Liveblog Archief donderdag 30 april 2020

Cijfers Amazon en Apple

Apple Q1 20 Earnings Results:

Rev. $58.31b, Est. $54.25b; Boosts Buyback By $50b

- Apple Boosts Qtr Dividend To 82c/Share From 77c, Est. 80c

Slot 293,8 dollar, nabeurs 293 dollar

Amazon Q1 20 Earnings Results:

- EPS: $5.01 (Estimate: $6.27)

- Revenue: $75.5B (Estimate: $73.74B)

Slot all time high, nabeurs 130 dollar lager

8829.45 future nassie - nog 5u49 min

8829.45 future nassie - nog 5u49 min

Dow futures drop more than 200 points after earnings drive Apple and Amazon lower

Dow futures drop more than 200 points after earnings drive Apple and Amazon lower

bedankt coach - aex -nassie -dow

bedankt coach - aex -nassie -dow

ziet er goed uit voor de posties

ziet er goed uit voor de posties

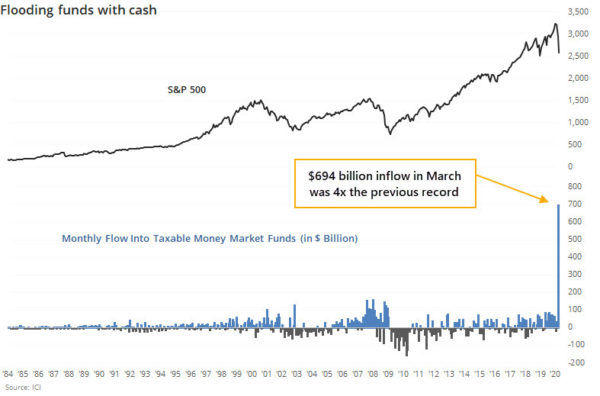

Recordcijfers voor wat betreft de economie, negatief wel te verstaan ... maar ook een absoluut record aan geld instroom op de money markets ... 700 miljard maar liefst, waar komt dat geld ineens vandaan? En kwam het wel op de juiste plek terecht? U mag het zeggen ...

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Eerste Aanvragen Werkloosheidsvergoeding | Actueel: 3.839K Verwacht: 3.500K Vorige: 4.442K |

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| EUROPA: Depositorente (Apr) | Actueel: -0,50% Verwacht: -0,50% Vorige: -0,50% | ||||

| EUROPA: Rentebesluit (Apr) | Actueel: 0,00% Verwacht: 0,00% Vorige: 0,00% | ||||

| EUROPA: Marginale beleningsfaciliteit ECB | Actueel: 0,25% Verwacht: Vorige: 0,25% |

Markt snapshot Wall Street

TOP NEWS

Millions more Americans likely filed claims for unemployment benefits last week, but the tide appears to be slowing, offering cautious hope of a peak in job losses from business closures and disruptions because of the novel coronavirus.

• Twitter tops sales estimates, sees rebound from Asia's eased coronavirus rules

Twitter said that its ads sales had slightly rebounded in Asia after a plunge due to the coronavirus outbreak and that it had accelerated work on tools to attract key advertisers, becoming the latest tech company to report a lighter blow from the pandemic than forecast.

• McDonald's profit slides as restaurants limit services

McDonald's reported a 16.7% slide in quarterly profit as most of its restaurants across the globe limited their services to deliveries and take-aways to halt the spread of the coronavirus pandemic.

• Shell cuts dividend for first time since World War Two

Royal Dutch Shell cut its dividend for the first time since World War Two as the energy company retrenched in the face of an unprecedented drop in oil demand due to the coronavirus pandemic.

• Already pumping cash at record pace, ECB under pressure to act again

Just weeks after unveiling a massive stimulus scheme, the European Central Bank is under pressure again to deploy even more firepower to prop up an economy that could shrink by a tenth this year.

BEFORE THE BELL

The Nasdaq stock index futures were higher on upbeat earnings from Facebook and Tesla, with investors awaiting weekly jobless claims data. European shares edged lower after a rare dividend cut by Royal Dutch Shell. Asian stocks rose, boosted by encouraging early results from a COVID-19 treatment trial. The euro was little changed ahead of the latest policy decision by the European Central Bank. Oil prices jumped, lifted by signs that the U.S. crude glut is not growing as quickly as expected. Gold prices rose. Major earnings from Apple, Amazon.com, Gilead Sciences and Visa will also be on the tap for the day.

STOCKS TO WATCH

Results

• Cigna Corp (CI). The company reported better-than-expected quarterly profit and stuck to its profit target for the year as it benefited from strong sales at its Express Scripts pharmacy benefits business (PBM). Cigna said it continues to expect 2020 adjusted income from operations to be between $18 and $18.60 per share. Analysts were expecting $18.32 per share. The insurer, which closed its $52 billion acquisition of Express Scripts in 2018, said adjusted revenue from the unit that houses the PBM rose nearly 21% to $27.17 billion. Excluding items, it earned $4.69 per share, beating the average analyst estimate of $4.35. Net income fell to $1.18 billion, or $3.15 per share, in the quarter ended March 31, from $1.37 billion, or $3.56 per share, a year earlier.

• Comcast Corp (CMCSA). The company reported its best quarter of broadband net additions in 12 years, but revenue fell shy of Wall Street's estimate as the coronavirus pandemic hurt advertising. In the first quarter, Comcast gained 477,000 broadband subscribers, beating analysts’ average estimate of 364,000 net additions, according to research firm FactSet. Revenue from the business grew 9.3% to $5 billion. Comcast reported first-quarter revenue of $26.61 billion, missing the Wall Street consensus estimate of $26.75 billion. Net income attributable to Comcast fell to $2.15 billion, or 46 cents per share, from $3.55 billion, or 77 cents per share, a year earlier.

