Liveblog Archief woensdag 26 mei 2021

TA verzoek - Nikola, Hyliion en Hyzon

Op verzoek van Anil bekijken we vandaag twee interessante aandelen, namelijk Nikola en Hyliion. Twee bedrijven waarbij het belangrijkste product trucks zijn welke op elektriciteit, gas en waterstof rijden. Klaar voor de toekomst (met minder CO2 uitstoot) zou u denken, maar hoe staan de charts…

Lees verder »Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: Ruwe Olievoorraden | Actueel: -1,662M Verwacht: -1,050M Vorige: 1,321M |

Markt snapshot Wall Street 26 mei

TOP NEWS

• Shareholder activism reaches milestone as Exxon board vote nears end

The showdown pitting Exxon Mobil against a tiny activist fund to determine the oil giant's board and future direction was too close to call early Wednesday, according to people familiar with the matter.

• Tech giants told to stop making money from disinformation in EU fake news fight

Facebook, Alphabet unit Google and other tech giants will have to commit to curb the monetisation of disinformation through advertisement placements under the European Commission's beefed up code of practice against fake news.

• WhatsApp sues Indian government over new privacy rules – sources

WhatsApp has filed a lawsuit in Delhi against the Indian government seeking to block regulations coming into force that experts say would compel Facebook's messaging app to break privacy protections, sources said.

• Coty names Andrew Stanleick as CEO of Kylie Jenner beauty brands

Coty appointed Andrew Stanleick as the chief executive officer for the beauty brands business created by celebrity and influencer Kylie Jenner.

• Michael Kors parent forecasts annual revenue above expectations

Capri Holdings forecast annual revenue above Wall Street expectations, betting on shoppers returning to stores in the United States following speedy vaccinations and pent-up demand for luxury goods in Europe.

BEFORE THE BELL

Futures for Wall Street’s major indexes rose after remarks from the U.S. Federal Reserve officials soothed investors' inflation worries. European shares were mostly higher, while London's FTSE 100 dipped following a fall in heavyweight mining and banking stocks. China stocks notched their highest close in three months and Japanese shares eked out small gains. The dollar held steady against its peers. Oil traded in a narrow range, supported by optimism about improving U.S. fuel demand but with the prospect of returning Iranian oil keeping any gains in check. Gold rose above the key $1,900 level for the first time since January.

STOCKS TO WATCH

Results

• Capri Holdings Ltd: The company forecast annual revenue above Wall Street expectations, betting on shoppers returning to stores in the United States following speedy vaccinations and pent-up demand for luxury goods in Europe. The Michael Kors and Versace parent expects revenue of about $5.1 billion for its fiscal 2022. Analysts were estimating $4.99 billion. The company beat estimates for fourth-quarter revenue, fueled by robust demand for its high-end bags and purses across markets. Revenue edged higher to $1.20 billion in the three months ended March 27, from $1.19 billion a year earlier. Analysts had expected $1.02 billion.

• Nordstrom Inc: The company posted a bigger-than-expected quarterly loss on Tuesday, hurt by price markdowns the department store chain had to initiate due to excess holiday inventory and increasing competition in the retail sector. The retailer's first-quarter sales declined 13% from 2019. In contrast, rival apparel retailer Urban Outfitters reported a 7.3% rise in net sales for the same period. The company reiterated its full-year revenue forecast of an over 25% increase. The company reported a net loss of $166 million, or $1.05 per share in the quarter ended May 1, compared with estimates of a loss of 57 cents per share.

• Pinduoduo Inc: Chinese e-commerce platform’s quarterly revenue beat Wall Street estimates, driven by steady demand for online shopping following the COVID-19 pandemic. Active buyers on Pinduoduo in the 12-month period ended March rose 31% to about 824 million, outpacing Alibaba's 811 million. Total revenue more than tripled to 22.17 billion yuan in the first quarter, boosted by Pinduoduo's online marketing services revenue. Analysts on average had expected revenue of 20.2 billion yuan. The interactive buying platform's net loss attributable to shareholders narrowed to 2.91 billion yuan in the quarter ended March 31, from 4.12 billion yuan a year earlier.

