Liveblog Archief dinsdag 7 september 2021

TA AEX, Vopak, ASML, ASMI, Prosus en Baidu

Onafhankelijkheidsdag in Brazilië, Indepedência do Brasil. Laat me eens weten hoe de berichtgeving in Nederland is, als u daar tijd voor heeft. Ik heb in ieder geval tijd voor het bekijken van zes grafieken. Daarmee hoop ik lezers Dowjones, ted.hulsman en Mister bluesky een plezier te doen!Wat in…

Lees verder »Markt snapshot Wall Street 7 september

TOP NEWS

• Deutsche Telekom lifts T-Mobile US stake in SoftBank swap deal

Deutsche Telekom has struck a $7 billion share-swap deal with SoftBank Group to increase its stake in U.S. unit T-Mobile and sold its Dutch unit in a major shake-up that strengthens the German group's transatlantic focus.

• State Street to buy Brown Brothers Harriman's unit for $3.5 billion

State Street will buy investment bank Brown Brothers Harriman's investor services business for $3.5 billion in cash, the companies said in a statement.

• U.S. probes Raytheon's dealings with consultant for Qatar Armed Forces - WSJ

U.S. authorities are investigating whether payments by U.S. weapons maker Raytheon Technologies to a consultant for the Qatar Armed Forces may have been bribes intended for a member of the country's ruling royal family, the Wall Street Journal reported, citing people familiar with the matter.

• Chinese prosecutors drop case against former Alibaba employee accused of sexual assault

Chinese prosecutors have dropped a case against a former Alibaba employee accused of sexually assaulting a female colleague, saying they had determined he had committed forcible indecency but not a crime.

• KKR-backed ForgeRock targets over $1.9 billion valuation in U.S. IPO

ForgeRock, a digital identity management company backed by an affiliate of private equity firm KKR, is aiming for a valuation of more than $1.9 billion in a U.S. initial public offering.

BEFORE THE BELL

Wall Street futures were little changed, following the Labor Day holiday, after the Nasdaq closed at a record high in the previous trading session. European stocks fell from recent highs as a flurry of deals in the telecom sector was offset by caution ahead of the ECB meeting later this week. Japanese shares ended higher on hopes of economic recovery. A stronger dollar weighed on the gold prices. Oil was down on concerns over future demand.

STOCKS TO WATCH

Deals Of The Day

• State Street Corp: State Street will buy investment bank Brown Brothers Harriman’s (BBH) investor services business for $3.5 billion in cash, the companies said in a statement. The deal will include BBH's custody, accounting, fund administration, global markets and technology services operations, State Street said. BBH will operate its separate private banking and investment management businesses after the sale of its investor services unit, the banks said. The division had $5.4 trillion in assets under custody at the end of June and will add to State Street's $31.9 trillion portfolio. The deal, which is expected to close by the end of the year, will also give State Street access to BBH's expertise in cross-border, alternatives, exchange-traded funds, and other high-growth asset classes.

In Other News

• Alibaba Group Holding Ltd: Chinese prosecutors have dropped a case against a former Alibaba employee accused of sexually assaulting a female colleague, saying they had determined he had committed forcible indecency but not a crime. The employee, identified by his surname Wang, was detained by police last month after a female Alibaba employee posted an 11-page account on Alibaba's intranet saying a manager and a client sexually assaulted her during a business trip to eastern China's Jinan city. She said superiors and human resources did not take her report seriously, triggering a fierce public backlash against the e-commerce giant, which later fired Wang and suspended other executives.

• Alphabet Inc: Google has temporarily locked down an unspecified number of Afghan government email accounts, according to a person familiar with the matter, as fears grow over the digital paper trail left by former officials and their international partners. In the weeks since the Taliban's swift takeover of Afghanistan from a U.S.-backed government, reports have highlighted how biometric and Afghan payroll databases might be exploited by the new rulers to hunt their enemies. In a statement on Friday, Google stopped short of confirming that Afghan government accounts were being locked down, saying that the company was monitoring the situation in Afghanistan and "taking temporary actions to secure relevant accounts."

