Liveblog Archief donderdag 1 juli 2021

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: ISM Productie Inkoopmanagersindex (PMI) (Jun) | Actueel: 60,6 Verwacht: 61,0 Vorige: 61,2 |

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Eerste Aanvragen Werkloosheidsvergoeding | Actueel: 364K Verwacht: 390K Vorige: 415K |

Markt snapshot Wall Street 1 juli

TOP NEWS

• Shell plans to exit California joint venture with Exxon Mobil -sources

Royal Dutch Shell plans to leave Aera, its California-based oil and gas-producing joint venture with Exxon Mobil, four people familiar with the talks told Reuters.

• Trump company's CFO surrenders ahead of expected unveiling of criminal tax charges

The chief financial officer of the Trump Organization surrendered to authorities as he and former U.S. President Donald Trump's namesake company prepare to face criminal charges, The New York Times said.

• PepsiCo vows to cut soda sugar levels by 25% in EU by 2025

PepsiCo said it plans to reduce sugar content in sodas and iced teas by a fourth in the European Union and launch more nutritious snacks by 2025, to attract more health-conscious consumers in its second-biggest market.

• MKS Instruments to buy Atotech for $5.1 billion

Semiconductor equipment maker MKS Instruments said it will buy specialty chemicals group Atotech in a cash-and-stock deal for about $5.1 billion.

• Australian regulator may authorise media group talks with Google, Facebook

Australia's competition watchdog said it issued draft proposals to authorise regional newspaper industry group, Country Press Australia, to negotiate with Google and Facebook for payments for news content on their platforms.

BEFORE THE BELL

Wall Street futures were muted, with investors awaiting a batch of economic data to gauge the health of U.S. economy. European shares rose as a slate of upbeat corporate results helped investors shake off concerns around a jump in inflation. Japan’s Nikkei closed lower, weighed down by worries that a resurgence of COVID-19 infections would lead to an extension of restrictions. The dollar was little changed and gold prices gained. Oilprices were up, supported by lower U.S. inventories and the prospect of strengthening demand.

STOCKS TO WATCH

Results

• Micron Technology Inc: The chipmaker on Wednesday beat Wall Street estimates for quarterly profit and forecast fourth-quarter revenue above expectations, as tight supplies of memory chips and continued strong demand kept prices high. The company forecast current-quarter revenue of $8.2 billion, plus or minus $200 million, while analysts on average were expecting $7.87 billion. The company's revenue for the third quarter ended June 3 rose 36% to $7.42 billion, beating estimates of $7.24 billion. Excluding items, the company earned $1.88 per share in the quarter, above estimates of $1.72. In prepared remarks, Micron Chief Executive Sanjay Mehrotra said the company expects industry-wide supplies of both kinds of chips to remain tight until the end of next year, keeping prices high.

Deals Of The Day

• Carlyle Group Inc: The company said it has taken a majority stake in Trans Maldivian Airways (TMA), the world's largest seaplane operator, from buyout firm Bain Capital following a debt restructuring deal. TMA began negotiating debt relief with Carlyle and its other creidtors after the airline grounded most of its fleet of 56 seaplanes last year, as the COVID-19 pandemic halted travel and tourism into the Maldives. Terms of the transaction were not disclosed, but people familiar with the matter, who requested anonymity, said Carlyle took majority ownership of TMA from Bain in exchange for agreeing to restructure the airline's outstanding debt of about $300 million. Lenders including hedge fund managers King Street Capital Management and Davidson Kempner Capital Management LP took stakes in TMA alongside Carlyle. Bain and Tempus Group, a Chinese tourism-focused conglomerate, retained minority stakes in TMA, according to the sources.

• MKS Instruments Inc & Atotech Ltd: Semiconductor equipment maker MKS Instruments said it will buy specialty chemicals group Atotech in a cash-and-stock deal for about $5.1 billion. MKS will acquire Atotech for $16.20 in cash and 0.0552 of MKS common stock for each Atotech share, or a per share value of about $26, according to Reuters calculations. The offer represents a premium of about 10% to Atotech's closing price on June 10, when Reuters reported that MKS had approached Atotech with an acquisition offer. The deal, expected to close by the fourth quarter of this year, would expand MKS' offerings in chip manufacturing through the addition of Atotech's plating chemicals.

• Philip Morris International Inc: The cigarette maker will buy nicotine gum maker Fertin Pharma from private equity firm EQT for $813.1 million, the company said, as it looks to build its smoke-free portfolio. Philip Morris has invested more than $8.1 billion over the years to develop smoke-free products, an area of business that it believes " will one day replace cigarettes." It plans to generate more than 50% of its revenue from smoke-free products and at least $1 billion from products beyond nicotine by 2025. The company is also focusing on its e-cigarette brand IQOS as people move away from combustible tobacco products like cigarettes.