Moves

• Coty Inc: The company appointed Andrew Stanleick as the chief executive officer for the beauty brands business created by celebrity and influencer Kylie Jenner. Stanleick will also manage reality TV star Kim Kardashian West's business for Coty, to drive global expansion and entry into new beauty categories. Kris Jenner, who held the role of interim CEO for her beauty business, will remain closely involved in startegic partnerships between the brands and Coty as a board member.

In Other News

• Alphabet Inc & Facebook Inc: Facebook, Alphabet unit Google and other tech giants will have to commit to curb the monetisation of disinformation through advertisement placements under the European Commission's beefed up code of practice against fake news. Concerns about the impact of disinformation have intensified amid the COVID-19 pandemic and claims about election fraud in the United States, with some critics pointing to the role of social media and tech giants in the spread of fake news. The EU executive said the strengthened non-binding guidelines set out a robust monitoring framework and clear performance indicators for companies to comply with, confirming a Reuters exclusive on May 19.

• Amazon.com Inc: The company said its cloud service unit will launch three data centres in the first half of 2022 in the United Arab Emirates, its second Middle East infrastructure region. The Abu Dhabi Investment Office (ADIO) said the deal was part of its efforts to attract investments that build technology capabilities and accelerate innovation.

• AstraZeneca Plc: A lawyer for the European Union accused the company of not having even tried to respect its contract with the 27-nation bloc for the supply of COVID-19 vaccines and of failing to warn it in time of large cuts to deliveries. The EU took the Anglo-Swedish firm to court in April after the drugmaker said it would aim to deliver only 100 million doses of its vaccine by the end of June, instead of the 300 million foreseen in the supply contract. The EU wants the company to deliver at least 120 million vaccines by the end of June. Separately, AstraZeneca and Nipro signed an agreement to supply the British-Swedish company's COVID-19 vaccine in Japan, Nipro said.

• BHP Group Ltd: A union representing workers at BHP’s Escondida and Spence copper mines has rejected the company´s contract offer, it told Reuters, and called on members to walk off the job from Thursday. The 205 workers run the global resources company’s Integrated Operations Center, which manages pits and cathode and concentrator plants in the north of Chile from Santiago, the capital. The impact of such a strike on BHP´s operations in Chile was not immediately clear, as the negotiation between the remote operations union and the company is the first of its kind.

• BioNTech SE: Taiwan directly accused China for the first time of blocking a deal with BioNTech for COVID-19 vaccines, in an escalating war of words after Beijing offered the shots to the island via a Chinese company. Taiwan has millions of shots on order, from AstraZeneca and Moderna, but has received only slightly more than 700,000 to date, and has only been able to vaccinate about 1% of its population as cases surge. While Taiwan has previously said it had been unable to sign a final contract with BioNTech, it had only implied that Chinese pressure was to blame. China has denied trying to block vaccines for Taiwan and has offered to provide them itself to the island as a gesture of goodwill.

• Exxon Mobil Corp: The showdown pitting Exxon Mobil against a tiny activist fund to determine the oil giant's board and future direction was too close to call early Wednesday, according to people familiar with the matter. Exxon's 12 directors are up for election in the first major boardroom contest where climate change is a central issue. Preliminary vote results are expected by midday. Results will show if there is broad support among energy investors for a transition to cleaner fuels. Never before have climate concerns become so crucial to director contest at a major oil company, said proxy experts.

• Facebook Inc: WhatsApp has filed a lawsuit in Delhi against the Indian government seeking to block regulations coming into force that experts say would compel Facebook's messaging app to break privacy protections, sources said. The case asks the Delhi High Court to declare that one of the new IT rules is a violation of privacy rights in India's constitution since it requires social media companies to identify the "first originator of information" when authorities demand it, people familiar with the lawsuit told Reuters. Meanwhile, the United States topped a list of the countries most frequently targeted by deceptive foreign influence operations using Facebook between 2017 and 2020, the social media company said in a new report released.

