Liveblog Archief donderdag 22 juli 2021

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Bestaande Huizenverkopen (Jun) | Actueel: 5,86M Verwacht: 5,90M Vorige: 5,78M |

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Eerste Aanvragen Werkloosheidsvergoeding | Actueel: 419K Verwacht: 350K Vorige: 368K |

Markt snapshot Wall Street 22 juli

TOP NEWS

• AT&T beats wireless subscriber additions estimate on 5G demand

AT&T beat analysts' estimates for monthly phone bill paying subscriber additions in the second quarter, fueled by more Americans converting to 5G phones.

• Southwest Airlines losses narrow as leisure travel bounces back

Southwest Airlines reported a smaller quarterly loss and said it would remain profitable for the rest of the year, as leisure bookings rebound thanks to aggressive vaccination drives.

• Inflation worries overshadow Unilever's strong first half, hit shares

Unilever warned that surging commodity costs would squeeze its full-year operating margin, overshadowing strong second-quarter sales growth fuelled by the easing of pandemic-related curbs in many of its markets.

• D.R. Horton profit jumps 77% on soaring house prices

Homebuilder D.R. Horton posted a 77% rise in quarterly profit, benefiting from record-high property prices as demand outpaced supply

• India watchdog accuses Amazon of concealing facts in deal for Future Group unit

India's antitrust regulator has accused Amazon.com of concealing facts and making false submissions when it sought approval for a 2019 investment in a Future Group unit, a letter to the U.S. e-commerce giant seen by Reuters showed.

BEFORE THE BELL

U.S. stock index futures were higher, ahead of a batch of earnings reports and data that will likely show the strength of labor market recovery. European stocks extended gains for a third session, as signs of a strong corporate earnings season and expectations that the European Central Bank will stick to a dovish stance lifted demand for risky equities. Japanese markets were closed for a holiday. Gold prices slipped on the back of a rebound in stocks, while the dollar was little changed. Oil prices rose, on expectations of tighter supplies until the end of the year as economies recover from the coronavirus crisis. Existing home sales data is also expected on the U.S. economic calendar later in the day. Intel and Twitter are scheduled to report after market.

STOCKS TO WATCH

Results

• ABB Ltd: The engineering company doubled its full year sales guidance thanks to resurgent global industrial demand and said it is forging ahead with plans to float its fast growing electric vehicle charging business next year. Sales of its high-speed electric vehicle chargers for buses and cars have seen an average growth rate of 50% since 2016, benefiting from a global boom in battery-powered vehicles. Chief Executive Bjorn Rosengren said the business could be listed early next year to help accelerate its growth. Announcing its second quarter 2021 earnings, ABB said its revenues rose 21% from 2020's coronavirus driven nadir to reach $7.45 billion, beating estimates of $7.24 billion. Net profit rose 136% to $752 million. ABB now expects full-year comparable revenues to rise by just below 10%, above its previous view for a 5% increase.

• AT&T Inc: The company beat analysts' estimates for monthly phone bill paying subscriber additions in the second quarter, fueled by more Americans converting to 5G phones. The company, which also raised its full-year revenue and adjusted earnings per share growth forecasts, added 789,000 net new postpaid phone subscribers during the quarter, above FactSet estimates of 278,000. AT&T raised its forecast for global HBO Max subscribers to between 70 million and 73 million by the end of the year. The company had earlier estimated 67 million to 70 million subscribers for the service. Total revenue at AT&T rose 7.6% to $44 billion, beating analysts' average estimate of $42.67 billion, according to IBES data from Refinitiv. AT&T now expects revenue growth in the 2% to 3% range and adjusted earnings per share to rise in the low- to mid-single digits.

• Dow Inc: The company posted a quarterly profit and revenue that blew past analysts' estimates, and said it was expecting to benefit from higher industrial production and consumer spending as demand recovers from pandemic lows. Dow's chemicals have seen a steady rise in prices on the back of strong consumer and industrial demand as economies emerge from pandemic-led lockdowns, with lower inventories also helping their cause. Prices jumped 16% in the second quarter from the prior period, while volumes rose 1%, helped by growing demand in infrastructure, industrial and personal-care end markets. Net income available for Dow stockholders rose to $1.9 billion, or $2.51 per share, in the three months ended June 30, from $991 million, or $1.32 per share, in the first quarter.

