Liveblog Archief dinsdag 24 augustus 2021

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Nieuwe Woningen Verkoop (Jul) | Actueel: 708K Verwacht: 700K Vorige: 701K |

Markt snapshot Wall Street 24 augustus

TOP NEWS

• Facing divisions, U.S. House Democrats postpone vote on $3.5 trillion Biden plan

Democrats in the U.S. House of Representatives postponed a vote to advance President Joe Biden's ambitious plan to expand social programs, as liberals and centrists remained at odds over which parts of his agenda should get priority.

• U.S. VP Harris meets company executives in Singapore to discuss supply shortages

U.S. Vice President Kamala Harris met company executives in Singapore to discuss supply shortages of essential items that have plagued the Biden administration and contributed to inflation.

• South Korea set to curb Google, Apple commission dominance

South Korea is likely to bar Google and Apple from requiring software developers to use their payment systems, effectively stopping them from charging commissions on in-app purchases, the first such curbs on the tech giants by a major economy.

• With holidays around the corner, Walmart starts last mile delivery service

Walmart launched a delivery service for other merchants throughout the United States, an announcement that comes as goods sellers scramble to secure deliveries ahead of the all-important holiday shopping season.

• Banco Santander unit to buy out U.S. consumer business for $2.5 billion

Santander's U.S. business is to buy the minority stake in its consumer unit it doesn't already hold for around $2.5 billion, a slightly higher price than it agreed to pay in July.

BEFORE THE BELL

Wall Street futures rose, and Asian stocks ended higher, boosted by full FDA approval of Pfizer-BioNTech's COVID-19 vaccine, while market participants awaited the Jackson Hole Symposium expected to convene later this week. European shares edged lower. The dollar steadied, while gold was slightly down. Oil prices rallied on a bullish demand outlook as Mexico suffered a big production outage.

STOCKS TO WATCH

Results

• Medtronic Plc: The company raised the lower end of its 2022 profit forecast range, buoyed by a recovery in demand for its medical devices as more people opted for non-urgent procedures deferred during the coronavirus-induced lockdowns. Revenue at Medtronic's heart devices unit, its biggest growth driver, increased 19% to $2.89 billion. Medtronic said it now expects 2022 adjusted earnings per share in the range of $5.65 to $5.75, from prior expectations of between $5.60 to $5.75. Net income attributable to the company rose to $763 million, or 56 cents per share, in the quarter, from $487 million, or 36 cents per share, a year earlier.

Deals Of The Day

• Banco Santander SA: The lender's U.S. business is to buy the minority stake in its consumer unit it doesn't already hold for around $2.5 billion, a slightly higher price than it agreed to pay in July. The deal values the entire Santander Consumer unit in the United States at $12.7 billion, Santander said in a statement. The offer of $41.5 per share for to buy out the around 20% in its U.S. consumer business represents an increase of 6.4% compared to the $39 per share or $2.36 billion it had offered originally to pay. Santander also said the offer price represents a premium of about 14% to the company's last close on July 1, when the deal was first announced.

• International Flavors & Fragrances Inc: German specialty chemicals maker Lanxess agreed to acquire International Flavors & Fragrances' (IFF) microbial control unit for $1.3 billion, in a move to capitalise on buoyant demand for disinfectants and surface cleaners. Lanxess's purchase of the IFF unit - a maker of ingredients in antifouling paint for ships, personal care products and detergents for livestock farmers - will more than double EBITDA at Lanxess's consumer protection unit, which has benefited from surging disinfectants demand during the coronavirus pandemic. The acquisition is expected to be earnings per share accretive in the first fiscal year after closing, the company statement said.

In Other News

• Alphabet Inc & Apple Inc: South Korea is likely to bar Google and Apple from requiring software developers to use their payment systems, effectively stopping them from charging commissions on in-app purchases, the first such curbs on the tech giants by a major economy. The parliament's legislation and judiciary committee is expected on Tuesday to approve the amendment of the Telecommunications Business Act, dubbed the "Anti-Google law," that takes aim at app store operators with dominant market positions. If the bill gets the committee's approval, it will be put to a final vote on Wednesday. Lawmakers in South Korea have pushed the issue of the commission structure since mid last year.