• Dow Inc (DOW). The company posted a drop in adjusted quarterly profit as its margins were squeezed by a double whammy of lower selling prices for its chemicals after a plunge in crude prices and a coronavirus-led demand hit in some end-markets. Dow said volumes fell 2% and prices declined by 8%. Net income available to Dow stockholders rose about 36% to $239 million on a pro forma basis, as the year-earlier quarter included higher charges related to its merger and later split from DowDupont. Excluding items, net operating income fell to $439 million, or 59 cents per share, in the first quarter ended March 31 from $729 million, or 98 cents per share, a year earlier.

• EBay Inc (EBAY). The company forecast current-quarter revenue above Wall Street estimates on Wednesday, as the e-commerce company benefited from a surge in online orders with people staying indoors because of the COVID-19 pandemic. The company said it expects second-quarter revenue in the range of $2.38 billion to $2.48 billion, while analysts were expecting $2.32 billion. First quarter revenue fell 2% to $2.37 billion, but was above analysts' average estimate of $2.32 billion. Net income from continuing operations fell 6% to $485 million for the first quarter, from a year earlier.

• Facebook Inc (FB). The company beat analysts' estimates for quarterly revenue on Wednesday and said it has seen "signs of stability" for sales in April after a plunge in March, in yet another signal that tech giants may weather the coronavirus-induced economic collapse better than other sectors. Facebook said advertising revenue was roughly flat in the first three weeks of April compared with the same period last year, a tentative early sign of recovery following a "steep decrease" in revenue in March as lockdowns took effect worldwide to slow the spread of the virus. Revenue growth was 18% in the first quarter, Facebook's slowest ever by a wide margin, although it beat analysts' expectations for growth of 16%. Ad sales, which make up nearly all of Facebook's revenue, rose 17% to $17.44 billion.

• McDonald's Corp (MCD). The company reported a 16.7% slide in quarterly profit as most of its restaurants across the globe limited their services to deliveries and take-aways to halt the spread of the coronavirus pandemic. The burger chain, which had pre-announced a 3.4% fall in first-quarter comparable store sales earlier this month, said net income fell to $1.11 billion, or $1.47 per share, in the first quarter ended March 31 from $1.33 billion, or $1.72 per share, a year earlier. Revenue fell 6.2% to $4.71 billion, compared with Wall Street estimates of $4.65 billion.

• Microsoft Corp (MSFT). The company on Wednesday beat Wall Street sales and profit expectations, powered by sharp demand for its Teams chat and online meeting app and Xbox gaming services as the world shifted to working and playing from home because of the novel coronavirus pandemic. For the fiscal fourth quarter, Microsoft gave business-unit forecasts that were below analyst estimates, predicting tough times for LinkedIn and some small-business software sales. Microsoft also benefited from strong demand for its Teams collaboration software, which Nadella said on a conference call now has 75 million users and competes with Zoom Video Communications and Slack Technologies. Third-quarter sales were helped by demand for cloud services. However, Azure growth slowed to 59% from 62% in the second quarter, which company officials said was a result of how large the business has become. Revenue rose 15% to $35.02 billion in the third quarter, beating estimates of $33.66 billion. Net income rose to $10.75 billion, or $1.40 per share, from $8.81 billion, or $1.14 per share, a year earlier.

• Qualcomm Inc (QCOM). The company on Wednesday forecast current-quarter revenue largely in line with expectations as it signed more contracts for 5G phones, which use higher-priced chips, at a time when the COVID-19 pandemic has disrupted production channels and led to a fall in demand for smartphones. The company also beat Wall Street estimates for second-quarter profit and revenue on the back of higher prices for its mobile chips, sending its shares up 5% in trading after the bell. Qualcomm forecast total revenue of between $4.4 billion and $5.2 billion for its third quarter. Analysts had estimated revenue of $4.89 billion. Total revenue for the company rose about 5% to $5.22 billion in the second quarter, beating analysts' estimates of $5.03 billion.

• Tesla Inc (TSLA). The company’s outspoken CEO Elon Musk on Wednesday called sweeping U.S. stay-at-home restrictions to curtail the coronavirus outbreak "fascist" as the electric carmaker posted its third quarterly profit in a row. His remarks overshadowed an otherwise successful quarter that took many investors by surprise as automaker peers were hit by a slump in consumer demand and forced factory shutdowns. Tesla said it expected production at its vehicle factories in Fremont, California and in Shanghai, China to ramp up gradually through the second quarter. The company said operations at its Shanghai plant were progressing better than expected, with production rates of its Model 3 sedan expected to hit 4,000 units per week, or 200,000 per year, by mid-2020. Excluding items, Tesla posted a profit of $1.24 per share. Analysts had expected a loss of 36 cents per share.

• Twitter Inc (TWTR). The company said that its ads sales had slightly rebounded in Asia after a plunge due to the coronavirus outbreak and that it had accelerated work on tools to attract key advertisers, becoming the latest tech company to report a lighter blow from the pandemic than forecast. The social media company announced greater first-quarter revenue and a smaller loss than financial analysts had expected. Daily users who can view ads grew 24% to 166 million, about 2 million above estimates, as people looked to Twitter for information related to the virus. Twitter's first-quarter revenue was $808 million, or 3% growth compared with a year earlier, above the average estimate of $776 million among analysts tracked by Refinitiv. Twitter lost $8 million in the first quarter, or a penny per share, better than the average estimate of two cents per share.

In Other News

• Apple Inc (AAPL). Orange is in intense discussions with Apple over developing France's smartphone app for tracing people who are at risk of coronavirus infection, the French company's CEO Stephane Richard said. Countries are rushing to develop apps to assess the risk that one person can infect another with the coronavirus, helping to isolate those who could spread it. "There are meetings almost every day. It's not a done deal yet (...) but we have a discussion dynamic with Apple that is not bad," Richard added.

• AstraZeneca PLC (AZN). The company joined forces with the University of Oxford to help develop, produce and distribute a potential COVID-19 vaccine, as drugmakers around the world race to find a solution to the deadly disease. UK Business Secretary Alok Sharma welcomed the tie-up as a vital step to making the Oxford vaccine available as soon as possible if it succeeds in clinical trials.

