Liveblog Archief dinsdag 25 mei 2021

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| USA: CB Consumentenvertrouwen (May) | Actueel: 117,2 Verwacht: 119,2 Vorige: 117,5 | ||||

| USA: Nieuwe Woningen Verkoop (Apr) | Actueel: 863K Verwacht: 970K Vorige: 917K |

Markt snapshot Wall Street vandaag

TOP NEWS

• At Epic v Apple's closing, judge probes implications of upending Apple's App Store

Federal Judge Yvonne Gonzalez Rogers held unconventional closing arguments Monday in the antitrust trial between Epic Games and Apple, peppering both sides' attorneys for three hours about how far she could - and should - go to change Apple's App Store business.

• German antitrust watchdog investigates Google over data use

Germany's antitrust watchdog has launched a probe into whether Google Germany, Google Ireland and its parent company Alphabet are exploiting their market dominance in the way they handle data, it said.

• Biden looks abroad for electric vehicle metals, in blow to U.S. miners

U.S. President Joe Biden will rely on ally countries to supply the bulk of the metals needed to build electric vehicles and focus on processing them domestically into battery parts, part of a strategy designed to placate environmentalists, two administration officials with direct knowledge told Reuters.

• UK competition regulator looking into $39 billion AstraZeneca-Alexion deal

Britain's competition regulator is reviewing AstraZeneca's $39 billion buyout of U.S.-based Alexion on concerns it could reduce competition in the UK market or elsewhere.

• China launches antitrust probe into Tencent-backed property broker KE -sources

China's market regulator has begun an investigation into suspected anti-competitive practices by KE Holdings, the country's biggest housing broker whose top backer is Tencent Holdings, two people who know of the matter said.

BEFORE THE BELL

Wall Street futures rose, helped by gains in technology-related stocks as inflation worries eased. European shares were higher, soothed by reassurance from Federal Reserve officials that monetary stimulus won't be clawed back anytime soon. Asian equities ended in the green. The dollar fell against a basket of currencies, while spot gold prices inched up. Oil prices slipped as expectations of an early return of oil exporter Iran to international crude markets waned.

STOCKS TO WATCH

Results

• Elbit Systems Ltd: The company reported higher quarterly profit and said it expects its night-vision business and other acquired operations to prosper as global defence spending continues to rise. "It has been a big success," Elbit Chief Executive Bezhalel Machlis told Reuters after reporting increased first-quarter profit and revenue. "We expect hundreds of millions of dollars in additional contracts in this area." Elbit said it earned $1.72 per diluted share in the first quarter, up from $1.63 a year earlier. Revenue rose to $1.12 billion from $1.07 billion.

• Lordstown Motors Corp: The company said that 2021 production of its Endurance truck will be half of prior expectations and that the electric vehicle startup needs additional capital to execute its plans, sending shares down 9.5% in after-hours trading. "Capital may limit our ability to make as many vehicles as we would like," Chief Executive Steve Burns said on a conference call. Burns said Endurance production this year will be limited and would be "at best 50%" of the company's prior expectations of 2,200 trucks. He said it was still on track for the September launch of the truck, with pre-production vehicle builds slated for July. Deliveries are scheduled to begin in the fourth quarter. Lordstown reported a first-quarter loss of 72 cents a share, wider than the 28-cents-per-share loss expected by analysts.

Deals Of The Day

• Legato Merger Corp: Canadian steelmaker Algoma Steel is becoming a publicly listed company through a merger agreed with the New York-based blank-check firm in a deal that will value the combined company at more than $1 billion. "Assuming no redemptions by Legato stockholders, the all-stock transaction implies a pro forma enterprise value of more than $1.3 billion at closing and approximately $1.7 billion inclusive of contingent consideration," Algoma Steel said. The deal is expected to provide Algoma Steel with $306 million of capital, including a $100 million fully committed private placement with key investors, the statement added. Algoma Steel will become a publicly listed company as a result of the deal, with its shares traded on the Nasdaq stock market.