• Texas Instruments Inc & Micron Technology Inc: Texas Instruments will buy Micron's factory in Lehi, Utah, for $900 million to boost its production capacity, the Dallas-based chipmaker said. Micron in March had said it would sell that facility, as it confirmed plans to end production of a certain type of memory chip made there exclusively. Texas Instruments said it plans to deploy its own technologies at Lehi, adding that it would offer workers at the site the opportunity to become its employees. Micron, meanwhile, plans to shift its development efforts to take advantage of a new, faster industry standard for connecting memory chips to computing chips called Compute Express Link.

Moves

• Boeing Co: The planemaker on Wednesday named former General Electric executive Brian West as its chief financial officer, more than two months after it announced the surprise retirement of long-time financial head Greg Smith. West, who will take charge on Aug. 27, spent 16 years at GE, where he served as CFO of its aviation and engine services businesses. "I have had the pleasure of working with Brian previously, and he is an exceptional leader," Boeing Chief Executive Officer David Calhoun said in a statement. West and Calhoun had worked together at GE earlier. West was with the conglomerate from 1990 to 2007, while Calhoun left it in 2006 after 26 years. West then joined Nielsen, which was then headed by Calhoun. Boeing has named senior vice president Dave Dohnalek as interim financial chief until West takes over.

In Other News

• Alphabet Inc: Australia's competition watchdog said it issued draft proposals to authorise regional newspaper industry group, Country Press Australia, to negotiate with Google and Facebook for payments for news content on their platforms. Country Press Australia (CPA) is seeking authorisation to allow its members to hammer out a payments deal with Google and Facebook for use of news content on the tech platforms, the Australian Competition and Consumer Commission (ACCC) said. CPA represents 81 news publishers that publish about 160 regional newspapers across the country. "Allowing the publishers of 160 newspapers to collectively negotiate with Google and Facebook should help address some of the considerable bargaining power imbalance that exists between the digital giants and these local news outlets," ACCC Chairman Rod Sims said in a statement.

• Alphabet Inc & Facebook Inc, Twitter Inc: A federal judge on Wednesday blocked a recently-enacted Florida law that was meant to authorize the state to penalize social media companies when they ban political candidates, with the judge saying the law likely violated free speech rights. U.S. District Judge Robert Hinkle in Tallahassee issued a preliminary injunction blocking enforcement of the law, which was scheduled to go into effect Thursday. The lawsuit said the bill signed by Florida Governor Ron DeSantis, a Republican, in May was unconstitutional. It was filed by internet lobbying groups NetChoice and Computer & Communications Industry Association (CCIA). The groups' members include Facebook, Twitter and Alphabet's Google. The law was criticized by internet law experts as unconstitutional and as pre-empted by Section 230, a federal law that shields online companies from liability over content posted by users.

• Carnival Corp: The cruise operator's Princess Cruises and P&O Cruises Australia on Wednesday canceled voyages in and out of the country through mid-December, citing uncertainty regarding the resumption of cruise holidays. P&O Cruises Australia said in a statement that the industry had been in talks with the Australian government and public health authorities since last October for the re-start of domestic-only cruising. "They (the cruise businesses) are like every business in Australia – they need certainty, and I am concerned they may find it increasingly difficult to hang on without a clear pathway forward," P&O Cruises Australia President Sture Myrmell said. Princess Cruises said in a separate statement that it would move guests booked for a canceled trip to an equivalent cruise next year.

• Citigroup Inc: The bank's corporate and investment banking revenue for its Saudi Arabia business has "nearly tripled" since returning to the kingdom in 2018, a senior executive said. Citi obtained a capital markets licence in 2017, allowing it to return to the kingdom in 2018 after a 13-year absence. It has advised Saudi Aramco on its $29.4 billion listing in 2019, in what was the world's biggest initial public offering, as well as on several sovereign and corporate bond deals. He did not provide more exact revenue figures, which include both onshore and offshore elements of the business, but said Saudi Arabia is one of the largest opportunities for Citigroup to acquire new clients. Citi's investment banking business in Saudi operates with four bankers, but the number will be increased, he said.

• Chevron Corp: The company is looking to sell two collections of conventional oil and gas fields in the Permian Basin valued at more than $1 billion combined, three sources told Reuters. Chevron confirmed that it is marketing conventional assets in the Permian Basin, but did not specify the value of the assets. Chevron has retained an investment bank to market some Permian oil and gas fields valued at $879 million and has additional assets of more than $200 million available for sale elsewhere in the basin, the sources said. Together, the assets Chevron is marketing could fetch as much as $1.2 billion, based upon the strength of oil futures, according to one of the people. The larger package of assets is well positioned for long-term implementation of carbon capture and sequestration, according to the people.