• Amazon.com Inc: Chief Executive Andy Jassy will join tech executives at a White House meeting with President Joe Biden on Wednesday to discuss efforts by private companies to improve cybersecurity, a source familiar with the matter told Reuters. The source asked not to be identified as the information was not public. Apple CEO Tim Cook and Microsoft Chief Executive Satya Nadella will also attend the White House cybersecurity event, Bloomberg News reported on Monday, citing sources. The chief executives of other large tech companies, banks, energy companies and water utilities, including Alphabet's Google, International Business Machines, Southern and JPMorgan Chase have also been invited, Bloomberg said.

• AmerisourceBergen Corp, Cardinal Health Inc, Johnson & Johnson & McKesson Corp: At least six U.S. states, including Georgia, did not fully sign on to a proposed $26 billion settlement with three drug distributors and Johnson & Johnson, which have been accused of fueling the nation's opioid epidemic, according to the states' attorneys general. States had until Saturday to decide whether to support the $21 billion proposed settlement with McKesson, AmerisourceBergen and Cardinal Health and a separate $5 billion agreement with J&J. But in a sign that talks were continuing despite the passing of the deadline, Georgia - the most populous hold-out state - on Monday indicated it could wind up backing the agreement.

• BHP Group Ltd: The miner is at risk of a two notch downgrade that would provoke its lowest ever credit rating as the sale of its petroleum business raises the miner's dependence on its major business of iron ore, S&P Global said. BHP has agreed to hive off its petroleum business to Woodside Petroleum in a nil-premium merger, in return for new Woodside shares which will go to BHP shareholders, who will own 48% of the enlarged group. The sale will reduce BHP's portfolio diversity and will raise its dependency on a single asset, the agency noted. S&P Global said it was placing 'A' long- and 'A-1' short-term ratings on BHP, as well as the 'A' issue rating on the group's senior unsecured notes on CreditWatch with negative implications.

• BioNTech SE & Pfizer Inc: The United States will ship just over 3 million doses of COVID-19 vaccine to Pakistan via the COVAX global distribution program, bringing the total number of doses sent to Pakistan to around 8.5 million, a White House official said. Scientific teams and legal and regulatory authorities from both countries worked together to ensure the prompt delivery of the 3,006,900 vaccine lots made by Pfizer and Germany's BioNTech, the official said. "The Biden-Harris administration understands that putting an end to this pandemic requires eliminating it around the world," the official said.

• Blackstone Inc: The U.S-based private equity firm is in talks to acquire Interplex Holdings, a Singapore-based technological services provider owned by Baring Private Equity Asia (BPEA), in a deal worth at least $1 billion, according to two people with knowledge of the matter. Final negotiations could still take weeks and there is no certainty in a deal yet, said the sources, who declined to be named as the information is confidential. Blackstone has no exclusivity in the deal, they added.

• Facebook Inc: The social media giant is letting some users make voice and video calls within its main app on a trial basis, aiming to make it easier to place calls without opening its standalone Messenger app. Facebook spun out Messenger from its main app years ago, meaning users would have to download a separate app in order to send messages and make calls. Facebook has been trying to tie together messaging across its suite of apps and first enabled it between Instagram and Messenger last September. The move enabled users of each service to find, message and hold video calls with contacts on the other without needing to download both apps. It plans to eventually integrate WhatsApp into the mix.

• McDonald's Corp: The burger chain said it had taken milkshakes and bottled drinks off the menu at all of its British restaurants as it battled the supply chain issues that are hitting businesses across the retail and hospitality sector. The company did not specify what the issues were but said it was working hard to return the items to the menu as soon as possible. "Like most retailers, we are currently experiencing some supply chain issues, impacting the availability of a small number of products," a McDonald's UK and Ireland spokesperson said in a statement. "Bottled drinks and milkshakes are temporarily unavailable in restaurants across England, Scotland and Wales."