• Boeing Co (BA). S&P Global on Wednesday lowered Boeing's credit rating closer to junk due to the expected impact of the coronavirus on the U.S. planemaker's earnings and cash flow over the next few years.S&P, which downgraded its rating to 'BBB-/A-3' from 'BBB/A-2', said it expects a significant decline in cash flow as Boeing tackles lower aircraft deliveries and aftermarket sales resulting from the impact of the coronavirus on air travel.

• Chevron Corp (CVX) & Exxon Mobil Corp (XOM). Nine companies including Chevron, Exxon Mobil and Alon USA have agreed to rent space to store 23 million barrels of crude in the U.S. emergency oil reserve, a U.S. official said on Wednesday, as the Trump administration tries to help energy firms deal with the crash in oil prices. The Department of Energy, said on April 2 it would offer to oil companies 30 million barrels of space in the Strategic Petroleum Reserve, or SPR. Later in the month, it said that companies were in contract negotiations for only 23 million barrels of space.

• Credit Suisse Group AG (CS). Shareholder support for Credit Suisse Chairman Urs Rohner dropped to its lowest level ever, as Rohner told the Swiss bank's annual meeting that its search for his successor was well under way. Shareholders voted to re-elect Rohner for a final term in office with 77.5% support. The 21.6% opposition he faced was the highest in his nearly a decade as chairman. It follows a spying scandal that cost former CEO Tidjane Thiam his role in February and divided investors over who ultimately should bear responsibility in the bank's highest ranks.

• Dine Brands Global Inc (DIN). Two influential proxy advisory firms said Dine Brands Global shareholders should reject a proposal to spin off its IHOP pancake house chain in a rebuke to activist investment firm JCP Investment Partnership which proposed the plan. Institutional Shareholder Services and Glass Lewis both recommended votes against JCP's shareholder proposal that Glendale, California-based Dine hire an investment bank in order to turn IHOP into a separately traded public company, the two reports, which were seen by Reuters on Wednesday, say. The firms' recommendations carry considerable weight with investors who will cast votes at Dine's annual meeting on May 12.

• Facebook Inc (FB). The social media giant will allow users in the United States and Canada to transfer photos and videos to a rival tech platform for the first time - a step that could assuage antitrust concerns by giving users an option to easily leave the company's services, the social media network said. The tool lets Facebook users transfer data stored on its servers directly to another photo storage service, in this case Google Photos - a feature known as data portability. U.S. and Canadian users will be able to access the tool through their Facebook accounts starting Thursday. The function has already been launched in several countries including in Europe and Latin America.

• Goldman Sachs Group Inc (GS). The company on Wednesday said it had created a council of traders, sales staff and others to share expertise on sustainable finance and investing, as clients search for ways to achieve climate-change investment commitments despite the twin shocks of the coronavirus and the sliding price of oil. The Global Markets Division Sustainable Solutions Council's roughly 20 members will meet every few weeks to share strategies and build data sets and analytics tools, said Stacy Selig, co-head of Goldman's global markets structuring and solutions business.

• HC2 Holdings Inc (HCHC). Proxy adviser Glass Lewis on Wednesday backed activist investor MG Capital by recommending that HC2 Holdings shareholders replace all board members with the investment firm's founder Michael Gorzynski and five other nominees. The backing, a rebuke of Philip Falcone, a former hedge fund manager who is now HC2's chief executive, is noteworthy as proxy advisers rarely recommend dissidents be awarded a majority of board seats. Glass Lewis has also said it does not like recommending people directly associated with the dissident, such as a founder or a partner.

• PolyOne Corp (POL). Swiss speciality chemicals maker Clariant aims to finalise the $1.6 billion sale of its masterbatches unit to PolyOne by September, Chairman Hariolf Kottmann said, dismissing concerns the coronavirus outbreak could derail the deal. A $1.03 billion shareholder payout hinges on disposal of the unit that makes colours, additives and concentrates for plastics. U.S.-based PolyOne indicated last week it remains committed to the transaction.

• Fiat Chrysler Automobiles NV (FCA). The company said its Italian network of approved dealers and mechanic workshops would reopen on May 4, when the country is set to start lifting a national lockdown put in place to limit the spread of the coronavirus. A vast majority of FCA's dealers and workshops in Italy are run by private operators, while the automaker directly operates some large ones in big cities.

• Tyson Foods Inc (TSN). The company is halting operations at a beef facility in Dakota City, Nebraska until May 4 to complete a deep cleaning of the plant amid the coronavirus outbreak, a unit of the largest U.S. meat supplier said on Wednesday. The facility employs 4,300 people and is among the largest beef processing plants in the United States, producing enough beef in one day to feed 18 million people, according to Tyson.

• Visa Inc (V). The company along with Safaricom have agreed a deal which will connect the Kenyan telecom operator's M-Pesa financial services platform with Visa's global network of merchants and cards. Under the deal, which requires regulatory approval, announced by both companies, M-Pesa's 24 million users and 173,000 local merchants will be linked to Visa's 61 million merchants and its more than 3 billion cards.

• Zoom Video Communications Inc (ZM). The video conferencing app does not have 300 million daily active users, the company admitted to the Verge, saying it "unintentionally" referred to daily meeting participants as users in a blog post. The Zoom blog from April 22, in which the video conferencing app announced a 50% jump in users over three weeks, has now been edited to say that the company had surpassed "300 million daily Zoom meeting participants" instead of "more than 300 million daily users".

ANALYSIS

'W-shaped' recovery may be too optimistic, Fed's Powell suggests

Federal Reserve Chair Jerome Powell has sketched out an altogether bumpier ride for the U.S. economy than many are predicting - one that sees business activity stop and start for months to come, until an effective treatment or vaccine for the novel coronavirus can be found.

