Liveblog Archief woensdag 29 april 2020

Let op, donderdag en maandag hele mooie kansen om op te handelen

Het lijkt nu behoorlijk op 20 februari wat betreft de beurzen, er lijkt zich een top te vormen binnen die enorme "Bear Market Rally" ... Die ga ik proberen op te pakken met enkele leuke posities die ik een tijdje ga aanhouden, ik ga nog altijd uit van een U-recessie in de VS en Europa ... Dat wil zeggen dat het nog altijd aannemelijk is dat de bodems worden hertest later dit jaar, dat kan zelfs heel snel gaan met de huidige marktsituatie ... Morgen en/of maandag komen er hele mooie kansen waar ik met signalen zal op inspelen. Vandaag werden de posities gesloten, die kan ik nu veel beter weer gaan opnemen ...

Wordt dus meteen lid, nu een proefabonnement voor €39 tot 1 JULI ... Schrijf u in via de site zodat u mee kunt doen met de SMS en mail signalen ...

https://www.usmarkets.nl/tradershop

Tot morgen ... Guy

Momenteel ziet het er op Wall Street zo uit, eigenlijk compleet tegenstellend, lijkt of er een soort inflatie op de aandelen insluipt. De waarderingen groeien snel op deze manier ...

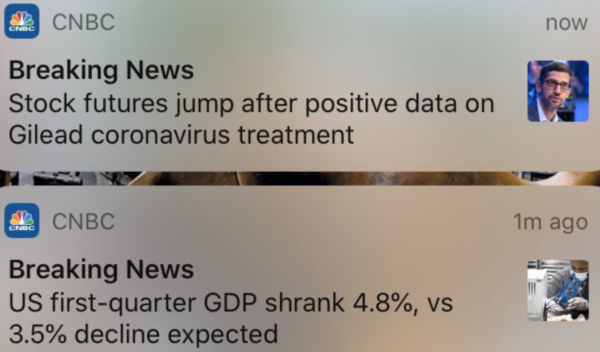

Vreemd rond 14:30 vanmiddag was hetgeen ik zag als push berichten van CNBC, zeer slecht economisch cijfer en 1 minuut later dat nieuws van Gilead over een remmer voor het COVID-19 virus ...

De cijfers van vanavond nabeurs ...

Tesla Q1 20 Earnings Results

- Adj EPS: $1.24 Vs -$2.90 Year On Year

- Revenue: $5.99B (Estimate: $5.81B)

- Q1 Impacted By Lower Deliveries

Gesloten met +4%

+4% nabeurs

Facebook Q1 20 Earnings Results

- EPS: $1.71 (Estimate: $1.71)

- Revenue: $17.74B (Estimate: $17.27B)

- Ad Revenue: $17.44B (Estimate $17.10B)

- Daily Active Users 1.73B (Estimate 1.68B)

Gesloten met +6%

+9,5% nabeurs

Microsoft Q3 20 Earnings Results

- EPS: $1.40 (Estimate: $1.27)

- Revenue: $35.02B (Estimate: $33.69B)

- Ntelligent Cloud Revenue: $12.28B (Estimate: $11.67B)

Gesloten met +4,5%

Aandeel +1,5%

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Rentevoetbeslissing | Actueel: 0,25% Verwacht: 0,25% Vorige: 0,25% |

Stevige stijging Wall Street, net de maand APRIL afgerond bij Trading

Op zich was er tot rond 14:30 niet zoveel aan de hand, ik ging er vanuit dat de markt zou afbrokkelen en zeker na de tegenvallende groeicijfers in de VS die op -4,8% uitkomen terwijl men rekende op -4%, daar zitten januari en februari nog bij wel te verstaan, dus u kunt al gaan denken hoe Q2 zal worden als ook de tijdens de maand mei alles nog grotendeels plat ligt. Maar goed, om 14:35 ongeveer, net na de cijfers kwam Gilead met nieuws dat een proefperiode met een vaccin goed uitpakt en we waren weer vertrokken. Het is heel moeilijk om te handelen in deze markt als elk sprankeltje hoop wordt beloond met een stevige koers sprong, als het zo doorgaat komen we straks uit op de hoogste standen ooit op Wall Street, ook Europa trekt aardig mee met de AEX die doorbreekt tot ruim boven de 525 punten, we staan al 140 punten boven de bodem van maart, en nu al 100 punten onder de top van februari ...

Door de sluiting van de maand april, en door dat ik de stoploss moest nemen, heb ik de lopende posities gesloten met verlies. Wel staan we voor deze maand APRIL wel met een mooie plus zoals u kunt zien via de tabel hieronder. Het was alles bij elkaar sinds vorige week dinsdag wikken en wegen met de posities, eerst neutraal, dan wat in de min, gisteren weer iets in de plus maar vandaag dus eruit geduwd door mijn eigen stoploss level wat ik ook toepas bij mijn eigen posities. Zoals ik aangeef zit ik zelf uiteraard ook in de markt als ik signalen verstuur naar de leden ...

Goed, nu alles weg, de weg ligt vrij voor de nieuwe maand, nu de maand MEI en daar kan ik morgen al mee beginnen, hangt af van hoe de indices staan vanavond en morgen. Zo ja, dan worden dat de eerste posities voor de nieuwe maand. Zorg ervoor dat u mee kunt doen want als we hier nog iets hoger geraken dan ontstaat er weer een mooie kans om wat te doen met nieuwe posities die dus short worden als ik naar de omstandigheden kijk. Doe mee tot 1 JULI voor €39 en schrijf u meteen in via de link hieronder ...

Inschrijven ... https://www.usmarkets.nl/tradershop

Tot straks ... Guy

Zorg ervoor dat u mee kunt doen want als we hier nog iets hoger geraken dan ontstaat er weer een mooie kans om wat te doen met nieuwe posities die dus short worden als ik naar de omstandigheden kijk. Doe mee tot 1 JULI voor €39 en schrijf u meteen in via de link hieronder ...

