Liveblog Archief donderdag 17 december 2020

TA AEX, Galapagos, ASM int en de "stop"

Vandaag gaat het van all-time-highs tot diep trieste koersontwikkelingen. Ik ga de grafieken bekijken van de AEX, ASM international en Galapagos. Daarnaast kijk ik met een schuin oog naar het fenomeen stops. Iedereen heeft waarschijnlijk de lunch achter de kiezen, dus we gaan snel van…

Lees verder »Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Philadelphia Fed Productie-index (Dec) | Actueel: 11,1 Verwacht: 20,0 Vorige: 26,3 |

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Bouwvergunningen (Nov) | Actueel: 1,639M Verwacht: 1,550M Vorige: 1,544M | ||||

| USA: Eerste Aanvragen Werkloosheidsvergoeding | Actueel: 885K Verwacht: 800K Vorige: 862K |

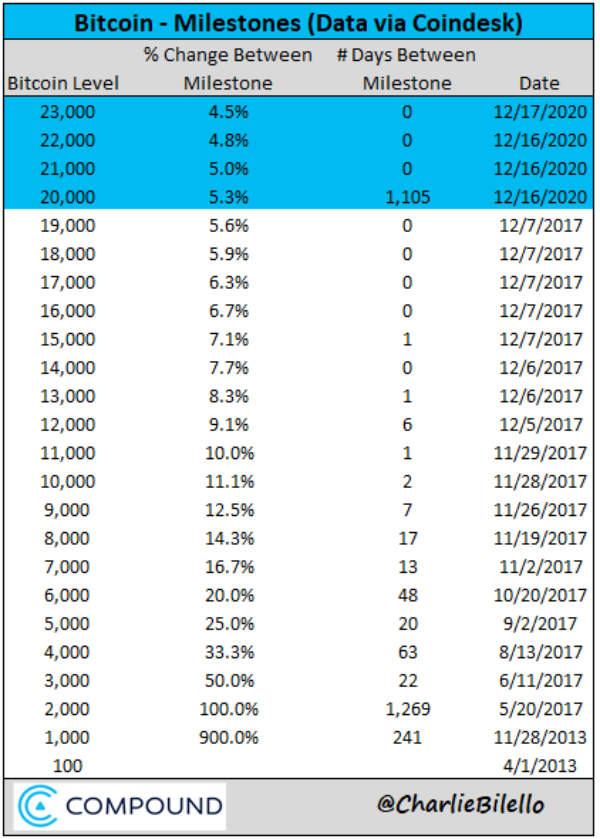

De grote vraag is? Hoe kan iets dat in 2012-2013 van $100 naar nu $23.000+ gaat?? Het gebeurt gewoon maar hoe loopt zoiets af??? Wat een markt momenteel, amper te begrijpen, of ik met 35 jaar ervaring begrijp er niks meer van. Wat denken jullie momenteel??? Laat maar weten, of brand maar los!!!

Markt snapshot Wall Street vandaag

TOP NEWS

• U.S. airlines closing in on new government assistance package

U.S. airlines are on the brink of receiving a four-month extension of a government assistance program that is expected to provide another $17 billion to fund payroll costs, congressional aides told Reuters.

• EU to order more Pfizer vaccine after declining earlier offer

The European Union will take up its option to buy up to 100 million more doses of Pfizer and BioNTech's COVID-19 vaccine after turning down an opportunity in July for a much bigger deal, according to EU officials and an internal document.

• Moderna's coronavirus vaccine faces U.S. FDA expert panel review

A panel of outside advisers to the U.S. Food and Drug Administration is expected to endorse emergency use of Moderna's coronavirus vaccine during a meeting, as the nation prepares to roll out a second vaccine.

• Biden's expected Energy Department pick, Granholm, could lead charge on electric cars

When Jennifer Granholm was governor of auto-manufacturing Michigan, she led a charge that secured a whopping $1.35 billion in federal funding for companies to make electric cars and batteries in her state.

• FOCUS-COVID vaccine is bonanza for digital supply chain tracking industry

More than half of vaccines go to waste globally every year because of temperature control, logistics and shipment-related issues.