ANALYSTS' RECOMMENDATION

• Facebook Inc (FB). UBS raises price target to $242 from $223, to reflect improved operating estimates as the company's business performance in March and April exceeded prior assumptions.

• Mastercard Inc (MA). Cowen and Company raises price target to $297 from $280, citing the company’s superior growth profile relative to the payments peer group as well as the defensiveness of its business model.

• Microsoft Corp (MSFT). RBC raises price target to $196 from $190, after the company reported a notably strong quarter.

• Spotify Technology SA (SPOT). RBC raises price target to $192 from $191, based on the company’s consistent trends on premium revenue growth, steady gross margin expansion, robust premium subscriber and monthly active users growth.

• Tesla Inc (TSLA). Piper Sandler raises price target to $939 from $819, following a stronger-than-expected performance in Q1.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0830 Personal income mm for Mar: Expected -1.5%; Prior 0.6%

0830 Personal consumption real mm for Mar: Prior 0.1%

0830 Consumption, adjusted mm for Mar: Expected -5.0%; Prior 0.2%

0830 Core PCE price index mm for Mar: Expected -0.1%; Prior 0.2%

0830 Core PCE price index yy for Mar: Expected 1.6%; Prior 1.8%

0830 PCE price index mm for Mar: Prior 0.1%

0830 PCE price index yy for Mar: Prior 1.8%

0830 Initial jobless claims: Expected 3,500,000; Prior 4,427,000

0830 Jobless claims 4-week average: Prior 5,786,500

0830 Continued jobless claims: Expected 19.238 mln; Prior 15.976 mln

0830 Employment wages qq for Q1: Prior 0.7%

0830 Employment benefits qq for Q1: Prior 0.5%

0830 Employment costs for Q1: Expected 0.6%; Prior 0.7%

0945 (approx.) Chicago PMI for Apr: Expected 38.0; Prior 47.8

1200 (approx.) Dallas fed PCE for Mar: Prior 1.4%

COMPANIES REPORTING RESULTS

Amazon.com Inc (AMZN). Expected Q1 earnings of $6.25 per share

American Airlines Group Inc (AAL). Expected Q1 loss of $2.33 per share

Amgen Inc (AMGN). Expected Q1 earnings of $3.76 per share

Apple Inc (AAPL). Expected Q2 earnings of $2.26 per share

Arthur J Gallagher & Co (AJG). Expected Q1 earnings of $1.73 per share

Baxter International Inc (BAX). Expected Q1 earnings of 72 cents per share

Concho Resources Inc (CXO). Expected Q1 earnings of 66 cents per share

Eastman Chemical Co (EMN). Expected Q1 earnings of $1.72 per share

Edison International (EIX). Expected Q1 earnings of 79 cents per share

Fortive Corp (FTV). Expected Q1 earnings of 71 cents per share

Fortune Brands Home & Security Inc (FBHS). Expected Q1 earnings of 67 cents per share

Franklin Resources Inc (BEN). Expected Q2 earnings of 42 cents per share

Gilead Sciences Inc (GILD). Expected Q1 earnings of $1.57 per share

Illumina Inc (ILMN). Expected Q1 earnings of $1.25 per share

Intercontinental Exchange Inc (ICE). Expected Q1 earnings of $1.24 per share

Kellogg Co (K). Expected Q1 earnings of 95 cents per share

MGM Resorts International (MGM). Expected Q1 loss of 35 cents per share

Parker-Hannifin Corp (PH). Expected Q3 earnings of $2.24 per share

Public Storage (PSA). Expected Q1 earnings of $1.71 per share

Resmed Inc (RMD). Expected Q3 earnings of $1.05 per share

Stryker Corp (SYK). Expected Q1 earnings of $1.69 per share

United Airlines Holdings Inc (UAL). Expected Q1 loss of $3.47 per share

Visa Inc (V). Expected Q2 earnings of $1.35 per share

Western Digital Corp (WDC). Expected Q3 earnings of 93 cents per share

Whirlpool Corp (WHR). Expected Q1 earnings of $2.63 per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Abiomed Inc (ABMD). Q4 earnings conference call