• Novartis AG: The drugmaker said its Kymriah CAR-T therapy did not meet its primary endpoint of event-free survival in a phase III study in patients with aggressive B-cell non-Hodgkin lymphoma (NHL) after relapse or lack of response to first-line treatment. The safety profile was consistent with the established safety profile of Kymriah and Novartis will complete a full evaluation of the BELINDA study data, the Swiss drugmaker said in a statement. ZKB, which rates the stock overweight, called the news negative in a note to investors.

• Rio Tinto Plc: The company said it has restarted operations at its Richards Bay Minerals project in South Africa after a furnace in July was shut down as the supply of raw materials was affected. The company declared a force majeure on customer contracts at the project in June, citing "an escalation in the security situation at the operations". The force majeure remains in place, Rio Tinto said on Tuesday, adding that operations would be ramping up as soon as possible, while the impact from the suspension was yet to be evaluated. The development follows a stabilisation of the security situation around the mine, the company said.

• Tesla Inc: Chief Executive Elon Musk said on Monday said that the electric-car maker was working on improving the much-awaited update to its self-driving software "as fast as possible." The billionaire entrepreneur tweeted that the Full Self-Driving Beta version 9.2 is "actually not great imo (in my opinion), but Autopilot/AI team is rallying to improve as fast as possible." "We're trying to have a single stack for both highway & city streets, but it requires massive NN (neural network) retraining."

• Walmart Inc: The company launched a delivery service for other merchants throughout the United States, an announcement that comes as goods sellers scramble to secure deliveries ahead of the all-important holiday shopping season. Through its latest program, called Walmart GoLocal, Walmart will dispatch workers from its Spark delivery network to merchants' stores to pick up items and then deliver them to shoppers. Over the past year, the retailer has doubled Spark's coverage to more than 500 cities, Walmart Chief Financial Officer Brett Biggs said last week on an earnings call. "We were looking at different potential revenue streams, ways to commercialize the capabilities and scale that Walmart has - and so we'll think about what that means as this program unfolds," said Tom Ward, senior vice president of Walmart's U.S. last mile business.

ANALYSIS

Delta variant disrupts Hollywood's box office comeback

Three months after Hollywood launched a marketing blitz that proclaimed "the big screen is back," the Delta variant of the coronavirus has interrupted cinema's rebound from the pandemic.

ANALYSTS' RECOMMENDATION

• Boston Omaha Corp: Wells Fargo raises target price to $39 from $35, after the company reported upbeat second-quarter results driven by strong growth in billboard and broadband segments.

• Kaman Corp: JPMorgan cuts target price to $45 from $51, to reflect on the company’s long-term headwinds caused by trajectory of Joint Programmable Fuzes (JPF) sales.

• Marathon Oil Corp: Raymond James cuts target price to $16 from $19, to factor in lower commodity prices.

• Palo Alto Networks Inc: Piper Sandler raises target price to $500 from $450, after the company reported strong fourth-quarter results.

• Tenaya Therapeutics Inc: Piper Sandler initiates coverage with overweight rating, believing that the company is positioned to generate assets capable of treating rare and prevalent cardiac indications.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0800 (approx.) Building permits R number for July: Prior 1.635 mln

0800 (approx.) Building permits R change mm for July: Prior 2.6%

1000 (approx.) New home sales-units for July: Expected 0.700 mln; Prior 0.676 mln

1000 (approx.) New home sales change mm for July: Prior -6.6%

1000 (approx.) Richmond Fed Composite Index for Aug: Prior 27

1000 (approx.) Richmond Fed Services Index for Aug: Prior 19

1000 (approx.) Richmond Fed Manufacturing Shipments for Aug: Prior 21

COMPANIES REPORTING RESULTS

Intuit Inc: Expected Q4 earnings of $1.59 cents per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0730 Pinduoduo Inc: Q2 earnings conference call