• Amazon.com Inc: The company plans to take a more proactive approach to determine what types of content violate its cloud service policies, such as rules against promoting violence, and enforce its removal, according to two sources, a move likely to renew debate about how much power tech companies should have to restrict free speech. Over the coming months, Amazon will expand the Trust & Safety team at the Amazon Web Services (AWS) division and hire a small group of people to develop expertise and work with outside researchers to monitor for future threats, one of the sources familiar with the matter said.

• Boeing Co: Singapore's aviation regulator said on Monday it would approve the return to service of the Boeing 737 MAX more than two years after the plane was grounded, becoming the latest country in the Asia Pacific region to do so. The approval is based on operators including Singapore Airlines Ltd complying with airworthiness directives and additional flight crew training requirements, the Civil Aviation Authority of Singapore (CAAS) said in a statement. Singapore Airlines said on Monday it would continue to work closely with CAAS and other relevant regulators in the coming weeks to meet the requirements to return its 737 MAX planes to service. Further details on its 737 MAX operations will be announced at a later date, the airline added.

• Canadian Pacific Railway Ltd & Kansas City Southern: Kansas City Southern said on Saturday it will initiate talks with Canadian Pacific Railway because CP's unsolicited proposal to acquire it could reasonably be expected to lead to a better proposal than one made by Canadian National Railway. Kansas City Southern intends to provide Canadian Pacific with nonpublic information, the company said in a news release. Canadian Pacific Railway said it would not be as willing to stick to its own $300 per share offer, worth $27 billion, after a Sept. 12 deadline. There can be no assurance that the discussions with Canadian Pacific will result in a transaction, Kansas City Southern said in the press release.

• Chubb Ltd & Travelers Companies Inc: Major U.S. insurers are joining new digital exchanges to sell not only their own policies but also those of rivals, a fresh twist in an industry known for fierce competition. The powerful new platforms, including Semsee, bolttech, Bold Penguin and Uncharted, pull data from many carriers, allowing agents to see multiple quotes for policies, much the way travel agents see competing air fares. Chubb, Travelers and Liberty Mutual have signed on recently as have agencies that also sell policies, executives said.

• Didi Global Inc: The ride hailing giant said on Saturday that media reports that the Beijing city government is coordinating companies to invest in it are not correct. "Didi is currently actively and fully cooperating with cybersecurity probe, foreign media reports that Beijing city government is coordinating companies to invest in it are incorrect," it said on Weibo. Under the preliminary proposal, some Beijing-based companies including Shouqi Group, part of the state-owned Beijing Tourism Group, would acquire a stake in Didi, Bloomberg reported.

• GoDaddy Inc: The website hosting service on Friday terminated services for the owner of an anti-abortion website that allows people to report suspected abortions in Texas. "Last night we informed prolifewhistleblower.comthey have violated GoDaddy's terms of service and have 24 hours to move to a different provider," the company said in a statement. Texas has imposed a near-total ban on abortions, which took effect early on Wednesday and leaves enforcement up to individual citizens, enabling them to sue anyone who provides or "aids or abets" an abortion after six weeks. Citizens who win such lawsuits would be entitled to at least $10,000.

• Johnson & Johnson, AmerisourceBergen Corp & Cardinal Health Inc: Three large U.S. drug distributors and drugmaker Johnson & Johnson will proceed with a proposed $26 billion settlement resolving claims that they fueled the opioid epidemic after "enough" states joined in, the companies said on Saturday. The companies had until Saturday to decide whether enough states back the $21 billion proposed settlement with McKesson Corp, AmerisourceBergen Corp and Cardinal Health Inc and a $5 billion agreement with J&J. The distributors said 42 states, five territories and Washington, D.C., signed on to their agreement. The companies will make their first annual settlement payment into escrow on or before Sept. 30, the distributors said.

• KKR & Co: ForgeRock Inc, a digital identity management company backed by an affiliate of private equity firm KKR, is aiming for a valuation of more than $1.9 billion in a U.S. initial public offering. The company plans to raise up to $264 million through the IPO, it said in a regulatory filing. It intends to sell 11 million shares, priced between $21 and $24 per share. A rise in cybersecurity attacks on businesses during the pandemic has pushed up demand for digital security measures, helping drive growth for companies such as ForgeRock.