• D.R. Horton Inc: The homebuilder posted a 77% rise in quarterly profit, benefiting from record-high property prices as demand outpaced supply. The largest U.S. homebuilder said it sold 21,588 homes in the third quarter, up from 17,642 a year earlier. "Housing market conditions remain very robust, with homebuyer demand exceeding our current capacity to deliver homes across all of our markets," Chairman Donald R. Horton said. Net income attributable to the company rose to $1.12 billion, or $3.06 per share, in the quarter ended June 30, from $630.7 million, or $1.72 per share, a year earlier.

• Kinder Morgan Inc: The company cut its 2021 profit forecast on Wednesday, just three months after the U.S. pipeline operator had raised its estimates following a surge in demand for natural gas during the February winter storm. The company lowered its full-year profit forecast to $1.7 billion, from as much as $2.9 billion it outlined in April, and lower than the $2.1 billion it originally forecast in January. The company said it expects to generate distributable cash flow of $5.4 billion for this year, compared with previous expectations of as much as $5.3 billion. Net loss attributable to Kinder Morgan stood at $757 million, or 34 cents per share, in the second quarter ended June 30, compared with a profit of $1.41 billion, or 62 cents per share, in the first quarter.

• Texas Instruments Inc: The company forecast current-quarter revenue slightly below Wall Street estimates on Wednesday, leaving investors concerned about the chipmaker's ability to meet searing demand in the face of a global shortage. "The common perception in the market is that demand still remains very strong, and many investors expect above-average revenue growth for the next couple of quarters," said Edward Jones analyst Logan Purk. "This guidance clearly flies in the face of that belief." The company expects third-quarter revenue between $4.40 billion and $4.76 billion, with the midpoint below analysts' expectations of $4.59 billion, according to IBES data from Refinitiv. For the second quarter, it earned $2.05 per share, beating analysts' average estimate of $1.83. Total revenue rose 41% to $4.58 billion, above expectations of $4.35 billion.

• Southwest Airlines Co: The company reported a smaller quarterly loss and said it would remain profitable for the rest of the year, as leisure bookings rebound thanks to aggressive vaccination drives. Southwest said it stopped burning cash in June, with an average core cash flow of about $4 million per day for the month. June leisure passenger traffic rose above June 2019 levels while passenger fares were on par with the same period two years ago, Chief Executive Officer Gary Kelly said, adding that the company expected to see further improvement in July. Southwest said it now expects July operating revenue to drop between 10% and 15% compared with the same period in 2019, an improvement from its prior forecast of a fall between 15% and 20%. The company expects August operating revenue to decline between 12% and 17% from two years earlier. Excluding items, Dallas-based Southwest's net loss narrowed to $206 million, or 35 cents per share, in the second quarter, from $1.50 billion, or $2.67 per share, a year earlier.

• Unilever Plc: The company warned that surging commodity costs would squeeze its full-year operating margin, overshadowing strong second-quarter sales growth fuelled by the easing of pandemic-related curbs in many of its markets. Underlying sales for the maker of Dove soap maker rose 5% in the three months ended June 30, above 4.8% forecast by analysts. However, rising prices of everything from crude to palm and soybean oil made the company cut its operating margin outlook to "about flat" from slightly up earlier and flag greater uncertainty surrounding that forecast. Half-year sales rose 5.4%, a touch above the 5.3% forecast, propelled by 8.1% growth in its Foods and Refreshment division, as living restrictions began to ease in many markets. "We believe full-year outlook will land well within the 3-5% growth range," Chief Financial Officer Graeme Pitkethly said on a media call.

Deals Of The Day

• AT&T Inc: The company said on Wednesday it would sell Vrio Corp, its DirecTV business unit in Latin America, to Argentina-based investment group Grupo Werthein after taking a $4.6 billion impairment charge. The telecom operator said it took the impairment charge in the second quarter of 2021 as it had classified Vrio as "held-for-sale". The company did not reveal the deal value at which it will sell Vrio to Grupo Werthein. The Vrio Corp deal is expected to close in early 2022.