• Consolidated Edison Inc: The New York utility company on Wednesday asked customers in the New York City area to limit energy use during a heat wave that has gripped sections of the United States. The company also said about 64,000 customers have been affected after it reduced power voltage by 8% to parts of the city's Queens borough while crews work to repair equipment. Customers throughout New York City and Westchester County have been asked to curb the use of "energy-intensive appliances," Con Edison said in a news release.

• CureVac NV: The German biotech firm said it was in discussions with its prospective customer, the European Union, about where in the world to best deploy its experimental COVID-19 vaccine if it wins approval. The company said late on Wednesday its vaccine was only 48% effective in the final analysis of its pivotal mass trial but it highlighted that efficacy was 77% in the age group younger than 60 years when considering only moderate to severe symptoms and excluding cases of mild disease. Many low and middle-income countries, which have fallen far behind developed nation in the global vaccination campaign, have a younger overall population than Europe. "This is about a broad approach to vaccinate the world population," CEO Haas added.

• Didi Global Inc: The Chinese ride-hailing company will be added to FTSE Russell's global equity indexes on July 8 in an expedited entry following Wednesday's U.S. stock market debut, the index publisher said. Didi shares will be included in the FTSE All-World Index, the FTSE Global Large Cap Index, and the FTSE Emerging Index, FTSE Russell said in a statement on its website. The announcement came as Didi, backed by Japan's SoftBank Group, rose slightly on its U.S. debut, valuing it at $68.49 billion, in the biggest U.S. listing by a Chinese company since 2014. Didi is also backed by technology companies Alibaba, Tencent and Uber.

• Exxon Mobil Corp: A lobbyist for Exxon Mobil said the company supports a carbon tax publicly because the plan to curb climate change would never gain enough political support to be adopted, according to an interview aired on Wednesday. Britain's Channel 4 network aired the interview of senior Washington-based lobbyist Keith McCoy it obtained from an investigative arm of environmental campaigner Greenpeace UK, in footage that drew the ire of Exxon's chairman and chief executive. Greenpeace activists posed as headhunters to conduct separate Zoom interviews with McCoy and a former Washington lobbyist for Exxon, Dan Easley. "There is not an appetite for a carbon tax. It's a nonstarter," McCoy said to the Greenpeace activists. "And the cynical side of me says, 'Yeah, we kind of know that.' But it gives us a talking point."

• Exxon Mobil Corp & Royal Dutch Shell PLC: Shell plans to leave Aera, its California-based oil and gas-producing joint venture with Exxon Mobil, four people familiar with the talks told Reuters. The company is also considering a sale of its assets in the Permian Basin of Texas, Reuters previously reported. Shell has notified Exxon of its plans to exit the venture, the people said, speaking on the condition of anonymity as the talks are private. A Shell spokesperson declined to comment, citing company policy. The joint venture, headquartered in Bakersfield, California, produces primarily in the San Joaquin Valley. Shell has previously sold all of its California oil refining operations, some of which had pipeline connections to the fields.

• FAST Acquisition Corp: Fertitta Entertainment, owned by billionaire Tilman Fertitta, said it has expanded its agreement to go public with blank-check company FAST Acquisition to include a few hospitality and restaurant entities. Steakhouse chain Vic and Anthony's, restaurant chains Catch and Mastro's, hospitality group Pleasure Pier, and a handful of smaller restaurant concepts will be added to the merger deal, the company said. "According to the amendment, the company has agreed to contribute certain operating businesses not originally included as part of the business combination with FAST for no additional debt," the company said in a statement. The expanded deal implies an enterprise value of $8.6 billion for restaurant and gaming company Golden Nugget and restaurant-chain operator Landry's, its parent Fertitta Entertainment said. The agreement announced in February had valued the combined entity at $6.6 billion.

• GlaxoSmithKline PLC: Activist investor Elliott said GlaxoSmithKline should review its leadership and consider the outright sale of its consumer healthcare business as it confirmed on Thursday that it had taken a significant stake in the British pharmaceuticals group. In a letter to the GSK board, setting out five recommendations, Elliott raised the pressure on GSK Chief Executive Emma Walmsley but stopped short of calling for her to stand aside. Elliott said the GSK board needed additional biopharmaceuticals and scientific expertise and should then decide on its leadership. The split will allow GSK to focus on its core drugs and vaccines business, which has been hit by a lack of fast-growing products and patients deferring treatments due to the COVID-19 pandemic, weighing on its shares.

• Krispy Kreme Inc: The doughnut chain priced its initial public offering well below the planned range to raise $500 million, indicating a lukewarm reception from investors during one of the busiest weeks for stock market debuts in the United States. The company priced 29.4 million shares at $17 each, below the $21 to $24 per share range it had set earlier. The IPO valued it at $2.7 billion. Known for its iconic glazed doughnuts, Krispy Kreme will start trading during one of the busiest weeks of 2021 for U.S. IPOs, with at least 17 companies scheduled to enter the market. The company intends to list on the Nasdaq on Thursday under the ticker symbol "DNUT".