0800 Best Buy Co Inc: Q2 earnings conference call

0800 Advance Auto Parts Inc: Q2 earnings conference call

0800 Youdao Inc: Q2 earnings conference call

0830 Genetron Holdings Ltd: Q2 earnings conference call

1200 Microchip Technology Inc: Annual Shareholders Meeting

1630 Intuit Inc: Q4 earnings conference call

1645 Nordstrom Inc: Q2 earnings conference call

1730 Urban Outfitters Inc: Q2 earnings conference call

EX-DIVIDENDS

Aramark: Amount $0.11

CDW Corp: Amount $0.40

Robert Half International Inc: Amount $0.38

TransUnion: Amount $0.09

Warner Music Group Corp: Amount $0.15

Yum China Holdings Inc: Amount $0.12

ZIM Integrated Shipping Services Ltd: Amount $2.00

Start van de week sterk, records voor de AEX en de Nasdaq

Goedemorgen,

Wat een streep omhoog maandag, vooral de tech aandelen knallen door hun dak met records voor de Nasdaq en de Nasdaq 100. Ook de AEX kon vooral door ASML goed mee en zet op slotbasis een nieuw record neer, wie had dat nog verwacht na dat de index donderdag even op 755 punten terecht kwam. De S&P 500 mist een nieuw record op een haar na, het scheelt 0,12 punt maar de index zette wel een hoogste stand ooit neer op 4489,88 punten maar sluit af op 4479,54 punten. De Dow Jones won ook 215 punten, de SOX index won 85 punten.

Update dinsdag 24 augustus:

Een sterke start van de week op Wall Street met vooral de tech aandelen die de kar trokken, de rest ging mee omhoog maar met wat minder kracht. Zo won de Dow Jones 215 punten (0,6%) terwijl de Nasdaq 1,55% won, de Nasdaq 100 er met 1,5% op vooruit ging. De SOX index won 2,6% en de Dow Transport 0,95%. In Europa begon de DAX heel sterk maar moest later wat inleveren om met 0,25% winst te sluiten, de AEX volgde duidelijk het pad van de tech indices op Wall Street en won 1,15%. Ook Frankrijk ging er op vooruit, de CAC 40 won 0,85%.

Vorige week nog kwam er de nodige schrik door het vooruitzicht van het langzaam dichtdraaien van de geldkraan maar de voorzitter van de Dallas Fed, Robert Kaplan, zei vrijdag dat hij zijn oproep om de obligatie-aankopen te gaan afbouwen mogelijk zal herroepen, als de deltavariant van het coronavirus de groeiverwachtingen aantast. Als er ook maar enig signaal komt dat de Amerikaanse economie zal vertragen dan zal de Fed niet beginnen met 'taperen'. En zo blijven we tussen wal en schip hangen met al deze tegenstrijdige berichtgevingen. Het gaat op alle vlakken veel te goed maar toch wil men niet toegeven aan een afbouw van het gebruik van de geldpers. Zo worden de problemen op een later tijdstip alleen maar groter.

Ook zal de aandacht van beleggers deze week uitgaan naar het jaarlijkse symposium van de FED in Jackson Hole. Tijdens dat evenement kunnen nieuwe hints worden gegeven over het monetaire beleid. Vrijdag zal FED-voorzitter Jerome Powell een toespraak geven.

Marktoverzicht:

Via het overzicht zien we de sterke start van de week duidelijk, vooral de AEX, de S&P 500, de Nasdaq en de SOX index vallen op met een stevige plus. De DAX en de Dow Jones zetten ook een plus neer maar in mindere mate. Records zijn er voor de Nasdaq en de AEX index, de S&P 500 zet wel een hoogste stand ooit neer maar mist op 0,12 punt een nieuwe hoogste slotstand. Wat ik wel zie is dat de Nasdaq de lijn over de toppen bereikt, de vraag is nu of de index er boven zal geraken de komende sessies?

