Liveblog Archief dinsdag 4 mei 2021

Een TA Analyse uit de VS over de tech sector ...

NASDAQ BACKS OFF FROM PREVIOUS HIGH... Chart 1 shows the recent rally in the Nasdaq Composite meeting new selling near...

Deze inhoud is alleen beschikbaar voor betalende leden.

TA Goud, Ahold, AEX en meer

Een hele goede vroege dinsdagmorgen! Wat gaan we vandaag doen? Ik heb twee verzoeken en die doe ik uitgebreid, oftewel de week- en de daggrafiek. Ik vul het aan met eigen keus, o.a. de DAX en de Bel-20. We gaan beginnen!Het eerste verzoek is Ahold Delhaize. Dit is de weekgrafiek van de…

Lees verder »Markt snapshot Wall Street 4 mei

TOP NEWS

• Pfizer lifts annual sales forecast for COVID-19 vaccine

Pfizer raised its annual sales forecast for the COVID-19 vaccine it co-developed with Germany's BioNTech, as a vaccination drive across the globe intensifies.

• CVS Health profit rises nearly 11% on drug store sales

CVS Health reported a 10.5% rise in first-quarter profit, helped in part by higher sales at its drug stores, with more customers seeking COVID-19 tests and vaccinations.

• Chipmaker TSMC eyeing expansion of planned Arizona plant - sources

Taiwan Semiconductor Manufacturing Co Ltd (TSMC) is planning to build several more chipmaking factories in the U.S. state of Arizona beyond the one currently planned, three people familiar with the matter told Reuters.

• DuPont raises 2021 forecast on robust demand from chip, auto makers

Industrial materials maker DuPont raised its full-year profit and revenue forecasts and breezed past first-quarter expectations, boosted by demand from chip companies as well as a recovery in automobile markets.

• India halts cricket league as coronavirus cases cross 20 million

India halted its most popular sports tournament and the country's opposition chief called for a nationwide lockdown as the number of coronavirus infections climbed past 20 million, a dismal milestone crossed only by the United States.

BEFORE THE BELL

U.S. stock futures were mixed, as investors awaited a slew of economic data including trade deficit and factory orders, due for release later during the day. European equities rose on bets of a strong global economic rebound backed by massive vaccination drives in developed countries. Australian shares rose after the central bank pledged to keep its policies super-supportive for a prolonged period, while China and Japan markets were closed for public holidays. The dollar index strengthened on likelihood of rise in U.S. interest rates due to roaring economic recovery, while gold prices edged lower. Oil prices rose, after more U.S. states eased lockdowns and the European Union sought to attract travellers.

STOCKS TO WATCH

Results

• Avis Budget Group Inc: The rental car company topped Wall Street estimates for first-quarter revenue on Monday, as more people started traveling again after getting vaccinated against COVID-19. Revenues recovered sequentially in the quarter, with revenue per day increasing 12% in the Americas, driven by improving demand. Americas, the company's largest market, posted a 14% fall in revenue to $1.08 billion versus last year, while revenue from its international segment fell 41%. Excluding items, the company lost 46 cents per share. Total revenue fell 22% to $1.37 billion, beating estimates of $1.29 billion.

• Bunge Ltd: The agricultural commodities trader said quarterly adjusted income rose more than three-fold from a year earlier, bolstered by strength in its core agribusiness segment. The company also raised its full-year 2021 adjusted earnings per share to about $7.50 per share from its earlier forecast of at least $6 per share. Adjusted net income available for common shareholders stood at $471 million, or $3.13 per share, in the quarter ended March 31, higher than $139 million, or 91 cents per share, a year earlier.

• CVS Health Corp: The company reported a 10.5% rise in first-quarter profit, helped in part by higher sales at its drug stores, with more customers seeking COVID-19 tests and vaccinations. CVS Health's net profit rose to $2.22 billion, or $1.68 per share, in the reported quarter, from $2.01 billion, or $1.53 per share, a year earlier. Sales rose to $69.1 billion from $66.76 billion.

• Dupont De Nemours Inc: The industrial materials maker raised its full-year profit and revenue forecasts and breezed past first-quarter expectations, boosted by demand from chip companies as well as a recovery in automobile markets. DuPont said it expects net sales between $15.70 billion and $15.90 billion and adjusted earnings per share in the range of $3.60 to $3.75 for the year ended December 2021. It had previously forecast sales between $15.40 billion and $15.60 billion on earnings of $3.30 to $3.45 per share. DuPont's adjusted earnings per share of 91 cents for the first quarter beat estimates of 76 cents.