0800 Dow Inc (DOW). Q1 earnings conference call

0800 LKQ Corp (LKQ). Q1 earnings conference call

0800 Nielsen Holdings PLC (NLSN). Q1 earnings conference call

0800 Stanley Black & Decker Inc (SWK). Q1 earnings conference call

0800 Syneos Health Inc (SYNH). Q1 earnings conference call

0800 Teleflex Inc (TFX). Q1 earnings conference call

0800 Textron Inc (TXT). Q1 earnings conference call

0800 Twitter Inc (TWTR). Q1 earnings conference call

0815 Raymond James Financial Inc (RJF). Q2 earnings conference call

0830 AGNC Investment Corp (AGNC). Q1 earnings conference call

0830 American Airlines Group Inc (AAL). Q1 earnings conference call

0830 Baxter International Inc (BAX). Q1 earnings conference call

0830 CACI International Inc (CACI). Q3 earnings conference call

0830 Carlyle Group Inc (CG). Q1 earnings conference call

0830 Cigna Corp (CI). Q1 earnings conference call

0830 Comcast Corp (CMCSA). Q1 earnings conference call

0830 Goldman Sachs Group Inc (GS). Annual Shareholders Meeting

0830 IDEXX Laboratories Inc (IDXX). Q1 earnings conference call

0830 Intercontinental Exchange Inc (ICE). Q1 earnings conference call

0830 JBG SMITH Properties (JBGS). Annual Shareholders Meeting

0830 Kraft Heinz Co (KHC). Q1 earnings conference call

0830 Marsh & McLennan Companies Inc (MMC). Q1 earnings conference call

0830 Mcdonald's Corp (MCD). Q1 earnings conference call

0900 Aflac Inc (AFL). Q1 earnings conference call

0900 Altria Group Inc (MO). Q1 earnings conference call

0900 Bio-Techne Corp (TECH). Q3 earnings conference call

0900 Cabot Oil & Gas Corp (COG). Annual Shareholders Meeting

0900 FTI Consulting Inc (FCN). Q1 earnings conference call

0900 Generac Holdings Inc (GNRC). Q1 earnings conference call

0900 Hartford Financial Services Group Inc (HIG). Q1 earnings conference call

0900 Pilgrims Pride Corp (PPC). Q1 earnings conference call

0900 Service Corporation International (SCI). Q1 earnings conference call

0930 Kellogg Co (K). Q1 earnings conference call

1000 Annaly Capital Management Inc (NLY). Q1 earnings conference call

1000 Capital One Financial Corp (COF). Annual Shareholders Meeting

1000 Church & Dwight Co Inc (CHD). Q1 earnings conference call

1000 Hubbell Inc (HUBB). Q1 earnings conference call

1000 International Paper Co (IP). Q1 earnings conference call

1000 NRG Energy Inc (NRG). Annual Shareholders Meeting

1000 Polaris Inc (PII). Annual Shareholders Meeting

1000 Tyler Technologies Inc (TYL). Q1 earnings conference call

1000 Welltower Inc (WELL). Annual Shareholders Meeting

1030 Crown Castle International Corp (CCI). Q1 earnings conference call

1100 Archer Daniels Midland Co (ADM). Q1 earnings conference call

1100 Corning Inc (GLW). Annual Shareholders Meeting

1100 Cullen/Frost Bankers Inc (CFR). Q1 earnings conference call

1100 CyrusOne Inc (CONE). Q1 earnings conference call

1100 Franklin Resources Inc (BEN). Q2 earnings conference call

1100 Globe Life Inc (GL). Annual Shareholders Meeting

1100 Medical Properties Trust Inc (MPW). Q1 earnings conference call

1100 Molson Coors Beverage Co (TAP). Q1 earnings conference call

1100 Parker-Hannifin Corp (PH). Q3 earnings conference call

1100 Tetra Tech Inc (TTEK). Q2 earnings conference call

1100 United Rentals Inc (URI). Q1 earnings conference call

1100 VICI Properties Inc (VICI). Annual Shareholders Meeting

1130 Moody's Corp (MCO). Q1 earnings conference call

1200 Church & Dwight Co Inc (CHD). Annual Shareholders Meeting

1200 ConocoPhillips (COP). Q1 earnings conference call

1200 CoreSite Realty Corp (COR). Q1 earnings conference call

1300 Arrow Electronics Inc (ARW). Q1 earnings conference call

1300 Kilroy Realty Corp (KRC). Q1 earnings conference call

1300 Southern Co (SO). Q1 earnings conference call

1400 Planet Fitness Inc (PLNT). Annual Shareholders Meeting

1500 Duke Realty Corp (DRE). Q1 earnings conference call

1500 EOG Resources Inc (EOG). Annual Shareholders Meeting

1500 Valero Energy Corp (VLO). Annual Shareholders Meeting

1600 Cadence Design Systems Inc (CDNS). Annual Shareholders Meeting

1630 Altice USA Inc (ATUS). Q1 earnings conference call

1630 Edison International (EIX). Q1 earnings conference call

1630 Fortune Brands Home & Security Inc (FBHS). Q1 earnings conference call

1630 Gilead Sciences Inc (GILD). Q1 earnings conference call

1630 Idacorp Inc (IDA). Q1 earnings conference call

1630 ResMed Inc (RMD). Q3 earnings conference call

1630 Seattle Genetics Inc (SGEN). Q1 earnings conference call

1630 Stryker Corp (SYK). Q1 earnings conference call

1630 Western Digital Corp (WDC). Q3 earnings conference call

1700 Apple Inc (AAPL). Q2 earnings conference call

1700 Columbia Sportswear Co (COLM). Q1 earnings conference call

1700 Illumina Inc (ILMN). Q1 earnings conference call

1700 LPL Financial Holdings Inc (LPLA). Q1 earnings conference call

1700 MGM Resorts International (MGM). Q1 earnings conference call

1700 National Instruments Corp (NATI). Q1 earnings conference call

1700 Solarwinds Corp (SWI). Q1 earnings conference call

1700 SS&C Technologies Holdings Inc (SSNC). Q1 earnings conference call

1700 Visa Inc (V). Q2 earnings conference call

1700 Zendesk Inc (ZEN). Q1 earnings conference call

1715 Arthur J Gallagher & Co (AJG). Q1 earnings conference call

1730 Amazon.com Inc (AMZN). Q1 earnings conference call

1730 Amgen Inc (AMGN). Q1 earnings conference call

1730 Fortive Corp (FTV). Q1 earnings conference call

EXDIVIDENDS

AES Corp (AES). Amount $0.14

Ally Financial Inc (ALLY). Amount $0.19

Aon PLC (AON). Amount $0.44

Caseys General Stores Inc (CASY). Amount $0.32

Costco Wholesale Corp (COST). Amount $0.70

Hasbro Inc (HAS). Amount $0.68

NRG Energy Inc (NRG). Amount $0.30

People's United Financial Inc (PBCT). Amount $0.18

Realty Income Corp (O). Amount $0.23

Videoblog: Markt, cijfers en gekte

Een kort overzicht met waar we staan en wat ik er van denk ...

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| EUROPA: CPI (Jaarlijks) (Apr) | Actueel: 0,4% Verwacht: 0,1% Vorige: 0,7% |

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| DEU: Duitse Werkloosheidswijziging (Apr) | Actueel: 373K Verwacht: 76K Vorige: 1K |

Shell lager, AEX moet mee met Wall Street maar met moeite

Even laten weten hoe ik me voel nu, op zich prima na een nacht slapen maar ik ben hoe dan ook een slechte verliezer, gisteren moest ik de posities sluiten met wat verlies en dat maakt me altijd wat chagrijnig, ik zou zeggen, vraag het maar aan mijn vrouw 😀😀

Maar goed, een nachtje slapen doet goed, want zoals jullie weten lukt mij dat altijd goed, is ook nodig om de ballast van u af te werpen en zeker wanneer je bezig bent met de beurs en je weet dat er een heleboel mensen met je meegaan als je een signaal afgeeft naar de leden. Ik kan u verzekeren dat als je zoiets doet en je beseft dat velen op je zitten te wachten het zwaar op je kan wegen. Daarom die chagrijn als ik dan verlies moet nemen. Onderschat het dus niet, daarom zie je ook dat er niet veel zijn die zoiets vol kunnen houden, ik doe het al sinds 1998 en ik ben er nog altijd. Met vallen en opstaan, goeie en slechte tijden, allerlei soorten markten voor de kiezen gekregen, maar 2020 ... ik ben er nog steeds en ik doe het graag ...