Inschrijven ... https://www.usmarkets.nl/tradershop

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Ruwe Olievoorraden | Actueel: 8,991M Verwacht: 10,619M Vorige: 15,022M |

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Voorlopige Huisverkopen (Maandelijks) (Mar) | Actueel: -20,8% Verwacht: -10,0% Vorige: 2,3% |

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: BBP (Kwartaal) (Q1) | Actueel: -4,8% Verwacht: -4,0% Vorige: 2,1% |

Markt snapshot Wall Street

TOP NEWS

• GE points to more pain ahead as cash flow worsens

General Electric's industrial businesses took a $1 billion hit to cash flow in the first quarter due to the COVID-19 pandemic as overall revenue fell almost 8%, and the company warned the damage would worsen in the next three months.

• Amazon turns to Chinese firm on U.S. blacklist to meet thermal camera needs

Amazon.com has bought cameras to take temperatures of workers during the coronavirus pandemic from a firm the United States blacklisted over allegations it helped China detain and monitor the Uighurs and other Muslim minorities, three people familiar with the matter told Reuters.

• Facebook ad sales appear to have ticked up since late March, offering investors reason for optimism even as decimated advertising budgets from the coronavirus are expected to weigh heavily on first-quarter earnings, according to data from firms that track online ads.

• When Tesla reports first-quarter results after the bell, many individual shareholders will not be looking for details on the subject that drives most conversations: the effect of the novel coronavirus pandemic.

• Health insurer Anthem beats revenue estimates on higher premiums

Anthem beat quarterly estimates for revenue, helped by the recent launch of its pharmacy benefits unit and higher premiums.

BEFORE THE BELL

Futures for Wall Street’s main indexes rose after Google-parent Alphabet reported upbeat quarterly earnings, with investors looking at GDP data and any forward guidance from the Federal Reserve’s policy statement. Most European stock indexes struggled to maintain early gains after a slide in defensive stocks. Easing coronavirus lockdowns supported Asian shares. The dollar weakened broadly against its rivals. Oil prices gained after U.S. stockpiles rose less than expected and gasoline stocks fell. Gold prices slipped. Major companies including Facebook, Microsoft, Tesla and Qualcomm are scheduled to report after market.

STOCKS TO WATCH

Results

• Advanced Micro Devices Inc (AMD). The company forecast current-quarter revenue largely below estimates and lowered its annual sales outlook, as lockdown measures globally choke demand and supply chains. AMD forecast 2020 revenue to grow by about 25%, plus or minus 5 percentage points, as it expects weaker demand in the second half of the year. The previous forecast was of 28% to 30% growth. Revenue from AMD's computing and graphics segment, which includes graphic chip sales to data centers, jumped 73% to $1.44 billion, while sales in enterprise, embedded and semi-custom segment, which also houses chips used in consoles, fell about 21%. AMD expects second-quarter revenue to be about $1.85 billion plus or minus $100 million, compared to analysts' average estimate of $1.92 billion.

• Alphabet Inc (GOOGL). A drop in Google ad sales steadied in April and some consumers returned to using the search engine for shopping in addition to finding novel coronavirus information, parent Alphabet said on Tuesday. Alphabet’s overall revenue in the first quarter was $41.2 billion, up 13% compared with the same period last year. The average estimate among financial analysts tracked by Refinitiv was $40.29 billion, up 10.87%, expecting the slowest growth since 11.1% in the second quarter of 2015. Alphabet’s first-quarter profit was $6.8 billion, or $9.87 per share, compared with the analysts’ average estimate of $7.21 billion, or $10.40 per share.

• Anthem Inc (ANTM). The health insurer beat quarterly estimates for revenue, helped by the recent launch of its pharmacy benefits unit and higher premiums. It reported a 1.8% drop in quarterly profit, hurt by weaker sales in the unit that sells employer-sponsored health plans. Its net income fell to $1.52 billion, or $5.94 per share, in the first quarter ended March 31, from $1.55 billion, or $5.91 per share, a year earlier. Total revenue rose to $29.62 billion from $24.67 billion. Analysts were expecting sales of $28.6 billion, according to Refinitiv IBES data.

• AstraZeneca PLC (AZN). The company topped analysts' estimates for quarterly profit and reiterated its targets for the year, as the British drugmaker benefited from higher demand for some of its medicines during the coronavirus pandemic. The drugmaker joined other big pharma firms in either maintaining or raising its forecast for 2020 and said its supply chain had proved resilient to the coronavirus-induced disruptions in the period. Revenues would increase by a high single-digit to a low double-digit percentage this year, the company said, comparing favourably to analysts current average forecast of 8.4%. Core earnings at the drugmaker rose 21% to $1.05 per share, while total revenue, which also includes payments from tie-ups, rose 17% to $6.35 billion from year earlier. Analysts on average had expected core earnings of 94 cents per share, according to a company provided consensus of 22 analysts.

• Deutsche Bank AG (DB). The bank swung to a loss in the first quarter and the outlook for the full year darkened, underlining the impact from a costly overhaul and pressure on revenue as the coronavirus crisis slams the brakes on the global economy. The German lender, which earlier this week published some earnings results, reported a bottom-line loss of $46.64 million attributable to shareholders in the quarter, compared with a 97 million euro profit a year ago. The net profit figure reported on Wednesday, like those disclosed on Sunday, was still better than analysts had initially expected, and reflect a revenue lift from a surge in trading as markets swung wildly.

• Facebook Inc (FB). The company’s ad sales appear to have ticked up since late March, offering investors reason for optimism even as decimated advertising budgets from the coronavirus are expected to weigh heavily on first-quarter earnings, according to data from firms that track online ads. Analysts on average expect Facebook to report 16.1% growth in first-quarter revenue, its lowest since the company went public in 2012. The estimates were revised down by about $1 billion since January to reflect a plunge in demand for ads for travel, restaurants and other shuttered consumer services because of the global coronavirus pandemic. But data from digital marketing agency Gupta Media indicates that the volume of ads shown on Facebook doubled late in the quarter as usage surged, even as prices declined by about half to $1.08 per thousand impressions at the end of March from $2.17 at the beginning.