Dow Jones:

De Dow Jones herpakt zich na een test van de steunlijn onder de bodems, de index won 215 punten maandag. We zien nu weerstand rond de topzone die uitkomt op 35.620 punten. Later weerstand rond de 35.750 en de 35.850 punten. Steun nu eerst de 35.150 en de 35.000 punten. Later de 34.750 punten waar het 50-daags gemiddelde samen met de lijn onder de bodems nu uitkomen.

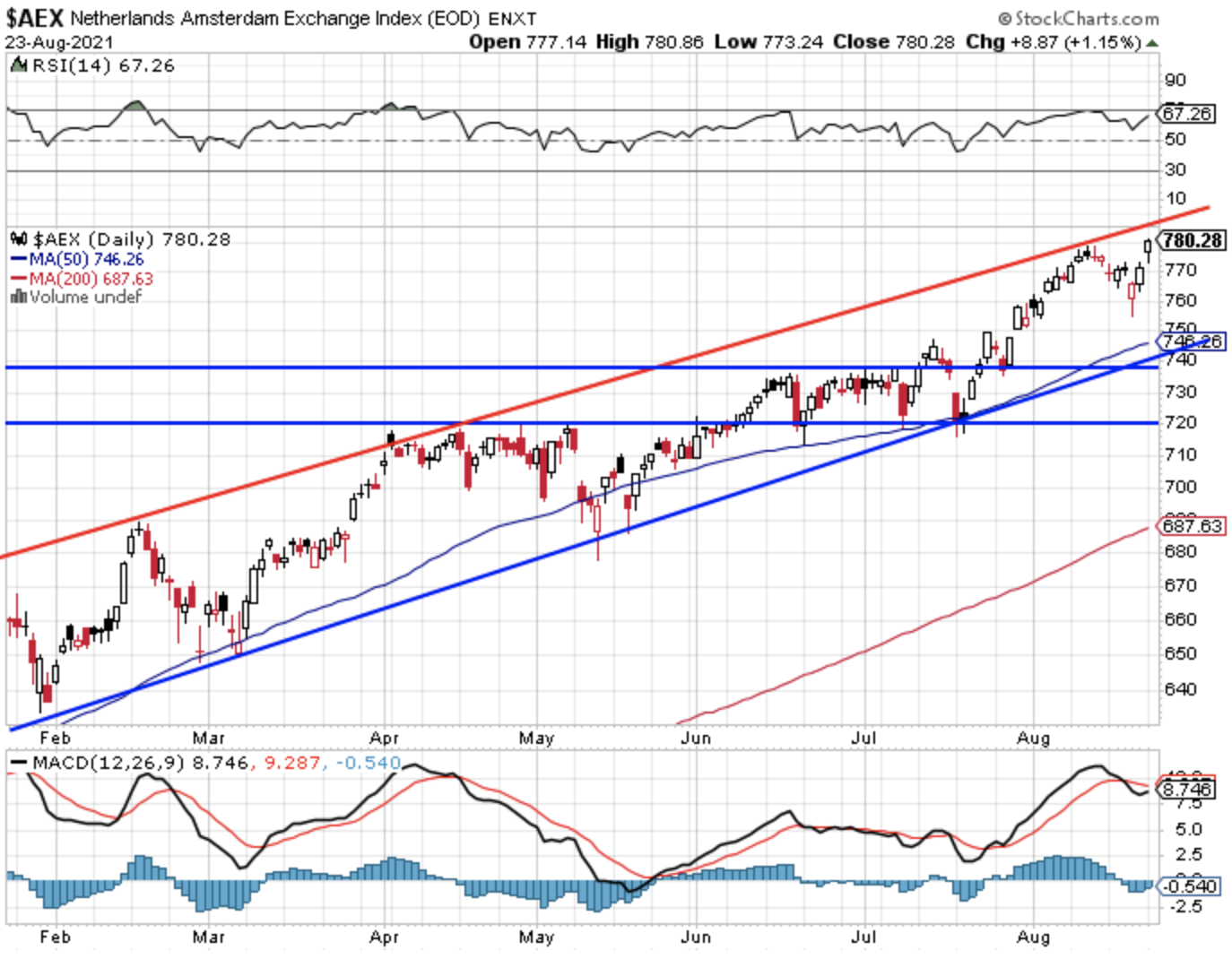

AEX index:

Bij de AEX een record op slotbasis en dat is 780,28 punten, de hoogste stand ooit zien we nu op 780,86 punten uitkomen. Wel mede door de tech aandelen en vooral door ASML dat weer een record neerzet. ASML blijft hoe dan ook de motor voor de AEX al viel Shell deze keer door de sterke stijging van de olieprijs ook op met een winst van 2,3%.

Een record voor de AEX en we zien wat verder de 785 en de 788 punten als weerstand door de lijn over de toppen vanaf begin dit jaar. Steun nu eerst de 773-775 punten, later de 760 en de bodem van afgelopen donderdag rond de 755 punten. Verder steun rond de 748 en de 736-738 punten.

DAX index:

De DAX begon heel sterk maar moest inleveren later op de dag, de index sluit wel weer boven de bekende 15.810 punten maar kwam er intraday wel even onder. Weerstand wordt nu de top rond de 16.020 punten, later zien we rond de 16.050 punten weerstand.

Steun nu de 15.810 punten, later de 15.600 en de bekende zone 15.500-15.550 punten.

Nasdaq Composite:

De tech indices doen het de afgelopen 3 sessies, en na de bodem van donderdag, heel goed want we zien 3 stevige stijgingen op de grafiek hieronder. De Nasdaq zet een record neer op 14.942 punten terwijl de index even op 14.963,47 punten stond wat dan meteen de hoogste stand ooit werd. De index komt nu wel weer tegen de rode lijn over de toppen terecht en daar mogen we normaal gezien weerstand verwachten al blijft zoiets relatief in deze markt.

Weerstand nu dus die lijn over de toppen rond de 14.970-14.975 punten, later de 15.100 en de 15.200 punten als weerstand. Steun zien we nu rond de 14.750 punten, later rond de 14.600 en de 14.400 punten steun. Verder kennen we de 14.210 punten als een stevige steun mocht het snel gaan dalen via een grotere correctie. Vergeet niet dat we donderdag intraday al even op 14.400 punten terecht kwamen, zo snel kan het gaan.

Overzicht resultaat 2021 blijft goed:

Er lopen nu wat kleine posities op enkele indices en ik zoek nog naar wat andere kansen de komende sessies. Zorg in ieder geval dat u net als ons het meest gunstige momentum kunt pakken om in de markt te stappen of wordt lid zodat u de signalen ontvangt op de indexen. Gisteren werd er al winst genomen op de CAC 40 positie in ieder geval en die werd later vervangen door een andere index.

Meedoen kan meteen als u lid wordt, de posities kunt u nog opnemen daarna want de details ziet u dan in onze Tradershop op de website. Schrijf u nu in via de nieuwe aanbieding tot 1 NOVEMBER voor €35 via de aanbieding., ga naar https://www.usmarkets.nl/trade... en doe meteen mee met de nieuwe posities ...

Met vriendelijke groet,

Guy Boscart

US Markets Trading

TA DAX, AEX, Adyen, Baidu, Alibaba en Brent Crude Oil

Soms zijn er geen verzoeken en soms heel veel. Vandaag is zo’n dag, zoveel verzoeken dat ik het niet in één column kwijt kan. Maar niet getreurd, ik spreid het gewoon over twee columns uit, de ene vandaag, de andere aanstaande donderdag. Ik steek van wal.De eerste grafiek van vandaag betreft…

Lees verder »