Gisteren was het weer een keer zo'n dag die zeer moeilijk was, zijn er 4 tot 5 van per jaar, ik noem het een sessie waar men de shorters een touw om de nek knoopt, het is dan aan mij of aan u om op tijd te ontsnappen, dat heb ik dan ook gedaan wat betreft Trading ... Even de zaken herschikken wat betreft de stand van zaken en vooral ook in het hoofd, voor mij zoals ik aangaf met de nodige chagrijn maar ach, dat is maar voor even. Ik weet dat velen dan niet de kracht in zich hebben om ook verlies te nemen, verlies nemen doet pijn, veel pijn maar soms moet het ... Doe het dan ook want je moet niet de slaaf worden van uzelf, u zelf pijn willen doen, of meer pijn in dat geval ...

De markt dan, de Amerikanen kijken nergens naar, wij hier in Europa zijn wat dat betreft veel voorzichtiger, we proberen wel mee te komen maar of dat lukt is de vraag zoals we zien vanmorgen. Het was een feest op Wall Street, Facebook nabeurs richting de hoogste stand ooit, Microsoft is er bijna met de indicaties nabeurs en Tesla (nog steeds 5 dollar verlies op jaarbasis volgens de gegevens via Marketwatch) staat voorbeurs op 870 dollar wat ook amper onder de hoogste stand ooit is. Facebook en Microsoft laten nu een koers winst verhouding zien van 32 bij de slotstand van gisteren. Het is maar dat u het weet, wat betreft de waarderingen die er nu zijn. Wel te verstaan, Tesla maakt nog niet eens winst, zoals ik aangaf 5 dollar verlies per jaar ... En vrijwel niemand koopt er nu een auto ...

Goed, dat terzijde, nu maar eens zien wat we kunnen doen vandaag, of maandag, ik zal wel wat keuzes maken waar het kan. De koersen lopen al wat terug maar ik zou graag de start van Wall Street willen afwachten, even geduld nog dus wat betreft de leden die op een nieuw signaal wachten. Let wel, bij Trading lopen er nu geen posities, bij de aandelen portefeuille heb ik wel nog 4 posities open staan die ik probeer wat langer aan te houden ... Meedoen met Trading en de signalen niet missen?

Wake-up call: Markt dendert door omhoog

Goedemorgen

Het lijkt er sterk op dat alles al achter de rug is wat betreft de beurzen, de stijging van gisteren liet het gemak weer eens zien waarmee de indices omhoog gaan op nieuwsfeiten die wel positief overkomen. De economie moet nog wel weer op gang komen maar dat zal wel meteen weer in orde zijn zo blijkt uit het gedrag van beleggers. Aan de andere kant is er de FED die gisteren aangaf oneindig de economie te zullen steunen waar dat nodig is, u leest het goed, oneindig. Dus als iedereen in de VS beslist om niet meer te gaan werken dan zal de FED wel zorgen dat men op tijd geld krijgt, zo gaat dat niet, dat kun je even volhouden maar oneindig? We gaan het zien, in ieder geval kwamen er gisteren wel heel wat berichten voorbij die al reden werden genomen om door te stijgen. Zo won de Nasdaq 300 punten, nabeurs nog 100 erbij en vanmorgen zien we er nog 100 bij via de futures, in totaal dus 500 punten sinds de start van de sessie gisteren erbij. De cijfers nabeurs van Microsoft, Facebook en Tesla werden zwaar beloont nabeurs ...

Het is maar goed dat ik de posities heb gesloten gisteren, had al zo'n vreemd voorgevoel dat het niet de dag zou worden om ze te laten staan, het waren shorts. Vandaag voorzie ik mogelijkheden om weer in te stappen maar dan op een hogere stand zoals u ziet. De leden krijgen bericht in de loop van de dag, of maandag want de beurzen in Europa zijn dicht morgen door 1 mei.

Eerst even de opening afwachten en kijken hoe de markt verder wil in de loop van de ochtend, daarna zie ik wel wat ik kan doen voor de leden. Om mee te doen kunt u gebruik maken van de aanbieding tot 1 JULI voor €39 ... https://www.usmarkets.nl/tradershop

Tot straks ... Guy

Markt snapshot Europa vandaag

GLOBAL TOP NEWS

The top U.S. infectious disease official said Gilead's experimental antiviral drug remdesivir will become the standard of care for COVID-19 after early clinical trial results on Wednesday showed it helped patients recover more quickly from the illness caused by the coronavirus.

Millions more Americans likely filed claims for unemployment benefits last week, but the tide appears to be slowing, offering cautious hope of a peak in job losses from business closures and disruptions because of the novel coronavirus.

China's factories suffered a collapse in export orders in April, twin surveys showed, suggesting a full-blown recovery appeared some way off as the coronavirus health crisis shut down large parts of the world economy.

EUROPEAN COMPANY NEWS

The British car industry faces losing output worth more than 8 billion pounds due to the coronavirus outbreak, which cut production in March by a third, falling to its lowest level since 2009, an industry body said.

GlaxoSmithKline beat quarterly profit expectations on rising sales of its blockbuster shingles vaccine and strong demand for pain and respiratory medicines during the coronavirus pandemic

France's Safran reported an 8.8% drop in like-for-like first-quarter revenue to 5.38 billion euros as the coronavirus crisis began to weigh on its aircraft engines and interiors business.