• Royal Dutch Shell PLC: The European oil major agreed to sell its controlling interest in a Texas refinery to partner Petroleos Mexicanos (Pemex) for about $596 million, the latest move by the company to cut its global refining footprint. The deal makes the Deer Park, Texas, facility the first foreign refinery that Mexico's state-run oil company will own solely in its history. The agreement was announced not long after Mexican President Andres Manuel Lopez Obrador complained that the 28-year-old joint venture had not been good for Mexico. Shell is shrinking its refining and chemicals portfolio as part of a broader shift by oil majors to reduce hydrocarbon emissions and shift to lower-carbon fuels. Separately, Australia's New South Wales state said it has awarded a A$3.2 billion contract to Royal Dutch Shell and renewable energy firm Edify to build a 100-megawatt battery to boost its energy supplies.

In Other News

• Alphabet Inc: Germany's antitrust watchdog has launched a probe into whether Google Germany, Google Ireland and its parent company Alphabet are exploiting their market dominance in the way they handle data, it said. The Federal Cartel Office said the investigation would consider whether the tech giant offers users enough choice in how it uses their data across the wide range of digital services it provides. Google said people use its services because they are helpful, not because they are forced to do so or because they cannot find any alternatives. "We give people easy control over how their information is used and we limit the use of personal information," spokesman Ralf Bremer said, adding Google would assist the cartel office with its inquiries. Separately, the UK treasury is refusing to back a global overhaul of corporation tax championed by U.S. President Joe Biden unless the White House supports its demand to crack down on U.S. tech titans, The Telegraph reported on Monday, citing treasury sources.

• Apple Inc: Federal Judge Yvonne Gonzalez Rogers held unconventional closing arguments in the antitrust trial between Epic Games and Apple, peppering both sides' attorneys for three hours about how far she could - and should - go to change Apple's App Store business. App makers and regulators around the world are watching the trial and Gonzalez Rogers has hinted in sharp questions to Apple that she may be receptive to some of the "Fortnite" game creators' allegations that Apple misuses its control over the App Store and hurts developers. She questioned Epic on whether there was a way to address its concerns without forcing Apple to open the iPhone to rival app stores, as Epic has proposed. That would be a sweeping change and "courts don't run businesses," she said. She also noted the windfall that a change would mean for Epic, whose own efforts to start a competing paid app store were discussed during the trial.

• Alexion Pharmaceuticals Inc & AstraZeneca PLC: Britain's competition regulator is reviewing AstraZeneca's $39 billion buyout of Alexion on concerns it could reduce competition in the UK market or elsewhere. The UK's Competition and Markets Authority (CMA) said it was inviting comments from any interested party on the deal to help its assessment, setting a deadline of June 3 for any submissions. "The commencement of the UK CMA’s formal review is another important step towards closing of the proposed acquisition, which we continue to expect will be in the third quarter of 2021," a representative for AstraZeneca said. Alexion did not immediately respond to a request for comment.

• Azul SA: The Brazilian airline said it has hired advisers to look at consolidation opportunities within the region and that it was in a strong position to drive that consolidation. Azul also said Chile's LATAM Airlines Group had ended a codeshare agreement for domestic flights in Brazil that was launched last year after the pandemic upended air travel - a move that Azul believes was a reaction to its exploration of consolidation opportunities. "Azul is emerging from this crisis in a leadership position in terms of liquidity, network recovery and competitive advantages. Our plans are unchanged and I am confident that we are in the best position to pursue strategic alternatives at this point in time," CEO John Rodgerson said in a statement.

• Boeing Co: Aircraft leasing firm SMBC Aviation Capital has agreed to buy an additional 14 Boeing 737 MAX aircraft with a low-cost carrier configuration, with deliveries due to begin later this year, it said. The company, a major Boeing customer, said the order is for jets that have already been built and will increase its MAX fleet to 121. But Chief Executive Peter Barrett said he was confident in demand for the MAX, which he said was finding increasing acceptance after regulators cleared it to fly late last year after its two-year grounding. "We thought this was a good opportunity to increase our portfolio of young, fuel-efficient, environmentally friendly narrowbody aircraft - the kind of planes we think are going to be in demand as this recovery takes a firmer footing," Barrett told Reuters.

• BHP Group Ltd: BHP's Cerro Colorado copper mine in Chile signed a new labor contract with its supervisory employees that will be in force for 36 months, the company announced in a statement. The new contract "is the result of the work carried out by the union an company negotiators," BHP said in the statement. The mine, which produced 68,900 tonnes of copper in 2020, has faced problems in its attempt to obtain environmental permits that would allow it to remain in operation.