• Salesforce.com Inc & Slack Technologies Inc: Business software maker Salesforce.com on Wednesday closed its $27.7 billion purchase of Slack, a massive bet that Slack's workplace app will become popular for collaborations within and between companies. U.S. antitrust regulators cleared the deal this week, allowing the creation of a stronger challenger to Microsoft, the top workplace software provider whose Teams app competes with Slack for market dominance. The merger partners hope the deal will bolster efforts to connect their joint customers to smooth out common business deals, Salesforce President Bret Taylor and Slack Chief Executive Stewart Butterfield said in an interview on Wednesday.

• Visa Inc: The company said that it had agreed to buy British cross-border payments provider Currencycloud at a valuation of $962.01 million. Visa has been a Currencycloud shareholder since 2020, and the financial consideration will be reduced by the equity that the card network company already owns in the startup, the company said. The aggressive acquisition strategy is part of Visa's push to diversify revenues beyond credit card payments, where it is one of the world's dominant players. Card companies have been facing increased pressure from regulators on fees, especially in Europe.

In Other News

• Amazon.com Inc: India's antitrust regulator has accused the company of concealing facts and making false submissions when it sought approval for a 2019 investment in a Future Group unit, a letter to the U.S. e-commerce giant seen by Reuters showed. In the letter dated June 4, the Competition Commission of India (CCI) said Amazon hid factual aspects of the transaction by not revealing its strategic interest in Future Retail when it sought approval for the 2019 deal. In the four-page letter, a so-called 'show cause notice', the CCI asked Amazon why it should not take action and penalise the company for providing false information. Amazon said in a statement to Reuters it had received a letter, was committed to complying with India's laws and would extend its full cooperation to the CCI.

• Amazon.com Inc & eBay Inc: The Australian antitrust regulator began an inquiry into the local units of Amazon.com Inc, eBay and other online markets to ensure fairness in a sector where sales have soared through the coronavirus pandemic. The Australian Competition and Consumer Commission (ACCC), which previously slapped the world's toughest content licencing rules on Facebook and Alphabet’s Google, said it was now looking at retail as part of a wider examination of so-called Big Tech. The ACCC would take submissions until mid-August with a final report due in March 2022, the regulator said. An Amazon spokesperson said the company looked "forward to engaging with the ACCC on these important topics in the coming months", while an eBay representative was not immediately available for comment.

• BHP Group PLC & Tesla Inc: The global miner said it signed a nickel supply agreement with Tesla and will work with the electric carmaker on lowering carbon emissions in the battery supply chain. BHP said the metal will be supplied from its Nickel West operation in Western Australia, which is set to add nickel sulphate - a key battery chemical, and one that has much higher margins than nickel metal - in the September quarter. BHP and Tesla will also look at end-to-end raw material tracing using blockchain, and work on energy storage solutions, the miner said.

• Comcast Corp: President Joe Biden on Wednesday selected friends and campaign donors for a set of ambassador slots, including nominating a Comcast adviser as the top U.S. diplomat in Canada. Biden picked David Cohen, a senior adviser to Comcast chief executive Brian Roberts and a key lobbyist for the media giant, to represent the United States in Ottawa.

• International Business Machines Corp: Spain's Amadeus will integrate IBM's digital health pass into its Traveler ID platform in a bid to simplify the verification of passengers' health credentials during the boarding process, the companies said in a joint statement. IBM's system - which uses encyryption and blockchain technologies to authenticate diagnostic tests such as antigen or PCR - assigns passengers a QR code which indicates whether they are fit to fly, rather than needing boarding-gate attendants to hand-verify the details of each traveller's test. "This approach helps airlines feel confident the health credentials added are valid and takes the expectation off of gate agents to verify health documents," said Greg Land, head of IBM's travel and transportation sector, told Reuters.

• NatWest Group PLC: Britain's government announced a new plan to sell some NatWest shares over the next year as it looks to bring the state's stake in the bank below 50%. The finance ministry said it had instructed Morgan Stanley to sell NatWest shares on its behalf in a scheme starting on Aug. 12 and running until Aug. 11, 2022. The government said it planned to sell up to 15% of the total volume of NatWest shares being traded on the market over the duration of the plan.