BEFORE THE BELL

Wall Street futures rose on hopes of a U.S. fiscal stimulus and the Federal Reserve's pledge to keep pumping cash into markets. European shares were up as potential COVID-19 vaccine rollouts in the continent strengthened the case for a global economic recovery. Most Asian stocks ended in the green. The general risk-on mood sent the dollar lower, whereas gold prices gained. Oil prices hit a nine-month high after government data showed a fall in U.S. crude stockpiles last week. U.S. weekly jobless claims figures and housing data for November are due for release later in the day.

STOCKS TO WATCH

Results

• Lennar Corp (LEN). The homebuilder beat quarterly profit and revenue estimates on Wednesday, as it reined in construction costs and benefited from a strong U.S. housing market. The company forecast first-quarter delivery of 12,200 to 12,500 homes, above analysts' estimates of 11,592. Revenue fell to $6.83 billion in the fourth quarter, from $6.97 billion a year earlier. Analysts were expecting revenue of $6.65 billion. Net earnings attributable to the company rose to $882.8 million, or $2.82 per share, from $674.3 million, or $2.13 per share, a year earlier. Analysts had expected earnings of 2.37 per share.

Deals Of The Day

• Novartis AG (NVS). The company said it would acquire U.S.-based neuroscience company Cadent for up to $770 million, gaining full rights to Cadent's portfolio. "Cadent will receive a $210 million upfront payment and will be eligible for up to $560 million in milestone payments, for a total potential consideration of $770 million," Cadent said in a statement. Novartis said the acquisition added two new clinical stage programs to its neuroscience portfolio, one for schizophrenia and the other for movement disorders. Cadent and Novartis said they expected the transaction to close in the first quarter of 2021. Closing of the transaction is subject to customary closing conditions.

Moves

• International Business Machines Corp (IBM). The company said on Wednesday Chief Executive Officer Arvind Krishna would take over as chairman from Jan. 1, replacing Ginni Rometty, who stepped down as its long-time CEO earlier this year. Rometty, who was the tech pioneer's first woman CEO, would occasionally be asked to act as an independent contractor after her retirement, IBM said.

• Nokia Oyj (NOK). The Finnish telecom equipment maker named rival Ericsson's former executive Nishant Batra as chief strategy and technology officer and member of its group leadership team, effective Jan. 18. The company said Batra, who is currently CTO at auto technology group Veoneer, will be based initially in Finland and then move to the United States.

• Rio Tinto Ltd (RIO). The company named Chief Financial Officer Jakob Stausholm as its next chief executive, defying expectations it would pick an external candidate to repair its image after its destruction of sacred Aboriginal rock shelters. "Some may perceive Mr Stausholm's appointment as potentially indicating little change in overall strategy," analysts at Morgan Stanley said, adding that the appointment should minimize the typical disruption period caused by management transitions. Rio said Stausholm, who was formerly at Royal Dutch Shell and Maersk, will take over as CEO on Jan. 1, 2021, and Peter Cunningham will be appointed as chief financial officer on an interim basis.

In Other News

• Alibaba Group Holding Ltd (BABA). The technology giant has facial recognition technology which can specifically pick out members of China's Uighur minority, surveillance industry researcher IPVM said in a report. An Alibaba Cloud spokeswoman said the technology was only confined to testing. "The ethnicity mention refers to a feature/function that was used within a testing environment during an exploration of our technical capability. It was never used outside the testing environment." U.S.-based IPVM in a report published on Wednesday said software capable of identifying Uighurs appears in Alibaba's Cloud Shield content moderation service for websites.

• Alphabet Inc (GOOGL). Online publishers including Genius Media Group and news website The Nation alleged in a lawsuit seeking class-action status on Wednesday that Google has unlawfully stifled advertising competition, hurting their businesses. Genius, which provides song lyrics, and two online magazines the Nation and the Progressive, said they used Google software to sell ads but received what they viewed as an unfair split of sales because the search giant had taken over the market. Separately, Staff on Google's Ethical AI research team on Wednesday demanded the company sideline a vice president and commit to greater academic freedom, escalating a confrontation with management following this month's termination of scientist Timnit Gebru.