• Credit Suisse Group AG: The bank has recovered more assets from its suspended Greensill-linked supply chain finance funds, bringing total recoveries to $5.9 billion for the $10 billion funds, it told investors. "Together with the initial cash distribution and current cash and cash equivalents in the funds, the total cash position amounts to $5.9 billion as of May 14, 2021, which is more than half of the total (assets under management) of the four funds at the time of their suspension," the bank's asset management arm said in a statement to investors. Having paid out some $4.8 billion in liquidation proceeds, the funds now hold some $1.06 billion in cash and cash equivalents. It expected to provide an update on the next payments in late May or early June, it said.

• Goldman Sachs Group Inc: Industrial and Commercial Bank of China said its unit had received approval to set up a foreign-controlled wealth management firm with Goldman Sachs Asset Management. The unit of U.S. banking giant Goldman Sachs Group will offer a 51% funding contribution ratio, while the wealth management unit of ICBC will offer 49%, the Chinese bank said in a exchange filing. The joint venture is "to create a world-class asset management business," said Goldman Sachs in an emailed statement to Reuters, as it "will combine Goldman Sachs Asset Management's expertise in investment and risk management with ICBC's strong brand recognition and unparalleled access to retail and institutional clients across China." ICBC said it "will be beneficial to the bank's provision of more diversified and professional wealth management services."

• KE Holdings Inc: China's market regulator has begun an investigation into suspected anti-competitive practices by KE Holdings, the country's biggest housing broker whose top backer is Tencent Holdings, two people who know of the matter said. The investigation is the latest into China's big so-called "platform" companies that match sellers and buyers, several of which have been accused by regulators of exploiting consumers. KE Holdings was warned last month by the State Administration for Market Regulation (SAMR), along with dozens of internet companies, against any abuse of market dominance and told to conduct self-inspections. SAMR has been formally investigating in recent weeks whether KE Holdings forces real estate developers to list housing information only on its platforms, including Lianjia and Beike, a tactic known as "choose one from two", the people said, declining to be named because the information is not public.

• Micron Technology Inc: U.S. Commerce Secretary Gina Raimondo said a proposed $52 billion boost in U.S. government funding for semiconductor production and research could result in seven to 10 new U.S. factories. Raimondo said at an event outside the company’s chip factory that she anticipated the government funding would generate "$150 billion-plus" in investment in chip production and research - including contributions from state and federal governments and private-sector firms. "We just need the federal money ... to unlock private capital," Raimondo said, adding, "it could be seven, could be eight, could be nine, could be 10 new factories in America by the time we're done." She said she expected states will compete for federal funding for chip facilities and that the Commerce department would have a transparent process for awarding funding.

• United Airlines: The company and its pilots' union have reached an agreement to prohibit the airline from mandating COVID-19 vaccinations to its pilots, the Air Line Pilots Association said. "Since the COVID vaccination is not mandatory, pilots who elect not to be vaccinated will not be subject to any discipline," the agreement stated. United's chief executive officer, Scott Kirby, had told workers at a meeting in January that the company may make the vaccine mandatory for employees and urged other companies to do the same. The agreement between the airline and the union also adds that those pilots who have been vaccinated would be eligible for extra pay.

• Walmart Inc: The retailer said it had blocked emails containing a racial slur from being sent from its domain, following backlash on social media. Several Twitter users posted screenshots of emails, from the company's official '[email protected]' address, that contained a slur instead of their names. Walmart said a "bad actor" had created fake Walmart accounts using people's real email addresses and altered first names to fool its automated reply system. The company said it did not know how many fake accounts were created, but that its systems had not been hacked and no customer data was compromised.

• Westpac Banking Corp: The company will reopen Australia's big banks bond-market taps for the first time in more than a year, in a deal marking the first use of a non-USD Libor benchmark rate to price the debt. The country's second-largest lender is offering senior bonds for the first time since January 2020, with part of the issue due to be priced at a spread over the Secured Overnight Financing Rate (SOFR), which is replacing Libor, according to a memo seen by Reuters. "There's been a long hiatus since we've seen the major banks access term funding markets given their access to the central banks' TFF and the substantial uplift in deposits," said Allan O'Sullivan, Westpac's head of debt capital markets syndication. "There's been some expectation amongst market participants as to when we might see the return of the major banks to the senior unsecured market, so it's positive that investors are seeing a transaction from them on their screens again," O'Sullivan added.