• Pacific Gas and Electric Corp: The California power company said on Wednesday it would bury 10,000 miles of power lines in high-risk fire zones as a safety measure after its equipment caused multiple destructive wildfires over several years. The utility, which called the project a multi-year initiative, maintains more than 25,000 miles of overhead distribution power lines in the highest fire-risk zones, or more than 30% of its total distribution overhead system, according to the company.

• UBS Group AG: The Swiss lender plans to raise the salaries of global banking analysts, associates and directors, a person familiar with the matter told Reuters, following a trend set by Wall Street peers. First-year analysts will earn about $100,000 annually while second- and third-year analysts will get $105,000 and $110,000, the person said late on Wednesday, without disclosing current salaries or percentage increases. Associates will earn $175,000 to $225,000, and directors will get around $275,000, said the person, who was not authorised to speak publicly on the matter and so declined to be identified. The salary increases - part of an initiative to support junior bankers - are effective from Aug. 1, the person said.

INSIGHT

Flush from Reddit rally, GameStop plots store revival

When GameStop shares surged by more than 2,500% in January, some customers joked to store staff they should thank the investors who fueled the video game retailer's extraordinary rally for their paychecks.

ANALYSTS' RECOMMENDATION

• CSX Corp: Credit Suisse raises price target to $39 from $38, saying the company is moving into the growth phases – supported by the recent acquisitions of Pan Am and Quality Carriers.

• Estee Lauder Companies Inc: Oppenheimer raises target price to $355 from $330, reflecting increased confidence in the company's delivery and a re-rating higher of the space.

• Las Vegas Sands Corp: Jefferies cuts target price to $60 from $70, following second quarter results.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0830 (approx.) Initial jobless claims: Expected 350,000; Prior 360,000

0830 (approx.) Jobless claims 4-week average: Prior 382,500

0830 (approx.) Continued jobless claims: Expected 3.100 mln; Prior 3.241 mln

0830 (approx.) National Activity Index for June: Prior 0.29

1000 Existing home sales for June: Expected 5.90 mln; Prior 5.80 mln

1000 Existing home sales percentage change for June: Prior -0.9%

1000 Leading index change mm for June: Expected 0.9%; Prior 1.3%

1100 (approx.) KC Fed Manufacturing for July: Prior 30

1100 (approx.) KC Fed Composite Index for July: Prior 27

COMPANIES REPORTING RESULTS

Abbott Laboratories: Expected Q2 earnings of $1.02 per share

Allegion PLC: Expected Q2 earnings of $1.32 per share

American Electric Power Company Inc: Expected Q2 earnings of $1.14 per share

Capital One Financial Corp: Expected Q2 earnings of $4.64 per share

Celanese Corp: Expected Q2 earnings of $4.44 per share

Danaher Corp: Expected Q2 earnings of $2.05 per share

Domino's Pizza Inc: Expected Q2 earnings of $2.87 per share

FirstEnergy Corp: Expected Q2 earnings of 57 cents per share

Freeport-McMoRan Inc: Expected Q2 earnings of 76 cents per share

Genuine Parts Co: Expected Q2 earnings of $1.54 per share

Intel Corp: Expected Q2 earnings of $1.06 per share

Marsh & McLennan Companies Inc: Expected Q2 earnings of $1.43 per share

Nucor Corp: Expected Q2 earnings of $4.79 per share

Pool Corp: Expected Q2 earnings of $5.48 per share

Robert Half International Inc: Expected Q2 earnings of $1.05 per share

SVB Financial Group: Expected Q2 earnings of $6.50 per share

Twitter Inc: Expected Q2 earnings of 07 cents per share

Union Pacific Corp: Expected Q2 earnings of $2.52 per share

Verisign Inc: Expected Q2 earnings of $1.33 per share

W R Berkley Corp: Expected Q2 earnings of $1.00 per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Biogen Inc: Q2 earnings conference call