• Facebook Inc & Twitter Inc: Facebook, Twitter and other social networks must have databases of Russian users on Russian territory by July 1 or face fines, the Interfax news agency cited communications regulator Roskomnadzor as saying. Russia is considering legislation that would force foreign technology companies to open offices in Russia or face penalties such as advertising bans, as part of Moscow's wider efforts to exert greater control over Big Tech. Facebook, Twitter and others must localise their databases of Russian users by July 1 or face a fine of up to 18 million roubles for non-compliance, the deputy head of Roskomnadzor Milos Wagner was cited as saying.

• Foresight Acquisition Corp: P3 Health Partners said on Tuesday it had agreed to go public through a merger with the blank-check firm in a deal valuing the combined company at $2.3 billion, including debt. The health population management company said the deal is expected to provide it with cash proceeds of at least $180 million and includes more than $200 million in private investment from Fidelity Management & Research Company and Janus Henderson Investors, among others. Including the cash proceeds, the estimated equity value of the combined company is $2.4 billion, P3 Health said. The combined company will be renamed P3 Health Partners and is expected to remain listed on the Nasdaq Capital Market, P3 Health said.

• GameStop Corp: Shares of the company soared 16.3% on Tuesday after hitting their highest level since late March, and other so-called "meme" stocks also rallied as investors shifted back into the retail favorites that had notched big gains earlier in the year. The video game retailer’s shares finished at $209.43, marking their first close above $200 since March 19. Shares of AMC Entertainment Holdings ended up about 20% while Koss gained 22.9%.

• General Motors Co: The company said on Tuesday the United Auto Workers union is "well positioned" to represent more than 2,300 workers at new U.S. joint venture battery plants with LG Chem. The UAW said it looks forward to starting discussions with GM on the "joint venture to produce batteries in Ohio and Tennessee so workers will have a voice at the table in order to create good paying union jobs and benefits.” The UAW wants U.S. automakers to recognize the union at joint-venture battery facilities. The union has said it represents about 48,500 U.S. workers at GM, though the automaker says about 49% of its U.S. workforce, or 46,000 workers, were represented by the UAW, as of the end of 2020.

• Johnson & Johnson: The Belgian government said it was suspending vaccinations with the company's COVID-19 vaccine for people under the age of 41 following the death of a woman from severe side-effects after receiving the jab. "The Inter-ministerial conference has decided to temporarily administer Janssen's vaccine to the general population from the age of 41 years, pending a more detailed benefit-risk analysis by the EMA," the Belgian health ministers said in a statement.

• Li Auto Inc: China's electric vehicle maker expects sales to reach 10,000 cars a month from September and will expand its sales network, executives said. Li Auto President Shen Yanan said Li Auto, which has only one model, expects monthly sales of its facelifted Li ONE extended-range electric sport-utility vehicle model to nearly double by September. It sold 5,539 cars in April. Shen said the firm would expand its sales network and continue to use a direct-sales model strategy to sell its vehicles, adding that it is building a team to research selling overseas. It has 75 stores in more than 50 Chinese cities.

• Morgan Stanley: The bank’s efforts to improve the diversity of its workforce and senior management have not proceeded as quickly as Chief Executive James Gorman would have liked, he said in prepared testimony posted on Tuesday. Wall Street bank chiefs are expected to face tough questions in U.S. Congress on hot-button social and economic issues when they appear before House and Senate committees on Wednesday. Ahead of the hearing, Morgan Stanley was asked to assess its successes and failures recruiting a diverse workforce generally and at the senior executive level specifically.

• Sony Group Corp & Taiwan Semiconductor Manufacturing Co Ltd: Japan's government wants Taiwan Semiconductor and Sony to invest 1 trillion yen to build the country's first 20 nanometre chip plant, the Nikkan Kogyo newspaper reported. The potential factory would be built close to Sony's image sensor plant in southwest Japan, according to a proposal floated by Japan's trade and industry ministry, the report said. Meanwhile, Sony said it will spend 2 trillion yen over the next three years on strategic investments, including a push to expand subscribers to its gaming and entertainment services.

• Tesla Inc: The company said on Tuesday it will drop a radar sensor in favour of a camera-focused Autopilot system for its Model 3 and Model Y vehicles in North America starting this month. The move came amid growing scrutiny by regulators and media about the safety of what Tesla dubs "Autopilot" and "Full Self-Driving (FSD)" features, following a series of crashes. "Pure vision Autopilot is now rolling out in North America," CEO Elon Musk said in a Tweet. He said it plans to release an improved "FSD beta V9.0" based on the pure vision system about three weeks later. "FSD subscription will be enabled around the same time," he said.

