Liveblog Archief woensdag 20 januari 2021

Markt snapshot Wall Street vandaag

TOP NEWS

• Biden to assume U.S. presidency amid deep divisions, raging pandemic

Democrat Joe Biden will be sworn in as the 46th president of the United States, assuming the helm of a country beset by deep political divides and battered by a raging coronavirus pandemic.

• UnitedHealth profit beats on lower medical costs due to deferred care

Health insurer UnitedHealth Group beat quarterly profit estimates for the fourth quarter, helped partly by lower medical costs due to fewer elective surgeries as hospitals made room for COVID-19 patients.

• Pfizer vaccine appears effective against coronavirus variant found in Britain - study

The COVID-19 vaccine developed by Pfizer and BioNTech is likely to protect against a more infectious variant of the virus discovered in Britain which has spread around the world, according to results of further lab tests released.

• Biden to sign 15 actions to address U.S. 'crises' after taking office

Joe Biden will sign 15 executive actions after he is sworn in as U.S. president, aides said, undoing policies put in place by outgoing President Donald Trump and making his first moves on the pandemic and climate change.

• Alibaba's Jack Ma makes first public appearance in three months

Alibaba Group founder Jack Ma made his first public appearance since October when he spoke to a group of teachers by video, easing concern about his unusual absence from the limelight and sending shares in the e-commerce giant surging.

BEFORE THE BELL

Wall Street futures rose as investors looked forward to another fiscal boost to support the pandemic-battered economy after President elect-Joe Biden takes office later in the day. European stocks were in the green, after chip equipment maker ASML and Swiss luxury group Richemont gave encouraging earnings updates. Japan's Nikkei ended lower on profit-booking. The dollar weakened on U.S. Treasury secretary nominee Janet Yellen's call to "act big" on measures to help the U.S. economy, pushing gold prices higher. Oil rose, supported by expectations of stimulus driven demand, OPEC curbs and forecasts of a drop in U.S. inventories.

STOCKS TO WATCH

Results

• Netflix Inc: The streaming platform, said on Tuesday its global subscriber rolls crossed 200 million at the end of 2020 and projected it will no longer need to borrow billions of dollars to finance its broad slate of TV shows and movies. Shares of Netflix rose in extended trading as the financial milestone validated the company's strategy of going into debt to take on big Hollywood studios with a flood of its own programming in multiple languages. Netflix said it will explore returning excess cash to shareholders via share buybacks. It plans to maintain $10 billion to $15 billion in gross debt. From October to December, Netflix signed up 8.5 million new paying streaming customers as it debuted widely praised series "The Queen's Gambit" and "Bridgerton," a new season of "The Crown" and the George Clooney film "The Midnight Sky." The additions topped Wall Street estimates of 6.1 million, according to Refinitiv data, despite increased competition and a U.S. price increase. Fourth-quarter earnings per share of $1.19 missed analyst expectations of $1.39.

• UnitedHealth Group Inc: The health insurer beat quarterly profit estimates for the fourth quarter, helped partly by lower medical costs due to fewer elective surgeries as hospitals made room for COVID-19 patients. UnitedHealth reported a medical loss ratio - the percentage of premiums paid out for medical services - of 79.1% in the fourth quarter, improving from 82.5% a year earlier, capped by COVID-19 testing, treatment and vaccine costs. The company maintained its 2021 profit forecast from December and said it expected adjusted net earnings of $17.75 to $18.25 per share, including a $1.80 per share hit due to treatment and testing costs related to COVID-19. The company reported adjusted earnings of $2.52 per share in the fourth quarter, beating estimates of $2.41 per share, according to IBES data from Refinitiv.

In Other News

• Alibaba Group Holding Ltd & Best Inc: New York-listed Best, a Chinese logistics firm backed by Alibaba, is considering a sale as part of a strategic review, six people with knowledge of the matter said. With the endorsement of Alibaba, its biggest shareholder, Best has tapped financial advisers to explore options as its shares have been underperforming and are worth a fifth of its IPO price in 2018, two of the people involved in the discussions said. Billionaire Jack Ma's Alibaba, which owns 33% of the firm, as well as Best founder and CEO Johnny Chou, who has a 11% stake on a fully diluted basis, could both end up selling their stakes, five of the people said. No formal sale process has been launched, and the company and Alibaba have not decided which option to take as the strategic review is still underway, cautioned the individuals, including two who were approached about a sale.