• Novartis AG: The Swiss drugmaker could get into the field of messenger ribonucleic acid (mRNA) technology, which has come to the fore in vaccine development during the coronavirus pandemic, Chairman Joerg Reinhardt said in a newspaper interview. In the Aargauer Zeitung interview, Reinhardt also highlighted the company's resurgent interest in anti-infective products that has also been driven by the pandemic. "The mRNA technology has proven to be an attractive option in this situation and of course every research company is questioning whether they should invest more in this area," he told the Swiss paper. Novartis had joined many other companies in 2018 when it abandoned anti-viral and anti-bacterial research at a facility in California, as it concluded the probability of success was relatively low and wanted to re-direct resources to other areas like gene therapy.

• PepsiCo Inc: The soda maker said it plans to reduce sugar content in sodas and iced teas by a fourth in the European Union and launch more nutritious snacks by 2025, to attract more health-conscious consumers in its second-biggest market. As part of its push, the company aims to reformulate products using low-calorie sweeteners, launch healthy snacks like its popcorn line PopWorks and take low-fat brands including the Lay's Oven Baked range to new markets. Europe accounted for nearly a fifth of PepsiCo's overall sales last year, making it the second-biggest revenue generating region after North America. The company is planning for a 25% reduction in added sugar levels by 2025 and a 50% cut by 2030 in beverages like Pepsi-Cola, Lipton Ice Tea and 7UP sold across Europe. PepsiCo is aiming for a more than tenfold increase in sales by 2025 and expanding it to a $1 billion portfolio by 2030.

• PG&E Corp: The company has proposed a rate increase from 2023, the utility said late on Wednesday, adding it would use some of the funds for wildfire prevention. If approved in its entirety by the California Public Utilities Commission (CPUC), the proposal would lead to a roughly $1 per day increase in the bills of its electricity and gas customers, PG&E said. "PG&E's GRC (general rate case) proposal includes approximately $7.4 billion in new investments from 2023-2026 to help keep customers safe and reduce the impacts of extreme weather and the threat of catastrophic wildfires," it said. "As part of this GRC and other filings, the average residential customer bill is expected to increase about 5% annually, on average, from 2021 through 2026," PG&E said in a statement.

INSIGHT

Concrete makers face heavy lift on climate pledges

Cemex, North America’s biggest concrete producer, has vowed to slash carbon dioxide emissions by 40% before 2030 and to eliminate them by 2050, ambitious goals reflecting growing pressure on the industry from regulators and investors.

ANALYSTS' RECOMMENDATION

• Bed Bath & Beyond Inc: Jefferies raises target price to $30 from $26, saying new team is highly capable and motivated to drive change.

• First Hawaiian Inc: Wells Fargo raises target price to $28 from $23, saying tourism is rebounding faster than the expectations and believing the Hawaiian economy is on the path to recovery.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0730 Challenger layoffs for June: Prior 24,586

0830 (approx.) Initial jobless claims: Expected 390,000; Prior 411,000

0830 (approx.) Jobless claims 4-week average: Prior 397,750

0830 (approx.) Continued jobless claims: Expected 3.382 mln; Prior 3.390 mln

0945 Markit Manufacturing PMI Final for June: Prior 62.6

1000 Construction spending mm for May: Expected 0.4%; Prior 0.2%

1000 ISM Manufacturing PMI for June: Expected 61.0; Prior 61.2

1000 ISM Manufacturing Prices Paid for June: Expected 86.5; Prior 88.0

1000 ISM Manufacturing Employment Index for June: Prior 50.9

1000 ISM Manufacturing New Orders Index for June: Prior 67.0

COMPANIES REPORTING RESULTS

McCormick & Company Inc: Expected Q2 earnings of 62 cents per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 McCormick & Company Inc: Q2 earnings conference call

0830 Simply Good Foods Co: Q3 earnings conference call

0830 Walgreens Boots Alliance Inc: Q3 earnings conference call

1100 Lindsay Corp: Q3 earnings conference call

EX-DIVIDENDS

American Express Co: Amount $0.43

Bristol-Myers Squibb Co: Amount $0.49

Encore Wire Corp: Amount $0.02

General Dynamics Corp: Amount $1.19

Globe Life Inc: Amount $0.19

Hannon Armstrong Sustainable Infrastructure Capital Inc: Amount $0.35

Helios Technologies Inc: Amount $0.09

Lennar Corp: Amount $0.25

New Residential Investment Corp: Amount $0.20

Regal Beloit Corp: Amount $0.33

Royal Gold Inc: Amount $0.30

Simon Property Group Inc: Amount $1.40

Sysco Corp: Amount $0.47

Thor Industries Inc: Amount $0.41

TA RD, AEX, Aegon, VW, goud en Nokia

Vandaag krijgt u een technische analyse van vier aandelen, een index en een edelmetaal. We blijven niet alleen in Nederland maar we gaan ook de grens over. Drie van de zes grafieken zijn op verzoek van lezers. We starten snel de machines op en gaan van start.Ik begin met een belangrijke mededeling:…