0800 Danaher Corp: Q2 earnings conference call

0800 Discover Financial Services: Q2 earnings conference call

0800 Dow Inc: Q2 earnings conference call

0800 Landstar System Inc: Q2 earnings conference call

0800 SLM Corp: Q2 earnings conference call

0800 Whirlpool Corp: Q2 earnings conference call

0830 American Airlines Group Inc: Q2 earnings conference call

0830 AT&T Inc: Q2 earnings conference call

0830 Crocs Inc: Q2 earnings conference call

0830 D R Horton Inc: Q3 earnings conference call

0830 Equifax Inc: Q2 earnings conference call

0830 Marsh & McLennan Companies Inc: Q2 earnings conference call

0830 Quest Diagnostics Inc: Q2 earnings conference call

0845 Union Pacific Corp: Q2 earnings conference call

0900 Abbott Laboratories: Q2 earnings conference call

0900 American Electric Power Company Inc: Q2 earnings conference call

0900 Blackstone Group Inc: Q2 earnings conference call

0900 Fifth Third Bancorp: Q2 earnings conference call

0900 OneMain Holdings Inc: Q2 earnings conference call

0900 Valmont Industries Inc: Q2 earnings conference call

0930 Brown-Forman Corp: Annual Shareholders Meeting

0930 Chart Industries Inc: Q2 earnings conference call

1000 Advanced Drainage Systems Inc: Annual Shareholders Meeting

1000 Churchill Capital IV Corp: Shareholders Meeting

1000 Cleveland-Cliffs Inc: Q2 earnings conference call

1000 Domino's Pizza Inc: Q2 earnings conference call

1000 Freeport-McMoRan Inc: Q2 earnings conference call

1000 Newmont Corporation: Q2 earnings conference call

1000 Safehold Inc: Q2 earnings conference call

1000 Snap-On Inc: Q2 earnings conference call

1000 Tenet Healthcare Corp: Q2 earnings conference call

1000 Watsco Inc: Q2 earnings conference call

1030 Crown Castle International Corp: Q2 earnings conference call

1100 First American Financial Corp: Q2 earnings conference call

1100 Genuine Parts Co: Q2 earnings conference call

1100 Globe Life Inc: Q2 earnings conference call

1100 Graco Inc: Q2 earnings conference call

1100 Pool Corp: Q2 earnings conference call

1100 Reliance Steel & Aluminum Co: Q2 earnings conference call

1100 RLI Corp: Q2 earnings conference call

1100 Sonoco Products Co: Q2 earnings conference call

1100 Valley National Bancorp: Q2 earnings conference call

1130 Alaska Air Group Inc: Q2 earnings conference call

1130 East West Bancorp Inc: Q2 earnings conference call

1230 Southwest Airlines Co: Q2 earnings conference call

1300 DoorDash Inc: Annual Shareholders Meeting

1300 Rexford Industrial Realty Inc: Q2 earnings conference call

1400 Nucor Corp: Q2 earnings conference call

1400 SL Green Realty Corp: Q2 earnings conference call

1500 Old Republic International Corp: Q2 earnings conference call

1630 Skechers USA Inc: Q2 earnings conference call

1630 Verisign Inc: Q2 earnings conference call

1700 Boston Beer Company Inc: Q2 earnings conference call

1700 Capital One Financial Corp: Q2 earnings conference call

1700 Carlisle Companies Inc: Q2 earnings conference call

1700 Intel Corp: Q2 earnings conference call

1700 Robert Half International Inc: Q2 earnings conference call

1700 Snap Inc: Q2 earnings conference call

1700 Vicor Corp: Q2 earnings conference call

1700 W R Berkley Corp: Q2 earnings conference call

1800 JPMorgan Chase & Co: Q2 earnings conference call

1800 SVB Financial Group: Q2 earnings conference call

1800 Twitter Inc: Q2 earnings conference call

2100 JPMorgan Chase & Co: Q2 earnings conference call

EX-DIVIDENDS

CVS Health Corp: Amount $0.50

nVent Electric PLC: Amount $0.17

Procter & Gamble Co: Amount $0.86

Williams-Sonoma Inc: Amount $0.59

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| EUROPA: Marginale beleningsfaciliteit ECB | Actueel: 0,25% Verwacht: Vorige: 0,25% |

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| EUROPA: Depositorente (Jul) | Actueel: -0,50% Verwacht: -0,50% Vorige: -0,50% | ||||

| EUROPA: Rentebesluit (Jul) | Actueel: 0,00% Verwacht: 0,00% Vorige: 0,00% |

Markten blijven volatiel, snel herstel naar de topzone nu?