• Itau Unibanco Holding SA: The Brazil's biggest lender on Monday reported better-than-expected first-quarter profit, as loan-loss provisions for bad loans fell and trading gains rose. Recurring net income, which excludes one-off items, came in at 6.398 billion reais, more than 11% above an estimate of 5.753 billion reais compiled by Reuters and 63.6% above results of a year earlier.

• Livent Corp: The lithium producer posted an adjusted quarterly profit on Monday that exceeded expectations on rising sales of the ultralight battery metal, with governments and automakers across the globe launching aggressive plans to make electric vehicles (EVs) mainstream. Livent posted a first-quarter net loss of $800,000, or a penny per share, compared to a net loss of $1.9 million, or a penny per share, in the year-ago period. Excluding one-time items, Livent earned 2 cents per share. By that measure, analysts expected earnings of a penny per share.

• Nutrien Ltd: The world's biggest fertilizer producer by capacity raised its full-year profit guidance and swung to a bigger than expected quarterly profit on Monday, as crop prices climb. Nutrien increased its 2021 guidance for adjusted net earnings to between $2.55 and $3.25 per share, up from a previous range of $2.05 to $2.75 per share. The company posted adjusted net income of $165 million, or 29 cents per share, in the first quarter, compared with a loss of $69 million, or 12 cents a share, a year earlier. Analysts were expecting a profit of 8 cents per share.

• Pfizer Inc: The company raised its annual sales forecast for the COVID-19 vaccine it co-developed with Germany's BioNTech, as a vaccination drive across the globe intensifies. The U.S. drugmaker now expects sales of $26 billion from the vaccine in 2021, up from its prior forecast of about $15 billion. The goal assumes that 1.6 billion vaccine doses will be delivered in the year. Cost and gross profit from the vaccine are split 50-50 between Pfizer and BioNTech. Separately, The U.S. Food and Drug Administration is preparing to authorize Pfizer and BioNTech's COVID-19 vaccine for adolescents aged between 12 and 15 years by early next week, the New York Times reported on Monday, citing federal officials familiar with the agency's plans.

• Qiagen NV: The U.S.-German genetic testing company reported slightly better-than-expected quarterly earnings on Monday as sales growth in its non-coronavirus products added to high demand for COVID-19 tests. The company said first-quarter adjusted earnings rose to 65 cents per share on a currency-adjusted basis, beating the 63 cents on average forecast by analysts in a Vara Research poll, as research laboratories around the world have returned to work and clinical labs moved beyond COVID-19 testing. Qiagen also confirmed its 2021 forecast for adjusted earnings of $2.42 to $2.46 per share and net sales growth of 18% to 20% at constant exchange rates.

• Thomson Reuters Corp: The company reported higher first quarter revenue and operating profit, helped by its three main divisions and a rebounding economy, saying full-year sales growth will be at the high end of original estimates. Adjusted earnings per share, which exclude a gain from the sale of the company's investment in Refinitiv and other adjustments, rose to 58 cents per share, from 48 cents in the prior-year period. That was well ahead of the 42 cents analysts expected. Thomson Reuters, which owns Reuters News, said in a statement that operating profit rose by a third to $387 million during the first quarter.

In Other News

• Bank of America Corp & Citigroup Inc: Bank of America has snapped up Emmanuel Regniez from Citigroup to co-head its investment banking franchise for France as it seeks to strengthen its network of European hubs after Brexit, according to a memo seen by Reuters. Regniez will share the investment banking leadership for France with Jerome Morisseau and will work closely with Stephane Courbon and Laurent Vieillevigne - respectively chairman of the bank's corporate and investment banking division for France and vice chairman of investment banking for France.

• Doordash Inc, Uber technologies Inc & Walgreen Boots Alliance Inc: Drugstore company Walgreens Boots Alliance said that it will partner with DoorDash, Uber and others to launch same-day delivery - in under two hours - for retail products in the United States. Walgreens same-day purchases made online or via its app will be packaged by store workers and then picked up by delivery drivers. There will be no minimum order amount and customers in most markets will pay a delivery fee of $7.99 that will go to Walgreens. Separately, British electric van and bus maker Arrival will develop an electric car for Uber that will go into production in late 2023, the two companies said.