TODAY'S COMPANY ANNOUNCEMENTS

2020 Bulkers Ltd Q1 2020 Earnings Call

Admiral Group PLC Annual Shareholders Meeting

Aeroporto Guglielmo Marconi di Bologna SpA Annual Shareholders Meeting

Aixtron SE Q1 2020 Earnings Release

Aker Solutions ASA Q1 2020 Earnings Call

Altech Advanced Materials AG Annual Shareholders Meeting

Altisource Portfolio Solutions SA Q1 2020 Earnings Call

Altri SGPS SA Annual Shareholders Meeting

AMAG Austria Metall AG Q1 2020 Earnings Call

Amarin Corporation PLC Q1 2020 Earnings Call

Amsterdam Commodities NV Annual Shareholders Meeting

Andritz AG Q1 2020 Earnings Call

Atlassian Corporation PLC Q3 2020 Earnings Call

Atresmedia Corporacion de Medios de Comunicacion SA Q1 2020 Earnings Call

Banco Bilbao Vizcaya Argentaria SA Q1 2020 Earnings Call

Banco de Sabadell SA Q1 2020 Earnings Release

Banque Cantonale Vaudoise Annual Shareholders Meeting

BASF SE Q1 2020 Earnings Call

BE Semiconductor Industries NV Q1 2020 Earnings Call

Befesa SA Q1 2020 Earnings Call

Blackrock World Mining Trust PLC Annual Shareholders Meeting

British American Tobacco PLC Annual Shareholders Meeting

Caixabank SA Q1 2020 Earnings Call

Catena AB Q1 2020 Earnings Call

Caverion Oyj Q1 2020 Earnings Call

Cavotec SA Q1 2020 Earnings Call

Cemex Latam Holdings SA Q1 2020 Earnings Call

Credit Suisse Group AG Annual Shareholders Meeting

Credito Emiliano SpA Annual Shareholders Meeting

Danske Bank A/S Q1 2020 Earnings Call

Deutsche Boerse AG Q1 2020 Earnings Call

Dialog Semiconductor PLC Annual Shareholders Meeting

Digitouch SpA Annual Shareholders Meeting

DNB ASA Q1 2020 Earnings Call

Draegerwerk AG & Co KGaA Q1 2020 Earnings Call

DSV Panalpina A/S Q1 2020 Earnings Call

Eaton Corporation PLC Q1 2020 Earnings Call

Ekornes ASA Q1 2020 Earnings Call

Entra ASA Q1 2020 Earnings Call

Erste Group Bank AG Q1 2020 Earnings Call

Eurazeo SE Annual Shareholders Meeting

exceet Group SA Q1 2020 Earnings Release

Fine Foods & Pharmaceuticals NTM SpA Annual Shareholders Meeting

Fos SpA Annual Shareholders Meeting

F-Secure Oyj Q1 2020 Earnings Call

Fuchs Petrolub SE Q1 2020 Earnings Call

Fugro NV Annual Shareholders Meeting

GAM Holding AG Annual Shareholders Meeting

Geberit AG Q1 2020 Earnings Call

Getlink SE Annual Shareholders Meeting

Granges AB Q1 2020 Earnings Call

Greencoat UK Wind PLC Annual Shareholders Meeting

Grupo Catalana Occidente SA Annual Shareholders Meeting

Hikma Pharmaceuticals PLC Annual Shareholders Meeting

Horizon Therapeutics PLC Annual Shareholders Meeting

International Personal Finance PLC Annual Shareholders Meeting

Interpump Group SpA Annual Shareholders Meeting

J Sainsbury PLC FY 2020 Earnings Call

James Fisher and Sons PLC Annual Shareholders Meeting

Janus Henderson Group PLC Annual Shareholders Meeting

Karolinska Development AB Q1 2020 Earnings Release

Kaz Minerals PLC Annual Shareholders Meeting

Kerry Group PLC Annual Shareholders Meeting

Klepierre SA Annual Shareholders Meeting

Koninklijke KPN NV Q1 2020 Earnings Call

Koninklijke Philips NV Annual Shareholders Meeting

Lanson BCC SA Annual Shareholders Meeting

Lectra SA Annual Shareholders Meeting

Lundin Energy AB Q1 2020 Earnings Call

Materialise NV Q1 2020 Earnings Call

Mediaset Espana Comunicacion SA Q1 2020 Earnings Call

Medicover AB Annual Shareholders Meeting

Millicom International Cellular SA Q1 2020 Earnings Call

MTU Aero Engines AG Q1 2020 Earnings Call

Nemetschek SE Q1 2020 Earnings Call

Neosperience SpA Annual Shareholders Meeting

Nokia Oyj Q1 2020 Earnings Call

Norwegian Finans Holding ASA Q1 2020 Earnings Call

Novocure Ltd Q1 2020 Earnings Call

Ocean Outdoor Ltd FY 2019 Earnings Call

Octopus Aim VCT 2 PLC Annual Shareholders Meeting

Olvi Oyj Q1 2020 Earnings Release

Orange SA Q1 2020 Earnings Call

Ossur hf Q1 2020 Earnings Call

Palfinger AG Q1 2020 Earnings Call

Pareto Bank ASA Q1 2020 Earnings Call

Pentair PLC Q1 2020 Earnings Call

Perrigo Company PLC Q1 2020 Earnings Call

Protector Forsikring ASA Q1 2020 Earnings Call

Proximus NV Q1 2020 Earnings Call

Radici Pietro Industries & Brands SpA Annual Shareholders Meeting

Royal Dutch Shell PLC Q1 2020 Earnings Call

RPS Group PLC Annual Shareholders Meeting

RTL Group SA Q1 2020 Earnings Release

