Liveblog Archief donderdag 29 juli 2021

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Voorlopige Huisverkopen (Maandelijks) (Jun) | Actueel: -1,9% Verwacht: 0,3% Vorige: 8,3% |

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: BBP (Kwartaal) (Q2) | Actueel: 6,5% Verwacht: 8,5% Vorige: 6,3% | ||||

| USA: Eerste Aanvragen Werkloosheidsvergoeding | Actueel: 400K Verwacht: 380K Vorige: 424K |

Markt snapshot Wall Street 29 juli

TOP NEWS

• Fiscal stimulus, vaccines likely fueled U.S. economic growth in the second quarter

The U.S. economy likely gained steam in the second quarter, with the pace of growth probably the second fastest in 38 years, as massive government aid and vaccinations against COVID-19 fueled spending on travel-related services.

• Facebook's slowdown warning hangs over strong ad sales, while Zuckerberg talks 'metaverse'

Facebook said on Wednesday it expects revenue growth to "decelerate significantly," sending the social media giant's shares down 3.5% in extended trading even as it reported strong ad sales.

• Merck sales rise 22% as drug demand recovers after COVID-19 hit

Merck reported a 22% rise in second-quarter sales as demand for drugs that need to be administered by medical professionals recovered following an initial hit due to the pandemic.

• Latest shift to tech leaves Cathie Wood's ARKK in the cold

A rebound in growth stocks over the last month is doing little to bolster the performance of Cathie Wood's ARK Innovation ETF, which has lagged this year after outperforming all other U.S. equity funds in 2020.

• Rights group urges U.S. customs to probe Goodyear Malaysia over worker abuse accusation

Rights group Liberty Shared has asked United States customs authorities to investigate the Malaysian operations of American tyre maker Goodyear Tire & Rubber over accusations of abusive labour practices, the group told Reuters.

BEFORE THE BELL

Futures tracking the Dow and the S&P 500 rose as comments from the Federal Reserve that the U.S. economic recovery was on track lifted economically sensitive stocks. European stockshit record highs as strong corporate earnings set an upbeat tone. Japan’s Nikkei ended higher, as Nissan Motor and some semiconductor firms delivered surprisingly strong earnings. Gold prices rose after Fed Chairman Jerome Powell reassured investors that a rate hike is not on the cards anytime soon, sending the dollar to multi-week lows. Oil prices rose as crude inventories in the world's top oil consumer, the United States, fell to their lowest since January 2020. U.S. GDP advance numbers for the second quarter, initial jobless claims and pending home sales data are due on the economic schedule later in the day. Amazon.com and Gilead Sciences are scheduled to report earnings after market close.

STOCKS TO WATCH

Results

• Anheuser Busch Inbev SA: The world's largest brewer underwhelmed on profit as costs increased and despite driving second-quarter revenue to above pre-pandemic levels. The brewer reported lower core profits in its two biggest markets, the United States and Brazil, as cans and distribution became more expensive. AB InBev retained its forecast that earnings before interest, tax, depreciation and amortisation (EBITDA) would grow by between 8% and 12% this year, with revenue increasing at a faster pace. The company stressed its outlook reflected its current assessment of the scale and magnitude of the pandemic and could be subject to change.

• ArcelorMittal SA: The world's largest steelmaker profited from the continued economic recovery from the COVID-19 pandemic to report its highest quarterly earnings in 13 years, beating expectations, and announced a new share buyback. The Luxembourg-based company also said it had raised its forecast for the growth in global steel consumption this year to 7.5-8.5% from 4.5-5.5% previously. The company said it would start a $2.2 billion buyback programme to be completed by the end of 2021. It said it had benefited from strong steel demand and low inventories, resulting in higher steel shipments, although an improvement in steel spreads was not yet fully reflected in the group's results due to order book lags.

• AstraZeneca PLC: Second-quarter sales of the drugmaker's COVID-19 vaccine more than tripled to $894 million from the previous three months, but the drugmaker once again delayed its U.S. application for approval. AstraZeneca said it now expected to seek U.S. approval for the vaccine in the second half of this year. Previously, it had planned an application during the first half. The company said the shot, developed by Oxford University, brought in $1.17 billion in sales in the first six months of year, putting it among its best selling products, behind first-placed lung cancer drug Tagrisso on $2.54 billion. AstraZeneca has said it will not make a profit from the shot during the pandemic, and costs related to the vaccine shaved a cent off second-quarter earnings per share. That's down from 3 cents in the first quarter.

• Canadian Pacific Railway Ltd: The company topped quarterly profit estimates on Wednesday, boosted by a recovery from the pandemic-led slump in freight volumes. Analysts had indicated a rebound in Canadian rail traffic through much of the second quarter, driven by a healthy recovery in the North American economy from last year's pandemic-induced lows. "Despite near term headwinds - forex, fuel pricing, network fire disruptions - we continue to view both Canadian National and Canadian Pacific as well situated to further benefit from ongoing recovery tailwinds," Raymond James analyst Steve Hansen said in a pre-earnings note. Canadian Pacific's operating ratio, a measure of operating expenses as a percentage of revenue, rose to 60.1% in the second quarter from 57% a year earlier. A lower operating ratio signals improved profitability. Revenue rose to C$2.05 billion from C$1.79 billion.

• Carlyle Group Inc: The U.S. buyout firm said its second-quarter distributable earnings nearly doubled following a sharp rise in asset divestments in its private equity and secondary market portfolios. The Washington, D.C.-based firm said its distributable earnings, which represents the cash available for paying dividends to shareholders, rose to $395.4 million from $198.4 million a year earlier. Carlyle said its private equity and credit funds appreciated by 12% and 8%, respectively. Carlyle's total assets under management rose to a record $276 billion, up 6% from the prior quarter, owing to fund appreciation and strong fundraising activity. It ended the quarter with $77 billion in unspent capital and declared a quarterly dividend of 25 cents.

• Cenovus Energy Inc: The Canadian oil and gas producer raised its full-year production forecast and posted a near 2% rise in profit in the second quarter, as crude prices returned to pre-pandemic levels. Cenovus, one of Canada's largest producers, said its total production fell 0.4% to 765,900 barrels of oil equivalent per day (boepd) in the quarter compared with the first. The company raised its production forecast range for the full year by about 2% to between 750,000 boepd and 790,000 boepd. The Calgary, Alberta-based company's net earnings rose to C$224 million, or 11 Canadian cents per share, in the second quarter ended June 30, from C$220 million, or 10 Canadian cents per share, in the first quarter.

• Credit Suisse Group AG: A "lackadaisical" attitude towards risk and "a lack of accountability" were to blame for the bank's $5.5 billion loss on investment fund Archegos, according to a review published, as the bank reported a near-80% fall in second-quarter profit. In a review unveiled along with the results, law firm Paul Weiss, Rifkind, Wharton & Garrisson gave a damning assessment of the bank's risk management practices, though it did add there was no evidence of fraudulent or illegal activity. Credit Suisse reported 7.3 billion francs in net asset outflows from its wealth management businesses, an indicator of a loss in business from rich clients, for the second quarter. Chief Financial Officer David Mathers told journalists on a call that 4.2 billion francs of the outflows were related to its efforts to limit its risk in Asia, and the outflows were concentrated early in the quarter. On the trading side, adjusted revenues from equity sales and trading posted a 17% decline excluding Archegos. Fixed income sales and trading fell 33%.