• Exxon Mobil Corp: Disputes over seniority rights and pay for union workers at Exxon Mobil's Beaumont, Texas, refinery led to Saturday's first lockout at the 118-year-old plant, according to people familiar with the matter. Workers represented by the United Steelworkers union (USW) walked picket lines for a third day outside the gates of the refinery and its lube oil plant. No talks took place and no proposals were swapped on Monday between two sides, the people said.

• KKR & Co Inc: The company has amassed about $18.5 billion for its latest flagship North America private equity fund, raising its biggest-ever fund in less than five months, people familiar with the matter said on Monday. KKR raised about $17 billion for KKR North America Fund XIII from investors including sovereign wealth funds, family offices and public and private pension funds, the sources said. An additional $1.5 billion has been committed to the fund by KKR and its employees, the sources added.

• Sinovac Biotech Ltd: Europe's medicines regulator said it has started a real-time review of Sinovac's COVID-19 vaccine, based on preliminary results from animal and human trials that suggested the vaccine produces an immune response against the coronavirus. Data on the vaccine, COVID-19 Vaccine (Vero Cell) Inactivated, will be assessed as they are made available to help speed up potential approvals, the European Medicines Agency (EMA) said.

• Taiwan Semiconductor Manufacturing Co Ltd: The company is planning to build several more chipmaking factories in the U.S. state of Arizona beyond the one currently planned, three people familiar with the matter told Reuters. Three sources familiar with the matter, speaking on condition of anonymity as they were not authorised to speak to the media, told Reuters that up to five additional fabs for Arizona are being planned.

• Telefonaktiebolaget LM Ericsson: Ericsson unveiled a subscription service for remote working in North America that would allow employees of small businesses to start working from home in minutes with access to licensed apps, cloud storage and security tools. A business customer can buy applications from a marketplace, access the platform from any device and would not need a dedicated IT technician to set up the system. Not only can one activate workers in minutes, they can decide which employees can get access to certain apps or capabilities, said Åsa Tamsons, head of business area technologies and new businesses.

• Under Armour Inc: The sports apparel maker has agreed to pay $9 million to settle Securities and Exchange Commission (SEC) charges that it misled investors about its revenue growth, the agency said on Monday. The SEC found that Under Armour failed to disclose to investors that it employed a sales tactic to accelerate or "pull forward" a total of $408 million in existing orders in the second half of 2015 after a warm winter began to hurt sales of the company's higher-priced cold weather apparel that customers had requested be shipped in future quarters.

INSIGHT

Is it over yet? Still no recession end date as U.S. economy hums along

The U.S. economy is growing at its fastest rate since the early 1980s while household bank accounts are bulging with cash doled out by the federal government to blunt the impact of the coronavirus pandemic.

ANALYSTS' RECOMMENDATION

• Ashland Global Holdings Inc: JP Morgan cuts rating to underweight from neutral, citing the company’s slower rate of organic volume growth.

• Cogent Communications Holdings: Credit Suisse raises rating to outperform from neutral, to reflect on the company’s return to Corporate topline growth and accelerated NetCentric dynamics.

• Dollar General Corp: Keybanc cuts rating to sector weight from overweight, noticing risks from the fading stimulus lift, difficult comparisons and inflationary pressures.

• Estee Lauder Companies Inc: D.A. Davidson raises target price to $367 from $348, believing the company’s share drop, after it reported first-quarter earnings, to be a buying opportunity.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0830 (approx.) International trade for Mar: Expected -$74.5 bln; Prior -$71.1 bln