• Alphabet Inc: Google is investigating a member of its ethical AI team and has locked the corporate account linked to that person after finding that thousands of files were retrieved from its server and shared with external accounts, the company said. Axios, which first reported the latest investigation around a member of Google's AI team, said Margaret Mitchell had been using automated scripts to look through her messages to find examples showing discriminatory treatment of Timnit Gebru, a former employee in the AI team who was fired. In other news, U.S. President Donald Trump said he had given a full pardon to a former Google engineer sentenced for stealing a trade secret on self-driving cars months before he briefly headed Uber's rival unit.

• Bank of America Corp & Citigroup Inc & JPMorgan Chase & Co: A swell of deposits during the coronavirus pandemic has put big U.S. banks on the back foot, with executives saying they hope regulators provide relief on rules that punish bloated balance sheets until loan demand snaps back. JPMorgan Chase, Bank of America and Citigroup took in more than $1 trillion in deposits last year, compared with a $92 billion increase in 2019. In a more normal economy, that kind of boost would be great, allowing banks to lend more or simply invest the money in short-term, low-risk securities, like Treasury bonds. But the stimulus payments and easy-money policies by the government that led to the inundation of deposits has also created a few problems for the banks: low interest rates that crimp lending profitability and stunted loan demand as customers and companies awash with cash spend less.

• BioNTech SE & Pfizer Inc: The COVID-19 vaccine developed by Pfizer and BioNTech is likely to protect against a more infectious variant of the virus discovered in Britain which has spread around the world, according to results of further lab tests released. The encouraging results from an analysis of blood of participants in trials are based on more extensive analysis than those released by the U.S. drugmaker last week. The latest study, posted on bioRxiv.org but not yet peer reviewed, was conducted on a synthetic virus with 10 mutations that are characteristic of the variant known as B117 identified in Britain. Among the 11 authors of the study are Ugur Sahin and Oezlem Tuereci, co-founders of BioNTech. Sahin is chief executive and his wife Tuereci is chief medical officer.

• Ford Motor Co: The company must recall 3 million vehicles with potentially defective driver-side Takata air bags, the U.S. auto safety regulator said on Tuesday, rejecting a bid by the second-largest U.S. automaker to avoid a recall. The National Highway Traffic Safety Administration (NHTSA) said it was denying petitions filed by Ford and Mazda Motor in 2017 seeking to avoid recalling vehicles with potentially dangerous inflators. The decision also will require Mazda to recall and repair driver air bags in approximately 5,800 vehicles. The recalls will cover various vehicles from the 2006 through 2012 model years.

• Microsoft Corp: Commerzbank said that it would widen its partnership with Microsoft by putting a significant portion of its applications in the cloud over the next five years. The two companies have been working together since 2018, and Commerzbank has been trying to increasingly digitize its business in recent years. The announcement comes as Germany's No. 2 lender works on a strategic plan under a new chief executive officer, with details expected in the coming weeks. "Cloud computing is a key technology for the digital transformation of Commerzbank," the bank said.

• Sinovac Biotech Ltd: China said three drugmakers had submitted applications to supply their COVID-19 vaccines to global vaccine-sharing scheme COVAX in the country's first formal move to provide locally developed shots to the initiative. Sinovac Biotech, China National Pharmaceutical Group (Sinopharm) and CanSino Biologics have applied to join the scheme, China's foreign ministry spokeswoman Hua Chunying told a news conference on Wednesday. The COVAX scheme - led by the World Health Organization and GAVI vaccine alliance - is due to start rolling out vaccines to poor and middle-income countries in February, with 2 of 3 billion doses expected to be delivered this year.

• Tyson Foods Inc: The company agreed to settle price-fixing litigation with two more groups of plaintiffs accusing it of illegally conspiring to inflate prices in the $65 billion chicken industry. The settlements with so-called "end-user" consumers and with more than 30 commercial purchasers were disclosed in filings on Tuesday in federal court in Chicago. Eight days ago, Tyson agreed to settle related antitrust claims by purchasers who bought chickens directly from the Springdale, Arkansas-based company. Tyson has also faced price-fixing claims by large restaurant and supermarket operators such as Chick-fil-A, Kroger and Walmart. Terms of the settlements were not disclosed, and court approvals are required.