• Diageo PLC: The spirits group reported a better-than-expected rise in full-year organic net sales growth, as North American bars and restaurants reopened helping boost demand for its tequila brands and Johnnie Walker whisky. By region, North America grew the strongest boosted by consumers trading up to more premium spirits such as tequila, liqueurs and higher-end bottles of Johnnie Walker scotch. The company said that, with 85% of restaurants and bars in North America now open, it saw higher levels of restocking and replenishment, boosting organic net sales by 20% in the region. The London-listed company said it expected organic net sales momentum to continue into fiscal 2022, but with volatility in the short term.

• Facebook Inc: The social media giant said on Wednesday it expects revenue growth to "decelerate significantly," sending the social media giant's shares down in extended trading even as it reported strong ad sales. The warning overshadowed the company's beat on Wall Street estimates for quarterly revenue, bolstered by increased advertising spending as businesses build their digital presence to cater to consumers spending more time and money online. Its revenue from advertising rose 56% to $28.58 billion in the second quarter ended June 30, Facebook said. It pointed to a 47% increase in price per ad. "In the third and fourth quarters of 2021, we expect year-over-year total revenue growth rates to decelerate significantly on a sequential basis as we lap periods of increasingly strong growth," Chief Financial Officer Dave Wehner said in the earnings release.

• Ford Motor Co: The automaker on Wednesday boosted its 2021 profit forecast after reporting better-than-expected quarterly results. Ford Chief Executive Jim Farley said the automaker was intent on shifting away from making vehicles that wind up stockpiled on dealer lots, to building them to customer orders, reducing discounts required to make a sale. "We are really committed to going to an order-based system and keeping inventories at 50 to 60 days' supply," Farley said. Ford raised its full-year operating profit estimate by about $3.5 billion, to between $9 billion and $10 billion. Ford estimated a roughly 30% increase in global sales to its dealers from the first to the second half of the year. However, higher commodity costs, investments in the company's "Ford+" plan and lower earnings by Ford Credit is expected to reduce operating profit in the second half, it added.

• Hilton Worldwide Holdings Inc: The U.S. hotel operator reported a quarterly profit, compared to a year-ago loss, as easing pandemic-related curbs led to a recovery in leisure travel. "While the pace of recovery varies by region, we expect continued strength in leisure demand and further upticks in business travel to drive continued resurgence in the back half of the year", Chief Executive Officer Christopher Nassetta said. The company reported a 233.8% rise in comparable RevPAR - a key performance measure for the hotel industry - for the quarter. The company reported net income attributable to Hilton stockholders of $130 million, or 46 cents per share, in the second quarter ended June 30, compared to a net loss of $430 million, or $1.55 per share, a year earlier.

• Lloyds Banking Group PLC: The bank swung to a first-half profit and announced an interim dividend, boosted by a house-buying frenzy and improved economic outlook in Britain. Lloyds posted pretax profit of 3.9 billion pounds for the six months to June, ahead of the 3.1 billion pound average of analyst forecasts compiled by the bank. The bank had posted a first-half loss of 602 million pounds the previous year, after setting aside billions to cover potential bad loans linked to the COVID-19 pandemic. Like rivals, Lloyds is looking to expand in wealth management on the basis of a pandemic-driven savings boom, to make up for squeezed margins from record low Bank of England rates.

• Merck & Co Inc: The pharma company reported a 22% rise in second-quarter sales as demand for drugs that need to be administered by medical professionals recovered following an initial hit due to the pandemic. The company said in April it was starting to see a recovery in sales of some products, albeit slower than previously expected due to a resurgence of COVID-19 cases. The company has said delayed cancer diagnoses during the pandemic contributed to less patients starting treatment with the therapy. Merck, however, has continued to gain expanded approvals for Keytruda's use, putting it on track to become the world's best selling drug by 2023, according to research firm GlobalData. The company's quarterly profit nearly halved as it took a $1.7 billion charge due to its acquisition of Pandion and expenses related to drug development.

• Nokia Oyj: The company raised its full-year outlook after reporting a stronger-than-expected second-quarter operating profit, as the telecom equipment maker benefits from a sharp turnaround in its business. A round of changes in the company's operations, greater investment on research and a geopolitical situation tilting in its favour has put Nokia firmly back in the global 5G rollout race just a year after CEO Pekka Lundmark took the reins, allowing it to gain ground on Swedish arch-rival Ericsson. "Our 5G position has clearly strengthened ... we are winning back customers," Lundmark said on a call, confirming a rosier outlook first signalled in February. Nokia said it now expects full-year net sales of 21.7 billion to 22.7 billion euros, up from its prior estimate of 20.6 billion to 21.8 billion euros, with an operating profit margin of 10-12% instead of the 7% to 10% expected previously.

• Northrop Grumman Corp: The defense contractor raised its full-year forecast on the back of continued strength in its space unit which makes satellites and missile systems. Analysts say Northrop's B-21 bomber and GBSD intercontinental ballistic missiles are likely to be the backbone for the company's growth over the next decade. The company now expects full-year adjusted earnings per share between $24.40 and $24.80, up from its prior range of $24 and $24.50. It expects full-year sales to be between $35.8 billion and $36.2 billion, above its previous forecast of $35.3 billion and $35.7 billion. Quarterly sales rose to $9.15 billion from $8.88 billion a year earlier. Adjusted net earnings was $1.04 billion, or $6.42 per share, in the second quarter, from $1.01 billion, or $6.01 per share, a year earlier.

• Orange SA: France's biggest telecom firm announced a 3.7 billion-euro impairment on the value of its Spanish activities, reflecting competition that has hurt sales and profits in its second-largest market. The state-controlled group has faced low-cost competition there, suffering similar problems to when Iliad's cheap Free Mobile service started a protracted price war in France, whose effects are still felt today. "The situation remains difficult," Orange Chief Financial Officer Ramon Fernandez told reporters on a call, referring to Spain. The group's first-half core operating profits in the country dropped by more than 16%. Orange confirmed its full-year targets, including for a slight decline in core operating profit and an underlying cash flow from telecom activities of over 2.2 billion euros. It also confirmed its targets for 2023, which include underlying cash flow from telecom activities of 3.5-4.0 billion euros.

• PayPal Holdings Inc: Shares fell on the payment company's downbeat current-quarter profit outlook that outweighed a better-than-expected profit in the second quarter from a pandemic-driven shift to digital spending. PayPal has been among the big winners of the COVID-19 pandemic as more people used its services to shop online and pay bills to avoid stepping out. Businesses, forced to move their stores online, also flocked to PayPal. PayPal said it expects third-quarter net revenue to be in the range of about $6.15 billion to $6.25 billion, representing growth of about 13%-14% at current spot rates, but missing analysts' average estimate of $6.45 billion. San Jose, California-based PayPal also said it expects adjusted profit of $1.07 per share, in-line with a year earlier, but lower than estimates of $1.14. It expects annual total payment volumes to rise between 33% and 35% on a spot and forex neutral basis.