FOCUS

In U.S. creator economy boom, big tech battles for online talent

In the last year, major social media companies have raced to announce dozens of features aimed at attracting creators, an estimated 50 million people like Katie Feeney, an 18-year-old from Olney, Maryland and Julian Shaw, Portland-based personal trainer, who range from internet personalities posting beauty tutorials on YouTube and TikTok to independent journalists selling newsletter subscriptions on Substack to video gamers live-streaming on Twitch.

ANALYSTS' RECOMMENDATION

• Agilent Technologies Inc: JPMorgan raises target price to $150 from $140, after the company increased its full-year guidance following strong second-quarter earnings.

• Autozone Inc: Jefferies raises target price to $1,650 from $1,455, following the company’s strong third-quarter earnings.

• Intuit Inc: RBC raises target price to $525 from $490, after the company reported better-than-expected third-quarter results and raised its full-year guidance.

• Nordstrom Inc: Barclays raises target price to $20 from $19, saying the company’s first-quarter operating performance was in line with expectations.

• Zscaler Inc: JPMorgan raises target price to $212 from $200, after the company’s third-quarter revenue beat estimates.

ECONOMIC EVENTS

No economic indicators are scheduled for release.

COMPANIES REPORTING RESULTS

DXC Technology Co: Expected Q4 earnings of 70 cents per share

NVIDIA Corp: Expected Q1 earnings of $3.28 cents per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0730 Pinduoduo Inc: Q1 earnings conference call