• General Electric Co (GE). The company's industrial businesses took a $1 billion hit to cash flow in the first quarter due to the COVID-19 pandemic as overall revenue fell almost 8%, and the company warned the damage would worsen in the next three months. The conglomerate had earlier this month pulled its 2020 forecast, citing uncertainties created by the coronavirus outbreak, but backed its first-quarter industrial free cash flow expectation of near negative $2 billion. Free cash flow from industrial operations was negative $2.2 billion in the first quarter, missing analysts' estimates of negative $2.02 billion, according to Refinitiv data. GE reported adjusted earnings of 5 cents per share, below the average estimate of 8 cents.

• Hasbro Inc (HAS). The company scrapped its full-year outlook and forecast a hit to its second-quarter revenue and earnings, as sales of its toys and games suffer from global lockdowns to contain the spread of the coronavirus pandemic. The company swung to a loss of $69.6 million, or 51 cents per share, in the first quarter, compared with a profit of $26.7 million, or 21 cents per share, a year earlier. The loss was due to Hasbro's $4 billion purchase of Peppa Pig series maker Entertainment One. Net revenue rose over 51% to $1.11 billion, boosted by Entertainment One distributed properties including Oscar winning film "1917". Hasbro previously said 2020 total revenue could be in excess of $6.2 billion, a 31.4% increase from the prior year. It also expected to increase operating profit margin to above 15% from 13.5% in 2019.

• Merck & Co Inc (MRK). The company said on Tuesday it expects the coronavirus pandemic to reduce 2020 sales by more than $2 billion, and the U.S. drugmaker lowered its profit forecast as a big drop in doctors' office visits during the outbreak will take a hefty toll. Merck beat analysts' first-quarter profit and sales estimates on increased demand for Keytruda, largely before the coronavirus epidemic put most of the country under stay-at-home orders. The company, which also suspended its share buyback program, now expects full-year adjusted profit of $5.17 to $5.37 per share, down from its prior view of $5.62 to $5.77. Excluding items, Merck earned $1.50 per share, beating analysts' average estimate by 16 cents.

• Mondelez International Inc (MDLZ). The company on Tuesday beat Wall Street estimates for quarterly results, driven by a strong demand in North America, even as the Oreo cookie maker withdrew its 2020 outlook, citing the uncertainty caused by the coronavirus pandemic. Revenue rose to $6.71 billion in the first quarter ended March 31 from $6.54 billion a year ago, beating analysts' average estimate of $6.61 billion. Excluding certain items, Mondelez earned 69 cents per share, above analysts' estimate of 66 cents.

• Omnicom Group Inc (OMC). The advertising firm said on Tuesday it was cutting jobs and furloughing employees as the coronavirus lockdowns dent ad spending by clients. The advertising giant said it had over $2.6 billion in cash and $2.9 billion in credit facility to tide over the virus crisis. The company, which did not disclose the number of job cuts, said a fall in revenue could hurt its operations and financial position, and the effects could be material. Omnicom's first-quarter revenue fell nearly 2% to $3.41 billion, but edged past analysts' average estimate of $3.36 billion

• Spotify Technology SA (SPOT). The company reported a better-than-expected 31% jump in paid music subscribers to 130 million and a 22% rise in revenue in the first quarter, weathering a slowdown in ad sales due to the spread of the coronavirus. For the second quarter, Spotify expects premium subscribers in the range of 133 million to 138 million. Analysts were expecting 136.5 million. It also forecast total revenue in the range of 1.75 billion euros ($1.90 billion) to 1.95 billion euros, below expectation of 2.02 billion euros. First-quarter premium subscribers, however, rose 31% from a year earlier. Analysts were expecting 128.6 million paid subscribers. Revenue rose to 1.85 billion euros for the three-months ended March 31 from 1.51 billion euros a year earlier. The company reported a loss attributable to shareholders of 20 euro cents per share.

• Starbucks Corp (SBUX). The company said on Tuesday it sees sales in China, the company's biggest growth market, recovering by the end of September, following a massive drop in same-store sales in the current quarter on fallout from the coronavirus pandemic, which forced Starbucks to close stores around the globe. It reported a 10% fall in global same-store sales for its fiscal second quarter. Starbucks forecast a drop in comparable sales in China in the current third quarter of between 25% and 35%, followed by a decline in fourth-quarter same-store sales of as much as 10% before ending roughly flat by the end of the fiscal year in September. For the full year, China same-store sales are seen decreasing 15% to 25%.

• Tesla Inc (TSLA). When the company reports first-quarter results after the bell, many individual shareholders will not be looking for details on the subject that drives most conversations: the effect of the novel coronavirus pandemic. Their view vastly differs from that of traditional analysts and institutional investors, who want to hear updates on Tesla's 2020 cash flow and potential moves to boost demand during a prolonged recession due to the epidemic. Submitting questions for Tesla's earnings call on a website, retail investors want to learn about Tesla's steps to expand into the robotaxi market, the company's self-driving technology and even plans to create airless tires to reduce maintenance costs.

• Valero Energy Corp (VLO). The refiner said it took a $2 billion hit to the value of its refining inventory and swung to a loss in the first quarter as lockdowns to suppress the coronavirus crushed demand for its products. Valero reported a net loss attributable to stockholders of $1.85 billion, or $4.54 per share, for the three months ended March 31, compared with a net income of $141 million, or 34 cents per share, in the year-ago period.

• Yum China Holdings Inc (YUMC). The company on Tuesday beat estimates for quarterly revenue and said the decline in same-store sales was slowing even as the vast majority of consumers still avoid going out in public to contain the spread of the coronavirus. Yum China said its month-to-date same-stores sales were down by more than 10%, still an improvement from the 15% decline it experienced in the first quarter ended March 31. Total revenue fell to $1.75 billion from $2.30 billion but well ahead of market expectations of $1.56 billion. Net income fell to $62 million, or 16 cents per share, from $222 million, or 57 cents per share, a year earlier.