• Lyft Inc: The company will cover all legal fees for the ride-hail company's drivers sued under a new Texas law imposing a near-total ban on abortion, Chief Executive Logan Green said on Friday. Lyft will also donate $1 million to women's health provider Planned Parenthood, Green said on Twitter. "This is an attack on women's access to healthcare and on their right to choose," Green said of the new Texas law.

• Pfizer Inc & Moderna Inc: Top U.S. infectious disease expert Dr. Anthony Fauci said on Sunday that officials were likely to soon get the regulatory go-ahead to administer COVID-19 vaccine booster shots made by Pfizer, although Moderna booster could take a little longer. Asked on CBS' "Face the Nation," about President Joe Biden's goal to give booster shots starting Sept. 20, Fauci said that "in some respects" that remained the plan. Scientists are still debating how much additional immunity boosters provide and whether all Americans should get another shot, rather than just those at high risk of severe illness. Speaking Sunday, Fauci emphasized that both boosters were assumed to be safe, but that the FDA and other officials would study the data to make sure.

• Qualcomm Inc: The company said on Monday it will supply a key computing chip for the digital dashboard in a new Renault electric vehicle. Qualcomm has been expanding into vehicles with chips that can power dashboards and infotainment systems at the same time. The company earlier this year announced a deal with General Motors to use Qualcomm chips. It said that Renault's Mégane E-TECH Electric will use its chips to power the vehicle's infotainment system using software from Alphabet Inc's Google, Qualcomm's longtime partner in the Android phone market.

• Raytheon Technologies Corp: U.S. authorities are investigating whether payments by the weapons maker to a consultant for the Qatar Armed Forces may have been bribes intended for a member of the country's ruling royal family, the Wall Street Journal reported, citing people familiar with the matter. The U.S. Securities and Exchange Commission began making inquiries into the allegations after the lawsuit was filed and the justice department soon followed suit, the report said.

• Talos Energy Inc: The offshore oil producer said on Sunday that the rate of oil flowing from a spill of unknown origin in U.S. Gulf of Mexico following Hurricane Ida appears to have decreased. Clean-up crews and a dive team were at the leak site in the Bay Marchand area of the Gulf of Mexico on Sunday seeking to contain the oil and pinpoint its source and location. A miles-long black streak of oil in the Gulf of Mexico off Louisiana was visible from the air after Hurricane Ida tore through the region a week ago. An evaluation by divers and sonar scan found no leaks tied to its oil pipelines.

• Tesla Inc: Germany will probably decide by the end of the year how much state aid the electric vehicle maker will receive for its planned battery cell factory near Berlin, an economy ministry spokesperson said on Sunday. Tesla plans to invest 5 billion euros in its battery cell factory at Gruenheide near Berlin to complement its nearly finished electric car factory at the same location, according to estimates from the German economy ministry. The unusually high investment volume means that the U.S. car manufacturer can count on German state subsidies of 1.14 billion euros, Tagesspiegel newspaper reported on Sunday.

• Toyota Motor Corp: The automaker said it expected to spend more than $13.5 billion by 2030 to develop batteries and its battery supply system, in a bid to take a lead in the key automotive technology over the next decade. Considered a leader in developing batteries for electric vehicles, Toyota said it aimed to slash the cost of its batteries by 30% or more by working on the materials used and the way the cells are structured. "Then, for the vehicle, we aim to improve power consumption, which is an indicator of the amount of electricity used per kilometer, by 30%, starting with the Toyota bZ4X," Chief Technology Officer Masahiko Maeda told a briefing, referring to an upcoming compact SUV model.

• Walmart Inc: Sachin Bansal, co-founder of e-commerce giant Flipkart, has mounted a court challenge against India's financial crime-fighting agency, which has accused him and others of violation of foreign investment laws, court records showed. Court records and media reports on Saturday showed Sachin Bansal has urged a state court in the southern state of Tamil Nadu to quash the agency's notice, arguing that it was issued after an inordinate delay. The judge in the case, R Mahadevan, heard the matter on Friday and asked the Enforcement Agency to file a response, reports said.

ANALYSIS

Sovereign wealth funds sweet on China, despite regulatory headwinds

Sovereign wealth funds remain keen on China, despite regulatory crackdowns, planning standalone investment strategies and piling into venture capital and real estate, according to data and analysts.

