Liveblog Archief donderdag 26 augustus 2021

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: BBP (Kwartaal) (Q2) | Actueel: 6,6% Verwacht: 6,7% Vorige: 6,5% | ||||

| USA: Eerste Aanvragen Werkloosheidsvergoeding | Actueel: 353K Verwacht: 350K Vorige: 349K |

Markt snapshot Wall Street 26 augustus

TOP NEWS

• Fed's Powell likely to give few hints on bond-buying taper timeline

Federal Reserve Chair Jerome Powell's highly anticipated speech to the Jackson Hole economic conference on Friday will likely offer few new hints about when the U.S. central bank may start reducing its massive asset purchases, analysts said.

• Deutsche fund arm faces U.S. probe over sustainable investments

The U.S. Securities and Exchange Commission is investigating Deutsche Bank's asset manager DWS over how it used sustainable investing criteria to manage its assets, two people with knowledge of the matter said.

• Japan suspends 1.6 million doses of Moderna shot days after contamination reports

Japan suspended the use of 1.63 million doses of Moderna's COVID-19 vaccine, more than a week after the domestic distributor received reports of contaminants in some vials.

• Coty forecasts return to sales growth betting on fragrance, makeup rebound

Cosmetics maker Coty said it expects to return to annual sales growth for the first time in at least three years as people splurge on fragrances and beauty products following the easing of coronavirus restrictions.

• Western Digital-Kioxia in talks to create chipmaker giant -source

Western Digital is in advanced talks for a possible $20 billion stock merger with Japanese chipmaker and partner Kioxia, a person familiar with the matter said, a move that would create a NAND memory giant to rival Samsung.

BEFORE THE BELL

The S&P 500 and the Nasdaq stock futures traded with losses, ahead of second-quarter GDP data and jobless claims numbers due for release later in the day, while the Fed's Jackson Hole policy symposium on Friday made investors steer clear of major moves. The dollar steadied, while gold prices dipped. Most Asian stocks ended in the red due to fears surrounding the spread of Delta coronavirus variant. European shares took a hit after data showed faltering German consumer morale. Oil prices dropped amid rising COVID-19 infections and as Mexico restored some oil production.

STOCKS TO WATCH

Results

• Canadian Imperial Bank of Commerce: The bank beat analysts' estimates for quarterly profit, as it released reserves set aside for loan losses and saw higher volumes and fees in its Canadian and U.S. banking and wealth management divisions. Net income excluding one-off items rose to C$1.81 billion, or C$3.93, in the three months ended July 31, compared with C$1.24 billion, or C$2.71 per share, a year earlier. Analysts had expected income of C$3.41 a share, according to IBES data from Refinitiv. Canada's fifth-largest lender reported overall net income of C$1.73 billion, or C$3.76 a share, up from C$1.2 billion or C$2.55, a year earlier.

• Coty Inc: The cosmetics maker said it expects to return to annual sales growth for the first time in at least three years as people splurge on fragrances and beauty products following the easing of coronavirus restrictions. Coty has cashed in on the change in customer behavior by rolling out new fragrances, including Burberry Hero and Calvin Klein Defy, marketed by actors Adam Driver and Richard Madden, respectively. "Coty is clearly strongly benefiting from a surge in fragrance consumption in two key markets (China and the United States)," Chief Executive Officer Sue Nabi told Reuters in an interview. Coty estimated its fiscal 2022 sales will increase in the low teens percentage range even as it flagged some uncertainty from the COVID-19 Delta variant. Net revenue in the quarter increased 90% to $1.06 billion, beating estimates of $1.01 billion, according to IBES data from Refinitiv.

• Salesforce.com Inc: The company on Wednesday signaled the shift to hybrid work would keep demand for its cloud-based software strong in the third quarter, after trumping market expectations for earnings in the May-July period. A slew of acquisitions, including workplace messaging app Slack, has helped Salesforce fend off competition from legacy players like Oracle, Microsoft and German competitor SAP. Revenue in the second quarter rose 23% to $6.34 billion, surpassing estimates of $6.24 billion, according to IBES data from Refinitiv. San Francisco, California-based Salesforce forecast third-quarter fiscal 2022 revenue between $6.78 billion and $6.79 billion, above estimates of $6.66 billion. It expects profit between 91 cents and 92 cents per share, compared with expectations of 82 cents.