ANALYSIS

After M&A boom via Zoom, dealmakers hit the road as COVID-19 subsides

Investment bankers' business of putting together mergers and acquisitions (M&A) has never been stronger. Neither has their fear of missing out on meeting clients.

ANALYSTS' RECOMMENDATION

• Beam Global: Cowen and Company cuts target price to $29 from $45, after the company’s first-quarter revenue fell short of analyst estimates.

• Cabot Oil & Gas Corp: Credit Suisse cuts target price to $19 from $20, following the company’s unexpected merger with Climarex Energy.

• Marriott International Inc: Berenberg raises target price to $130 from $119, citing the company’s increased focus on the recovery phase.

• NGM Biopharmaceuticals Inc: Cowen and Company cuts target price to $20 from $30, after the company’s drug aldafermin failed to demonstrate improvement in fibrosis.

• Ormat Technologies Inc: Cowen and Company raises target price to $73 from $72, as the company is set to acquire 3 geothermal assets in Nevada for $377 million.

ECONOMIC EVENTS (All timings in U.S. Eastern Time)

0800 (approx.) Building permits R number for Apr : Prior 1.760 mln

0800 (approx.) Building permits R change mm for Apr : Prior 0.3%

0900 (approx.) Monthly home prices mm for Mar : Prior 0.9%

0900 (approx.) Monthly home prices yy for Mar : Prior 12.2%

0900 (approx.) Monthly Home Price Index for Mar : Prior 319.7

1000 (approx.) Consumer Confidence for May : Expected 119.4; Prior 121.7

1000 (approx.) New home sales-units for Apr : Expected 0.970 mln; Prior 1.021 mln

1000 (approx.) New home sales change mm for Apr : Prior 20.7%

1000 (approx.) Rich Fed Composite Index for May : Prior 17

1000 (approx.) Rich Fed Services Index for May : Prior 22

1000 (approx.) Rich Fed Manufacturing Shipments for May : Prior 16

COMPANIES REPORTING RESULTS

Agilent Technologies Inc: Expected Q2 earnings of 83 cents per share

Intuit Inc: Expected Q3 earnings of $6.51 cents per share

CORPORATE EVENTS (All timings in U.S. Eastern Time)