ANALYSTS' RECOMMENDATION

• Joann Inc: Barclays cuts rating to equal weight from overweight to account for the increased risks of slowing sales and margin pressure in the near term.

• Lululemon Athletica Inc: Piper Sandler raises target price to $446 from $445, saying the company's investment in MIRROR is paying off and expect this piece of the business to pick up this quarter.

• Netflix Inc: Evercore ISI raises target price to $695 from $635, following proprietary U.S. and India surveys, as well as their analysis of what appears to be a very robust content slate.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

1000 Employment Trends for Aug: Prior 109.80

COMPANIES REPORTING RESULTS

No major S&P 500 companies are scheduled to report for the day.

CORPORATE EVENTS (All timings in U.S. Eastern Time)

1630 Coupa Software Inc: Q2 earnings conference call

1630 Smartsheet Inc: Q2 earnings conference call

1700 Meridianlink Inc: Q2 earnings conference call

1700 Uipath Inc: Q2 earnings conference call

2100 Dada Nexus Ltd: Q2 earnings conference call

EX-DIVIDENDS

Amcor PLC: Amount $0.11

Ameren Corp: Amount $0.55

Cigna Corp: Amount $1.00

First American Financial Corp: Amount $0.51

Golub Capital BDC Inc: Amount $0.29

Guess? Inc: Amount $0.11

HP Inc: Amount $0.19

Kohls Corp: Amount $0.25

PDC Energy Inc: Amount $0.12

PJT Partners Inc: Amount $0.05

Public Service Enterprise Group Inc: Amount $0.51

Texas Pacific Land Corp: Amount $2.75

Texas Roadhouse Inc: Amount $0.40

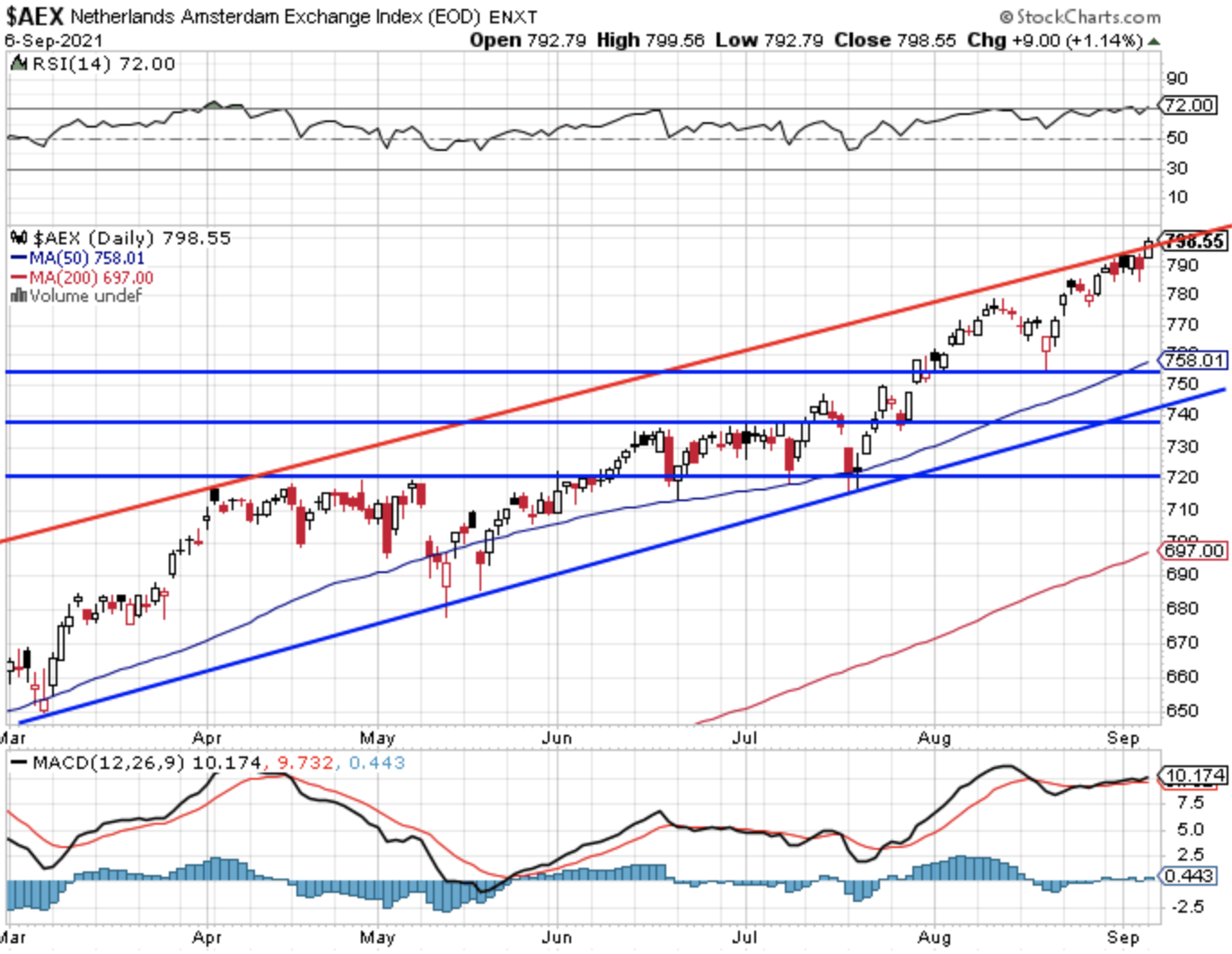

AEX knalt door met record tot net onder de 800 punten

Via de futures zien we vanmorgen vlak in Europa terwijl Wall Street een iets hogere start aangeeft, Wall Street bleef dicht gisteren door Labor Day. De AEX wist tot net onder de 800 punten te geraken gedurende de sessie maar sloot af op 798,55 punten wat wel weer een nieuw record is. De DAX test de topzone opnieuw maar geraakte nog niet tot de 16.000 punten. Wat ook opvalt is dat de Nikkei in Japan in 5 sessies zo'n 2400 punten hoger staat.

Update dinsdag 7 september:

Een sterke dag hier in Europa met de DAX die er 150 punten op vooruit ging terwijl de AEX 9 punten winst boekte en gedurende de sessie even de 800 punten zo goed als aantikte. Zonder Wall Street dat dicht bleef door Labor Day, vandaag start ook daar de week, de futures liepen trouwens wel gewoon mee en bleven de gehele sessie positief. In Azië valt de Nikkei op met een koersexplosie van zo'n 2400 punten binnen enkele sessies, ook vanmorgen sluit de Nikkei weer wat hoger.

Bij de AEX was het opnieuw ASML dat voor het grootste deel van de winst zorgde, het aandeel won maar liefst €19 en sluit op een nieuw record dat uitkomt op €740,9. Verder bij de rest ook plussen binnen de AEX maar op zich viel dat mee. Het was vooral door ASML dat de AEX zo fors omhoog ging want het aandeel weegt al meer dan 20% binnen de index waardoor ongeveer 5 punten van de stijging maandag alleen al kwam door ASML. Ook de afgelopen weken is het vooral ASML dat de AEX omhoog stuwt en dat blijft gevaarlijk, als het aandeel via een correctie van de tech aandelen een keer fors moet inleveren zal dat zeker de AEX versnellen naar omlaag.

Nu is het wachten op wat er vandaag zal gebeuren, Wall Street doet weer mee en hier in Europa zijn we nu toch ook veel te ver door aan het schieten. Op alle vlakken schreeuwen de markten om een gezonde, en lees het goed, een gezonde correctie na een fase van zware overdrijving. Er moet tussen de 5 en 8% af kunnen van de huidige standen, mogelijk zelfs tot 10%. Dan nog zitten de markten in een positieve flow maar het kan de markten helpen om de overdreven waarderingen wat terug te brengen.

Op dit moment zitten we met de signaaldiensten in de markt met wat kleine posities. Waar ik kansen zie zal ik zeker nog enkele posities erbij nemen maar we doen alles rustig aan. Bij Guy Trading zal ik ook kijken om wat aandelen op te nemen want vanaf nu kunnen we via Boosters en Turbo's ook weer LONG posities kopen op Amerikaanse aandelen die toch veel meer kansen bieden wat betreft de volatiliteit dan de aandelen binnen de AEX.