• Toronto-Dominion Bank: The bank reported higher third-quarter profit that beat analysts' estimates, as it recovered reserves set aside for loan losses and saw growth in its Canadian and U.S. retail banking divisions. Net income excluding one-off items rose to C$3.63 billion, or C$1.96 per share, in the three months ended July 31, compared with C$2.33 billion, or C$1.25, a year earlier. Analysts had expected C$1.92 a share, according to IBES data from Refinitiv. Canada's second-largest lender by market value reported overall net profit of C$3.55 billion, or C$1.92 a share, up from C$2.25 billion or C$1.21, a year ago.

Deals Of The Day

• ON Semiconductor Corp: The company said on Wednesday it would buy GT Advanced Technologies, a manufacturer of a key material used in chips for electric vehicles called silicon carbide, for $415 million in cash. The move is a major push further into electric vehicles for Onsemi, which already supplies other automotive chips such as sensors in driver safety systems. Onsemi said the deal will help it secure and grow its supply of the material to make silicon carbide chips and give it greater control over the technology, which still remains less advanced than chips using older materials. “This transaction reflects our confidence and stated commitment to meaningfully invest in silicon carbide solutions,” Hassane El-Khoury, president and chief executive officer of Onsemi, said in a statement.

In Other News

• AstraZeneca Plc: The drugmaker said a late-stage trial showed its medicine for a rare disease that causes accumulation of copper in the body was three times more successful in helping remove deposits from tissues compared with standard care. The treatment, developed by the drugmaker's recently acquired Alexion rare diseases unit, was being tested for Wilson disease, a genetic condition in which the body's ability to remove excess copper is compromised. The experimental oral medicine taken once-daily could provide a less invasive option for patients who are typically given treatments which involve injecting a metal removing solution into the blood or zinc therapy. The study met the main goal of improvement in the daily mean copper mobilised from tissues over a period of 48 weeks.

• Barclays Plc: The bank announced it is pumping in more than $400 million into its India arm to tap rising corporate and investment banking activity in the country that is now recovering from the pandemic. This is Barclays' single largest capital infusion in its Indian business in the last three decades. It comes after the British lender pulled out of the retail business in Asia's third-largest economy in 2011 and exited its equity investment business in 2016. Barclays said the investment would help grow its corporate and debt investment banking, as well as private clients businesses. "As economic activity gathers momentum, there is increased demand for capital from clients," said Jaideep Khanna, Barclays country CEO for India.

• BHP Group Ltd: High levels of dust at two of the company's iron ore mines in Western Australia are impairing the health of workers and nearby residents, a union said this week, as BHP said it had undertaken a raft of measures to limit dust in the arid region. The state's environmental regulator this month began a review into elevated levels of airborne dust at BHP's Whaleback and Newman mines in the Pilbara, as part of a review into BHP's licence conditions and public submissions closed this week. The review will be undertaken over the second half of this year and could result in changes to BHP's license conditions. The mines are some 1,065 kilometres (662 miles) north east of Perth. BHP said in a statement that it prioritises the health and safety of its employees and host communities, and was committed to managing our dust levels in Newman.

• Boeing Co: India's SpiceJet said it expects Boeing's grounded 737 MAX jets in its fleet to return to service at the end of September following a settlement struck with lessor Avolon on leases of the aircraft. The resumption of MAX aircraft services in India would be subject to regulatory approvals, SpiceJet said. With easing of the travel restrictions and increasing pace of vaccinations, there might be some pick-up in air traffic and SpiceJet's settlement to restart MAX aircraft could help it to get back on track, said Likhita Chepa, senior research analyst at CapitalVia Global Research. Boeing continues to work with global regulators to safely return the 737-8 and 737-9 to service, the U.S. planemaker said in a statement to Reuters, while declining to comment on the compensation.