Maandag hebben er velen gedacht we gaan 10% corrigeren maar dat pakt zo te zien weer anders uit, beleggers kopen de DIP snel weer op, zelfs maandagavond net voor het slot was het al merkbaar op Wall Street. Dinsdag kwam er een stevige rebound die gisteren een vervolg kreeg. Europa deed nu ook volop mee en vooral de AEX won fors met 12 punten, de DAX won 206 punten terwijl de CAC 40 met 117 punten winst afsloot. De olie herpakt zich ook sterk na de stevige daling van maandag. Aan volatiliteit ontbreekt het weer niet, de markt blijft in beweging en beleggers willen nog altijd elke DIP opkopen.

Update 22 juli:

Nu was het de AEX die opviel met een stevige stijging en we moeten natuurlijk niet ver zoeken waardoor dat kwam want het aandeel ASML weegt enorm op de index en na de cijfers van gisteren won ASML maar liefst €18,2. Dat stuwde de AEX mede omhoog met 12 punten (1,6%), de DAX kwam maar moeilijk op gang maar richting het slot wist de DAX toch met 206 punten te herstellen om zo weer dicht bij de zware weerstand uit te komen (15.500-15.550). We gaan zien wat de markt vandaag gaat doen hier in Europa, veel zal natuurlijk ook afhangen van wat er op Wall Street gaat gebeuren na enkele dagen met een stevig herstel.

Op Wall Street zien we dat de Dow Jones er nog 286 punten bij doet om zo het verlies van maandag helemaal weg te werken, de index komt zo weer heel dicht bij de recordstand want nog zo'n 290 punten te gaan en we zijn er opnieuw. De S&P 500 wan 36 punten en komt met een slot op 4359 punten ook weer dicht bij de hoogste stand ooit, de recordstand wacht op 4393 punten. De Nasdaq lag er ook weer goed bij en won 133 punten met een slot op 14.632 punten, ook de Nasdaq komt nu snel dichter bij de hoogste stand ooit die we zien op 14.803 punten.

De index die het deze week het best doet is de semi-conductor index SOX, deze index won 98 punten (ruim 3%) en staat na een stevige terugval van de afgelopen 2 weken amper 80 punten onder de top. Maandag moest deze index nog even terug tot rond de 3088 punten, het slot van gisteren lag daar 200 punten boven ofwel 6,5%. Ook de Dow Transport won met 141 punten 1% gisteren.

De beurzen herstellen dus verder na de daling van maandag, men vergeet maar even waar men aan dacht eind vorige week en maandag en men stapt blijkbaar massaal weer in. Zorgen over de Delta-variant van het COVID virus, de inflatie en vooral ook het verloop van de economie later dit jaar geraken zo in de doofpot. Deze zaken zijn nog niet uit beeld verdwenen, vergeet dat vooral niet, men denkt er gewoon weer even niet aan. Het enige wat ik kan zeggen is dat beleggers het van zich af schuiven.

Hoe dan ook verwacht ik dat de markten naar verwachting zenuwachtig zullen blijven in aanloop naar nog heel wat cijfers die eraan zitten te komen van de grote tech bedrijven. Het is wel zo dat 60 bedrijven uit de S&P 500 index tot dusver hun kwartaalcijfers publiceerden en daarvan deed 85% het beter dan de verwachting die werd afgegeven door de analisten.

Doelen bereikt, de posities mooi afgerond:

Meedoen met US Markets Trading kan uiteraard door lid te worden, maandag heb ik op tijd winst genomen zodat we deze maand al met een mooie winst staan. Ik blijf rustig en hou me aan het plan voor de komende periode, rustig naar kansen zoeken en waar het kan wat posities opnemen. Als u de signalen wilt ontvangen wordt dan vandaag nog lid via de nieuwe aanbieding voor €35 die loopt tot 1 oktober ...