• Boeing Co (BA). The company is hiring up to 160 pilots to be embedded at airlines in its latest bid to ensure its 737 MAX has a smooth comeback after a 20-month safety ban, according to a recruitment document seen by Reuters and people familiar with the move. The new "Global Engagement Pilots" will act as instructors or cockpit observers on 35-day assignments at an equivalent annual salary that could reach $200,000, for a total potential cost of $32 million, one of the people said. "Duties include: consulting activities and assist in customer support, including flying opportunities," according to a summary seen by Reuters of job terms from a contracting firm carrying out the recruitment on behalf of Boeing. Separately, Transport Canada is set to announce approval of design changes to Boeing’s 737 MAX as early as Thursday, in a first step toward bringing the aircraft back to the country's skies after a near two-year flight ban, two sources familiar with the matter said.

• Facebook Inc (FB) & Alphabet Inc (GOOGL). The two biggest players in online advertising used a series of deals to consolidate their market power illegally, Texas and nine other states alleged in a lawsuit against Google on Wednesday. Google reached similar partnerships with other advertising companies as part of an effort to maintain market share that was internally codenamed Project Jedi, a source with direct knowledge of the matter said. But what Google did not announce publicly is that it gave Facebook preferential treatment, the complaint alleged. Facebook agreed to back down from supporting competing software, which publishers had developed to dent Google's market power, the complaint said. "Facebook decided to dangle the threat of competition in Google's face and then cut a deal to manipulate the auction," it said, citing internal communications.

• MacroGenics Inc (MGNX). The cancer drug developer said on Wednesday the U.S. Food and Drug Administration (FDA) had approved its drug Margenza in combination with chemotherapy for the treatment of an advanced type of breast cancer in patients who failed two or more prior therapies. The company said it was expecting to launch the drug, the first to be approved from its pipeline, in March. The approval is based on results of a late-stage study, which showed that a combination of Margenza and chemotherapy caused significant reduction in the risk of disease progression or death compared with Roche's Herceptin plus chemotherapy, the company said.

• Moderna Inc (MRNA). A panel of outside advisers to the U.S. Food and Drug Administration is expected to endorse emergency use of Moderna's coronavirus vaccine during a meeting, as the nation prepares to roll out a second vaccine. The panel vote on whether the vaccine's benefits outweigh its risks is likely to come some time after 3 pm ET, with an FDA authorization expected as soon as Friday. The FDA advisory committee is likely to discuss Moderna's reports of side effects from its 30,000-person trial, which were more frequent than those reported by Pfizer. SVB Leerink analysts said the Moderna vaccine appears less tolerable than the Pfizer/BioNTech shot, but noted that is not a proper comparison across trials and unlikely to stand in the way of an EUA.

• Novavax Inc (NVAX). The European Union has concluded preliminary talks with the company to secure up to 200 million doses of its COVID-19 vaccine candidate, a Commission spokesman said. "The envisaged contract foresees the possibility for member states to buy 100 million doses with the option of buying another 100 million doses," the spokesman said. Separately, the company said it had entered an agreement with the government of New Zealand for 10.7 million doses of its COVID-19 vaccine candidate.

• Pfizer Inc (PFE) & BioNTech SE (BNTX). The European Union will take up its option to buy up to 100 million more doses of Pfizer and BioNTech's COVID-19 vaccine after turning down an opportunity in July for a much bigger deal, according to EU officials and an internal document. The European Commission decided on Tuesday to exercise its option to buy up to 100 million additional doses under an existing contract with Pfizer and BioNTech, a spokesman for the EU executive told Reuters. Under the same contract it has already ordered 200 million doses. The extra 100 million doses would be supplied at the same price, but with the timetable to be negotiated, EU officials said. Separately, the U.S. Food and Drug Administration said on Wednesday that extra doses from vials of Pfizer's COVID-19 vaccine can be used after reports of vaccine doses being thrown away by pharmacists due to labeling confusion.

• Roku Inc (ROKU) & AT&T Inc (T). HBO Max, the streaming service from AT&T owned WarnerMedia, will be available on the Roku streaming platform beginning Dec. 17, the companies said on Wednesday. Roku users will now be able to download HBO Max from the Roku channel store and subscribe directly on their device to access all of HBO Max, which includes 10,000 hours of content from WarnerMedia brands and libraries such as Warner Bros, New Line Cinema and Cartoon Network.

• Twitter Inc (TWTR). The microblogging site is reversing changes made to its retweet function intended to curb the spread of misinformation during the U.S. presidential election, the company said. Twitter said it will no longer prompt quote tweets from the retweet icon. "Retweet functionality will be returning to the way it was before," the company said in a statement on Wednesday. Quote tweets instead of retweets was intended to encourage thoughtful amplification, but that has not happened in practice, the company said. "The use of Quote Tweets increased, but 45% of them included single-word affirmations and 70% had less than 25 characters," it said.