• Walt Disney Co: The company said on Tuesday it had eliminated performance-based bonuses last year for top executives, including Executive Chairman Bob Iger, as the media company looks to soften the impact of the COVID-19 fallout. Iger received a total compensation of $21 million for fiscal year 2020, significantly lower than the $47.5 million he had received in the prior year, Disney disclosed in a regulatory filing. The compensation package of Chief Executive Officer Bob Chapek, who took on the role last February, totaled to $14.2 million. Last year, Disney said Iger would forgo his salary while Chapek took a 50% pay cut amid the coronavirus crisis.

ANALYSISPricey U.S. stock valuations put burden on earnings to keep rally going

U.S. corporate results and profit outlooks are becoming increasingly important in sustaining investor optimism in a stock market rally that has driven valuations close to a 20-year high.

ANALYSTS' RECOMMENDATION

• Ally Financial Inc: JPMorgan raises target price to $47 from $32, reflecting a favourable funding and stable credit outlook.

• American Express Co: JPMorgan raises to overweight from underweight, assuming that high-end spend is likely to rebound sharply and early as the economy recovers.

• Citrix Systems Inc: Jefferies raises target price to $150 from $140, following the announcement of its acquisition of Wrike, a SaaS collaborative work management.

• Logitech International SA: Wedbush raises target price to $110 from $95, saying the company benefited from extended lockdowns, boosting the demand for gaming products, video communication and streaming among others.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

1000 NAHB Housing Market Index for Jan: Expected 86; Prior 86

COMPANIES REPORTING RESULTS

Bank of New York Mellon Corp: Expected Q4 earnings of 91 cents per share

Discover Financial Services: Expected Q4 earnings of $2.42 per share

Kinder Morgan Inc: Expected Q4 earnings of 24 cents per share

Morgan Stanley: Expected Q4 earnings of $1.27 per share

United Airlines Holdings Inc: Expected Q4 loss of $6.60 per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Bank of New York Mellon Corp: Q4 earnings conference call

0800 Citizens Financial Group Inc: Q4 earnings conference call

0830 Morgan Stanley: Q4 earnings conference call

0830 Procter & Gamble Co: Q2 earnings conference call

0845 UnitedHealth Group Inc: Q4 earnings conference call

0900 U.S. Bancorp: Q4 earnings conference call

0930 Pinnacle Financial Partners Inc: Q4 earnings conference call

1000 Fastenal Co: Q4 earnings conference call

1000 BOK Financial Corp: Q4 earnings conference call

1100 D.R. Horton Inc: Annual Shareholders Meeting

1630 Kinder Morgan Inc: Q4 earnings conference call

EX-DIVIDENDS

Cabot Oil & Gas Corp: Amount $0.10

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| EUROPA: CPI (Jaarlijks) (Dec) | Actueel: -0,3% Verwacht: -0,3% Vorige: -0,3% |