Kortom, daar zal ik waar het kan zeker wat mee gaan doen de komende tijd. Om mee te doen met de indexen of de aandelen, wordt lid nu tot 1 november voor €35 via de aanbieding. Ga naar https://www.usmarkets.nl/trade... en schrijf u meteen in ...

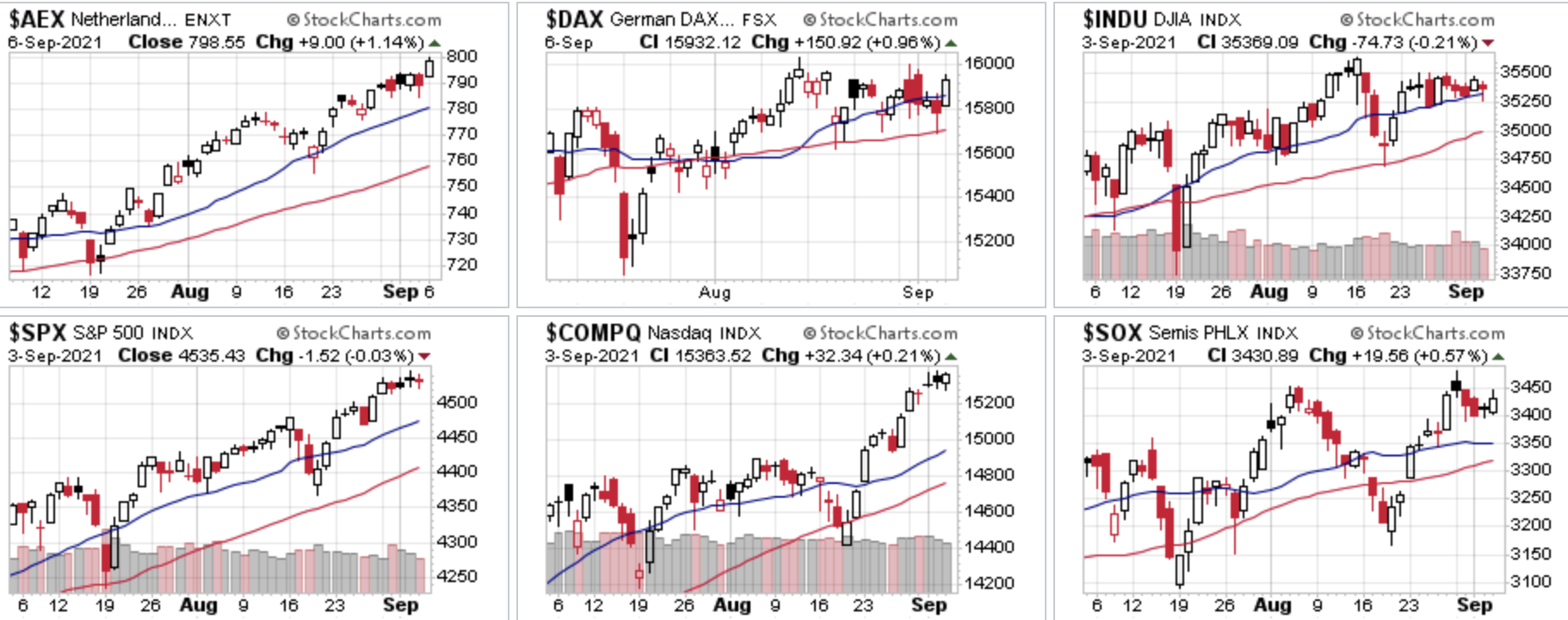

Marktoverzicht:

Via het overzicht zien we dat de Nasdaq, de S&P 500 en de AEX er in feite nog sterk bijliggen al werd het vrijdag wat betreft de AEX index die wel open was maandag werd er weer een nieuw record neergezet. De DAX herpakt zich na dat de index vrijdag weer onder de 15.810 punten terecht kwam.

De markt blijft dus sterk liggen maar we merken ook dat de markt nog altijd zeer afhankelijk blijft van een paar zeer sterke aandelen die met de dag zwaarder gaan wegen op het geheel en bepalend zullen worden bij de volgende fase zodra die er komt.