• WPP PLC (WPP). The world's biggest advertising company expects its net sales to bounce back to pre-pandemic levels earlier than previously forecast thanks to the rapid global corporate switch to e-commerce and digital services. WPP said it expected its key measurement of underlying net sales to drop 8.4% in 2020 before rising by a mid single digit percentage next year and reaching pre-pandemic levels in 2022. It then expects annual growth of 3% to 4%. Chief Executive Mark Read said the business had proved more resilient than many had expected and a strategy set out two years ago to offer clients a combination of digital expertise with data and creativity had proved invaluable during 2020.

INSIGHT

Investors waiting for Fed long-end buying have to wait some more

Investors hoping the U.S. Federal Reserve would make a concerted push into longer-duration bonds at Wednesday’s meeting did not get what were waiting for.

ANALYSTS' RECOMMENDATION

• American Woodmark Corp (AMWD). Jefferies initiates coverage with buy rating and $111 target price, saying the company is poised to see sales accelerate and margins improve, with robust residential construction.

• Boyd Gaming Corp (BYD). JPMorgan raises target price to $52 from $49, based on the company's favorable localized/regional footprint predominantly focused on a drive-to, leisure gaming customer.

• Hilton Worldwide Holdings Inc (HLT). JPMorgan raises target price to $97 from $90, taking into account a reasonable level of global travel recovery post COVID-19, saying its near-term net rooms growth outlook is better, with a growing dependence on lower-risk conversions.

• Orion Engineered Carbons SA (OEC). Jefferies raises target price to $21 from $18, saying the company should benefit from positive demand trends in auto, tire and general industry.

• Stanley Black & Decker Inc (SWK). JPMorgan raises target price to $189 from $184, as the company raised its fourth-quarter organic sales guidance, led by stronger than expected trends at Tools & Storage across North America.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0830 (approx.) Building permits number for Nov: Expected 1.550 mln; Prior 1.544 mln

0830 (approx.) Building permits change mm for Nov: Prior -0.1%

0830 (approx.) Housing starts number for Nov: Expected 1.530 mln; Prior 1.530 mln

0830 (approx.) Housing starts change mm for Nov: Prior 4.9%

0830 Initial jobless claims: Expected 800,000; Prior 853,000

0830 Jobless claims 4-week average: Prior 776,000

0830 Continues jobless claims: Expected 5.598 mln; Prior 5.757 mln

0830 (approx.) Philly Fed Business Index for Dec: Expected 20.0; Prior 26.3

0830 (approx.) Philly Fed 6M Index for Dec: Prior 44.30

0830 (approx.) Philly Fed Capex Index for Dec: Prior 25.50

0830 (approx.) Philly Fed Employment for Dec: Prior 27.20

0830 (approx.) Philly Fed Prices Paid for Dec: Prior 38.90

0830 (approx.) Philly Fed New Orders for Dec: Prior 37.90

1100 (approx.) KC Fed Manufacturing for Dec: Prior 20

1100 (approx.) KC Fed Composite Index for Dec: Prior 11

COMPANIES REPORTING RESULTS

FedEx Corp (FDX). Expected Q2 earnings of $4.01 cents per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0830 ABM Industries Inc (ABM). Q4 earnings conference call