Schroders PLC Annual Shareholders Meeting

Seche Environnement SA Annual Shareholders Meeting

Shop Apotheke Europe NV Annual Shareholders Meeting

Smurfit Kappa Group PLC Annual Shareholders Meeting

Sonae SGPS SA Annual Shareholders Meeting

Stef SA Annual Shareholders Meeting

Storebrand ASA Q1 2020 Earnings Call

Subsea 7 SA Q1 2020 Earnings Call

Suez SA Q1 2020 Earnings Call

Swiss Re AG Q1 2020 Earnings Call

Swisscom AG Q1 2020 Earnings Call

Takkt AG Q1 2020 Earnings Call

Tarkett SA Annual Shareholders Meeting

Telenet Group Holding NV Q1 2020 Earnings Call

Televerbier SA Annual Shareholders Meeting

Tenaris SA Q1 2020 Earnings Call

Tetragon Financial Group Ltd Q1 2020 Earnings Call

Transocean Ltd Q1 2020 Earnings Call

Ucb SA Annual Shareholders Meeting

Umicore SA Annual Shareholders Meeting

Unilever NV Annual Shareholders Meeting

Unipol Gruppo SpA Annual Shareholders Meeting

Valaris PLC Q1 2020 Earnings Call

Verona Pharma PLC Q1 2020 Earnings Call

Wacker Chemie AG Q1 2020 Earnings Call

Willis Towers Watson PLC Q1 2020 Earnings Call

Yit Oyj Q1 2020 Earnings Call

ECONOMIC EVENTS (All times GMT)

0530 France GDP Preliminary qq for Q1: Expected -3.5%; Prior -0.1%

0530 (approx.) France GDP yy Prelim for Q1: Prior 0.8%

0600 (approx.) Germany Retail Sales mm Real for Mar: Expected -7.3%; Prior 1.2%

0600 (approx.) Germany Retail Sales yy Real for Mar: Prior 6.4%

0630 Switzerland Retail Sales yy for Mar: Prior 0.3%

0645 France Consumer Spending mm for Mar: Expected -5.5%; Prior -0.1%

0645 France CPI (EU Norm) Prelim yy for Apr: Expected 0.2%; Prior 0.8%

0645 (approx.) France CPI (EU Norm) Prelim mm for Apr: Prior 0.1%

0645 (approx.) France CPI Prelim yy NSA for Apr: Prior 0.7%

0645 (approx.) France CPI Prelim mm NSA for Apr: Prior 0.1%

0645 France Producer Prices mm for Mar: Prior -0.6%

0645 (approx.) France Producer Prices yy for Mar: Prior -0.9%

0700 Spain Estimated GDP qq for Q1: Expected -4.4%; Prior 0.4%

0700 Spain Estimated GDP yy for Q1: Expected -3.2%; Prior 1.8%

0700 Spain HICP Flash yy for Apr: Expected -0.8%; Prior 0.1%

0700 (approx.) Spain CPI yy Flash NSA for Apr: Expected -0.8%; Prior 0.0%

0700 (approx.) Spain HICP Flash mm for Apr: Expected 0.2%; Prior 0.6%

0700 (approx.) Spain CPI mm Flash NSA for Apr: Expected 0.20%; Prior -0.40%

0700 (approx.) Spain CPI Flash NSA for Apr: Prior 103.680

0700 Switzerland KOF Indicator for Apr: Expected 63.5; Prior 92.9

0700 Austria GDP Growth qq Prelim for Q1: Expected -2.5%; Prior 0.3%

0700 Austria PPI mm for Mar: Prior -0.5%

0700 Austria PPI yy for Mar: Prior -0.8%

0755 Germany Unemployment Chg SA for Apr: Expected 76,000; Prior 1,000

0755 Germany Unemployment Total NSA for Apr: Expected 2.470 mln; Prior 2.335 mln

0755 Germany Unemployment Rate SA for Apr: Expected 5.2%; Prior 5.0%

0755 Germany Unemployment Total SA for Apr: Prior 2.267 mln

0800 Italy Unemployment Rate for Mar: Expected 10.5%; Prior 9.7%

0800 (approx.) Spain Current Account Balance for Feb: Prior -1.73 bln EUR

0830 (approx.) Portugal CPI Flash mm for Apr: Prior 1.4%

0830 (approx.) Portugal CPI Flash yy for Apr: Prior 0.0%

0900 Italy Consumer Price Prelim mm for Apr: Expected -0.3%; Prior 0.1%

0900 Italy Consumer Price Prelim yy for Apr: Expected -0.2%; Prior 0.1%

0900 Italy CPI (EU Norm) Prelim mm for Apr: Expected 0.1%; Prior 2.2%

0900 Italy CPI (EU Norm) Prelim yy for Apr: Expected -0.3%; Prior 0.1%

0900 (approx.) Italy CPI NSA for Apr: Prior 102.9

0900 Euro Zone HICP Flash yy for Apr: Expected 0.1%; Prior 0.7%

0900 Euro Zone HICP-X F&E Flash yy for Apr: Expected 0.8%; Prior 1.2%

0900 Euro Zone HICP-X F,E,A&T Flash yy for Apr: Expected 0.7%; Prior 1.0%

0900 (approx.) Euro Zone HICP-X F, E, A, T Flash mm for Apr: Prior 1.10%

0900 (approx.) Euro Zone CPI NSA for Apr: Prior 105.12

0900 Euro Zone GDP Flash Prelim yy for Q1: Expected -3.1%; Prior 1.0%

0900 Euro Zone GDP Flash Prelim qq for Q1: Expected -3.5%; Prior 0.1%

0900 Euro Zone Unemployment Rate for Mar: Expected 7.7%; Prior 7.3%

1000 Italy GDP Prelim qq for Q1: Expected -5.0%; Prior -0.3%

1000 Italy GDP Prelim yy for Q1: Expected -5.1%; Prior 0.1%

1145 Euro Zone ECB Refinancing Rate for Apr: Expected 0.00%; Prior 0.00%

1145 Euro Zone ECB Deposit Rate for Apr: Expected -0.50%; Prior -0.50%