0830 (approx.) Goods trade balance R for Mar: Prior -$90.59 bln

0945 ISM-New York Index for Apr: Prior 804.5

0945 ISM New York Business Conditions for Apr: Prior 37.2

1000 (approx.) Durables ex-defense, R mm for Mar: Prior 0.5%

1000 (approx.) Durable goods, R mm for Mar: Prior 0.5%

1000 (approx.) Factory orders mm for Mar: Expected 1.3%; Prior -0.8%

1000 (approx.) Durables ex-transport R mm for Mar: Prior 1.6%

1000 (approx.) Nondefense cap ex-air R mm for Mar: Prior 0.9%

1000 (approx.) Factory ex-transport mm for Mar: Prior -0.6%

COMPANIES REPORTING RESULTS

Activision Blizzard Inc: Expected Q1 earnings of 70 cents per share

Akamai Technologies Inc: Expected Q1 earnings of $1.30 per share

Amcor PLC: Expected Q3 earnings of 17 cents per share

Arista Networks Inc: Expected Q1 earnings of $2.38 per share

Assurant Inc: Expected Q1 earnings of $1.96 per share

Broadridge Financial Solutions Inc: Expected Q3 earnings of $1.68 per share

Caesars Entertainment Inc: Expected Q1 loss of $1.80 per share

Corteva Inc: Expected Q1 earnings of 65 cents per share

Cummins Inc: Expected Q1 earnings of $3.47 per share

Devon Energy Corp: Expected Q1 earnings of 33 cents per share

Dominion Energy Inc: Expected Q1 earnings of $1.08 per share

Franklin Resources Inc: Expected Q2 earnings of 74 cents per share

Gartner Inc: Expected Q1 earnings of $1.05 per share

Global Payments Inc: Expected Q1 earnings of $1.78 per share

Healthpeak Properties Inc: Expected Q1 earnings of 05 cents per share

Host Hotels & Resorts Inc: Expected Q1 loss of 40 cents per share

Incyte Corp: Expected Q1 earnings of 64 cents per share

IPG Photonics Corp: Expected Q1 earnings of $1.10 per share

Leidos Holdings Inc: Expected Q1 earnings of $1.48 per share

Martin Marietta Materials Inc: Expected Q1 earnings of 50 cents per share

Monolithic Power Systems Inc: Expected Q1 earnings of $1.34 per share

Paycom Software Inc: Expected Q1 earnings of $1.42 per share

PerkinElmer Inc: Expected Q1 earnings of $3.07 per share

Pioneer Natural Resources Co: Expected Q1 earnings of $1.45 per share

Progressive Corp: Expected Q1 earnings of $1.42 per share

Prudential Financial Inc: Expected Q1 earnings of $2.76 per share

Sealed Air Corp: Expected Q1 earnings of 70 cents per share

Sysco Corp: Expected Q3 earnings of 20 cents per share

T-Mobile US Inc: Expected Q1 earnings of 57 cents per share

Verisk Analytics Inc: Expected Q1 earnings of $1.25 per share

Vulcan Materials Co: Expected Q1 earnings of 45 cents per share

Western Union Co: Expected Q1 earnings of 45 cents per share

Xilinx Inc: Expected Q4 earnings of 71 cents per share

Xylem Inc: Expected Q1 earnings of 38 cents per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Bunge Ltd: Q1 earnings conference call