0830 Jabil Inc (JBL). Q1 earnings conference call

0900 General Mills Inc (GIS). Q2 earnings conference call

0930 Herman Miller Inc (MLHR). Q2 earnings conference call

1100 Lennar Corp (LEN). Q4 earnings conference call

1100 Sanderson Farms Inc (SAFM). Q4 earnings conference call

1400 Worthington Industries Inc (WOR). Q2 earnings conference call

1500 Factset Research Systems Inc (FDS). Annual Shareholders Meeting

1645 AAR Corp (AIR). Q2 earnings conference call

1730 FedEx Corp (FDX). Q2 earnings conference call

EXDIVIDENDS

Advance Auto Parts Inc (AAP). Amount $0.25

Air Lease Corp (AL). Amount $0.16

Altra Industrial Motion Corp (AIMC). Amount $0.06

Amkor Technology Inc (AMKR). Amount $0.04

Avient Corp (AVNT). Amount $0.21

Belden Inc (BDC). Amount $0.05

Douglas Dynamics Inc (PLOW). Amount $0.28

EnerSys (ENS). Amount $0.17

First Midwest Bancorp Inc (FMBI). Amount $0.14

Greif Inc (GEF). Amount $0.44

Hanover Insurance Group Inc (THG). Amount $0.70

Huntington Bancshares Inc (HBAN). Amount $0.15

Moelis & Co (MC). Amount $2.00

Nordson Corp (NDSN). Amount $0.39

Paccar Inc (PCAR). Amount $0.70

Prologis Inc (PLD). Amount $0.58

Renasant Corp (RNST). Amount $0.22

Sempra Energy (SRE). Amount $1.04

Systemax Inc (SYX). Amount $2.00

TTEC Holdings Inc (TTEC). Amount $2.14

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| EUROPA: CPI (Jaarlijks) (Nov) | Actueel: -0,3% Verwacht: -0,3% Vorige: -0,3% |

Wake-up call: Gekte blijft aanhouden, Euro boven de 1,22 en Bitcoin 22.200

Goedemorgen

Een greep uit het nieuws voor vandaag is dat de hoop op een Brexit de op opsteekt, verder krijgen we nog maar eens berichten dat er een spoedig akkoord komt over meer steun in de VS om het pakket aan steun rond te krijgen. Let wel, er is nog niks rond maar inmiddels zien we dat de markt er met nieuwe toppen op blijft reageren. Verder kwam de FED gisteren nog met als belangrijk bericht dat ze doorgaan met het opkopen van obligaties tot de pandemie voorbij is.

Powell zei ook dat de FED zal doorgaan met het opkopen van leningen tot er sprake is van "substantiële verbetering" van de economie, werkgelegenheid en het verloop daarvan tijdens de pandemie. Voor het eerst zei Powell dat de prijzen van de aandelen niet te hoog zijn door dat de rente laag staat. Vreemde uitspraak maar hij zal het wel weten ga ik vanuit.

De markt wist opnieuw hoger te sluiten gisteren, over het algemeen dan want Europa deed het goed desondanks de grote stijging van de euro ten opzichte van de dollar, dat is wel eens anders geweest natuurlijk maar blijkbaar is momenteel alles anders dan vroeger. De AEX won net als dinsdag 4,5 punten, de DAX won 203 punten. Op Wall Street moest alleen de Dow Jones wat inleveren, een verliesje van 44 punten. De Nasdaq en de Nasdaq 100 wonnen wel weer 0,5% en sluiten op nieuwe recordstanden. De SP 500 won 6 punten gisteren.

Euro, olie en goud:

De euro zien we nu rond de 1.223 dollar, de prijs van een vat Brent olie komt uit op 51,7 dollar terwijl een troy ounce goud nu op 1875 dollar staat.

Posities en strategie:

We hebben nog altijd wat posities open staan bij de signaaldiensten, die kunt u nog opnemen door lid te worden. De posities hebben we voor als de markt de grote draai maakt die eraan zit te komen. Waar dat kan of moet zal ik snel schakelen, de posities wisselen of waar nodig uitbreiden. Wat betreft 2021 zie ik zeker genoeg mooie kansen om met het handelen er een mooi jaar van te maken ...

U kunt mij en dus @USMarkets uiteraard ook volgen via onze Twitter account, ga naar ... https://twitter.com/USMarkets waar ik tussentijds wat charts over de markt en sentiment plaats, ook opvallende beursfeiten komen er vaak langs !

Maak nu gebruik van de aanbieding op US Markets Trading:

Zoals ik al aangaf sta hoe dan ook klaar om goed uit te pakken in 2021 wat betreft Trading, lid worden is nu dus belangrijk om alles optimaal te volgen.

Doe nu mee via de nieuwe proef aanbieding voor €39 tot 1 MAART. Dan pakt u december en de eerste 2 maanden van het nieuwe jaar meteen mee als lid en ontvangt u alle updates en signalen. Voor Polleke Trading is dat dan €49 tot 1 maart 2021 ...

Schrijf u vandaag nog in via de link https://www.usmarkets.nl/tradershop en dan staat u meteen op de lijst.