Zo ziet u hieronder dat de eerste resultaten voor deze maand JULI er nu bij staan. Ook deze maand halen we dus met voorzichtig handelen een mooi resultaat, u kunt nu meedoen met de nieuwe posities die er aan zitten te komen in de loop van deze week door lid te worden via de nieuwe aanbieding. Bij Guy Trading kijk ik ook naar wat aandelen waar er wat mee kan worden gedaan. Schrijf u dus op tijd in, ik zal in ieder geval het momentum kiezen om in te stappen.

Bij Systeem Trading ziet u hieronder hoe de 7 maanden dit jaar verlopen, u ziet dat elke maand positief werd afgerond.

De nieuwe aanbieding loopt tot 1 OKTOBER en dat voor €35 (Polleke Trading €45 en COMBI-Trading voor €75). Inschrijven kan via de link https://www.usmarkets.nl/tradershop

Hieronder het resultaat van deze maand (JULI) en dit jaar (2021):

Marktoverzicht:

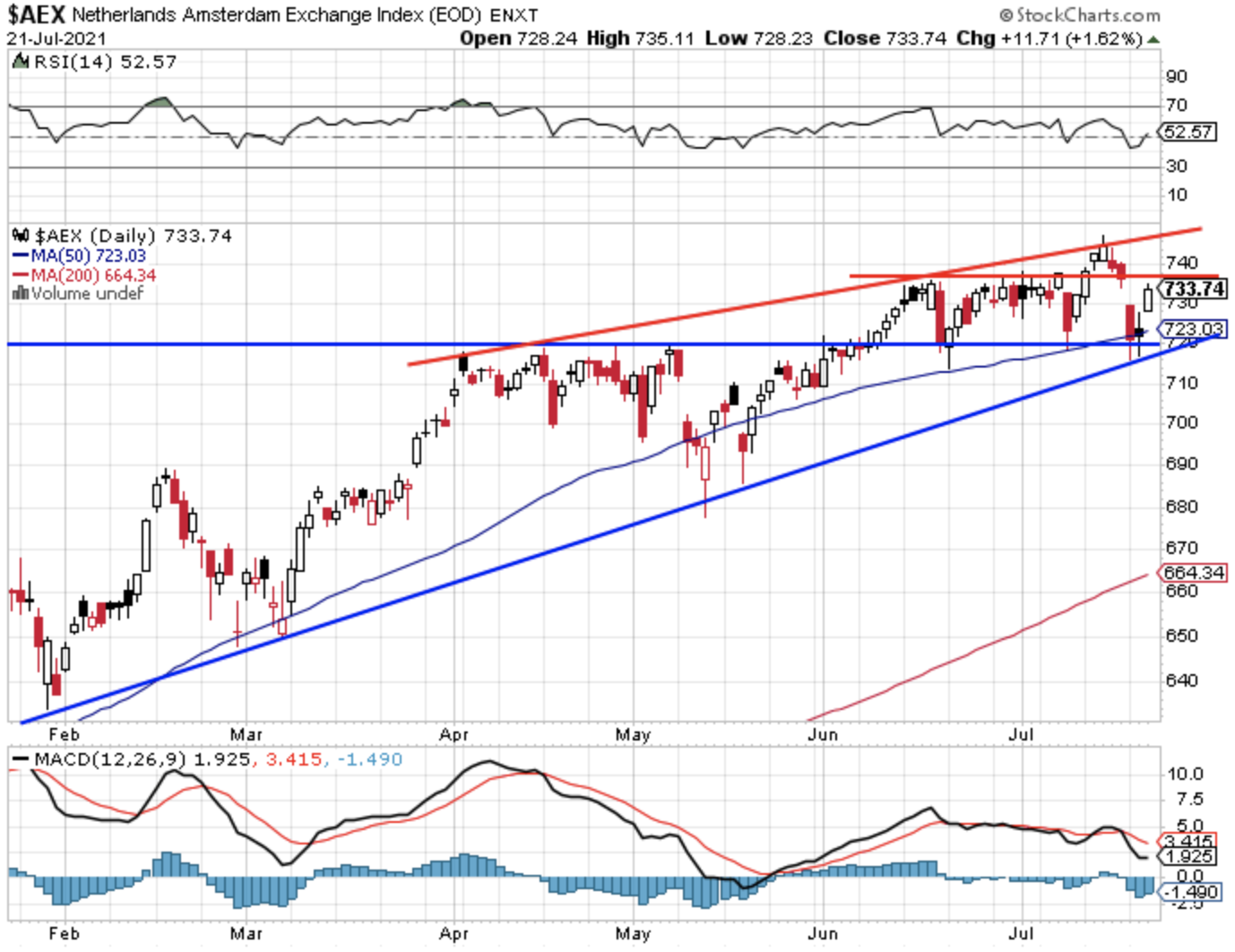

Technische conditie AEX:

De AEX lag er vooral door ASML zeer sterk bij woensdag, de index won 12 punten en komt zo weer dicht bij de 736-738 zone uit waar we een tijd met een zware weerstand zaten. Dat kan het doel worden op korte termijn, bij een uitbraak zien we de top rond de 747 punten als richtpunt maar zo ver is het nog niet.

Weerstand nu de 736-738 punten, later de topzone rond de 747 punten. Steun zien we nu rond de 728 en de 723 punten, later de 717-719 en de bodem van maandag rond de 716 punten.

Technische conditie DAX:

De DAX lag er slecht bij na de daling onder de trendlijn maar de index herpakt zich nog duidelijk. Wel blijven opletten de komende dagen want de DAX staat dan wel weer binnen de zone 15.310-15.800 punten maar de index blijft zeer kwetsbaar momenteel.

Steun nu eerst de 15.300 punten, later zien we de 15.000 en de 14.800 punten als steun. Weerstand nu de bekende zone 15.500-15.550 punten. Daarna de 15.650 en de topzone rond de 15.800 punten.

S&P 500 analyse:

De S&P 500 zet de stijging door en won opnieuw 35 punten om zo weer een stap dichter bij de recordstand die we zien rond de 4394 punten. Dat wordt nu de eerste weerstand, we zien daar ook de lijn over de toppen die iets hoger uitkomt.