0800 CVS Health Corp: Q1 earnings conference call

0800 DuPont de Nemours Inc: Q1 earnings conference call

0800 Gartner Inc: Q1 earnings conference call

0800 Global Payments Inc: Q1 earnings conference call

0800 Incyte Corp: Q1 earnings conference call

0800 Leidos Holdings Inc: Q1 earnings conference call

0800 R1 RCM Inc: Q1 earnings conference call

0800 SAGE Therapeutics Inc: Q1 earnings conference call

0815 Catalent Inc: Q3 earnings conference call

0830 AMETEK Inc: Q1 earnings conference call

0830 Apollo Global Management Inc: Q1 earnings conference call

0830 Avis Budget Group Inc: Q1 earnings conference call

0830 Broadridge Financial Solutions Inc: Q3 earnings conference call

0830 Chemours Co: Q1 earnings conference call

0830 IDEXX Laboratories Inc: Q1 earnings conference call

0830 Leggett & Platt Inc: Q1 earnings conference call

0830 Repligen Corp: Q1 earnings conference call

0830 Under Armour Inc: Q1 earnings conference call

0830 Virtu Financial Inc: Q1 earnings conference call

0830 Warner Music Group Corp: Q2 earnings conference call

0830 XPO Logistics Inc: Q1 earnings conference call

0830 Zebra Technologies Corp: Q1 earnings conference call

0830 Zimmer Biomet Holdings Inc: Q1 earnings conference call

0845 Jack Henry & Associates Inc: Q3 earnings conference call

0900 Agree Realty Corp: Q1 earnings conference call

0900 Ally Financial Inc: Annual Shareholders Meeting

0900 American Express Co: Annual Shareholders Meeting

0900 American Water Works Company Inc: Q1 earnings conference call

0900 Brookfield Renewable Corp: Q1 earnings conference call

0900 BWX Technologies Inc: Q1 earnings conference call

0900 Charles River Laboratories International Inc: Q1 earnings conference call

0900 Diamondback Energy Inc: Q1 earnings conference call

0900 Fortune Brands Home & Security Inc: Annual Shareholders Meeting

0900 Hubbell Inc: Annual Shareholders Meeting

0900 IAA Inc: Q1 earnings conference call

0900 Ingredion Inc: Q1 earnings conference call

0900 Lamar Advertising Co: Q1 earnings conference call

0900 Nexstar Media Group Inc: Q1 earnings conference call

0900 Sabre Corp: Q1 earnings conference call

0900 Service Corporation International: Q1 earnings conference call

0930 MPLX LP: Q1 earnings conference call

0930 Williams Companies Inc: Q1 earnings conference call

1000 Avangrid Inc: Q1 earnings conference call

1000 Baxter International Inc: Annual Shareholders Meeting

1000 Berry Global Group Inc: Q2 earnings conference call

1000 Bristol-Myers Squibb Co: Annual Shareholders Meeting

1000 Brixmor Property Group Inc: Q1 earnings conference call

1000 Crane Co: Q1 earnings conference call

1000 Cummins Inc: Q1 earnings conference call

1000 Dominion Energy Inc: Q1 earnings conference call

1000 Franklin Resources Inc: Q2 earnings conference call

1000 General Electric Co: Annual Shareholders Meeting

1000 Henry Schein Inc: Q1 earnings conference call

1000 IPG Photonics Corp: Q1 earnings conference call

1000 KKR & Co Inc: Q1 earnings conference call

1000 Lancaster Colony Corp: Q3 earnings conference call

1000 Omega Healthcare Investors Inc: Q1 earnings conference call

1000 Omnicom Group Inc: Annual Shareholders Meeting

1000 Pfizer Inc: Q1 earnings conference call

1000 Pool Corp: Annual Shareholders Meeting

1000 Regal Beloit Corp: Q1 earnings conference call

1000 Rexnord Corp: Annual Shareholders Meeting

1000 Sealed Air Corp: Q1 earnings conference call

1000 Sysco Corp: Q3 earnings conference call

1000 Vulcan Materials Co: Q1 earnings conference call

1000 Xylem Inc: Q1 earnings conference call

1030 National Retail Properties Inc: Q1 earnings conference call

1100 CF Industries Holdings Inc: Annual Shareholders Meeting

1100 Diamondback Energy Inc: Q1 earnings conference call

1100 Evergy Inc: Annual Shareholders Meeting

1100 Flowserve Corp: Q1 earnings conference call

1100 Louisiana-Pacific Corp: Q1 earnings conference call

1100 Marathon Petroleum Corp: Q1 earnings conference call

1100 Martin Marietta Materials Inc: Q1 earnings conference call

1100 Mosaic Co: Q1 earnings conference call

1100 Teradata Corp: Annual Shareholders Meeting

1100 Westlake Chemical Corp: Q1 earnings conference call