In Other News

• Alphabet Inc (GOOGL). Google said any user will soon be able to host free video conferences on Meet, turning its previously business-only tool into a bigger rival to Zoom and others battling for users during the coronavirus outbreak. Meet, which has 100 million daily users, had required a Google business or education account to set up calls. The company gradually will open Meet in the coming weeks, and users can sign up to know when their account gains access.

• Amazon.com Inc (AMZN). The online retailer has bought cameras to take temperatures of workers during the coronavirus pandemic from a firm the United States blacklisted over allegations it helped China detain and monitor the Uighurs and other Muslim minorities, three people familiar with the matter told Reuters. China's Zhejiang Dahua Technology shipped 1,500 cameras to Amazon this month in a deal valued close to $10 million, one of the people said. At least 500 systems from Dahua - the blacklisted firm - are for Amazon's use in the United States, another person said.

• AMC Entertainment Holdings Inc (AMC). The world's largest movie theater operator, said on Tuesday it would no longer play Universal Studios films in any of its theaters globally, arguing that the studio is "breaking the business model". The decision came in shortly after the Wall Street Journal quoted NBCUniversal Chief Executive Officer Jeff Shell as saying he expects to release movies simultaneously in theaters and direct-to-home formats.

• Blackstone Group Inc (BX). The private equity company bought a near 10% stake in Australian casino operator Crown Resorts Ltd CWN.AX from Macau's Melco Resorts & Entertainment Ltd MLCO.O, sending Crown shares soaring amid hopes of a buyout. The deal accomplishes Melco's plan to exit its Crown holdings as casino companies around the world rein in spending to cope with a shutdown to slow the spread of the coronavirus. Crown disclosed the deal in a market filing.

• Boeing Co (BA). The company is working with investment banks on a multibillion-dollar bond-fueled financing package, aiming to shore up its balance sheet amid a sharp travel downturn from the pandemic, three people familiar with the matter said on Tuesday. Boeing has lined up investment banks to potentially market an offering to bond investors in the coming days, provided that market conditions are favorable, the sources said, cautioning that the exact timing and size of the offering had not been decided. The proceeds could amount to $10 billion or more, depending on investor demand, one of the sources added.

• Estee Lauder Companies Inc (EL). Unilever, L'Oreal and Estee Lauder are among firms vying to buy British makeup brand Charlotte Tilbury Beauty, Bloomberg reported on Tuesday. The London-based brand, founded by makeup artist Charlotte Tilbury, is working with advisers at Goldman Sachs Group and Jefferies Financial Group, and could fetch more than $1.24 billion, Bloomberg said, citing sources.

• JD.com Inc (JD). The Chinese e-commerce retailer is pressing ahead with plans for a secondary listing in Hong Kong within the next few months despite the coronavirus pandemic still roiling financial markets, said sources with direct knowledge of the matter. The Nasdaq-listed company has confidentially made an application to the Hong Kong Stock Exchange to list as soon as June, in a deal that could raise at least $3 billion, which would be the largest equity capital market transaction in Hong Kong this year, they said.

• Oasis Petroleum Inc (OAS). The company has begun to wind down all drilling in the Bakken, three sources familiar with the matter said on Tuesday, as production cuts intensify across the United States the aftermath of a historic plunge in crude oil prices. The company has asked its frac crews in the region to take time off, known as a frac holiday, and will completely halt all drilling activity within weeks, two sources said.

• Quest Diagnostic Inc (DGX). The company said on Tuesday individuals can purchase its COVID-19 antibody test for themselves through its website QuestDirect at $119 without having to visit a doctor's office. Each test request is reviewed and, if appropriate, an order for testing is issued by a licensed physician, the company said, adding that individuals have the opportunity to speak with a licensed physician about their results.

PREVIEW

The Federal Reserve, which has pumped trillions in emergency funding into U.S. financial markets to stem the damage from the coronavirus pandemic, is expected on Wednesday to reiterate its promise to do whatever it takes to support the world's largest economy.

ANALYSTS' RECOMMENDATION

• Alphabet Inc (GOOGL). JPMorgan raises price target to $1505 from $1340, saying the company’s fundamentals are strong and that it will remain a primary beneficiary of the secular shift to online spending.

• Caterpillar Inc (CAT). Credit Suisse cuts target price to $144 from $148, stating the market is concerned that the company is not reacting quick enough to changing demand conditions associated with COVID-19.

• D.R. Horton Inc (DHI). Susquehanna raises price target to $55 from $48, following the company’s better-that-expected Q2 results.

• PepsiCo Inc (PEP). Cowen and Company raises target price to $156 from $135, given the company's track record of achieving targeted earnings growth.

• Starbucks Corp (SBUX). Keybanc raises price target to $82 from $80, saying the company is in a strong position to win back customer visits as the U.S. gets back to work due to its growing digital user base, strong balance sheet, innovation pipeline, and marketing scale.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0830 GDP advance for Q1: Expected -4.0%; Prior 2.1%

0830 GDP sales advance for Q1: Prior 3.1%

0830 GDP consumer spending advance for Q1: Prior 1.8%

0830 GDP deflator advance for Q1: Expected 1.2%; Prior 1.4%

0830 Core PCE prices advance for Q1: Expected 1.4%; Prior 1.3%

0830 PCE prices advance for Q1: Prior 1.4%

1000 Pending Homes Index for Mar: Prior 111.5

1000 Pending home sales mm for Mar: Expected -10.0%; Prior 2.4%

1400 Fed funds target rate for Apr: Expected 0-0.25%; Prior 0-0.25%

1400 Fed interest on excess reserves for Apr: Prior 0.10%

COMPANIES REPORTING RESULTS

Aflac Inc (AFL). Expected Q1 earnings of $1.10 per share

Align Technology Inc (ALGN). Expected Q1 earnings of $1.00 per share

Archer Daniels Midland Co (ADM). Expected Q1 earnings of 55 cents per share

Boeing Co (BA). Expected Q1 loss of $1.61 per share

Crown Castle International Corp (CCI). Expected Q1 earnings of 49 cents per share