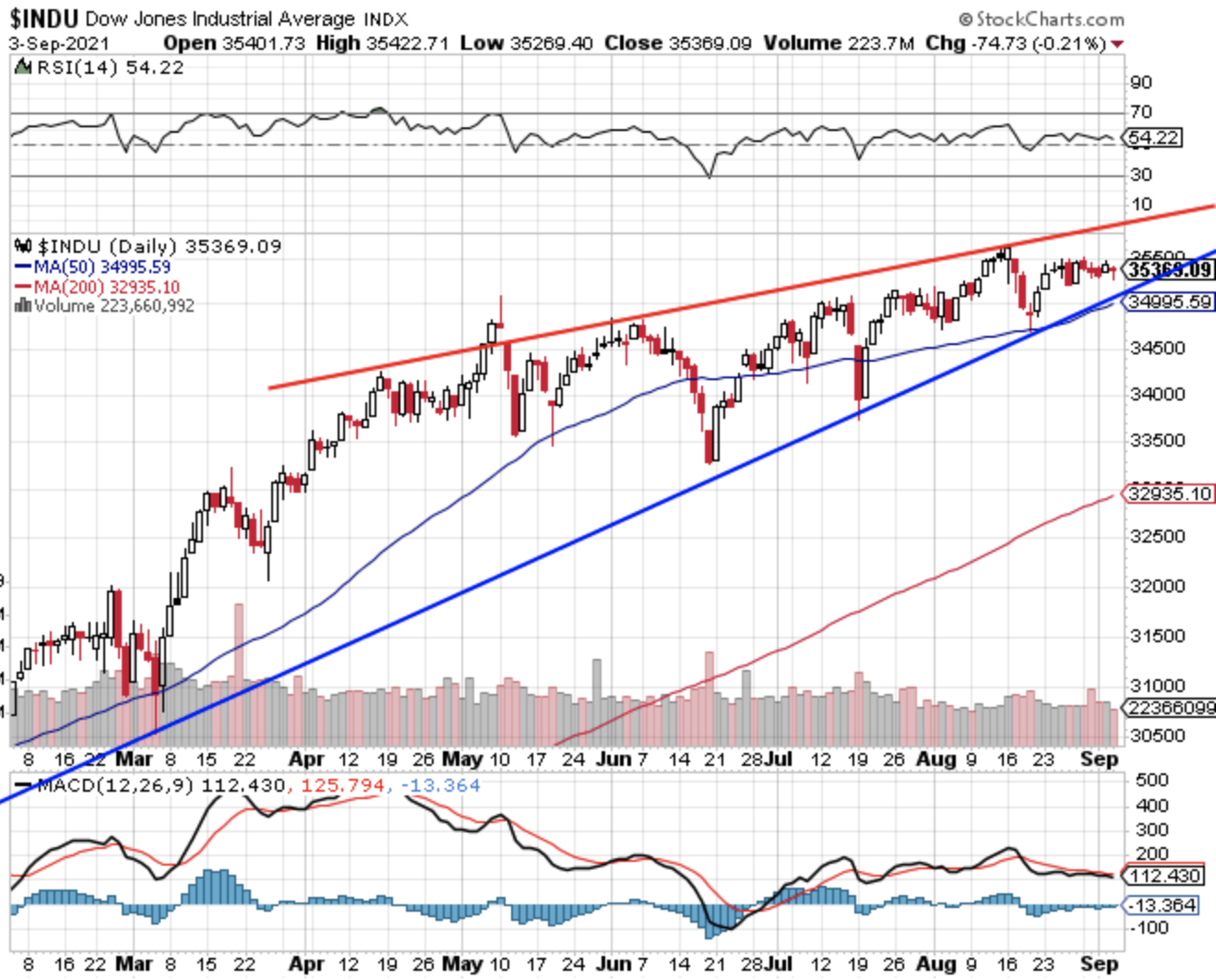

Dow Jones:

De Dow Jones verloor 75 punten vrijdag, op weekbasis zien we dat de index dan toch met 0,25% verlies afsluit. De Dow Jones laat dus opnieuw een behoorlijke divergentie zien ten opzichte van de S&P 500 (+0,6%) en de Nasdaq (+1,55%) die beiden op weekbasis winst boeken. Vandaag doet Wall Street weer mee na een vrije dag gisteren.