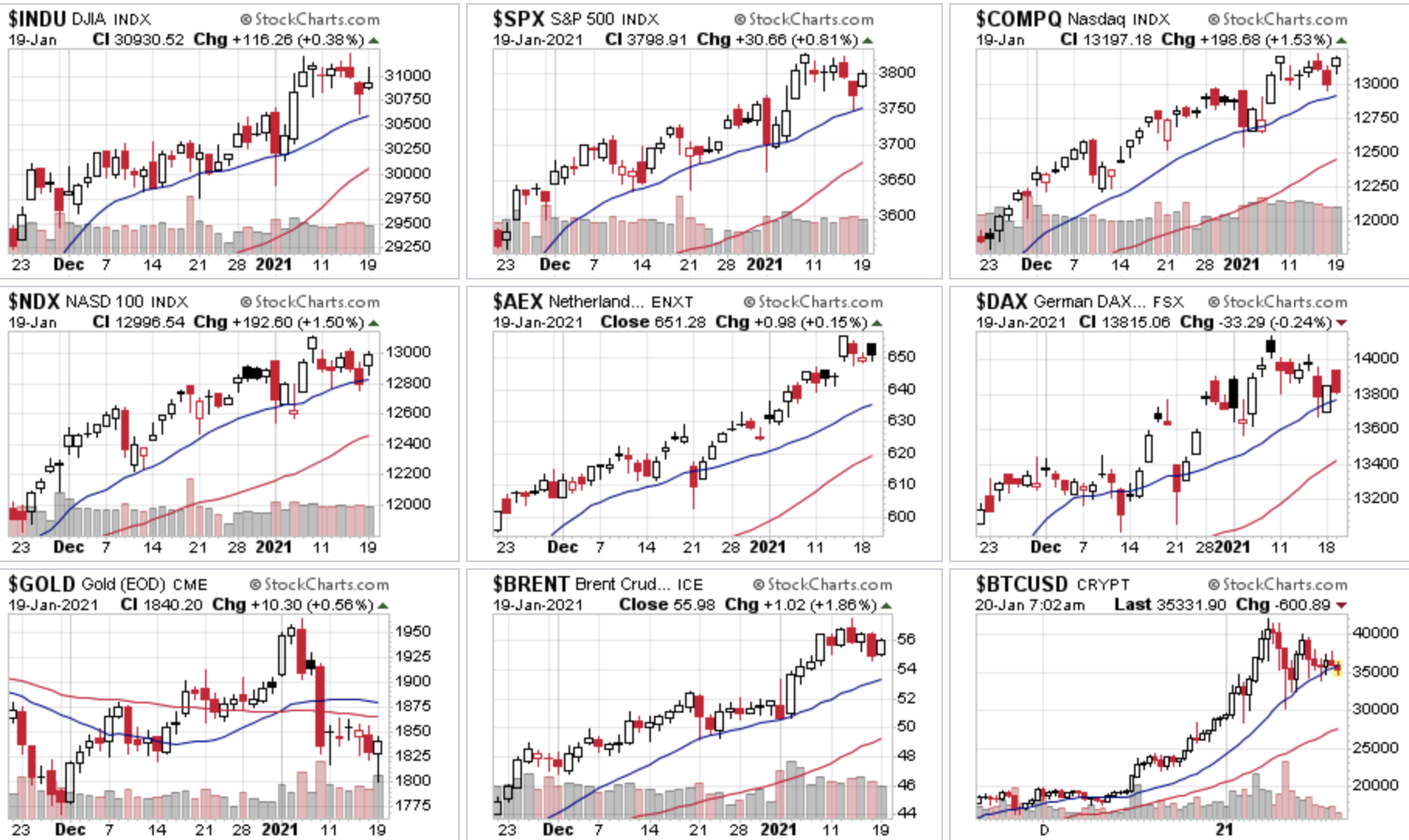

Wake-up call: Technologie sterk, andere indices twijfelen wat

Goedemorgen

De indicaties laten vanmorgen zien dat Europa wat lager kan openen terwijl Wall Street vlak tot wat hoger kan starten later vandaag gezien de stand van de futures. Vandaag wordt de nieuwe president ingewijd in de VS, het is nu de beurt aan Joe Biden om het land door een hoop problemen en uitdagingen te loodsen de komende 4 jaar.

We zien een kleine 10 punten verlies bij de DAX, de AEX kan zo te zien tot 5 punten hoger starten vooral door ASML na de cijfers, we moeten nog zien hoe dat na de opening zal gaan. Frankrijk wint 15 punten voorbeurs. Als ik naar Wall Street kijk dan staan de futures daar wat hoger, de Dow zo'n 20 punten, de Nasdaq future 75 punten en de S&P future rond de 9 punten.

Cijfers ASML:

Dan even een korte blik op de cijfers van ASML, het bedrijf behaalde de eigen doelstellingen ruimschoots maar een kleine tegenvaller was dat het bedrijf de verwachtingen voor 2021 niet verhoogde deze keer. Het uitdagende jaar 2020 was een jaar met sterke groei vertelde de CEO erbij. ASML maakte een omzet van €4,25 miljard met een brutomarge van 52%. De verwachtingen lagen wat lager, op €3,6 tot €3,8 miljard met een brutomarge van 50%. De nettowinst in Q4 bedroeg €1,35 miljard wat goed is voor €3,23 per aandeel.