0800 BlackRock Inc: Annual Shareholders Meeting

0800 GSX Techedu Inc: Q1 earnings conference call

0800 iClick Interactive Asia Group Ltd: Q1 earnings conference call

0800 Li Auto Inc: Q1 earnings conference call

0800 Skyline Champion Corp: Q4 earnings conference call

0830 Abercrombie & Fitch Co: Q1 earnings conference call

0830 ADT Inc: Annual Shareholders Meeting

0830 Advance Auto Parts Inc: Annual Shareholders Meeting

0830 Toll Brothers Inc: Q2 earnings conference call

0900 Anthem Inc: Annual Shareholders Meeting

0900 Avis Budget Group Inc: Annual Shareholders Meeting

0900 Customers Bancorp Inc: Annual Shareholders Meeting

0900 Denbury Inc: Annual Shareholders Meeting

0900 Focus Financial Partners Inc: Annual Shareholders Meeting

0900 HEICO Corp: Q2 earnings conference call

0900 MicroVision Inc: Annual Shareholders Meeting

0900 Surgery Partners Inc: Annual Shareholders Meeting

0930 Stericycle Inc: Annual Shareholders Meeting

1000 Aveanna Healthcare Holdings Inc: Q1 earnings conference call

1000 Columbus McKinnon Corp: Q4 earnings conference call

1000 DENTSPLY SIRONA Inc: Annual Shareholders Meeting

1000 Dick's Sporting Goods Inc: Q1 earnings conference call

1000 Dollar General Corp: Annual Shareholders Meeting

1000 Gohealth Inc: Annual Shareholders Meeting

1000 Graphic Packaging Holding Co: Annual Shareholders Meeting

1000 Horace Mann Educators Corp: Annual Shareholders Meeting

1000 Laureate Education Inc: Annual Shareholders Meeting

1000 LivePerson Inc: Annual Shareholders Meeting

1000 MicroStrategy Inc: Annual Shareholders Meeting

1000 New York Community Bancorp Inc: Annual Shareholders Meeting

1000 ONEOK Inc: Annual Shareholders Meeting

1000 PC Connection Inc: Annual Shareholders Meeting

1000 PDC Energy Inc: Annual Shareholders Meeting

1000 Ranpak Holdings Corp: Annual Shareholders Meeting

1000 Seacoast Banking Corporation of Florida: Annual Shareholders Meeting

1000 Southern Co: Annual Shareholders Meeting

1000 Sprout Social Inc: Annual Shareholders Meeting

1000 Steven Madden Ltd: Annual Shareholders Meeting

1000 United Airlines Holdings Inc: Annual Shareholders Meeting

1030 Corcept Therapeutics Inc: Annual Shareholders Meeting

1030 Exxon Mobil Corp: Annual Shareholders Meeting

1030 Stifel Financial Corp: Annual Shareholders Meeting

1100 Air Transport Services Group Inc: Annual Shareholders Meeting

1100 American Tower Corp: Annual Shareholders Meeting

1100 Big Lots Inc: Annual Shareholders Meeting

1100 Chevron Corp: Annual Shareholders Meeting

1100 Liberty Broadband Corp: Annual Shareholders Meeting

1100 Molson Coors Beverage Co: Annual Shareholders Meeting

1100 PayPal Holdings Inc: Annual Shareholders Meeting

1100 Sprouts Farmers Market Inc: Annual Shareholders Meeting

1100 Sterling Bancorp: Annual Shareholders Meeting

1100 Taylor Morrison Home Corp: Annual Shareholders Meeting

1200 Amazon.com Inc: Annual Shareholders Meeting

1200 Compass Diversified Holdings: Annual Shareholders Meeting

1200 Exelixis Inc: Annual Shareholders Meeting

1200 Hibbett Sports Inc: Annual Shareholders Meeting

1200 Illumina Inc: Annual Shareholders Meeting

1200 Kratos Defense and Security Solutions Inc: Annual Shareholders Meeting

1200 Mattel Inc: Annual Shareholders Meeting

1200 TTEC Holdings Inc: Annual Shareholders Meeting

1200 Upstart Holdings Inc: Annual Shareholders Meeting

1230 California Water Service Group: Annual Shareholders Meeting

1300 Advantage Solutions Inc: Annual Shareholders Meeting

1300 Columbia Banking System Inc: Annual Shareholders Meeting

1300 Equinix Inc: Annual Shareholders Meeting

1300 Facebook Inc: Annual Shareholders Meeting

1300 Incyte Corp: Annual Shareholders Meeting

1300 Sixth Street Specialty Lending Inc: Annual Shareholders Meeting

1330 Belden Inc: Annual Shareholders Meeting

1330 Sixth Street Specialty Lending Inc: Shareholders Meeting

1330 Welltower Inc: Annual Shareholders Meeting

1400 Brigham Minerals Inc: Annual Shareholders Meeting

1400 PennyMac Mortgage Investment Trust: Annual Shareholders Meeting

1500 Coupa Software Inc: Annual Shareholders Meeting

1500 FibroGen Inc: Annual Shareholders Meeting

1600 Skechers USA Inc: Annual Shareholders Meeting

1630 American Eagle Outfitters Inc: Q1 earnings conference call

1630 DermTech Inc: Annual Shareholders Meeting

1630 Designer Brands Inc: Q1 earnings conference call

1630 elf Beauty Inc: Q4 earnings conference call

1630 Nutanix Inc: Q3 earnings conference call

1630 Workday Inc: Q1 earnings conference call

1700 DXC Technology Co: Q4 earnings conference call