Weerstand blijft nog altijd de top rond de 35.631 punten en dat is 260 punten (0,75%) boven de slotstand van vrijdag en blijft zo binnen bereik. Rond de 35.500 punten zien we nu ook wat weerstand in eerste instantie. Boven het record verwacht ik weerstand rond de rode lijn over de toppen die nu rond de 36.125 punten uitkomt. Dus rond de 35.500, de 35.630 en rond de 36.125 punten weerstand voor wat betreft de Dow Jones index.

Steun nu eerst de recente bodem rond de 35.200 punten, later rond de lijn onder de bodems die we rond de 35.075 punten zien uitkomen als volgende steun met net daaronder al het 50-daags gemiddelde rond de 35.000 punten.

AEX index:

De AEX zet een nieuw record neer op 798,55 punten maar de hoogste stand werd bereikt net onder de 800 punten (799,56). Zoals ik al aangaf door ASML dat voor ongeveer 5 punten op de index invloed had. De AEX kijkt even boven de lijn over de toppen die ik nog altijd als weerstand zie.

Weerstand nu de 800 punten, later ligt alles open maar het zal aan ASML liggen of we door die 800 punten gaan of niet. Later kijken we naar de 810, 815 en 825 punten als richtpunten voor de index.

Steun nu eerst de 790 punten, later de 780 en de 765 punten als steun. Het kan allemaal snel gaan eens de rek eruit geraakt en ook dat zal komen door het verdere verloop van ASML, zoveel is duidelijk.

DAX index:

De DAX herpakt zich tot boven die 15.810 punten en kon weer tot boven de 15.900 punten geraken. Weerstand blijft de 16.030 punten ofwel de top. Boven die 16.030 zien we rond de 16.100 en de 16.250 punten wat weerstand maar de index moet eerst nog tot of boven dat record zien te geraken.

Steun nu rondom die 15.810 punten, later rond de 15.700 punten waar we het 50-daags gemiddelde zien uitkomen nu. Daarna komt de zone 15.500-15.550 punten weer als steun in beeld.

Nasdaq Composite:

De Nasdaq blijft nog altijd heel sterk liggen en zet zelfs op een mindere sessie nog een nieuw record neer vrijdag, zoals u merkt op de grafiek hieronder breekt de Nasdaq door de zware weerstand die we zien door de lijn over de toppen vanaf begin juli. De uitbraak maakt zo de weg vrij richting nieuwe hoogtepunten zonder dat we weerstand zien, dat kan doorgaan tot er een echte top staat. Het is moeilijk om aan te geven waar de top zal uitkomen maar op een gegeven moment is het genoeg en kan de index daarna behoorlijk gaan inleveren door winstnemingen na deze unieke. en zeer positieve fase. Op weekbasis won de Nasdaq 1.55%. Vandaag doet de Nasdaq weer mee na een vrije dag maandag.

Weinig weerstand dus, we zetten wel een paar niveaus neer om in de gaten te houden, eerst de 15.400 met daarna de 15.500 punten, later de 15.650 punten als mogelijke weerstand. Steun nu de lijn over de eerdere toppen die uitkomt rond de 15.125 punten, later steun rond de 14.900 punten met net daaronder het 50-daags gemiddelde rond de 14.765 punten als steun. Eerst maar eens bekijken hoe de index zich de komende sessies verder zal ontwikkelen.

Overzicht resultaat 2021 blijft goed:

Er lopen op dit moment vanaf de top wat kleine posities die meteen de eerste worden voor de maand september. Zorg in ieder geval voor dat u ook een mooi en gunstige momentum kunt pakken om in de markt te stappen of wordt lid zodat u de signalen ontvangt op de indexen. Na de rally en het bereiken van de top verwacht ik een 5 tot 8% correctie die ik graag wil meepakken voor de leden.

Meedoen kan meteen als u lid wordt, de posities kunt u nog opnemen daarna want de details ziet u dan in onze Tradershop op de website. Schrijf u nu in via de nieuwe aanbieding tot 1 NOVEMBER voor €35 via de aanbieding., ga naar https://www.usmarkets.nl/trade... en doe meteen mee met de nieuwe posities ...

Met vriendelijke groet,

Guy Boscart

US Markets Trading