Duke Realty Corp (DRE). Expected Q1 earnings of 10 cents per share

eBay Inc (EBAY). Expected Q1 earnings of 72 cents per share

Facebook Inc (FB). Expected Q1 earnings of $1.74 per share

Hartford Financial Services Group Inc (HIG). Expected Q1 earnings of $1.35 per share

Hologic Inc (HOLX). Expected Q2 earnings of 57 cents per share

Mastercard Inc (MA). Expected Q1 earnings of $1.73 per share

Microsoft Corp (MSFT). Expected Q3 earnings of $1.26 per share

Norfolk Southern Corp (NSC). Expected Q1 earnings of $2.25 per share

Qualcomm Inc (QCOM). Expected Q2 earnings of 78 cents per share

Raymond James Financial Inc (RJF). Expected Q2 earnings of $1.46 per share

Rollins Inc (ROL). Expected Q1 earnings of 13 cents per share

ServiceNow Inc (NOW). Expected Q1 earnings of 95 cents per share

United Rentals Inc (URI). Expected Q1 earnings of $2.69 per share

Vertex Pharmaceuticals Inc (VRTX). Expected Q1 earnings of $1.85 per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Boston Scientific Corp (BSX). Q1 earnings conference call

0800 General Electric Co (GE). Q1 earnings conference call

0800 Hasbro Inc (HAS). Q1 earnings conference call

0800 Masco Corp (MAS). Q1 earnings conference call

0800 Moderna Inc (MRNA). Annual Shareholders Meeting

0800 Northrop Grumman Corp (NOC). Q1 earnings conference call

0800 Santander Consumer USA Holdings Inc (SC). Q1 earnings conference call

0800 Sensata Technologies Holding PLC (ST). Q1 earnings conference call

0800 Spotify Technology SA (SPOT). Q1 earnings conference call

0815 Yum! Brands Inc (YUM). Q1 earnings conference call

0830 American Tower Corp (AMT). Q1 earnings conference call

0830 Anthem Inc (ANTM). Q1 earnings conference call

0830 Automatic Data Processing Inc (ADP). Q3 earnings conference call

0830 C.H. Robinson Worldwide Inc (CHRW). Q1 earnings conference call

0830 CME Group Inc (CME). Q1 earnings conference call

0830 CNA Financial Corp (CNA). Annual Shareholders Meeting

0830 MKS Instruments Inc (MKSI). Q1 earnings conference call

0830 New York Community Bancorp Inc (NYCB). Q1 earnings conference call

0845 Norfolk Southern Corp (NSC). Q1 earnings conference call

0900 BorgWarner Inc (BWA). Annual Shareholders Meeting

0900 Encompass Health Corp (EHC). Q1 earnings conference call

0900 Euronet Worldwide Inc (EEFT). Q1 earnings conference call

0900 General Dynamics Corp (GD). Q1 earnings conference call

0900 Laboratory Corporation of America Holdings (LH). Q1 earnings conference call

0900 Mastercard Inc (MA). Q1 earnings conference call

0900 Oshkosh Corp (OSK). Q2 earnings conference call

0900 Regency Centers Corp (REG). Annual Shareholders Meeting

0900 Trex Company Inc (TREX). Annual Shareholders Meeting

0900 United Therapeutics Corp (UTHR). Q1 earnings conference call

0930 Ball Corp (BLL). Annual Shareholders Meeting

0930 Global Payments Inc (GPN). Annual Shareholders Meeting

0930 Markel Corp (MKL). Q1 earnings conference call

1000 Avangrid Inc (AGR). Q1 earnings conference call

1000 Boston Properties Inc (BXP). Q1 earnings conference call

1000 Chemed Corp (CHE). Q1 earnings conference call

1000 Duke Realty Corp (DRE). Annual Shareholders Meeting

1000 Entegris Inc (ENTG). Annual Shareholders Meeting

1000 Enterprise Products Partners LP (EPD). Q1 earnings conference call

1000 Humana Inc (HUM). Q1 earnings conference call

1000 Kimberly-Clark Corp (KMB). Annual Shareholders Meeting

1000 Marathon Petroleum Corp (MPC). Annual Shareholders Meeting

1000 Marketaxess Holdings Inc (MKTX). Q1 earnings conference call

1000 Pilgrims Pride Corp (PPC). Annual Shareholders Meeting

1000 Pool Corp (POOL). Annual Shareholders Meeting

1000 Rollins Inc (ROL). Q1 earnings conference call

1000 Valero Energy Corp (VLO). Q1 earnings conference call

1000 Vistra Energy Corp (VST). Annual Shareholders Meeting

1030 Boeing Co (BA). Q1 earnings conference call

1100 ONEOK Inc (OKE). Q1 earnings conference call

1100 Sherwin-Williams Co (SHW). Q1 earnings conference call

1100 Textron Inc (TXT). Annual Shareholders Meeting

1100 W W Grainger Inc (GWW). Annual Shareholders Meeting

1130 Prosperity Bancshares Inc (PB). Q1 earnings conference call

1200 Ameriprise Financial Inc (AMP). Annual Shareholders Meeting

1300 Avery Dennison Corp (AVY). Q1 earnings conference call

1415 Axalta Coating Systems Ltd (AXTA). Annual Shareholders Meeting

1615 Biomarin Pharmaceutical Inc (BMRN). Q1 earnings conference call

1630 Align Technology Inc (ALGN). Q1 earnings conference call

1630 Hologic Inc (HOLX). Q2 earnings conference call

1630 Prologis Inc (PLD). Annual Shareholders Meeting

1630 Teladoc Health Inc (TDOC). Q1 earnings conference call

1645 Qualcomm Inc (QCOM). Q2 earnings conference call

1700 Avantor Inc (AVTR). Q1 earnings conference call

1700 Facebook Inc (FB). Q1 earnings conference call

1700 Fair Isaac Corp (FICO). Q2 earnings conference call

1700 Pegasystems Inc (PEGA). Q1 earnings conference call

1700 PTC Inc (PTC). Q2 earnings conference call

1700 ServiceNow Inc (NOW). Q1 earnings conference call