Met vriendelijke groet,

Guy Boscart

Markt snapshot Europa vandaag

GLOBAL TOP NEWS

The Federal Reserve on Wednesday vowed to keep funneling cash into financial markets until the U.S. economic recovery is secure, a promise of long-term help that fell short of hopes of an immediate move to shore up a recent pandemic-related slide.

Britain and the European Union have moved closer to sealing a new trade deal but it was still unclear if they would succeed, the bloc's chief executive said on Wednesday.

The Bank of England is expected to refrain from yet more stimulus as it waits to see if a possible no-deal Brexit in two weeks' time deepens the problems already facing Britain's coronavirus-damaged economy.

EUROPEAN COMPANY NEWS

Germany will roll out the Pfizer-BioNTech vaccine against COVID-19 on Dec. 27, with priority given to the elderly in care homes, Berlin city government said on Wednesday.

An Italian court has reserved a decision relating to French media group Vivendi's voting stake in broadcaster Mediaset, two legal sources said on Wednesday.

UBS is selling its domestic Austrian wealth management business to Liechenstein-based private bank LGT, the Swiss banking giant said on Wednesday.

TODAY'S COMPANY ANNOUNCEMENTS

Accenture PLC Q1 2021 Earnings Call

Amplitude Surgical SA Annual Shareholders Meeting

AVI Global Trust PLC Annual Shareholders Meeting

Bonduelle SA Annual Shareholders Meeting

Claranova SA Shareholders Meeting

Editions du Signe SA Annual Shareholders Meeting

Falanx Group Ltd Annual Shareholders Meeting

Frontier IP Group PLC Annual Shareholders Meeting

Griffin Mining Ltd Annual Shareholders Meeting

J D Wetherspoon PLC Annual Shareholders Meeting

Kier Group PLC Annual Shareholders Meeting

Netcall PLC Annual Shareholders Meeting

Ovoca Bio PLC Annual Shareholders Meeting

Petra Diamonds Ltd Annual Shareholders Meeting

Schroder Income Growth Fund PLC Annual Shareholders Meeting

Sesa SpA Shareholders Meeting

SkiStar AB Q1 2021 Earnings Release

SSP Group PLC FY 2020 Earnings Call

Unieuro SpA Shareholders Meeting

Voluntis SA Shareholders Meeting

ECONOMIC EVENTS (All times GMT)

0530 (approx.) Netherlands Unemployment Rate Monthly SA for Nov: Prior 4.3%

0745 France Business Climate Manufacturing for Dec: Expected 93; Prior 92

0745 (approx.) France Business Climate Overall for Dec: Prior 79

0800 (approx.) Austria HICP mm for Nov: Prior 0.2%

0800 (approx.) Austria HICP yy for Nov: Prior 1.1%

0800 (approx.) Austria CPI yy NSA for Nov: Prior 1.30%

0800 (approx.) Austria CPI mm NSA for Nov: Prior 0.18%

0800 (approx.) Austria CPI NSA for Nov: Prior 108.7

0830 Switzerland SNB Policy Rate for Q4: Expected -0.75%; Prior -0.75%

0830 Sweden Unemployment Rate for Nov: Expected 8.4%; Prior 7.8%

0830 Sweden Unemployment Rate SA for Nov: Expected 8.8%; Prior 8.6%

1000 Belgium Consumer Confidence Index for Dec: Prior -15

1000 Euro Zone HICP Final mm for Nov: Expected -0.3%; Prior 0.2%

1000 Euro Zone HICP Final yy for Nov: Expected -0.3%; Prior -0.3%

1000 Euro Zone HICP-X F, E, A, T Final mm for Nov: Expected -0.5%; Prior -0.5%

1000 Euro Zone HICP-X F, E, A, T Final yy for Nov: Expected 0.2%; Prior 0.2%

1200 (approx.) United Kingdom BOE Bank Rate for Dec: Prior 0.10%

1200 (approx.) United Kingdom GB BOE QE Gilts for Dec: Prior 875 bln GBP

1200 (approx.) United Kingdom GB BOE QE Corp for Dec: Prior 20 bln GBP

1200 (approx.) United Kingdom BOE MPC Vote Hike for Dec: Expected 0; Prior 0

1200 (approx.) United Kingdom BOE MPC Vote Unchanged for Dec: Expected 9; Prior 9

1200 (approx.) United Kingdom BOE MPC Vote Cut for Dec: Expected 0; Prior 0