1200 ConocoPhillips: Q1 earnings conference call

1300 Edwards Lifesciences Corp: Annual Shareholders Meeting

1400 West Pharmaceutical Services Inc: Annual Shareholders Meeting

1430 Realty Income Corp: Q1 earnings conference call

1530 BOK Financial Corp: Annual Shareholders Meeting

1630 Activision Blizzard Inc: Q1 earnings conference call

1630 Akamai Technologies Inc: Q1 earnings conference call

1630 Arista Networks Inc: Q1 earnings conference call

1630 Arrowhead Pharmaceuticals Inc: Q2 earnings conference call

1630 Globus Medical Inc: Q1 earnings conference call

1630 Invitae Corp: Q1 earnings conference call

1630 LYFT Inc: Q1 earnings conference call

1630 Penumbra Inc: Q1 earnings conference call

1630 T-Mobile US Inc: Q1 earnings conference call

1630 Western Union Co: Q1 earnings conference call

1700 Alteryx Inc: Q1 earnings conference call

1700 Caesars Entertainment Inc: Q1 earnings conference call

1700 Coursera Inc: Q1 earnings conference call

1700 Dolby Laboratories Inc: Q2 earnings conference call

1700 Exact Sciences Corp: Q1 earnings conference call

1700 Inspire Medical Systems Inc: Q1 earnings conference call

1700 Lattice Semiconductor Corp: Q1 earnings conference call

1700 Mcafee Corp: Q1 earnings conference call

1700 Monolithic Power Systems Inc: Q1 earnings conference call

1700 Paycom Software Inc: Q1 earnings conference call

1700 PerkinElmer Inc: Q1 earnings conference call

1700 RingCentral Inc: Q1 earnings conference call

1700 Simpson Manufacturing Co Inc: Annual Shareholders Meeting

1700 Skillz Inc: Q1 earnings conference call

1700 Ultragenyx Pharmaceutical Inc: Q1 earnings conference call

1700 Upwork Inc: Q1 earnings conference call

1700 Workiva Inc: Q1 earnings conference call

1700 Xp Inc: Q1 earnings conference call

1700 Zillow Group Inc: Q1 earnings conference call

1730 Amcor PLC: Q3 earnings conference call

1730 Plains All American Pipeline LP: Q1 earnings conference call

EXDIVIDENDS

Idacorp Inc: Amount $0.71

Webster Financial Corp: Amount $0.40

Europa start maand positief, Dow ook sterk maar Nasdaq omlaag ...

Goedemorgen

Vanmorgen zien we lagere futures over de gehele lijn al blijven de verschillen ten opzichte van gisteren minimaal. Ook Europa kan wat lager van start zien we via de futures. Het is wel zo dat men nu kijkt vooral kijkt naar de cyclische aandelen en dan worden de Tech aandelen weer verkocht en zo krijgen we weer een divergentie hetgeen wat er nu al weken gaande is. Dat zien we het best op Wall Street, de Dow Jones en ook de Dow Transport stijgen dan terwijl Nasdaq een stapje terug moest en dat ondanks een sterke start na de opening.

Beleggers blijven optimistisch gestemd door de signalen die erop duiden dat de economische groei aantrekt waardoor de winstgroei en ook de verwachtingen van bedrijven blijven bijdragen aan het positieve sentiment van de afgelopen periode. Er zijn ook wel zaken om vooral voorzichtig te blijven want de verdere verspreiding van het coronavirus in veel delen van de wereld blijft niet ongezien terwijl men zich ook zorgen begint te maken over te verwachten inflatie. Neem daar nog bij dat President Biden met duizenden miljarden aan het gooien is en dat hij meteen ook de belastingen zal verhogen. Toch een MIX van feiten die beleggers kunnen doen twijfelen en dat zien we ook aan het verloop van de indexen, de top evenaren lukt nog wel maar een uitbraak blijft voorlopig uit.

Marktoverzicht:

Volgens mij ligt er hoe dan ook een grotere correctie op de loer zodra men meer gaat kijken naar de economische data die wel heel goed overkomen momenteel maar gelijktijdig zal men ook inzien dat een dubbele waardering ten opzichte van normaal wat te optimistisch overkomt om dat voor een langere periode vol te houden. Verder ziet het er technisch ook zo naar uit dat de markt enorm aan het twijfelen is, als de markt niet door de toppen geraakt dan zal die eerst moeten corrigeren. Via de grafieken is dat goed te zien momenteel.

Het komt wel goed zoals ik het nu bekijk, voor de leden heb ik al wat posities opgenomen in die richting waarbij het de bedoeling is om wat langer in de posities blijven, ik wil graag inzetten bij deze keuze op een correctie van 2 tot 5%.