• Deutsche Bank AG: The U.S. Securities and Exchange Commission is investigating the German bank's asset manager DWS over how it used sustainable investing criteria to manage its assets, two people with knowledge of the matter said. If it progresses, the case will be watched closely by the asset management industry. The SEC investigation follows a report earlier this month, also by The Wall Street Journal (WSJ), citing the former head of sustainability at DWS saying the fund manager overstated how it used sustainable investing criteria to manage investments. An SEC spokesperson said: "The SEC does not comment on the existence or nonexistence of a possible investigation."

• Facebook Inc: The social media giant has approached academics and policy experts about forming a commission to advise it on issues relating to global elections, the New York Times reported on Wednesday, citing five people with knowledge of the matter. The proposed body could decide on matters such as political ads and their viability and concerns around election-related misinformation, according to the report. An announcement on the commission could come this fall in preparation for the 2022 U.S. midterm elections, the report said, cautioning such efforts were preliminary and could still fall apart.

• iQiyi Inc: The Chinese video streaming platform said it would stop showing all "idol competition" programs, calling them unhealthy amid a regulatory crackdown that has seen Beijing criticise firms for encouraging celebrity worship. China's equivalent of Netflix, IQiyi had amassed a number of hits with programs such as "Youth with You" which allowed viewers to vote for boy band contestants by purchasing products with voting codes. "We will cancel idol talent shows and off-site online voting, be responsible as a platform, resist bad influences, and maintain a healthy and clean internet as well as audio-visual environment for our users," the company said in a statement.

• JD.com Inc: The Chinese e-commerce giant is in advanced talks to acquire a controlling stake in storage facilities manager China Logistics Property Holdings for an undisclosed sum, Bloomberg News reported, citing people familiar with the matter. China Logistics Chairman Li Shifa and private equity firm RRJ Capital have put more than 50% of the firm up for sale, seeking a valuation of about $2 billion, according to the report. The companies have not made a final decision, and talks could still fall apart, according to the report. JD and China Logistics did not immediately respond to Reuters requests for comment.

• JOYY Inc: The company's top two shareholders, its Chairman David Li and Xiaomi founder Lei Jun, plan to take the Nasdaq-listed company private in a deal that could value it at up to $8 billion, three people with knowledge of the matter said. They are teaming up for the deal as they believe the Chinese social media company is undervalued in the U.S. market, the people added. JOYY had an average market value of $3.9 billion over the past month, while its net asset value totalled $5.6 billion as of June 30, based on its quarterly results. Li and Lei are looking to offer $75-$100 per share to take the cash-rich JOYY private, two of the people said, a premium of 50-100% to the share's average price over the past month.

• Kroger Co: The U.S. grocery chain is gearing up to administer 1 million COVID-19 booster shots a week once they are available to the general public, and plans to offer vaccines in nursing homes for those who cannot go to its stores. Retailers including Kroger, CVS Health, Walgreens and Walmart are likely to play a role in administering the booster shots. Colleen Lindholz, president of Kroger Health, told Reuters in an interview that about 100 of its U.S. locations would have dedicated workers providing vaccinations all day long. Lindholz said the targeted 1 million shots a week would be twice the rate at which it had given first and second doses of the vaccine at the height of the pandemic.

• Moderna Inc: Japan suspended the use of 1.63 million doses of the drugmaker's COVID-19 vaccine, more than a week after the domestic distributor received reports of contaminants in some vials. Both Japan and Moderna said that no safety or efficacy issues had been identified and that the suspension was just a precaution. But the move prompted several Japanese companies to cancel worker vaccinations planned for Thursday. "Moderna confirms having been notified of cases of particulate matter being seen in drug product vials of its COVID-19 vaccine," Moderna said in a statement. "The company is investigating the reports and remains committed to working expeditiously with its partner, Takeda, and regulators to address this," it added, referring to Japan's Takeda Pharmaceutical, which distributes the vaccine in the country.

• Vector Acquisition Corp: New Zealand entrepreneur Peter Beck said his space firm Rocket Lab was the result of a lifelong quest for signs of life outside earth, as the startup hit a new milestone with a Nasdaq listing. The small satellite launch firm, often compared to Tesla CEO Elon Musk’s SpaceX, listed on the Nasdaq Composite on Thursday with a market capitalisation of about $4.4 billion. "For me personally, the biggest question that I can possibly answer in my lifetime, and the biggest question for everybody on earth really comes down to are we the only life in the universe or not," Beck told Reuters from New Zealand after the listing.