• Qualcomm Inc: The chipmaker on Wednesday predicted a rise in sales of chips for 5G phones, including Apple's iPhone, as the company said it had mitigated supply shortfalls that have contributed to a global chip shortage. Qualcomm total revenues rose 63% to nearly $8 billion, boosted by soaring sales of chips for connected devices that hit $1.4 billion. Qualcomm Chief Executive Officer Cristiano Amon told investors during a conference call that the company's efforts to secure its chips from multiple manufacturing partners were making progress bolstering supplies, with the first shipments of significant volume in the fiscal third quarter and more to come in the coming months. "We're still on track to materially improve supply by the end of the calendar year," Amon said. Qualcomm's chip revenue forecast for the current fiscal fourth quarter had a midpoint of $7.25 billion, compared with analyst estimates of $6.83 billion, according to Refinitiv data.

• Relx PLC: The company expects 2021 underlying growth rates to be slightly above historical trends due to strong demand for its analytics and fraud prevention services, helping the information provider increase its dividend. Relx lifted its interim dividend by 5% after it reported a 4% rise in first-half revenue at constant currency, its recent historical average. Adjusted operating profit rose 11% to 1 billion pounds. "We have increased the dividend consistently over many years, we were able to do so last year, and clearly in increasing the dividend at this stage, then we would expect to continue that record," Finance Director Nick Luff told reporters.

• Royal Dutch Shell PLC: The oil company boosted its dividend and launched a $2 billion share buyback programme on Thursday after a sharp rise in oil and gas prices drove second quarter profits to their highest in more than two years. "We are stepping up our shareholder distributions today, increasing dividends and starting share buybacks, while we continue to invest for the future of energy," Shell Chief Executive Ben van Beurden said in a statement. Shell increased its dividend for a second consecutive quarter by 38% to 24 cents, a year after it cut its dividend for the first time since the 1940s in response to the collapse in energy demand caused by the pandemic. Shell said it will maintain its 2021 capital spending at below $22 billion.

• Sanofi SA: The French drugmaker raised its 2021 profit forecast after its vaccines and star eczema treatment Dupixent helped it beat second-quarter results expectations. Sanofi said it was now targeting earnings per share growth of around 12% at constant exchange rates this year, up from "high single digit" percentage growth previously. Revenue at the vaccines unit was up 16.2% to 1 billion euros, helped by stronger demand for booster and meningitis shots. Overall, Sanofi's sales rose 12.4% in the second quarter to 8.74 billion euros, while business net income - a figure the company uses as its core metric to measure profits - was up 16.8% to 1.73 billion euros.

• STMicroelectronics NV: The Franco-Italian chipmaker raised full-year sales and investment outlook as surging demand from car and phone makers boosted second-quarter profits and kept its factories under pressure to meet orders. "During the second quarter we were again operating with a backdrop of strong demand, stretching the global supply chains," STMicro Chief Executive Officer Jean-Marc Chery said on a call with analysts. "We have continued to work closely with our customers across all verticals and channels to adapt to this difficult allocation situation." The group plans to generate $1 billion from the sales of these chips by 2025. It increased its investment plan again for the year to $2.1 billion, from $1.28 billion in 2020. It also improved its full-year revenue target, now expecting it to be around $12.5 billion, up from the $12.1 billion previously announced.

• Suncor Energy Inc: The Canadian oil producer posted a second-quarter profit compared to a year ago loss on Wednesday, as crude prices rebounded from pandemic-driven lows. Like many of its peers, Suncor has been generating bumper free cash flow this year thanks to higher oil prices. The bulk of the company's operations are in northern Alberta's oil sands, and it is aiming to cut carbon emissions by one-third while also boosting production. The company said its total upstream production rose to 699,700 barrels of oil equivalent per day (boepd) during the second quarter from 655,500 boepd a year earlier. The company, Canada's second-largest oil producer, posted net earnings of C$868 million, or 58 Canadian cents per share, in the three months ended June 30, compared with a loss of C$614 million, or 40 Canadian cents per share, year earlier.

• Telefonica S.A.: The Spanish telecoms group raised its outlook for the full year, after posting a record net income of 7.74 billion euros thanks to the sale of its Telxius tower unit and the UK tie-up of O2 and Virgin Media. Telefonica said it now expects revenue and core profit to be "stable" or to see "a slight growth" in 2021, buoyed in part by its Brazilian and German markets which reported strong results on Wednesday. It had forecast a "stabilisation" three months ago. For the second quarter, the company posted core profit of 13.47 billion euros, an organic 3.3% increase compared with the same quarter last year, but a 3.6% drop in real terms as it continues to struggle with high costs and competition.

• Textron Inc: The company beat Wall Street estimates for quarterly revenue and raised its full-year adjusted profit forecast for the second time this year, as demand for its business jets rebounds from pandemic lows. The company said it expects 2021 adjusted earnings of $3.00 to $3.20 per share, compared to its previous forecast of $2.80 to $3. "As the economy strengthens, our outlook reflects continued growth in business aviation," said Chief Executive Scott Donnelly. Textron's aviation unit delivered 44 jets, higher than the 23 a year earlier, and 33 commercial turboprops, up from 15 in 2020. Revenue rose 29% to $3.19 billion, above analysts' average estimate of $2.97 billion, according to Refinitv data.

• TotalEnergies SE: The French oil major said it would use part of its cash flow for share buybacks, as rising oil and gas prices boosted profit and helped to offset the hit from selling out of one of its Venezuelan ventures at a loss. The group said it expected to generate more than $25 billion in cash flow this year, based on current high oil price forecasts, and would invest in more new projects and return surplus amounts to shareholders if oil prices remained high. "The board of directors decided to allocate up to 40% of the additional cash flow generated above $60 per barrel to share buybacks," TotalEnergies said in a statement. It said it would also pay a second interim dividend of 0.66 euros per share for 2021, stable from the first quarter.

• Vale SA: The Brazilian iron ore miner presented mixed quarterly figures on Wednesday, helped by higher metal prices and strong sales but held back by rising freight costs and provisions related to the company's coal business. In a securities filing, Vale reported second-quarter net income of $7.586 billion, up over 600% from the same period a year ago, but slightly below the Refinitiv consensus estimate of $7.67 billion. The company benefited from significant demand and increasing prices for iron ore, its main product. Vale said it realized $182.80 per tonne of iron ore fines in the second quarter, up from $88.90 in the same period last year. The strengthening of the Brazilian real currency also had a positive impact.