0800 Burning Rock Biotech Ltd: Q1 earnings conference call

0800 Establishment Labs Holdings Inc: Annual Shareholders Meeting

0800 FinVolution Group: Q1 earnings conference call

0800 UP Fintech Holding Ltd: Q1 earnings conference call

0830 Flagstar Bancorp Inc: Annual Shareholders Meeting

0830 iRobot Corp: Annual Shareholders Meeting

0830 Nordson Corp: Q2 earnings conference call

0830 Radius Global Infrastructure Inc: Annual Shareholders Meeting

0900 Dycom Industries Inc: Q1 earnings conference call

0900 Howmet Aerospace Inc: Annual Shareholders Meeting

0900 Investors Bancorp Inc: Annual Shareholders Meeting

0900 Jamf Holding Corp: Annual Shareholders Meeting

0900 Merck & Co Inc: Annual Shareholders Meeting

0900 Nielsen Holdings PLC: Annual Shareholders Meeting

0900 Targa Resources Corp: Annual Shareholders Meeting

0900 Ventas Inc: Annual Shareholders Meeting

0900 Vishay Intertechnology Inc: Annual Shareholders Meeting

0915 ConnectOne Bancorp Inc: Annual Shareholders Meeting

0930 ViacomCBS Inc: Annual Shareholders Meeting

1000 Allscripts Healthcare Solutions Inc: Annual Shareholders Meeting

1000 Atlas Air Worldwide Holdings Inc: Annual Shareholders Meeting

1000 Autozone Inc: Q3 earnings conference call

1000 BankUnited Inc: Annual Shareholders Meeting

1000 BioCryst Pharmaceuticals Inc: Annual Shareholders Meeting

1000 Envista Holdings Corp: Annual Shareholders Meeting

1000 First Financial Bancorp: Annual Shareholders Meeting

1000 Fulton Financial Corp: Annual Shareholders Meeting

1000 Liberty Media Corp: Annual Shareholders Meeting

1000 NBT Bancorp Inc: Annual Shareholders Meeting

1000 ProAssurance Corp: Annual Shareholders Meeting

1000 Raven Industries Inc: Annual Shareholders Meeting

1000 US Ecology Inc: Annual Shareholders Meeting

1000 Varonis Systems Inc: Annual Shareholders Meeting

1015 Qurate Retail Inc: Annual Shareholders Meeting

1100 America's CAR-MART Inc: Q4 earnings conference call

1100 Conduent Inc: Annual Shareholders Meeting

1100 Cracker Barrel Old Country Store Inc: Q3 earnings conference call

1100 Dycom Industries Inc: Annual Shareholders Meeting

1100 First Foundation Inc: Annual Shareholders Meeting

1100 Leggett & Platt Inc: Annual Shareholders Meeting

1100 M&T Bank Corp: Shareholders Meeting

1100 Middlesex Water Co: Annual Shareholders Meeting

1100 NiSource Inc: Annual Shareholders Meeting

1100 Open Lending Corp: Annual Shareholders Meeting

1100 People's United Financial Inc: Shareholders Meeting

1100 Perficient Inc: Annual Shareholders Meeting

1130 Sangamo Therapeutics Inc: Annual Shareholders Meeting

1200 Allstate Corp: Annual Shareholders Meeting

1200 Biomarin Pharmaceutical Inc: Annual Shareholders Meeting

1200 Verra Mobility Corp: Annual Shareholders Meeting

1300 Rocket Companies Inc: Annual Shareholders Meeting

1300 Tenable Holdings Inc: Annual Shareholders Meeting

1330 Nevro Corp: Annual Shareholders Meeting

1400 OneMain Holdings Inc: Annual Shareholders Meeting

1400 ViaSat Inc: Q4 earnings conference call

1430 Natera Inc: Annual Shareholders Meeting

1630 Agilent Technologies Inc: Q2 earnings conference call

1630 DoubleVerify Holdings Inc: Q1 earnings conference call

1630 Intuit Inc: Q3 earnings conference call

1630 Liveramp Holdings Inc: Q4 earnings conference call

1630 Omnicell Inc: Annual Shareholders Meeting

1630 Treace Medical Concepts Inc: Q1 earnings conference call

1630 Zscaler Inc: Q3 earnings conference call

1645 Nordstrom Inc: Q1 earnings conference call

1700 Reynolds Consumer Products Inc: Annual Shareholders Meeting

1730 Allakos Inc: Annual Shareholders Meeting

1730 Urban Outfitters Inc: Q1 earnings conference call

EX-DIVIDENDS

Amcor PLC: Amount $0.11

Aramark: Amount $0.11

Jack in the Box Inc: Amount $0.44

Loews Corp: Amount $0.06

Newmark Group Inc: Amount $0.01

S&P Global Inc: Amount $0.77

Teradyne Inc: Amount $0.10

TransUnion: Amount $0.09

Voya Financial Inc: Amount $0.16

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| DEU: Duitse Ifo Bedrijfsklimaat Index (May) | Actueel: 99,2 Verwacht: 98,2 Vorige: 96,8 |

Sterke start week op Wall Street, winst bij de Nasdaq

Goeiemorgen,

De week start sterk op Wall Street, hier in Europa verliep alles wat rustiger want de AEX was open maar met weinig volume door 2e Pinksteren, de DAX bleef zelfs dicht al liepen de futures wel mee. Vooral de tech aandelen vielen op met een behoorlijke winst want de Nasdaq won rond de 200 punten. De Dow Jones sluit 186 punten hoger. Verder valt het op dat enkele indices hun top weer naderen, dat zal vooral zo zijn bij de DAX en de CAC vandaag. De AEX moet er nog wat bij zien te behalen maar we zitten er dicht bij nu.