Yellen met wat uitspraken dinsdag:

Janet Yellen zei dat de staatsschuld sterk gestegen is, maar dat de lasten om die te financieren door dat de rente laag staat te overzien zijn hetgeen ruimte geeft om nog meer geld de economie in te pompen om de crisis te lijf te gaan. Over China zei Yellen dat het land de belangrijkste rivaal van de VS blijft en dat ze bereid is om alle instrumenten in te zetten om misbruik en oneerlijke en illegale praktijken door China aan te pakken. De beste manier om dat te doen is door met bondgenoten samen te werken, volgens Yellen.

Opvallend was dat de banken overal in moesten leveren, op Wall Street na de cijfers van Goldman Sachs zien we dat al want het aandeel verloor 2% na de sterke cijfers. In Europa verloor Deutsche Bank 3% maar ook Santander, BNP Paribas, ING, ABN Amro en KBC verloren dinsdag. Goldman Sachs boekte afgelopen jaar 9,6 miljard dollar winst waardoor de winst veel hoger uitkwam dan verwacht vooral door de handel op aandelen wat goed verliep.

Nabeurs kwam Netflix met cijfers en liet een sterke groei van abonnees zien tijdens het 4e kwartaal. Het aandeel steeg nabeurs ruim 12%. Netflix kwam zoals altijd als eerste uit de FAANG groep met cijfers. Grote techbedrijven zoals Facebook, Alphabet en Amazon uit de bekende FAANG groep hadden ook een sterke dag dinsdag. Tesla profiteerde mee van het sterke sentiment bij de technologie en steeg opnieuw 2%.

Economische cijfers:

08:00 Producentenprijzen - December (Dld)

11:00 Inflatie - December (Europa)

16:00 Vertrouwen huizenbouwers - Januari (VS)

18:00 Presidentiële inauguratie Joe Biden (VS)

Kwartaalcijfers vandaag:

13:00 Morgan Stanley

13:00 Procter & Gamble

13:00 UnitedHealth

22:00 Alcoa

22:00 United Airlines

Verder nog de cijfers deze week via het overzicht hieronder

U kunt mij en dus @USMarkets uiteraard ook volgen via onze Twitter account, ga naar ...https://twitter.com/USMarkets waar ik tussentijds wat charts over de markt en sentiment plaats, ook opvallende beursfeiten komen er vaak langs !

Euro, olie en goud:

De euro zien we nu rond de 1.215 dollar, de prijs van een vat Brent olie komt uit op 56,3 dollar terwijl een troy ounce goud nu op 1853 dollar staat. De Bitcoin herpakt zich na enkele dolle dagen, nu moet je 35.300 dollar neertellen voor 1 Bitcoin ...

Strategische posities:

Zodra u lid wordt ontvangt u de signalen en kunt u meteen de lopende posities inzien via onze Tradershop op de website. Ik probeer in ieder geval zo goed als dat kan om met de markt mee te gaan, wel is het zo dat de markt volatiel blijft voorlopig en die kan zelfs nog wat gaan toenemen. Wat ik moet doen is in ieder geval blijven schakelen tussen long en short.

Maak nu gebruik van de proef aanbieding:

Mis in ieder geval de start van 2021 niet want er komen hoe dan ook hele mooie kansen ... Via deze aanbieding ... €39 tot 1 APRIL 2021 ... Polleke €49 tot 1 APRIL 2021 !!!

Systeem Trading (€39 tot 1 APRIL)

Index Trading (€39 tot 1 APRIL)

Polleke Trading (€49 tot 1 APRIL)

Aandelen portefeuille (€30 tot 1 APRIL)

COMBI TRADING (€79 tot 1 APRIL)

Met vriendelijke groet,

Guy Boscart

Markt snapshot Europa vandaag

GLOBAL TOP NEWS

Janet Yellen, U.S. President-elect Joe Biden's nominee for Treasury Secretary, urged lawmakers on Tuesday to "act big" on coronavirus relief spending, arguing that the economic benefits far outweigh the risks of a higher debt burden.

Pfizer told Canada on Tuesday it will receive no coronavirus vaccines next week, officials said, an unexpected development that promises more pain for provinces already complaining about a shortage of supplies.

Bank of England chief economist Andy Haldane said on Tuesday that he expected Britain's economy to begin to recover "at a rate of knots" from the second quarter of this year, as vaccines against COVID-19 are rolled out.

EUROPEAN COMPANY NEWS

London Stock Exchange said on Tuesday that it should complete its $27 billion acquisition of Refinitiv on Jan. 29, as it bulks up into a major financial data provider to compete with Bloomberg.