• Valero Energy Corp: The oil refiner said its adjusted profit rose in the second quarter from the previous three-month period, as fuel consumption improved with the easing of coronavirus-related travel restrictions. The company's second-quarter refining margin was $1.97 billion, compared with $1.45 billion in the previous quarter. Its Chief Executive Officer Joe Gorder said the margin environment for refining was "weak, but otherwise improving." Valero, the first U.S. refiner to post quarterly results, said its refining throughput, or the amount of crude it processed, rose more than 16% sequentially to 2.8 million barrels per day. Adjusted net income attributable to Valero stockholders was $197 million, or 48 cents per share, for the three months ended June 30, compared with $140 million, or 34 cents per share, in the prior quarter.

IPOs

• Robinhood Markets Inc: The owner of the trading app which emerged as the go-to destination for retail investors speculating on this year's "meme' stock trading frenzy, raised $2.1 billion in its initial public offering on Wednesday. The IPO valued Robinhood at $31.8 billion, making it greater as a function of its revenue than many of its traditional rivals such as Charles Schwab, but the offering priced at the bottom of the company's indicated range. Robinhood said it sold 55 million shares in the IPO at $38 apiece, the low end of its $38 to $42 price range. This makes it one of the most valuable U.S. companies to have gone public year-to-date, amid a red-hot market for new listings. In an unusual move, Robinhood had said it would reserve between 20% and 35% of its shares for its users.

In Other News

• Boeing Co: Europe's Airbus took aim at one of Boeing's most profitable strongholds with plans for a freighter version of its A350 passenger jet, gambling that a pandemic boom in Internet shopping will outlast the global health crisis. Boeing has for years dominated the market for air freighters even as its European rival grabbed its crown as the world's largest maker of passenger jets. Airbus said its board had backed an A350 freighter to enter service in 2025 but did not immediately announce customers. The move is seen certain to trigger a response after Boeing Chief Executive Dave Calhoun on Wednesday listed developments including "I hope in the relatively near term" a freighter version of the 777X.

• Chevron Corp: All personnel at the company's Segundo, California oil refinery site were safe and accounted for after an unidentified substance was identified in an office, the company said on Wednesday. A building was evacuated at after the release of an unidentified "white powder" from a package delivered to the facility, a filing with the California Governor's Office of Emergency Services said. The employee who opened the package will be provided medical attention for exposure and local hazmat officials are responding, the filing said, quoting another filing with the U.S. National Response Center. Chevron said the "unknown substance" was found in an office at the 269,000 barrel-per-day El Segundo refinery.

• Dell Technologies Inc: The PC maker said it has stopped shipping some versions of its powerful gaming systems to California and five other states because the products do not meet new energy efficiency standards. The regulations affect "select configurations" of its Alienware Aurora R10 and R12 gaming PCs, Dell said in a statement sent to Reuters late on Tuesday. Gaming PCs made by Dell and others use powerful chips for cutting-edge graphics in video games. Those components mean gaming systems typically consume far more electricity than an average computer. Dell said it planned to have new models and configurations that "will meet or exceed these regulations, in line with our long-term focus to address energy and emissions." The Alienware Aurora Ryzen Edition R10 gaming desktop, which is among the affected products, costs $1,819.99, according to Dell's website.

• Equinor ASA & TotalEnergies SE: The two oil majors have agreed to sell their stakes in Venezuela's onshore Petrocedeno project to a unit of state oil firm PDVSA, which will become the sole owner, Equinor said. TotalEnergies separately confirmed the transaction and said it would mean a loss of $1.38 billion for the French company. "The Petrocedeno project aims to upgrade extra-heavy crude oil into lighter crude from the Orinoco Belt area," Equinor said in a statement. "The transaction supports Equinor's corporate strategy to focus its portfolio on international core areas and prioritised geographies where Equinor can leverage its competitive advantages," it said.

• Goodyear Tire & Rubber Co: Rights group Liberty Shared has asked United States customs authorities to investigate Malaysian operations of the American tyre maker over accusations of abusive labour practices, the group told Reuters. The southeast Asian nation employs millions of foreign workers and has faced growing accusations of exploitative labour practices, receiving the worst ranking this month in an annual U.S. report on human trafficking. "The conditions and treatment they have endured seem to satisfy the International Labour Organisation's forced labour indicators," the group's managing director, Duncan Jepson, said in its first comments to media on the issue. He added that he understood U.S. customs was pursuing the matter. Goodyear, one of the world's largest tyre makers, said it was not aware of any petition by Liberty Shared and had strong policies to protect human rights.

• Johnson & Johnson & Emergent BioSolutions Inc: The U.S. Food & Drug Administration extended the shelf life for the drugmaker's single-shot COVID-19 vaccine to six months from four-and-a-half months, the company said late Wednesday. The FDA's decision is based on data from ongoing studies, which showed the vaccine is stable at six months when refrigerated at 2 to 8 degrees Celsius (36–46 degrees Fahrenheit), the drugmaker said. In a letter to the company, the FDA said it had completed the review of data provided by J&J, and based on the information submitted, it concurs with the extension. Meanwhile, Emergent BioSolutions said on Wednesday it would resume production of Johnson & Johnson's COVID-19 vaccine at its troubled Baltimore facility, where operations were stopped in April after millions of doses were found to be contaminated.

• Twitter Inc, Alphabet Inc, Facebook Inc, Lyft Inc & Netflix Inc: Twitter is shutting its reopened offices in United States, while other big tech companies are making vaccination mandatory for on-campus employees, as the highly infectious Delta COVID-19 variant drives a resurgence in cases. Alphabet's Google and Facebook said on Wednesday all U.S. employees must get vaccinated to step into offices. Google is also planning to expand its vaccination drive to other regions in the coming months. San Francisco-based ride-hailing company Lyft, which had already made vaccinations mandatory for employees returning to the office, postponed its reopening to February from September. According to a Deadline report, streaming giant Netflix has also implemented a policy mandating vaccinations for the cast and crew on all its U.S productions.

• Uber Technologies Inc: SoftBank is selling about 45 million of its shares in Uber, a source familiar with the matter told Reuters on Wednesday. Any buyer will have a 30-day lockup period, the source said. The person added that the Japanese investment giant's motive was unrelated to the performance of Didi and Alibaba and SoftBank just thought it was a good time to cash out partially on its Uber stake and take some profit. SoftBank's stake in Uber is now down to less than 100 million shares, CNBC added, citing one source. "Gains from selling Uber shares should help to offset losses on other shares held in its portfolio to an extent," said Jun Kitazawa, strategist at Miki Securities.

• Walmart Inc & Amazon.com Inc: The companies have asked India's Supreme Court to restrain the country's antitrust body from seeking sensitive business information in an e-commerce investigation, according to filings seen by Reuters. The requests, in court documents which have not been made public, illustrate the level of concern at the two e-commerce giants over the investigation, which has prompted public spats between U.S. firms and the Indian government. In its investigation, the Competition Commission of India (CCI) sought a list of Amazon and Flipkart's top sellers, online discounts and pacts with smartphone makers, among 32 questions it asked on July 15, the documents showed. Flipkart told the Supreme Court the details sought reinforced its fear of the "invasive nature" of the investigation, and asked for both the information request and the overall investigation to be put on hold. Amazon made a similar request of the court, saying the watchdog had sought a "wealth of sensitive information within a deadline as short as 15 days."