Maandag kende de AEX dus een rustig verloop met een winst van 0,5% met een slot op 710,5 punten. Kijken we naar Wall Street dan werden beleggers geholpen door de FED die de inflatie vooruitzichten temperde en ook de groei van de economie gunstig noemt. Vooral de rentes stond wat onder druk al moeten we dat nu ook niet te zwaar zien want ik zie de rente al een tijdje rond de huidige standen bewegen. onder druk en vooral technologie aandelen wisten hiervan te profiteren. Wel is het zo dat als de rente in de gunstige richting beweegt je dat meteen merkt aan het verloop van de tech aandelen en gisteren was dat weer eens het geval. De divergenties blijven aanhouden wat het extra moeilijk maakt om richting te kiezen en zeker ook in welke sectoren je stapt.

De FED gaf in maart nog aan dat de rente niet voor 2024 zal worden verhoogd en dat blijft een belangrijk ijkpunt voor de markt. De grote vraag blijft echter wel of ze het zo lang kunnen volhouden met de inflatie die om de hoek komt kijken. Het blijven allemaal zaken die de markten beide richtingen op kan sturen, zowel omhoog als omlaag want alles hangt af van de berichtgeving en de economische cijfers.

We gaan kijken of er vandaag, of later deze week wat kan worden gedaan, ik wacht al bijna een week op een nieuwe mogelijkheid en die komt er wel. We moeten in ieder geval pas instappen wanneer het momentum het beste is. Dus dat komt wel weer, in ieder geval loopt alles prima voor de leden zoals u kunt zien verder in deze update.

Resultaat dit jaar verloopt naar wens maar we blijven rustig:

Deze maand (mei) heb ik tot nu toe 3 keer met posities winst kunnen behalen, er lopen op dit moment geen posities en ik wacht op wat nieuwe mogelijkheden die er wel gaan komen zodra de markt weer een top of bodem neer weet te zetten. Bij de huidige omstandigheden ga ik in ieder geval na een herstel voor een nieuwe terugval. We staan er deze maand in ieder geval al goed voor dus ik kan voorzichtig verder, ook dit jaar loopt meer dan goed iets wat ik graag zo wil houden. Ik verwacht dat er de komende sessies wat kan worden gedaan met wat indices.

Wordt nu dus lid en volg de signalen, er komen nog hele leuke kansen dit jaar omdat ik de nodige volatiliteit verwacht op beurzen ... Zie hieronder het resultaat van deze maand per abonnement.

LET OP !! Maak nu gebruik van de aanbieding die loopt tot 1 AUGUSTUS voor €39 (Polleke Trading €49)... Via de site en dan de Tradershop kunt zich inschrijven en daar kunt u als lid meteen ook de lopende posities met alle details inzien. Ga naar de Tradershop en schrijf u meteen in ... https://www.usmarkets.nl/tradershop

Technische ontwikkeling markt:

De start van de week was sterk want alle indices boeken winst en sommige zelfs behoorlijk en dan vooral de technologie sector. Alles loopt zo te zien weer heel snel op richting de topzone al blijven de Nasdaq, de Nasdaq 100 en de SOX index daar nog ver onder. De AEX is er nu weer bijna terwijl de DAX al met een nieuwe recordstand van start kan gaan vandaag. Verder lopen de S&P 500 en de Dow Jones op richting de topzone al blijven ze er wel nog een eindje onder op slotbasis.

De komende dagen maar eens bekijken waar we naartoe kunnen met de markt na het vlotte herstel van de afgelopen dagen. Technisch zitten we hoe dan ook in een fase waar we beide kanten op kunnen maar dan ook snel zo te zien.

Overzicht markt:

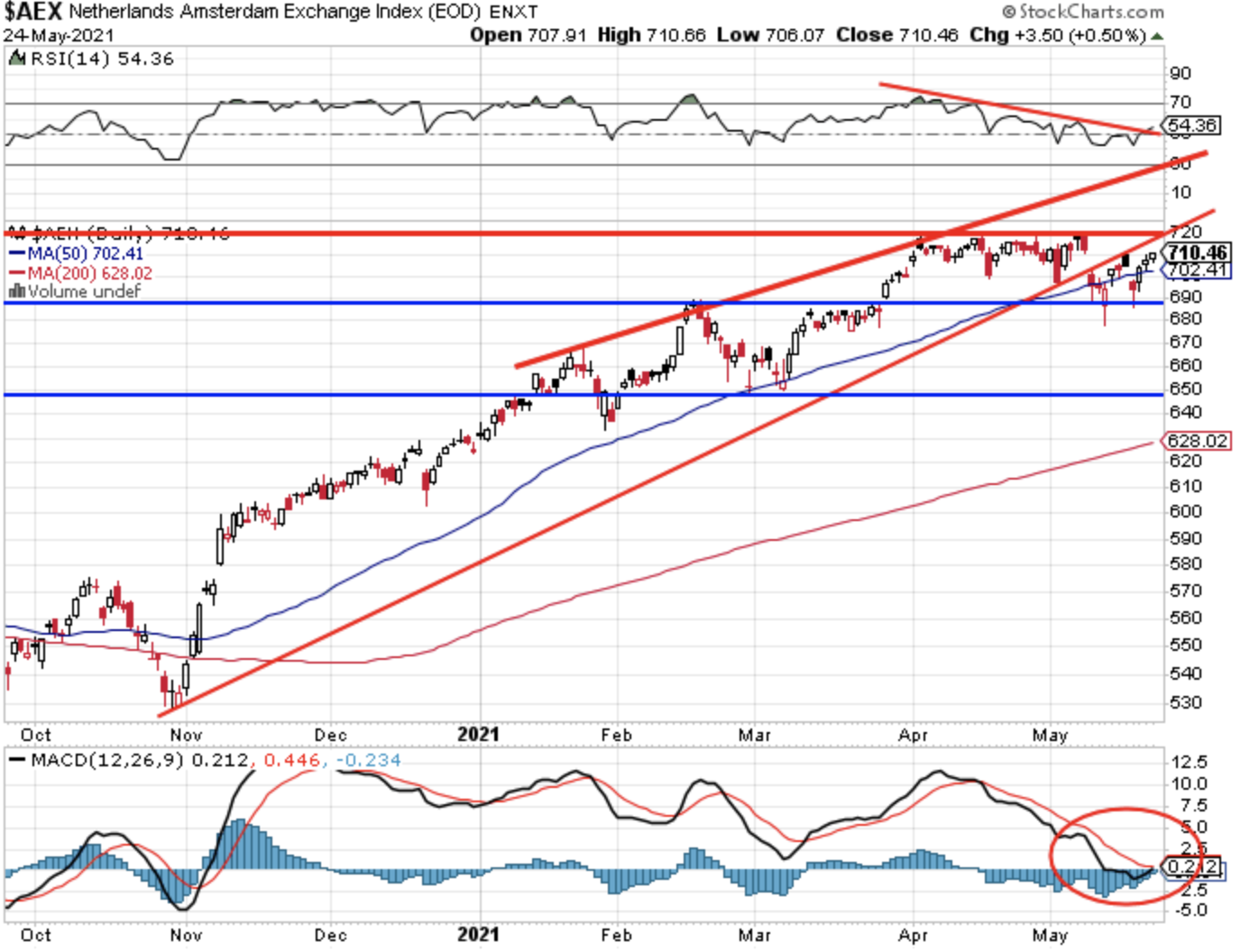

Technische conditie AEX:

De AEX zich verder tot ronde de 710 punten ofwel tot net onder de 712 weerstand, we letten daar vandaag in ieder geval op want mocht de index erboven geraken dan ligt de weg open richting de top 718-719 punten. Steun nu de 708, later de zone 702-703 punten en de 685-698 punten. We weten als er naar de afgelopen weken wordt gekeken dat we daar snel weer naartoe kunnen. Het 50-MA komt nu uit rond de 702,5 punten en blijft binnen het geheel belangrijk, de index beweegt daar nu duidelijk omheen.

De indicatoren bevestigen niet echt veel hoop op een nieuwe uitbraak omhoog maar we moeten nu afwachten op wat er de komende dagen zal komen.

Technische conditie DAX:

De DAX bleef dicht gisteren maar via de futures die wel mee deden zien we vanmorgen dat de index op recordniveau uitkomt nu. Weerstand de bekende topzone rondom de 15.530-15.540 punten, bij een duidelijke uitbraak kan de DAX richting de 15.750 en de 15.850 punten waar ik weerstand verwacht maar dan zitten we in een open veld waar op zicht niks in de weg ligt. Onder die 15.500 punten letten we op de 15.400 en de 15.200-15.225 punten als steun.