• Western Digital Corp: The company is in advanced talks for a possible $20 billion stock merger with Japanese chipmaker and partner Kioxia, a person familiar with the matter said, a move that would create a NAND memory giant to rival Samsung. The companies could reach an agreement as early as mid-September, and Western Digital CEO David Goeckeler would run the combined firm, the person said, requesting anonymity to discuss confidential matters. A combination of the two would rewrite the competition to capture robust demand for memory chips that has been driven by 5G expansion and a pandemic-fueled rise in work from home. "Such a deal would be a defensive, but prudent, move by Western to reinforce its competitive position in the swiftly consolidating chip market," Morningstar analyst William Kerwin said in a research note.

ANALYSIS

Investors see no speed bump in Fed's Jackson Hole event

Despite weeks of anticipation, investors have lowered their expectations for Friday's Jackson Hole event, saying that U.S. Federal Reserve Chair Jerome Powell has little reason to rock the boat.

ANALYSTS' RECOMMENDATION

• Advance Auto Parts Inc: Stephens raises target price to $235 from $220, impressed by the company’s gross margin strength in the second quarter, despite difficult supply chain headwinds.

• Dick's Sporting Goods Inc: Barclays raises target price to $173 from $150, after the company reported upbeat second-quarter results.

• Roblox Corp: Jefferies initiates coverage with hold rating, to reflect skepticism about the company’s growth in the longer term.

• Salesforce.com Inc: Piper Sandler raises target price to $280 from $240, after the company reported upbeat second-quarter revenue driven by strength in sales cloud, service cloud, and strong multi-cloud segment deals.

• Talos Energy Inc: KeyBanc raises rating to overweight from sector weight, citing carbon capture potential & production upside in 2021.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0830 (approx.) Corporate profits preliminary for Q2: Prior 1.7%

0830 (approx.) GDP 2nd estimate for Q2: Expected 6.7%; Prior 6.5%

0830 (approx.) GDP sales preliminary for Q2: Prior 7.7%

0830 (approx.) GDP consumer spending preliminary for Q2: Prior 11.8%

0830 (approx.) GDP deflator preliminary for Q2: Expected 6.0%; Prior 6.1%

0830 (approx.) Core PCE prices preliminary for Q2: Expected 6.1%; Prior 6.1%

0830 (approx.) PCE prices preliminary for Q2: Prior 6.4%

0830 (approx.) Initial jobless claims: Expected 350,000; Prior 348,000

0830 (approx.) Jobless claims 4-week average: Prior 377,750

0830 (approx.) Continued jobless claims: Expected 2.790 mln; Prior 2.820 mln

1100 (approx.) KC Fed Manufacturing for Aug: Prior 41

1100 (approx.) KC Fed Composite Index for Aug: Prior 30

COMPANIES REPORTING RESULTS

Dollar Tree Inc: Expected Q2 earnings of $1.00 cents per share

Gap Inc: Expected Q2 earnings of 46 cents per share

HP Inc: Expected Q3 earnings of 84 cents per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 1-800-Flowers.Com Inc: Q4 earnings conference call