ANALYSIS

As Fed tiptoes around tapering, investors look to Jackson Hole meeting for clarity

Investors looking for clear guidelines on when the Federal Reserve will begin tapering its massive bond purchases were left waiting Wednesday, with all eyes next on the annual Jackson Hole conference of central bankers in August.

ANALYSTS' RECOMMENDATION

• Align Technology Inc: Jefferies raises target price to $720 from $715, stating that the company continues to deliver exceptional growth ahead of already high expectations.

• Facebook Inc: Credit Suisse raises target price to $500 from $480, saying as video content now comprises half of the time spent, Facebook is in a position to see ongoing benefits to ad pricing.

• General Dynamics Corp: Credit Suisse raises target price to $198 from $182, reflecting a strong second quarter and positive Gulfstream outlook.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0830 (approx.) GDP advance for Q2: Expected 8.5%; Prior 6.4%

0830 (approx.) GDP sales advance for Q2: Prior 9.2%

0830 (approx.) GDP cons spending advance for Q2: Prior 11.4%

0830 (approx.) GDP deflator advance for Q2: Expected 5.4%; Prior 4.3%

0830 (approx.) Core PCE prices advance for Q2: Expected 5.9%; Prior 2.5%

0830 (approx.) PCE prices advance for Q2: Prior 3.7%

0830 (approx.) Initial jobless claims: Expected 380,000; Prior 419,000

0830 (approx.) Jobless claims 4-week average: Prior 385,250

0830 (approx.) Continued jobless claims: Expected 3.196 mln; Prior 3.236 mln

1000 Pending Homes Sales Index for June: Prior 114.7

1000 Pending home sales change mm for June: Expected 0.3%; Prior 8.0%

COMPANIES REPORTING RESULTS

A O Smith Corp: Expected Q2 earnings of 65 cents per share

Amazon.com Inc: Expected Q2 earnings of $12.30 cents per share

Arthur J Gallagher & Co: Expected Q2 earnings of $1.08 cents per share

Bio Rad Laboratories Inc: Expected Q2 earnings of $2.66 cents per share

CBRE Group Inc: Expected Q2 earnings of 77 cents per share

CMS Energy Corp: Expected Q2 earnings of 46 cents per share

Dexcom Inc: Expected Q2 earnings of 44 cents per share

Edison International: Expected Q2 earnings of $1.02 cents per share

Edwards Lifesciences Corp: Expected Q2 earnings of 56 cents per share

Eversource Energy: Expected Q2 earnings of 80 cents per share

Fortinet Inc: Expected Q2 earnings of 88 cents per share

Fortive Corp: Expected Q2 earnings of 60 cents per share

Gilead Sciences Inc: Expected Q2 earnings of $1.73 cents per share

Huntington Bancshares Inc: Expected Q2 earnings of 28 cents per share

Intercontinental Exchange Inc: Expected Q2 earnings of $1.16 cents per share

International Paper Co: Expected Q2 earnings of $1.06 cents per share

Kimco Realty Corp: Expected Q2 earnings of 12 cents per share

KLA Corp: Expected Q4 earnings of $3.99 cents per share

LKQ Corp: Expected Q2 earnings of 75 cents per share

Martin Marietta Materials Inc: Expected Q2 earnings of $3.84 cents per share

Masco Corp: Expected Q2 earnings of $1.04 cents per share

Mastercard Inc: Expected Q2 earnings of $1.75 cents per share

Mettler-Toledo International Inc: Expected Q2 earnings of $7.62 cents per share

Mohawk Industries Inc: Expected Q2 earnings of $3.68 cents per share

Republic Services Inc: Expected Q2 earnings of 96 cents per share

Skyworks Solutions Inc: Expected Q3 earnings of $2.14 cents per share

Southern Co: Expected Q2 earnings of 79 cents per share

T-Mobile US Inc: Expected Q2 earnings of 53 cents per share

Vertex Pharmaceuticals Inc: Expected Q2 earnings of $2.51 cents per share

Welltower Inc: Expected Q2 earnings of 10 cents per share

West Pharmaceutical Services Inc: Expected Q2 earnings of $1.74 cents per share

Westinghouse Air Brake Technologies Corp: Expected Q2 earnings of 95 cents per share

Xcel Energy Inc: Expected Q2 earnings of 56 cents per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Masco Corp: Q2 earnings conference call

