in voor Polleke Trading (€49 tot 1 JUNI)

Schrijf u in voor de Aandelen portefeuille (€30 tot 1 JUNI)

Schrijf u in voor COMBI TRADING (€79 tot 1 JUNI)

Hieronder het resultaat tot nu toe dit jaar (2021) ...

Met vriendelijke groet,

Guy Boscart

Markt snapshot Europa 24 maart

GLOBAL TOP NEWS

The European Commission on Wednesday will extend EU powers to potentially block COVID-19 vaccineexports to Britain and other areas with much higher vaccination rates, and to cover instances of companies backloading contracted supplies, EU officials said.

Treasury Secretary Janet Yellen said on Tuesday the U.S. economy remains in crisis from the pandemic even as she defended developing plans for future tax increases to pay for new public investments.

Intel will greatly expand its advanced chip manufacturing capacity as the new chief executive announced plans to spend as much as $20 billion to build two factories in Arizona and open its factories to outside customers.

EUROPEAN COMPANY NEWS

Hong Kong authorities suspended COVID-19 vaccinations with two batches of Pfizer/BioNTech's shot citing defective packaging but said manufacturers indicated they had no reason to believe safety was at risk.

Norway will block Rolls-Royce from selling a Norwegian maritime engine maker to a Russian company on national security grounds, its justice minister told parliament on Tuesday.

Amazon.com will see its stake in Deliveroo fall to 11.5% when the British food delivery company goes public via an initial public offering, the IPO prospectus showed.

TODAY'S COMPANY ANNOUNCEMENTS

Andritz AG Annual Shareholders Meeting

Antares Vision SpA Annual Shareholders Meeting

Arden Partners PLC Annual Shareholders Meeting

Axfood AB Annual Shareholders Meeting

Bellway PLC HY 2021 Earnings Call

BlackRock Throgmorton Trust plc Annual Shareholders Meeting

Burford Capital Ltd FY 2020 Earnings Release

CA Immobilien Anlagen AG Q4 2020 Earnings Release

Caverion Oyj Annual Shareholders Meeting

DIC Asset AG Annual Shareholders Meeting

E.ON SE Q4 2020 Earnings Release

Flsmidth & Co A/S Annual Shareholders Meeting

Gjensidige Forsikring ASA Annual Shareholders Meeting

Hera SpA Q4 2020 Earnings Call

Kemira Oyj Annual Shareholders Meeting

Kenmare Resources PLC FY 2020 Earnings Call

LPKF Laser & Electronics AG Q4 2020 Earnings Release

MHP SE FY 2020 Earnings Release

Mitchells & Butlers PLC Annual Shareholders Meeting

Navios Maritime Partners LP Q4 2020 Earnings Call

Nordea Bank Abp Annual Shareholders Meeting

NORMA Group SE FY 2020 Earnings Release

Pendragon PLC FY 2020 Earnings Release

PGS ASA Q4 2020 Annual Report

Pirelli & C SpA Annual Shareholders Meeting

Rights and Issues Investment Trust PLC Annual Shareholders Meeting

Sartorius Stedim Biotech SA Annual Shareholders Meeting

Sensorion SA Annual Shareholders Meeting

Simcorp A/S Annual Shareholders Meeting

Sligro Food Group NV Annual Shareholders Meeting

Softcat PLC HY 2021 Earnings Call

Telit Communications PLC FY 2020 Earnings Call

Terna Rete Elettrica Nazionale SpA FY 2020 Earnings Call

Unternehmens Invest AG Annual Shareholders Meeting

ECONOMIC EVENTS (All times GMT)

0700 (approx.) United Kingdom Core CPI mm for Feb: Expected 0.5%; Prior -0.5%

0700 (approx.) United Kingdom Core CPI yy for Feb: Expected 1.4%; Prior 1.4%

0700 (approx.) United Kingdom CPI mm for Feb: Expected 0.5%; Prior -0.2%

0700 (approx.) United Kingdom CPI yy for Feb: Expected 0.8%; Prior 0.7%

0700 (approx.) United Kingdom RPI mm for Feb: Expected 0.6%; Prior -0.3%

0700 (approx.) United Kingdom RPI yy for Feb: Expected 1.6%; Prior 1.4%

0700 (approx.) United Kingdom RPI-X (Retail Prices) mm for Feb: Prior -0.3%

0700 (approx.) United Kingdom RPIX yy for Feb: Prior 1.6%

0700 (approx.) United Kingdom RPI Index for Feb: Prior 294.6

0700 (approx.) United Kingdom CPI NSA for Feb: Prior 109.0

0700 (approx.) United Kingdom PPI Input Prices mm NSA for Feb: Expected 0.7%; Prior 0.7%

0700 (approx.) United Kingdom PPI Input Prices yy NSA for Feb: Expected 2.6%; Prior 1.3%

0700 (approx.) United Kingdom PPI Output Prices mm NSA for Feb: Expected 0.3%; Prior 0.4%

0700 (approx.) United Kingdom PPI Output Prices yy NSA for Feb: Expected 0.3%; Prior -0.2%

0700 (approx.) United Kingdom PPI Core Output mm NSA for Feb: Prior 0.3%

0700 (approx.) United Kingdom PPI Core Output yy NSA for Feb: Prior 1.4%

0815 France Markit Manufacturing Flash PMI for Mar: Expected 56.5; Prior 56.1

0815 France Markit Services Flash PMI for Mar: Expected 45.5; Prior 45.6

0815 France Markit Composite Flash PMI for Mar: Expected 47.2; Prior 47.0

0830 Germany Markit Manufacturing Flash PMI for Mar: Expected 60.8; Prior 60.7

0830 Germany Markit Services Flash PMI for Mar: Expected 46.2; Prior 45.7

0830 Germany Markit Composite Flash PMI for Mar: Expected 51.6; Prior 51.1

0900 Euro Zone Markit Manufacturing Flash PMI for Mar: Expected 57.7; Prior 57.9

0900 Euro Zone Markit Services Flash PMI for Mar: Expected 46.0; Prior 45.7

0900 Euro Zone Markit Composite Flash PMI for Mar: Expected 49.1; Prior 48.8

0930 United Kingdom Flash Composite PMI for Mar: Expected 51.1; Prior 49.6

0930 United Kingdom Flash Manufacturing PMI for Mar: Expected 55.0; Prior 55.1

0930 United Kingdom Flash Services PMI for Mar: Expected 51.0; Prior 49.5

1500 Euro Zone Consumer Confidence Flash for Mar: Expected -14.5; Prior -14.8