Het 50-MA zien we nu rond de 15.075 punten uitkomen, ook dat moeten we in de gaten blijven houden. Wat betreft de indicatoren moet ik zeggen dat die voorlopig niet bevestigen dat de index fors uit gaat breken, aan de andere kant kan het nieuwe optimisme voor rare bewegingen zorgen uiteraard.

S&P 500 analyse:

De S&P 500 start de week sterk en loopt op tot net onder de 4200 punten maar stond even op 4209 punten. Weerstand nu de top rond de 4238 punten waar de index nu naartoe wordt gezogen. De vraag is nu of de markt het zal toelaten om nog een keer de topzone op te zoeken, je zou denken dat we er bijna zijn dus het gaan makkelijk. Aan de andere kant blijven we ook dicht bij de bodemzone ofwel de oplopende steunlijn en het 50-MA dat ook rond dezelfde stand uitkomt. Dat niveau zien we rond de 4095-4100 punten ofwel zo'n 100 punten onder de huidige stand.

Weerstand nu de top rond de 4238 punten, later de 4300 en de 4350 punten. Steun zien we rond de 4120 en de dubbele steun rond de 4090-4095 punten . Ook bij de S&P 500 zien we de indicatoren zeker niet overtuigen en eerder zwak voorkomen. We gaan zien of er een nieuwe poging omlaag komt vanaf vandaag of morgen. Ook deze keer zal het snel verlopen denk ik.

Analyse Nasdaq:

De Nasdaq laat weer een sterke dag zien na de terugval van vrijdag, het gaat snel op en neer met de tech indices maar dat raken we gewend. De index staat wel nog ver onder de top nu, de slotstand van gisteren komt uit op 13.660 punten terwijl de top rond de 14.211 punten wacht, daar staan we nu zo'n 550 punten onder nog. Wel zien we vanaf de bodem van afgelopen week nu al een herstel van zo'n 600 punten wat best veel is. Een lagere top blijft dus mogelijk, dat kan vandaag al of in de loop van de week. We gaan het zien en waar het kan zal ik er een positie op nemen in ieder geval.

Weerstand nu ronde de 13.750 punten, later rond de 13.850 en de 14.000 punten. Mocht de index verder oplopen dan komt pas de topzone in beeld, die zien we op 14.211 punten uitkomen nu. Hetzelfde zien we nu bij de Nasdaq 100 index en de SOX index.

Euro, olie en goud:

De euro zien we nu rond de 1.223 dollar, de prijs van een vat Brent olie komt uit op 68,5 dollar terwijl een troy ounce goud nu op 1877 dollar staat.

De LIVEBLOG en Twitter:

Via de LIVEBLOG en tussendoor ook via mijn Twitter account laat ik gedurende de dag ook wat grafiekjes met korte uitleg voorbij komen over de markt. Op Twitter kunt u mij volgen via @USMarkets dan kunt u deze snelle informatie die ik deel uiteraard ook inzien .... https://twitter.com/USMarkets , ook opvallende beursfeiten komen er vaak langs !

LET OP !! Maak nu gebruik van de aanbieding die loopt tot 1 AUGUSTUS voor €39 (Polleke Trading €49)... Via de site en dan de Tradershop kunt zich inschrijven en daar kunt u als lid meteen ook de lopende posities met alle details inzien. Ga naar de Tradershop en schrijf u meteen in ... https://www.usmarkets.nl/tradershop

Hieronder de resultaten van dit jaar (2021):

Met vriendelijke groet,

Guy Boscart

Marktcijfers

| Actueel | Verwacht | Vorige | |||

|---|---|---|---|---|---|

| DEU: Duitse BBP (Kwartaal) (Q1) | Actueel: -1,8% Verwacht: -1,7% Vorige: 0,3% |

TA Signify, ASML, DSM, Akzo en IMCD

Het zal toch niet waar zijn!? Dit dacht ik na een blik op de grafiek van DSM te hebben geworpen. In de column van vandaag besteed ik aandacht aan de daggrafiek van DSM alsmede Akzo, Signify, ASML en IMCD. We gaan van start!De eerste grafiek die we vandaag gaan bekijken is IMCD. Herkent u het nog…

Lees verder »