0800 Merck & Co Inc: Q2 earnings conference call

0800 Teleflex Inc: Q2 earnings conference call

0800 Textron Inc: Q2 earnings conference call

0800 Molina Healthcare Inc: Q2 earnings conference call

0800 LKQ Corp: Q2 earnings conference call

0800 Tempur Sealy International Inc: Q2 earnings conference call

0800 Colfax Corp: Q2 earnings conference call

0800 Keurig Dr Pepper Inc: Q2 earnings conference call

0800 Nielsen Holdings PLC: Q2 earnings conference call

0800 CLARIVATE PLC: Q2 earnings conference call

0815 Raymond James Financial Inc: Q3 earnings conference call

0815 Citrix Systems Inc: Q2 earnings conference call

0815 Yum! Brands Inc: Q2 earnings conference call

0830 Baxter International Inc: Q2 earnings conference call

0830 Kimco Realty Corp: Q2 earnings conference call

0830 Westinghouse Air Brake Technologies Corp: Q2 earnings conference call

0830 MKS Instruments Inc: Q2 earnings conference call

0830 S&P Global Inc: Q2 earnings conference call

0830 American Tower Corp: Q2 earnings conference call

0830 Huntington Bancshares Inc: Q2 earnings conference call

0830 Hartford Financial Services Group Inc: Q2 earnings conference call

0830 Hershey Co: Q2 earnings conference call

0830 Comcast Corp: Q2 earnings conference call

0830 Alliance Data Systems Corp: Q2 earnings conference call

0830 Omnicell Inc: Q2 earnings conference call

0830 CBRE Group Inc: Q2 earnings conference call

0830 Carlyle Group Inc: Q2 earnings conference call

0830 Intercontinental Exchange Inc: Q2 earnings conference call

0830 KBR Inc: Q2 earnings conference call

0830 XPO Logistics Inc: Q2 earnings conference call

0830 Marriott Vacations Worldwide Corp: Q2 earnings conference call

0830 Element Solutions Inc: Q2 earnings conference call

0830 MSA Safety Inc: Q2 earnings conference call

0830 Blueprint Medicines Corp: Q2 earnings conference call

0830 Albertsons Companies Inc: Q1 earnings conference call

0830 Wyndham Hotels & Resorts Inc: Q2 earnings conference call

0830 Carrier Global Corp: Q2 earnings conference call

0900 Aflac Inc: Q2 earnings conference call

0900 Lawson Products Inc: Q2 earnings conference call

0900 Pilgrims Pride Corp: Q2 earnings conference call

0900 Annaly Capital Management Inc: Q2 earnings conference call

0900 Altria Group Inc: Q2 earnings conference call

0900 FTI Consulting Inc: Q2 earnings conference call

0900 Laboratory Corporation of America Holdings: Q2 earnings conference call

0900 Service Corporation International: Q2 earnings conference call

0900 Churchill Downs Inc: Q2 earnings conference call

0900 Northrop Grumman Corp: Q2 earnings conference call

0900 West Pharmaceutical Services Inc: Q2 earnings conference call

0900 Mastercard Inc: Q2 earnings conference call

0900 Oshkosh Corp: Q3 earnings conference call

0900 Ingersoll Rand Inc: Q2 earnings conference call

0900 ChampionX Corp: Q2 earnings conference call

0900 Steris plc: Annual Shareholders Meeting

0930 AllianceBernstein Holding LP: Q2 earnings conference call

0930 CMS Energy Corp: Q2 earnings conference call

0930 Ralph Lauren Corp: Annual Shareholders Meeting

0930 Tradeweb Markets Inc: Q2 earnings conference call

1000 International Paper Co: Q2 earnings conference call

1000 Selective Insurance Group Inc: Q2 earnings conference call

1000 EQT Corp: Q2 earnings conference call

1000 A O Smith Corp: Q2 earnings conference call

1000 Xcel Energy Inc: Q2 earnings conference call

1000 Tyler Technologies Inc: Q2 earnings conference call

1000 Valero Energy Corp: Q2 earnings conference call

1000 AGCO Corp: Q2 earnings conference call

1000 Mid-America Apartment Communities Inc: Q2 earnings conference call

1000 Regal Beloit Corp: Q2 earnings conference call

1000 Saia Inc: Q2 earnings conference call

1000 WEX Inc: Q2 earnings conference call

1000 Hilton Worldwide Holdings Inc: Q2 earnings conference call

1000 VICI Properties Inc: Q2 earnings conference call

1030 EMCOR Group Inc: Q2 earnings conference call

1100 Brunswick Corp: Q2 earnings conference call

1100 O'Reilly Automotive Inc: Q2 earnings conference call

1100 Molson Coors Beverage Co: Q2 earnings conference call

1100 United Rentals Inc: Q2 earnings conference call

1100 Tetra Tech Inc: Q3 earnings conference call

1100 PG&E Corp: Q2 earnings conference call

1100 Cincinnati Financial Corp: Q2 earnings conference call

1100 Martin Marietta Materials Inc: Q2 earnings conference call

1100 CyrusOne Inc: Q2 earnings conference call

1100 Invitation Homes Inc: Q2 earnings conference call

1200 CoreSite Realty Corp: Q2 earnings conference call

1200 Ares Management Corp: Q2 earnings conference call

1200 Antero Midstream Corp: Q2 earnings conference call

1300 Southern Co: Q2 earnings conference call

1300 Kilroy Realty Corp: Q2 earnings conference call

1300 UDR Inc: Q2 earnings conference call

1300 Ensign Group Inc: Q2 earnings conference call

1330 Magellan Midstream Partners LP: Q2 earnings conference call

1400 Cullen/Frost Bankers Inc: Q2 earnings conference call

1400 Avalonbay Communities Inc: Q2 earnings conference call

1500 Duke Realty Corp: Q2 earnings conference call

1500 AMC Entertainment Holdings Inc: Annual Shareholders Meeting

1630 Gilead Sciences Inc: Q2 earnings conference call

1630 Idacorp Inc: Q2 earnings conference call

1630 Exponent Inc: Q2 earnings conference call

1630 Edison International: Q2 earnings conference call

1630 Deckers Outdoor Corp: Q1 earnings conference call

1630 Power Integrations Inc: Q2 earnings conference call

1630 Seagen Inc: Q2 earnings conference call

1630 Skyworks Solutions Inc: Q3 earnings conference call

1630 T-Mobile US Inc: Q2 earnings conference call

1630 DexCom Inc: Q2 earnings conference call

1630 First Solar Inc: Q2 earnings conference call

1630 Fortinet Inc: Q2 earnings conference call

1630 Pinterest Inc: Q2 earnings conference call

1630 DoubleVerify Holdings Inc: Q2 earnings conference call

1700 Republic Services Inc: Q2 earnings conference call

1700 KLA Corp: Q4 earnings conference call

1700 Credit Acceptance Corp: Q2 earnings conference call

1700 National Instruments Corp: Q2 earnings conference call

1700 MicroStrategy Inc: Q2 earnings conference call

1700 Mettler-Toledo International Inc: Q2 earnings conference call

1700 Edwards Lifesciences Corp: Q2 earnings conference call

1700 Texas Roadhouse Inc: Q2 earnings conference call

1700 Dolby Laboratories Inc: Q3 earnings conference call

1700 LPL Financial Holdings Inc: Q2 earnings conference call

1700 Zendesk Inc: Q2 earnings conference call

1700 Twilio Inc: Q2 earnings conference call

1700 Upwork Inc: Q2 earnings conference call

1715 Arthur J Gallagher & Co: Q2 earnings conference call

1730 Amazon.com Inc: Q2 earnings conference call

1730 Vertex Pharmaceuticals Inc: Q2 earnings conference call

1730 Fortive Corp: Q2 earnings conference call

1800 Bio Rad Laboratories Inc: Q2 earnings conference call

EX-DIVIDENDS

A O Smith Corp: Amount $0.26

AGNC Investment Corp: Amount $0.12

Agree Realty Corp: Amount $0.21

Alliant Energy Corp: Amount $0.40

CIT Group Inc: Amount $0.35

Citizens Financial Group Inc: Amount $0.39

Costco Wholesale Corp: Amount $0.79

DuPont de Nemours Inc: Amount $0.30

First Citizens BancShares Inc (Delaware): Amount $0.47

Jacobs Engineering Group Inc: Amount $0.21

Morgan Stanley: Amount $0.70

National Retail Properties Inc: Amount $0.53

NiSource Inc: Amount $0.22

People's United Financial Inc: Amount $0.18

Pfizer Inc: Amount $0.39

Signature Bank: Amount $0.56

SL Green Realty Corp: Amount $0.30

STAG Industrial Inc: Amount $0.12

Targa Resources Corp: Amount $0.10

Unum Group: Amount $0.30

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| DEU: Duitse Werkloosheidswijziging (Jul) | Actueel: -91K Verwacht: -28K Vorige: -38K |

Markt wacht af rond topzone, AEX sterk herstel

Na de cijfers van dinsdag een verdeelde markt, de Nasdaq kon zich herpakken na de daling van dinsdag maar het was nu vooral de Dow Jones die een stapje terug moest. In Europa zien we een sterke sessie bij de AEX index terwijl de DAX wat blijft hangen rond de belangrijke steun-weerstand zone. Er was ook weinig reactie na het statement van de FED waar men verder wil met het opkoop programma.