Lees verder »Europa twijfelt, Wall Street weet zich nog sterk te houden

De laatste sessie van de maand en het 2e kwartaal verliep volatiel met Europa dat wat omlaag moest en Wall Street waar we divergentie zien tussen de traditionele indices en de tech indices. Nu is het ook zo dat de tech de dagen ervoor al een behoorlijke stijging lieten zien en nu wat stoom afblazen. Verder zie ik niet veel redenen dat de markt makkelijk verder zal stijgen maar het blijft een kwestie van het sentiment en dat blijft voorlopig positief. Wel zit er op zeer korte termijn wel een correctie aan te komen van pakweg 3 tot 5%, het is wachten op het juiste momentum.

Update 1 juli:

Europa moest woensdag een stapje omlaag en zo werd het eerste half jaar met een stevige stijging afgerond want vanaf vandaag start het 3e kwartaal. Daarom even een overzicht, de AEX won al 17% dit jaar, de DAX staat al 13% in de plus terwijl de Bel 20 ongeveer 14% en de Franse CAC 40 net zoals de AEX op 17% winst staat voor dit jaar. Wel moesten de indices inleveren gisteren door dat vooral de banken, de auto aandelen en binnen de AEX ook ASML een slechte dag hadden. Maar als we kijken naar het verloop vanaf 1 januari dan zien we een stevige plus staan, wel is het zo dat een correctie van pakweg 3 tot 5% zeer goed mogelijk wordt vanaf deze hoge niveaus.

Dan Wall Street, de S&P 500 zet voor de 33 keer een record slot neer dit jaar terwijl de Nasdaq een stapje terug moest. De Dow Jones kende een sterke sessie en ging in tegenstelling tot de tech sector omhoog. Beide Nasdaq indices en de SOX index leveren iets in woensdag. Bekeken over de gehele maand juni dan verloor de Dow 0,1% terwijl de S&P 500 met 2,2% omhoog ging. De Nasdaq deed het in juni heel goed en won 5,5%. Als we dan kijken naar hoe het jaar verloopt, de Dow Jones staat op een winst van ongeveer 13%, de S&P 500 staat op 14,5% winst en de Nasdaq zien we 12,5% hoger uitkomen.

Europa deed het dan toch iets beter dan Wall Street al zou je dat gezien de afgelopen weken niet aanvoelen. Toch is het zo dat we het hier iets beter hebben gedaan. Maar alsnog, dat komt vooral door dat de Nasdaq en de S&P 500 dit jaar 2 keer iets verder terug moesten dan wij hier in Europa. Nu maar eens zien hoe de markten het verder zullen doen dit jaar.

Verder wat nieuws:

Men begint zich wat meer zorgen te maken over de de opkomst van de delta-variant van het coronavirus op het vasteland hier in Europa en plots deed dat het sentiment geen goed. Of dat weer strengere maatregelen zal uitlokken weten we niet maar men zal wel voorzichtiger worden denk ik. De reis sector kan daardoor mogelijk weer een tik krijgen ofwel beleggers zullen voorzichtiger worden. Wat ik al opmerkte is dat sommige landen plots te snel teveel toelaten en mensen die nog geen vaccin hebben gekregen kunnen daar de dupe van worden. We gaan het zien, voorlopig lijkt alles weer te goed te gaan, nu maar hopen dat het kan blijven zoals het is want nieuwe maatregelen zit niemand meer op te wachten.

Iets wat nog opviel gisteren was dat de Britse economie het eerste kwartaal van dit jaar (2021) is gekrompen met 1,6%. De economische groei daar ligt nu nog zo'n 8,8% lager dan Q4 van 2019, het laatste kwartaal van voor de uitbraak van de pandemie.

Nieuwe mogelijkheden komen er aan:

We blijven in ieder geval zoeken naar nieuwe mogelijkheden om op de handelen met wat indices. We blijven rustig handelen en ik zal zeker geen te grote risico's nemen. Eerst maar eens zien wat de markt gaat doen nu alles rond de hoogste standen ooit staan. De volgende posities zullen waarschijnlijk short worden zoals het er nu naar uit ziet.

Mis de volgende kans in ieder geval niet, als u de signalen wilt ontvangen wordt dan vandaag nog lid via de nieuwe aanbieding die loopt tot 1 september ...

Maand JUNI werd afgerond met een mooie winst:

De maand juni zit erop en er lopen momenteel geen posities. Het is nu al de 7e maand op rij dat alle abonnementen de maand met winst afronden en dat in toch een redelijk moeilijke markt. Ik zal er alles aan doen om ook deze maand goed voor de dag te komen, u kunt meedoen door lid te worden. Het zal denk ik ook niet lang duren voor we weer een kans krijgen om in te stappen op onder andere de Nasdaq, de Dow Jones, de AEX, de DAX en de CAC 40.