1700 First Interstate BancSystem Inc: Annual Shareholders Meeting

1700 NextGen Healthcare Inc: Q4 earnings conference call

1700 NVIDIA Corp: Q1 earnings conference call

1700 Okta Inc: Q1 earnings conference call

1700 Pure Storage Inc: Q1 earnings conference call

1700 QAD Inc: Q1 earnings conference call

1700 Snowflake Inc.: Q1 earnings conference call

1700 Universal Corp: Q4 earnings conference call

1700 Williams-Sonoma Inc: Q1 earnings conference call

1700 Zuora Inc: Q1 earnings conference call

2000 LTC Properties Inc: Annual Shareholders Meeting

EX-DIVIDENDS

Applied Materials Inc: Amount $0.24

Barnes Group Inc: Amount $0.16

Chemed Corp: Amount $0.34

Cooper Tire & Rubber Co: Amount $0.10

Forward Air Corp: Amount $0.21

John Bean Technologies Corp: Amount $0.10

Kinsale Capital Group Inc: Amount $0.11

Materion Corp: Amount $0.12

Prospect Capital Corp: Amount $0.06

Scotts Miracle-Gro Co: Amount $0.62

Xylem Inc: Amount $0.28

Wat lager slot Wall Street, AEX dicht bij de topzone

Goedemorgen

De sessie van gisteren was rustig als we het over de gehele dag bekijken, wel wat beweging maar op slotbasis is er amper wat anders dan de dag ervoor toen alles wel nog fors opliep. Het lijkt wat moeizamer te verlopen nu, wel blijven er wat indices dicht bij de topzone hangen zodat een uitschieter omhoog nog altijd mogelijk blijft. Andere indices staan nog een eind onder de top. Europa blijft daarbij opvallend sterk liggen valt me al een aantal dagen op maar ook dat kan snel weer veranderen.

De beurzen begonnen de week goed door enkele opmerkingen van de FED die de zorgen over de stijgende inflatie wisten te temperen. Op zich moeilijk te begrijpen met de oplopende grondstoffen prijzen maar het lijkt erop dat de FED vrijwel altijd gunstig nieuws wil verspreiden in deze moeilijke fase. We noemen dat ook wat er nog niet is moeten we ook niet te vroeg melden, op een gegeven moment zal de FED niet anders kunnen dat hetgeen we doormaken te moeten herkennen maar dat zal dan wel later dit jaar komen. Alle zaken staan te hoog momenteel en dat zijn de aandelen, de grondstoffen en speculatieve beleggingen waardoor je niet anders kan dan inflatie te erkennen op een gegeven moment. Dinsdag sloot beleidsmaker Charles Evans van de Federal Reserve Bank van Chicago zich daarbij aan.

De economische vooruitzichten blijven in ieder geval nog sterk maar voor hoe lang nog? De volatiliteit in de markt laat wel zien dat beleggers beginnen te twijfelen na de extreem sterke rally die nu al meer dan een jaar loopt, een top in de markt kan er best wel eens snel komen te staan. De Chinese autoriteiten uiten ook hun zorgen over oplopende prijzen van de veel gebruikte grondstoffen zoals olie, ijzer en koper. We gaan zien tot wat al deze waarnemingen toe zullen leiden, voorlopig is het weer feest op de markten alleen moeten we ook op de waarderingen blijven letten en die blijven torenhoog.

Resultaat dit jaar verloopt naar wens maar we blijven rustig:

Deze maand (mei) heb ik tot nu toe 3 keer met posities winst kunnen behalen, er lopen op dit moment geen posities en ik wacht op wat nieuwe mogelijkheden die er wel gaan komen zodra de markt weer een top of bodem neer weet te zetten. Bij de huidige omstandigheden ga ik in ieder geval na een herstel voor een nieuwe terugval. We staan er deze maand in ieder geval al goed voor dus ik kan voorzichtig verder, ook dit jaar loopt meer dan goed iets wat ik graag zo wil houden. Ik verwacht dat er de komende sessies wat kan worden gedaan met wat indices.

Wordt nu dus lid en volg de signalen, er komen nog hele leuke kansen dit jaar omdat ik de nodige volatiliteit verwacht op beurzen ... Zie hieronder het resultaat van deze maand per abonnement.

LET OP !! Maak nu gebruik van de aanbieding die loopt tot 1 AUGUSTUS voor €39 (Polleke Trading €49)... Via de site en dan de Tradershop kunt zich inschrijven en daar kunt u als lid meteen ook de lopende posities met alle details inzien. Ga naar de Tradershop en schrijf u meteen in ... https://www.usmarkets.nl/tradershop

Technische ontwikkeling markt:

De sessie van gisteren bracht niet veel wat betreft duidelijkheid, voorzichtig een poging richting de top bij de DAX, de S&P 500 en de AEX maar richting het slot werd duidelijk dat het moeilijk liep. De Dow en de beide Nasdaq indices lieten ook weinig animo zien, deze indexen blijven dan ook nog ruim onder de topzone. We zitten wel in een fase waar het wat te makkelijk gaat allemaal, dat komt door dat beleggers hopen dat het wel zal meevallen met de rente die oploopt en dat de inflatie wel zal temperen maar zo zeker is dat nog lang niet.