Update 29 juli:

Veel beleggers willen weten wat de FED gaat doen de komende tijd en Powell gaf aan dat het aftellen is begonnen om te starten met het terugschroeven van de massale steun voor de Amerikaanse economie maar er werd natuurlijk geen duidelijke lijn getrokken zodat we niet kunnen weten wanneer dat zal starten? Men noemt zoiets ook om de pot draaien, je zegt iets maar in feite zeg je helemaal niets. De markten reageren er amper op deze keer.

Wel is het zo dat alles gestaag weer oploopt richting de records, zowel op Wall Street als in Europa waar de AEX er zo goed als op terecht komt. We zitten wel met een zware weerstand maar de afgelopen weken hebben we ook kunnen merken dat de markt er vrij makkelijk door weet te breken. De DAX daarentegen blijft wat achter momenteel, de index blijft wat hangen rond de belangrijke steun/weerstand zodat de index de komende sessies een richting zal moeten kiezen. Zelf wacht ik even af wat er gaat gebeuren rondom deze niveaus, de maand is zo goed als afgerond, nu op zoek naar een instap voor de komende maand.

We blijven nog midden in het cijferseizoen, gisteren kwam Facebook met cijfers en vanavond komt Amazon met cijfers. Dan hebben we alle TOP-5 bedrijven gehad, tot nu toe doet de markt er nog niet heel veel mee, deze aandelen blijven aan de bovenkant hangen.

Vanmorgen zien we wel een sterke sessie in Azié met een stevige plus bij de Hang Seng index. Ook China en Japan sluiten met een mooie plus.

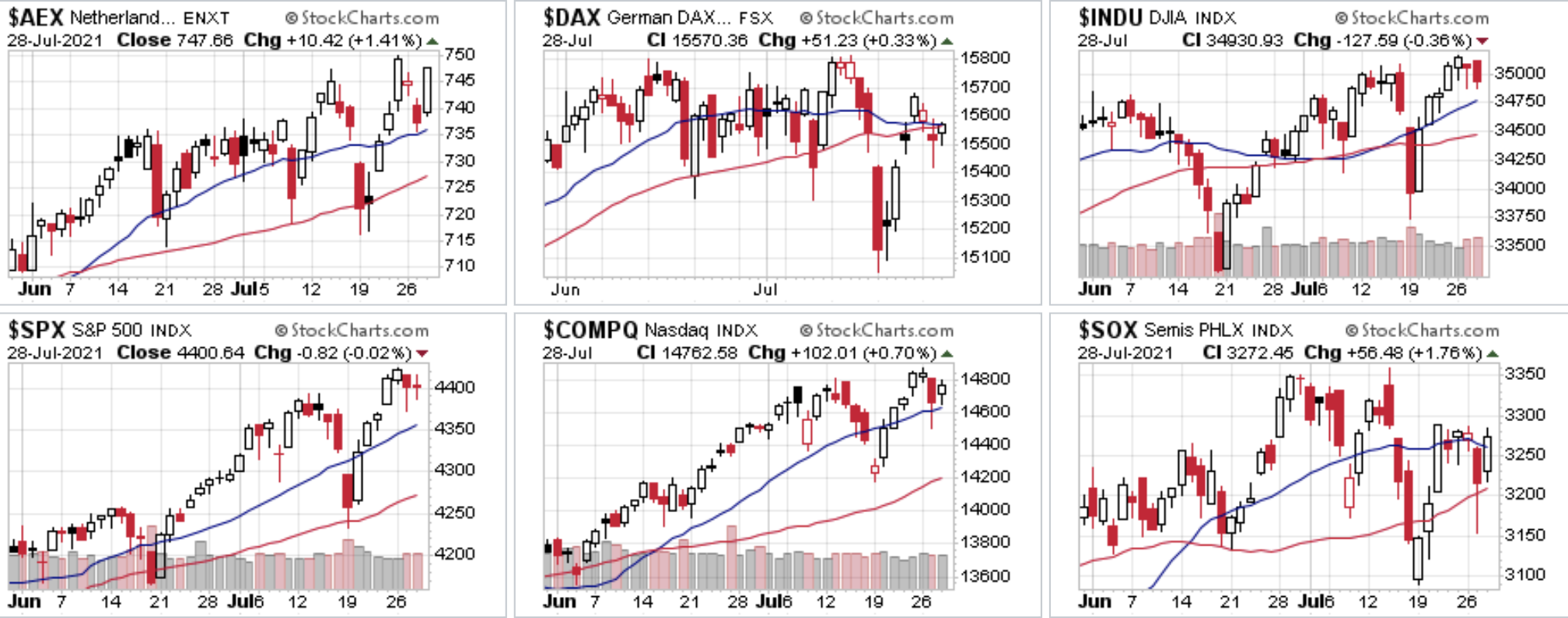

Hoe presteren de belangrijkste indices?

De Dow Jones verloor voor de 2e dag op rij en nu 127 punten, de S&P 500 verloor net geen punt. De tech indices lieten na de daling van dinsdag wat herstel zien, de Nasdaq won 0,7% terwijl de Nasdaq 100 met 0,4% winst afsloot. De cijfers van de grote 3 (Apple, Microsoft en Google) waren heel goed maar een echte reactie hebben we niet gezien. De aandelen sluiten met kleine verschillen de sessie af. Ook de SOX wist zich te herpakken, de index won 1,75%. Verder zien we dat de Dow Transport opnieuw wat verloor, de index sluit 0,6% lager gisteren.

Europa herpakt zich na de daling van dinsdag, de AEX en dan vooral weer door ASML sluit fors hoger en wint 10,5 punten om de topzone weer op te zoeken. De DAX won 51 punten terwijl de CAC 40 een winst van 77 punten liet zien gisteren.

Dinsdag wat winst genomen, deze maand sluiten we goed af:

Meedoen met US Markets Trading kan uiteraard door lid te worden, dinsdag heb ik winst genomen op de posities die open stonden zodat het resultaat er goed uitziet voor de maand juli. Ik blijf rustig en hou me aan het plan voor de komende periode, rustig naar kansen zoeken en waar het kan wat posities opnemen. Als u de signalen wilt ontvangen wordt dan vandaag nog lid via de nieuwe aanbieding voor €35 die loopt tot 1 oktober ...

Hieronder ziet u het resultaat voor de maand JULI en dat is nu voor de 8e maand op rij dat we winst behalen via alle signaaldiensten. Bij Guy Trading kijk ik ook naar wat aandelen waar er wat mee kan worden gedaan. Schrijf u dus op tijd in, ik zal snel weer een momentum kiezen om in te stappen met een paar posities op indexen.