Stellantis, the carmaker forged from the merger of Fiat Chrysler and Peugeot-owner PSA, will give all its 14 brands a chance at success and keep all options on the table for revitalising its struggling Chinese business, it top executive said on Tuesday.

BHP forecast record iron ore production for fiscal 2021, as the world's biggest listed miner looks to cash in on high prices for the commodity following restart of its Brazilian operations.

TODAY'S COMPANY ANNOUNCEMENTS

ASML Holding NV Q4 2020 Earnings Release

Diploma PLC Annual Shareholders Meeting

Edinburgh Worldwide Investment Trust PLC Annual Shareholders Meeting

Italian Wine Brands SpA Shareholders Meeting

Majedie Investments PLC Annual Shareholders Meeting

ECONOMIC EVENTS (All times GMT)0700 (approx.) Germany Producer Prices mm for Dec: Expected 0.3%; Prior 0.2%0700 (approx.) Germany Producer Prices yy for Dec: Expected -0.3%; Prior -0.5%0700 (approx.) United Kingdom Core CPI mm for Dec: Expected 0.2%; Prior -0.1%0700 (approx.) United Kingdom Core CPI yy for Dec: Expected 1.3%; Prior 1.1%0700 (approx.) United Kingdom CPI mm for Dec: Expected 0.2%; Prior -0.1%0700 (approx.) United Kingdom CPI yy for Dec: Expected 0.5%; Prior 0.3%0700 (approx.) United Kingdom Retail Prices (RPI) mm for Dec: Expected 0.5%; Prior -0.3%0700 (approx.) United Kingdom RPI yy for Dec: Expected 1.2%; Prior 0.9%0700 (approx.) United Kingdom RPI-X mm for Dec: Prior -0.3%0700 (approx.) United Kingdom RPI-X yy for Dec: Prior 1.1%0700 (approx.) United Kingdom RPI Index for Dec: Prior 293.50700 (approx.) United Kingdom CPI NSA for Dec: Prior 108.90800 (approx.) Austria HICP mm for Dec: Prior 0.2%0800 (approx.) Austria HICP yy for Dec: Prior 1.1%0800 (approx.) Austria CPI yy NSA for Dec: Prior 1.21%0800 (approx.) Austria CPI mm NSA for Dec: Prior 0.18%0800 (approx.) Austria CPI NSA for Dec: Prior 108.90930 (approx.) United Kingdom PPI Input Prices mm NSA for Dec: Expected 0.7%; Prior 0.2%0930 (approx.) United Kingdom PPI Input Prices yy NSA for Dec: Expected 1.0%; Prior -0.5%0930 (approx.) United Kingdom PPI Output Prices mm NSA for Dec: Expected 0.2%; Prior 0.2%0930 (approx.) United Kingdom PPI Output Prices yy NSA for Dec: Expected -0.6%; Prior -0.8%0930 (approx.) United Kingdom PPI Core Output mm NSA for Dec: Prior 0.0%0930 (approx.) United Kingdom PPI Core Output yy NSA for Dec: Prior 0.9%1000 Euro Zone HICP Final mm for Dec: Expected 0.3%; Prior -0.3%1000 Euro Zone HICP Final yy for Dec: Expected -0.3%; Prior -0.3%1000 Euro Zone HICP-X food & energy mm for Dec: Expected 0.3%; Prior -0.4%

1000 Euro Zone HICP-X food & energy final yy for Dec: Expected 0.4%; Prior 0.4%

1000 Euro Zone HICP-X tobacco mm for Dec: Prior -0.4%

1000 Euro Zone HICP-X tobacco yy for Dec: Prior -0.4%

1000 Euro Zone HICP-X food, energy, alcohol & tobacco final mm for Dec: Expected 0.4%; Prior 0.4%

1000 Euro Zone HICP-X food, energy, alcohol & tobacco final yy for Dec: Expected 0.2%; Prior 0.2%

1000 (approx.) Euro Zone HICP-X tobacco revised for Dec: Prior 104.35

1000 (approx.) Euro Zone HICP-X tobacco unrevised for Dec: Prior 104.35

1100 (approx.) Portugal Current Account Balance for Nov: Prior -1.823 bln EUR