1700 Vertex Pharmaceuticals Inc (VRTX). Q1 earnings conference call

1730 Microsoft Corp (MSFT). Q3 earnings conference call

1800 eBay Inc (EBAY). Q1 earnings conference call

1830 Tesla Inc (TSLA). Q1 earnings conference call

EXDIVIDENDS

A. O. Smith Corp (AOS). Amount $0.24

AGNC Investment Corp (AGNC). Amount $0.12

Alliant Energy Corp (LNT). Amount $0.38

Conagra Brands Inc (CAG). Amount $0.21

First Republic Bank (FRC). Amount $0.20

Morgan Stanley (MS). Amount $0.35

National Retail Properties Inc (NNN). Amount $0.51

NiSource Inc (NI). Amount $0.21

Omega Healthcare Investors Inc (OHI). Amount $0.67

.

Opening ziet er wat twijfelachtig uit

Gisteren na de middag kwam de daling pas op gang, vandaag stond rond de opening alles hoger maar we zien dan toch wat verkoopdruk op gang komen. De Nasdaq staat 80 punten hoger maar vergeleken met de hoogste stand van gisteren scheelt het nog altijd een goeie 175-180 punten, de vraag is of Google vanmiddag echt zoveel hoger zal openen en dat vooral zal vasthouden. Verder komen er nog cijfers voor de opening, iets waar men naar uit kijkt nu is Boeing, hoe zit het met de business daar?

Kortom, veel factoren zullen vandaag meespelen, ook vanavond nabeurs zal er een en ander naar buiten komen, denk aan Microsoft en Facebook die met cijfers komen. En de maand is zo goed als voorbij, wordt het een ouderwets "sell in may" moment?

Hoe dan ook, het blijft verwondering wekken dat de beurzen als een warm mes door de boter gaan met de condities waar we mee te maken hebben. Vergeet niet dat nog nooit eerder in de geschiedenis de economie zo'n tegenslag kreeg als nu, vrijwel alles staat stil, het geld blijft in de zak momenteel ...

We gaan het nog wel merken, maar de situatie van nu is zoals die is, de markt zoekt zijn weg zoals altijd, we zitten met de bekende situatie FOMO (Fear Of Missing Out) ... De realiteit zal zich op een gegeven moment wel weer laten zien ...

Vergeet niet om met de posities, signalen mee te doen, ik blijf rustig, zoek naar kansen en begeleid de leden waar dat nodig is ... Nu €39 tot 1 JULI ... https://www.usmarkets.nl/tradershop

Tot straks ... Guy

Wake-up call: Futures hoger, wachten op meer cijfers

Goedemorgen

Voor het eerst sinds enkele weken regen, het was nodig gezien de droogte die er was sinds de afgelopen weken. Regen wil meteen ook zeggen dat je meer binnen blijft en dan voel je meteen dat de wereld om je heen nog wat kleiner wordt. Wel merken we dat meer mensen de regels overtreden, men is het gewoon moe om afgezonderd te zitten, op zich een logisch gevolg van waar we mee te maken hebben. De cijfers dalen overal wat momenteel maar velen waarschuwen om het nog niet helemaal los te laten, probeer verstandig te blijven in deze fase want zolang er geen vaccin is kan het virus zo weer toeslaan en dan zijn we nog verder van huis.

De markten blijven op zich ook sterk liggen, gisteren wel wat daling op Wall Street met de Nasdaq voorop maar als we naar de futures kijken vanmorgen dan is alles weer ingehaald, al staan we wel nog onder de toppen van gisteren. Alphabet verdiende dan wel minder door de dalende advertentie inkomsten maar de omzet groeide wel weer wat waardoor het aandeel nabeurs 7% opliep. Het blijft een moeilijke markt zoals u merkt, beleggers kijken al heel ver vooruit maar door de mist die er is zie je niet zo ver vooruit en daarom blijf ik voorzichtig met de vooruitzichten. De gehele markt blijft moeilijk te lezen aangezien het erop lijkt dat sommige indices maar 1 doel hebben en dat is zo snel als mogelijk weer de records van februari aanvallen. We zijn amper 2 maand verder nu, en alles zou dan al opgelost moeten zijn? We gaan het meemaken, wel lijkt het erop dat deze Bear Market Rally van een ander kaliber is dan die van 2008.

Maar goed, de tsunami aan geld dat mogelijk tot 5 keer meer is dan in 2008, en wie weet nog meer wereldwijd, lijkt zijn weg te vinden naar de markten. Daar is moeilijk tegen in te gaan al weet je in het achterhoofd dat je dat wel moet doen omdat de waarderingen nu eenmaal niet passen bij de huidige stand van zaken. Wel is het zo dat de markt op zoek zal gaan naar een correcte waardering, mogelijk was die op 20 februari veel te hoog, op 23 maart te laag en nu opnieuw te hoog. Wat mij betreft zal de waarheid wel ergens in het midden uitkomen. Dus wat betreft de Dow Jones rond de 22.000 punten, bij de AEX rond de 460 punten en wat betreft de Nasdaq in de buurt van de 7600 punten ...

Om mee te doen met de signalen, posities en coaching kunt u nu een proefabonnement nemen tot 1 JULI voor €39 ... https://www.usmarkets.nl/tradershop

Tot straks ... Guy

Om mee te doen met de signalen, posities en coaching kunt u nu een proefabonnement nemen tot 1 JULI voor €39 ... https://www.usmarkets.nl/tradershop

Markt snapshot vandaag

GLOBAL TOP NEWS

The U.S. economy likely contracted in the first quarter at its sharpest pace since the Great Recession as stringent measures to slow the spread of the novel coronavirus almost shut down the country, ending the longest expansion in the nation's history.