0800 Chindata Group Holdings Ltd: Q2 earnings conference call

0800 Coty Inc: Q4 earnings conference call

0800 Xpeng Inc: Q2 earnings conference call

0830 Abercrombie & Fitch Co: Q2 earnings conference call

0830 Burlington Stores Inc: Q2 earnings conference call

0830 Hain Celestial Group Inc: Q4 earnings conference call

0830 Malibu Boats Inc: Q4 earnings conference call

0830 Membership Collective Group Inc: Q2 earnings conference call

0900 American Woodmark Corp: Annual Shareholders Meeting

0900 Dollar Tree Inc: Q2 earnings conference call

0900 J M Smucker Co: Q1 earnings conference call

0900 Owl Rock Capital Corp: Annual Shareholders Meeting

0900 Phibro Animal Health Corp: Q4 earnings conference call

1000 Dollar General Corp: Q2 earnings conference call

1000 Lancaster Colony Corp: Q4 earnings conference call

1100 Liberty All-Star Equity Fund: Annual Shareholders Meeting

1130 elf Beauty Inc: Annual Shareholders Meeting

1300 Dynatrace Inc: Annual Shareholders Meeting

1630 Bill.com Holdings Inc: Q4 earnings conference call

1630 F45 Training Holdings Inc: Q2 earnings conference call

1630 HP Inc: Q3 earnings conference call

1630 Ollie's Bargain Outlet Holdings Inc: Q2 earnings conference call

1630 Snap One Holdings Corp: Q1 earnings conference call

1630 VMware Inc: Q2 earnings conference call

1630 Workday Inc: Q2 earnings conference call

1645 Marvell Technology Inc: Q2 earnings conference call

1700 Afya Ltd: Q2 earnings conference call

1700 Domo Inc: Q2 earnings conference call

1700 Gap Inc: Q2 earnings conference call

1700 Peloton Interactive Inc: Q4 earnings conference call

1730 Dell Technologies Inc: Q2 earnings conference call

2100 Missfresh Ltd: Q2 earnings conference call

EX-DIVIDENDS

Altus Midstream Co: Amount $1.50

Analog Devices Inc: Amount $0.69

Badger Meter Inc: Amount $0.20

Cabot Corp: Amount $0.35

Evercore Inc: Amount $0.68

Fortune Brands Home & Security Inc: Amount $0.26

H&E Equipment Services Inc: Amount $0.27

Herman Miller Inc: Amount $0.18

Huntington Ingalls Industries Inc: Amount $1.14

Main Street Capital Corp: Amount $0.20

National Bank Holdings Corp: Amount $0.22

Nextera Energy Inc: Amount $0.38

NU Skin Enterprises Inc: Amount $0.38

Parker-Hannifin Corp: Amount $1.03

Piper Sandler Companies: Amount $0.55

Prospect Capital Corp: Amount $0.06

Scotts Miracle-Gro Co: Amount $0.66

Whirlpool Corp: Amount $1.40

Yum! Brands Inc: Amount $0.50

TA Nasdaq, AEX, Philips, Prosus, Goud en Alfen

Zoals afgelopen dinsdag beloofd ga ik vandaag door met de vele verzoeken die door u zijn gedaan. Vandaag zien we de technische analyses van twee indices en vier aandelen. U komt onder andere Philips, Goud en de Nasdaq tegen in deze column.+++++ + + + + + Leest u wel vaak mijn column, maar heeft u…

Lees verder »Wall Street nog wat hoger, Europa laat het even afweten

Een kleine plus op Wall Street met dan toch weer een nieuw record voor de S&P 500, de Nasdaq en de Nasdaq 100. De Dow Jones liet een verdeeld beeld zien maar wist iets hoger te sluiten donderdag, nog geen record voorlopig voor de Dow Jones. In Europa moesten de meeste indices wat inleveren, de AEX en de DAX verloren 1,25 en 45 punten.

Update donderdag 26 augustus:

Europa moet wat inleveren na de stevige rally van de afgelopen dagen, de AEX geraakt zo niet meer tot een nieuw record na het grootste deel van de sessie wel hoger te hebben gestaan. De index moest inleveren tijdens het laatste uur desondanks Wall Street hoger opende en in de plus bleef. De DAX die het al wat moeilijker kreeg verloor ook gisteren. We kunnen moeilijk zeggen of de draai er nu komt want daarvoor staan we weer veel te dicht bij de recordstanden nu. Voorbeurs zien we in ieder geval de Europa wat lager zal starten.

Beleggers kijken nu vooral uit naar wat de FED zal melden morgen want Powell zal spreken en men zal vooral luisteren naar hem om iets te onthullen over het moment dat de FED zal beginnen met het afbouwen van het opkoop programma. Op Wall Street dus nog wel plussen woensdag en records bij de S&P 500, de Nasdaq en de Nasdaq 100. De voorpret blijft gericht op een leuke boodschap van de FED dat ze nog wat langer blijven opkopen en de woorden terugnemen die we vorige week uit de FED notulen te horen kregen.