Overzicht markt:

LET OP !! Vanaf vandaag een nieuwe aanbieding die loopt vanaf nu tot 1 JULI voor €39 (Polleke Trading €49)... Via de site en dan de Tradershop kunt zich inschrijven en daar kunt u als lid de lopende posities met alle details altijd inzien. Ga naar de Tradershop en schrijf u meteen in ... https://www.usmarkets.nl/tradershop

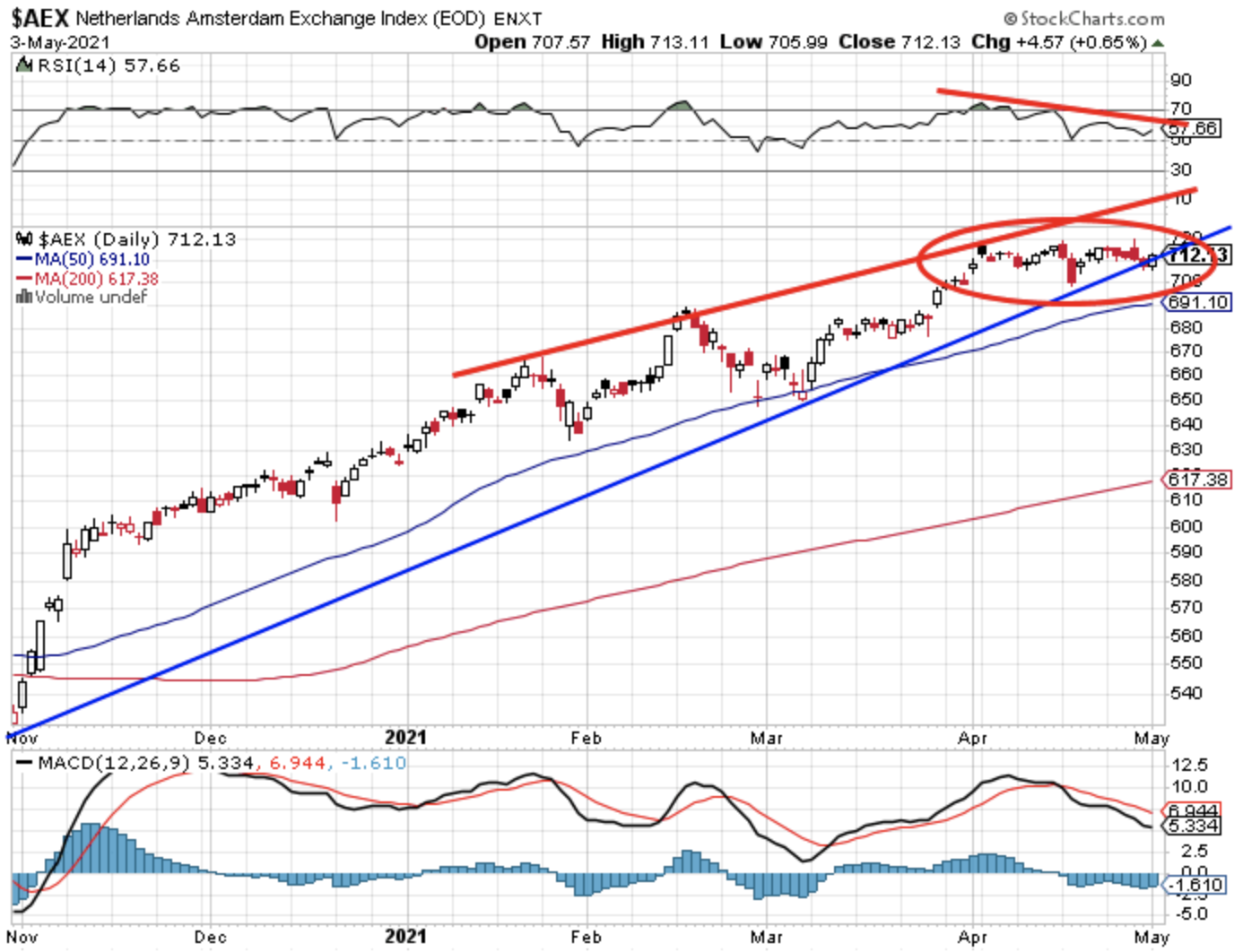

Technische conditie AEX en DAX:

De AEX ziet u via een chart hieronder, zowel via de indicatoren en het koersverloop merken we dat het ontbreken van een nieuwe top een behoorlijke verzwakking aangeeft bij deze index. Wel blijft de weerstand nu eerst de 712 en meteen daarna de 715 punten met later de topzone 718 punten. Pas als er echt een uitbraak komt met kracht zijn er kansen richting de 725 of zelfs 735 punten. Of de index het na die vlakke toppen nog in zich heeft om uit te breken betwijfel ik maar we moeten er altijd wel rekening mee houden.