Ford Motor said on Tuesday its second-quarter loss would more than double to over $5 billion from $2 billion in the first quarter due to the impact of the coronavirus pandemic, but added it had enough money despite the crisis to last the rest of 2020.

Samsung said it expected profit to decline in the current quarter due to a coronavirus-related slump in sales of smartphones and TVs, although the chip business would remain solid.

EUROPEAN COMPANY NEWS

Standard Chartered said its first-quarter profit tumbled 12%, as the emerging markets-focused bank boosted provisions against bad loans as the coronavirus crisis hammers its borrowers.

Lufthansa might seek some form of protection from creditors while talking to the Berlin government about a 9 billion euro rescue package, a company source said on Tuesday after government and airline sources said talks on a deal were continuing.

Carrefour said on Tuesday that revenue growth accelerated in the first quarter, reflecting strong food sales in March in all its markets and notably in the core French market as people stayed at home due to coronavirus lockdowns.

TODAY'S COMPANY ANNOUNCEMENTS

Aena SME SA Q1 2020 Earnings Call

AIB Group plc Annual Shareholders Meeting

Airbus SE Q1 2020 Earnings Call

Alkermes Plc Q1 2020 Earnings Call

Amplifon SpA Q1 2020 Earnings Call

Ams AG Q1 2020 Earnings Call

Apax Global Alpha Ltd Annual Shareholders Meeting

Arcus ASA Q1 2020 Earnings Call

Arterra Bioscience SpA Annual Shareholders Meeting

Assa Abloy AB Annual Shareholders Meeting

AstraZeneca PLC Annual Shareholders Meeting

Atresmedia Corporacion de Medios de Comunicacion SA Annual Shareholders Meeting

Banca Finnat Euramerica SpA Annual Shareholders Meeting

Bankia SA Q1 2020 Earnings Call

Barclays PLC Q1 2020 Earnings Call

Beiersdorf AG Annual Shareholders Meeting

Bilia AB Earnings Call

Blackbird PLC FY 2019 Earnings Call

Bolsas y Mercados Espanoles SHMSF SA Ordinary Shareholders Meeting

Centrale del Latte d'Italia SpA Annual Shareholders Meeting

CFT SpA Annual Shareholders Meeting

Concordia Maritime AB Q1 2020 Earnings Call

Confinvest FL SpA Annual Shareholders Meeting

Costamare Inc Q1 2020 Earnings Call

Covestro AG Q1 2020 Earnings Call

Criteo SA Q1 2020 Earnings Call

CTT Correios de Portugal SA Annual Shareholders Meeting

Daimler AG Q1 2020 Earnings Call

Destiny Pharma PLC FY 2019 Earnings Call

Deutsche Bank AG Q1 2020 Earnings Call

Digital360 SpA Annual Shareholders Meeting

Doxee SpA Annual Shareholders Meeting

DWS Group GmbH & Co KgaA Q1 2020 Earnings Call

Edgeware AB (publ) Q1 2020 Earnings Call

EFG International AG Annual Shareholders Meeting

Elementis PLC Annual Shareholders Meeting

Elettra Investimenti SpA Annual Shareholders Meeting

Eltel AB Q1 2020 Earnings Call

Emak SpA Annual Shareholders Meeting

ENCE Energia y Celulosa SA Q1 2020 Earnings Call

Enervit SpA Annual Shareholders Meeting

EuKedos SpA Annual Shareholders Meeting

Fervi SpA Annual Shareholders Meeting

Fidia SpA Annual Shareholders Meeting

Finlogic SpA Annual Shareholders Meeting

Finnair Plc Q1 2020 Earnings Call

Garmin Ltd Q1 2020 Earnings Call

Gensight Biologics SA Annual Shareholders Meeting

Gk Software Se Q4 2019 Earnings Release

GlaxoSmithKline PLC Q1 2020 Earnings Call

GN Store Nord A/S Q1 2020 Earnings Call

Grafton Group PLC Annual Shareholders Meeting

Hera SpA Annual Shareholders Meeting

Hexagon AB Q1 2020 Earnings Call

Hexagon AB Annual Shareholders Meeting

Holmen AB Q1 2020 Earnings Call

Huhtamaki Oyj Annual Shareholders Meeting

Iberdrola SA Q1 2020 Earnings Call

ICA Gruppen AB Q1 2020 Earnings Call

Il Sole 24 Ore SpA Annual Shareholders Meeting

Imerys SA Q1 2020 Earnings Call

IRCE SpA Annual Shareholders Meeting

Iren SpA Annual Shareholders Meeting

Italgas SpA Q1 2020 Earnings Call

Karo Pharma AB Q1 2020 Earnings Release

Kolinpharma SpA Annual Shareholders Meeting

Konecranes Abp Q1 2020 Earnings Call

Korian SA HY 2020 Earnings Release

Krones AG Q1 2020 Earnings Call

Lancashire Holdings Ltd Annual Shareholders Meeting

Lindab International AB Annual Shareholders Meeting

LivaNova PLC Q1 2020 Earnings Call

Mayr Melnhof Karton AG Annual Shareholders Meeting

Medistim ASA Q1 2020 Earnings Call

Melexis NV Q1 2020 Earnings Call

Metsa Board Oyj Q1 2020 Earnings Release

MIPS AB Q1 2020 Earnings Call

Muenchener Rueckversicherungs Gesellschaft AG in Muenchen Annual Shareholders Meeting