Bij Guy Trading kijk ik ook naar een 2 a 3 aandelen waar ik wat mee kan doen. Schrijf u dus op tijd in, ik zal in ieder geval het momentum kiezen om in te stappen.

Maak nu gebruik van de nieuwe aanbieding tot 1 SEPTEMBER voor €39 (Polleke Trading €49) https://www.usmarkets.nl/tradershop

Hieronder het resultaat van deze maand (JUNI) en dit jaar (2021):

Overzicht markt:

Markt technisch bekeken:

Weer een verloop met de nodige divergentie omdat de Dow Jones behoorlijk in de plus wist af te sluiten (+210 punten) terwijl de tech indices wat inleveren. Europa daarentegen verloor tussen de 0,7 a 1% zodat alles iets verder onder de top terecht kwam. We kunnen weer niet spreken over een markt die aan het inleveren is, daarvoor is het nog te vroegen moeten we wachten op het vervolg. Via de ledenupdate heb ik dat al aangegeven, onze kans komt wel maar we moeten zeker niet te vroeg wat gaan doen in deze fase. De grotere correctie komt er wel, het zal een kwestie van timing zijn om zo goed mogelijk in te stappen. Ook al dachten we gisteren dat we vertrokken waren maar tegen het slot op Wall Street viel dat nog tegen en zeker via hetgeen we hebben gezien bij de Dow Jones.

We zoeken naar een instap en die kan er sneller komen dan we denken maar we moeten geduldig blijven. Het is nu toch al voor de 7e maand op rij dat we met de abonnementen op winst de maand afsluiten nu de maand juni voorbij is, dat mag ook als positief bekeken worden en zeker in deze marktfase.