Steun nu de 707, de 702-703 en later de 688-690 punten zone waar de meest recente top en zware weerstand van februari en maart wacht als belangrijke steun. De komende week maar eens heel goed kijken en vooral overwegen wat we met de AEX index kunnen doen. Let nu vooral op de zone 712-715 punten. Ik heb wel een mooi plan in gedachte voor wat betreft de AEX index. Ook bij enkele andere indices zie ik kansen maar we moeten geduld hebben voor we echt wat kunnen gaan doen.

De DAX kwam na een valse uitbraak tot net boven de 15.500 punten weer helemaal terug naar de range 15.100-15.300 punten, zo blijkt maar weer eens dat de stevige uitbraak vorige week nogal voorbarig was. Een valse move ofwel een "BULL TRAP" zoals we dat ook noemen.

De DAX zit dus weer in de slopende range 15.100-15.300 punten. Weerstand nu de 15.300 en de top die werd gezet rond de 15.500 punten. Steun nu die 15.100, de 15.000, de 14.850 en de 14.750 punten. Ik denk dat we moeten opletten met de DAX de komende dagen, er staat iets te gebeuren met deze index.

S&P 500 analyse:

Op Wall Street blijft alles nog dicht bij de toppen hangen al kwam er een terugval op gang eind vorige week. Op de grafieken merken we een vrijwel vlak verloop op Wall Street bekeken over de afgelopen weken, er zit wel een sessie tussen die even boven de weerstand geraakt maar er zit geen nieuwe stevige vooruitgang meer in zo te zien. Ook blijven de divergenties opvallen tussen de verschillende sectoren op Wall Street, op zich is dat ook geen goed teken voor het vervolg.

Weerstand nog altijd de zone 4150-4200 punten, alleen bij een duidelijke uitbraak kansen richting de 4250-4300 en hoger. Steun nu die 4150 en de 4100 punten, later het 50-MA rond de 4010 punten. Het 200-MA wacht nu rond de 3660 punten.

Resultaat dit jaar verloopt naar wens maar rustig:

De maand april werd afgerond en we sluiten zonder verlies maar ook werd er geen winst behaald, wel iets zodat we de 5e maand na elkaar met winst kunnen afsluiten en dat is een mooie reeks en dat zeker bij de huidige marktomstandigheden. We starten nu de nieuwe maand (MEI) op en er lopen voorlopig nog geen posities, dat komt er wel aan de komende week denk ik, zorg dat u op tijd lid wordt om mee te doen met de signalen die ik verstuur op onder andere de AEX, de DAX, de Dow Jones of de Nasdaq 100.

De grote reden dat ik de afgelopen weken weinig kon doen is omdat er telkens behoorlijke divergenties zijn, de ene sector of regio beweegt tegengesteld aan de andere en dat maakt de keuze momenteel enorm moeilijk. Dat heb ik ook een paar keer aangegeven richting de leden en die geven vaak aan dat dit hoe dan ook de juiste keuze is in deze fase. Een abonnement is meer dan alleen maar signalen versturen, het is ook de leden proberen te coachen waar dat nodig is zodat ze weten waar ze aan toe zijn.

Het handelen moet nog altijd voorzichtig gebeuren want ik hou in het achterhoofd rekening met een aanstaande grote correctie over de gehele markt. Deze manier van werken wil ik hoe dan ook proberen aan te houden, het handelen onder de huidige omstandigheden krijg ik steeds beter onder controle en ik probeer met kleine posities zo als goed mogelijk te werken voor de leden. Onderaan deze update ziet u nog een overzicht hoe we er dit jaar voor staan wat betreft het resultaat via de signalen die we naar onze leden versturen.

Euro, olie en goud:

De euro zien we nu rond de 1.204 dollar, de prijs van een vat Brent olie komt uit op 67,5 dollar terwijl een troy ounce goud nu op 1785 dollar staat.

De LIVEBLOG en Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

LET OP !! Vanaf vandaag een nieuwe aanbieding die loopt vanaf nu tot 1 JULI voor €39 (Polleke Trading €49)... Via de site en dan de Tradershop kunt zich inschrijven en daar kunt u als lid de lopende posities met alle details altijd inzien. Ga naar de Tradershop en schrijf u meteen in ... https://www.usmarkets.nl/tradershop

Met vriendelijke groet,

Guy Boscart