Naturgy Energy Group SA Q1 2020 Earnings Call

Net Insight AB Q1 2020 Earnings Call

NetEnt AB (publ) Annual Shareholders Meeting

Newlat Food SpA Annual Shareholders Meeting

Nordea Bank Abp Q1 2020 Earnings Call

Norsk Hydro ASA Q1 2020 Earnings Call

Notorious Pictures SpA Annual Shareholders Meeting

Novozymes A/S Q1 2020 Earnings Call

OMV AG Q1 2020 Earnings Call

Orsted A/S Q1 2020 Earnings Release

Pandox AB Q1 2020 Earnings Call

Persimmon PLC Annual Shareholders Meeting

Piovan SpA Annual Shareholders Meeting

Piteco SpA Annual Shareholders Meeting

PLC SpA Annual Shareholders Meeting

Portale Sardegna SpA Annual Shareholders Meeting

Portobello SpA Annual Shareholders Meeting

Q-Free ASA Q1 2020 Earnings Call

Raute Oyj Q1 2020 Earnings Call

Recordati Industria Chimica e Farmaceutica SpA Annual Shareholders Meeting

Renergetica SpA Annual Shareholders Meeting

Reno De Medici SpA Annual Shareholders Meeting

Restart Societa di Investimento Immobiliare Quotata SpA Annual Shareholders Meeting

Rizzoli Corriere della Sera Mediagroup SpA Annual Shareholders Meeting

Royal Bank of Scotland Group PLC Annual Shareholders Meeting

Saipem SpA Annual Shareholders Meeting

Sanoma Oyj Q1 2020 Earnings Call

Scor SE Q1 2020 Earnings Call

Sdiptech AB (publ) Q1 2020 Earnings Call

Shedir Pharma Srl Unipersonale Annual Shareholders Meeting

Shurgard Self Storage SA Q1 2020 Earnings Call

Sinch AB (publ) Q1 2020 Earnings Call

Skandinaviska Enskilda Banken AB Q1 2020 Earnings Call

Societa Editoriale Il Fatto SpA Annual Shareholders Meeting

Somec SpA Annual Shareholders Meeting

Spirent Communications plc Annual Shareholders Meeting

St Galler Kantonalbank AG Annual Shareholders Meeting

STRABAG SE FY 2019 Earnings Release

Strongpoint ASA Q1 2020 Earnings Call

Swedish Orphan Biovitrum AB (publ) Q1 2020 Earnings Call

Sydbank A/S Q1 2020 Earnings Release

Synthomer PLC Annual Shareholders Meeting

Tamburi Investment Partners SpA Annual Shareholders Meeting

Tarkett SA Q1 2020 Earnings Call

Techedge SpA Annual Shareholders Meeting

Telekom Austria AG Q1 2020 Earnings Call

Telenet Group Holding NV Annual Shareholders Meeting

Television Francaise 1 SA Q1 2020 Earnings Call

Tenaris SA Q1 2020 Earnings Release

TietoEVRY Corp Annual Shareholders Meeting

Tobii AB Q1 2020 Earnings Call

Tokmanni Group Corp Q1 2020 Earnings Call

Toscana Aeroporti SpA Annual Shareholders Meeting

Transocean Ltd Q1 2020 Earnings Release

TraWell Co SpA Annual Shareholders Meeting

UBS Group AG Annual Shareholders Meeting

Unidata SpA Annual Shareholders Meeting

Unilever PLC Annual Shareholders Meeting

UnipolSai Assicurazioni SpA Annual Shareholders Meeting

Uponor Oyj Q1 2020 Earnings Release

Vastned Retail Belgium SA Annual Shareholders Meeting

Volkswagen AG Q1 2020 Earnings Call

Warehouses de Pauw Comm VA Annual Shareholders Meeting

Wiit SpA Annual Shareholders Meeting

Witan Investment Trust PLC Annual Shareholders Meeting

WM Capital SpA Annual Shareholders Meeting

XXL ASA Q1 2020 Earnings Call

ECONOMIC EVENTS (All times GMT)

0600 (approx.) Germany Import Prices mm for Mar: Expected -2.5%; Prior -0.9%

0600 (approx.) Germany Import Prices yy for Mar: Expected -4.0%; Prior -2.0%

0600 Denmark Industrial Outlook for Apr: Prior -7

0700 (approx.) Spain Retail Sales yy for Mar: Prior 1.8%

0730 Sweden Household Lending Growth yy for Mar: Prior 5.2%

0730 (approx.) Sweden Broad Money for Mar: Prior 3,668,667 mln SEK

0800 (approx.) Italy Producer Prices mm for Mar: Prior -0.4%

0800 (approx.) Italy Producer Prices yy for Mar: Prior -2.6%

0800 Switzerland Investor Sentiment for Apr: Prior -45.8

0830 (approx.) Portugal Business Confidence for Apr: Prior 1.80

0830 (approx.) Portugal Consumer Confidence for Apr: Prior -9.90

0900 (approx.) Euro Zone Money-M3 Annual Growth for Mar: Expected 5.5%; Prior 5.5%

0900 Euro Zone Loans to Households for Mar: Expected 3.6%; Prior 3.8%

0900 Euro Zone Loans to Non-Fin for Mar: Prior 3.0%

0900 (approx.) Euro Zone Broad Money for Mar: Prior 13,147,011 mln EUR

0900 Euro Zone Business Climate for Apr: Prior -0.28

0900 Euro Zone Economic Sentiment for Apr: Expected 74.7; Prior 94.5

0900 Euro Zone Industrial Sentiment for Apr: Expected -25.7; Prior -10.8

0900 Euro Zone Services Sentiment for Apr: Expected -27.0; Prior -2.2

0900 Euro Zone Consumer Confidence Final for Apr: Expected -22.7; Prior -22.7

0900 Euro Zone Cons Inflation Expectation for Apr: Prior 23.0

0900 Euro Zone Selling Price Expectation for Apr: Prior -0.7

0930 (approx.) Belgium CPI mm for Apr: Prior 0.16%

0930 (approx.) Belgium CPI yy for Apr: Prior 0.62%

1000 (approx.) Portugal Unemployment Rate for Mar: Prior 6.50%

1200 (approx.) Germany CPI Prelim mm for Apr: Expected 0.0%; Prior 0.1%

1200 (approx.) Germany CPI Prelim yy for Apr: Expected 0.6%; Prior 1.4%

1200 (approx.) Germany HICP Prelim mm for Apr: Expected 0.1%; Prior 0.1%

1200 (approx.) Germany HICP Prelim yy for Apr: Expected 0.5%; Prior 1.3%