Steun kunnen we nu weer verwachten rond de 4350 punten met later de 4290 punten. Verder zien we rond de 4230-4240 punten een belangrijke steunzone door de lijn onder de bodems. Zoals ik aangaf kan de index beter niet onder deze belangrijke steun sluiten want dan zie ik mogelijkheden richting de 4150 en zelfs tot de 4050 punten. Zo ver is het nog lang niet maar we hebben we gemerkt dat het snel kan gaan zodra er een verkoopgolf op gang komt.

Weerstand nu eerst de 4375 punten met later de topzone rond de 4395-4400 punten.

Analyse Nasdaq:

De Nasdaq trekt nog even door omhoog en komt zo weer snel dichter bij de topzone die we rond de 14.800 punten zien uitkomen. De eerste weerstand nu rond de 14.800 punten ofwel de topzone, later de 14.900 en de 15.000 punten als richtpunten omhoog.

Steun zien we nu eerst rond de 14.500 punten, later de 14.400 en bodem van maandag rond de 14.200 punten waar ook de oude toppen van februari en april uitkomen. Pas onder de 14.200 punten ziet het er voor de Nasdaq heel slecht uit.

Momenteel kan ik niks uitsluiten, het kan snel weer naar de topzone 14.800 punten maar net zo goed richting de bodem van maandag rond de 14.200 punten. Op de grafiek zien we dat we in een week tijd deze beide niveaus al hebben aangetikt.

Euro, olie en goud:

De euro zien we nu rond de 1,18 dollar, de prijs van een vat Brent olie komt uit op 71,9 dollar terwijl een troy ounce goud nu op 1810dollar staat.

De LIVEBLOG en Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

Met vriendelijke groet,

Guy Boscart

TA Boskalis, BAM, AEX, Greenyard en Galapagos

Drie aanvragen om een grafiek te bekijken en ik voeg er zelf twee aan toe. Op verzoek van een lezer kijk ik naar BAM, Boskalis en Greenyard. Ik doe er twee grafieken bij: de AEX en Galapagos. Lezer polyglot wil graag weten hoe het staat met de technische conditie van BAM Groep, Greenyard en…

Lees verder »