De komende dagen worden hoe dan ook weer belangrijk, we gaan het zo goed als mogelijk volgen en waar het kan zal ik zeker wat kleine posities opnemen.

Overzicht markt:

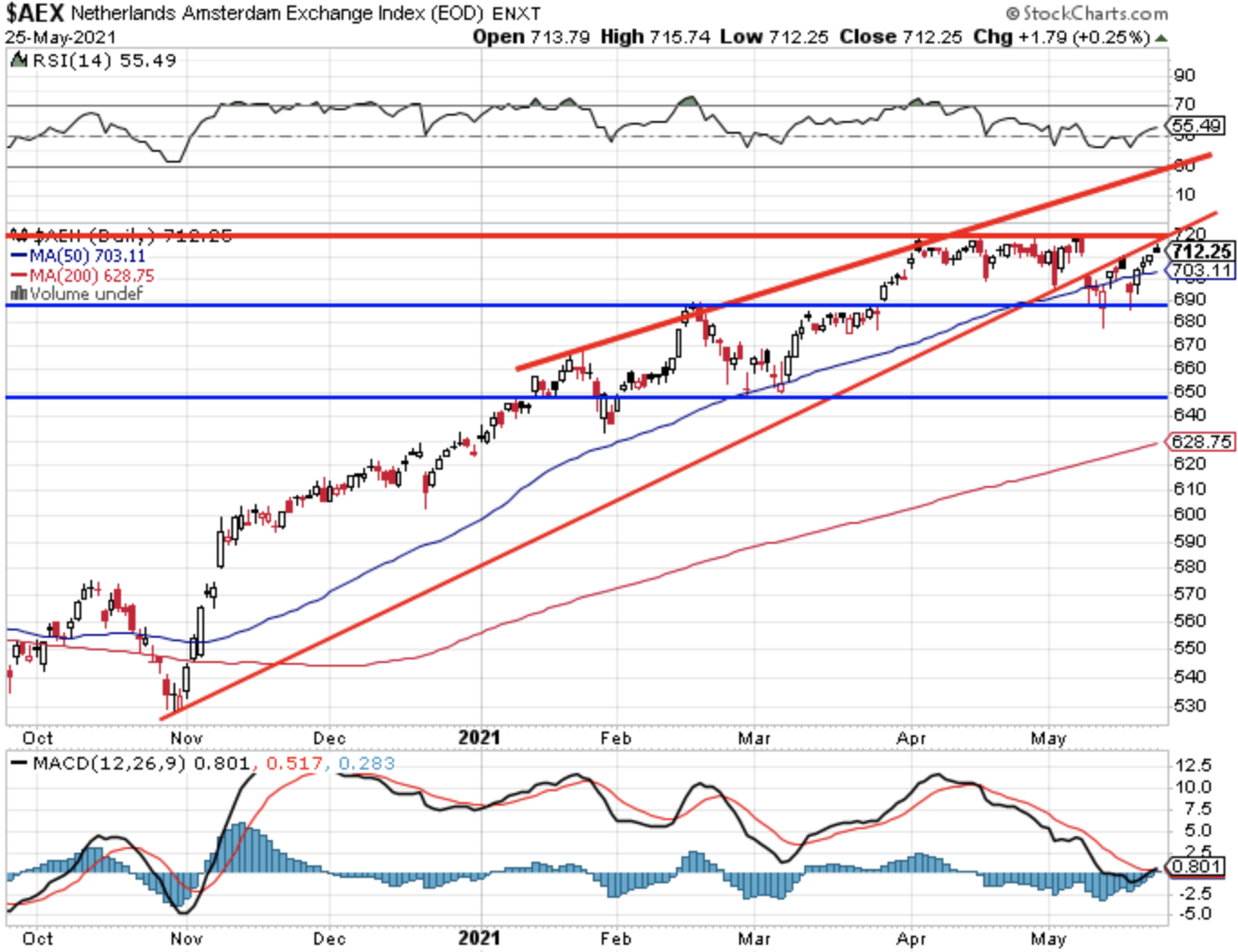

Technische conditie AEX:

De AEX loopt verder op tot rond de 712 punten ofwel tot rond de weerstand, op die weerstand letten we vandaag in ieder geval want mocht de index erboven geraken dan ligt de weg open richting de top 718-719 punten. Steun nu de 708, later de zone 702-703 punten en de 685-698 punten. We weten als er naar de afgelopen weken wordt gekeken dat we daar snel weer naartoe kunnen. Het 50-MA komt nu uit rond de 703 punten en blijft binnen het geheel belangrijk, de index beweegt daar nu duidelijk omheen.