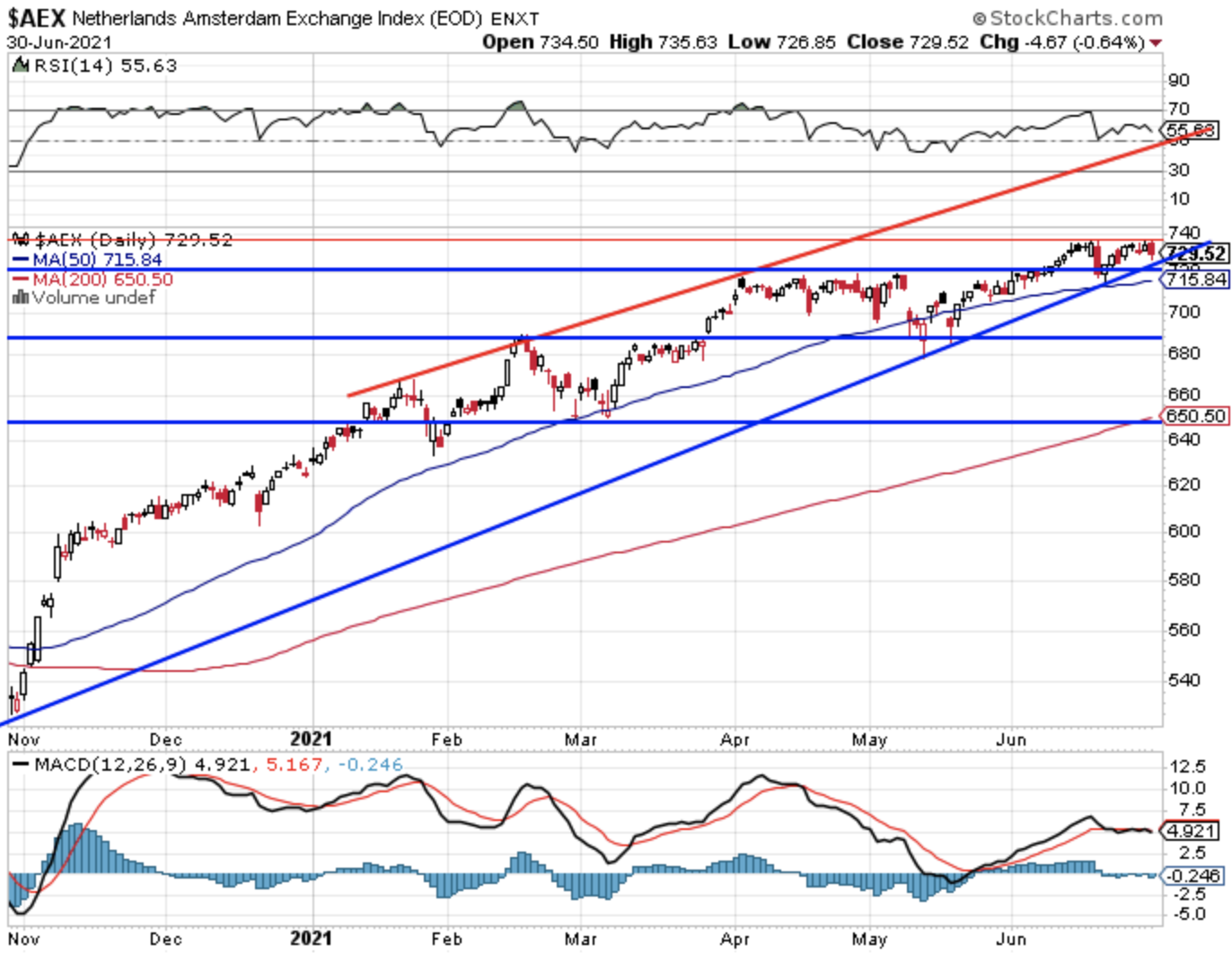

Technische conditie AEX:

De AEX kende een slechte dag en sluit onder de 730 punten, de recordstand die op 736 punten wacht ligt nu weer wat verder weg. Wel werd de hoogste stand ooit weer getest aan het begin van de sessie maar nadien kwamen er snel winstnemingen tot zelfs rond de 727 punten. We moeten nu vooral blijven kijken of de belangrijke andere indices, komt er via Wall Street een correctie aan op korte termijn of niet? Daarbij houden we vooral de technologie indices in de gaten omdat ASML zwaar meeweegt en zeer bepalend blijft voor het verloop van de AEX. Woensdag verloor ASML €10 en dat zien we meteen aan het verloop van de AEX index. Aan de andere kant leveren de Nasdaq en de SOX index nog amper in, mogelijk moet dat nog komen later tijdens de maand juli?

Weerstand nu het record op 736 punten, later de 740 en daarna moeten we al letten op de 750 punten. Steun blijft nu eerst weer die 718-719 punten waar de oude top wacht, later de 716 (recente bodem en het 50-daags gemiddelde.

Technische conditie DAX:

De DAX lag er gisteren slecht bij en moest weer even tot onder de zone 15.500-15.550 punten. Op slotbasis wist de DAX zich te herpakken tot binnen die zone zodat het nu weer wachten is op de volgende beweging van de index. Zo blijft de index aan de ene kant op recordjacht waar de 15.802 punten nu als eerste zware weerstand wacht maar gelijktijdig kan de index via een slechte dag snel weer fors inleveren.

Boven de top op 15.802 punten zien we weerstand rond de 15.900 en de 16.000 punten. Steun blijft uiteraard de zone 15.500-15.550 punten, later de 15.430 punten waar het 50-daags gemiddelde uitkomt, daar onder in ieder geval de laatste bodem rond de 15.310 punten.

S&P 500 analyse:

De S&P 500 zet opnieuw een record neer en nu op 4302,43 punten na een sterke sessie, de slotstand kwam uit op 4297,5 punten wat weer iets hoger is dan dinsdag en het hoogste slot ooit wordt. Een vreemd verloop met nieuwe records die slechts amper hoger uitkomen ten opzichte van het record de dag ervoor, dus geen stevige stijgingen maar wel records. Weerstand nu de 4300 punten, later de 4350 en de 4400 punten.

Steun wordt nu eerst de 4237 punten waar de eerdere ofwel de oude top uitkwam, later de 4200 punten waar nog steeds zowel de steunlijn onder de bodems samen met het 50-daags gemiddelde uitkomen, pas onder deze steun moeten we opletten want dan kan het snel richting de 4150, de 4125 en de 4100 punten.

Analyse Nasdaq:

De Nasdaq moet wat inleveren en onderbreekt een reeks van records, de eerste weerstand wordt nu de top die wacht op 14.536 punten met daarboven de 14.650 punten. Later richten we ons op 14.750, 14.850 en zelfs al de 16.000 punten. De Nasdaq blijft uiteraard volatiel en zit nog altijd in een sterke fase waar correcties snel worden opgekocht, de top 7 van de grote bedrijven liggen er nog altijd wel goed bij maar ik verwacht op korte termijn toch grotere winstnemingen. Steun nu eerst 14.400 punten met daarna de eerdere top rond de 14.211 punten. Later zien we rond de 14.000 en de 13.855 steun waar we het 50-MA zien uitkomen.

Na de uitbraak met toch redelijk wat kracht maar eens kijken waar de index naartoe kan en of er nog veel meer in het vat zit, aan de andere kant moeten we hier altijd opletten voor een stevige draai omlaag eens er een duidelijke nieuwe top staat.

Euro, olie en goud:

De euro zien we nu rond de 1.184 dollar, de prijs van een vat Brent olie komt uit op 74,8 dollar terwijl een troy ounce goud nu op 1777 dollar staat.