In feite hopen beleggers dus dat de pandemie nog wat langer zal aanhouden hoe vreemd het ook klinkt want dat is nu de enige reden waardoor de FED zich stil zal houden. Het klinkt bizar maar het is een feit dat beleggers juist door die reden hopen op verdere steun door de FED. Morgen maar eens aanhoren wat er wordt gemeld in ieder geval.

Marktoverzicht:

Via het overzicht zien we het sterke verloop van de indices duidelijk, vooral de S&P 500 en de Nasdaq vallen op met een nieuwe hoogste stand ooit. Bij de S&P 500 is dat al record nummer 51 dit jaar. Verder zien we dat de AEX en de DAX wat moeten inleveren terwijl de SOX een vreemde sessie neerzet die een top kan aangeven. De Dow Jones geraakt ook amper verder omhoog nu.

Dow Jones:

De Dow Jones herpakt zich nog wat verder na de test van de steunlijn onder de bodems vorige week donderdag, de index won 39 punten woensdag en geraakt zo met kleine stapjes verder omhoog. We zien weinig kracht in ieder geval bij de Dow Jones die achterblijft bij vooral de Nasdaq en de S&P 500 index. De eerste weerstand blijft de topzone die uitkomt rond de 35.620 punten. Later weerstand rond de 35.750 en de 35.850 punten.

Steun nu eerst de 35.150 en de 35.000 punten. Later een belangrijke steun rond de 34.800 punten waar het 50-daags gemiddelde samen met de lijn onder de bodems nu uitkomen.