Technische conditie DAX:

Weerstand de bekende topzone rondom de 15.530-15.540 punten, bij een duidelijke uitbraak kan de DAX richting de 15.750 en de 15.850 punten waar ik weerstand verwacht maar dan zitten we in een open veld waar op zicht niks in de weg ligt. Onder die 15.500 punten letten we op de 15.400 en de 15.200-15.225 punten als steun.

Het 50-MA zien we nu rond de 15.095 punten uitkomen, ook dat moeten we in de gaten blijven houden. Wat betreft de indicatoren moet ik zeggen dat die voorlopig niet bevestigen dat de index fors uit gaat breken, aan de andere kant kan het nieuwe optimisme voor rare bewegingen zorgen uiteraard.

S&P 500 analyse:

De S&P 500 moest wat terug na de sterke start van maandag, de 4200 werd wel even doorbroken met een poging richting de top maar de index moest richting het slot inleveren. De vraag is nu of de markt het zal toelaten om nog een keer de topzone op te zoeken, je zou denken dat we er bijna zijn dus het kan makkelijk. Aan de andere kant blijven we ook dicht bij de bodemzone ofwel de oplopende steunlijn en het 50-MA dat ook rond dezelfde stand uitkomt. Dat niveau zien we rond de 4095-4100 punten ofwel zo'n 100 punten onder de huidige stand.

Weerstand nu de top rond de 4238 punten, later de 4275 en de 4300 punten. Steun zien we rond de 4120 en de dubbele steun rond de 4090-4095 punten . Bij de S&P 500 zien we de indicatoren zeker niet overtuigen en eerder zwak voorkomen. We gaan zien of er een nieuwe poging omlaag komt vanaf de topzone, ook deze keer kan het weer snel verlopen denk ik.

Analyse Nasdaq:

De Nasdaq liet een sterke start zien maar moest tegen het einde van de sessie alles inleveren om vrijwel vlak te sluiten. Het blijft snel op en neer gaan met de tech indices maar dat raken we gewend. De index staat nog ver onder de top, de slotstand van gisteren komt uit op 13.657 punten terwijl de top rond de 14.211 punten wacht, daar staan we nu zo'n 550 punten onder nog. Vanaf de bodem van afgelopen week nu toch al een herstel van zo'n 600 punten wat best veel is. Een lagere top blijft mogelijk, dat kan vanaf vandaag al of in de loop van de week. We gaan het zien en waar het kan zal ik er een positie op nemen in ieder geval.

Weerstand nu ronde de 13.750 punten, later rond de 13.850 en de 14.000 punten. Mocht de index verder oplopen dan komt pas de topzone in beeld, die zien we op 14.211 punten uitkomen nu. Steun nu eerst de 13.500 en de 13.300 punten, later de bodemzone rond de 13.000 punten als steun. Hetzelfde zien we nu bij de Nasdaq 100 index en de SOX index.

Euro, olie en goud:

De euro zien we nu rond de 1.225 dollar, de prijs van een vat Brent olie komt uit op 68,6 dollar terwijl een troy ounce goud nu op 1904 dollar staat.

De LIVEBLOG en Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

LET OP !! Maak nu gebruik van de aanbieding die loopt tot 1 AUGUSTUS voor €39 (Polleke Trading €49)... Via de site en dan de Tradershop kunt zich inschrijven en daar kunt u als lid meteen ook de lopende posities met alle details inzien. Ga naar de Tradershop en schrijf u meteen in ... https://www.usmarkets.nl/tradershop

Hieronder de resultaten van dit jaar (2021):

Met vriendelijke groet,

Guy Boscart