De nieuwe aanbieding loopt tot 1 OKTOBER en dat voor €35 (Polleke Trading €45 en COMBI-Trading voor €75). Inschrijven kan via de link https://www.usmarkets.nl/tradershop

Hieronder het resultaat van deze maand (JULI) en dit jaar (2021):

Marktoverzicht:

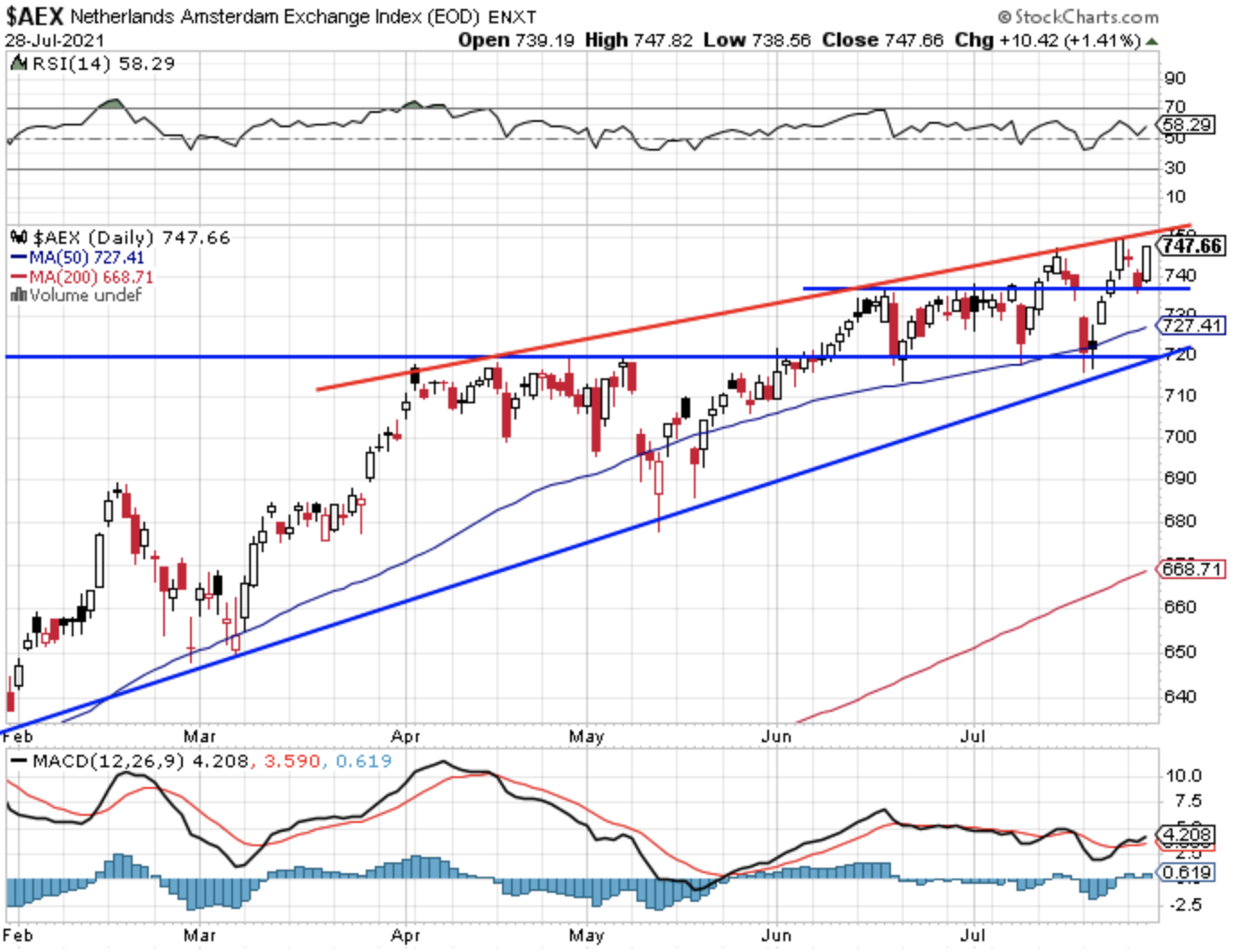

Technische conditie AEX:

De AEX kwam weer eens heel sterk voor de dag en dat kwam natuurlijk weer voor een groot deel door ASML dat opnieuw €20 hoger geraakte na dinsdag even een stapje terug te doen. En ja, als ASML €20 oploopt dan zie je het meteen aan de AEX, de index sloot 10,5 punten hoger en komt zo weer op een zucht van het record terecht. Rond de 749-751 punten zien we een zware weerstand zone nu, eerst de top van vrijdag met iets erboven de lijn over de toppen.

Steun nu de bodem van dinsdag rond de 736-738 punten, later zien we steun rond de 728, de 723 en de 717-718 punten. Het 50-daags gemiddelde zien we nu ook rond die 728 punten uitkomen zodat we daar nu toch een stevige steun zien.

Technische conditie DAX:

De DAX moest deze week even weer terug tot onder de 15.500 punten maar kon zich herpakken om zo weer net boven deze zeer belangrijke grens te sluiten. Steun blijft de 15.500 punten, later de 15.400 en de 15.300 punten. Verder zien we nog steun rond de 15.300, de 15.150 en de 15.000 punten. Weerstand wordt nu de 15.625 punten, later de topzone rond de 15.800 punten.

S&P 500 analyse:

De S&P 500 stopt de recordrace nu even en moest weer wat inleveren, de index moest terug na het aantikken van de lijn over de toppen waar er een zware weerstand wacht. Steun zien we nu eerst rond de 4400 punten, later de 4355 en de 4325 punten met daar net onder de 4290 punten en het 50-daags gemiddelde dat nu rond de 4272 punten uitkomt. Weerstand zien we rond de topzone die rond de 4420-4425 punten, later komt de 4450 punten als weerstand in beeld maar dan alleen bij een snelle uitbraak tot boven de zware weerstand.

Analyse Nasdaq:

De Nasdaq herpakt zich na de daling van dinsdag voor een deel en komt nu uit rond de eerste belangrijke weerstand die we rond de 14.750 punten zien. De top wacht nog zo'n 60 punten hoger rondom de 14.810 punten. De bodem van dinsdag rond 14.500 punten houden we nu in de gaten als eerste steun, later komt de 14.210 punten weer in beeld als een stevige steun door de oude toppen van februari en april.

De Nasdaq blijft volatiel en vooral ook via de subsectoren binnen deze index kwetsbaar, gisteren waren het vooral de semi-conductor aandelen die het goed deden, de grote 5 moesten een stapje terug na de cijfers van Apple, Microsoft en Google al viel dat nog mee.

Euro, olie en goud:

De euro zien we nu rond de 1,185 dollar, de prijs van een vat Brent olie komt uit op 74,1 dollar terwijl een troy ounce goud nu op 1815 dollar staat.

De LIVEBLOG en Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

Met vriendelijke groet,

Guy Boscart

TA Nasdaq, ING, Akzo, ASMI, Heineken en meer!

In de column van vandaag 29 juli komen maar liefst zes grafieken voorbij. Twee indices, te weten de Nasdaq en de AEX. Daarnaast vier aandelen, dat zijn ASM International, Akzo, ING en Heineken. Ik stel voor maar direct van start te gaan. Op de chart van de Nasdaq zie ik drie dingen. Natuurlijk zie…

Lees verder »