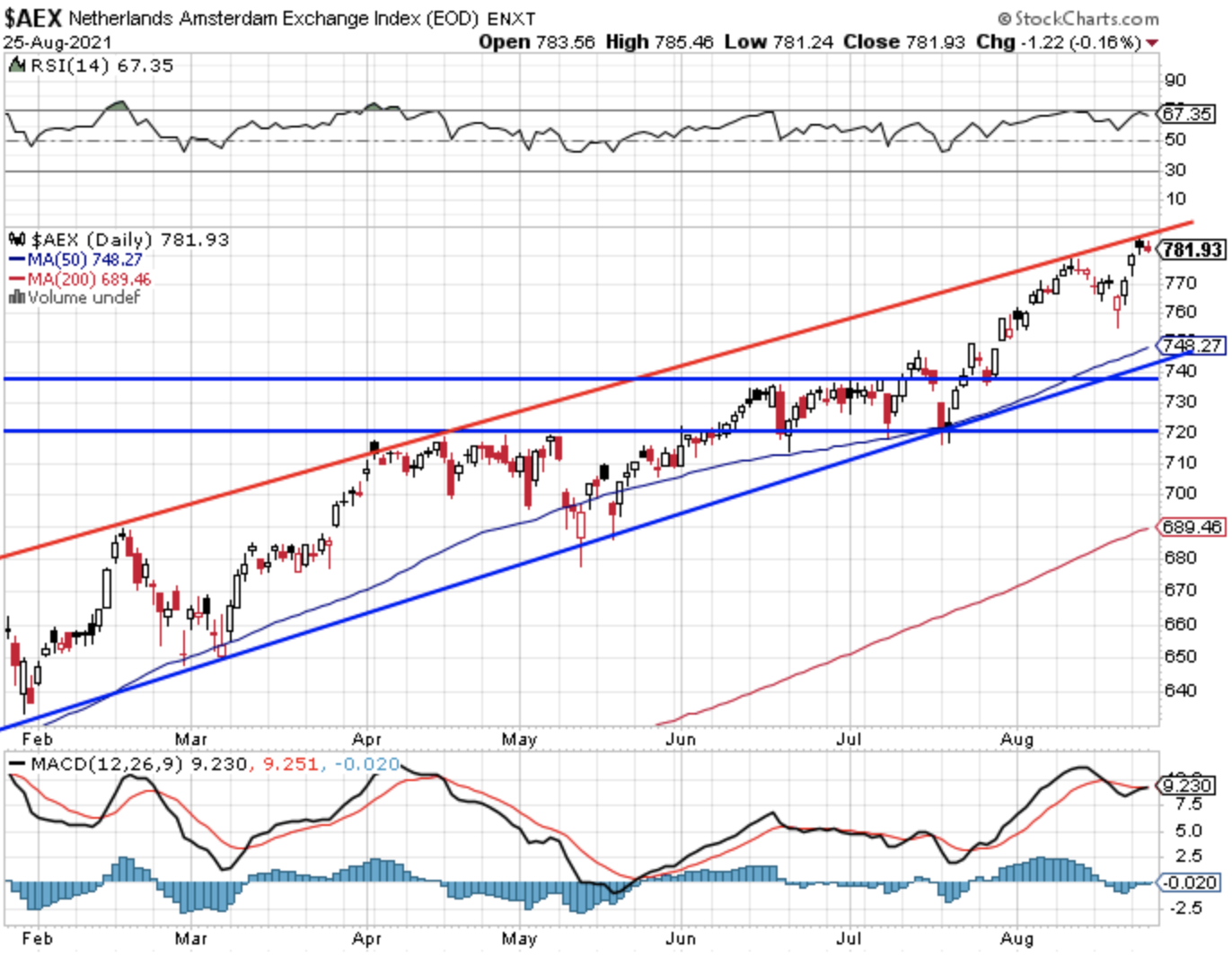

AEX index:

Geen record meer voor de AEX index die wat terug moest, niet veel maar toch een klein verlies. De index staat nu op 782 punten, de hoogste stand ooit zien we rond de 785 punten en dat wordt de eerste weerstand nu. Verder verwacht ik rond de 788 en de 792 punten weerstand, daarna komt de 800 punten snel dichterbij en dat kan een richtpunt worden mocht de markt verder omhoog willen.

Steun nu eerst de 773-775 punten, later de 760 en de bodem van afgelopen donderdag rond de 755 punten. Verder zien we nog steun rond de 748 en de 736-738 punten.

DAX index:

De DAX index sluit nog net boven de bekende 15.810 punten maar de index geraakt niet gemakkelijk meer verder richting de recordstand die we rond de 16.030 punten zien uitkomen. De verwachting is nu dat de index eerder de eerste belangrijke steun zal gaan opzoeken en die blijft rond de 18.810 punten. Onder deze steun verwacht ik snel een daling richting eerst de 15.660 en later tot de bekende volgende steunzone tussen de 15.500-15.550 punten.

Weerstand blijft de topzone rond de 16.030 punten, later weerstand rond de 16.150 en de 16.250 punten.

Nasdaq Composite:

De tech indices doen het nog steeds goed na de bodem van donderdag maar de vaart loopt eruit nu. De Nasdaq zet wel weer een record neer op 15.041,86 punten terwijl de index even op 15.059,43 punten stond wat dan ook meteen de hoogste stand ooit werd. De index komt nu tegen de rode lijn over de toppen terecht en daar mogen we normaal gezien weerstand verwachten al blijft zoiets relatief in deze markt.

Weerstand nu dus die lijn over de toppen rond de 15.050-15.060 punten, later de 15.150 en de 15.250 punten. Steun nu rond de 14.900 punten, later rond de 14.750 en de 14.620 punten waar we het 50-daags gemiddelde zien uitkomen. Verder nog de 14.400 punten waar de bodem van vorige week donderdag uitkomt en de 14.210 punten die ik als de stevige steun zien voor de Nasdaq de komende periode. Vergeet niet dat de index vorige week donderdag intraday al even op 14.400 punten terecht kwam, zo snel kan het gaan.

Overzicht resultaat 2021 blijft goed:

Er lopen nu wat kleine posities op enkele indices en ik zoek nog naar wat andere kansen de komende sessies. Zorg in ieder geval dat u net als ons het meest gunstige momentum kunt pakken om in de markt te stappen of wordt lid zodat u de signalen ontvangt op de indexen.

Meedoen kan meteen als u lid wordt, de posities kunt u nog opnemen daarna want de details ziet u dan in onze Tradershop op de website. Schrijf u nu in via de nieuwe aanbieding tot 1 NOVEMBER voor €35 via de aanbieding., ga naar https://www.usmarkets.nl/trade... en doe meteen mee met de nieuwe posities ...

Met vriendelijke groet,

Guy Boscart

US Markets Trading