De LIVEBLOG en Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

Met vriendelijke groet,

Guy Boscart

Markt snapshot Europa 1 juli

GLOBAL TOP NEWS

Amazon.com filed a petition on Wednesday asking for Federal Trade Commission (FTC) Chair Lina Khan to be recused on antitrust matters related to the online retail giant, according to documents filed with the agency.

Asia's factory activity saw momentum weaken in June as some countries struggled with rising input costs and the reintroduction of curbs to combat a new wave of coronavirus infections, surveys showed.

Didi Global shares ended their first day of U.S. trading slightly over their initial public offering (IPO) price, valuing the ride-hailing giant at $68.49 billion in the biggest U.S. listing by a Chinese company since 2014.

EUROPEAN COMPANY NEWS

Credit Suisse expects to decide on a new strategy by the end of the year, Chairman Antonio Horta-Osorio said in his first interview since assuming the role at the troubled lender.

Royal Dutch Shell plans to leave Aera, its California-based oil and gas-producing joint venture with Exxon Mobil, four people familiar with the talks told Reuters.

CureVac said its COVID-19 vaccine was 48% effective in the final analysis of its pivotal mass trial, only marginally better than the 47% reported after an initial read-out two weeks ago.

TODAY'S COMPANY ANNOUNCEMENTS

3i Group PLC Annual Shareholders Meeting

Abcam PLC Annual Shareholders Meeting

Affimed NV Q1 2021 Earnings Call

Ahlstrom-Munksjo Oyj Q1 2021 Earnings Call

AO World PLC Preliminary Q4 2021 Earnings Call

Argentex Group PLC FY 2021 Earnings Call

C&C Group PLC Annual Shareholders Meeting

Corpfin Capital Prime Retail II Socimi SA Annual Shareholders Meeting

DP Aircraft I Ltd Annual Shareholders Meeting

EJF Investments Ltd Annual Shareholders Meeting

FACC AG Annual Shareholders Meeting

H & M Hennes & Mauritz AB Q2 2021 Earnings Call

JD Sports Fashion PLC Annual Shareholders Meeting

McKay Securities PLC Annual Shareholders Meeting

Micro Focus International PLC HY 2021 Earnings Release

MS Industrie AG Annual Shareholders Meeting

Pelatro PLC Shareholders Meeting

Pierre et Vacances SA Shareholders Meeting

Polar Capital Holdings PLC Q4 2021 Earnings Call

Quadient SA Annual Shareholders Meeting

Stolt-Nielsen Ltd Q2 2021 Earnings Release

Trainline PLC Annual Shareholders Meeting

Ubisoft Entertainment SA Annual Shareholders Meeting

ECONOMIC EVENTS (All times GMT)

0600 (approx.) Germany Retail Sales mm Real for May: Expected 5.0%; Prior -5.5%

0600 (approx.) Germany Retail Sales yy Real for May: Prior 4.4%

0630 Switzerland CPI mm for Jun: Expected 0.2%; Prior 0.3%

0630 Switzerland CPI yy for Jun: Expected 0.7%; Prior 0.6%

0630 (approx.) Switzerland CPI NSA for Jun: Prior 101.0

0630 Switzerland Retail Sales yy for May: Prior 35.7%

0630 (approx.) Sweden PMI Manufacturing Sector for Jun: Prior 66.4

0700 (approx.) Netherlands PMI - Manufacturing for Jun: Prior 69.4

0700 (approx.) Austria Unemployment for Jun: Prior 317,000

0700 (approx.) Austria Unemployment Rate for Jun: Prior 7.7%

0715 Spain Manufacturing PMI for Jun: Expected 59.3; Prior 59.4

0730 Switzerland Manufacturing PMI for Jun: Expected 69.7; Prior 69.9

0730 (approx.) Sweden Riksbank Rate for Jul: Expected 0.00%; Prior 0.00%

0745 Italy Markit/IHS Manufacturing PMI for Jun: Expected 62.2; Prior 62.3

0750 France Markit Manufacturing PMI for Jun: Expected 58.6; Prior 58.6

0755 Germany Markit/BME Manufacturing PMI for Jun: Expected 64.9; Prior 64.9

0800 Italy Unemployment Rate for May: Expected 10.8%; Prior 10.7%

0800 (approx.) Spain Car Registration mm for Jun: Prior 21.4%

0800 (approx.) Spain Car Registration yy for Jun: Prior 177.8%

0800 Euro Zone Markit Manufacturing Final PMI for Jun: Expected 63.1; Prior 63.1

0830 United Kingdom Markit/CIPS Manufacturing PMI Final for Jun: Expected 64.2; Prior 64.2

0900 Italy ISTAT Public Deficit/GDP for Q1: Prior 5.2%

0900 Euro Zone Unemployment Rate for May: Expected 8.0%; Prior 8.0%